Get more information on Atrial Fibrillation Devices Market - Request Free Sample Report

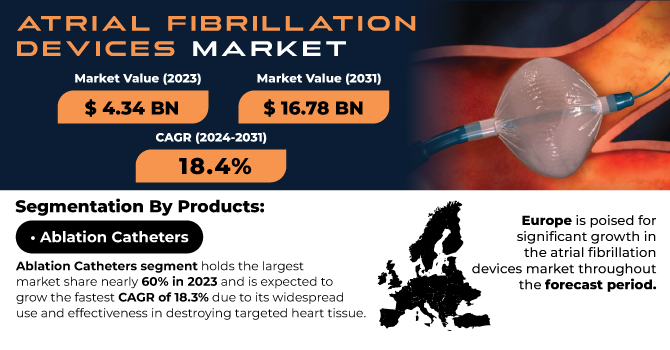

The Atrial Fibrillation Devices Market was valued at USD 10.30 billion in 2023 and is expected to reach USD 30.47 billion by 2032, growing at a CAGR of 12.85% from 2024-2032.

The report on atrial fibrillation devices provides data-driven insights with data-driven analysis of key market dynamics. It includes an in-depth analysis of the incidence and prevalence level (2023-2032) to estimate the growing burden of atrial fibrillation in the major regions. Furthermore, this report analyzes regional prescription trends (2023), giving a comparative analysis of treatment adoption patterns. The report additionally includes a device volume forecast by region that tracks the growth in the markets and could work as a tool to accommodate device digestion.

Market dynamics

Drivers

Atrial fibrillation (AF) is one of the most common and fastest-growing cardiac arrhythmias worldwide, driven by an aging population and the increasing prevalence of risk factors such as hypertension, diabetes, and obesity.

Atrial fibrillation (AF) is one of the most common and rapidly progressive cardiac arrhythmias globally and is primarily due to associated factors such as the population’s elderly aging and the growing burden of cardiovascular risk factors, including hypertension, diabetes mellitus, and obesity. With prevalence increasing in tandem with the aging global population, particularly in developed nations, the number of patients diagnosed with AF is multiplying and establishes a great need for effective treatment options. The American Heart Association estimates the population of AF patients in the U.S. will double to 12.1 million by 2050. Increasing prevalence directly impacts the demand for AF devices like ablation catheters, pacemakers, and monitoring systems to manage and treat the condition.

Recent innovations like Abbott Laboratories Volt Pulsed Field Ablation (PFA) System are addressing this gap by offering better therapies for heart rhythm disorders like AF. Although it has been used only in clinical trials conducted in Australia and a few other locations, the Volt PFA System readiness is a hallmark of continued progress to enhance the treatment landscape for AF. Devices that address this patient population include the Micra Transcatheter Pacing System (Medtronic), which exemplifies this trend toward smaller, less invasive approaches to treatment.

Technological progress in ablation therapies is revolutionizing the treatment of atrial fibrillation.

Novel developments in ablation technologies are changing the landscape of treatment for atrial fibrillation. Advances in cryoablation, radiofrequency ablation, and pulsed-field ablation technologies allow the placement of more propriety and less invasive techniques. This results in enhanced patient outcomes via reduced recovery times and lower procedural risks. Getting a less-invasive means to treat AF is driving acceptance of ablation devices, especially in patients who would have used to need open-heart surgery. As a result, these technologies are becoming increasingly efficient in treating, managing, and potentially curing AF, thereby driving the growth of the AF devices market.

Ablation procedures such as Medtronic's Arctic Front Advance CryoAblation Catheter maintain high success rates, with literature reviews reporting an 80-90% success rate in patients undergoing cryoablation for AF. For instance, one-year data from highly efficient tools such as Affera's HD-mapping and dual-energy ablation catheter, which was recently cleared by the FDA in 2024, is a testament to how technology continues to propel accuracy in treatment. These advanced technologies offer better mapping and treatment choices to patients with persistent AF and atrial flutter and are another major driving factor behind the high demand for advanced treatment solutions in the AF devices market.

Restraint

High cost associated with the treatment devices for cases of advanced atrial fibrillation (AF) is a key restraint for the market growth

Pulsed-field ablation systems, cryoablation catheters, and high-precision mapping technologies are thus extremely advanced but very expensive, deterring healthcare providers in price-sensitive areas from purchasing them. Although these devices provide superior treatment and fewer complications, the initial cost often restricts their use, especially in developing nations with tighter healthcare budgets.

For example, products such as Abbott's Volt-Pulsed Field Ablation (PFA) System and Medtronic's Arctic Front Advance CryoAblation Catheter necessitate considerable investment in the device as well as in infrastructure required to perform the procedures. Such high price points can limit the widespread adoption of these devices in hospitals and clinics, especially in low-to-middle-income nations, thus hampering the overall growth of the devices market.

Opportunities

The increasing preference for minimally invasive procedures presents a significant opportunity for the atrial fibrillation (AF) devices market.

A growing number of healthcare professionals and patients are pressing for less invasive alternatives and shorter recovery times, suggesting opportunities for catheter-based ablation systems used in minimally invasive AF treatments and advanced mapping technologies. These minimally invasive techniques usually result in fewer complications, shorter hospitalizations, and quicker recovery, making them preferable for patients and providers.

Increasing patient awareness and the trend towards outpatient procedures are driving a burgeoning market for AF devices that support these less invasive treatments. Devices such as Medtronic's Micra Transcatheter Pacing System and Abbott’s sTactiCath Contact Force Ablation Catheter, which treat AF without having to open the patient's body, are gaining traction, for example. Led by innovation in technology and patient preference, this move towards minimally invasive has offered medical device manufacturers the perfect marketing avenue for new devices.

Challenges

Technological complexity of the devices and the extensive training required for healthcare professionals to operate them effectively.

Complex structures behind advanced treatment devices, including electrophysiology mapping systems, catheter-based ablation systems, and pulsed-field ablation technologies, depend on skilled operators for successful outcomes. These devices require in-depth electrophysiological knowledge, appropriate device manipulation, and patient-specific therapy planning.

These systems can be complex, which can be a deterrent to adoption, as hospitals and clinics are required to place significant investment into training programs for physicians, electrophysiologists, and other staff. This, combined with the lengthy and expensive training involved, can prevent some healthcare facilities from consistently adopting these newest forms of technology. Such advanced devices are complex and require specialized training, and without the proper training and expertise, these devices could not only result in treatment complications but also lead to inexperienced staff performing suboptimal procedures, which would make some healthcare providers wary of adopting these advanced devices. Solving this issue entails actual education and training programs, as well as providing timely support for the healthcare professional in ensuring appropriate use of devices for improved patient outcomes.

Segmentation Analysis

By product

The Atrial Fibrillation (AF) devices market was dominated by the ablation catheters segment in 2023 with 54.28% of market share, owing to their effectiveness and popularity in the treatment of AF patients. Ablation catheters are needed to perform catheter-based ablation procedures, which are regarded as common and effective measures for AF treatment. These procedures destroy the part of the heart tissue that forms the rogue electrical signals, thereby restoring normal heart rhythms. Ablation has become the treatment of choice in patients who do not respond satisfactorily to medication and in AF with more advanced forms. Additional factors, such as the rising preference for minimally invasive surgeries such as previous ones, which provide rapid recovery and lesser complications, have also increased the demand for ablation catheters.

The growing burden of atrial fibrillation, particularly in the elderly, has spurred the demand for efficient and safe treatment modalities. Owing to their demonstrated ability to restore sinus rhythm and relieve symptoms linked to AF, ablation catheters have emerged as an essential element of therapeutic protocols. Moreover, developments in catheter technologies, including enhanced mapping systems, greater precision, and more efficient ablation techniques, have further facilitated their increased utilization. This is why the ablation catheters segment holds the largest overall share in the global market, as both the patients and the physicians prefer a highly effective solution to manage atrial fibrillation.

By End User

The hospital segment dominated the market and accounted for a 63.22% market share in 2023, owing to the delivery of wide-ranging and advanced healthcare services at these facilities, which provide complex cardiovascular condition treatment, making a place to provide care for all AF cases. Line (e.g., health systems) have modern diagnostic and therapeutic technology (e.g., modern ablation catheters, EP lab, and also a dedicated cardiovascular department). Such institutions offer holistic space for the assessment, evaluation, and management of the AF population, particularly those with advanced or complex diseases. Multidisciplinary care teams at hospitals are also important for treating AF patients, who often need additional therapy like stroke prevention, anticoagulation therapy, and post-ablation monitoring. The complex mix of state-of-the-art technology, specialized skillsets, and coordinated care pathways put hospitals in a unique position as the preferred lead provider of AF services.

The cardiac catheterization laboratories segment is projected to grow at the fastest rate over the forecast period, owing to the rising use of less invasive methods to treat atrial fibrillation. Catheterization labs are specialized in-hospital or outpatient medical center areas where physicians perform catheter-based procedures (i.e., ablations and diagnostic angiographies). AF also needs catheter-based interventions, which drive demand for advanced catheterization lab facilities, leading to the transition to minimally invasive and non-invasive treatment. These labs offer high precision and constant monitoring, fulfilling the requirements of performing complicated procedures such as catheter ablation, the primary treatment modality for AF. The increasing number of such procedures performed across developing and developed nations, coupled with higher investments in cath lab infrastructure and technology, is poised to drive the growth of this segment in the periodic timeframe. With healthcare providers focused on improving patient outcomes and lowering recovery times, cardiac catheterization labs will remain a leading venue for innovations in AF therapy.

Regional analysis

North America dominated the atrial Fibrillation (AF) devices market with a 39.46% market share, which can be credited to the presence of developed infrastructure of healthcare, heavy spending on healthcare, and the established presence of key market players in the region. The United States, especially, contributes a large share because of its existing healthcare system and widespread adoption of innovative medical technologies. Furthermore, the region has a high incidence of atrial fibrillation, as the older population is more prone to heart disease, generating a constant demand for AF-related therapies and devices. Also, the North American regulatory scene (including FDA approvals) makes sure that with huge facilities, unique and advanced treatment devices are quickly available, instigating market growth.

Europe is expected to register the fastest growth in the Atrial Fibrillation devices market with a CAGR of 15.27% in the forecast years, driven by growing investments in healthcare infrastructure, increasing awareness regarding atrial fibrillation, and growing adoption of advanced treatment alternatives in the region. The prevalence of atrial fibrillation in European countries is on the rise due to aging demographics and lifestyle factors, including obesity and hypertension. The increasing availability of advanced medical technologies, such as novel AF devices (including catheter-based ablation systems) and the latest mapping technologies, has led to an upsurge in aortic valve disease across the region. In addition, Europe experiences solid backing from regulatory agencies, resulting in swifter device approvals and a higher mandate for better treatment solutions. As these initiatives strengthen patient care and expand healthcare access, Europe is set to continue experiencing strong growth in the AF devices market in the coming years.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players in the Atrial Fibrillation Devices Market

Medtronic (Micra Transcatheter Pacing System, Arctic Front Advance CryoAblation Catheter)

Abbott Laboratories (Xience V Coronary Stent, TactiCath Contact Force Ablation Catheter)

Boston Scientific (FlexAbility Ablation Catheter, Watchman Left Atrial Appendage Closure Device)

Biotronik (Orsiro Coronary Stent, GoldTip Ablation Catheter)

Johnson & Johnson (Biosense Webster Carto 3 System, Thermocool SmartTouch Catheter)

Siemens Healthineers (Acuson SC2000 Ultrasound System, Artis zee Floor Angiography System)

Philips Healthcare (Rhythmia Mapping System, Stellaris PC)

LivaNova (Essenz ECG, Vagus Nerve Stimulation Therapy)

CardioFocus (HeartLight Endoscopic Ablation System, HeartLight X3 System)

Abbott Medical (TactiCath Contact Force Ablation Catheter, Rhythmia Mapping System)

AtriCure, Inc. (Isolator Synergy Ablation System, AtriClip Left Atrial Appendage Exclusion System)

Stereotaxis, Inc. (Niobe ES Robotic Magnetic Navigation System, Vdrive Robotic Arm System)

Medico (Advantage RF Ablation System, EpiqTM Ablation System)

MicroPort Scientific Corporation (GlidePath Ablation Catheter, Cardiac Resynchronization Therapy Device)

Biomerics (Coronary Ablation Catheter, Deflectable Sheath System)

Gore Medical (GORE TAG Thoracic Endoprosthesis, GORE VIABAHN Endoprosthesis)

AtriCure Inc. (AtriClip LAA Exclusion System, AtriCure Synergy Ablation System)

Cook Medical (Cook Biopsy Needle, Cook Percutaneous Drainage Catheter)

Terumo Corporation (ThermoCool SmartTouch Catheter, Guidewire System)

Imricor Medical Systems (Vision-MR Ablation Catheter, MRI Compatible Pacing System)

Suppliers

Medtronic

Abbott Laboratories

Boston Scientific

Biotronik

Johnson & Johnson

Siemens Healthineers

Philips Healthcare

LivaNova

AtriCure, Inc.

Stereotaxis, Inc.

Recent development

In January 2025, Affera launched its innovative HD-mapping and dual-energy ablation catheter combining RF and pulsed field. OnX 4D, as the fourth-generation on-label in the OnX valve platform, received U.S. Food and Drug Administration (FDA) approval in October 2024 for addressing persistent atrial fibrillation (AFib) and cavotricuspid isthmus (CTI) dependent atrial flutter.

In Jan 2024, Abbott announced the first global procedures completed with its Volt Pulsed Field Ablation (PFA) System to treat patients with common irregular heartbeats, including atrial fibrillation (AFib). As part of Abbott’s Volt CE Mark study, a pre-market, multi-center clinical trial designed to evaluate the safety and efficacy of the system, more than 30 patients in Australia received treatment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 10.30 Billion |

| Market Size by 2032 | US$ 30.47 Billion |

| CAGR | CAGR of 12.85 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Laboratory Devices, Ablation Catheters, Diagnostic Catheters, Access Devices) • By End User (Hospitals, Ambulatory Surgical Centers, Cardiac Catheterization Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic, Abbott Laboratories, Boston Scientific, Biotronik, Johnson & Johnson, Siemens Healthineers, Philips Healthcare, LivaNova, CardioFocus, Abbott Medical, AtriCure, Inc., Stereotaxis, Inc., Medico, MicroPort Scientific Corporation, Biomerics, Gore Medical, AtriCure Inc., Cook Medical, Terumo Corporation, Imricor Medical Systems, and other players. |

Ans: The Atrial Fibrillation Devices Market is expected to grow at a CAGR of 12.85% during 2024-2032.

Ans: The Atrial Fibrillation Devices Market was USD 10.30 billion in 2023 and is expected to Reach USD 30.37 billion by 2032.

Ans: Atrial fibrillation (AF) is one of the most common and fastest-growing cardiac arrhythmias worldwide, driven by an aging population and the increasing prevalence of risk factors such as hypertension, diabetes, and obesity.

Ans: The “Ablation Catheters” segment dominated the Atrial Fibrillation Devices Market.

Ans: North America dominated the Atrial Fibrillation Devices Market in 2023

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Atrial Fibrillation Devices Market Segmentation, by Product

7.1 Chapter Overview

7.2 Laboratory Devices

7.2.1 Laboratory Devices Market Trends Analysis (2020-2032)

7.2.2 Laboratory Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 3D Mapping Systems

7.2.3.1 3D Mapping Systems Market Trends Analysis (2020-2032)

7.2.3.2 3D Mapping Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 EP Recording Systems

7.2.4.1 EP Recording Systems Market Trends Analysis (2020-2032)

7.2.4.2 EP Recording Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 RF Ablation Systems

7.2.5.1 RF Ablation Systems Market Trends Analysis (2020-2032)

7.2.5.2 RF Ablation Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 ICE Systems

7.2.6.1 ICE Systems Market Trends Analysis (2020-2032)

7.2.6.2 ICE Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Cardiac Stimulators

7.2.7.1 Cardiac Stimulators Market Trends Analysis (2020-2032)

7.2.7.2 Cardiac Stimulators Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Others

7.2.8.1 Others Market Trends Analysis (2020-2032)

7.2.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Ablation Catheters

7.3.1 Ablation Catheters Market Trends Analysis (2020-2032)

7.3.2 Ablation Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Cryoablation

7.3.3.1 Cryoablation Market Trends Analysis (2020-2032)

7.3.3.2 Cryoablation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 RF Ablation

7.3.4.1 RF Ablation market Trends Analysis (2020-2032)

7.3.4.2 RF Ablation market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Irrigated Tip RF

7.3.5.1 Irrigated Tip RF Market Trends Analysis (2020-2032)

7.3.5.2 Irrigated Tip RF Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Laser

7.3.6.1 Laser Market Trends Analysis (2020-2032)

7.3.6.2 Laser Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4. Diagnostic Catheters

7.4.1 Diagnostic Catheters Market Trends Analysis (2020-2032)

7.4.2 Diagnostic Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Ultrasound

7.4.3.1 Ultrasound Market Trends Analysis (2020-2032)

7.4.3.2 Ultrasound Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Conventional

7.4.4.1 Conventional Market Trends Analysis (2020-2032)

7.4.4.2 Conventional Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Advanced

7.4.5.1 Advanced Market Trends Analysis (2020-2032)

7.4.5.2 Advanced Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Access Devices

7.5.1 Access Devices Market Trends Analysis (2020-2032)

7.5.2 Access Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Atrial Fibrillation Devices Market Segmentation, by End User

8.1 Chapter Overview

8.2 Hospitals

8.2.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Ambulatory Surgical Centers

8.3.1 Ambulatory Surgical Centers Market Trends Analysis (2020-2032)

8.3.2 Ambulatory Surgical Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Cardiac Catheterization Laboratories

8.4.1 Cardiac Catheterization Laboratories Market Trends Analysis (2020-2032)

8.4.2 Cardiac Catheterization Laboratories Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Healthcare Predictive Analytic Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Healthcare Predictive Analytic Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Atrial Fibrillation Devices Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Atrial Fibrillation Devices Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Atrial Fibrillation Devices Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10. Company Profiles

10.1 Medtronic

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Abbott Laboratories

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Boston Scientific

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Biotronik

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Siemens Healthineers

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Philips Healthcare

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 LivaNova

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 CardioFocus

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Abbott Medical

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 AtriCure, Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Products

Laboratory Devices

3D Mapping Systems

EP Recording Systems

RF Ablation Systems

ICE Systems

Cardiac Stimulators

Others

Ablation Catheters

Cryoablation

RF Ablation

Irrigated Tip RF

Laser

Diagnostic Catheters

Conventional

Advanced

Ultrasound

Access Devices

By End User

Hospitals

Ambulatory Surgical Centers

Cardiac Catheterization Laboratories

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Pharmaceutical Contract Packaging Market size was valued at USD 15.30 bn in 2023 and is expected to grow at a CAGR of 8.33% to reach USD 31.56 bn by 2032.

The Speech Therapy Market Size was valued at USD 11.13 billion in 2023 and is expected to reach at USD 18.19 billion in 2032 and grow at a CAGR of 5.64% by 2024-2032.

Leukemia Therapeutics Market Size was valued at USD 17.2 Billion in 2023 and is expected to reach USD 32.3 Billion by 2032, growing at a CAGR of 7.3% over the forecast period 2024-2032.

The global 3D Printing Medical Devices Market Size was valued at USD 2.69 billion in 2023 and is expected to reach USD 11.46 billion by 2032 and grow at a CAGR of 17.49% by 2024-2032.

The Angioplasty Balloon market size was USD 2.66 Billion in 2023 and is expected to reach USD 3.58 Billion by 2032 and grow at a CAGR of 3.36% over the forecast period of 2024-2032.

The Healthcare Analytical Testing Services Market Size was valued at USD 7.37 Bn in 2023, expected to reach USD 19.14 Bn by 2032 growing at a CAGR of 11.21%.

Hi! Click one of our member below to chat on Phone