Automation and Control Market Report Scope & Overview:

Automation and Control Market was valued at USD 231.02 billion in 2023 and is expected to reach USD 545.93 billion by 2032, growing at a CAGR of 10.09% from 2024-2032. This report includes insights into adoption rates, investment trends and regulatory impacts affecting the industry. It also assesses customer feedback and satisfaction that helps improve products and services, and identifies the impact of supply chain trends on development in the market. This report explores the increase in demand for automation and control systems that improve efficiency across a number of sectors that will drive healthy growth in these markets for years to come.

Get more information on Automation and Control Market - Request Sample Report

Market Dynamics

Drivers

-

Rising Industrial Automation Demand in Manufacturing, Automotive, and Chemicals for Enhanced Efficiency, Precision, and Cost-Effective Production

Industries such as manufacturing, automotive, and chemicals are witnessing an ever-increasing demand for industrial automation. Automation in manufacturing allows for higher productivity that helps to cut down operational costs and also ensures consistent output. Automotive firms are using automation to make the assembly lines more efficient in addition to improving the quality of vehicles with a lesser number of errors. Likewise, the chemical industry depends on automation systems to deliver accuracy in chemical processes, efficiency in production rates, and compliance with safety regulations. The industries have now welcomed automation solutions to sustain their business in the competitive market, to reduce human error, and increasing demand. With the advancement of technology, the automation in these sectors ensures smoother functioning and production at lower costs.

Restraints

-

Increased Cybersecurity Risks Due to Interconnected Automation Systems Expose Businesses to Data Breaches and Operational Disruptions

As automation systems become more interconnected, they are increasingly exposed to potential cyber threats. With the integration of IoT, AI, and cloud-based platforms, these systems create more entry points for malicious attacks. A breach in an automation system can lead to significant data loss, operational disruption, and damage to a company's reputation. Industries such as manufacturing, energy, and healthcare, which rely heavily on automation, face heightened risks, as sensitive operational data and control systems are targeted. Moreover, the complexity of securing such vast, interconnected infrastructures adds to the challenge. As these risks continue to grow, companies must invest in robust cybersecurity measures, which can increase operational costs and hinder the seamless implementation of automation technologies.

Opportunities

-

AI and Machine Learning Integration in Automation Enhances Efficiency, Decision-Making, Predictive Maintenance, and Equipment Longevity

The integration of AI and machine learning into automation systems is transforming industries by significantly enhancing their efficiency and capabilities. AI-powered automation solutions allow for better decision-making by analyzing large amounts of data in real-time, leading to optimized operations. Machine learning algorithms further improve system performance by enabling predictive maintenance, identifying potential issues before they cause costly breakdowns. This helps minimize downtime, cut maintenance expenses, and prolong the lifespan of equipment. As industries strive for more intelligent, self-learning systems, the use of AI and machine learning will become pivotal in driving continuous improvement and ensuring higher productivity across various sectors, such as manufacturing, energy, and logistics.

Challenges

-

Maintaining Advanced Automation Systems Requires Specialized Knowledge, Ongoing Investment, and Skilled Personnel for Effective Operation

Maintaining and troubleshooting automation systems can be a significant hurdle for businesses, as these systems often require specialized knowledge and technical expertise. The complexity of modern automation technologies, including robotics, AI, and IoT integration, means that regular maintenance is essential to ensure smooth and efficient operation. Businesses must invest in skilled personnel who are well-versed in the latest technologies to handle system diagnostics, repairs, and software updates. Moreover, as automation systems evolve rapidly, staying current with new tools, software updates, and security patches becomes an ongoing commitment. The need for continuous training and specialized support can increase operational costs, complicate workforce management, and strain resources, especially for smaller businesses with limited technical capabilities.

Segment Analysis

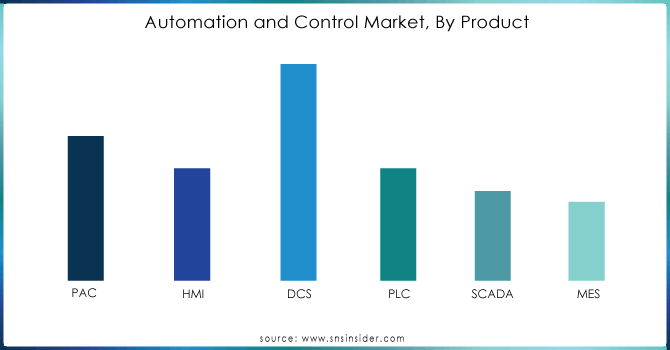

By Product

The PLC segment dominated the Automation and Control Market in 2023, capturing the highest revenue share of approximately 27%. This dominance is attributed to PLCs’ widespread adoption in industrial automation for controlling manufacturing processes. Their robustness, reliability, cost-effectiveness, and flexibility in managing complex tasks make them integral in various sectors, including automotive, energy, and manufacturing, driving their continued market dominance.

The PAC segment is expected to grow at the fastest CAGR of about 13.19% from 2024 to 2032. PACs combine the capabilities of both PLCs and PCs, offering enhanced processing power, networking flexibility, and scalability. Their ability to integrate with other industrial control systems and their adaptability to complex manufacturing environments makes them increasingly popular, particularly in industries requiring high-performance automation and real-time data processing.

Get a Customized Report as per your Business Requirement - Request For Customized Report

By End Use

The Industrial segment dominated the Automation and Control Market in 2023, holding the highest revenue share of about 57%. This dominance is driven by the widespread use of automation in industrial applications such as manufacturing, energy, and chemicals. Automation improves efficiency, reduces costs, and ensures consistent quality in industrial processes, making it essential for modern industries. As industries continue to embrace Industry 4.0, the demand for automation systems remains strong.

