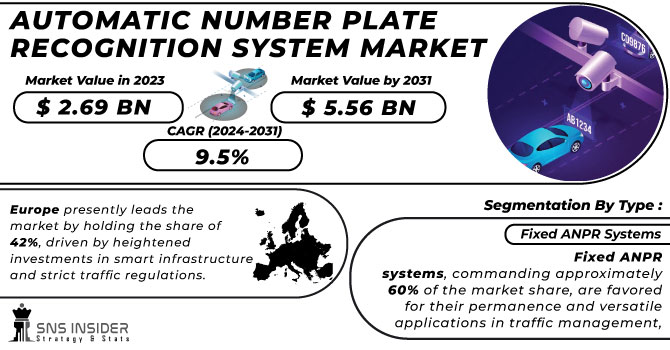

Automatic Number Plate Recognition (ANPR) System Market Size was valued at USD 3.17 Billion in 2023 and is expected to reach USD 6.96 Billion by 2032 and grow at a CAGR of 9.15% over the forecast period 2024-2032.

Get More Information on Automatic Number Plate Recognition System Market - Request Sample Report

The Automatic Number Plate Recognition (ANPR) System market is experiencing rapid growth because of increased global demand for intelligent traffic management and security systems. In 2023 and 2024, nations such as Japan, China, USA, France, Germany, and India have been at the forefront in implementing ANPR systems to improve road safety and strengthen law enforcement. For example, the Indian government is deploying ANPR systems in urban areas under its Smart Cities Mission for automatic traffic rule enforcement. As of late 2023, 6,271 projects worth ₹1.16 lakh crore have been completed under this mission. The USA and Germany are also adopting ANPR technology for border security and toll management systems.

Recent technological advancements like AI-powered image recognition and cloud-based ANPR solutions significantly improved accuracy and scalability. In 2023, Japan released a high-end ANPR system with both IoT and 5G capabilities, enabling real-time monitoring and paving the future of the product. The expansion of smart city initiatives and urban sustainability development in governments provides tremendous growth opportunities for ANPR system adoption. This has increased interest in decreasing vehicle theft and the implementation of more efficient parking management systems, thus growing the potential in this market. Industry players are now cooperating to ensure data privacy, among other challenges, in compliance with regional regulations.

KEY DRIVERS:

Governments around the world are implementing ANPR to manage traffic efficiently.

Smart traffic management is becoming the foundation of city infrastructure as cities strive to deal with rising vehicle numbers. Automatic Number Plate Recognition (ANPR) System are critical for reducing congestion and enforcing traffic laws because they can automatically identify any vehicles violating regulations. For instance, the French government has reported an increase of 27% in the issuance of penalties through automated Automatic Number Plate Recognition systems in 2023, which proves it to be effective. Besides, integrating Automatic Number Plate Recognition in toll collection systems has simplified the process and more than 40% of toll plazas in China use ANPR technology. The push toward smart cities and real-time traffic data collection further drives demand for Automatic Number Plate Recognition systems globally.

Automatic Number Plate Recognition helps the police keep track of and identify suspect cars.

The growing rate at which crimes are committed that involve vehicles has increased demand for Automatic Number Plate Recognition systems. Governments are adopting these systems to monitor public spaces and discover unauthorized or stolen vehicles. For example, Automatic Number Plate Recognition technology allowed the Japanese government to trace more than 1,200 stolen vehicles in 2023. The connectivity of this system with national databases will ensure alerts in real-time and thus add to security. With rising urbanization, public safety concerns are also compelling investment in Automatic Number Plate Recognition technologies in India and the USA, where security applications form more than 35% of deployment in those regions.

RESTRAIN:

High-end hardware and infrastructure restrict the use of ANPR systems in developing countries.

The Automatic Number Plate Recognition system requires significant investment in high-resolution cameras, robust software, and supporting infrastructure. This makes it very expensive to deploy Automatic Number Plate Recognition systems at a large scale, especially in developing countries. For instance, a standard Automatic Number Plate Recognition camera costs around USD 10,000, not considering installation and maintenance costs. Governments in developing countries like India face budgetary constraints, which slows down large-scale deployment. In addition, these systems require periodic updates and integration with other databases, which increases costs. Despite initial reductions in operational costs, the front-end investment is still the largest barrier to market entry. To break through this, industry players are researching cheaper, scalable models for developing markets.

