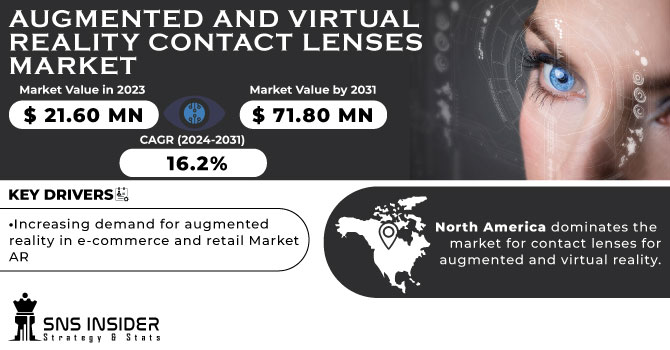

The Augmented and Virtual Reality Contact Lenses Market size was valued at USD 21.60 Million in 2023 and is expected to grow to USD 71.80 Million by 2031 and grow at a CAGR of 16.2 % over the forecast period of 2024-2031.

These lenses are utilized for collaborative experiences in the education sector as well as interactive experiences in the entertainment sector, such as streaming a concert. Mobile applications can employ the lenses for a variety of purposes, including navigation, gaming, education, and healthcare. The market for augmented and virtual reality contact lenses would grow as a result of all these causes.

To Get More Information on Augmented and Virtual Reality Contact Lenses Market - Request Sample Report

The market for augmented and virtual reality contact lenses will be led by the AR contact lens category. The augmented reality market, which is expected to reach US$ 61.39 Bn in 2023, is supporting the AR contact lens market and is expanding quickly. The market for augmented contact lenses is expanding as a result of rising investments from major technological companies. An expanding prospect in the enterprise sector, significant growth in the travel and tourism sector, and increased demand for augmented reality architecture are all contributing to the growth of the AR contact lens market.

MARKET DYNAMICS

KEY DRIVERS:

Increasing demand for augmented reality in e-commerce and retail Market AR

Due to the pandemic, online purchasing has suddenly become more popular. Since many websites' return policies were disabled during the pandemic, virtual try-ons for jewelry and cosmetics helped shoppers decide if the product was right for them.

They really fit the merchandise. Their shopping convenience was aided by this. The convenience will result in higher demand in this industry, which would support the market expansion for augmented reality. Augmented reality technologies help to boost consumer satisfaction.

RESTRAIN:

There are health risks linked with the excessive use of augmented reality technology.

Games for the augmented reality (AR) market are more involved and keep the player immersed in the game for longer hours, which can lead to problems like anxiety, eye strain, obesity, and lack of attention. Devices were used in experiments by researchers from the National Toxicology Program (NTP), an interagency federal program run by the National Health Institutes (US).

OPPORTUNITY:

Uses Of Augmented Reality

There are a ton of chances in enterprise applications. Large-scale expenditures made by businesses in smart manufacturing will be a key factor in the corporate sector's growth in the AR market. Companies with plants in many locations can adopt AR and hire a few engineers to oversee a big setup.

CHALLENGES:

Increasing the use of HMDs in virtual reality training

Devices and technologies for virtual reality can be utilized to monitor the factory's workflow, assuring timely activities and production.

The supervisor can use virtual reality technology to protect the safety of the employees by tracking their whereabouts and receiving alerts for potentially hazardous areas. With the use of VR, a manager or supervisor in a factory or industry can also lead training sessions for the employees.

IMPACT OF RUSSIA-UKRAINE WAR

Several months after the start of the Russia-Ukraine War, the ICT industry has been impacted by supply chain interruptions, changes in demand in Eastern Europe, and sanctions against Russia. Many Western technology companies have either closed their headquarters in Russia or suspended operations and sales there, eliminating millions of dollars worth of tech spending there in 2022. Russia will need to become independent and rely on domestic companies or new alliances to get technology items as the Russia-Ukraine War has left it cut off. On the other side, technology for human augmentation has shown to be essential for programs that identify people and visualize conflict information.