The Residential segment is expected to grow at the fastest CAGR of about 13.11% from 2024 to 2032. This growth is fueled by the increasing adoption of smart home technologies, driven by consumer demand for energy-efficient, secure, and automated living environments. Innovations in home automation, such as smart lighting, security, and climate control systems, are transforming residential properties, making them more convenient, cost-effective, and sustainable for homeowners.

By Application

The HVAC segment held the largest revenue share, around 35% in 2023. Mainly because the demand for energy-efficient HVAC systems has increased from commercial to residential buildings. The automation of HVAC systems provides comfort, energy efficiency, and contributes to sustainability goals. As concern about energy efficiency and climate change grows, HVAC automation is and will be a growing factor influencing the market.

This segment is expected to grow at the fastest rate (11.82%). The growth is attributed to the growing demand in the residential, commercial, and industrial sectors for advanced surveillance, access control, and fire safety systems. Automation technologies also provide real-time monitoring, risk detection, and proactive protection; thus, they are indispensable for increasing security and safety standards.

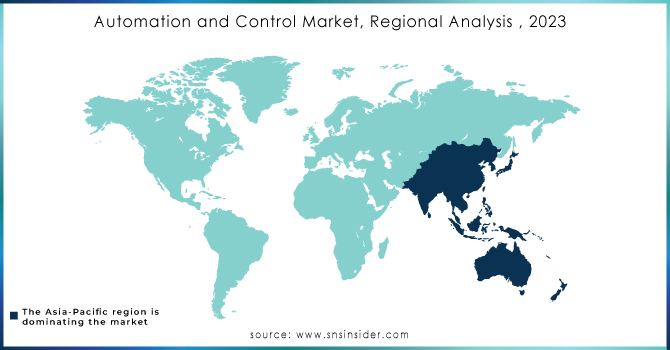

Regional Analysis

In 2023, North America dominated the Automation and Control Market with the highest revenue share of about 36%. This dominance could be explained with the region's early adoption of advanced automation technologies, a very strong industrial base, and prime investment in research and development. The demand for automation solutions will continue to be led by industries such as manufacturing, automotive, and energy, with a key focus on efficiency and global competitiveness.

Asia Pacific is projected to grow at the fastest CAGR of around 11.62%, from 2024 to 2032. Rapid industrialization in the region, increased adoption of Industry 4.0 technologies, and government initiatives to promote smart manufacturing are supporting robust growth in this market. With rising investments toward infrastructure, automation is being realized as a major tool for enhancing productivity and competitiveness while reducing costs and ensuring sustainability. Therefore, it positions Asia Pacific as one of the major growth drivers of the global automation market over the years to come.

Key Players

-

Schneider Electric (EcoStruxure, Modicon PLC)

-

Honeywell International Inc. (Experion PKS, SmartLine Transmitters)

-

Rockwell Automation Inc. (FactoryTalk, Allen-Bradley PLCs)

-

OMRON Corporation (Sysmac Studio, NJ Series PLC)

-

Fanuc Corporation (ROBOGUIDE, FANUC Robots)

-

Emerson Electric Co. (DeltaV, Ovation)

-

Dwyer Instruments, Inc. (Series 2000, Series 2000 Pressure Transducers)

-

ABB (Ability, ACS880 Drives)

-

Advantech Co. Ltd. (WebAccess, Adam Modules)

-

AMETEK, Inc. (PowerMate, TDI Digital Controllers)

-

SLB (Subsea Control Systems, Reservoir Management Software)

-

Yokogawa Electric Corporation (Centum VP, ProSafe-RS)

-

Bosch Rexroth AG (IndraDrive, Rexroth Linear Motion Systems)

-

Stratasys (FDM 3D Printers, PolyJet 3D Printers)

-

KUKA AG (KUKA Robotics, KUKA.AI)

-

Mitsubishi Electric Corporation (MELSEC PLCs, iQ-R Series)

-

M+W Group (Facility Automation, Integrated Process Solutions)

-

Endress+Hauser Group Services AG (Proline, Liquiphant)

Recent Developments:

-

In November 2024, Schneider Electric showcased its exciting 2025 automation innovations at the SPS Fair, focusing on open automation and digital solutions, including the Modicon M660 Industrial PC Motion controller for enhanced system performance.

-

In January 2025, ABB and Agilent Technologies announced a collaboration to advance laboratory automation, aiming to enhance the efficiency and capabilities of laboratory processes through integrated automation solutions

-

In March 2024, Bosch Rexroth presented its innovative solutions for automated material transport at LogiMAT, showcasing the integration of its autonomous mobile robot (AMR) ACTIVE Shuttle with K.Hartwall's A-MATE® FreeLift, enhancing in-plant material handling.

| Report Attributes | Details |

| Market Size in 2023 | USD 231.02 Billion |

| Market Size by 2032 | USD 545.93 Billion |

| CAGR | CAGR of 10.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (PLC, SCADA, PAC, DCS, HMI, MES) • By Application (HVAC, Safety & Security, Lighting, Others) • By End Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schneider Electric, Honeywell International Inc., Rockwell Automation Inc., OMRON Corporation, Fanuc Corporation, Emerson Electric Co., Dwyer Instruments, Inc., ABB, Advantech Co. Ltd., AMETEK, Inc., SLB, Yokogawa Electric Corporation, Bosch Rexroth AG, Stratasys, KUKA AG, Mitsubishi Electric Corporation, M+W Group, Endress+Hauser Group Services AG |