Get more information on Automated Sortation System Market - Request Sample Report

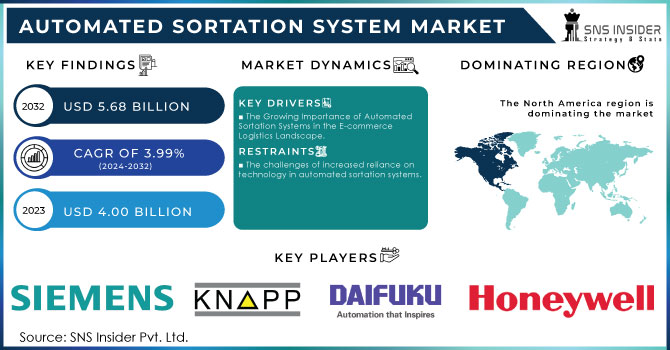

The Automated Sortation System Market Size was valued at USD 4.00 Billion in 2023 and is expected to reach USD 5.68 Billion by 2032 and grow at a CAGR of 3.99% over the forecast period 2024-2032.

The automated sortation systems market is experiencing substantial growth, fueled by the rising need for effective logistics and supply chain operations in different sectors. Automated sorting systems utilize cutting-edge technologies like robotics, artificial intelligence (AI), and machine learning to enhance the efficiency of the goods sorting process, leading to a notable decrease in manual work and an increase in both accuracy and speed. The fast expansion of e-commerce is a key factor in driving the growth of this market. In the United States, the e-commerce sector has seen impressive expansion, with sales surpassing USD 1.03 trillion in 2023. This increase accounts for 14.6% of all retail sales and is expected to surpass USD 1.5 trillion by 2025. 63% of American adults buy things on the Internet every month, and it is predicted that mobile shopping will make up 44% of all online sales, totaling approximately USD 450 billion by 2023. With the increase in online shopping, companies are looking for ways to effectively handle larger quantities of orders. Automated sorting systems help companies to quickly and accurately organize products, leading to faster order processing and enhanced customer contentment. For example, big players in the e-commerce sector have implemented these systems to streamline their distribution centers, ensuring that products are organized and shipped quickly.

In recent years, there has been significant advancement in the technology of automated sortation systems. Different industry needs are met by a variety of systems like conveyor-based sortation systems, AGVs, and robotic sortation systems. Conveyor systems are optimal for operations with large volumes, whereas AGVs provide adaptability when transferring goods between facilities. For example, FlexiMove Solutions focuses on advanced material handling systems that combine conveyor technology with Automated Guided Vehicles (AGVs) to enhance high-volume operations. Their conveyor systems effectively move various products, and AGVs offer the ability to smoothly transport goods between facilities. by incorporating a clever control system that monitors and schedules in real time, we improve workflow efficiency and minimize bottlenecks. Robotic systems, with AI algorithms, are capable of adjusting to varying sorting needs, which makes them appropriate for dynamic settings.

Drivers

The Growing Importance of Automated Sortation Systems in the E-commerce Logistics Landscape.

The rise of e-commerce has drastically increased the need for automated sortation systems. As more and more people use online shopping as the primary source of their purchases, the logistics and supply chain management industry had to adjust to this shift, as such turning into an important source of business for companies of all sizes from all over the world. Automated sortation systems, in their turn, provide an easy and efficient way of sorting products, and do it quickly, which is crucial for the process of meeting customer demands of fast delivery. Combined with the rising desire of e-commerce companies to improve their operational efficiency and reduce delivery times, this accounts for the rising demand for automated sortation systems and other related technologies. Today, the industry growth is expected to continue in the future, too. As such companies sort and differentiate a great number of their products and need to do it in an efficient and fast way, automated sortation systems help them do it by sorting product items and transferring them according to their size, weight, and destination they are supposed to be sent to. Doing this rapidly is essential due to the rise in demand, especially during the peak season. In addition, as the speed of service grows in importance, the logistics companies integrate automated systems to be able to manage and sort the increased amount of orders without the need to have the workforce increase proportionally, which allows them to preserve the profit while enhancing the capacity of the service they offer.

The growing importance of automated sortation systems in enhancing business efficiency and reducing costs.

