Get More Information on Aspartic Acid Market - Request Sample Report

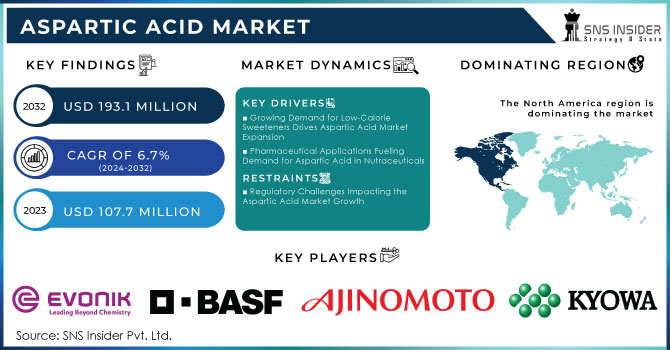

The Aspartic Acid Market Size was valued at USD 107.7 million in 2023 and is expected to reach USD 193.1 million by 2032 and grow at a CAGR of 6.7% over the forecast period 2024-2032.

The Aspartic Acid market is growing due to the rising demand in such diverse sectors as food and beverages, pharmaceuticals, and agriculture. The amino acid is used extensively as an artificial sweetener, especially to make up aspartame, that low-calorie sugar substitute widely used in diet foods and drinks. This is largely because of the increased awareness about health problems, and thus, customers require low-calorie and sugar-free products. In consequence, the demand for aspartic acid is directly acquired from this latter market demand and is a crucial building block in synthesizing proteins in nutritional supplements that accelerate the dynamics of the market. Another outcome of the global attention on health and fitness is that aspartic acid has been introduced into fitness and well-being-promoting products.

Development in production technologies also positively impacted the market. For example, development in fermentation technologies enhanced the productivity and sustainability of aspartic acid production. Some are using bio-based approaches whereby aspartic acid is produced from renewable feedstocks more sustainably. This shift helps align the new global goals with sustainability while reducing the environmental footprint of a production process. Such innovations lead to improved profitability but also attract environmentally sensitive consumers and businesses. The integration of green chemistry into a manufacturing process has attracted investments and partnerships that aim at developing better ways of cleaner and efficient production.

Another important driver of the Aspartic Acid market is the pharmaceuticals industry, particularly in pharmaceutical formulation and nutritional commodities. Aspartic acid is used in the production of various pharmaceutical intermediates and APIs. The growing incidences of chronic diseases have increased the demand for effective pharmaceuticals, thus raising the demand for amino acids such as aspartic acid. Companies are interested in increasing the number of drugs and dietary supplements that have amino acids as the base amino acids. For instance, companies recently introduced new formulas that have aspartic acid in combination with some other amino acids to maximize the effectiveness and to assist the muscle tissues in recovering from the stresses that occur in athletes.

Strategic alliances between manufacturers and mergers have also shaped the market's competitive environment. These partnerships will further enhance the product portfolios of both companies and improve the distribution channels as well. For instance, recent collaborations have led to the formulation of designer aspartic acid derivatives tailored for industrial-specific applications such as biodegradable plastics and coatings. This diversification brings in revenue streams but is also perfectly in line with the bigger picture of market trends, which are continuously changing toward sustainable and more eco-friendly products. Innovative applications along with strategic positioning of aspartic acid, and therefore, it forms an appropriate structure wherein the suitability and importance in various sectors of end-use contribute to the overall growth trajectory in the market.

Drivers:

Growing Demand for Low-Calorie Sweeteners Drives Aspartic Acid Market Expansion

Greater health awareness among consumers has fueled demand for low-calorie sweeteners, thus driving the growth of the aspartic acid market. Aspartic acid is one of the main constituents of aspartame, the most widely used low-calorie artificial sweetener in foods and beverages, often associated with "diet" and "sugar-free" applications. The rising desire to cut sugar, hence calorie, consumption as a consequence of increasingly surging obesity statistics and related health problems remains one of the significant drivers for aspartame and aspartic acid. This trend is backed by increased applications for aspartame-containing soft drinks, snacks, dairy products, and baked goods. The food and beverage industry caters to health-conscious consumers by reformulating its products to contain aspartame as a sugar substitute. Moreover, approval for artificial sweeteners with evaluations concerning their safety has boosted the consumer's confidence and therefore increased market penetration. As health-conscious attitudes lead to increased attention towards healthier diets, the aspartic acid market is likely to see continued growth from its fundamental role in the production of low-calorie sweeteners.

Pharmaceutical Applications Fueling Demand for Aspartic Acid in Nutraceuticals

The pharmaceutical industry is rising as one of the primary drivers for the aspartic acid market through nutraceutical and dietary supplement formulation. Aspartic acid is an essential amino acid that, in this regard, assumes critical importance in the synthesis of proteins ever so increasingly being integrated into health products that are meant to promote overall physical well-being. The increasing awareness of health and fitness today is what fuels the demand for dietary supplements targeted at supporting muscle recovery, immune function, and overall health. Manufacturers are busy developing products that combine aspartic acid with other amino acids and nutrients to make the formula more potent in delivering the potential for muscle building and recovery in athletes and fitness enthusiasts. Aspartic acid has been found to have a role in the production of neurotransmitters, an area of growing interest in the nutraceutical market. The growth of the sports nutrition segment and increasing trends of individualized nutrition present further supporting calls for increasing demand for aspartic acid-based products. This growing application of the product in pharmaceuticals and nutraceuticals positions aspartic acid as one of the essential active ingredients in combating contemporary health issues and consumer demands.

Restraint:

Regulatory Challenges Impacting the Aspartic Acid Market Growth

Despite the excellent growth prospects of the aspartic acid market, regulatory challenges are one of the main constraints. Nevertheless, stringent guidelines imposed by several regulatory agencies around the world on food additives, including artificial sweeteners such as aspartame, a derivative of aspartic acid, demand very rigorous safety assessment and approbation before a novel product can be released to market. Apart from the above considerations, safety controversies over the adverse health impact associated with long-term intake of artificial sweeteners have increased the level of examination by the regulatory authorities and consumer watchdogs. Regulatory issues are likely to increase in terms of restrictive measures or prohibitions on certain products in different areas, and hence it adversely affects the market landscape. Companies have to face the complex regulation environment to ensure safety compliance which costs more than usual and extends the product development period. An environment of increased vigilance by the regulators is likely to create uncertainty in the market dynamics. The growth potential of the aspartic acid market is limited by regulatory hurdles, for a company cannot invest in new product lines if there are possible problems of regulation.

Opportunity:

Advancements in Sustainable Production Techniques for Aspartic Acid

Advanced developments in more sustainable production techniques propel a tremendous opportunity for aspartic acid at a time when governments of the world are urging its sustainability along with greater emphasis on eco-friendliness. As concerns for the environment grow, there is an increasing trend towards bio-based and renewable methods of production. Advances in fermentation technology and biotechnology have driven the pursuit of increasingly more sustainable methods of producing aspartic acid, not relying on petroleum-based processes. Companies are exploring renewable feedstocks from which to source aspartic acid-plant-based materials that contribute not only to lessened environmental impact but also activate demand from eco-sensitive consumers and businesses, helping manufacturers to strengthen their market positions and seize the growing consumer preference for green products. Moreover, regulatory moves on green chemistry create opportunities for the acceptance of these technologies. This is likely to promote investment and encourage even more cooperation among stakeholders in the company. Since the market is moving toward sustainability, companies that embrace eco-friendly manufacturing processes for aspartic acid will be expected to have a competitive advantage. Companies that embrace eco-friendly production processes for aspartic acid will be able to capitalize on new market segments focused on sustainable solutions.

Challenge:

Competition from Alternative Sweeteners Threatening Aspartic Acid Market Share

Alternative sweeteners, increasingly competitive in their market are posing a strong challenge to the aspartic acid market. Besides synthetic aspartame, consumers seek more alternatives so, the varieties of natural and organic types of sweeteners are increasingly becoming popular with a change in preference. Marketing of these health conscious and natural varieties includes stevia, monk fruit extract, and erythritol. Clean label products, emphasizing greater transparency and lesser processing, will further amplify the competition for aspartic acid-based sweeteners. The interest that increases regarding artificial-free products in the market further creates competition for aspartic acid manufacturers because they must diligently make consumers aware of the safety and benefits of their products. In addition to this, new sweetening agents that receive considerable marketing effort can also challenge consumer interest from the traditional artificial sweetener. Companies must innovate and develop formulations of the products that match the preference alterations of the consumer while making its product, aspartic acid safer. By this, stakeholders can approach the competition in an active manner with their market positioning so that it stays innovative in the sweetener market.

By Type

In 2023, L-aspartic acid dominated the aspartic acid market with an estimated market share of approximately 70%. This dominance is primarily due to L-aspartic acid's widespread application in food and beverage products, where it serves as a key ingredient in low-calorie sweeteners like aspartame. The increasing consumer demand for healthier dietary options has driven the growth of products utilizing L-aspartic acid, particularly in the booming diet and sugar-free segments. Furthermore, L-aspartic acid is essential in the synthesis of various pharmaceuticals, including supplements aimed at enhancing athletic performance and recovery. For example, its role in creating protein powders and energy drinks has made it a preferred choice among fitness enthusiasts, contributing to its significant share in the market.

By Form

In 2023, the powder form of aspartic acid dominated the aspartic acid market with an estimated market share of around 65%. The powder form's prevalence is attributed to its versatility and ease of incorporation into various applications, especially in the food and beverage industry. Manufacturers favor powdered aspartic acid for its extended shelf life and convenience in formulations, making it a popular choice for product developers. For instance, powdered aspartic acid is widely used in protein supplements, sports nutrition products, and health foods, where it serves as an essential amino acid for muscle recovery and growth. Additionally, the powder form's compatibility with various production processes further solidifies its position as the dominating segment in the market.

By Application

In 2023, the food and beverage application segment dominated the aspartic acid market, capturing approximately 60% of the market share. This segment's prominence is largely driven by the increasing demand for low-calorie and sugar-free products, that utilize aspartame—a sweetener derived from L-aspartic acid. With consumers becoming more health-conscious and opting for products that offer reduced sugar content, the food and beverage industry has significantly integrated aspartic acid into its formulations. For example, many leading beverage brands have reformulated their products to include aspartame, enhancing their appeal in the competitive market. Additionally, as manufacturers continue to innovate and create new flavor profiles for diet products, the demand for aspartic acid in this application is expected to grow.

By End-User Industry

In 2023, the food industry dominated the end-user segment in the aspartic acid market, accounting for an estimated 55% market share. The food industry's leading position is largely driven by the growing consumer preference for healthier, low-calorie options and the increasing use of aspartame in various food products, including soft drinks, candies, and dairy items. As manufacturers respond to the rising demand for sugar alternatives, they are increasingly incorporating aspartic acid into their formulations to create appealing products for health-conscious consumers. Additionally, the versatility of aspartic acid in enhancing flavor profiles and improving overall product quality further cements its importance in the food industry. As trends continue to favor healthier eating habits, the food industry is expected to maintain its dominance in the aspartic acid market.

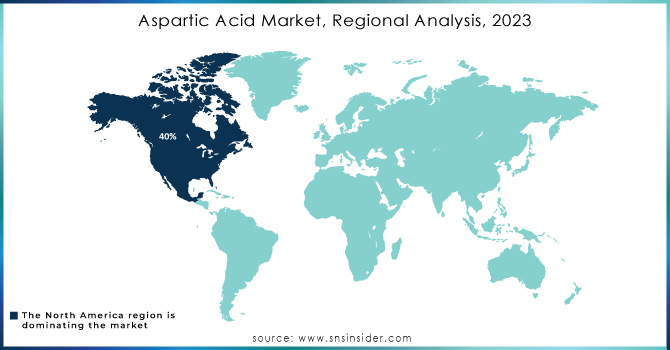

In 2023, North America dominated the aspartic acid market, holding an estimated market share of around 40%. This dominance is attributed to the region's well-established food and beverage industry, which increasingly incorporates low-calorie sweeteners, including aspartame, into various products. The rising health consciousness among consumers has led to a growing demand for sugar substitutes, particularly in the United States, where numerous brands have reformulated their products to meet the needs of health-focused consumers. Additionally, the robust pharmaceutical sector in North America contributes significantly to the demand for aspartic acid, as it is widely used in dietary supplements and performance-enhancing products. For example, major brands in the sports nutrition segment utilize aspartic acid in their formulations to promote muscle recovery, further solidifying North America’s leading position in the aspartic acid market.

Moreover, in 2023, the Asia-Pacific region emerged as the fastest-growing market for aspartic acid, with an estimated CAGR of approximately 6%. This rapid growth can be attributed to the increasing demand for processed food and beverages in emerging economies such as China and India, where rising disposable incomes and changing lifestyles drive consumer preferences toward healthier alternatives. The region is witnessing a surge in the adoption of low-calorie sweeteners in various applications, including soft drinks, snacks, and dairy products, as manufacturers respond to the growing health awareness among consumers. Additionally, the expanding pharmaceutical and nutraceutical sectors in the Asia-Pacific region are further propelling the demand for aspartic acid. For instance, the popularity of sports supplements is rising, leading to an increased incorporation of aspartic acid in product formulations aimed at fitness enthusiasts. As these trends continue, the Asia-Pacific region is poised for sustained growth in the aspartic acid market.

Need Any Customization Research On Aspartic Acid Market - Inquiry Now

October 2023: Ronish Bioceuticals introduced the L-Ornithine L-Aspartate Syrup, which, in combination with Silymarin, demonstrates our commitment to providing healthcare professionals, wholesalers, and medical representatives with exceptional formulations.

Ajinomoto Co., Inc. (Aspartame, L-Aspartic Acid)

BASF SE (Aspartic Acid, Bio-based Surfactants)

Cargill, Incorporated (Aspartame, L-Aspartic Acid)

Evonik Industries AG (L-Aspartic Acid, Surfactants)

Fufeng Group Company Limited (Aspartic Acid, Feed Grade Amino Acids)

Hunan Huasheng Biotechnology Co., Ltd. (L-Aspartic Acid, Aspartic Acid)

Kyowa Hakko Bio Co., Ltd. (Kyowa AjiPro-L, L-Aspartic Acid)

Mitsubishi Gas Chemical Company, Inc. (L-Aspartic Acid, Amino Acids)

Mitsui & Co., Ltd. (Aspartic Acid, Amino Acid Products)

Ningxia Sunnyfield Food Co., Ltd. (L-Aspartic Acid, Food Grade Amino Acids)

Amino GmbH (Amino Acids, L-Aspartic Acid)

Ginkgo BioWorks, Inc. (Genetically Engineered Aspartic Acid, Bioengineered Products)

Green Biologics Ltd. (Biobased Chemicals, L-Aspartic Acid)

Hefei TNJ Chemical Industry Co., Ltd. (Aspartic Acid, Amino Acids)

Hangzhou Kelin Chemicals Co., Ltd. (L-Aspartic Acid, Amino Acids)

Hubei Hongyuan Pharmaceutical Co., Ltd. (Aspartic Acid, L-Aspartic Acid)

Lactic Acid Bacteria Co., Ltd. (Amino Acids, L-Aspartic Acid)

Puyang Shucheng Chemical Co., Ltd. (L-Aspartic Acid, Aspartic Acid)

Shanghai Jiuding Chemical Co., Ltd. (L-Aspartic Acid, Amino Acids)

Tianjin Zhongxin Chemtech Co., Ltd. (Aspartic Acid, L-Aspartic Acid)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 107.7 Million |

| Market Size by 2032 | US$ 193.1 Billion |

| CAGR | CAGR of 6.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (L-Aspartic Acid, D-Aspartic Acid) •By Form (Powder, Liquid) •By Application (Food & Beverage, Pharmaceuticals, Animal Feed, Personal Care Products, Industrial Applications) •By End-User Industry (Food Industry, Nutraceuticals, Agriculture, Chemical Industry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ajinomoto Co., Inc., Evonik Industries AG, BASF SE, Mitsubishi Gas Chemical Company, Inc., Kyowa Hakko Bio Co., Ltd., Cargill, Incorporated, Fufeng Group Company Limited, Mitsui & Co., Ltd., Ningxia Sunnyfield Food Co., Ltd., Hunan Huasheng Biotechnology Co., Ltd. and other key players |

| Key Drivers | • Growing Demand for Low-Calorie Sweeteners Drives Aspartic Acid Market Expansion • Pharmaceutical Applications Fueling Demand for Aspartic Acid in Nutraceuticals |

| RESTRAINTS | • Regulatory Challenges Impacting the Aspartic Acid Market Growth |

Ans: The Aspartic Acid Market is expected to grow at a CAGR of 6.7%

Ans: The Aspartic Acid Market Size was valued at USD 107.7 million in 2023 and is expected to reach USD 193.1 million by 2032.

Ans: Advancements in Sustainable Production Techniques for Aspartic Acid

Ans: Competition from Alternative Sweeteners Threatening Aspartic Acid Market Share.

Ans: The North American region dominated the Aspartic Acid market holding the largest market share of about 40% during the forecast period.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Aspartic Acid Market Segmentation, by Type

7.1 Chapter Overview

7.2 L-Aspartic Acid

7.2.1 L-Aspartic Acid Market Trends Analysis (2020-2032)

7.2.2 L-Aspartic Acid Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 D-Aspartic Acid

7.3.1 D-Aspartic Acid Market Trends Analysis (2020-2032)

7.3.2 D-Aspartic Acid Market Size Estimates and Forecasts to 2032 (USD Million)

8. Aspartic Acid Market Segmentation, by Form

8.1 Chapter Overview

8.2 Powder

8.2.1 Powder Market Trends Analysis (2020-2032)

8.2.2 Powder Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Liquid

8.3.1 Liquid Market Trends Analysis (2020-2032)

8.3.2 Liquid Market Size Estimates and Forecasts to 2032 (USD Million)

9. Aspartic Acid Market Segmentation, by Application

9.1 Chapter Overview

9.2 Food & Beverage

9.2.1 Food & Beverage Market Trends Analysis (2020-2032)

9.2.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Pharmaceuticals

9.3.1 Pharmaceuticals Market Trends Analysis (2020-2032)

9.3.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Animal Feed

9.4.1 Animal Feed Market Trends Analysis (2020-2032)

9.4.2 Animal Feed Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Personal Care Products

9.5.1 Personal Care Products Market Trends Analysis (2020-2032)

9.5.2 Personal Care Products Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Industrial Applications

9.6.1 Industrial Applications Market Trends Analysis (2020-2032)

9.6.2 Industrial Applications Market Size Estimates and Forecasts to 2032 (USD Million)

10. Aspartic Acid Market Segmentation, by Material

10.1 Chapter Overview

10.2 Food Industry

10.2.1 Food Industry Market Trends Analysis (2020-2032)

10.2.2 Food Industry Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Nutraceuticals

10.3.1 Nutraceuticals Market Trends Analysis (2020-2032)

10.3.2 Nutraceuticals Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Agriculture

10.4.1 Agriculture Market Trends Analysis (2020-2032)

10.4.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Chemical Industry

10.5.1 Chemical Industry Market Trends Analysis (2020-2032)

10.5.2 Chemical Industry Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.4 North America Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.5 North America Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.6 North America Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 USA Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.7.3 USA Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.7.4 USA Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.2 Canada Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.8.3 Canada Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.8.4 Canada Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.9.2 Mexico Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.2.9.3 Mexico Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.2.9.4 Mexico Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.7.3 Poland Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.7.4 Poland Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.8.3 Romania Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.8.4 Romania Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.9.3 Hungary Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.9.4 Hungary Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.10.3 Turkey Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.10.4 Turkey Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.5 Western Europe Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.6 Western Europe Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.7.3 Germany Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.7.4 Germany Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.2 France Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.8.3 France Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.8.4 France Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.2 UK Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.9.3 UK Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.9.4 UK Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.10.3 Italy Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.10.4 Italy Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.11.3 Spain Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.11.4 Spain Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.14.3 Austria Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.14.4 Austria Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.4 Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.5 Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.6 Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.2 China Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.7.3 China Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.7.4 China Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.2 India Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.8.3 India Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.8.4 India Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.2 Japan Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.9.3 Japan Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.9.4 Japan Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.10.2 South Korea Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.10.3 South Korea Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.10.4 South Korea Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.11.3 Vietnam Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.11.4 Vietnam Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.2 Singapore Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.12.3 Singapore Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.12.4 Singapore Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.2 Australia Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.13.3 Australia Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.13.4 Australia Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.4.14.3 Rest of Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.4.14.4 Rest of Asia Pacific Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.4 Middle East Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.5 Middle East Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.6 Middle East Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.7.3 UAE Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.7.4 UAE Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.8.3 Egypt Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.8.4 Egypt Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.10.3 Qatar Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.10.4 Qatar Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.4 Africa Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.5 Africa Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.6 Africa Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.7.3 South Africa Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.7.4 South Africa Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Aspartic Acid Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.4 Latin America Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.5 Latin America Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.6 Latin America Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.2 Brazil Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.7.3 Brazil Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.7.4 Brazil Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.2 Argentina Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.8.3 Argentina Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.8.4 Argentina Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.2 Colombia Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.9.3 Colombia Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.9.4 Colombia Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Aspartic Acid Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Aspartic Acid Market Estimates and Forecasts, by Form (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Aspartic Acid Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Aspartic Acid Market Estimates and Forecasts, by Material (2020-2032) (USD Million)

12. Company Profiles

12.1 Ajinomoto Co., Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Evonik Industries AG

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 BASF SE

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Mitsubishi Gas Chemical Company, Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Kyowa Hakko Bio Co., Ltd.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Cargill, Incorporated

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Fufeng Group Company Limited

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Mitsui & Co., Ltd.

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Ningxia Sunnyfield Food Co., Ltd.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Hunan Huasheng Biotechnology Co., Ltd.

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

L-Aspartic Acid

D-Aspartic Acid

By Form

Powder

Liquid

By Application

Food & Beverage

Pharmaceuticals

Animal Feed

Personal Care Products

Industrial Applications

By End-User Industry

Food Industry

Nutraceuticals

Agriculture

Chemical Industry

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Cold Chain Monitoring Market Size was USD 5.7 Billion in 2023 and is expected to reach $22.1 Billion by 2032 and grow at a CAGR of 16.2% by 2024-2032.

Antimicrobial Preservatives Market size was USD 3.1 Billion in 2023 and is projected to reach USD 4.6 Billion by 2032, at a CAGR of 4.5% from 2024 to 2032.

The Toluene Market Size was valued at USD 28.6 Billion in 2023. It is expected to grow to USD 40.9 Billion by 2032, growing at a CAGR of 5.4% from 2024-2032.

Oleochemicals Market was valued at USD 24.0 billion in 2023 and is expected to reach USD 43.3 billion by 2032, growing at a CAGR of 6.8% from 2024 to 2032.

The Industrial Evaporators Market size was valued at USD 20.4 billion in 2023 and is expected to reach USD 32.6 billion by 2032, at a CAGR of 5.4% by 2024-2032.

The Thin Film Material Market was USD 13.03 billion in 2023 and is expected to reach USD 19.04 billion by 2032, growing at a CAGR of 4.30% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone