Aspherical Lens Market Size & Growth:

The Aspherical Lens Market was valued at USD 9.23 billion in 2023 and is projected to reach USD 15.76 billion by 2032, growing at a CAGR of 6.13% from 2024 to 2032. key drivers of this growth is the technological advancements in the manufacturing process, which have led to enhanced efficiency, reduced production costs, and improved optical performance. Moreover, the demand for high-precision lenses is on the rise, particularly in applications such as consumer electronics, medical devices, and automotive sectors. These lenses offer superior image quality, minimal distortion, and compact designs, which makes them ideal for cutting-edge devices like smartphones and digital cameras.

To Get more information on Aspherical Lens Market - Request Free Sample Report

The industry is also seeing a shift towards sustainability, with manufacturers focusing on eco-friendly production processes and recyclable materials to meet increasing consumer and regulatory demands. Furthermore, raw material dependency continues to be a challenge, with fluctuations in the supply of essential materials like rare earth elements affecting production costs. To mitigate these challenges, R&D in new lens materials is actively progressing, leading to the development of innovative materials that enhance durability, weight reduction, and optical performance. The US Aspherical Lens Market was valued at USD 1.96 billion in 2023 and is expected to grow to USD 3.45 billion by 2032 with a CAGR 6.49%, driven by strong demand in the automotive, consumer electronics, and optical instrument industries, reflecting the region’s adoption of advanced imaging technologies.

Aspheric Lenses Market Dynamics:

Drivers:

-

Advancements in Aspherical Lenses for High-Resolution Imaging and Market Growth

Aspherical lenses are becoming increasingly popular due to their ability to improve high-resolution imaging in different applications, including medical imaging, industrial inspection, and terahertz (THz) imaging, which is expected to drive market growth. Aspherical lenses are further used in medical imaging to enhance optical coherence tomography (OCT) and refine endoscopic accuracy, leading to clearer diagnostics and minimally invasive procedures. In industrial inspection, they optimize laser-based imaging by reducing aberrations, increasing precision, and eliminating oversampling artifacts. Secondary, HDPE aspherical lenses technology has prevailed in THz imaging system, which can extend DOF to 85mm (depth of focus) and improve the contrast over 15%, accomplishing high-precision imaging at distance greater than 415mm. Such innovations are propelling the aspherical lens market, with increasing demand for these through healthcare, semiconductor, and aerospace industries, as companies continue to seek superior imaging performance and efficiency.

Restraints:

-

Material Limitations in Aspherical Lenses Challenges in Durability Thermal Expansion and Environmental Resistance

Material limitations pose a significant restraint in the aspherical lens market, as certain lenses made from polymers or specialty glass face challenges related to durability, thermal expansion, and environmental resistance. Polymer-based aspherical lenses, while cost-effective and lightweight, often suffer from lower scratch resistance and degradation under prolonged UV exposure, limiting their lifespan in harsh conditions. Specialty glass lenses, on the other hand, offer superior optical performance but are prone to thermal expansion, causing distortions in high-temperature environments such as industrial laser systems and aerospace applications. Additionally, environmental factors like humidity and chemical exposure can alter the refractive index or lead to surface damage, reducing optical efficiency. These material constraints necessitate advanced coatings or hybrid material solutions, increasing production costs and limiting the widespread adoption of aspherical lenses in demanding applications like precision optics and high-power laser systems.

Opportunities:

-

Rising Demand for Aspherical Lenses in Autonomous Vehicles and ADAS

The growing prevalence of autonomous cars and Advanced Driver Assistance Systems (ADAS) is driving demand for high-performance optical components like custom aspheric lenses. LiDAR sensors, which are a key technology for vehicle perception, use these lenses to increase the amount of light that reaches the sensor (called optical throughput), reduce optical aberrations, and increase depth accuracy. Aspherical lenses play a key role in improving camera resolution and making object detection more accurate in pursuit of safe navigation in self-driving cars. ADAS equipment like lane departure warnings, adaptive cruise control, and night vision systems are also improved through using aspherical optics that enable better use of imaging capabilities. As the industry continues this trend towards a future of autonomous mobility, regulatory mandates around vehicle safety are increasing and are also expediting the integration of LiDAR and camera-based perception systems which are generating tremendous growth opportunities for aspherical lens manufacturers. With the global autonomous vehicle market projected to expand rapidly, the demand for advanced optical components is expected to rise, further driving innovation in lens design and production.

Challenges:

-

Achieving the desired optical performance in aspherical lenses requires complex design and precision manufacturing, making production highly challenging.

Traditional spherical lenses, aspherical lenses have varying surface curvatures that must be meticulously engineered to minimize aberrations and enhance image quality. This intricate shaping demands advanced fabrication techniques such as precision molding, diamond turning, or computer-controlled polishing, all of which are time-consuming and expensive. Even minor deviations in curvature can lead to optical distortions, requiring rigorous quality control and testing. Additionally, integrating these lenses into optical systems necessitates precise alignment, further increasing production complexity. The lack of standardized designs also means that each lens often requires customization, adding to costs and development time. As a result, despite their superior optical performance, aspherical lenses remain challenging to mass-produce, limiting their widespread adoption in cost-sensitive applications.

Aspherical Lens Market Segment Analysis:

By Type

In 2023, the glass aspherical lens segment held the largest revenue share in the aspherical lens market of around 69%, driven by its superior optical performance, durability, and resistance to environmental factors. Glass aspherical lenses offer high refractive indices and low dispersion, making them ideal for applications requiring precision, such as high-end cameras, medical imaging devices, and LiDAR systems. Unlike plastic alternatives, glass lenses maintain their shape and optical properties under varying temperatures, ensuring long-term stability. Additionally, advancements in glass molding technology have improved cost efficiency, enabling mass production without compromising quality. The growing demand for high-resolution imaging in industries like automotive, aerospace, and consumer electronics has further fueled the dominance of glass aspherical lenses. As technological innovations continue, glass lenses are expected to remain the preferred choice for applications requiring exceptional optical clarity and reliability.

The plastic aspherical lens segment is the fastest-growing in the aspherical lens market over the forecast period 2024–2032, driven by its cost-effectiveness, lightweight properties, and ease of mass production. Plastic lenses are commonly used in consumer electronics including smartphones, VR headsets, and automotive displays, since they can be molded into complicated shapes with low post-processing. Recent technology developments in polymer materials have enhanced optical properties so that aberrations are reduced and clarity improved, also making polymer materials competitive to glass alternatives. Moreover, the increasing need for compact, lightweight optical systems in new applications such as augmented reality (AR) and advanced driver-assistance systems (ADAS) is driving market growth as well. With manufacturers focusing on enhancing thermal stability along with scratch resistance, the adoption of plastic aspherical lenses across multiple industries including automotive and electronics, is anticipated to grow significantly, which in turn is set to propel their rapid market growth.

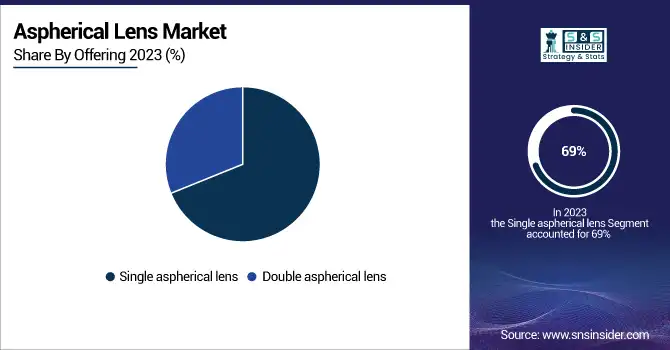

By Offering

The single aspherical lens segment held the largest revenue share of approximately 69% in the aspherical lens market in 2023, driven by its extensive adoption in imaging, consumer electronics, and optical precision instruments. These lenses efficiently correct spherical aberrations with a single optical element, reducing the need for multiple lenses while maintaining superior image quality. Their lightweight design, cost-effectiveness, and ability to enhance optical performance make them ideal for applications in cameras, eyeglasses, medical imaging devices, and laser systems. The growing demand for high-resolution imaging, compact optical systems, and advanced vision correction solutions is further propelling the adoption of single aspherical lenses. As industries continue to focus on miniaturization and performance optimization, the dominance of this segment is expected to persist over the forecast period.

The double aspherical lens segment is the fastest-growing in the aspherical lens market over the forecast period 2024-2032, due to its increased optical performance and capability to reduce distortions more effectively than that of the single aspherical lenses. Huge prism lens for high-precision applications: advanced cameras, AR/VR headsets, automotive optics, and industrial imaging systems. Incorporating aspherical surfaces on both the front and the rear surfaces, double aspherical lenses contribute to even higher image quality, with minimal aberration and maximum light transmission, which is crucial for the next generation of optical devices. However, with growing demand for compact, lightweight, high-performance optical components across the consumer electronics, healthcare, and automotive sectors, further yielding their swift acceptance. Moreover, technological advancements in precision manufacturing and optical design technologies are expected to augment this segment's growth over the next few years.

By Manufacturing Technology

The molding segment dominated the aspherical lens market with the largest revenue share of approximately 51% in 2023 and is expected to be the fastest-growing segment over the forecast period 2024-2032. Molding techniques, such as injection molding for plastic lenses and precision glass molding (PGM) for glass lenses, enable cost-effective mass production while maintaining high optical performance. These processes allow manufacturers to create complex aspherical designs with minimal post-processing, reducing production costs and improving efficiency. The growing demand for lightweight and compact optical components in industries such as consumer electronics, automotive, and medical imaging is driving the expansion of this segment. Additionally, advancements in material science and molding technologies are enhancing the quality and durability of molded aspherical lenses, further fueling their adoption across various high-performance optical applications.

By Application

The consumer electronics segment held the largest revenue share of approximately 45% in the aspherical lens market in 2023, driven by the increasing demand for high-quality optical components in smartphones, tablets, cameras, and augmented reality (AR)/virtual reality (VR) devices. Aspherical lenses play a crucial role in enhancing image quality by minimizing distortions, reducing aberrations, and improving light transmission, making them essential for compact and high-resolution camera modules. The rise of multi-camera setups in smartphones and the growing popularity of AR/VR headsets have further fueled the adoption of these lenses. Additionally, advancements in lens manufacturing techniques, such as precision molding and hybrid aspherical lens technology, have enabled cost-effective production, supporting market growth. With continuous innovations in imaging technology and increasing consumer demand for enhanced visual experiences, the consumer electronics segment is expected to remain a key driver of the aspherical lens market.

The automotive segment is the fastest-growing sector in the aspherical lens market, due to the growing adoption of advanced driver-assistance systems (ADAS) across the world as well as the demand for LiDAR technology and high-performance lighting solutions. As a result, aspherical lenses are highly coveted in modern automotive applications, reducing optical aberrations, providing crisp, high-quality images, and increasing light efficiency. As the demand for autonomous and semi-autonomous vehicles grows, so too do the demands for high precision optical components, especially in sensors and cameras deployed for collision detection, lane departure detection, and night vision systems. Moreover, automotive makers are using aspherical lenses in head-up displays (HUDs) and adaptive LED headlights to further improve driver safety and visibility. The growing investments in electric and smart vehicles, coupled with advancements in optical technology, are expected to fuel significant growth in the automotive aspherical lens market from 2024 to 2032.

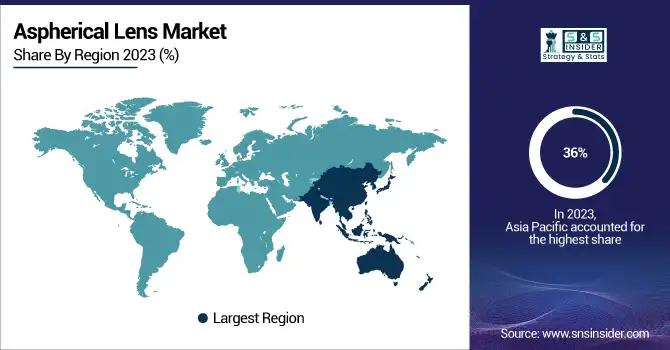

Aspheric Lenses Market Regional Landscape:

The Asia-Pacific region dominated the aspherical lens market with the largest revenue share of approximately 36% in 2023, driven by the rapid expansion of industries such as consumer electronics, automotive, and telecommunications. Countries like China, Japan, South Korea, and Taiwan are leading manufacturers of smartphones, cameras, and optical devices, fueling the demand for high-precision aspherical lenses. The region also benefits from a strong presence of key market players, robust supply chains, and technological advancements in optics manufacturing. Additionally, the growing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) in the automotive sector is further propelling demand.

North America is expected to be the fastest-growing region in the aspherical lens market over the forecast period from 2024 to 2032, due to rapid technological advancements in autonomous vehicles, consumer electronics, and aerospace applications. Market growth is being driven by the growing use of LiDAR technology in self-driving cars, as well as a need for high-performance optical components in AR/VR devices and also high-resolution imaging systems. In the U.S. and Canada, the presence of leading technology companies and research institutions is driving growth in precision optics manufacturing. Growing investments in healthcare imaging solutions, defence optics, and telecommunications is another factor that is driving the growth of the market. The push from government to support semiconductor and optical technology development also augments the region’s growth with high potential. Growing demand for miniaturized and high-precision optical components is estimated to fuel the growth of North America aspherical lens market during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players Listed in Aspherical Lens Market are:

-

Nikon Corporation (Japan) – Camera lenses, optical lenses, industrial lenses

-

Canon Inc. (Japan) – Camera lenses, medical optics, semiconductor optics

-

Panasonic Holdings Corporation (Japan) – Camera lenses, automotive lenses, industrial optics

-

HOYA Corporation (Japan) – Eyewear lenses, optical glass, medical optics

-

Asahi Glass (AGC Inc.) (Japan) – Glass materials, optical lenses, coatings

-

Tokai Optical (Japan) – Prescription lenses, aspherical lenses

-

SEIKO Optical Products Co., Ltd. (Japan) – Eyeglass lenses, aspherical lenses

-

OptoSigma (Japan) – Optical lenses, optomechanical components

-

Carl Zeiss AG (Germany) – High-end camera lenses, medical optics, industrial lenses

-

SCHOTT AG (Germany) – Precision optical lenses, specialty glass

-

Asphericon (Germany) – Custom aspherical lenses, high-precision optics

-

Ophir Spiricon (USA) – Laser optics, precision lenses

-

Coastal Optical Systems (USA) – Infrared optics, aspherical lenses

-

Thorlabs (USA) – Optical components, precision lenses

-

Edmund Optics (USA) – Industrial optics, aspherical lenses, imaging lenses

-

Samyang Optics (South Korea) – Camera lenses, cine lenses, industrial lenses

-

Mei Jiuping Optics (China) – Aspherical optical lenses, precision optics

-

Attley Optic Technology (China) – Optical coatings, precision aspherical lenses

-

Calin Technology Co., Ltd. (Taiwan) – Optical components, aspherical lenses

Recent Development:

-

In February 2025, Nikon launched the NIKKOR Z 35mm f/1.2 S, a high-performance wide-angle prime lens with superior optical quality, smooth bokeh, and advanced coatings to minimize aberrations. Designed for full-frame mirrorless cameras, it excels in portraits, street photography, and video recording.

-

In June 2024, Canon introduced the RF35mm F1.4 L VCM, the first in a new hybrid RF lens series designed for both video and still photography. Featuring a manual iris ring, minimal focus breathing, and advanced optical elements, it enhances low-light performance and supports professional cinematography.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.23 Billion |

| Market Size by 2032 | USD 15.76 Billion |

| CAGR | CAGR of 6.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Glass aspherical lens, Plastic aspherical lens, Others), By Offering (Single aspherical lens, Double aspherical lens) • By Manufacturing Technology(Molding, Polishing & Grinding, Others) • By Offering (Consumer Electronics, Digital Cameras, Automotive, Ophthalmic, Fiber Optics & Photonics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nikon Corporation (Japan), Canon Inc. (Japan), Panasonic Holdings Corporation (Japan), HOYA Corporation (Japan), Asahi Glass (AGC Inc.) (Japan), Tokai Optical (Japan), SEIKO Optical Products Co., Ltd. (Japan), OptoSigma (Japan), Carl Zeiss AG (Germany), SCHOTT AG (Germany), Asphericon (Germany), Ophir Spiricon (USA), Coastal Optical Systems (USA), Thorlabs (USA), Edmund Optics (USA), Samyang Optics (South Korea), Mei Jiuping Optics (China), Attley Optic Technology (China), Calin Technology Co., Ltd. (Taiwan). |