Automated sortation systems allow businesses to reduce costs and increase productivity. Although the initial investment required for their implementation is usually high, their long-term benefits will be generally higher to the extent that the initial investment will not be significant in a broader perspective. Specifically, automated sortation limits the scope for manual labor on a significant scale by performing the function of sorting the products. As such, the businesses’ costs will be reduced as the cost of labor constitutes one of the most significant components of the businesses’ costs. Moreover, automated sortation is more productive than its manual counterpart as it is not affected by periodic interruptions due to requests for work breaks, lunch hours, or sleep hours. Combined with the lesser share of human labor, these factors multiply the output of the automated sortation in comparison to its manual variety. The higher productivity translates into a faster period of order fulfillment, which is likely to become an essential competitive advantage in rapidly developing e-commerce sectors and similar industries. Additionally, the cost of the businesses as well as their costs would be further limited by the lesser frequency of mistakes. Human errors such as mislabeling the boxes may result in high returns, which will be associated with high costs the limited number of these mistakes will reduce the number of such returns and increase the businesses’ profitability. Hence, given the increasing demand for optimal operational efficiency of modern businesses, the demand for automated sortation is likely to meet their demand.

Restraints

The challenges of increased reliance on technology in automated sortation systems.

One of the main challenges associated with automated sortation systems is the increasing dependence on technology to conduct sorting operations. Although automated systems are a necessary and justifiable upgrade in the context of large organizations, reliance on technology introduces a vulnerability, particularly in such areas as cybersecurity. Many automated sortation systems rely on technological networks and the internet, in particular, to operate and connect with other systems. Businesses, therefore, face the risk of cyber-attacks, which can compromise data or shut down the sorting process altogether. While such risks existed before the introduction of those systems, it has since escalated with businesses forced to take a range of cybersecurity measures. Another point of weakness, which is not directly related to the use of technology is the risk of technical failures, such as software or hardware issues, which can also shut down the system. In conclusion, most of the challenges associated with the use of automated sortation systems are related to the use of technology for conducting sorting operations. While technological failures are not directly related to cybersecurity, both types of failures are enabled by technology and demand a tailored response. The potential reliance on technology demands that businesses also invest in developing contingency planning, due to the increased susceptibility of such technology to failures. This will likely remain one of the main challenges for the implementation of automated systems, with some businesses opting not to adopt the solutions due to these vulnerabilities.

by Type

Linear sorting dominated the market with a 65% market share in 2023 because of its ability to effectively manage high capacity in a system that sorts items in a straight line. It is perfect for quickly organizing packages or items that have consistent sizes, commonly seen in sectors like e-commerce, retail, and distribution centers. The ease of scaling and incorporating a linear system into current infrastructure is due to its simplicity. Amazon and Walmart utilize linear sortation systems to optimize operations within their large fulfillment centers. These systems are utilized in expansive postal facilities for sorting mail and packages quickly and efficiently.

Loop sorting is increasing rapidly with the fastest CAGR during 2024-2032 due to its flexibility and ability to manage intricate sorting tasks with multiple destinations in a single cycle. This system, designed for industries with various product sizes like fashion, electronics, and pharmaceuticals, circulates items circularly. Loop sortation is frequently utilized in facilities dealing with a wide range of products, providing flexibility and efficiency in warehouse operations. For instance, Zara and IKEA utilize loop sortation systems to improve their handling and distribution processes, guaranteeing swift and precise sorting for different types of items.

by Applications

The retail & e-commerce sector led the market with a 38% market share in 2023, fueled by the speedy expansion of online shopping and customers' desire for quicker deliveries. Companies like Amazon and Alibaba are utilizing automated sortation systems in their warehouses to streamline their logistics and guarantee fast, precise shipments. With these systems, it is possible to efficiently handle a large number of orders accurately, resulting in improved customer satisfaction. Retailers also depend on sorting technology to efficiently manage returns, further emphasizing its significance. Siemens and Daifuku offer sorting systems designed for retail use, guaranteeing flexibility and adaptability to different sizes of orders and types of products.

The food & beverage sector is to experience the fastest growth rate during 2024-2032 due to increasing consumer demand for fast delivery of fresh and perishable items. Implementing automation in this industry boosts the efficiency of product distribution, especially for perishable items like dairy, meat, and fresh produce, which need to be handled quickly and accurately to ensure their quality is preserved. Companies such as Walmart and Kroger are implementing automated sorting systems to improve their cold chain logistics, decrease product wastage, and increase operational effectiveness.

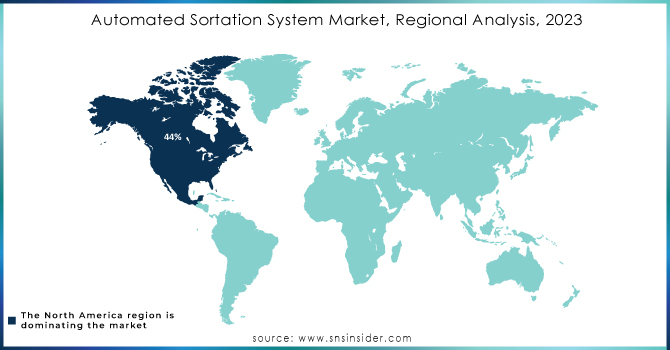

North America dominated the market with a 44% market share in 2023 because of its advanced technology and strong need for automation in industries like e-commerce, retail, and logistics. The area's strong investment in technology and innovation is leading to the implementation of automated sorting systems to improve efficiency and accuracy in fulfilling orders. Businesses like Amazon and FedEx have greatly incorporated automated sorting systems into their warehouses and distribution centers, enhancing their sorting efficiency to keep up with the increasing need for prompt and precise deliveries.

The APAC region is accounted to become the fastest-growing with rapid CAGR during 2024-2032 due to fast industrialization, urbanization, and growth in the e-commerce sector. Nations such as China and India are experiencing significant investment in automation technologies to improve efficiency in logistics and distribution operations. The growing need for effective sorting systems in warehouses and distribution centers is driven by the surge in e-commerce and the requirement for prompt deliveries. Key players like Alibaba and JD.com are incorporating cutting-edge automated sorting solutions in their processes to efficiently manage large numbers of orders.

Need any customization research on Automated Sortation System Market - Enquiry Now

Key Players

The major key players in the market are:

Siemens AG (VarioSort, SIMATIC Sortation Systems)

KNAPP AG (OSR Shuttle, KiSoft Sorter)

Dematic (Dematic Crossbelt Sorter, Dematic Modular Conveyor System)

Bastian Solutions, Inc. (Bastian Conveyor System, Bastian Automated Guided Vehicles)

Daifuku Co., Ltd. (Sorting Transfer Vehicle (STV), Daifuku Conveyor Systems)

Honeywell Intelligrated (Tilt-tray Sorter, IntelliSort Sliding Shoe Sorter)

Interroll Group (Interroll Horizontal Crossbelt Sorter, Interroll Dynamic Storage)

Murata Machinery, Ltd. (Shuttle Rack M, Picking Sorter)

BEUMER GROUP (BG Line Sorter, Crisplant Tilt-tray Sorter)

GW Logistics Group (Automated Parcel Sorting System, Conveyor Belt Sorting System)

Vanderlande Industries (Vanderlande Cross-docking System, Airtrax Compact Sorter)

Fives Group (GENI-Ant Sorter, SOLI-X Optical Sorter)

SSI SCHAEFER (Schäfer Miniload Crane, Schäfer Case Picking)

KION Group (via Egemin) (E’gv® Sortation System, E’gv® Pallet Shuttle)

MHS Global (MHS Cross-Belt Sorter, MHS High-Speed Shoe Sorter)

Okura Yusoki Co., Ltd. (Okura Automated Sorter, Pallet Conveyor System)

TGW Logistics Group (Natrix Belt Conveyor, KingDrive® Conveyor System)

Swisslog Holding AG (AutoStore, Vectura Automated Warehouse)

SICK AG (SICK Identification Solutions, SICK RFID Sortation Systems)

Falcon Autotech (AutoD Sortation Conveyor, Falcon Pallet Conveyor)

Recent Development

August 2024: Daifuku unveiled a new line of automated sortation systems that utilize AI for real-time decision-making in logistics operations. This launch aims to enhance sorting speed and accuracy for e-commerce applications.

January 2024: Dematic released a series of innovative sortation systems incorporating advanced robotics and artificial intelligence. These solutions are aimed at improving operational efficiency for warehouse management and distribution centers.

June 2023: Honeywell announced enhancements to its sortation solutions, including advanced algorithms and machine learning capabilities aimed at improving accuracy and throughput. These updates are part of their efforts to meet the increasing demand for automated logistics solutions

March 2023: SICK AG launched its SORTER system, designed to optimize the handling of items in logistics operations. This automated sortation solution integrates advanced sensor technology to increase efficiency and reduce operational costs for warehouse environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.00 Billion |

| Market Size by 2032 | USD 5.68 Billion |

| CAGR | CAGR of 3.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Linear Sortation, Loop Sortation) • By Application (Retail & E-Commerce, Post & Parcel, Food & Beverage, Pharmaceuticals & Medical Supply, Large Airports, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens AG, KNAPP AG, Dematic, Bastian Solutions, Inc., Daifuku Co., Ltd., Honeywell Intelligrated, Interroll Group, Murata Machinery, Ltd., BEUMER GROUP, GW Logistics Group, Vanderlande Industries, Fives Group, SSI SCHAEFER, KION Group, MHS Global, Okura Yusoki Co., Ltd., TGW Logistics Group, Swisslog Holding AG, SICK AG, Falcon Autotech. |

| Key Drivers | • The Growing Importance of Automated Sortation Systems in the E-commerce Logistics Landscape. • The growing importance of automated sortation systems in enhancing business efficiency and reducing costs. |

| RESTRAINTS | • The challenges of increased reliance on technology in automated sortation systems. |

Ans: The Automated Sortation System Market is expected to grow at a CAGR of 3.99% during 2024-2032.

Ans: Automated Sortation System Market size was USD 4.00 Billion in 2023 and is expected to Reach USD 5.68 Billion by 2032.

Ans: The Linear segment dominated the Automated Sortation System Market.

Ans: The growing importance of automated sortation systems in the e-commerce logistics landscape is the major growth factor of the Automated Sortation System Market.

Ans: North America dominated the Automated Sortation System Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates (2023)

5.2 Regulatory Environment, (2023), by Region

5.3 Sales Volume and Revenue Analysis, by Region (2020-2032)

5.4 Supply Chain Dynamics, 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Automated Sortation System Market Segmentation, by Type

7.1 Chapter Overview

7.2 Linear Sortation

7.2.1 Linear Sortation Market Trends Analysis (2020-2032)

7.2.2 Linear Sortation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Loop Sortation

7.3.1 Loop Sortation Market Trends Analysis (2020-2032)

7.3.2 Loop Sortation Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Automated Sortation System Market Segmentation, by Application

8.1 Chapter Overview

8.2 Retail & E-Commerce

8.2.1 Retail & E-Commerce Market Trends Analysis (2020-2032)

8.2.2 Retail & E-Commerce Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Post & Parcel

8.3.1 Post & Parcel Market Trends Analysis (2020-2032)

8.3.2 Post & Parcel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Food & Beverage

8.4.1 Food & Beverage Market Trends Analysis (2020-2032)

8.4.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Pharmaceuticals & Medical Supply

8.5.1 Pharmaceuticals & Medical Supply Market Trends Analysis (2020-2032)

8.5.2 Pharmaceuticals & Medical Supply Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Large Airports

8.6.1 Large Airports Market Trends Analysis (2020-2032)

8.6.2 Large Airports Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Automated Sortation System Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Automated Sortation System Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Automated Sortation System Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Siemens AG

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 KNAPP AG

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Dematic

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Bastian Solutions, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Daifuku Co., Ltd.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Honeywell Intelligrated

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Interroll Group

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Murata Machinery, Ltd.

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 BEUMER GROUP

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 GW Logistics Group

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Linear Sortation

Loop Sortation

By Applications

Retail & E-Commerce

Post & Parcel

Food & Beverage

Pharmaceuticals & Medical Supply

Large Airports

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Sensor Fusion Market Size was valued at USD 6.86 Billion in 2023 and is expected to grow at a CAGR of 18.65% to reach USD 31.91 Billion by 2032.

The Transient Protection Device Market was valued at 3.87 Billion in 2023 and is projected to reach USD 6.30 Billion by 2032, growing at a CAGR of 5.57% from 2024 to 2032.

The Semiconductor Assembly and Packaging Services Market size was valued at USD 18.78 Billion in 2023 and expected to reach USD 35.04 Billion by 2032 with a growing CAGR of 7.19% over the forecast period 2024-2032.

The Commercial Lighting Market Size was valued at USD 13.97 Billion in 2023 & is expected to grow at a CAGR of 21.36% to reach USD 79.47 Billion by 2032

The Micro-Location Technology Market was valued at USD 18.29 Billion in 2023 and is expected to grow at a CAGR of 15.42% to reach USD 66.31 Billion by 2032

The Quantum Cascade Laser Market was valued at USD 416.85 million in 2023 and is expected to reach USD 617.93 million by 2032, growing at a CAGR of 4.50% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone