Artificial Intelligence (AI) in Diagnostics Market Report Scope & Overview:

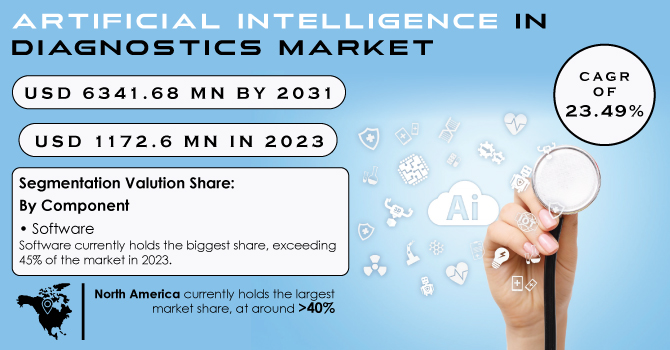

Artificial Intelligence (AI) in Diagnostics Market Size was valued at USD 1.25 Billion in 2023 and is expected to reach USD 7.75 Billion by 2032, growing at a CAGR of 22.5% over the forecast period 2024-2032.

The Artificial Intelligence (AI) in Diagnostics Market report, provides statistical insights & trends of AI-assisted diagnosis prevalence, adoption in hospitals & clinics, and AI-powered imaging & pathology analysis. The report provides details analysis of healthcare spending on AI diagnostics, with investment breakdowns by governments, insurers, and private providers AI has an impact on workflow and cost. Report also follows regulatory approvals (FDA, EMA, etc.) and compliance trends, alongside AI workflow, efficiency and cost savings data related to reduced diagnosis time & errors, and operational cost reduction via AI. The Artificial Intelligence (AI) in Diagnostics market is experiencing robust growth, driven by the increasing prevalence of chronic diseases and advancements in AI technologies.

Get more information on Artificial Intelligence (AI) In Diagnostics Market - Request Sample Report

Market Dynamics:

Drivers

-

Rapid advancements in AI technology enhance diagnostic accuracy and efficiency.

Artificial intelligence (AI) is developing rapidly, which is improving the quality and efficiency of diagnosis in healthcare. One key recent example is the NHS's announcement of the world's largest breast cancer diagnosis AI trial, with around 700,000 mammograms. The trial will evaluate whether AI it better than radiologists in identifying breast cancer, which could help facilitate diagnosis and help maximize use of specialists.

AI tools have proven better than traditional methods in the detection of prostate cancer. According to a UCLA study, an AI was able to identify prostate cancer with an 84% accuracy rate while human doctors performed at 67% accuracy. From clinical data, the ASIST AI used a doctors' algorithm to produce 3D maps estimating where the cancer was, helping identify precise cancer margins. In addition, AI is advancing the early detection of diseases such as Alzheimer's. An AI tool that can predict the onset of Alzheimer's disease 80% accurately has been developed by researchers at Cambridge University. This algorithm analyzes cognitive test results and MRI scans, offering predictions that are three times more accurate than current clinical methods. Notably, these advancements highlight the transformative role of AI in diagnostics and its potential impact in terms of earlier and more precise diagnoses as well as better patient outcomes.

Restraint:

-

Regulatory uncertainties and the need for robust validation of AI diagnostic tools.

The integration of AI in diagnostics faces significant challenges with regulatory uncertainties. A recent review by the Innovation Ecosystem Programme, commissioned by NHS England, highlighted that disjointed policies and a risk-averse culture are hindering health innovation in the UK, potentially preventing patients from benefiting from new technologies. Even as pilot programs have succeeded in reducing the time to diagnosis using AI in radiology by 30%, these barriers are hampering broader advancement. Moreover, nearly 900 AI/ML-based medical devices based on FDA approval or clearance have emerged, with 76% for use in radiology. Continually updating the algorithm regulatory framework is still under development by agencies and adds uncertainty for developers. These examples highlight both the challenges and the evolving nature of AI diagnostic regulatory landscapes.

Opportunity:

-

Integration of AI with imaging devices for real-time analysis.

Integrating artificial intelligence (AI) with imaging devices offers significant opportunities to enhance diagnostic accuracy and efficiency. As an example, the UK's National Health Service (NHS) has launched the largest breast cancer diagnosis trial with AI in the world using about 700,000 mammograms. The goal of this trial is to compare the performance of AI with that of radiologists at identifying breast cancer to help provide quicker diagnoses and reduce the burden on specialists. In South Australia, the Medical Imaging (SAMI) sites have implemented AI from Annalise.ai Use for chest X-ray diagnoses By using this technology as a sort of "spell check" for X-rays, AI highlights areas of interest and offers potential diagnoses for review to physicians, improving accuracy. Moreover, an AI algorithm has been created that provides 98% high accuracy in detecting diseases from tongue colours. This technique allows to detection of diabetes, cancer, or strokes, making it a non-invasive diagnostic tool. These advancements highlight the disruptive role AI can play in medical imaging for better patient outcomes with early and accurate disease detection.

Challenge

-

Ensuring data privacy and security in AI-driven diagnostics.

One of the biggest challenges in AI-powered diagnostics is ensuring data privacy and security. One of the leading causes for concern is the vulnerability of data breaches and hacking practices, primarily as such entities are a main target for hackers to expose protected information. Unauthorized access to patient records can lead to identity theft and financial loss. Another challenge is collecting sensitive data without proper consent. If not appropriately handled, the need for huge data can lead to the violation of patient privacy rights in one way or another which is one of the main reasons why patients are not accepting healthcare AI wholeheartedly.

Moreover, data anonymization cannot be regarded as completely safe, and, with studies showing even anonymized datasets to be at risk of re-identification, the implications for patient confidentiality are significant. On top of that, compliance with regulations is another complication. Regulatory compliances like GDPR and HIPAA mandate a considerable amount of resources and policymakers to refine how AI systems operate and ensure compliance with changing national and international legal frameworks. These problems are reflected in public concerns in 2024, nearly half of U.S. adults reported being worried about data privacy and security regarding healthcare AI use. To overcome these challenges, strong encryption, controlled access, and constant assessments of patient data safety are necessary.

Segment analysis:

By Component

In 2023, 45% of the market revenue share was held by the software component segment as the solutions are crucial for analyzing massive datasets which include electronic health records, and medical imaging. The challenge of shortage of radiologists and rising healthcare expenditure, has compelled many governments out there to actively promote the usage of digital healthcare platforms. Such as, in China, government initiatives are being rolled out for AI-underpinned startups aimed at diagnostic solutions, and in Europe, investment is going toward cross-sector synergies around enablers of AI adoption. Funding initiatives from governments across regions are supporting the adoption of software solutions. North America is another region where heavy investments have been made in the healthcare sector with the U.S. government funding the development of advanced diagnostic software.

AI-based software not only improves diagnostic precision but also reduces workloads for medical professionals. This segment has grown further in strength owing to the increasing focus on big data analytics and machine learning algorithms. Continued demand for software capable of driving efficiency and reducing costs as healthcare systems transition to value-based care models will drive growth in this segment.

By Diagnosis Type

The neurology diagnosis segment accounted for the largest market share in 2023, at 25% of revenues owing to the usage of AI tools for the detection of neurological disorders such as Alzheimer, and Parkinsons disease. Focused governments are identifying research on AI applications in neurology, with large amounts of funding designated to early detection programs. In contrast, radiology is anticipated to see the highest growth rate during the forecast period owing to developments in hybrid imaging modalities such as PET/MRI15.

The application of machine learning, an important subset of AI, has many key advantages in radiology, including the ability to manipulate large amounts of complex imaging data with significant accuracy. For instance, PET/MRI systems have achieved 87.3% accuracy in detecting cancer, outperforming MRI or PET standalone modalities. Combined with the government's push towards innovation, this advancement makes for a strong growth profile in radiology.

Regional Analysis:

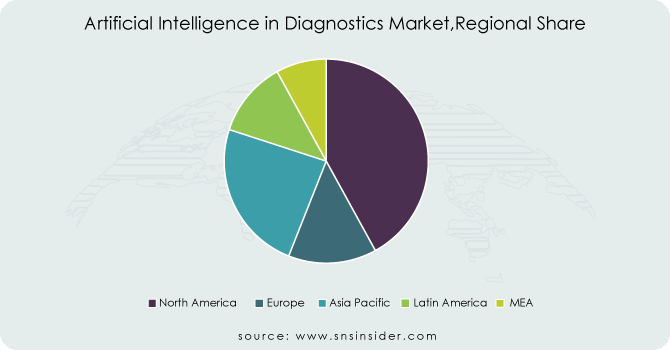

The AI diagnostics market was dominated by North America in 2023 with a revenue share of 57%. The region enjoys such dominance because of a mature healthcare infrastructure, a significant adoption rate of AI-enabled technologies, and robust financial backing from both the public and private fronts. The US was the primary contributor to this leadership, accounting for USD 412.2 million in revenue, driven mainly by the government, big investments, and a strong relationship between healthcare vendors and AI solution vendors. Moreover, the growing utilization of AI for initial disease identification, customized treatment plans, and process optimization in medical diagnostics has also bolstered the North American market.

Asia Pacific is anticipated to witness the highest CAGR over the forecast period, emerging as the key growth engine for AI diagnostics. This rapid acceptance of AI-founded medical analysis is due to the expanded electronic healthcare world and effective government initiatives in countries like China, India, and Japan. Countries such as these are also creating a regulatory environment that will see them invest heavily into AI-driven health solutions whilst creating a public institution and technology providers alliance. Nonprofit organizations and international funding agencies are also promoting AI-powered health accessibility and affordability initiatives as well. The use of AI diagnostics is critical in tackling growing healthcare demand; insufficient physician supply and cost-efficiency challenges in the region.

Need any customization research on Artificial Intelligence (AI) In Diagnostics Market - Enquiry Now

Key Players:

Key Service Providers/Manufacturers

-

IBM Watson Health (Watson for Oncology, Imaging AI)

-

GE Healthcare (Edison AI, Critical Care Suite)

-

Siemens Healthineers (AI-Rad Companion, syngo.via)

-

Philips Healthcare (IntelliSpace AI Workflow Suite, AI Manager)

-

Aidoc (Aidoc Radiology AI, Aidoc Cardiology AI)

-

Qure.ai (qXR, qER)

-

Zebra Medical Vision (HealthCXR, HealthMammo)

-

Arterys (Arterys Cardio AI, Arterys Lung AI)

-

Lunit (Lunit INSIGHT CXR, Lunit INSIGHT MMG)

-

DeepMind (Google Health) (Streams AI, AlphaFold AI)

Key Users

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Medicine

-

Massachusetts General Hospital

-

Stanford Health Care

-

Mount Sinai Health System

-

Apollo Hospitals

-

National Institutes of Health (NIH)

-

Harvard Medical School

-

University College London Hospitals (UCLH)

Recent Developments:

-

GE HealthCare launched Revolution RT, a CT solution that aims to enhance both precision and workflow in radiation therapy on May 1, 2024. The company also announced innovations in iRT features at ESTRO 2024, along with recently-acquired MIM Software.

-

QAi Prostate, an advanced diagnostic tool for prostate cancer, was launched by Qritive in March 2023. This includes an artificial intelligence algorithm that assists pathologists in the identification of prostatic adenocarcinoma and differentiation of malignant from benign tumors in biopsy material.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 1.25 Billion |

|

Market Size by 2032 |

USD 7.75 Billion |

|

CAGR |

CAGR of 22.5% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Software, Hardware, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Philips Healthcare, Cerner Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, IBM Watson Health, Salesforce Health Cloud, Optum (UnitedHealth Group), Medecision, eClinicalWorks, Health Catalyst |