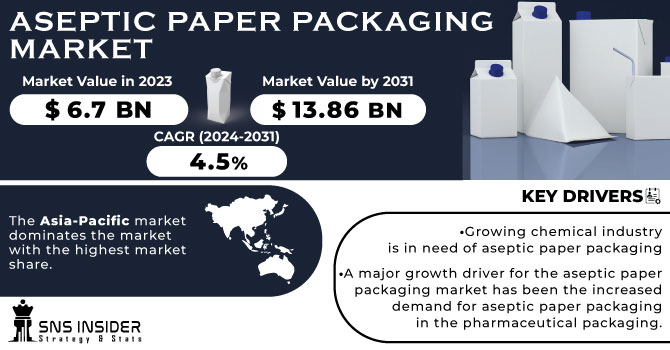

The Aseptic Paper Packaging Market size was USD 6.7 billion in 2023 and is expected to Reach USD 13.86 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The market for Aseptic paper packaging has grown significantly and is becoming the preferred choice for packaging solutions in the food and beverage industry. Aseptic paper packaging combines the benefits of paper-based packaging with aseptic technology to ensure product freshness, extend shelf life, and reduce reliance on preservatives and refrigeration.

Get More Information on Aseptic Paper Packaging Market - Request Sample Report

One of the major drivers of the Aseptic paper packaging market is the growing consumer demand for convenience and sustainability. Consumers are looking for packaging solutions that are easy to use, have a long shelf life and have minimal environmental impact. Aseptic paper packaging meets these needs by providing storage and transportation convenience while reducing food waste and carbon footprint management. Made from renewable raw materials such as cellulose, it offers a more sustainable alternative to plastic packaging.

The increased demand for packaged foodstuffs and beverages is a further factor that contributes to the growth of the Aseptic Paper Packaging Market. As urbanization and busy lifestyles continue to prevail, consumers are opting for convenient on-the-go products. Aseptic paper packaging provides safe and hygienic packaging solutions for a wide range of products such as dairy products, juices, sauces, soups and baby food. The extended shelf life of aseptic packaging allows manufacturers to reach wider geographic markets, reduce food waste and increase product availability.

Additionally, regulatory efforts and environmental concerns continue to drive the adoption of Aseptic paper packaging. Governments and regulators are introducing strict regulations to reduce plastic waste and encourage sustainable packaging practices. Aseptic paper packaging is consistent with these efforts as it is Recyclable Packaging, reduces our carbon footprint, minimizes the need for preservatives and contributes to a circular economy.

KEY DRIVERS:

Growing chemical industry is in need of aseptic paper packaging

During the product life cycle, chemical products often require specific packaging in order to guarantee their integrity, prevention of contamination and maintenance of quality. The perfect solution is the aseptic paper package, which has a great barrier action to protect chemicals from moisture, light and oxygen. As a result, the chemical industry is increasingly adopting aseptic paper packaging, driving its growth in this sector.

A major growth driver for the aseptic paper packaging market has been the increased demand for aseptic paper packaging in the pharmaceutical packaging.

RESTRAIN:

With respect to packaging for some products, concerns in relation to the compatibility of aseptic paper.

OPPORTUNITY:

The growing emphasis on sustainability offers opportunities for the aseptic paper packaging

Companies can position aseptic paper packaging as an environmentally friendly alternative to plastic and metal packaging. By emphasizing the renewable and recyclable nature of aseptic paper packaging, manufacturers can appeal to environmentally conscious consumers and businesses seeking sustainable packaging solutions.

With the UHT technology, Aseptic Packaging acts as an agile packaging solution that could contribute to market growth.

CHALLENGES:

The growth of the market will be hampered by high investment costs and environmental impacts resulting from aseptic paper packaging.

Conflicts have adversely affected businesses in various industries. The war also affected the market for aseptic packaging. A major problem in the aseptic paper packaging industry has been the supply of raw materials in the form of plastic, polyethylene or other materials containing metal. These raw materials majorly contribute to the production. Supply chain disruptions between nations have affected the costs of this raw material, which resulted in less production and higher costs of production.

Higher oil and gas prices pushed up production costs across the European region. Crude oil prices rose to $120 per barrel in March 2022. Natural gas prices rose to €270/MWh.

Russia has an export capacity of 5 million barrels per day, half of which goes to Europe. The war reduced oil and gas exports which is majorly required to operate the plants and machinery.

During the war, the price of metals such as aluminium soared. Aluminium prices climbed to $4,100 per ton, the highest ever. This affected production around the world.

Companies have to deal with the loss and find ways to sustain the business at the time of this conflict.

Consumer behaviour throughout the world has been greatly altered by the recession. US spending increased by 40%. Panic buying, combined with factory closures and global shortages of cardboard and polymers, has led to higher commodity prices. Operating and labor costs have risen, and food prices have soared.

During the recession, corporate Research &Development investment fell by 13%, slowing the progress of new products. This slows down the overall market growth. New innovations and advancements in every industry fuel the market. Therefore, market growth either decreases or exhibits a significant increase during recessions.

By Material

Metals

Plastics

Glass

Others

By Paper Type

Aseptic Bleached Paperboard

Aseptic Coated Unbleached Kraft Paperboard

By Packaging Type

Bags & Pouches

Cans

Cartons

Others

By Thickness

Up to 100 microns

100-200 microns

200-300 microns

Above 300 microns

By Application

Food & Beverage

Dairy Packaging

Pharmaceuticals

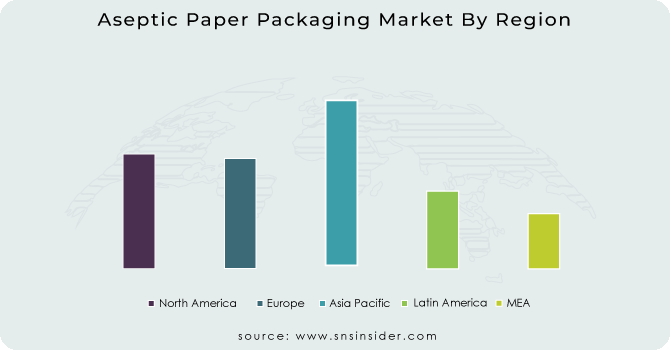

The Asia-Pacific market dominates the market with the highest market share. The region has the highest market share in the global region due to high consumer demand for ready-to-eat foods in the region. Aldo, the rise of the pharmaceutical industry has further increased the demand for aseptic paper packaging. Population growth is creating demand for better healthcare and nutrition. This includes essentials such as dairy products that need to be aseptically packaged to keep the product fresh longer. Rising income levels have further increased the demand for innovative and attractive aseptic packaging.

In the North American region, the rapid growth of the pharmaceutical industry has increased the demand for aseptic packaging. The ability to manufacture technologically advanced medical products, fueled by the country's advanced economic strength, drives product consumption. In addition, with many demographics seeking better medical care, the product consumption of medical packaging for medicines, vials and ampoules also continues to increase.

Packaging consumption in Europe is driven by companies investing in better beverage packaging solutions. The high demand for spirits and other non-alcoholic beverages in the region has increased the need for aseptic paper packaging for the beverage industry. Companies can invest in this package to prevent contamination of these beverages.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The Major Players are Amcor Limited, Mondi Limited, Elopak SA, Nampak Limited, Uflex Limited, Tetra Pak International SA, Ducart Group, Sealed Air Corporation, IMA Group, DS Smith and other players.

SIG announced that it would invest EUR 60 million to build its first aseptic packaging plant in India, with an expected production capacity of 4 billion packs per year.

The company, UFLEX Limited, which is a Flexible Packaging Materials Manufacturer and Polymer Sciences Company, intends to initiate an initiative in order to achieve the sustainability of its business by setting up India's 1st UFLEX shaped paper straw manufacturing line that will produce aseptic packaging.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.7 Billion |

| Market Size by 2031 | US$ 13.86 Billion |

| CAGR | CAGR of 4.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Paper & Paperboard, Metals, Plastics, Glass, Others) • By Paper Type (Aseptic Bleached Paperboard, Aseptic Coated Unbleached Kraft Paperboard) • By Packaging Type (Bags & Pouches, Cans, Cartons, Others) • By Thickness (Up to 100 microns, 100-200 microns, 200-300 microns, Above 300 microns) • By Application (Food & Beverage, Dairy Packaging, Pharmaceuticals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Limited, Mondi Limited, Elopak SA, Nampak Limited, Uflex Limited, Tetra Pak International SA, Ducart Group, Sealed Air Corporation, IMA Group, DS Smith |

| Key Drivers | • Growing chemical industry is in need of aseptic paper packaging • A major growth driver for the aseptic paper packaging market has been the increased demand for aseptic paper packaging in the pharmaceutical packaging. |

| Market Restraints | • With respect to packaging for some products, concerns in relation to the compatibility of aseptic paper. |

Ans: Aseptic Paper Packaging Market is expected to grow at a CAGR of 4.5%.

Ans: Aseptic Paper Packaging Market reached USD 9.6 billion in 2023.

Ans: Aseptic Paper Packaging Market is expected to Reach USD 13.86 million by 2031.

Ans: Constraints in terms of the shape and size of boxes, product compatibility as well as possible higher production costs than traditional packaging materials.

Ans: The Asia-Pacific has the highest market share and provides opportunities for the growth of the market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4 Impact Of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Aseptic Paper Packaging Market Segmentation, By Material

8.1 Paper & Paperboard

8.2 Metals

8.3 Plastics

8.4 Glass

8.5 Others

9. Aseptic Paper Packaging Market Segmentation, By Paper Type

9.1 Aseptic Bleached Paperboard

9.2 Aseptic Coated Unbleached Kraft Paperboard

10. Aseptic Paper Packaging Market Segmentation, By Packaging Type

10.1 Bags & Pouches

10.2 Cans

10.3 Cartons

10.4 Others

11. Aseptic Paper Packaging Market Segmentation, By Thickness

11.1 Up to 100 microns

11.2 100-200 microns

11.3 200-300 microns

11. 4 Above 300 microns

12. Aseptic Paper Packaging Market Segmentation, By Application

12.1 Food & Beverage

12.3 Dairy Packaging

12.4 Pharmaceuticals

12.5 Other Industries

13. Regional Analysis

13.1 Introduction

13.2 North America

13.2.1 North America Aseptic Paper Packaging Market By Country

13.2.2 North America Aseptic Paper Packaging Market By Material

13.2.3 North America Aseptic Paper Packaging Market By Paper Type

13.2.4 North America Aseptic Paper Packaging Market By Packaging Type

13.2.5 North America Aseptic Paper Packaging Market By Thickness

13.2.6 North America Aseptic Paper Packaging Market By Application

13.2.7 USA

13.2.7.1 USA Aseptic Paper Packaging Market By Material

13.2.7.2 USA Aseptic Paper Packaging Market By Paper Type

13.2.7.3 USA Aseptic Paper Packaging Market By Packaging Type

13.2.7.4 USA Aseptic Paper Packaging Market By Thickness

13.2.7.5 USA Aseptic Paper Packaging Market By Application

13.2.8 Canada

13.2.8.1 Canada Aseptic Paper Packaging Market By Material

13.2.8.2 Canada Aseptic Paper Packaging Market By Paper Type

13.2.8.3 Canada Aseptic Paper Packaging Market By Packaging Type

13.2.8.4 Canada Aseptic Paper Packaging Market By Thickness

13.2.8.5 Canada Aseptic Paper Packaging Market By Application

13.2.9 Mexico

13.2.9.1 Mexico Aseptic Paper Packaging Market By Material

13.2.9.2 Mexico Aseptic Paper Packaging Market By Paper Type

13.2.9.3 Mexico Aseptic Paper Packaging Market By Packaging Type

13.2.9.4 Mexico Aseptic Paper Packaging Market By Thickness

13.2.9.5 Mexico Aseptic Paper Packaging Market By Application

13.3 Europe

13.3.1 Eastern Europe

13.3.1.1 Eastern Europe Aseptic Paper Packaging Market By Country

13.3.1.2 Eastern Europe Aseptic Paper Packaging Market By Material

13.3.1.3 Eastern Europe Aseptic Paper Packaging Market By Paper Type

13.3.1.4 Eastern Europe Aseptic Paper Packaging Market By Packaging Type

13.3.1.5 Eastern Europe Aseptic Paper Packaging Market By Thickness

13.3.1.6 Eastern Europe Aseptic Paper Packaging Market By Application

13.3.1.7 Poland

13.3.1.7.1 Poland Aseptic Paper Packaging Market By Material

13.3.1.7.2 Poland Aseptic Paper Packaging Market By Paper Type

13.3.1.7.3 Poland Aseptic Paper Packaging Market By Packaging Type

13.3.1.7.4 Poland Aseptic Paper Packaging Market By Thickness

13.3.1.7.5 Poland Aseptic Paper Packaging Market By Application

13.3.1.8 Romania

13.3.1.8.1 Romania Aseptic Paper Packaging Market By Material

13.3.1.8.2 Romania Aseptic Paper Packaging Market By Paper Type

13.3.1.8.3 Romania Aseptic Paper Packaging Market By Packaging Type

13.3.1.8.4 Romania Aseptic Paper Packaging Market By Thickness

13.3.1.8.5 Romania Aseptic Paper Packaging Market By Application

13.3.1.9 Hungary

13.3.1.9.1 Hungary Aseptic Paper Packaging Market By Material

13.3.1.9.2 Hungary Aseptic Paper Packaging Market By Paper Type

13.3.1.9.3 Hungary Aseptic Paper Packaging Market By Packaging Type

13.3.1.9.4 Hungary Aseptic Paper Packaging Market By Thickness

13.3.1.9.5 Hungary Aseptic Paper Packaging Market By Application

13.3.1.10 Turkey

13.3.1.10.1 Turkey Aseptic Paper Packaging Market By Material

13.3.1.10.2 Turkey Aseptic Paper Packaging Market By Paper Type

13.3.1.10.3 Turkey Aseptic Paper Packaging Market By Packaging Type

13.3.1.10.4 Turkey Aseptic Paper Packaging Market By Thickness

13.3.1.10.5 Turkey Aseptic Paper Packaging Market By Application

13.3.1.11 Rest of Eastern Europe

13.3.1.11.1 Rest of Eastern Europe Aseptic Paper Packaging Market By Material

13.3.1.11.2 Rest of Eastern Europe Aseptic Paper Packaging Market By Paper Type

13.3.1.11.3 Rest of Eastern Europe Aseptic Paper Packaging Market By Packaging Type

13.3.1.11.4 Rest of Eastern Europe Aseptic Paper Packaging Market By Thickness

13.3.1.11.5 Rest of Eastern Europe Aseptic Paper Packaging Market By Application

13.3.2 Western Europe

13.3.2.1 Western Europe Aseptic Paper Packaging Market By Country

13.3.2.2 Western Europe Aseptic Paper Packaging Market By Material

13.3.2.3 Western Europe Aseptic Paper Packaging Market By Paper Type

13.3.2.4 Western Europe Aseptic Paper Packaging Market By Packaging Type

13.3.2.5 Western Europe Aseptic Paper Packaging Market By Thickness

13.3.2.6 Western Europe Aseptic Paper Packaging Market By Application

13.3.2.7 Germany

13.3.2.7.1 Germany Aseptic Paper Packaging Market By Material

13.3.2.7.2 Germany Aseptic Paper Packaging Market By Paper Type

13.3.2.7.3 Germany Aseptic Paper Packaging Market By Packaging Type

13.3.2.7.4 Germany Aseptic Paper Packaging Market By Thickness

13.3.2.7.5 Germany Aseptic Paper Packaging Market By Application

13.3.2.8 France

13.3.2.8.1 France Aseptic Paper Packaging Market By Material

13.3.2.8.2 France Aseptic Paper Packaging Market By Paper Type

13.3.2.8.3 France Aseptic Paper Packaging Market By Packaging Type

13.3.2.8.4 France Aseptic Paper Packaging Market By Thickness

13.3.2.8.5 France Aseptic Paper Packaging Market By Application

13.3.2.9 UK

13.3.2.9.1 UK Aseptic Paper Packaging Market By Material

13.3.2.9.2 UK Aseptic Paper Packaging Market By Paper Type

13.3.2.9.3 UK Aseptic Paper Packaging Market By Packaging Type

13.3.2.9.4 UK Aseptic Paper Packaging Market By Thickness

13.3.2.9.5 UK Aseptic Paper Packaging Market By Application

13.3.2.10 Italy

13.3.2.10.1 Italy Aseptic Paper Packaging Market By Material

13.3.2.10.2 Italy Aseptic Paper Packaging Market By Paper Type

13.3.2.10.3 Italy Aseptic Paper Packaging Market By Packaging Type

13.3.2.10.4 Italy Aseptic Paper Packaging Market By Thickness

13.3.2.10.5 Italy Aseptic Paper Packaging Market By Application

13.3.2.11 Spain

13.3.2.11.1 Spain Aseptic Paper Packaging Market By Material

13.3.2.11.2 Spain Aseptic Paper Packaging Market By Paper Type

13.3.2.11.3 Spain Aseptic Paper Packaging Market By Packaging Type

13.3.2.11.4 Spain Aseptic Paper Packaging Market By Thickness

13.3.2.11.5 Spain Aseptic Paper Packaging Market By Application

13.3.2.12 The Netherlands

13.3.2.12.1 Netherlands Aseptic Paper Packaging Market By Material

13.3.2.12.2 Netherlands Aseptic Paper Packaging Market By Paper Type

13.3.2.12.3 Netherlands Aseptic Paper Packaging Market By Packaging Type

13.3.2.12.4 Netherlands Aseptic Paper Packaging Market By Thickness

13.3.2.12.5 Netherlands Aseptic Paper Packaging Market By Application

13.3.2.13 Switzerland

13.3.2.13.1 Switzerland Aseptic Paper Packaging Market By Material

13.3.2.13.2 Switzerland Aseptic Paper Packaging Market By Paper Type

13.3.2.13.3 Switzerland Aseptic Paper Packaging Market By Packaging Type

13.3.2.13.4 Switzerland Aseptic Paper Packaging Market By Thickness

13.3.2.13.5 Switzerland Aseptic Paper Packaging Market By Application

13.3.2.14 Austria

13.3.2.14.1 Austria Aseptic Paper Packaging Market By Material

13.3.2.14.2 Austria Aseptic Paper Packaging Market By Paper Type

13.3.2.14.3 Austria Aseptic Paper Packaging Market By Packaging Type

13.3.2.14.4 Austria Aseptic Paper Packaging Market By Thickness

13.3.2.14.5 Austria Aseptic Paper Packaging Market By Application

13.3.2.15 Rest of Western Europe

13.3.2.15.1 Rest of Western Europe Aseptic Paper Packaging Market By Material

13.3.2.15.2 Rest of Western Europe Aseptic Paper Packaging Market By Paper Type

13.3.2.15.3 Rest of Western Europe Aseptic Paper Packaging Market By Packaging Type

13.3.2.15.4 Rest of Western Europe Aseptic Paper Packaging Market By Thickness

13.3.2.15.5 Rest of Western Europe Aseptic Paper Packaging Market By Application

13.4 Asia-Pacific

13.4.1 Asia Pacific Aseptic Paper Packaging Market By Country

13.4.2 Asia Pacific Aseptic Paper Packaging Market By Material

13.4.3 Asia Pacific Aseptic Paper Packaging Market By Paper Type

13.4.4 Asia Pacific Aseptic Paper Packaging Market By Packaging Type

13.4.5 Asia Pacific Aseptic Paper Packaging Market By Thickness

13.4.6 Asia Pacific Aseptic Paper Packaging Market By Application

13.4.7 China

13.4.7.1 China Aseptic Paper Packaging Market By Material

13.4.7.2 China Aseptic Paper Packaging Market By Paper Type

13.4.7.3 China Aseptic Paper Packaging Market By Packaging Type

13.4.7.4 China Aseptic Paper Packaging Market By Thickness

13.4.7.5 China Aseptic Paper Packaging Market By Application

13.4.8 India

13.4.8.1 India Aseptic Paper Packaging Market By Material

13.4.8.2 India Aseptic Paper Packaging Market By Paper Type

13.4.8.3 India Aseptic Paper Packaging Market By Packaging Type

13.4.8.4 India Aseptic Paper Packaging Market By Thickness

13.4.8.5 India Aseptic Paper Packaging Market By Application

13.4.9 Japan

13.4.9.1 Japan Aseptic Paper Packaging Market By Material

13.4.9.2 Japan Aseptic Paper Packaging Market By Paper Type

13.4.9.3 Japan Aseptic Paper Packaging Market By Packaging Type

13.4.9.4 Japan Aseptic Paper Packaging Market By Thickness

13.4.9.5 Japan Aseptic Paper Packaging Market By Application

13.4.10 South Korea

13.4.10.1 South Korea Aseptic Paper Packaging Market By Material

13.4.10.2 South Korea Aseptic Paper Packaging Market By Paper Type

13.4.10.3 South Korea Aseptic Paper Packaging Market By Packaging Type

13.4.10.4 South Korea Aseptic Paper Packaging Market By Thickness

13.4.10.5 South Korea Aseptic Paper Packaging Market By Application

13.4.11 Vietnam

13.4.11.1 Vietnam Aseptic Paper Packaging Market By Material

13.4.11.2 Vietnam Aseptic Paper Packaging Market By Paper Type

13.4.11.3 Vietnam Aseptic Paper Packaging Market By Packaging Type

13.4.11.4 Vietnam Aseptic Paper Packaging Market By Thickness

13.4.11.5 Vietnam Aseptic Paper Packaging Market By Application

13.4.12 Singapore

13.4.12.1 Singapore Aseptic Paper Packaging Market By Material

13.4.12.2 Singapore Aseptic Paper Packaging Market By Paper Type

13.4.12.3 Singapore Aseptic Paper Packaging Market By Packaging Type

13.4.12.4 Singapore Aseptic Paper Packaging Market By Thickness

13.4.12.5 Singapore Aseptic Paper Packaging Market By Application

13.4.13 Australia

13.4.13.1 Australia Aseptic Paper Packaging Market By Material

13.4.13.2 Australia Aseptic Paper Packaging Market By Paper Type

13.4.13.3 Australia Aseptic Paper Packaging Market By Packaging Type

13.4.13.4 Australia Aseptic Paper Packaging Market By Thickness

13.4.13.5 Australia Aseptic Paper Packaging Market By Application

13.4.14 Rest of Asia-Pacific

13.4.14.1 APAC Aseptic Paper Packaging Market By Material

13.4.14.2 APAC Aseptic Paper Packaging Market By Paper Type

13.4.14.3 APAC Aseptic Paper Packaging Market By Packaging Type

13.4.14.4 APAC Aseptic Paper Packaging Market By Thickness

13.4.14.5 APAC Aseptic Paper Packaging Market By Application

13.5 The Middle East & Africa

13.5.1 Middle East

13.5.1.1 Middle East Aseptic Paper Packaging Market By Country

13.5.1.2 Middle East Aseptic Paper Packaging Market By Material

13.5.1.3 Middle East Aseptic Paper Packaging Market By Paper Type

13.5.1.4 Middle East Aseptic Paper Packaging Market By Packaging Type

13.5.1.5 Middle East Aseptic Paper Packaging Market By Thickness

13.5.1.6 Middle East Aseptic Paper Packaging Market By Application

13.5.1.7 UAE

13.5.1.7.1 UAE Aseptic Paper Packaging Market By Material

13.5.1.7.2 UAE Aseptic Paper Packaging Market By Paper Type

13.5.1.7.3 UAE Aseptic Paper Packaging Market By Packaging Type

13.5.1.7.4 UAE Aseptic Paper Packaging Market By Thickness

13.5.1.7.5 UAE Aseptic Paper Packaging Market By Application

13.5.1.8 Egypt

13.5.1.8.1 Egypt Aseptic Paper Packaging Market By Material

13.5.1.8.2 Egypt Aseptic Paper Packaging Market By Paper Type

13.5.1.8.3 Egypt Aseptic Paper Packaging Market By Packaging Type

13.5.1.8.4 Egypt Aseptic Paper Packaging Market By Thickness

13.5.1.8.5 Egypt Aseptic Paper Packaging Market By Application

13.5.1.9 Saudi Arabia

13.5.1.9.1 Saudi Arabia Aseptic Paper Packaging Market By Material

13.5.1.9.2 Saudi Arabia Aseptic Paper Packaging Market By Paper Type

13.5.1.9.3 Saudi Arabia Aseptic Paper Packaging Market By Packaging Type

13.5.1.9.4 Saudi Arabia Aseptic Paper Packaging Market By Thickness

13.5.1.9.5 Saudi Arabia Aseptic Paper Packaging Market By Application

13.5.1.10 Qatar

13.5.1.10.1 Qatar Aseptic Paper Packaging Market By Material

13.5.1.10.2 Qatar Aseptic Paper Packaging Market By Paper Type

13.5.1.10.3 Qatar Aseptic Paper Packaging Market By Packaging Type

13.5.1.10.4 Qatar Aseptic Paper Packaging Market By Thickness

13.5.1.10.5 Qatar Aseptic Paper Packaging Market By Application

13.5.1.11 Rest of Middle East

13.5.1.11.1 Rest of Middle East Aseptic Paper Packaging Market By Material

13.5.1.11.2 Rest of Middle East Aseptic Paper Packaging Market By Paper Type

13.5.1.11.3 Rest of Middle East Aseptic Paper Packaging Market By Packaging Type

13.5.1.11.4 Rest of Middle East Aseptic Paper Packaging Market By Thickness

13.5.1.11.5 Rest of Middle East Aseptic Paper Packaging Market By Application

13.5.2 Africa

13.5.2.1 Africa Aseptic Paper Packaging Market By Country

13.5.2.2 Africa Aseptic Paper Packaging Market By Material

13.5.2.3 Africa Aseptic Paper Packaging Market By Paper Type

13.5.2.4 Africa Aseptic Paper Packaging Market By Packaging Type

13.5.2.5 Africa Aseptic Paper Packaging Market By Thickness

13.5.2.6 Africa Aseptic Paper Packaging Market By Application

13.5.2.7 Nigeria

13.5.2.7.1 Nigeria Aseptic Paper Packaging Market By Material

13.5.2.7.2 Nigeria Aseptic Paper Packaging Market By Paper Type

13.5.2.7.3 Nigeria Aseptic Paper Packaging Market By Packaging Type

13.5.2.7.4 Nigeria Aseptic Paper Packaging Market By Thickness

13.5.2.7.5 Nigeria Aseptic Paper Packaging Market By Application

13.5.2.8 South Africa

13.5.2.8.1 South Africa Aseptic Paper Packaging Market By Material

13.5.2.8.2 South Africa Aseptic Paper Packaging Market By Paper Type

13.5.2.8.3 South Africa Aseptic Paper Packaging Market By Packaging Type

13.5.2.8.4 South Africa Aseptic Paper Packaging Market By Thickness

13.5.2.8.5 South Africa Aseptic Paper Packaging Market By Application

13.5.2.9 Rest of Africa

13.5.2.9.1 Rest of Africa Aseptic Paper Packaging Market By Material

13.5.2.9.2 Rest of Africa Aseptic Paper Packaging Market By Paper Type

13.5.2.9.3 Rest of Africa Aseptic Paper Packaging Market By Packaging Type

13.5.2.9.4 Rest of Africa Aseptic Paper Packaging Market By Thickness

13.5.2.9.5 Rest of Africa Aseptic Paper Packaging Market By Application

13.6 Latin America

13.6.1 Latin America Aseptic Paper Packaging Market By Country

13.6.2 Latin America Aseptic Paper Packaging Market By Material

13.6.3 Latin America Aseptic Paper Packaging Market By Paper Type

13.6.4 Latin America Aseptic Paper Packaging Market By Packaging Type

13.6.5 Latin America Aseptic Paper Packaging Market By Thickness

13.6.6 Latin America Aseptic Paper Packaging Market By Application

13.6.7 Brazil

13.6.7.1 Brazil Aseptic Paper Packaging Market By Material

13.6.7.2 Brazil Africa Aseptic Paper Packaging Market By Paper Type

13.6.7.3Brazil Aseptic Paper Packaging Market By Packaging Type

13.6.7.4 Brazil Aseptic Paper Packaging Market By Thickness

13.6.7.5 Brazil Aseptic Paper Packaging Market By Application

13.6.8 Argentina

13.6.8.1 Argentina Aseptic Paper Packaging Market By Material

13.6.8.2 Argentina Aseptic Paper Packaging Market By Paper Type

13.6.8.3 Argentina Aseptic Paper Packaging Market By Packaging Type

13.6.8.4 Argentina Aseptic Paper Packaging Market By Thickness

13.6.8.5 Argentina Aseptic Paper Packaging Market By Application

13.6.9 Colombia

13.6.9.1 Colombia Aseptic Paper Packaging Market By Material

13.6.9.2 Colombia Aseptic Paper Packaging Market By Paper Type

13.6.9.3 Colombia Aseptic Paper Packaging Market By Packaging Type

13.6.9.4 Colombia Aseptic Paper Packaging Market By Thickness

13.6.9.5 Colombia Aseptic Paper Packaging Market By Application

13.6.10 Rest of Latin America

13.6.10.1 Rest of Latin America Aseptic Paper Packaging Market By Material

13.6.10.2 Rest of Latin America Aseptic Paper Packaging Market By Paper Type

13.6.10.3 Rest of Latin America Aseptic Paper Packaging Market By Packaging Type

13.6.10.4 Rest of Latin America Aseptic Paper Packaging Market By Thickness

13.6.10.5 Rest of Latin America Aseptic Paper Packaging Market By Application

14 Company Profile

14.1 Amcor Limited

14.1.1 Company Overview

14.1.2 Financials

14.1.3 Product/Services Offered

14.1.4 SWOT Analysis

14.1.5 The SNS View

14.2 Mondi Limited

14.2.1 Company Overview

14.2.2 Financials

14.2.3 Product/Services Offered

14.2.4 SWOT Analysis

14.2.5 The SNS View

14.3 Elopak SA

14.3.1 Company Overview

14.3.2 Financials

14.3.3 Product/Services Offered

14.3.4 SWOT Analysis

14.3.5 The SNS View

14.4 Nampak Limited

14.4.1 Company Overview

14.4.2 Financials

14.4.3 Product/Services Offered

14.4.4 SWOT Analysis

14.4.5 The SNS View

14.5 Uflex Limited

14.5.1 Company Overview

14.5.2 Financials

14.5.3 Product/Services Offered

14.5.4 SWOT Analysis

14.5.5 The SNS View

14.6 Tetra Pak International SA

14.6.1 Company Overview

14.6.2 Financials

14.6.3 Product/Services Offered

14.6.4 SWOT Analysis

14.6.5 The SNS View

14.7 Ducart Group

14.7.1 Company Overview

14.7.2 Financials

14.7.3 Product/Services Offered

14.7.4 SWOT Analysis

14.7.5 The SNS View

14.8 Sealed Air Corporation

14.8.1 Company Overview

14.8.2 Financials

14.8.3 Product/Services Offered

14.8.4 SWOT Analysis

14.8.5 The SNS View

14.9 IMA Group

14.9.1 Company Overview

14.9.2 Financials

14.9.3 Product/Services Offered

14.9.4 SWOT Analysis

14.9.5 The SNS View

14.10 DS Smith

14.10.1 Company Overview

14.10.2 Financials

14.10.3 Product/Services Offered

14.10.4 SWOT Analysis

14.10.5 The SNS View

15. Competitive Landscape

15.1 Competitive Benchmarking

15.2 Market Share Analysis

15.3 Recent Developments

15.3.1 Industry News

15.3.2 Company News

15.3.3 Mergers & Acquisitions

16. USE Cases and Best Practices

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Awnings Market size was USD 9006.90 million in 2023 and is expected to Reach USD 14906.39 million by 2031 and grow at a CAGR of 6.5% over the forecast period of 2024-2031.

The Sterile Medical Packaging Market size was USD 47.70 billion in 2023 and will reach USD 107.95 billion by 2032 and grow at a CAGR of 9.5% by 2024-2032.

The Beverage Packaging Market was USD 144.23 billion in 2023, is anticipated to reach USD 226.64 billion by 2032, growing at a CAGR of 5.16% by 2024-2032.

The PET Packaging Market size was valued at USD 77.24 billion in 2023 and is expected to Reach USD 120.85 billion by 2032 and grow at a CAGR of 5.1% over the forecast period of 2024-2032.

The Modular Container Market size projected to reach at USD 52.05 billion by 2032 & was valued at USD 28.05 billion in 2023 with CAGR of 7.8% by 2024-2032.

The Spouted Pouch Market size was USD 25.45 billion in 2023 and is expected to Reach USD 41.80 billion by 2031 and grow at a CAGR of 6.4% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone