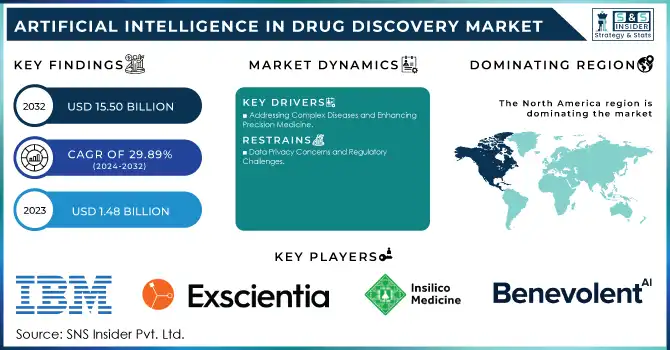

The Artificial Intelligence in Drug Discovery Market was valued at USD 1.48 billion in 2023 and is expected to reach USD 15.50 billion by 2032 with a growing CAGR of 29.89% over the forecast period of 2024-2032.

To get more information on Artificial Intelligence In Drug Discovery Market - Request Sample Report

The Artificial Intelligence (AI) in Drug Discovery Market is experiencing remarkable growth, driven by the need for more efficient, faster, and cost-effective drug development processes. Traditional drug discovery is often slow, with an average time of 10-15 years and costs of up to USD 2.6 billion to bring a drug to market. AI technologies, particularly machine learning, deep learning, and natural language processing, can significantly reduce these timelines and costs by streamlining the discovery process and providing valuable insights from complex datasets.

One of the key advantages of AI in drug discovery is its ability to predict molecular interactions and simulate clinical trials. For example, Insilico Medicine, a leader in AI-driven drug discovery, used AI to design a novel drug candidate for fibrosis in just 46 days, a process that typically takes years using conventional methods. Similarly, AI-powered platforms like Atomwise have revolutionized compound screening by analyzing millions of compounds in a fraction of the required time. Atomwise's AI system has been instrumental in identifying potential drug candidates for diseases such as Ebola and Malaria, demonstrating its capacity to discover viable treatments rapidly.

The growing complexity of diseases such as cancer, Alzheimer's, and rare genetic disorders has underscored the need for more advanced discovery tools. AI can handle vast amounts of genetic, clinical, and chemical data to identify new therapeutic targets, enhancing the efficiency of drug development. For instance, Tempus is utilizing AI to personalize cancer treatments by analyzing genomic data to tailor treatment plans based on individual patient profiles, thus improving outcomes and reducing adverse effects.

In 2020, BenevolentAI used AI to identify Baricitinib, an existing rheumatoid arthritis drug, as a potential treatment for COVID-19, leading to its emergency use authorization by regulatory bodies. This capability to rapidly identify existing drugs for new uses highlights the agility AI brings to the drug discovery process.

Additionally, regulatory bodies like the FDA are increasingly providing guidelines for using AI in drug development, facilitating its broader acceptance and integration into the pharmaceutical industry. These advancements in AI technology, along with strategic partnerships between AI startups, pharmaceutical companies, and academic institutions, are helping drive innovation and efficiency, transforming the future of drug discovery.

Drivers

Reducing Costs and Accelerating Drug Discovery

The growing pressure to minimize the time and cost associated with traditional drug discovery is one of the key drivers for AI adoption in the industry. Conventional drug development can take 10-15 years and cost over USD 2.6 billion. AI technologies offer the capability to streamline this process by automating tedious tasks such as data analysis and compound screening. Machine learning and deep learning algorithms can analyze vast datasets, predict molecular interactions, and optimize the selection of drug candidates. This automation not only accelerates drug discovery but also minimizes human error, ensuring more accurate results. AI tools can identify promising drug candidates in a fraction of the time compared to traditional methods, ultimately reducing the cost of bringing a drug to market and increasing the efficiency of the development pipeline.

Addressing Complex Diseases and Enhancing Precision Medicine

The increasing complexity of diseases such as cancer, Alzheimer's, and rare genetic disorders is prompting the adoption of AI to identify novel therapeutic targets and design effective treatments. AI’s ability to process vast amounts of genetic, clinical, and biochemical data enables a deeper understanding of disease mechanisms. By leveraging these insights, AI models can help researchers identify biomarkers and predict how drugs will interact with specific disease pathways. This precision approach is key to developing personalized therapies tailored to individual patients' genetic profiles. The use of AI in this way is crucial for addressing diseases that require more targeted, effective, and personalized treatment strategies, as it accelerates the identification of the most promising therapeutic options.

Leveraging Big Data and Enhancing Drug Discovery Outcomes

The ever-expanding volume of healthcare data, including patient records, clinical trials, and research studies, is another significant factor driving the AI in drug discovery market. With the ability to process and extract meaningful insights from these large datasets, AI technologies are transforming the drug discovery process. Machine learning models can quickly sift through massive amounts of data to identify patterns and correlations that might be missed by traditional methods. This helps researchers make informed decisions about drug candidates, reducing trial and error. Moreover, AI enhances the process of drug repurposing, enabling the identification of existing drugs that could be effective for new indications, further speeding up the discovery process and improving overall outcomes.

Restraints

Data Privacy Concerns and Regulatory Challenges

One of the primary restraints of AI in the Drug Discovery market is the ongoing challenge of data privacy and security, especially when dealing with sensitive patient data. The use of AI in healthcare requires access to large volumes of clinical, genetic, and patient data, raising concerns about the protection of personal health information. Regulatory bodies, including the FDA and EMA, are working on frameworks to ensure AI models meet stringent standards for data protection and privacy. However, these regulations often vary by region, adding complexity to the adoption of AI technologies across global markets. Additionally, the lack of standardized guidelines and ethical considerations regarding the use of AI in drug discovery makes it difficult for companies to navigate the approval processes. These barriers can slow down AI adoption, especially for smaller companies and startups that may face challenges in complying with diverse regulations and ensuring the security of sensitive data in their AI-driven drug development processes.

By Application

In 2023, Drug Optimization and Repurposing was the dominant application segment in the AI in Drug Discovery market which held significant share of 40%. Drug repurposing has become a key focus, especially in response to urgent healthcare needs, as it allows for faster identification of treatments. AI models can quickly analyze existing drug libraries to find new uses for approved medications, dramatically cutting development time and costs. A prime example is BenevolentAI, which used AI to repurpose Baricitinib for COVID-19 treatment. The ability of AI to rapidly identify viable drug candidates for new indications is one of the primary reasons this application remains the dominant force in AI-driven drug discovery.

The Preclinical Testing segment is experiencing the fastest growth within the AI in drug discovery landscape. AI is transforming the preclinical phase by providing innovative tools to predict drug toxicity, side effects, and efficacy earlier in the process. These advancements are minimizing the need for animal testing and enabling more precise preclinical evaluations, speeding up the transition to human clinical trials. This growing demand for faster, cost-effective, and more accurate testing methods is contributing significantly to the rapid growth of this segment.

By Therapeutic Area

In 2023, Oncology accounted for the largest share of the AI-driven drug discovery market, holding 45% of the market. The complexity of cancer treatment, combined with the increasing global burden of cancer cases, has made oncology a primary focus area for AI technologies. AI helps in identifying new therapeutic targets, optimizing clinical trials, and personalizing treatment options based on patients' genetic data. Platforms like Tempus are using AI to integrate genomic data for more effective cancer treatments, which is a driving factor behind oncology's dominance. As the demand for more effective and personalized cancer therapies grows, oncology will continue to be a key area of focus.

The Neurodegenerative Diseases segment is the fastest-growing therapeutic area in AI-driven drug discovery. The increasing global prevalence of diseases like Alzheimer's and Parkinson's has spurred the need for more targeted and effective treatments. AI is enabling more efficient identification of biomarkers and potential drug candidates that can alter the course of these debilitating diseases. By analyzing complex neurological data, AI is helping researchers better understand the underlying mechanisms of these conditions, leading to new therapeutic possibilities. With a greater focus on personalized medicine and early intervention, this segment is rapidly expanding as researchers strive to find solutions for these complex diseases.

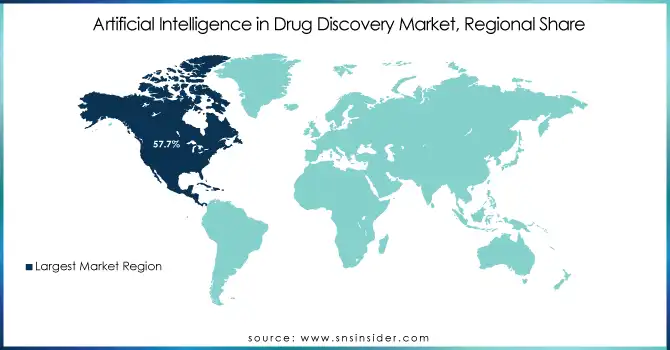

In 2023, North America dominated the global AI in Drug Discovery market, accounting for a 57.7% share due to the region's robust healthcare infrastructure, advanced technological landscape, and high levels of investment in pharmaceutical research and development. The United States, in particular, stands out with numerous AI-driven initiatives in drug discovery, led by major companies like IBM Watson Health and Tempus. Government support, including funding for AI research and regulatory efforts to streamline AI adoption in drug discovery, further contributes to North America's dominance. The high concentration of biotech and pharmaceutical companies and academic institutions positions the region at the forefront of AI innovation in drug development.

Asia-Pacific, particularly countries like China and India, is witnessing the fastest AI Drug Discovery market growth. China’s government is heavily investing in AI and biotechnology, aiming to become a global leader in AI-driven healthcare innovation. The region also benefits from a large pool of data and increasing partnerships between technology companies and pharmaceutical firms, driving the rapid adoption of AI technologies in drug discovery.

Need any customization research on Artificial Intelligence In Drug Discovery Market - Enquiry Now

IBM Watson for Drug Discovery

Centaur Chemist

Insilico Medicine

PandaOmics

ChemICo

GNS Healthcare (Aitia)

Aitia AI Drug Discovery Platform

Google (DeepMind)

AlphaFold

BenevolentAI Drug Discovery Platform

BioSymetrics, Inc.

BioSymetrics Drug Discovery Platform

Berg Health (BPGbio Inc.)

Interrogative Biology

Atomwise Inc.

AtomNet

Insitro

Insitro Platform

CYCLICA (Acquired by Recursion)

Ligand Express

Cyclica's AI Drug Discovery Platform

Clara Discovery

Schrödinger, Inc.

Schrödinger’s Platform

Microsoft

Project Hanover

Illumina, Inc.

BaseSpace Sequence Hub

Numedii, Inc.

AI Drug Discovery Platform

Xtalpi Inc.

Xtalpi AI Drug Discovery Platform

Iktos

de novo design platform

Tempus

Tempus’ AI-powered platform for Drug Discovery

DEEP GENOMICS

The Deep Genomics AI platform

Verge Genomics

Verge’s AI-driven platform

BenchSci

BenchSci AI-powered platform

Valo Health

Valo Health AI-powered platform

BPGBio, Inc.

BPGBio Drug Discovery Platform

Merck KGaA

Merck’s AI Drug Discovery Platform

IQVIA

IQVIA AI-driven solutions

Tencent Holdings Limited

Tencent AI Drug Discovery Platform

Predictive Oncology, Inc.

TumorGenesis

CytoReason

CytoReason Platform

Owkin, Inc.

Owkin’s AI Platform for Drug Discovery

Cloud Pharmaceuticals

Cloud Pharmaceuticals AI drug design platform

Evaxion Biotech

EVX-01 (AI-driven vaccine development platform)

Standigm

Standigm Drug Discovery Platform

BIOAGE

BIOAGE AI Platform for Age-Related Diseases

Envisagenics

SpliceAI

AbCellera

AbCellera Antibody Discovery Platform

Centella

Centella AI-powered drug discovery platform

In Jan 2025, Advanced Micro Devices (AMD) made a USD 20 million investment in Absci Corp., a company specializing in AI-driven drug discovery. AMD will also collaborate with Absci to support its research initiatives.

In Jan 2025, Collaborations Pharmaceuticals, Inc. (CPI) partnered with Bausch + Lomb to utilize CPI's AI and machine learning capabilities in the discovery of new treatments for eye diseases. The financial details of the collaboration have not been revealed.

In Jan 2025, Adnexus Biotechnologies Inc. launched Trapicolast, a groundbreaking antimalarial drug developed using its AI-powered Sutra platform. This innovative medication targets dual mechanisms in the Plasmodium parasite, focusing on the apicoplast and vesicular trafficking pathways, with the help of AI-discovered ADX1 and ADX2.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.48 Billion |

| Market Size by 2032 | USD 15.50 Billion |

| CAGR | CAGR of 29.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Drug optimization and repurposing, Preclinical testing, Others] • By Therapeutic Area [Oncology, Neurodegenerative Diseases, Cardiovascular Disease, Metabolic Diseases, Infectious Disease, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Exscientia, Insilico Medicine, GNS Healthcare (Aitia), Google (DeepMind), BenevolentAI, BioSymetrics, Inc., Berg Health (BPGbio Inc.), Atomwise Inc., Insitro, CYCLICA (Acquired by Recursion), NVIDIA Corporation, Schrödinger, Inc., Microsoft, Illumina, Inc., Numedii, Inc., Xtalpi Inc., Iktos, Tempus, DEEP GENOMICS, Verge Genomics, BenchSci, Valo Health, BPGBio, Inc., Merck KGaA, IQVIA, Tencent Holdings Limited, Predictive Oncology, Inc., CytoReason, Owkin, Inc., Cloud Pharmaceuticals, Evaxion Biotech, Standigm, BIOAGE, Envisagenics, AbCellera, Centella. |

| Key Drivers | • Reducing Costs and Accelerating Drug Discovery • Addressing Complex Diseases and Enhancing Precision Medicine • Leveraging Big Data and Enhancing Drug Discovery Outcomes |

| Restraints | • Data Privacy Concerns and Regulatory Challenges |

Ans: The Artificial Intelligence (AI) in Drug Discovery Market was valued at USD 1.48 billion in 2023.

Ans: The expected CAGR of the global Artificial Intelligence (AI) in Drug Discovery Market during the forecast period is 29.89%.

Ans. Neurodegenerative diseases, immuno-oncology, cardiovascular diseases, and metabolic diseases form AI in the drug discovery industry. Due to the growing demand for effective cancer treatment, the immuno-oncology segment holds the highest share of AI in the drug discovery market.

Ans. North America has the largest market share in AI in Drug Discovery Market.

Ans. The drivers of AI in Drug Discovery Market include Increasing Adoption of Artificial Intelligence in Healthcare Sector and growing Investment in Healthcare Sector

Table of content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption, by Region (2020-2032)

5.2 Investment Trends and Funding by Region (2023)

5.3 Regulatory Landscape and Policy Trends (2023)

5.4 Clinical Trial Success Rates (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Artificial Intelligence in Drug Discovery Market Segmentation, by Application

7.1 Chapter Overview

7.2 Drug optimization and repurposing

7.2.1 Drug optimization and repurposing Market Trends Analysis (2020-2032)

7.2.2 Drug optimization and repurposing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Preclinical testing

7.3.1 Preclinical Testing Market Trends Analysis (2020-2032)

7.3.2 Preclinical Testing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Artificial Intelligence in Drug Discovery Market Segmentation, by Therapeutic Area

8.1 Chapter Overview

8.2 Oncology

8.2.1 Oncology Market Trends Analysis (2020-2032)

8.2.2 Oncology Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Neurodegenerative Diseases

8.3.1 Neurodegenerative Diseases Market Trends Analysis (2020-2032)

8.3.2 Neurodegenerative Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Cardiovascular Disease

8.4.1 Cardiovascular Disease Market Trends Analysis (2020-2032)

8.4.2 Cardiovascular Disease Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Metabolic Diseases

8.5.1 Metabolic Diseases Market Trends Analysis (2020-2032)

8.5.2 Metabolic Diseases Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Infectious Disease

8.6.1 Infectious Disease Market Trends Analysis (2020-2032)

8.6.2 Infectious Disease Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Artificial Intelligence in Drug Discovery Market Estimates and Forecasts, by Therapeutic Area (2020-2032) (USD Billion)

10. Company Profiles

10.1 IBM

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 Exscientia

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Insilico Medicine

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 GNS Healthcare (Aitia)

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Google (DeepMind)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 BenevolentAI

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 BioSymetrics, Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 NVIDIA Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Microsoft

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Illumina, Inc.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Application

Drug optimization and repurposing

Preclinical testing

Others

By Therapeutic Area

Oncology

Neurodegenerative Diseases

Cardiovascular Disease

Metabolic Diseases

Infectious Disease

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Disinfection Cap Market Size was valued at USD 368.2 million in 2023 and is expected to reach USD 515.9 million by 2032, growing at a CAGR of 3.84% over the forecast period 2024-2032.

The Dental Tourism Market was valued at USD 10.91 billion in 2023 and is expected to reach USD 65.4 billion by 2032, growing at a CAGR of 22.03% over the forecast period 2024-2032.

The Defibrillator Market Size was valued at USD 7.31 billion in 2023 and is expected to reach USD 14.85 billion by 2032 and grow at a CAGR of 8.2%.

The Multimodal Imaging Market size was valued at USD 4.43 billion in 2023 and is expected to reach USD 7.43 Billion by 2032, growing at a CAGR of 5.93% during the forecast period of 2024-2032.

The Artificial Intelligence In Animal Health Market was valued at USD 1.28 billion in 2023 and is expected to reach USD 7.06 billion by 2032, growing at a CAGR of 20.94% over the forecast period 2024-2032.

The Orthopedic Devices Market size was USD 60.00 Billion in 2023 and is expected to reach USD 89.60 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone