Autoinjectors Market Report Scope & Overview:

The Autoinjectors Market size is estimated at USD 11.04 billion in 2025 and is expected to reach USD 32.61 billion by 2033, growing at a CAGR of 14.50% over the forecast period of 2026-2033.

The global autoinjectors market trend is rising prevalence of chronic diseases, including rheumatoid arthritis, diabetes, multiple sclerosis, and anaphylaxis, on account of aging populations, lifestyle changes, and increasing disease awareness are impacting the growth of the market. Other factors driving this market trend include patients' growing preference for self-administration and home healthcare solutions. As patients gain the ability to manage their conditions on their own, the disposable and reusable autoinjector segments will expand both domestically and internationally.

For instance, in March 2024, growing adoption of self-injection devices drove a 22% increase in home-based chronic disease management in North America, boosting demand for user-friendly autoinjector systems and reducing hospital visits.

Autoinjectors Market Size and Forecast:

-

Market Size in 2025E: USD 11.04 billion

-

Market Size by 2033: USD 32.61 billion

-

CAGR: 14.50% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Autoinjectors Market - Request Free Sample Report

Autoinjectors Market Trends:

-

Rising diabetes, rheumatoid arthritis, multiple sclerosis, and severe allergies driving demand for safe, convenient self-injection devices.

-

Smart autoinjectors with connectivity, dose tracking, and injection monitoring improving adherence and outcomes.

-

Needle-free systems, adjustable doses, and enhanced safety reducing injection errors and needle-stick injuries.

-

Mobile apps, Bluetooth devices, and cloud platforms enable real-time tracking, reminders, and data sharing.

-

Growing demand for prefilled disposable and reusable autoinjectors for convenience, lower contamination, and better medication stability.

-

Pharma, device, and biotech partnerships develop drug-device combos and expand therapeutic uses.

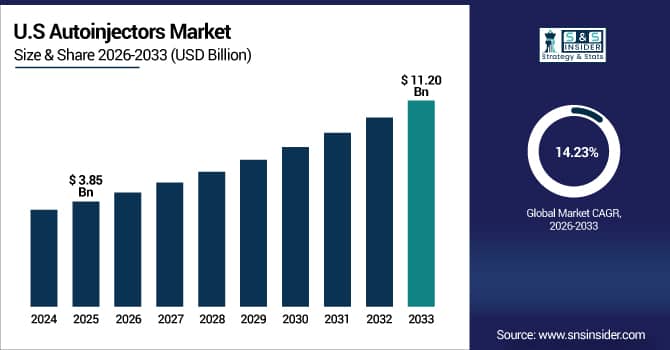

The U.S. Autoinjectors Market is estimated at USD 3.85 billion in 2025 and is expected to reach USD 11.20 billion by 2033, growing at a CAGR of 14.23% from 2026-2033. Due to the high frequency of chronic illnesses, growing patient preference for self-administration, and the availability of sophisticated healthcare infrastructure, the U.S. has the largest market share for autoinjectors. Strong reimbursement regulations, a comparatively high uptake of cutting-edge drug delivery systems, and increased healthcare spending on biologics and specialty drugs all contribute to market expansion. Furthermore, early adoption of smart linked autoinjectors and legislative support propel the United States to become the world's largest regional market.

Autoinjectors Market Growth Drivers:

-

Rising Chronic Disease Prevalence is Driving the Autoinjectors Market Growth

Growing prevalence of chronic diseases, such as diabetes, rheumatoid arthritis, multiple sclerosis, and anaphylaxis, which necessitate daily injectable medicine, is the primary growth driver for the market share of autoinjectors. Convenient, safe, and patient-friendly delivery systems that allow self-administration at home are necessary for these situations. These systems drive the market's base, penetrate the disposable and reusable autoinjector sectors, and increase the market share globally.

For instance, in June 2025, diabetes and autoimmune disease treatments delivered via autoinjectors accounted for ~42% of the total U.S. injectable biologics market, reflecting growing patient preference and expanding market share.

Autoinjectors Market Restraints:

-

High Device Costs and Limited Reimbursement are Hampering the Autoinjectors Market Growth

The market for autoinjectors is further constrained by high device costs and low reimbursement as many patients who need injectable medicines cannot afford them, especially for sophisticated smart devices and reusable systems. This could result in delayed drug commencement, poor adherence, and medication termination. In areas with insufficient insurance coverage and excessive out-of-pocket costs, patient outcomes deteriorate and market expansion is impeded.

Autoinjectors Market Opportunities:

-

Smart Connected Device Innovation Drives Future Growth Opportunities for the Autoinjectors Market

Bluetooth-enabled injectors, mobile health apps, and AI-powered dose management systems present opportunities for smart connected device innovation in the autoinjectors sector. These solutions offer individualized medication reminders, adherence monitoring, and real-time injection tracking. These technologies may decrease treatment failures, increase drug compliance, and broaden the market through improved clinical results, remote patient monitoring capabilities, and more patient participation, especially in the management of chronic diseases.

