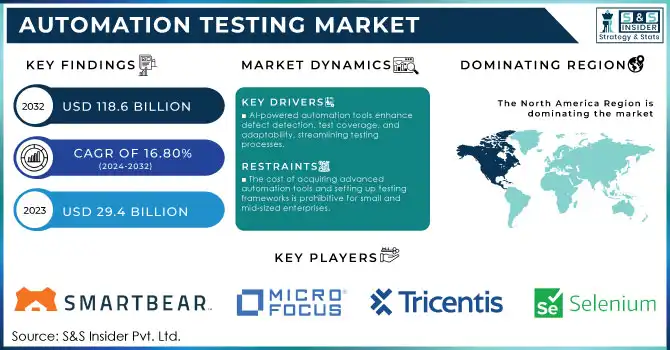

Automation Testing Market Size & Overview:

The Automation Testing Market was valued at USD 29.4 billion in 2023 and is expected to reach USD 118.6 billion by 2032, growing at a CAGR of 16.80% over 2024-2032.

To Get More Information on Automation Testing Market - Request Sample Report

The automation testing market is rapidly growing, driven by the need for streamlined software delivery and enhanced quality assurance processes, and the increasing adoption of automation technologies across various industries. This expansion underscores automation's critical role in reducing time-to-market while ensuring software reliability. Innovations such as AI-integrated testing frameworks have revolutionized the industry. For instance, tools like Tricentis Tosca leverage vision-based artificial intelligence for faster defect detection and improved test coverage, significantly reducing manual intervention. Additionally, partnerships like the 2023 collaboration between UiPath and Peraton highlight automation's growing significance in high-security applications, especially in government and defense sectors.

Practical applications of automation testing demonstrate its transformative impact. In the banking industry, automated regression testing ensures compliance with stringent regulations while minimizing errors. Similarly, in healthcare, automated testing validates the security and accuracy of electronic health records (EHRs), supporting critical, error-free functionalities. The rise of web and mobile applications has further accelerated the adoption of automation. Dynamic testing, which executes and analyzes code in real-time, constituted about 58.5% of testing processes in 2023, providing immediate feedback essential for performance optimization in customer-facing applications.

Automation testing's integration into CI/CD pipelines has been pivotal. Companies like IBM and Microsoft have developed advanced solutions that automate unit and performance testing tasks. For example, the application of API automation in software testing reduces debugging time by nearly 30%, streamlining development workflows.

In conclusion, automation testing has become an indispensable tool for organizations aiming to scale efficiently while maintaining robust software integrity. Its adoption is driven by continuous technological advancements, strategic collaborations, and an increasing reliance on automated solutions tailored to meet diverse industry demands.

Automation Testing Market Dynamics

Drivers

-

AI-powered automation tools enhance defect detection, test coverage, and adaptability, streamlining testing processes.

-

Automation reduces manual testing efforts, speeds up delivery timelines, and lowers operational costs in software development.

-

Increasing complexity in web and mobile applications drives the need for dynamic testing tools that provide real-time performance insights.

The increasing complexity of web and mobile applications has amplified the demand for dynamic testing tools within the automation testing market. These modern applications integrate advanced features alongside technologies like AI, IoT, and third-party APIs, creating a need for testing methods that evaluate functionality, performance, security, and user experience comprehensively and in real time.

Dynamic testing, a cornerstone of automation testing, executes application code during runtime to detect defects and monitor performance. This process is critical for ensuring the reliability of web and mobile applications, as performance issues or bugs can directly impact user satisfaction, brand reputation, and revenue. For instance, e-commerce platforms depend on dynamic testing to manage high-traffic periods, such as sales events, ensuring uninterrupted operations under significant loads. The growing reliance on real-time insights has popularized tools like Selenium, Appium, and Tricentis Tosca, which enable developers to simulate user interactions, address performance bottlenecks, and meet rigorous benchmarks. These tools also facilitate regression testing, ensuring that updates or new features do not interfere with existing functionalities.

Furthermore, the adoption of continuous integration and continuous deployment (CI/CD) pipelines has made dynamic testing indispensable for modern development processes. Automated testing in CI/CD workflows ensures every code change is thoroughly tested, maintaining software quality at the pace of rapid development. For example, dynamic testing for mobile applications can emulate various device configurations and network conditions, ensuring consistent performance across different platforms.

As web and mobile applications become increasingly advanced, dynamic testing is pivotal in the automation testing market. It provides real-time, in-depth evaluation of software, enabling organizations to deliver high-quality, dependable applications that meet the evolving demands of users and modern technology environments.

Restraints

-

The cost of acquiring advanced automation tools and setting up testing frameworks is prohibitive for small and mid-sized enterprises.

-

Automated tests require frequent updates to align with changing application features, increasing maintenance costs and complexity.

-

Automation tools often require specialized knowledge, creating challenges for teams lacking skilled professionals or proper training.

Automation tools are very powerful yet often need a deep understanding of the intricacies to implement them effectively. The continuous reliance on skilled professionals turns into a huge obstacle for organizations, especially SMEs or those who are shifting from Manual Testing to Automated Testing. Tools like Selenium, Appium, Tricentis Tosca, etc., can enable automation testing in a more advanced way but demand expertise in programming, framework integration, and script development. In addition to ensuring you have experience with these tools, automated tests for complex applications require intimate knowledge of the software’s architecture. New teams without proper training or experience may create, tune, and maintain these scripts, leading to inefficiencies and lower returns on investment. Automated test scripts need regular updates as software applications must evolve with time if they take on new features or undergo any functionality changes. It gets particularly tough to maintain these scripts for teams who do not have robust coding backgrounds. Additionally, teams that are lacking in skillset find it hard to overcome these challenges, as technical knowledge is required to troubleshoot false positives or failed test execution. These challenges are further intensified by the integration of newer technologies in automation testing tools, which makes their implementation even more complex. These technologies, while destined to enhance testing efficiency and efficacy, require an increased understanding of algorithms, data management, and predictive analytics — all of which make the process of testing seem even less seamless. As a result, organizations either invest in training programs for in-house automation testers or outsource automation testing to experienced testers. Both of these solutions, though, are costly and add delays in projects which can discourage companies from going all out with automation testing.

The need for personalized expertise in automation tools is a tremendous market barrier for organizations with a skill shortage or limited resources. Addressing this issue will involve educating more people, creating tools that are easier to use, and providing better training so that the market can grow.

Automation Testing Market Segment Analysis

By Component

In 2023, the Service segment dominated the market and contributed more than 58.10% of the revenue share. The service segment includes planning & development, advisory & consulting services, managed services, implementation services, and others. The implementation services segment contributed to a prominent revenue share in the market. Ease of integration — Implementation services ease the inclusion of automation into a running infrastructure of software testing. This service allows you to have automation added to an existing software automation testing infrastructure. The solutions cannot be adequately integrated without connecting with several hardware components and evaluating the whole functionality of the system. Concerning the type of testing, this segment is forecasted to grow at the highest CAGR of more than 17.8% during the 2024 to 2032 period.

Static testing is a type of software testing that detects program bugs without executing the code. It takes place at the initial phase of SDLC before the code is implemented. Static testing uses a variety of techniques, such as technical reviews, structured walkthroughs, and software inspection static testing uses static analysis and review. The static review of these types of documentation is typically performed to uncover and eliminate mistakes and ambiguities. It analyzes documents such as software requirements specifications, designs, and test cases. The next stage is static analysis, where the developer's code is analyzed. This evaluation is conducted to determine any architectural problems that will cause errors every time the script is run.

By Organization Size

The large enterprises held the largest revenue share of over 67.5% in 2023. In large enterprises where systems are complex, applications are multiple, and test cases are numerous, automation testing is integral. This will assist in making automation approaches, reducing human intervention, increasing test coverage, and improving the quality of software applications. Automation for large enterprises needs to align with a comprehensive test strategy. Those entail selecting the correct automation resources, frameworks, and methodologies depending on a company’s needs. Planning for the test should be focused on identifying which test cases to automate first, such as the most critical functions, the highest risk areas, and the tests you run most frequently.

The small and medium-sized enterprises segment is anticipated to grow at the highest CAGR during the forecast period. In small-sized enterprises, automation testing is an important component because it helps increase the efficiency of testing processes, saves time and resources, and ensures the quality of software applications. In small-scale test environments with limited time and resources, focus on rendering automatic test case selection, prioritizing automating critical functionalities, risk-prone areas, and frequently executed scenarios drives the market. This will also help to ensure that maximum coverage is gained with minimum effort and resources.

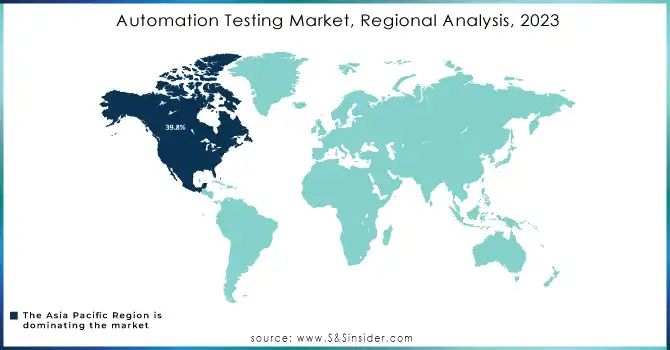

Automation Testing Market Regional Analysis

North America dominated the Automation Testing Market and represented a significant revenue share of 39.8% in 2023, driven by the widespread distribution of technology suppliers. The market is growing due to the increasing trend of smart consumer devices like smart TVs, home appliances, and laptops in the US. Smart consumer electronics have a closer affinity to software, web applications, and operating systems (OS). With its acceptance amongst consumers, the smart appliance market is bound to blossom, thus creating a demand for test automation services in the region.

Asia Pacific is expected to have the highest CAGR during the forecast period. The regional market looks optimistic with the existence of economies such as Singapore, China, India, Japan, New Zealand, and Hong Kong which have the potential to increase the growth of automation analysis-performing organizations. Countries like China and India which possess a large population of consumers play a major role in the growth of the Asia pacific region. This has led governments to enforce the growing adoption of advanced technology such as automation, AI & ML, mobile & web applications, cloud services, and much more.

Do You Need any Customization Research on Automation Testing Market - Enquire Now

Key Players

The major key players along with their products are

-

Selenium - Selenium WebDriver

-

Tricentis - Tosca

-

IBM - Rational Functional Tester

-

Micro Focus - UFT (Unified Functional Testing)

-

SmartBear - TestComplete

-

Cucumber - CucumberStudio

-

Appium - Appium

-

Katalon - Katalon Studio

-

Ranorex - Ranorex Studio

-

Worksoft - Worksoft Certify

-

Sahi - Sahi Pro

-

LambdaTest - LambdaTest

-

Eggplant - Eggplant Functional

-

Perfecto - Perfecto Test Automation

-

TestComplete - TestComplete

-

Telerik - Test Studio

-

Sauce Labs - Sauce Labs Selenium Grid

-

Applitools - Visual AI Testing

-

Postman - Postman API Testing

-

Tricentis – qTest

Recent Developments in the Automation Testing Market

-

March 2024 – Sauce Labs announced a strategic partnership with GitHub Actions. This collaboration aims to streamline continuous testing workflows by enabling developers to trigger tests directly within their GitHub repositories. This integration enhances automated testing for web and mobile applications within CI/CD pipelines.

-

February 2024 – Micro Focus launched UFT One 17.5, which introduces advanced features like scriptless automation, AI-driven test maintenance, and enhanced reporting capabilities. These updates aim to simplify automation testing, reduce maintenance efforts, and improve software quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 29.4 Bn |

| Market Size by 2031 | US$ 118.6 Bn |

| CAGR | CAGR of 16.8% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Testing Type, Service) • By Organization Size (Small And Medium-Sized Enterprises, Large Enterprises) • By Vertical (Healthcare, IT & Telecommunication, Energy & Utilities, BFSI, Government, Defense And Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Selenium, Tricentis, IBM, Micro Focus, SmartBear, Cucumber, Appium, Katalon, Ranorex, Worksoft, Sahi, LambdaTest, Eggplant, Perfecto, TestComplete |

| Key Drivers | • AI-powered automation tools enhance defect detection, test coverage, and adaptability, streamlining testing processes. • Automation reduces manual testing efforts, speeds up delivery timelines, and lowers operational costs in software development. • Increasing complexity in web and mobile applications drives the need for dynamic testing tools that provide real-time performance insights. |

| Market Restraints | • The cost of acquiring advanced automation tools and setting up testing frameworks is prohibitive for small and mid-sized enterprises. • Automated tests require frequent updates to align with changing application features, increasing maintenance costs and complexity. • Automation tools often require specialized knowledge, creating challenges for teams lacking skilled professionals or proper training. |