BY COMPONENT

In 2023, the Hardware segment dominated the market with a share of 73.64%. This is because high-resolution cameras and sensors are necessary for capturing clear images of vehicles. Advances in hardware, such as night vision and weather-resistant designs, increase demand.

The Software segment is expected to grow with the fastest CAGR of 9.51% during the forecast period from 2024 to 2032. Enhanced algorithms, cloud computing, and artificial intelligence boost the adoption of software for real-time data processing and analytics. The governments are increasingly investing in AI-driven software for improving recognition accuracy and efficiency in systems. Both hardware and software developments together bring forth a robust and scalable Automatic Number Plate Recognition system for varied application needs, such as traffic management to surveillance.

BY TYPE

In 2023, Mobile ANPR systems segment held the largest share, with 52.33% market share, owing to its flexibility and integration into law enforcement vehicles. These systems are highly effective for patrolling and real-time monitoring, gaining traction in regions like the USA and Europe.

Portable ANPR systems segment, on the other hand, are projected to grow with the fastest CAGR of 9.60% during the forecast period 2024–2032. Their ease of deployment and cost-effectiveness make them ideal for temporary installations, such as event security or construction zones. Fixed systems are still an integral part of toll management and smart city infrastructure and are continuously monitored. Technological advancements will continue to advance Automatic Number Plate Recognition systems in terms of efficiency and adaptability in various environments.

Get Customized Report as per your Business Requirement - Request For Customized Report

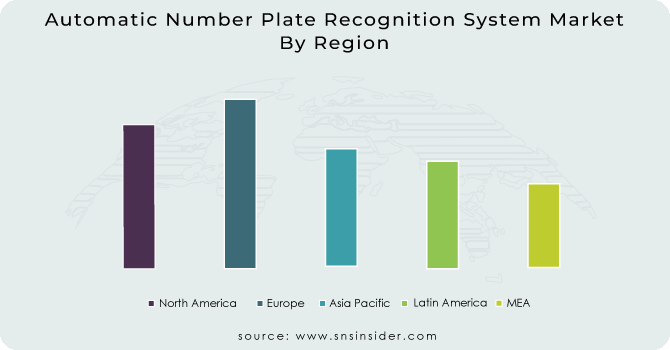

Asia Pacific region was the most dominant in 2023, accounting for 32.48% of the market share, due to strong infrastructure projects and government-led smart city initiatives in countries such as China and India. These regions are experiencing rapid urbanization, thus requiring advanced traffic management solutions.

Europe region is likely to see the fastest growth at a compound annual growth rate of 9.47% during 2024–2032 due to stringent vehicle emission norms and increasing investments in surveillance systems. The USA is another prominent country adopting Automatic Number Plate Recognition for border security and crime control. The growth of the market can be seen as an initiative of collaborations between the industries and governments in these geographies.

Some of the major players in the Automatic Number Plate Recognition (ANPR) System Market are

Kapsch TrafficCom (ANPR Cameras, Toll Collection Systems)

Genetec (Security Center AutoVu, Cloud-based ANPR Software)

Siemens Mobility (ANPR Hardware Solutions, Smart Traffic Systems)

Conduent (Parking Management Systems, Tolling Services)

Hikvision (Intelligent ANPR Cameras, Video Surveillance Solutions)

Bosch Security Systems (License Plate Cameras, AI-based ANPR Software)

Jenoptik (Traffic Law Enforcement Systems, Traffic Cameras)

Neology (RFID Solutions, Automated Toll Systems)

Tattile (Smart ANPR Cameras, Traffic Monitoring Systems)

PIPS Technology (Mobile ANPR Systems, Integrated Data Management Tools)

Elsag North America (Fixed ANPR Cameras, Mobile Plate Hunter Systems)

Axis Communications (Network Cameras, Edge-based ANPR Software)

TagMaster (RFID Solutions, ANPR Sensors)

Digital Recognition Systems (Vehicle Recognition Software, ANPR Cameras)

Leonardo (Traffic Surveillance Systems, Border Control Solutions)

Adaptive Recognition (Automatic Plate Readers, Intelligent Analytics Tools)

Vigilant Solutions (LEARN Cloud Platform, Mobile ANPR Systems)

