To Get More Information on Audio Visual Hardware Market - Request Sample Report

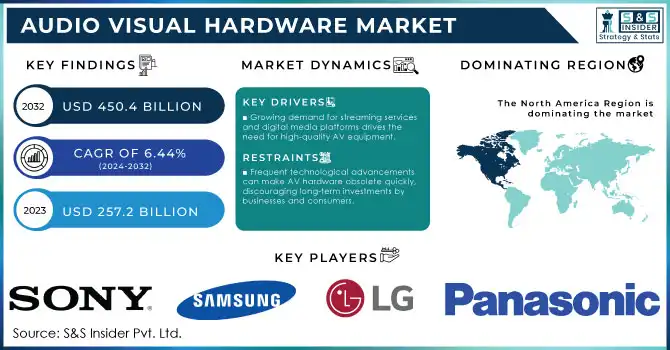

The Audio Visual Hardware Market size was valued at USD 257.2 billion in 2023 and is expected to reach USD 450.4 Billion by 2032, growing at a CAGR of 6.44% from 2024-2032.

The audio-visual (AV) hardware market is driven by growing demand for AV devices in different end-user sectors including entertainment, education, corporate, and retail. This growth is being driven by the world's ongoing consumption of digital content and the growing demand for experiential, participatory opportunities. This is evident in the massive adoption of 4K and later 8K televisions, such as those from Samsung and LG, and the use of advanced projectors and sound systems. The availability of smart classrooms and learning has substantially fueled the demand for AV equipment such as interactive displays and projectors in the education sector. Moreover, the growing integration of virtual and augmented reality (VR/AR) technologies is providing exciting new growth opportunities for automation vehicles with hardware manufacturers. As an example, the increase in the adoption of VR headsets with AV systems used in gaming and simulation in 2023 provided a boost to the growth of the market. With hybrid work models on the rise, the pandemic-driven boom has also heightened the demand for video conferencing hardware solutions such as camera, microphone and AV processor equipment to create better remote communication--both for companies and their employees.

AV hardware is more commonly used in retail for digital signage, advertising, and in-store customer experience. In 2023, the reliance on AV technology for many retailers was further displayed as new retailers rolled out AV solutions to garner attention and sales.

With yet another year passing by, technology continues to advance, particularly in the sound processing department when it comes to AI-enhanced understanding of audio people want to hear and how to best deliver it to them, as well as improvements in image quality that keep this portion of the AV hardware market in development. The growing adoption of connected smart devices over the globe such as smart TVs, soundbars, & voice-activated assistants, among others, is contributing to the growth of the market through offering consumers audio-visual experiences that are enjoyable & seamless.

Drivers

Growing demand for streaming services and digital media platforms drives the need for high-quality AV equipment.

Educational institutions are increasingly using AV hardware like interactive displays and projectors for digital learning environments.

Increased interest in 4K and 8K TVs, VR, and AR technology reflects a trend toward more immersive and interactive media experiences.

The audio-visual (AV) hardware market is rapidly progressing, owing to the increasing proliferation of ultra-high-definition 4K and 8K displays as well as augmented reality and virtual reality (AR/VR) technologies. This indicates a promising direction for greater experiential, interactive output within consumer, corporate, educational, and retail sectors. With rising expectations for better sound and image quality, AV hardware makers are rethinking their designs to offer higher-resolution, crisper audio and visual out of the box. The latest trend involves 4K and 8K high-definition screens that boast improved detail, color depth, and contrast to create more realistic visuals that improve viewing experiences. Such sophisticated displays are also being sought for professional uses, where premium AV systems elevate presentations, training and digital signage beyond entertainment. The adoption of VR and AR only propels the AV market forward, offering experiences beyond the average screen. VR headsets, which combine visual and audio effects for immersive 360-degree experiences, became popular for gaming, simulations, and virtual meetings. As an example, when it comes to gaming, VR makes it possible by simulating a realistic environment where the user can interact as though it was real. VR/AR are reinventing training in industries such as healthcare and manufacturing through simulation of real-world scenarios that facilitate improved learning while minimizing risk to the organization.

As businesses continue to integrate advanced AV solutions to enhance customer engagement and streamline operations, this desire for immersive technologies is changing consumer behaviors and business practices. With the growing demand for high-quality, interactive AV technology, innovation in the AV industry is accelerating as manufacturers focus on creating visuals with sharper clarity, more immersive sound quality, and enhanced interactivity. With the expanding spectrum of interest around these solutions included across different domains, the AV hardware market is likely to forge on into the future, evolving to provide immersive experiences across various domains.

Restraints

Frequent technological advancements can make AV hardware obsolete quickly, discouraging long-term investments by businesses and consumers.

Integrating AV hardware with existing IT and communication systems can be complex and costly, especially in corporate settings, which may slow down adoption.

The AV hardware industry faces scrutiny over e-waste and energy consumption, with increased pressure to adopt sustainable practices, which can add to costs.

The audio-visual (AV) hardware industry is increasingly under scrutiny from various stakeholders for its environmental impact, such as e-waste and energy usage. New technologies such as 4K/8K displays, VR/AR systems, and high-end audio equipment drive new demand in Consumer AV, and outside of our industry the competition between existing devices creates more e-waste every year as upgrades remove dated appliances. The accelerating speed of technology evolution and shortened lifecycle has compounded the problem, leading manufacturers to seek environmentally friendly practices such as recyclable materials and take-back programs for obsolete equipment.

A similar scenario is also present in the AV sector with regards to energy consumption. A powerful visual screen or massive public-facing video screen with dynamic reminders requires high (and continuous) energy consumption (and carbon emissions), for full-time commercial deployments such as digital signage and video-conferencing, typical with multiple projectors and/or mega-sound systems. In response, regulators and environmentally-conscious consumers are calling for reductions in the carbon footprint of AV products. To that end, manufacturers are incorporating energy-efficient features such as LED displays and AV systems with “eco-mode” functions that minimize off-peak power use.

However such environment-friendly initiatives mean extra cost for manufacturers. Some companies are spending in this direction on research and development of energy-saving components, eco-friendly designs, and modular designs that can be easily repaired or upgraded. Though they reduce the environmental footprint of production, these improvements raise production costs, and one can assume that some manufacturers will pass those costs on to consumers, thereby raising prices and putting the brakes on high-end AV high-tech adoption.

By Application

Professional segment dominated the market and represented significant revenue share in 2023. This industry is characterized by fierce competition with both national and international, large and small players. Brand reputation also plays a huge role in the buying decisions of potential customers since established brands are often synonymous with quality and features. Companies such as AVI-SPL Inc., AVI Systems Inc., Ford Audio-Video LLC, Solotech Inc. are the leaders in the market. Expect healthy competition among these respective top vendors, with an opportunity for a market expansion in the future.

We anticipate that the market will see considerable growth on the consumer side. There has also been an upsurge in demand amongst consumers for AV products that can be easily integrated into smart home networks and offer features such as voice control and automation. In parallel with the expansion of streaming services and online gaming, there has been a push for evermore high-performing AV gear to provide high-quality picture, sound, and low-latency performance. Other commonly used devices, like tablet devices and wireless speakers, are also rising in popularity because they are portable and user-friendly. Value-add capabilities such as integrated streaming and fitness tracking are increasing the attractiveness of consumer audio visual systems, thus creating a dynamic and rapidly evolving marketplace.

By Type

In 2023, the equipment segment dominated the market and accounting for 77.2% of revenue. The key factors boosting this growth are the growing use of high-resolution display usage, advanced audio system requirements, and use of VR/AR technologies. Manufacturers have come up with multi-purpose devices like smart TVs and in terms of installation, new wireless solutions have simplified their installation. As technology evolves, better user experience with intuitive interfaces, voice control, and personalization would further propel this growth.

The digital signal management (DSM) segment is expected to register highest CAGR during the forecast period. This growth is the result of increasing complexity of AV systems requiring routing, processing and control of signals, hence DSM solutions are positioned to provide effective solutions in these areas. Also, the merging AV devices and transition to an IP-centric ecosystem, thus exhibiting the requirement for centralized management, an aspect well performed under a DSM platform. As the demand for seamless, integrated experiences continues to grow, DSM presents the perfect balance of automating processes while also visualizing the omega human interface for its intuitive GUI. As AV technology continues to evolve, DSM's role in providing efficient, reliable, and user-centric audio-visual experiences is likely to become even more essential.

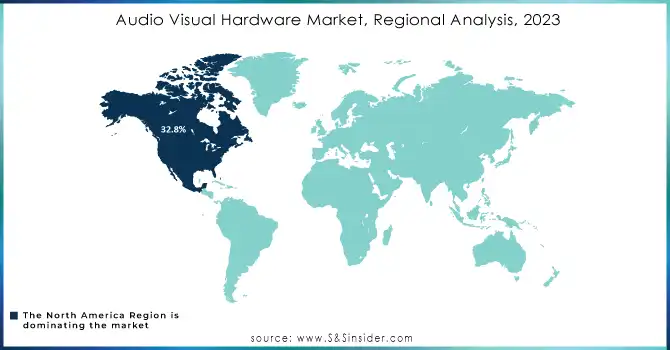

North America dominated the market and accounted for a total market share of 32.8% in 2023. Fewer consumers in the region are still in search of AV solutions that can offer both flexibility and convenience. Premium products still dominate, however there is increasing demand for entry-level models which provide core functionality with more flexibility. For instance In 2023, a notable budget-friendly option was the launch of the Roku Streambar. Combining a soundbar and streaming capabilities, this affordable product provides decent sound projection and clarity, making it an excellent choice for users looking to upgrade their TV's audio without breaking the bank. Although it lacks some of the high-end cinematic features of more expensive models, like advanced surround sound, the Streambar offers great value with 4K HDR support and Bluetooth connectivity. This product is a solid alternative for those with limited space and budget

Asia-Pacific region is expected to see substantial growth during 2024 2032. Factors contributing to this growth include surging demand for smart home solutions, favorable expansion of high-speed internet networks, and adoption of OTT streaming services that are driving increasing demand for high-resolution displays and immersive audio systems. Moreover, academic and corporate settings are adopting AV technology for remote work, e-learning, and virtual meetings. Furthermore, integration of Artificial Intelligence (AI) & Augmented Reality (AR) into AV hardware is creating a better user experience and showcases the demand of intelligence in vehicles that are changed in the region.

Do You Need any Customization Research on Audio Visual Hardware Market - Inquire Now

The major key players are

Sony Corporation – Sony Bravia XR A80J OLED TV

Samsung Electronics – Samsung QLED 8K TV

LG Electronics – LG C1 OLED TV

Panasonic Corporation – Panasonic 4K Blu-ray Player

Bose Corporation – Bose Soundbar 700

Vizio Inc. – Vizio 4K Smart TV

Harman International – JBL Bar 9.1 Soundbar

Sharp Corporation – Sharp 8K TV

Epson America Inc. – Epson EF-100 Mini-Laser Projector

BenQ Corporation – BenQ TK850i 4K UHD Projector

Crestron Electronics – Crestron Mercury Conference System

Barco – Barco ClickShare Conference

NEC Display Solutions – NEC MultiSync UN552S

Mitsubishi Electric – Mitsubishi LaserVue TV

Epson – Epson Home Cinema 3800 Projector

Pioneer Electronics – Pioneer Elite SC-LX704 AV Receiver

Yamaha Corporation – Yamaha YSP-5600 Soundbar

JVC Kenwood Corporation – JVC DLA-NX9 4K Projector

Harman Kardon – Harman Kardon Citation 500 Speaker

February 2024: Companies like Sony and LG Electronics have been pushing innovations in high-resolution digital signage, with more widespread adoption of 4K and 8K displays. These are increasingly used in retail and public spaces for dynamic, real-time updates, offering businesses more interactive ways to engage customers.

January 2024: Focus AV discusses the rise of advanced video conferencing solutions and immersive presentation technologies, such as AR and VR, transforming corporate and educational settings. These technologies are revolutionizing business meetings and training, with AI-driven enhancements for automated camera tracking and voice improvements.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 257.2 Billion |

| Market Size by 2032 | USD 450.4 Billion |

| CAGR | CAGR of 6.44% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Equipment, Digital Signal Management (DSM), Cables & Connectors) • By Application (Professional, Consumer) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sony Corporation, Samsung Electronics, LG Electronics, Panasonic Corporation, Sonos Inc., Bose Corporation, Vizio Inc., Harman International, Sharp Corporation, Epson America Inc., BenQ Corporation, Crestron Electronics, Barco, NEC Display Solutions. |

| Key Drivers | • Growing demand for streaming services and digital media platforms drives the need for high-quality AV equipment. • Educational institutions are increasingly using AV hardware like interactive displays and projectors for digital learning environments. |

| Restraints | • Frequent technological advancements can make AV hardware obsolete quickly, discouraging long-term investments by businesses and consumers. • Integrating AV hardware with existing IT and communication systems can be complex and costly, especially in corporate settings, which may slow down adoption. |

Ans- Audio Visual Hardware Market was valued at USD 257.2 billion in 2023 and is expected to reach USD 450.4 Billion by 2032, growing at a CAGR of 6.44% from 2024-2032.

Ans- The CAGR of Audio Visual Hardware Market during the forecast period is of 6.44% from 2024-2032.

Ans- The North America dominated the market and represented significant revenue share in 2023

Ans- one main growth factor for the Audio Visual Hardware Market is

Ans- Challenges in Audio Visual Hardware Market are

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Wafer Production Volumes, by Region (2023)

5.2 Chip Design Trends (Historic and Future)

5.3 Fab Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Audio Visual Hardware Market Segmentation, by Type

7.1 Chapter Overview

7.2 Equipment

7.2.1 Equipment Market Trends Analysis (2020-2032)

7.2.2 Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Microphones

7.2.3.1 Microphones Market Trends Analysis (2020-2032)

7.2.3.2 Microphones Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Speakers

7.2.4.1 Speakers Market Trends Analysis (2020-2032)

7.2.4.2 Speakers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Mixing Consoles

7.2.5.1 Mixing Consoles Market Trends Analysis (2020-2032)

7.2.5.2 Mixing Consoles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Amplifiers

7.2.6.1 Amplifiers Market Trends Analysis (2020-2032)

7.2.6.2 Amplifiers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Displays

7.2.7.1 Displays Market Trends Analysis (2020-2032)

7.2.7.2 Displays Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Projectors

7.2.8.1 Projectors Market Trends Analysis (2020-2032)

7.2.8.2 Projectors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.9 Cameras

7.2.9.1 Cameras Market Trends Analysis (2020-2032)

7.2.9.2 Cameras Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.10 Gaming Consoles

7.2.10.1 Gaming Consoles Market Trends Analysis (2020-2032)

7.2.10.2 Gaming Consoles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Digital Signal Management (DSM)

7.3.1 Digital Signal Management (DSM) Market Trends Analysis (2020-2032)

7.3.2 Digital Signal Management (DSM) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Matrix Switchers

7.3.3.1 Matrix Switchers Market Trends Analysis (2020-2032)

7.3.3.2 Matrix Switchers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Video Wall Processors

7.3.4.1 Video Wall Processors Market Trends Analysis (2020-2032)

7.3.4.2 Video Wall Processors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Signal Extenders

7.3.5.1 Signal Extenders Market Trends Analysis (2020-2032)

7.3.5.2 Signal Extenders Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 KVM Systems

7.3.6.1 KVM Systems Market Trends Analysis (2020-2032)

7.3.6.2 KVM Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.7 Audio DSP (Digital Signal Processing)

7.3.7.1 Audio DSP (Digital Signal Processing) Market Trends Analysis (2020-2032)

7.3.7.2 Audio DSP (Digital Signal Processing) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cables & Connectors

7.4.1 Cables & Connectors Market Trends Analysis (2020-2032)

7.4.2 Cables & Connectors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 HDMI Cables

7.4.3.1 HDMI Cables Market Trends Analysis (2020-2032)

7.4.3.2 HDMI Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Displayport Cables

7.4.4.1 Displayport Cables Market Trends Analysis (2020-2032)

7.4.4.2 Displayport Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Coaxial Cables

7.4.5.1 Coaxial Cables Market Trends Analysis (2020-2032)

7.4.5.2 Coaxial Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.6 Fiber Optic Cables

7.4.6.1 Fiber Optic Cables Market Trends Analysis (2020-2032)

7.4.6.2 Fiber Optic Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.7 Audio Cables

7.4.7.1 Audio Cables Market Trends Analysis (2020-2032)

7.4.7.2 Audio Cables Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.8 Connectors

7.4.8.1 Connectors Market Trends Analysis (2020-2032)

7.4.8.2 Connectors Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.9 Wireless Technologies (Wi-Fi, Bluetooth)

7.4.9.1 Wireless Technologies (Wi-Fi, Bluetooth) Market Trends Analysis (2020-2032)

7.4.9.2 Wireless Technologies (Wi-Fi, Bluetooth) Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Audio Visual Hardware Market Segmentation, by Application

8.1 Chapter Overview

8.2 Professional

8.2.1 Professional Market Trends Analysis (2020-2032)

8.2.2 Professional Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Corporate Offices

8.2.3.1 Corporate Offices Market Trends Analysis (2020-2032)

8.2.3.2 Corporate Offices Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Education

8.2.4.1 Education Market Trends Analysis (2020-2032)

8.2.4.2 Education Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Government Facilities

8.2.5.1 Government Facilities Market Trends Analysis (2020-2032)

8.2.5.2 Government Facilities Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.6 Healthcare

8.2.6.1 Healthcare Market Trends Analysis (2020-2032)

8.2.6.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.7 Hospitality

8.2.7.1 Hospitality Market Trends Analysis (2020-2032)

8.2.7.2 Hospitality Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.8 Retail

8.2.8.1 Retail Market Trends Analysis (2020-2032)

8.2.8.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.9 Transportation

8.2.9.1 Transportation Market Trends Analysis (2020-2032)

8.2.9.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.10 Sports & Entertainment

8.2.10.1 Sports & Entertainment Market Trends Analysis (2020-2032)

8.2.10.2 Sports & Entertainment Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.11 Others

8.2.11.1 Others Market Trends Analysis (2020-2032)

8.2.11.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3Consumer

8.3.1Consumer Market Trends Analysis (2020-2032)

8.3.2Consumer Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.3 Home Theaters

8.3.3.1Home Theaters Market Trends Analysis (2020-2032)

8.3.3.2Home Theaters Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.4 Gaming Setups

8.3.4.1Gaming Setups Market Trends Analysis (2020-2032)

8.3.4.2Gaming Setups Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.5Streaming Setups

8.3.5.1Streaming Setups Market Trends Analysis (2020-2032)

8.3.5.2Streaming Setups Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3.6Smart Home Integration

8.3.6.1Smart Home Integration Market Trends Analysis (2020-2032)

8.3.6.2Smart Home Integration Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Audio Visual Hardware Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Audio Visual Hardware Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Audio Visual Hardware Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 NVIDIA Corporation

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Intel Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Google LLC

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Amazon Web Services, Inc

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Qualcomm Incorporated

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 IBM Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Microsoft Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 AMD (Advanced Micro Devices, Inc.)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Graphcore Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Apple Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Equipment

Microphones

Speakers

Mixing Consoles

Amplifiers

Displays

Projectors

Cameras

Gaming Consoles

Digital Signal Management (DSM)

Matrix Switchers

Video Wall Processors

Signal Extenders

KVM Systems

Audio DSP (Digital Signal Processing)

Cables & Connectors

HDMI Cables

Displayport Cables

Coaxial Cables

Fiber Optic Cables

Audio Cables

Connectors

Wireless Technologies (Wi-Fi, Bluetooth)

By Application

Professional

Corporate Offices

Education

Government Facilities

Healthcare

Hospitality

Retail

Transportation

Sports & Entertainment

Others

Consumer

Home Theaters

Gaming Setups

Streaming Setups

Smart Home Integration

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hyperspectral Imaging Systems Market Size was valued at USD 16.17 Bn in 2023 and will reach USD 42.35 Bn by 2032 and grow at a CAGR of 11.31% by forecast period 2024-2032.

The Structured Cabling Market Size was valued at USD 12.26 Billion in 2023 and is expected to reach USD 28.90 Billion by 2032 and grow at a CAGR of 10.0% over the forecast period 2024-2032.

The High Voltage Switchgear Market size was valued at USD 20.53 Billion in 2023. It is estimated to reach USD 30.32 Billion at 4.46% CAGR by 2024-2032

The 3D Sensor Market size was valued at USD 4.10 billion in 2023and expected to reach USD 22.48 billion by 2032 and grow at a CAGR of 20.81% over the forecast period of 2024-2032.

The Office Peripherals and Products Market Size valued at USD 42.45 Billion in 2023 and is expected to grow at 5.85% CAGR to reach USD 70.50 Billion by 2032

The Consumer Network Attached Storage Market Size was valued at USD 5.52 Billion in 2023 and is expected to grow at a CAGR of 12.18% by forecast 2024-2032.

Hi! Click one of our member below to chat on Phone