ATP Assays Market Report Scope & Overview:

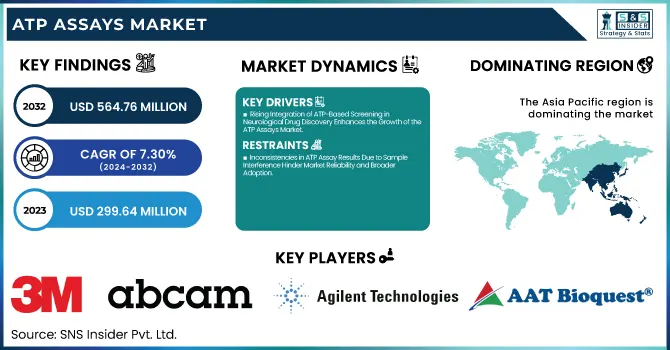

The ATP Assays Market Size was valued at USD 299.64 Million in 2023 and is expected to reach USD 564.76 Million by 2032, growing at a CAGR of 7.30% over the forecast period of 2024-2032.

Get More Information on ATP Assays Market - Request Sample Report

The ATP assays market is evolving rapidly with groundbreaking developments enhancing its global significance. Our report uncovers key insights, starting with rising funding trends in assay technology, as public and private investments fuel innovation in diagnostic tools. It also highlights the increasing number of clinical trials using ATP assays, reflecting their vital role in drug discovery. The supplier landscape and raw material sources section maps out crucial contributors to the assay value chain. A detailed import and export analysis by region provides clarity on global trade dynamics and market dependencies. Finally, the adoption of AI and automation in assay processing is transforming efficiency, offering faster and more accurate results, reshaping laboratory operations across pharmaceutical and research sectors.

The US ATP Assays Market Size was valued at USD 96.84 Million in 2023 with a market share of around 81% and growing at a significant CAGR over the forecast period of 2024-2032.

The US ATP assays market is witnessing robust growth, driven by increasing R&D investments in pharmaceutical and biotechnology sectors, rising demand for cell viability testing, and expanding applications in food safety and environmental monitoring. Organizations like the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC) are actively funding research using ATP-based assays for disease diagnostics and antimicrobial resistance studies. U.S.-based companies such as Thermo Fisher Scientific and Promega Corporation are leading innovation with high-throughput luminometric assays tailored for drug discovery. Additionally, the FDA’s focus on contamination detection in manufacturing is further propelling adoption of ATP assays across food and pharmaceutical industries.

Market Dynamics

Drivers

-

Rising Integration of ATP-Based Screening in Neurological Drug Discovery Enhances the Growth of the ATP Assays Market

The growing prevalence of neurological disorders such as Alzheimer’s, Parkinson’s, and epilepsy has fueled research into mechanisms of neuronal energy metabolism and synaptic functionality. Adenosine triphosphate assays have become a cornerstone for analyzing energy-dependent processes in neuronal cells and drug responses. Researchers and pharmaceutical companies are increasingly leveraging ATP assays to evaluate the cytotoxicity and bioenergetics of novel drug candidates targeting the central nervous system. Organizations like the National Institutes of Health in the United States are funding large-scale neuroscience initiatives that integrate ATP-based cell viability and mitochondrial assays. Moreover, real-time monitoring using bioluminescent ATP assays is aiding in the early identification of neuroprotective compounds. This growing application base not only enhances therapeutic efficacy but also reduces trial-and-error in drug pipelines. The integration of such assays into high-content screening platforms significantly boosts throughput, accuracy, and decision-making speed. Consequently, the adoption of ATP assays in neurological research is anticipated to fuel sustained demand, driving market growth in specialized pharmaceutical research applications.

Restraints

-

Inconsistencies in ATP Assay Results Due to Sample Interference Hinder Market Reliability and Broader Adoption

One of the significant restraints in the adenosine triphosphate assays market is the variability and interference observed in certain complex biological or environmental samples. These inconsistencies are often caused by the presence of enzymes, heavy metals, or organic compounds that inhibit luciferase activity or degrade ATP before detection. Such interference leads to inaccurate results, compromising data reliability and decision-making. For example, in pharmaceutical screening, false positives or negatives due to ATP degradation can affect the efficacy and safety evaluation of drug candidates. Similarly, in environmental testing, the presence of chemical disinfectants or biofilms may reduce assay sensitivity, leading to underreporting of microbial contamination. These issues often necessitate additional confirmatory tests, increasing operational time and costs. Although advancements in reagent formulation and sample preparation protocols are improving, the challenge of interference persists, especially in field-based testing scenarios. This technical limitation can discourage users from fully transitioning to ATP assays, especially in regulated environments where data accuracy is critical.

Opportunities

-

Rising Demand for Real-Time Hygiene Monitoring in Smart Manufacturing Creates Growth Opportunities for ATP Assay Developers

The industrial shift toward smart manufacturing and real-time quality control has opened up new avenues for ATP assay integration in hygiene monitoring systems. Industries such as pharmaceuticals, cosmetics, and food processing are investing in automated, sensor-based cleanliness verification protocols to ensure compliance and product safety. ATP assays, with their capacity to deliver instant microbial detection on surfaces and in liquid systems, align perfectly with these evolving needs. In the United States, companies like 3M and Hygiena are pioneering digital ATP monitoring tools that feed data directly into quality management software. This integration allows for predictive maintenance, immediate corrective actions, and comprehensive traceability. As industries embrace Industry 4.0 practices, the demand for ATP assay kits and instruments designed for seamless digital compatibility is surging. This digital transformation trend offers a lucrative opportunity for assay developers to innovate and expand their presence in smart manufacturing ecosystems.

Challenge

-

Regulatory Variability Across Regions Challenges the Global Standardization and Adoption of ATP Assay Technologies

Despite their widespread utility, adenosine triphosphate assays face considerable challenges related to regulatory inconsistencies across global markets. Different regions maintain distinct standards for assay validation, data interpretation, and equipment calibration. In the United States, the Food and Drug Administration provides clear guidelines for ATP-based assays in pharmaceutical manufacturing and food safety, but similar frameworks are lacking or inconsistent in emerging markets. This disparity complicates global product deployment and hampers cross-border collaborations. Additionally, the absence of harmonized quality benchmarks often leads to delays in product approvals and market entry. Companies are forced to customize products for each market, increasing development costs and time. Without globally recognized assay protocols, scaling ATP-based solutions for multi-national applications becomes challenging. These regulatory roadblocks limit the broader adoption and standardization of ATP assays, especially in high-growth regions.

Segmental Analysis

By Product

The consumables segment dominated the Adenosine Triphosphate Assays Market in 2023 with a commanding market share of 50.3%. This dominance is attributed to the recurring nature of consumables such as ATP swabs, assay plates, and reagent buffers that are essential for routine laboratory operations. These items are required in high volume for continuous research, quality testing, and diagnostic workflows. For instance, the United States Food and Drug Administration (FDA) mandates ATP testing in food processing environments, significantly increasing the demand for consumables. Moreover, clinical diagnostics and pharma labs, including those operating under the Centers for Disease Control and Prevention (CDC), use ATP consumables in contamination and sterility checks. Their frequent use, combined with high turnover rates, has made them essential across industries like biotechnology, pharmaceuticals, food safety, and environmental testing—solidifying their dominant position in the market.

By Assay Type

Luminometric ATP assays led the Adenosine Triphosphate Assays Market in 2023, accounting for a 41.7% market share. These assays dominate due to their high sensitivity and rapid quantification capabilities using bioluminescence. The method is widely adopted across industrial hygiene, food safety, and clinical diagnostics for real-time microbial detection. For example, the Environmental Protection Agency (EPA) in the United States supports luminometric ATP methods for surface cleanliness monitoring in water testing applications. Additionally, hospitals and pharmaceutical manufacturers prefer luminometric assays for their precision and compatibility with automation, reducing error margins in sterile environments. Prominent institutions like the U.S. Department of Agriculture (USDA) also advocate ATP-based luminometric assays for evaluating surface contamination in food production. Their applicability across sectors—ranging from pharma to public sanitation has fueled their rapid adoption, securing a leadership position in assay types.

By Application

Drug discovery and development emerged as the dominant application segment in the Adenosine Triphosphate Assays Market in 2023, representing a 39.6% share. The surge is driven by the rising demand for cell viability assays, cytotoxicity studies, and screening platforms in pharmaceutical R&D. Leading regulatory bodies like the National Institutes of Health (NIH) and pharmaceutical giants across the U.S. have expanded funding for early-phase drug screening using ATP assays. These assays provide a reliable indication of cell health and proliferation, essential for evaluating compound efficacy and safety. Furthermore, the COVID-19 pandemic accelerated the development of ATP-based rapid assays for antiviral drug testing, supported by initiatives from the Biomedical Advanced Research and Development Authority (BARDA). Their cost-effectiveness, reproducibility, and integration with high-throughput screening tools have made them indispensable in preclinical and clinical drug testing, reinforcing their dominance in application.

By End-user

Pharmaceutical and biotechnology companies held the largest share in the Adenosine Triphosphate Assays Market in 2023 at 46.2%, owing to their extensive use of ATP assays in product development, sterility testing, and process monitoring. These companies deploy ATP assays to assess cell viability, microbial contamination, and energy metabolism in experimental models. For instance, Pfizer and Johnson & Johnson employ ATP-based assays during their biologics and vaccine production stages. Additionally, the U.S. Pharmacopeial Convention (USP) recommends ATP bioluminescence testing for rapid microbial enumeration in cleanroom environments. The expanding pipeline of biologics and the need for stringent quality controls have driven assay integration across all development stages. The adoption of 21 CFR Part 11-compliant ATP assay systems further enables regulatory-compliant workflows in biotech firms, driving robust segment growth and cementing their dominance.

Regional Analysis

Asia Pacific dominated the Adenosine Triphosphate Assays Market in 2023 with a market share of 41.5%, propelled by rising pharmaceutical investments, expanding food safety regulations, and the boom in biotechnology research. Countries like China, Japan, and India are at the forefront of this growth. In China, government initiatives under the "Healthy China 2030" plan have encouraged widespread adoption of biosafety testing, including ATP-based methods. The Indian Council of Medical Research (ICMR) also promotes ATP assays for rapid bacterial detection in diagnostic labs. Japan, home to key pharma firms like Takeda and Astellas, utilizes ATP assays in drug discovery and cleanroom monitoring. Increased outsourcing of clinical trials to Asia due to lower costs and skilled workforce further contributes to assay demand. Moreover, local production of cost-effective consumables and instruments makes ATP testing more accessible in emerging markets, establishing Asia Pacific not only as a dominant region but also as the fastest-growing during the forecast period.

On the other hand, North America emerged as the fastest-growing region in the Adenosine Triphosphate Assays Market during the forecast period with a substantial growth rate. This rapid growth stems from advanced healthcare infrastructure, strong biotech presence, and active regulatory oversight. The United States leads the regional market due to initiatives by the Food and Drug Administration (FDA) to integrate rapid microbial testing technologies, including ATP assays, across pharmaceutical and food industries. Major biotech hubs like Boston and San Diego are witnessing increasing adoption of ATP-based assays for drug screening and quality assurance. Additionally, the Centers for Disease Control and Prevention (CDC) promotes ATP-based hygiene monitoring in hospitals, further expanding their application scope. Canada is emerging as the fastest-growing country in the region due to rising government funding for life sciences research and increased collaboration with U.S.-based assay developers. Mexico, meanwhile, benefits from growing investments in food safety and cross-border pharmaceutical manufacturing, boosting demand for ATP assays.

Need any customization research on ATP Assays Market - Enquiry Now

Key Players

-

3M Company (Clean-Trace ATP Water Test, Clean-Trace Surface ATP Test)

-

Abcam plc (ATP Assay Kit Colorimetric, ATP Assay Kit Luminescence)

-

Agilent Technologies Inc. (BioTek Synergy H1 ATP Detection System, CellTiter-Glo Compatibility Assays)

-

AAT Bioquest, Inc. (ATP Colorimetric Assay Kit, ATP-Glo Bioluminescent Assay Kit)

-

Abnova Corporation (ATP Colorimetric Assay Kit, ATP Fluorometric Assay Kit)

-

BioThema AB (ATP Biomass Kit HS, ViaLight Plus Kit)

-

BioVision Inc. (ATP Assay Kit Colorimetric, PicoProbe ATP Fluorometric Assay Kit)

-

Biotium, Inc. (ATP-Glo Bioluminescent Assay Kit, ViaFluor Cell Viability Kit)

-

Cayman Chemical (ATP Detection Assay Kit Luminescent, Mitochondrial ATP Assay Kit)

-

Danaher Corporation (ViaLight Plus Cell Proliferation Kit, EnSight Multimode Plate Reader)

-

Elabscience Biotechnology Inc. (ATP Assay Kit Colorimetric, ATP Assay Kit Luminescent)

-

Geno Technology, Inc. (ATP Colorimetric/Fluorometric Assay Kit, ATP Detection Kit)

-

Lonza Group Ltd. (Lucetta 2 ATP Assay, Luminometer Systems for ATP Testing)

-

Merck KGaA (ATP Assay Kit Luminescent, ATP Determination Kit)

-

MBL International Corporation (Luminescent ATP Detection Kit, Cell Viability ATP Assay Kit)

-

PerkinElmer Inc. (ATPlite Luminescence Assay System, EnSpire Multimode Plate Reader)

-

PromoCell GmbH (CellTiter ATP Assay Kit, PromoKine ATP Detection Kit)

-

Promega Corporation (CellTiter-Glo Luminescent Cell Viability Assay, ENLITEN ATP Assay System)

-

Thermo Fisher Scientific Inc. (ATP Determination Kit, Luminescent ATP Detection Assay Kit)

-

Neogen Corporation (AccuPoint Advanced ATP Sanitation Monitoring System, AccuPoint ATP Surface Test)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 299.64 Million |

| Market Size by 2032 | USD 564.76 Million |

| CAGR | CAGR of 7.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Instruments, Reagents and Kits, Consumables) •By Assay Type (Luminometric ATP Assays, Enzymatic ATP Assays, Bioluminescence Resonance Energy Transfer (BRET) ATP Assays, Cell-based ATP Assays, Others) •By Application (Drug Discovery and Development, Clinical Diagnostics, Environmental Testing, Food Safety and Quality Testing, Others) •By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospital and Diagnostics Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Promega Corporation, PerkinElmer Inc., Merck KGaA, Danaher Corporation, Agilent Technologies Inc., Lonza Group Ltd., Abcam plc, BioVision Inc., 3M Company and other key players |