Q-Free (Tolling Solutions, Traffic Management Systems)

Parkopedia (Parking Data Solutions, ANPR-based Access Control Systems)

ARH Inc. (High-Resolution ANPR Cameras, Intelligent Vehicle Identification Systems)

MAJOR SUPPLIERS (Components, Technologies)

Sony Corporation (Image Sensors, Camera Components)

NVIDIA (AI Processors, GPUs)

Intel (Processors, IoT Platforms)

Ambarella (Video Processing Chips, AI-based SoCs)

ON Semiconductor (Image Sensors, Power Management ICs)

Analog Devices (Signal Processing Components, Power ICs)

Texas Instruments (Microcontrollers, Power Management ICs)

Broadcom (Networking Components, Connectivity Solutions)

Samsung Electronics (Memory Chips, Processing Units)

LG Innotek (Optical Modules, Camera Modules)

MAJOR CLIENTS

National Highway Authorities (e.g., USA, India)

Municipal Traffic Departments

Airport Authorities

Smart City Administrations

Toll Road Operators

Police Departments

Commercial Parking Operators

Logistics Companies

Retail Chains

Public Transport Authorities

Siemens (Germany)-Company Financial Analysis

April 2023: Kapsch TrafficCom has recently published a major update to its ANPR software. With the new version, top performance is possible in the automatic recognition of number plates, depending on the application. This latest release includes a totally reworked architecture that contains numerous deep learning elements, hence significantly improving performance. Hundreds of thousands of images were used in the training of an artificial intelligence software that was later employed in the identification of number plates with new ANPR software in a GDPR-compliant manner.

October 2023: Hikvision India released its Latest Multilane ANPR Cameras and ANPR Cameras with in-built Radar at TrafficInfraTech. The keynote features of the exhibition are latest Transportation Security Systems, intelligent traffic management solutions with a multilane 3D Radar with detection range up to 150 meters. Hikvision India took part in the 11th edition of TrafficInfraTech Expo 2023 with the latest technologies, products, and solutions meant for India's fastgrowing transportation sector.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

US$ 3.17 Billion |

|

Market Size by 2032 |

US$ 6.96 Billion |

|

CAGR |

CAGR of 9.15% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Fixed ANPR Systems, Portable ANPR Systems, Mobile ANPR Systems), |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Kapsch TrafficCom, Genetec, Siemens Mobility, Conduent, Hikvision, Bosch Security Systems, Jenoptik, Neology, Tattile, PIPS Technology, Elsag North America, Axis Communications, TagMaster, Digital Recognition Systems, Leonardo, Adaptive Recognition, Vigilant Solutions, Q-Free, Parkopedia, ARH Inc. |

|

Key Drivers |

• Governments around the world are implementing ANPR to manage traffic efficiently. |

|

Restraints |

• High-end hardware and infrastructure restrict the use of ANPR systems in developing countries. |

Ans: Asia Pacific dominated the Automatic Number Plate Recognition (ANPR) System Market in 2023.

Ans: The Hardware segment dominated the Automatic Number Plate Recognition (ANPR) System Market.

Ans: The major growth factors of the Automatic Number Plate Recognition (ANPR) System Market is Rising Need for Enhanced Security in Public Spaces.

Ans: Automatic Number Plate Recognition (ANPR) System Market size was USD 3.17 Billion in 2023 and is expected to Reach USD 6.96 Billion by 2032.

Ans: The Automatic Number Plate Recognition (ANPR) System Market is expected to grow at a CAGR of 9.15% during 2024-2032.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Key Vendors and Feature Analysis, 2023

5.2 Performance Benchmarks, 2023

5.3 Integration Capabilities, by Software

5.4 Usage Statistics, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automatic Number Plate Recognition (ANPR) System Market Segmentation, By Type

7.1 Chapter Overview

7.2 Fixed ANPR Systems

7.2.1 Fixed ANPR Systems Market Trends Analysis (2020-2032)

7.2.2 Fixed ANPR Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Portable ANPR Systems

7.3.1 Portable ANPR Systems Market Trends Analysis (2020-2032)

7.3.2 Portable ANPR Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Mobile ANPR Systems

7.4.1 Mobile ANPR Systems Market Trends Analysis (2020-2032)

7.4.2 Mobile ANPR Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automatic Number Plate Recognition (ANPR) System Market Segmentation, by Application

8.1 Chapter Overview

8.2 Traffic Management

8.2.1 Traffic Management Market Trends Analysis (2020-2032)

8.2.2 Traffic Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Parking Management

8.3.1 Parking Management Market Trends Analysis (2020-2032)

8.3.2 Parking Management Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Law Enforcement

8.4.1 Law Enforcement Market Trends Analysis (2020-2032)

8.4.2 Law Enforcement Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Electronic Toll Collection

8.5.1 Electronic Toll Collection Market Trends Analysis (2020-2032)

8.5.2 Electronic Toll Collection Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Access Control

8.6.1 Access Control Market Trends Analysis (2020-2032)

8.6.2 Access Control Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Automatic Number Plate Recognition (ANPR) System Market Segmentation, By Component

9.1 Chapter Overview

9.2 Hardware

9.2.1 Hardware Market Trends Analysis (2020-2032)

9.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Software

9.3.1 Software Market Trends Analysis (2020-2032)

9.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Automatic Number Plate Recognition (ANPR) System Market Segmentation, By End-User

10.1 Chapter Overview

10.2 Government

10.2.1 Government Market Trends Analysis (2020-2032)

10.2.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Institutions

10.3.1 Institutions Market Trends Analysis (2020-2032)

10.3.2 Institutions Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Commercial

10.4.1 Commercial Market Trends Analysis (2020-2032)

10.4.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.4 North America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.5 North America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.6 North America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.2 USA Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.7.3 USA Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.4 USA Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.2 Canada Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.8.3 Canada Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.4 Canada Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.2.9.3 Mexico Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.4 Mexico Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.7.3 Poland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.4 Poland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.8.3 Romania Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.4 Romania Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.5 Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.6 Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.7.3 Germany Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.4 Germany Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.2 France Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.8.3 France Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.4 France Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.9.3 UK Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.4 UK Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.10.3 Italy Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.4 Italy Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.11.3 Spain Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.4 Spain Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.14.3 Austria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.4 Austria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.5 Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.6 Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.2 China Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.7.3 China Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.4 China Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.2 India Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.8.3 India Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.4 India Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.2 Japan Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.9.3 Japan Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.4 Japan Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.10.3 South Korea Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.4 South Korea Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.11.3 Vietnam Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.4 Vietnam Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.12.3 Singapore Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.4 Singapore Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.2 Australia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.13.3 Australia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.4 Australia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.5 Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.6 Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.7.3 UAE Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.4 UAE Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.4 Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.5 Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.6 Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.4 Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.5 Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.6 Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.7.3 Brazil Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.4 Brazil Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.8.3 Argentina Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.4 Argentina Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.9.3 Colombia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.4 Colombia Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Automatic Number Plate Recognition (ANPR) System Market Estimates and Forecasts, By End-User (2020-2032) (USD Billion)

12. Company Profiles

12.1 Kapsch TrafficCom

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Genetec

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Siemens Mobility

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Conduent

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Hikvision

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Bosch Security Systems

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Jenoptik

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Tattile

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 PIPS Technology

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Elsag North America

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

BY TYPE

BY COMPONENT

BY APPLICATION

BY END-USER

Request for Segment Customization as per your Business Requirement: Segment Customization Request

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Automotive Turbocharger Market size was valued at USD 14.21 billion in 2023 & will reach USD 26.12 billion by 2032 and grow at a CAGR of 7% by 2024-2032

The Car Rental Market Size was valued at USD 130.45 billion in 2023 and will reach USD 311.63 billion by 2031 and grow at a CAGR of 11.5% by 2024-2031

The Electric 3-Wheeler Market size was valued at USD 2.90 billion in 2023, and is expected to reach USD 7.42 billion by 2032, and grow at a CAGR of 9.88% over the forecast period 2024-2032.

The Bus Seat Market Size was valued at USD 13.5 billion in 2023 and is expected to reach USD 21.67 billion by 2032 and grow at a CAGR of 5.4% by 2024-2032.

The Automotive Battery Management System Market Size was valued at USD 5.27 Billion in 2023 and is expected to reach USD 21.24 Billion by 2032 growing at a CAGR of 16.78% over the forecast period 2024-2032.

The Automotive Grille Market Size was $10.32 billion in 2023 and is expected to reach USD 16.02 billion by 2032 and grow at a CAGR of 5% by 2024-2032.

Hi! Click one of our member below to chat on Phone