For instance, in March 2024, the CDC reported that approximately 38.4 million Americans live with diabetes, highlighting rising disease prevalence and increasing demand for convenient insulin delivery systems including autoinjectors.

Autoinjectors Market Segment Analysis:

-

By type, disposable auto-injectors held the largest share of around 67.34% in 2025E, and is expected to register the highest growth with a CAGR of 14.68%.

-

By indication, the diabetes segment dominated the market with approximately 36.21% share in 2025E, while the rheumatoid arthritis is expected to register the highest growth with a CAGR of 15.12%.

-

By end-use, homecare settings accounted for the leading share of nearly 58.47% in 2025E, and is expected to register the highest growth with a CAGR of 15.01%.

By Type, Disposable Auto-injectors Lead the Market, and Register Fastest Growth

The disposable auto-injectors segment held the largest revenue share of 67.34% in 2025, due to convenience, lower contamination risk, no maintenance, and strong patient and provider preference. Emerging trends include growing use of prefilled single-use devices for biologics and specialty drugs.

The segment is also expected to record the highest CAGR of ~14.68% during 2026–2033, driven by demand for ready-to-use systems, improved safety, and simplified administration. Key drivers include infection control awareness, availability of prefilled disposable devices across therapeutic areas, and pharma preference for drug-device combos. The reusable auto-injectors segment, including prefilled and empty systems, continues to appeal to cost-conscious patients needing frequent injections, offering environmental and long-term economic benefits.

By Indication, the Diabetes Segment Dominates, while the Rheumatoid Arthritis Segment Shows Rapid Growth

The diabetes segment held the largest revenue share of ~36.21% in 2025 due to the high global prevalence and use of insulin and GLP-1 receptor agonist injections. Key factors include increased patient awareness, early diagnosis, physician preference for injectables, and availability of advanced insulin autoinjectors.

The multiple sclerosis segment remains significant due to the chronic nature of the disease and need for regular disease-modifying therapy. The anaphylaxis segment, though smaller, is critical, fueled by epinephrine autoinjector use for emergency allergic reactions. The rheumatoid arthritis segment is projected to grow at the highest CAGR of ~15.12% during 2026–2033, supported by rising diagnoses, biologic therapy adoption, and preference for subcutaneous delivery, enhanced awareness, improved outcomes with self-administered biologics, and physician recommendations for targeted immunomodulators. The other therapies segment covers psoriasis, Crohn's disease, and other injectable treatment-requiring conditions.

By End-Use, Homecare Settings Lead, and Register Fastest Growth

The homecare settings held the largest share of the autoinjectors market at 58.47%, driven by patient preference for self-administration, at-home convenience, and cost-reduction initiatives. Growth in home-based chronic disease management is fueled by patient-centric care models, improved device usability, and enhanced education programs.

It is also projected to grow fastest, at a CAGR of 15.01% during 2026–2033, due to greater treatment flexibility, better quality of life, and reduced healthcare facility burden. User-friendly devices and telemedicine support enhance adoption and medication adherence. Hospitals and clinics remain vital for initial training, complex cases, and acute care. Ambulatory surgical centers cater to patients needing supervised administration or transitioning to self-injection, offering intermediate care with professional oversight and immediate support.

Autoinjectors Market Regional Highlights:

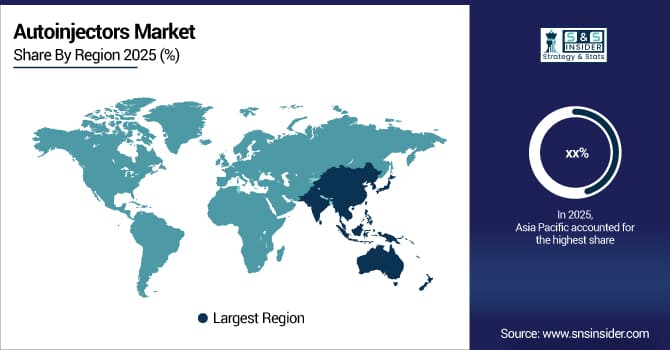

Asia Pacific Autoinjectors Market Insights:

With a compound annual growth rate (CAGR) of 15.87%, Asia Pacific is the autoinjectors market sector with the quickest rate of growth due to increased awareness of managing chronic diseases, the prevalence of diabetes, and advancements in healthcare infrastructure. Increased use of biologics and self-injection devices, a growing middle class with greater healthcare spending, and rapid urbanization are all driving market expansion. Access to autoinjectors has improved, particularly in rural regions, thanks to e-commerce and digital health efforts. Early diagnosis and treatment are supported by government initiatives and campaigns to prevent diabetes. Growth in the area is further fueled by lower manufacturing costs when compared to Western markets, and rising disposable and reusable autoinjector availability and affordability.

Get Customized Report as Per Your Business Requirement - Enquiry Now

North America Autoinjectors Market Insights:

Due to high incidence of diabetes, rheumatoid arthritis, and multiple sclerosis, a robust healthcare system, and the extensive use of self-administration technology, North America held the biggest revenue share of around 42.15% of the autoinjectors market in 2025. Easy access to cutting-edge autoinjectors, high diagnostic rates, all-inclusive insurance, and growing adoption of smart connected injection devices are growth factors. Furthermore, major pharmaceutical investments in drug-device combos, government initiatives, and patient support programs are maintaining market supremacy and robust revenues on a global scale.

Europe Autoinjectors Market Insights:

Due to growing patient empowerment, a robust healthcare system, and an increase in the prevalence of chronic diseases, Europe has the second-largest autoinjector market after North America. Sustained market expansion in top European nations is further supported by the adoption of biosimilars with autoinjector systems, sophisticated medical device laws, advantageous reimbursement policies, and government-backed chronic illness initiatives.

Latin America (LATAM) and Middle East & Africa (MEA) Autoinjectors Market Insights:

The market for autoinjectors is growing in Latin America and the Middle East and Africa due to the rising prevalence of chronic illnesses and increased healthcare awareness brought about by access to contemporary drug delivery technologies. Technology adoption and treatment access are supported by a wider range of reasonably priced equipment, growing healthcare infrastructure, medical tourism, and multinational pharmaceutical alliances. These areas' expanding urban populations and rising disposable incomes are driving market expansion.

Autoinjectors Market Competitive Landscape:

Becton, Dickinson and Company (BD) (est. 1897) is a global medical technology leader that focuses on improving drug delivery and enhancing patient outcomes. It uses its manufacturing expertise and strategic innovation to produce cutting-edge autoinjector systems with patient-centric design features.

-

In January 2025, it expanded its autoinjector portfolio with a next-generation smart injection system featuring Bluetooth connectivity and mobile app integration for chronic disease management, aiming to improve medication adherence and patient engagement.

Ypsomed AG (est. 1984) is a renowned Swiss medical device company focused on injection and infusion systems for self-medication. It invests in innovative autoinjector platforms and drug-device combination development with the hopes of revolutionizing patient self-care with reliable, intuitive, and versatile injection solutions.

-

In March 2024, launched a new prefilled autoinjector platform designed for high-viscosity biologics, enhancing patient comfort and expanding partnership opportunities with pharmaceutical companies developing advanced therapeutic proteins.

Gerresheimer AG (est. 1864) is a global partner to the pharma and healthcare industry specializing in drug containment and delivery systems. The company's autoinjector product portfolio focuses on innovative glass and polymer-based solutions, and features a strong R&D innovation pipeline to complement the strong market presence in both emerging and developed markets.

-

In November 2024, received FDA clearance for a reusable autoinjector system with adjustable dose settings for chronic disease management, strengthening its drug delivery portfolio and expanding treatment options across multiple therapeutic areas.

Autoinjectors Market Key Players:

-

Becton, Dickinson and Company

-

Ypsomed AG

-

Gerresheimer AG

-

Mylan N.V. (Viatris Inc.)

-

Pfizer Inc.

-

Teva Pharmaceutical Industries Ltd.

-

Amgen Inc.

-

Johnson & Johnson

-

Sanofi S.A.

-

Eli Lilly and Company

-

Novartis AG

-

AbbVie Inc.

-

Merck & Co., Inc.

-

Biogen Inc.

-

Owen Mumford Ltd.

-

Haselmeier GmbH

-

West Pharmaceutical Services, Inc.

-

SHL Medical AG

-

Antares Pharma, Inc.

-

Consort Medical plc

-

Scandinavian Health Ltd (SHL Group)

-

Enable Injections, Inc.

-

Credence MedSystems, Inc.

-

Bespak (Recipharm)

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 11.04 Billion |

| Market Size by 2033 | USD 32.61 Billion |

| CAGR | CAGR of 14.50% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Disposable auto-injectors, Reusable auto-injectors (Prefilled, Empty)] • By Indication [Rheumatoid Arthritis, Multiple Sclerosis, Diabetes, Anaphylaxis, Other Therapies] • By End Use [Homecare Settings, Hospitals & Clinics, Ambulatory Surgical Centers] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, Ypsomed AG, Gerresheimer AG, Mylan N.V. (Viatris Inc.), Pfizer Inc., Teva Pharmaceutical Industries Ltd., Amgen Inc., Johnson & Johnson, Sanofi S.A., Eli Lilly and Company, Novartis AG, AbbVie Inc., Merck & Co., Inc., Biogen Inc., Owen Mumford Ltd., Haselmeier GmbH, West Pharmaceutical Services, Inc., SHL Medical AG, Antares Pharma, Inc., Consort Medical plc, Scandinavian Health Ltd (SHL Group), Enable Injections, Inc., Credence MedSystems, Inc., Bespak (Recipharm) |