To get more information on Attitude and Heading Reference Systems (AHRS) Market - Request Free Sample Report

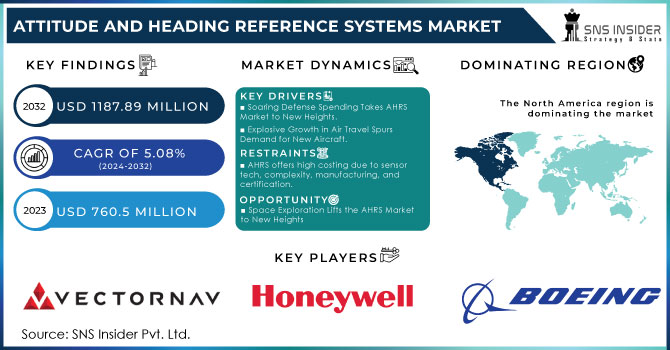

The Attitude and Heading Reference Systems Market Size was valued at US$ 760.5 million in 2023 and is expected to reach USD 1187.89 million by 2032 with an emerging CAGR of 5.08% over the forecast period 2024-2032.

The Attitude and Heading Reference Systems (AHRS) fueled by the rise of aviation industry rising towards a future to enhanced safety and efficiency. These compact marvels replace bulky traditional gyroscopic instruments, offering a multi-sensor solution for superior navigation and flight stability.

AHRS combines gyroscopes, accelerometer, and magnetometers to provide ultra-accurate data on an aircraft's position, orientation, and movement in all directions. This results to smoother flight, improved navigation, and a significant boost in pilot situational awareness. AHRS boasts a compact design, minimizing weight and space requirements. This translates to not only a sleeker aircraft but also increased fuel efficiency and improved payload capacity. Additionally, the solid-state or MEMS technology within AHRS offers superior reliability and lower maintenance needs compared to older systems, reducing operating costs for airlines.

KEY DRIVERS:

Soaring Defense Spending Takes AHRS Market to New Heights.

Explosive Growth in Air Travel Spurs Demand for New Aircraft.

The rise in military might, with defense spending flexing its muscles. A recent report by the Stockholm International Peace Research Institute (SIPRI) revealed a 2.6% increase in global military expenditure, reaching a staggering $1.82 trillion. This surge in spending is predicted to ignite a firestorm of demand for technologically advanced aircraft think fighter jets, unmanned aerial vehicles (UAVs), and helicopters. As these high-tech machines take to the skies, the need for sophisticated navigation systems like Attitude and Heading Reference Systems (AHRS) is expected to skyrocket in parallel. This translates to a potential windfall for the AHRS market in the coming years, with the industry poised to take flight alongside the rise of modern military aviation.

RESTRAIN:

AHRS offers high costing due to sensor tech, complexity, manufacturing, and certification.

Attitude and Heading Reference Systems (AHRS) can come with a hefty price tag. This might seem counterintuitive considering the advancements in AHRS technology. The manufacturers have found ways to reduce production costs through miniaturization and improved sensor technology, several factors contribute to the overall expense of AHRS. The complexity of the system itself plays a role. AHRS goes beyond just gyroscopes. It integrates multiple sensors like accelerometers and magnetometers along with sophisticated processing algorithms to deliver accurate orientation data. This intricate design adds to the manufacturing cost. certification is a crucial aspect for AHRS used in critical applications like aviation and aerospace. These certifications ensure the system meets stringent safety and reliability standards. The rigorous testing procedures involved significantly increase the overall cost.

OPPORTUNITY:

Rising global defense budgets could boost demand for AHRS in advanced military aircraft.

Space Exploration Lifts the AHRS Market to New Heights.

The countries allocate more resources to military modernization, they prioritize upgrading existing aircraft fleets and procuring new ones. These advanced military aircraft, including fighter jets, unmanned aerial vehicles (UAVs), and helicopters, heavily rely on sophisticated AHRS. AHRS provide precise orientation and positioning data, crucial for effective navigation in complex environments and precision targeting of enemy positions. Advanced AHRS contribute to superior flight control capabilities, especially for high-performance military aircraft that require exceptional maneuverability. Increased defense spending fosters investment in next-generation military technologies like autonomous weapons systems and hypersonic missiles. These advanced systems necessitate highly accurate and reliable AHRS for precise positioning and guidance in dynamic operational scenarios.

CHALLENGES:

Defense budgets of several developed countries have been cut.

Several developed nations are witnessing reductions in their defense budgets. This trend can be attributed to a confluence of factors. The conclusion of the Cold War, a period marked by heightened East-West tensions, With the perceived threat of a large-scale conventional war diminished, some countries feel less compelled to maintain vast military forces. This allows them to re-evaluate spending priorities and potentially channel resources towards social welfare programs, education, or infrastructure development. Economic realities also play a significant role. Budgetary constraints, driven by factors like national debt or deficits, often necessitate cuts across government spending, with defense not immune. Governments may find it difficult to justify high military expenditure when other areas like healthcare or education demand significant investment.

The impact of Russia-Ukraine has slowed the AHRS market. Supply chains are snarled, making it difficult and expensive to get key materials like semiconductors. This translates to production delays and potential shortages. War-induced inflation also pushes up raw material costs, further increasing the price of AHRS units. Economic uncertainty might also lead companies to reduce their expenses, delaying investments in new AHRS technology and upgrades, potentially slowing market growth. European markets could be hit particularly hard if they relied on components or finished products from the war zone. Increased defense spending by some countries could boost demand for military AHRS applications.

The impact of economic downturn has majorly affected the AHRS market. Reduces their expenses and investment delays across industries could lead to decreased demand for new units and upgrades. Price sensitivity might also rise as companies seek cost-effective options. However, AHRS in essential sectors like aviation and defense might see stable demand, and there could be a shift towards advanced, efficiency-enhancing AHRS solutions as companies look to optimize costs during challenging times.

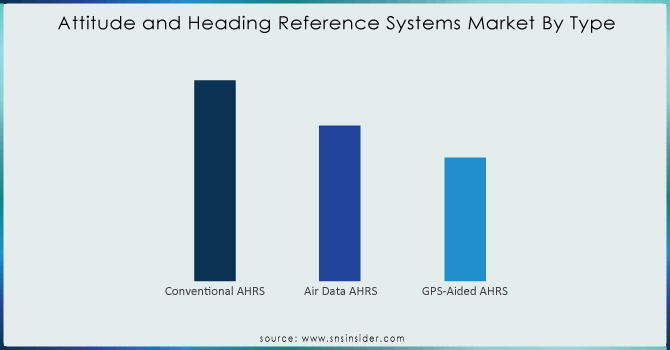

By Type

Conventional AHRS

Air Data AHRS

GPS-Aided AHRS

The Conventional AHRS sub-segment is leading the Attitude and Heading Reference Systems (AHRS), capturing over 45% Market Share in 2023 by type. These offer a cost-effective balance of functionality and affordability, making them popular in commercial aircraft, general aviation, and various industrial applications. GPS-Aided AHRS Integrating GPS technology for enhanced performance, these AHRS are becoming increasingly popular for their precision navigation, especially in environments with limited satellite signal availability. Growing demand for precision navigation in UAVs and high-performance military aircraft fuels this segment's rise.

Need any customization research on Attitude and Heading Reference Systems (AHRS) Market - Enquiry Now

By Component

Inertial Sensing Unit

Magnetic Sensing Unit

Digital Processing Unit

The Inertial Sensing Unit (ISU) sub-segment is dominating is the Attitude and Heading Reference Systems market in 2023 by component, housing accelerometers, gyroscopes, and sometimes magnetometers to measure motion and orientation. Advancements in sensor miniaturization and performance are driving growth in this segment. The Digital Processing Unit (DPU) processes sensor data and calculates the AHRS output. As AHRS functionalities become more complex, requiring advanced data processing algorithms, the DPU segment is witnessing growth.

By End-User

Civil Aviation

Military Aviation

Unmanned Vehicles

Marine

Civil Aviation sub-segment is dominating in the Attitude and Heading Reference Systems by capturing 40% market share in 2023 by end-user. Commercial airlines remain the biggest consumers of AHRS due to the sheer volume of passenger and cargo aircraft needing reliable navigation systems. Strict safety regulations also mandate advanced AHRS in civil aviation. Military aviatiom budgets and the need for sophisticated military aircraft equipped with advanced navigation and control systems are driving the AHRS market in defense. Integration of AHRS in military UAVs further fuels segment growth.

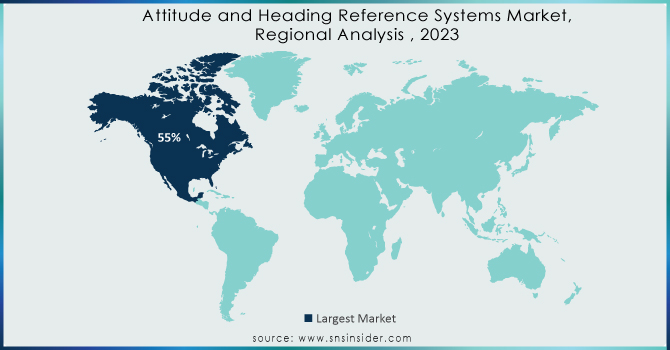

The North America leading the Attitude and Heading Reference Systems (AHRS) market in 2023, capturing over 55% of the market share. This region reigns supreme due to the presence of major players like Honeywell, Northrop Grumman, Raytheon Technologies, and Moog Inc. These industry giants heavily invest in AHRS research and development, solidifying North America's position. Additionally, a strong and established aerospace and defense sector in the region fuels demand for advanced AHRS technology. Europe is the second dominating aviation industry with a presence of leading airlines and aircraft manufacturers like Airbus. Stringent safety regulations in the region also necessitate the use of high-precision AHRS in various aviation applications. Additionally, government initiatives promoting unmanned aerial vehicle (UAV) technology further contribute to market growth.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key Players

Some of the major players in the attitude and heading reference systems (AHRS) market are Boeing (U.S.), Honeywell International Inc. (US), Vectornav Technologies, LLC (US), Ixblue, Inc. (US), Sparton Navigation and Exploration, LLC (US), Lord Microstrain (US), Safran SA (France), Lord Microstrain (US), Raytheon Technologies Corporation (US), Meggitt PLC (UK), Northrop Grumman Corporation (US), Moog, Inc. (US), and other players.

The Major Players are Moog Inc., Sparton Navigation and Exploration LLC, Lord MicroStrain, iXBLUE Inc., Honeywell International Inc., Safran S.A, Rockwell Collins Inc, Meggitt Plc, VectorNav Technologies LLC, Northrop Grumman, and other players

In April 2024: Exail, a leading navigation company, has secured a contract to supply its Octans AHRS units to Bourbon, a French maritime services provider. These AHRS systems will be installed on Bourbon's Evolution 800 Series MPSVs, designed for deep-sea operations (up to 3,000 meters). Exail's Octans, boasting IMO-HSC certification, enhances the efficiency of Bourbon's vessels for oil and gas, and offshore wind operations. This survey-grade system provides precise roll, pitch, and heave measurements, integrating seamlessly with the vessels' DP3 system.

In June 2023: Airbus Helicopters equipped their upgraded Tiger attack helicopters with cutting-edge navigation and flight control systems from Safran Electronics & Defense. This advanced technology empowers crews from France and Spain to dominate any mission, even in the toughest environments.

In January 2024: Honeywell International joined forces with Boeing to develop the next-generation Attitude and Heading Reference System (AHRS) specifically designed for the 737 MAX 10 aircraft. This collaboration signifies Safran's expertise in critical flight control technology and positions them as a partner for Boeing's future endeavors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 760.5 Million |

| Market Size by 2032 | US$ 1187.89 Million |

| CAGR | CAGR of 5.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End-User (Civil Aviation, Military Aviation, Unmanned Vehicles, & Marine) • By Component (Inertial Sensors, Magnetic Sensors, & Processor, Gyroscopes, Magnetometer, Accelerometers, and Digital Processing Unit) • By Type (Conventional AHRS, Air Data AHRS and GPS-Aided AHRS) • By Platform (Fixed Wing, Rotary Wing, and UAV)) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Moog Inc., Sparton Navigation and Exploration LLC, Lord MicroStrain, iXBLUE Inc., Honeywell International Inc., Safran S.A, Rockwell Collins Inc, Meggitt Plc, VectorNav Technologies LLC, Northrop Grumman, and other players. |

| DRIVERS | • Increasing Passenger Traffic And Important Demand For New Aircraft. • Increasing Interest in AHRS for Use in UAVs |

| RESTRAINTS | • Several developed countries' defence budgets have been reducedy |

Technological Advances in MEMS Technology and AHRS Integration with GPS and Other Systems

According to SNS insiders, the Attitude and Heading Reference Systems Market size was USD 760.5 million in 2023 and is expected to reach USD 1187.89 million by 2028 with a CAGR of 5.08% over the forecasted period.

Yes, you will get an free sample of this report for that you have to make an contact with our team.

Yes, this report cover top down , bottom up Quantitative Research. Qualitative Research, Fundamental Research, data triangulation, ID’s & FGD’s Analytical research, And other as per report requirement.

Manufacturers/Service provider, Consultant, Association, Research institute, private and universities libraries, Suppliers and Distributors of the product.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Attitude and Heading Reference Systems (AHRS) Market Segmentation, By End-User

9.1 Introduction

9.2 Trend Analysis

9.3 Civil Aviation

9.4 Military Aviation

9.5 Unmanned Vehicles

9.6 Marine

10. Attitude and Heading Reference Systems (AHRS) Market Segmentation, By Type

10.1 Introduction

10.2 Trend Analysis

10.3 Conventional AHRS

10.4 Air Data AHRS

10.5 GPS-Aided AHRS

11. Attitude and Heading Reference Systems (AHRS) Market Segmentation, By Component

11.1 Introduction

11.2 Trend Analysis

11.3 Inertial Sensing Unit

11.4 Magnetic Sensing Unit

11.5 Digital Processing Unit

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Attitude and Heading Reference Systems (AHRS) Market by Country

12.2.3 North America Attitude and Heading Reference Systems (AHRS) Market By End-User

12.2.4 North America Attitude and Heading Reference Systems (AHRS) Market By Type

12.2.5 North America Attitude and Heading Reference Systems (AHRS) Market By Component

12.2.6 USA

12.2.6.1 USA Attitude and Heading Reference Systems (AHRS) Market By End-User

12.2.6.2 USA Attitude and Heading Reference Systems (AHRS) Market By Type

12.2.6.3 USA Attitude and Heading Reference Systems (AHRS) Market By Component

12.2.7 Canada

12.2.7.1 Canada Attitude and Heading Reference Systems (AHRS) Market By End-User

12.2.7.2 Canada Attitude and Heading Reference Systems (AHRS) Market By Type

12.2.7.3 Canada Attitude and Heading Reference Systems (AHRS) Market By Component

12.2.8 Mexico

12.2.8.1 Mexico Attitude and Heading Reference Systems (AHRS) Market By End-User

12.2.8.2 Mexico Attitude and Heading Reference Systems (AHRS) Market By Type

12.2.8.3 Mexico Attitude and Heading Reference Systems (AHRS) Market By Component

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Attitude and Heading Reference Systems (AHRS) Market by Country

12.3.2.2 Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.3 Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.4 Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.2.5 Poland

12.3.2.5.1 Poland Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.5.2 Poland Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.5.3 Poland Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.2.6 Romania

12.3.2.6.1 Romania Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.6.2 Romania Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.6.4 Romania Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.2.7 Hungary

12.3.2.7.1 Hungary Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.7.2 Hungary Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.7.3 Hungary Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.2.8 Turkey

12.3.2.8.1 Turkey Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.8.2 Turkey Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.8.3 Turkey Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.2.9.2 Rest of Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.2.9.3 Rest of Eastern Europe Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3 Western Europe

12.3.3.1 Western Europe Attitude and Heading Reference Systems (AHRS) Market by Country

12.3.3.2 Western Europe Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.3 Western Europe Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.4 Western Europe Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.5 Germany

12.3.3.5.1 Germany Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.5.2 Germany Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.5.3 Germany Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.6 France

12.3.3.6.1 France Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.6.2 France Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.6.3 France Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.7 UK

12.3.3.7.1 UK Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.7.2 UK Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.7.3 UK Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.8 Italy

12.3.3.8.1 Italy Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.8.2 Italy Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.8.3 Italy Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.9 Spain

12.3.3.9.1 Spain Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.9.2 Spain Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.9.3 Spain Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.10.2 Netherlands Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.10.3 Netherlands Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.11.2 Switzerland Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.11.3 Switzerland Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.1.12 Austria

12.3.3.12.1 Austria Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.12.2 Austria Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.12.3 Austria Attitude and Heading Reference Systems (AHRS) Market By Component

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Attitude and Heading Reference Systems (AHRS) Market By End-User

12.3.3.13.2 Rest of Western Europe Attitude and Heading Reference Systems (AHRS) Market By Type

12.3.3.13.3 Rest of Western Europe Attitude and Heading Reference Systems (AHRS) Market By Component

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market by Country

12.4.3 Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.4 Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.5 Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.6 China

12.4.6.1 China Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.6.2 China Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.6.3 China Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.7 India

12.4.7.1 India Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.7.2 India Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.7.3 India Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.8 Japan

12.4.8.1 Japan Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.8.2 Japan Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.8.3 Japan Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.9 South Korea

12.4.9.1 South Korea Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.9.2 South Korea Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.9.3 South Korea Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.10 Vietnam

12.4.10.1 Vietnam Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.10.2 Vietnam Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.10.3 Vietnam Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.11 Singapore

12.4.11.1 Singapore Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.11.2 Singapore Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.11.3 Singapore Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.12 Australia

12.4.12.1 Australia Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.12.2 Australia Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.12.3 Australia Attitude and Heading Reference Systems (AHRS) Market By Component

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By End-User

12.4.13.2 Rest of Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By Type

12.4.13.3 Rest of Asia-Pacific Attitude and Heading Reference Systems (AHRS) Market By Component

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Attitude and Heading Reference Systems (AHRS) Market by Country

12.5.2.2 Middle East Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.3 Middle East Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.4 Middle East Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.2.5 UAE

12.5.2.5.1 UAE Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.5.2 UAE Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.5.3 UAE Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.2.6 Egypt

12.5.2.6.1 Egypt Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.6.2 Egypt Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.6.3 Egypt Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.7.2 Saudi Arabia Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.7.3 Saudi Arabia Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.2.8 Qatar

12.5.2.8.1 Qatar Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.8.2 Qatar Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.8.3 Qatar Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.2.9.2 Rest of Middle East Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.2.9.3 Rest of Middle East Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.3 Africa

12.5.3.1 Africa Attitude and Heading Reference Systems (AHRS) Market by Country

12.5.3.2 Africa Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.3.3 Africa Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.3.4 Africa Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.3.5.2 Nigeria Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.3.5.3 Nigeria Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.3.6 South Africa

12.5.3.6.1 South Africa Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.3.6.2 South Africa Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.3.6.3 South Africa Attitude and Heading Reference Systems (AHRS) Market By Component

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Attitude and Heading Reference Systems (AHRS) Market By End-User

12.5.3.7.2 Rest of Africa Attitude and Heading Reference Systems (AHRS) Market By Type

12.5.3.7.3 Rest of Africa Attitude and Heading Reference Systems (AHRS) Market By Component

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Attitude and Heading Reference Systems (AHRS) Market by country

12.6.3 Latin America Attitude and Heading Reference Systems (AHRS) Market By End-User

12.6.4 Latin America Attitude and Heading Reference Systems (AHRS) Market By Type

12.6.5 Latin America Attitude and Heading Reference Systems (AHRS) Market By Component

12.6.6 Brazil

12.6.6.1 Brazil Attitude and Heading Reference Systems (AHRS) Market By End-User

12.6.6.2 Brazil Attitude and Heading Reference Systems (AHRS) Market By Type

12.6.6.3 Brazil Attitude and Heading Reference Systems (AHRS) Market By Component

12.6.7 Argentina

12.6.7.1 Argentina Attitude and Heading Reference Systems (AHRS) Market By End-User

12.6.7.2 Argentina Attitude and Heading Reference Systems (AHRS) Market By Type

12.6.7.3 Argentina Attitude and Heading Reference Systems (AHRS) Market By Component

12.6.8 Colombia

12.6.8.1 Colombia Attitude and Heading Reference Systems (AHRS) Market By End-User

12.6.8.2 Colombia Attitude and Heading Reference Systems (AHRS) Market By Type

12.6.8.3 Colombia Attitude and Heading Reference Systems (AHRS) Market By Component

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Attitude and Heading Reference Systems (AHRS) Market By End-User

12.6.9.2 Rest of Latin America Attitude and Heading Reference Systems (AHRS) Market By Type

12.6.9.3 Rest of Latin America Attitude and Heading Reference Systems (AHRS) Market By Component

13. Company Profiles

13.1 Boeing (U.S.)

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Honeywell International Inc. (US)

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Vectornav Technologies LLC. (US)

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Sparton Navigation and Exploration, LLC (US)

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Lord Microstrain (US)

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Safran SA (France)

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Lord Microstrain (US)

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Ixblue, Inc. (US)

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Raytheon Technologies Corporation (US)

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Meggitt PLC (UK)

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Northrop Grumman Corporation (US)

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Moog, Inc. (US)

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Aircraft Engine Nacelle Market size was USD 3.98 billion in 2023 and is expected to reach USD 4.86 billion by 2032, growing at a CAGR of 2.3% over the forecast period of 2024-2032.

The Mine Detection System Market Size was valued at USD 5.63 billion in 2022 and is expected to reach USD 9.18 billion by 2030 with a growing CAGR of 6.3% over the forecast period 2023-2030.

The Sonar System Market is estimated to be USD 6.21 billion in 2023 and is projected to reach USD 7.15 billion by 2031, at a CAGR of 1.7% from 2024 to 2031.

The Utility Aircraft Market size was USD 192.8 billion in 2023 and is expected to reach USD 289.6 billion by 2032, growing at a CAGR of 4.98% over the forecast period of 2024-2032.

The Electric Ship Market size was valued at USD 3.90 billion in 2023 and is projected to reach USD 18.77 billion by 2032, growing at an impressive CAGR of 19.2% during the forecast period of 2024-2032.

The Remote Towers Market Size was valued at USD 0.35 billion in 2023 and is expected to reach USD 1.79 billion by 2032 and grow at a CAGR of 19.9% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone