Get more information on Asset Integrity Management Market - Request Sample Report

The Asset Integrity Management Market size was valued at USD 22.37 billion in 2023 and is expected to grow to USD 34.11 billion by 2032 and grow at a CAGR of 4.8% over the forecast period of 2024-2032.

The global asset integrity management (AIM) market is growing with stringent regulatory norms, as well as safety concerns and demands for operational efficiency across diverse industries. It has driven the need to get upgraded due to aging infrastructure, strict regulations, as well as advancement in technology, and is expanding its market growth. Oil & gas, power generation, manufacturing, and aerospace are the key application sectors fuelling AIM solutions demand. Growing digitalization and implementation of IoT transform the market by facilitating real-time tracking, and predictive maintenance strategies. Adoption of Asset Integrity Management solutions through cloud technologies for new offshore areas and increasing demand from the market. Despite increasing costs and configuration complexities still being major market restraints.

Asset integrity management services are important for monitoring of investments throughout their lifecycle, aiding in maintenance decisions to prevent breakdowns and reduce risks. Companies such as GE are making significant investments in AIM technologies in the energy, aviation, and healthcare sectors by employing platforms like Predix for asset performance management. Government Commitment, The US Department of Energy, has funded $75M to AIM projects across the energy landscape, and recent news reports that up to 500 USD billion will be invested in infrastructure modernization within the US Infrastructure Investment and Jobs Act to improving critical asset integrity. Moreover, prominent industry players such as Baker Hughes are making substantial investments in AI and IoT-based AIM solutions to enhance the reliability of assets. These initiatives highlight the increasing role AIM is playing in supporting operational efficiency and regulatory compliance across global industries.

Drivers

Increasing need to maintain and upgrade aging infrastructure in industries such as oil & gas, power, and chemical.

Integration of advanced technologies such as IoT, AI, and big data analytics for real-time monitoring and predictive maintenance.

Growing emphasis on safety and risk management to prevent accidents and environmental hazards.

Increasing energy consumption driving the need for efficient asset management in the energy sector.

The increasing need to manage aged assets in high-risk industries is a significant factor that propels the growth of the asset integrity management market. The susceptibility of aging infrastructure and equipment is deteriorating at an accelerated pace, creating higher operational reliability and safety risks. This is where Achieving Effective AIM becomes important, especially in industries such as Oil and Gas, Petrochemicals & Power that are usually exposed to a harsh operating environment with its business imperative of complying with the ever-toughened regulatory requirements. Whilst a risk-based approach is employed to prioritize the allocation of resources and interventions based on asset criticality, potential failure modes and preservation of heritage assets with extended lifespan combined with performance optimization are facilitated by proactive maintenance strategies. Aging assets most often denote a high-risk facility and the organizations that operate in such facilities are consistently looking for ways to reduce downtime and improve safety while optimizing the value of their assets - making aging asset maintenance one of its top priorities and underscoring an urgent need for AIM solutions, especially within high-risk industries.

The growth of the power sector in developing countries presents lucrative opportunities for the AIM market. Increasing demand for power generation and distribution infrastructure in developing countries on account of rapid industrialization and urbanization The Checking of Critical assets like Power plants, Transmission lines, and Substations requires robust AIM practices for Cost-Effective growth with Reliability, Safety & Regulatory Compliance. Furthermore, several emerging economies have not developed asset management frameworks so AIM providers can offer customized solutions and expertise to help in the development and optimization of power infrastructure. These growth opportunities can help AIM companies increase their market share by efficiently supplying the rising power needs among emerging nations.

Restraints

Significant upfront investment is required for implementing asset integrity management systems and technologies.

Challenges associated with integrating new technologies with existing legacy systems, and Lack of skilled professionals.

Ongoing maintenance and operational costs associated with asset integrity management systems.

The asset integrity management (AIM) system faces restrain in installation complexity, and the high cost is a major constraint to this market. Integrating AIM systems is a complex proposition that generally requires very specific expertise and resources to implement, proving costly for organizations. The implementation cost (including software, hardware, and training) is an entry barrier to small enterprises with constrained budgets. As a result, such complexity and high costs make it difficult for AIM solutions to become more pervasive in organizations which is especially the case when most of those companies are on limited budgets and resources.

By Service Type

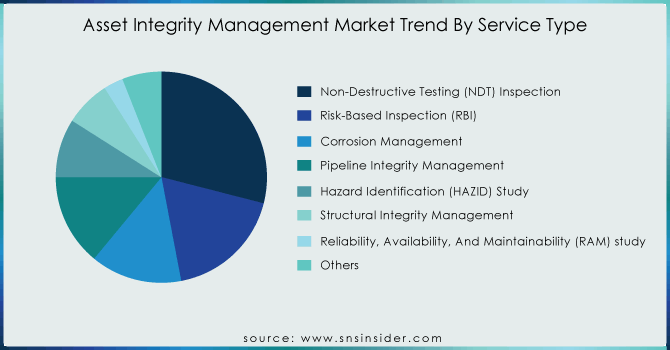

In 2023, the non-destructive testing (NDT) inspection segment is dominated the asset integrity management market It accounted for a higher share of more than 29% as it plays an important role in maintaining the safety, reliability & compliance of industrial assets across multiple industries. NDT methods are good for the assessment of assets as they allow a full examination without harm - compared to conventional approaches. The versatility of NDT as a technology for finding flaws, defects, and weaknesses in materials, welds, or components without interrupting operations delivers necessary insights into asset condition. The importance of safety, regulatory compliance, and cost savings in the industry is set to increase the requirement for NDT inspection services with NDT inspection maintaining its dominance.

Need any customization research/data on Asset Integrity Management Market - Enquiry Now

By Industry

The asset integrity management market is led by the power sector, with an accounted revenue share of more than 23.5% in 2023. The growing acceptance of renewable energy sources is leading to this, in turn increasing demand for efficient asset management tools. Further, the increasing globalization of power infrastructure is driving demand for monitoring and maintenance solutions to satisfy regulatory needs while simultaneously managing risk as global infrastructures continue to age. Increased electricity requirements in developing countries, coupled with the expansion of power infrastructure are subsequently driving demand for asset management services. Further, the advent of digitalization and smart grid technologies in the industry demand advanced monitoring & maintenance solutions that support the power sector to lead the asset integrity management market.

Regional analysis

The growth of the asset integrity management market in North America is increasing because of the presence of many oil and gas, manufacturing, power generation, and aerospace industries in the area which results in to increase in demand for asset integrity management services that will ensure operational reliability and safety. NA held the revenue share of more than 34% in 2023, Sophisticated asset monitoring and maintenance solutions will see increased adoption in North America as a result of advanced technological capabilities and mature/regulatory framework. Its commitment to innovation and infrastructure modernization has also solidified its place as a leader in the market. Rising focuses on sustainability and environmental stewardship further solidify North American dominance. The US asset integrity management market is expected to grow heavily by 2032. Increasing need for asset integrity management in oil and gas pipelines, power plants, and bridges among other critical assets driving the growth of the market. The demand for pipeline integrity management is fuelled by extensive oil and gas sector infrastructure networks, with the need to monitor leaks, corrosion as well as other possible factors causing disruption in case of any casualty. AIM is also important for the development and expansion of renewable energy production, overall system operation as well as needed grid reinforcement around a modernized power sector further bolstering market demand.

The Asia Pacific region is expected to grow at the highest CAGR in the asset integrity management market, as rapid industrialization and infrastructure development will lead to an increased demand for efficient AIM solutions that can provide operational safety and reliability. The oil & gas, manufacturing, and power generation industries have been increasingly adopting advanced technologies such as IoT and AI which could pave the way for real-time monitoring along with predictive maintenance activities thereby fuelling the market growth. Furthermore, rising energy consumption in developing markets and renewable investments increase the requirement for comprehensive AIM services. High CAGR in this region is expected to be driven by stringent regulatory requirements and increased awareness of asset optimization & safety. For instance, Shell announced $1 billion over five years to invest in digital technology, including AIM for AI and IoT use cases like predictive maintenance, real-time monitoring of things that go boom, etc. The asset-intensive make-in-India initiative of the Indian govt has made mandatory to use of AIM technologies for achieving optimum levels of Safety & Performance in industry, where it is enabling several private companies also by way of an economic investment-benefit with a few collaborations, implementing advanced AIM solutions. In the UK, £100m of funding has been earmarked by the government under its Industrial Strategy Challenge Fund for innovation in AIM technologies to aid research on digital twins and AI for asset management. The European Union has set aside €1 billion for digital transformation efforts such as AIM projects under its Horizon Europe program aimed at fostering innovation in areas like predictive maintenance, digital twins, and remote monitoring technologies within the process industry.

The Major players in the market are SGS, Rosen Swiss, Bureau Veritas, MISTRAS Group Inc., TWI, Intertek Group, TechnipFMC, Aker Solutions, LifeTech, Genesis Oil and Gas Consultants, EM&I, Metegrity, FORCE Technology, Lloyd's Register, RINA, TÜV SÜD, and others in the final report.

Recent Developments

In October 2023 Applus+, under its diagnostics Services delivery line was awarded a contract (Master agreement) covering inspection & expediting activities throughout the globe with one major Oil & Gas player operating out from Italy. The agreement includes Applus+ specialists in oil and gas drilling and production solutions, who also offer asset integrity services to ensure regulatory compliance meets or exceeds standards for increased safety efficiency.

Harbour Energy secured a five-year contract with Fluor Corporation for Integrated Asset Integrity Services for the AELE hub and extension of service offering into Solan, J-Area Great Britannia Area, up to 7 Years of Work. This partnership solidifies Stork's commitment to fully integrated integrity services within the offshore oil and gas industry.

Baker Hughes and BP p.l.c. collaborated to develop CordantTM, integrated asset performance management solutions, and process optimization suite In March 2023, with an emphasis on reliability improvements to increase efficiency while reducing risks.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 22.37 billion |

| Market Size by 2032 | US$ 43.11 Billion |

| CAGR | CAGR of 4.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Non-Destructive Testing (NDT) Inspection, Risk-Based Inspection (RBI), Corrosion Management, Pipeline Integrity Management, Hazard Identification (HAZID) Study, Structural Integrity Management, Reliability, Availability, And Maintainability (RAM) study, Others) • By Industry (Oil & gas, Power, Mining, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SGS, Rosen Swiss, Bureau Veritas, MISTRAS Group Inc., TWI, Intertek Group, TechnipFMC, Aker Solutions, LifeTech, Genesis Oil and Gas Consultants, EM&I, Metegrity, FORCE Technology, Lloyd's Register, RINA, TÜV SÜD |

| Key Drivers | • Increasing need to maintain and upgrade aging infrastructure in industries such as oil & gas, power, and chemical. • Integration of advanced technologies such as IoT, AI, and big data analytics for real-time monitoring and predictive maintenance. |

| RESTRAINTS | • Significant upfront investment is required for implementing asset integrity management systems and technologies. |

Growth rate of the Asset Integrity Management Market is CAGR 4.8 %.

The market is expected to grow to USD 34.11 billion by the forecast period of 2032.

The major players are SGS (Switzerland), Bureau Veritas (France), Intertek Group (UK), TechnipFMC (UK), Aker Solutions (Norway), Rosen Swiss (Switzerland), LifeTech (UK), EM&I (UK), Metegrity (Canada), TWI (UK), TÜV SÜD (Germany) and others in final report, etc.

North America is dominating region in the asset Integritiy management market.

The forecast period for the Asset Integrity Management Market is 2024-2032.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Asset Integrity Management Market Segmentation, By Service Type

7.1 Introduction

7.2 Non-Destructive Testing (NDT) Inspection

7.3 Risk-Based Inspection (RBI)

7.4 Corrosion Management

7.5 Pipeline Integrity Management

7.6 Hazard Identification (HAZID) Study

7.7 Structural Integrity Management

7.8 Reliability, Availability, And Maintainability (RAM) study

7.9 Others

8. Asset Integrity Management Market Segmentation, By Industry

8.1 Introduction

8.2 Oil & gas

8.3 Power

8.4 Mining

8.5 Aerospace

8.6 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Asset Integrity Management Market by Country

9.2.3 North America Asset Integrity Management Market By Service Type

9.2.4 North America Asset Integrity Management Market By Industry

9.2.5 USA

9.2.5.1 USA Asset Integrity Management Market By Service Type

9.2.5.2 USA Asset Integrity Management Market By Industry

9.2.6 Canada

9.2.6.1 Canada Asset Integrity Management Market By Service Type

9.2.6.2 Canada Asset Integrity Management Market By Industry

9.2.7 Mexico

9.2.7.1 Mexico Asset Integrity Management Market By Service Type

9.2.7.2 Mexico Asset Integrity Management Market By Industry

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Asset Integrity Management Market by Country

9.3.2.2 Eastern Europe Asset Integrity Management Market By Service Type

9.3.2.3 Eastern Europe Asset Integrity Management Market By Industry

9.3.2.4 Poland

9.3.2.4.1 Poland Asset Integrity Management Market By Service Type

9.3.2.4.2 Poland Asset Integrity Management Market By Industry

9.3.2.5 Romania

9.3.2.5.1 Romania Asset Integrity Management Market By Service Type

9.3.2.5.2 Romania Asset Integrity Management Market By Industry

9.3.2.6 Hungary

9.3.2.6.1 Hungary Asset Integrity Management Market By Service Type

9.3.2.6.2 Hungary Asset Integrity Management Market By Industry

9.3.2.7 Turkey

9.3.2.7.1 Turkey Asset Integrity Management Market By Service Type

9.3.2.7.2 Turkey Asset Integrity Management Market By Industry

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Asset Integrity Management Market By Service Type

9.3.2.8.2 Rest of Eastern Europe Asset Integrity Management Market By Industry

9.3.3 Western Europe

9.3.3.1 Western Europe Asset Integrity Management Market by Country

9.3.3.2 Western Europe Asset Integrity Management Market By Service Type

9.3.3.3 Western Europe Asset Integrity Management Market By Industry

9.3.3.4 Germany

9.3.3.4.1 Germany Asset Integrity Management Market By Service Type

9.3.3.4.2 Germany Asset Integrity Management Market By Industry

9.3.3.5 France

9.3.3.5.1 France Asset Integrity Management Market By Service Type

9.3.3.5.2 France Asset Integrity Management Market By Industry

9.3.3.6 UK

9.3.3.6.1 UK Asset Integrity Management Market By Service Type

9.3.3.6.2 UK Asset Integrity Management Market By Industry

9.3.3.7 Italy

9.3.3.7.1 Italy Asset Integrity Management Market By Service Type

9.3.3.7.2 Italy Asset Integrity Management Market By Industry

9.3.3.8 Spain

9.3.3.8.1 Spain Asset Integrity Management Market By Service Type

9.3.3.8.2 Spain Asset Integrity Management Market By Industry

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Asset Integrity Management Market By Service Type

9.3.3.9.2 Netherlands Asset Integrity Management Market By Industry

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Asset Integrity Management Market By Service Type

9.3.3.10.2 Switzerland Asset Integrity Management Market By Industry

9.3.3.11 Austria

9.3.3.11.1 Austria Asset Integrity Management Market By Service Type

9.3.3.11.2 Austria Asset Integrity Management Market By Industry

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Asset Integrity Management Market By Service Type

9.3.2.12.2 Rest of Western Europe Asset Integrity Management Market By Industry

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Asset Integrity Management Market by Country

9.4.3 Asia Pacific Asset Integrity Management Market By Service Type

9.4.4 Asia Pacific Asset Integrity Management Market By Industry

9.4.5 China

9.4.5.1 China Asset Integrity Management Market By Service Type

9.4.5.2 China Asset Integrity Management Market By Industry

9.4.6 India

9.4.6.1 India Asset Integrity Management Market By Service Type

9.4.6.2 India Asset Integrity Management Market By Industry

9.4.7 Japan

9.4.7.1 Japan Asset Integrity Management Market By Service Type

9.4.7.2 Japan Asset Integrity Management Market By Industry

9.4.8 South Korea

9.4.8.1 South Korea Asset Integrity Management Market By Service Type

9.4.8.2 South Korea Asset Integrity Management Market By Industry

9.4.9 Vietnam

9.4.9.1 Vietnam Asset Integrity Management Market By Service Type

9.4.9.2 Vietnam Asset Integrity Management Market By Industry

9.4.10 Singapore

9.4.10.1 Singapore Asset Integrity Management Market By Service Type

9.4.10.2 Singapore Asset Integrity Management Market By Industry

9.4.11 Australia

9.4.11.1 Australia Asset Integrity Management Market By Service Type

9.4.11.2 Australia Asset Integrity Management Market By Industry

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Asset Integrity Management Market By Service Type

9.4.12.2 Rest of Asia-Pacific Asset Integrity Management Market By Industry

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Asset Integrity Management Market by Country

9.5.2.2 Middle East Asset Integrity Management Market By Service Type

9.5.2.3 Middle East Asset Integrity Management Market By Industry

9.5.2.4 UAE

9.5.2.4.1 UAE Asset Integrity Management Market By Service Type

9.5.2.4.2 UAE Asset Integrity Management Market By Industry

9.5.2.5 Egypt

9.5.2.5.1 Egypt Asset Integrity Management Market By Service Type

9.5.2.5.2 Egypt Asset Integrity Management Market By Industry

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Asset Integrity Management Market By Service Type

9.5.2.6.2 Saudi Arabia Asset Integrity Management Market By Industry

9.5.2.7 Qatar

9.5.2.7.1 Qatar Asset Integrity Management Market By Service Type

9.5.2.7.2 Qatar Asset Integrity Management Market By Industry

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Asset Integrity Management Market By Service Type

9.5.2.8.2 Rest of Middle East Asset Integrity Management Market By Industry

9.5.3 Africa

9.5.3.1 Africa Asset Integrity Management Market by Country

9.5.3.2 Africa Asset Integrity Management Market By Service Type

9.5.3.3 Africa Asset Integrity Management Market By Industry

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Asset Integrity Management Market By Service Type

9.5.2.4.2 Nigeria Asset Integrity Management Market By Industry

9.5.2.5 South Africa

9.5.2.5.1 South Africa Asset Integrity Management Market By Service Type

9.5.2.5.2 South Africa Asset Integrity Management Market By Industry

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Asset Integrity Management Market By Service Type

9.5.2.6.2 Rest of Africa Asset Integrity Management Market By Industry

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Asset Integrity Management Market by Country

9.6.3 Latin America Asset Integrity Management Market By Service Type

9.6.4 Latin America Asset Integrity Management Market By Industry

9.6.5 Brazil

9.6.5.1 Brazil Asset Integrity Management Market By Service Type

9.6.5.2 Brazil Asset Integrity Management Market By Industry

9.6.6 Argentina

9.6.6.1 Argentina Asset Integrity Management Market By Service Type

9.6.6.2 Argentina Asset Integrity Management Market By Industry

9.6.7 Colombia

9.6.7.1 Colombia Asset Integrity Management Market By Service Type

9.6.7.2 Colombia Asset Integrity Management Market By Industry

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Asset Integrity Management Market By Service Type

9.6.8.2 Rest of Latin America Asset Integrity Management Market By Industry

10. Company Profiles

10.1 SGS

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Rosen Swiss

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Bureau Veritas

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 MISTRAS Group Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 TWI

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Intertek Group

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 TechnipFMC

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Aker Solutions

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 LifeTech

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Genesis Oil and Gas Consultants

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Service Type

Non-Destructive Testing (NDT) Inspection

Risk-Based Inspection (RBI)

Corrosion Management

Pipeline Integrity Management

Hazard Identification (HAZID) Study

Structural Integrity Management

Reliability, Availability, And Maintainability (RAM) study

Others

By Industry

Oil & gas

Power

Mining

Aerospace

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Virtual Reality in Healthcare Market Size was USD 3.20 billion in 2023 and will reach USD 46.40 Bn by 2032, growing at a CAGR of 33.30% from 2024-2032.

The Embedded Hypervisor Market Size was USD 12.02 Billion in 2023 and will reach to USD 23.63 Billion by 2032 and grow at a CAGR of 7.80% by 2024-2032.

Product Analytics Market was valued at USD 14.73 billion in 2023 and is expected to reach USD 84.33 billion by 2032, growing at a CAGR of 21.45% from 2024-2032.

The 3D Rendering Market was valued at USD 4.07 billion in 2023 and is expected to reach USD 23.02 billion by 2032, growing at a CAGR of 21.27% over the forecast period 2024-2032.

The Broadcast Scheduling Software Market Size was valued at USD 1.6 Billion in 2023 and is expected to reach USD 7.84 Billion by 2032, growing at a CAGR of 19.34% over the forecast period 2024-2032.

Content Intelligence Market was valued at USD 1.54 billion in 2023 and is expected to reach USD 17.59 billion by 2032, growing at a CAGR of 31.15% from 2024-2032.

Hi! Click one of our member below to chat on Phone