The Quarterly Augmented and Virtual Reality Headset Tracker predicts that $220 million less will be spent on AR headsets in 2022 as a result of companies leaving the Russian market. This gap in spending will take a few years to close.

Top of Form

By Technology

AR technology

Marker-based AR technology

Active marker

Passive marker

Marker less AR technology

Model-base tracking

Image processing-based tracking

Anchor-based AR

VR Technology

Non-immersive technology

Semi-immersive and fully immersive technology

By Offerings

Hardware

Sensors

Accelerometers

Gyroscopes

Magnetometers

Semiconductor components

Controllers and processors

Integrated Circuits

Display and projectors

Position trackers

Cameras

Others

Computers

Video generators and combiners

Software

Software development kits

Cloud-based services

By Device

AR devices

Head-mounted displays

AR smart glasses

Smart helmets

VR devices

Head-mounted displays

Gesture-tracking devices

Displays and projectors

By Enterprise

Small Enterprise

Medium enterprise

Large enterprise

By Application

Consumer

Gaming

Sports

Entertainment

Theme parks

Museums

Art exhibitions and galleries

Commercial

Retail and e-commerce

Beauty and cosmetics

Apparel fitting

Jewellery

Grocery shopping

Footwear

Furniture

Travel and tourism

E-learning

Enterprise

Manufacturing

Healthcare

Surgery

Fitness management

Patient care management

Pharmacy management

Medical training and education

Radiology

Aerospace and Defence

Automotive

Energy

Others

Construction

Agriculture

Telecom/IT services

Transportation and Logistics

Public Safety

REGIONAL ANALYSIS

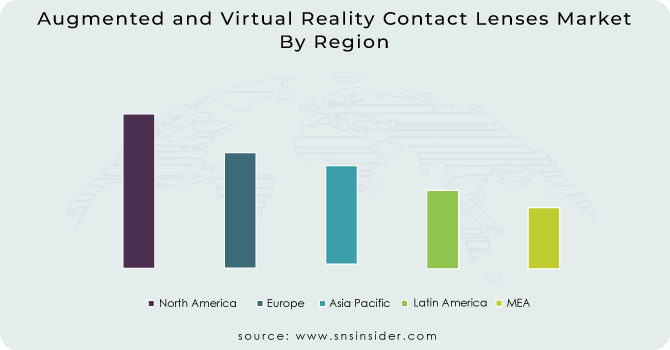

North America dominates the market for contact lenses for augmented and virtual reality. The market in this area is primarily driven by the increased use of AR and VR technology and increased R&D spending by major competitors.

The Asia Pacific is expected to grow at the fastest growth rate. In supported by a rising number of technology users in the region, particularly in developing nations like China and India. Additionally, the area will experience industrial growth due to new technology developments, which will further propel the market for contact lenses for augmented and virtual reality. These variables will cause Asia Pacific to experience the highest CAGR of any region during the projection period.

Do You Need any Customization Research on Augmented and Virtual Reality Contact Lenses Market - Enquire Now

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major players are Google, Microsoft, Sony Corporation, Samsung Electronics, HTC, Apple Inc., PTC Inc., Seiko Epson, Oculus VR (by Facebook), Lenovo and other players are listed in a final report.

Samsung Electronics (South Korea)-Company Financial Analysis

RECENT DEVELOPMENTS

Viveverse, a cross-platform metaverse that is an open-source VR metaverse made up of multiple interactive environments, apps, and games, was introduced by HTC Vive in February 2022. It makes it possible for consumers to switch between different platforms like Vive Sync and Engage.

Sony improved an already-existing VR headgear, the PSVR headset, in January 2022. Since the PSVR headset will be directly connected to the PlayStation 5 console, Sony said that it developed it for a better virtual reality experience in PlayStation.

HTC released a wrist tracker for the Vive Focus 3 in January 2022. This wearable device aids in tracking by infrared LEDs that are detected optically by the device's built-in camera sensors. Even if the tracker is not visible to the camera, its velocity and trajectory can still be tracked employing advanced kinetic models and high frequency IMU data

The development of AR smart glasses, which add more information, animation, videos, and more realistic experiences to users by superimposing computer-generated or digital information on users' actual surroundings, was announced by Google in December 2021.

| Report Attributes | Details |

| Market Size in 2023 | US$ 21.60 Mn |

| Market Size by 2031 | US$ 71.80 Mn |

| CAGR | CAGR of 16.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (AR technology, VR Technology) • By Offerings (Hardware, Software) • By Device (AR devices, VR devices) • By Enterprise (Small enterprise, medium enterprise, large enterprise) • By Application (Consumer, Commercial, Enterprise, Manufacturing, Healthcare, Aerospace and Defence, Automotive, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Google (US), Microsoft (US), Sony Corporation (Japan), Samsung Electronics (South Korea), HTC (Taiwan), Apple Inc., (US), PTC Inc., (US), Seiko Epson (Japan), Oculus VR (by Facebook (US), Lenovo (China) |

| Key Drivers | • Increasing demand for augmented reality in e-commerce and retail Market AR |

| Market Restraints | • There are health risks linked with excessive use of augmented reality technology. |

Ans: Augmented and Virtual Reality Contact Lenses Market is anticipated to expand by 25.3 % from 2023 to 2030.

Ans: 71.80 Million is expected to grow by 2031.

Ans: Augmented and Virtual Reality Contact Lenses Market size was valued at USD 21.60 billion in 2023

Ans: North America is dominating the market.

Ans: Increasing the use of HMDs in virtual reality training

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Augmented and Virtual Reality Contact Lenses Market Segmentation, By Technology

8.1 AR technology

8.1.1 Marker-based AR technology

8.1.1.1 Active marker

8.1.1.2 Passive marker

8.1.2 Marker less AR technology

8.1.2.1 Model-base tracking

8.1.2.2 Image processing-based tracking

8.1.2.3 Anchor-based AR

8.2 VR Technology

8.2.1 Non-immersive technology

8.2.2 Semi-immersive and fully immersive technology

9. Augmented and Virtual Reality Contact Lenses Market Segmentation, By Offerings

9.1 Hardware

9.1.1 Sensors

9.1.1.1 Accelerometers

9.1.1.2 Gyroscopes

9.1.1.3 Magnetometers

9.1.1.4 Proximity sensors

9.1.2 Semiconductor components

9.1.2.1 Controllers and processors

9.1.2.2 Integrated Circuits

9.1.3 Display and projectors

9.1.4 Position trackers

9.1.5 Cameras

9.1.5 Others

9.1.5.1 Computers

9.1.5.2 Video generators and combiners

9.2 Software

9.2.1 Software development kits

9.2.2 Cloud-based services

10. Augmented and Virtual Reality Contact Lenses Market Segmentation, By Device

10.1 AR devices

10.1.1 Head-mounted displays

10.1.1.1 AR smart glasses

10.1.1.2 Smart helmets

10.1.2 Heads-up display

10.2 VR devices

10.2.1 Head-mounted displays

10.2.2 Gesture-tracking devices

10.2.3 Displays and projectors

11. Augmented and Virtual Reality Contact Lenses Market Segmentation, By Enterprise

11.1 Small enterprise

11.1.1 Medium enterprise

11.1.2 Large enterprise

12. Augmented and Virtual Reality Contact Lenses Market Segmentation, By Application

12.1 Consumer

12.1.1 Gaming

12.1.2 Sports

12.1.3 Entertainment

12.1.3.1 Theme parks

12.1.3.2 Museums

12.1.3.3 Art exhibitions and galleries

12.2 Commercial

12.2.1 Retail and e-commerce

12.2.1.1 Beauty and cosmetics

12.2.1.2 Apparel fitting

12.2.1.3 Jewellery

12.2.1.4 Grocery shopping

12.2.1.5 Footwear

12.2.1.6 Furniture

12.2.2 Travel and tourism

12.2.3 E-learning

12.3 Enterprise

12.3.1 Manufacturing

12.4 Healthcare

12.4.1 Surgery

12.4.2 Fitness management

12.4.3 Patient care management

12.4.4 Pharmacy management

12.4.5 Medical training and education

12.4.6 Radiology

12.5 Aerospace and Defense

12.6 Automotive

12.7 Energy

12.8 Others

12.8.1 Construction

12.8.2 Agriculture

12.8.3 Telecom/IT services

12.8.4 Transportation and Logistics

12.8.5 Public Safety

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 North America Augmented and Virtual Reality Contact Lenses Market by Country

13.2.2 North America Augmented and Virtual Reality Contact Lenses Market by Technology

13.2.3 North America Augmented and Virtual Reality Contact Lenses Market by Offering

13.2.4 North America Augmented and Virtual Reality Contact Lenses Market by Device

13.2.5 North America Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.2.6 North America Augmented and Virtual Reality Contact Lenses Market by Application

13.2.7 USA

13.2.7.1 USA Augmented and Virtual Reality Contact Lenses Market by Technology

13.2.7.2 USA Augmented and Virtual Reality Contact Lenses Market by Offering

13.2.7.3 USA Augmented and Virtual Reality Contact Lenses Market by Device

13.2.7.4 USA Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.2.7.5 USA Augmented and Virtual Reality Contact Lenses Market by Application

13.2.8 Canada

13.2.8.1 Canada Augmented and Virtual Reality Contact Lenses Market by Technology

13.2.8.2 Canada Augmented and Virtual Reality Contact Lenses Market by Offering

13.2.8.3 Canada Augmented and Virtual Reality Contact Lenses Market by Device

13.2.8.4 Canada Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.2.8.5 Canada Augmented and Virtual Reality Contact Lenses Market by Application

13.2.9 Mexico

13.2.9.1 Mexico Augmented and Virtual Reality Contact Lenses Market by Technology

13.2.9.2 Mexico Augmented and Virtual Reality Contact Lenses Market by Offering

13.2.9.3 Mexico Augmented and Virtual Reality Contact Lenses Market by Device

13.2.9.4 Mexico Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.2.9.5 Mexico Augmented and Virtual Reality Contact Lenses Market by Application

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Country

13.3.1.2 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.3 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.4 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.5 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.6 Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Application

13.3.1.7 Poland

13.3.1.7.1 Poland Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.7.2 Poland Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.7.3 Poland Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.7.4 Poland Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.7.5 Poland Augmented and Virtual Reality Contact Lenses Market by Application

13.3.1.8 Romania

13.3.1.8.1 Romania Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.8.2 Romania Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.8.3 Romania Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.8.4 Romania Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.8.5 Romania Augmented and Virtual Reality Contact Lenses Market by Application

13.3.1.9 Hungary

13.3.1.9.1 Hungary Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.9.2 Hungary Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.9.3 Hungary Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.9.4 Hungary Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.9.5 Hungary Augmented and Virtual Reality Contact Lenses Market by Application

13.3.1.10 Turkey

13.3.1.10.1 Turkey Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.10.2 Turkey Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.10.3 Turkey Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.10.4 Turkey Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.10.5 Turkey Augmented and Virtual Reality Contact Lenses Market by Application

13.3.1.11 Rest of Eastern Europe

13.3.1.11.1 Rest of Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.1.11.2 Rest of Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.1.11.3 Rest of Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Device

13.3.1.11.4 Rest of Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.1.11.5 Rest of Eastern Europe Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2 Western Europe

13.3.2.1 Western Europe Augmented and Virtual Reality Contact Lenses Market by Country

13.3.2.2 Western Europe Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.3 Western Europe Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.4 Western Europe Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.5 Western Europe Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.6 Western Europe Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.7 Germany

13.3.2.7.1 Germany Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.7.2 Germany Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.7.3 Germany Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.7.4 Germany Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.7.5 Germany Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.8 France

13.3.2.8.1 France Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.8.2 France Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.8.3 France Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.8.4 France Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.8.5 France Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.9 UK

13.3.2.9.1 UK Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.9.2 UK Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.9.3 UK Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.9.4 UK Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.9.5 UK Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.10 Italy

13.3.2.10.1 Italy Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.10.2 Italy Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.10.3 Italy Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.10.4 Italy Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.10.5 Italy Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.11 Spain

13.3.2.11.1 Spain Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.11.2 Spain Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.11.3 Spain Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.11.4 Spain Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.11.5 Spain Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.12 The Netherlands

13.3.2.12.1 Netherlands Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.12.2 Netherlands Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.12.3 Netherlands Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.12.4 Netherlands Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.12.5 Netherlands Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.13 Switzerland

13.3.2.13.1 Switzerland Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.13.2 Switzerland Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.13.3 Switzerland Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.13.4 Switzerland Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.13.5 Switzerland Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.14 Austria

13.3.2.14.1 Austria Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.14.2 Austria Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.14.3 Austria Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.14.4 Austria Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.14.5 Austria Augmented and Virtual Reality Contact Lenses Market by Application

13.3.2.15 Rest of Western Europe

13.3.2.15.1 Rest of Western Europe Augmented and Virtual Reality Contact Lenses Market by Technology

13.3.2.15.2 Rest of Western Europe Augmented and Virtual Reality Contact Lenses Market by Offering

13.3.2.15.3 Rest of Western Europe Augmented and Virtual Reality Contact Lenses Market by Device

13.3.2.15.4 Rest of Western Europe Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.3.2.15.5 Rest of Western Europe Augmented and Virtual Reality Contact Lenses Market by Application

13.4 Asia-Pacific

13.4.1 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Country

13.4.2 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.3 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.4 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Device

13.4.5 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.6 Asia Pacific Augmented and Virtual Reality Contact Lenses Market by Application

13.4.7 China

13.4.7.1 China Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.7.2 China Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.7.3 China Augmented and Virtual Reality Contact Lenses Market by Device

13.4.7.4 China Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.7.5 China Augmented and Virtual Reality Contact Lenses Market by Application

13.4.8 India

13.4.8.1 India Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.8.2 India Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.8.3 India Augmented and Virtual Reality Contact Lenses Market by Device

13.4.8.4 India Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.8.5 India Augmented and Virtual Reality Contact Lenses Market by Application

13.4.9 Japan

13.4.9.1 Japan Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.9.2 Japan Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.9.3 Japan Augmented and Virtual Reality Contact Lenses Market by Device

13.4.9.4 Japan Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.9.5 Japan Augmented and Virtual Reality Contact Lenses Market by Application

13.4.10 South Korea

13.4.10.1 South Korea Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.10.2 South Korea Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.10.3 South Korea Augmented and Virtual Reality Contact Lenses Market by Device

13.4.10.4 South Korea Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.10.5 South Korea Augmented and Virtual Reality Contact Lenses Market by Application

13.4.11 Vietnam

13.4.11.1 Vietnam Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.11.2 Vietnam Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.11.3 Vietnam Augmented and Virtual Reality Contact Lenses Market by Device

13.4.11.4 Vietnam Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.11.5 Vietnam Augmented and Virtual Reality Contact Lenses Market by Application

13.4.12 Singapore

13.4.12.1 Singapore Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.12.2 Singapore Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.12.3 Singapore Augmented and Virtual Reality Contact Lenses Market by Device

13.4.12.4 Singapore Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.12.5 Singapore Augmented and Virtual Reality Contact Lenses Market by Application

13.4.13 Australia

13.4.13.1 Australia Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.13.2 Australia Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.13.3 Australia Augmented and Virtual Reality Contact Lenses Market by Device

13.4.13.4 Australia Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.13.5 Australia Augmented and Virtual Reality Contact Lenses Market by Application

13.4.14 Rest of Asia-Pacific

13.4.14.1 APAC Augmented and Virtual Reality Contact Lenses Market by Technology

13.4.14.2 APAC Augmented and Virtual Reality Contact Lenses Market by Offering

13.4.14.3 APAC Augmented and Virtual Reality Contact Lenses Market by Device

13.4.14.4 APAC Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.4.14.5 APAC Augmented and Virtual Reality Contact Lenses Market by Application

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 Middle East Augmented and Virtual Reality Contact Lenses Market By country

13.5.1.2 Middle East Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.3 Middle East Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.4 Middle East Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.5 Middle East Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.6 Middle East Augmented and Virtual Reality Contact Lenses Market by Application

13.5.1.7 UAE

13.5.1.7.1 UAE Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.7.2 UAE Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.7.3 UAE Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.7.4 UAE Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.7.5 UAE Augmented and Virtual Reality Contact Lenses Market by Application

13.5.1.8 Egypt

13.5.1.8.1 Egypt Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.8.2 Egypt Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.8.3 Egypt Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.8.4 Egypt Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.8.5 Egypt Augmented and Virtual Reality Contact Lenses Market by Application

13.5.1.9 Saudi Arabia

13.5.1.9.1 Saudi Arabia Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.9.2 Saudi Arabia Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.9.3 Saudi Arabia Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.9.4 Saudi Arabia Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.9.5 Saudi Arabia Augmented and Virtual Reality Contact Lenses Market by Application

13.5.1.10 Qatar

13.5.1.10.1 Qatar Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.10.2 Qatar Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.10.3 Qatar Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.10.4 Qatar Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.10.5 Qatar Augmented and Virtual Reality Contact Lenses Market by Application

13.5.1.11 Rest of Middle East

13.5.1.11.1 Rest of Middle East Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.1.11.2 Rest of Middle East Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.1.11.3 Rest of Middle East Augmented and Virtual Reality Contact Lenses Market by Device

13.5.1.11.4 Rest of Middle East Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.1.11.5 Rest of Middle East Augmented and Virtual Reality Contact Lenses Market by Application

13.5.2 Africa

13.5.2.1 Africa Augmented and Virtual Reality Contact Lenses Market by Country

13.5.2.2 Africa Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.2.3 Africa Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.2.4 Africa Augmented and Virtual Reality Contact Lenses Market by Device

13.5.2.5 Africa Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.2.6 Africa Augmented and Virtual Reality Contact Lenses Market by Application

13.5.2.7 Nigeria

13.5.2.7.1 Nigeria Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.2.7.2 Nigeria Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.2.7.3 Nigeria Augmented and Virtual Reality Contact Lenses Market by Device

13.5.2.7.4 Nigeria Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.2.7.5 Nigeria Augmented and Virtual Reality Contact Lenses Market by Application

13.5.2.8 South Africa

13.5.2.8.1 South Africa Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.2.8.2 South Africa Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.2.8.3 South Africa Augmented and Virtual Reality Contact Lenses Market by Device

13.5.2.8.4 South Africa Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.2.8.5 South Africa Augmented and Virtual Reality Contact Lenses Market by Application

13.5.2.9 Rest of Africa

13.5.2.9.1 Rest of Africa Augmented and Virtual Reality Contact Lenses Market by Technology

13.5.2.9.2 Rest of Africa Augmented and Virtual Reality Contact Lenses Market by Offering

13.5.2.9.3 Rest of Africa Augmented and Virtual Reality Contact Lenses Market by Device

13.5.2.9.4 Rest of Africa Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.5.2.9.5 Rest of Africa Augmented and Virtual Reality Contact Lenses Market by Application

13.6 Latin America

13.6.1 Latin America Augmented and Virtual Reality Contact Lenses Market by Country

13.6.2 Latin America Augmented and Virtual Reality Contact Lenses Market by Technology

13.6.3 Latin America Augmented and Virtual Reality Contact Lenses Market by Offering

13.6.4 Latin America Augmented and Virtual Reality Contact Lenses Market by Device

13.6.5 Latin America Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.6.6 Latin America Augmented and Virtual Reality Contact Lenses Market by Application

13.6.7 Brazil

13.6.7.1 Brazil Augmented and Virtual Reality Contact Lenses Market by Technology

13.6.7.2 Brazil Africa Augmented and Virtual Reality Contact Lenses Market by Offering

13.6.7.3Brazil Augmented and Virtual Reality Contact Lenses Market by Device

13.6.7.4 Brazil Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.6.7.5 Brazil Augmented and Virtual Reality Contact Lenses Market by Application

13.6.8 Argentina

13.6.8.1 Argentina Augmented and Virtual Reality Contact Lenses Market by Technology

13.6.8.2 Argentina Augmented and Virtual Reality Contact Lenses Market by Offering

13.6.8.3 Argentina Augmented and Virtual Reality Contact Lenses Market by Device

13.6.8.4 Argentina Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.6.8.5 Argentina Augmented and Virtual Reality Contact Lenses Market by Application

13.6.9 Colombia

13.6.9.1 Colombia Augmented and Virtual Reality Contact Lenses Market by Technology

13.6.9.2 Colombia Augmented and Virtual Reality Contact Lenses Market by Offering

13.6.9.3 Colombia Augmented and Virtual Reality Contact Lenses Market by Device

13.6.9.4 Colombia Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.6.9.5 Colombia Augmented and Virtual Reality Contact Lenses Market by Application

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Augmented and Virtual Reality Contact Lenses Market by Technology

13.6.10.2 Rest of Latin America Augmented and Virtual Reality Contact Lenses Market by Offering

13.6.10.3 Rest of Latin America Augmented and Virtual Reality Contact Lenses Market by Device

13.6.10.4 Rest of Latin America Augmented and Virtual Reality Contact Lenses Market by Enterprise

13.6.10.5 Rest of Latin America Augmented and Virtual Reality Contact Lenses Market by Application

14. Company Profile

14.1 Google (US)

14.1.1Company Overview

14.1.2 Financials

14.1.3 Product/Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Microsoft (US)

14.2.1Company Overview

14.2.2 Financials

14.2.3 Product/Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Sony Corporation (Japan)

14.3.1Company Overview

14.3.2 Financials

14.3.3 Product/Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 Samsung Electronics (South Korea)

14.4.1Company Overview

14.4.2 Financials

14.4.3 Product/Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 HTC (Taiwan)

14.5.1Company Overview

14.5.2 Financials

14.5.3 Product/Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Apple Inc., (US)

14.6.1Company Overview

14.6.2 Financials

14.6.3 Product/Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 PTC Inc., (US)

14.7.1Company Overview

14.7.2 Financials

14.7.3 Product/Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Seiko Epson (Japan)

14.8.1Company Overview

14.8.2 Financials

14.8.3 Product/Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 Oculus VR (by Facebook (US)

14.9.1Company Overview

14.9.2 Financials

14.9.3 Product/Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 Zumtobel Group (Austria)

14.10.1Company Overview

14.10.2 Financials

14.10.3 Product/Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

14.11 Lenovo (China)

14.11.1Company Overview

14.11.2 Financials

14.11.3 Product/Services Offered

14.11.4 SWOT Analysis

14.11.5 The SNS View

14.12 Facebook (US)

14.12.1Company Overview

14.12.2 Financials

14.12.3 Product/Services Offered

14.12.4 SWOT Analysis

14.12.5 The SNS View

15. Competitive Landscape

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. USE Cases and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Laboratory Information Management System Market size to grow from USD 2.29 billion in 2023 to USD 4.61 billion by 2032, with a CAGR of 8.12%.

The Microcarriers Market Size was valued at USD 1.8 Billion in 2023, expected to reach USD 4.5 billion by 2032 and grow at 10.6% CAGR by 2024-2032

The Pharmaceutical Processing Seals Market Size was valued at USD 2.55 Billion in 2023 and is expected to reach USD 6.05 Billion by 2032 and grow at a CAGR of 10.11% over the forecast period 2024-2032.

The 3D Printed Prosthetics Market Size was valued at USD 1.51 Billion in 2023 and is expected to reach USD 2.97 Billion by 2032, growing at a CAGR of 7.84% over the forecast period 2024-2032.

The Fibromyalgia Treatment Market Size was valued at USD 3.32 billion in 2023, and is expected to reach USD 4.7 billion by 2032, and grow at a CAGR of 3.9% over the forecast period 2024-2032.

The Healthcare Market Size was valued at USD 21,222.5 Billion in 2023, and is expected to reach USD 44,760.73 Billion by 2032, and grow at a CAGR of 9.07% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone