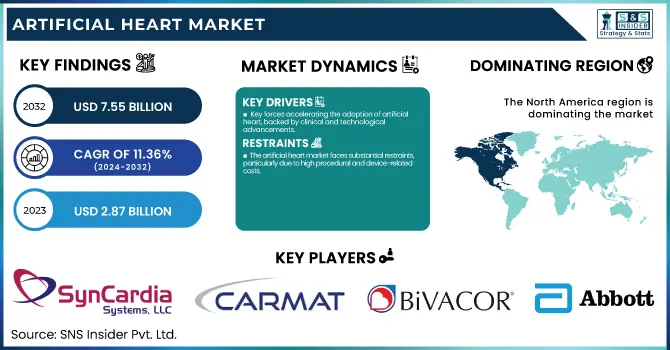

The Artificial Heart Market was valued at USD 2.87 billion in 2023 and is expected to reach USD 7.55 billion by 2032, growing at a CAGR of 11.36% over the forecast period of 2024-2032.

To Get more information on Artificial Heart Market - Request Free Sample Report

This report emphasizes the increasing incidence and prevalence of end-stage heart failure throughout geographies, driving demand for sophisticated cardiac support solutions. The research analyzes waitlist and transplant gap data, showing an expanding need for other therapies, such as artificial hearts, owing to shortages in donors. Healthcare expenditure trends for mechanical circulatory support devices are evaluated by type of payer, with both public and private payers making major contributions to market growth. The study also examines the rate of technological adoption and innovations in the R&D pipeline, such as fully implantable systems and biocompatible materials, as well as rehospitalization and mortality reduction trends, which highlight the clinical benefit of artificial heart technologies.

The U.S. Artificial Heart Market was valued at USD 1.43 billion in 2023 and is expected to reach USD 3.46 billion by 2032, growing at a CAGR of 10.34% over the forecast period of 2024-2032. In the United States, the market is growing strongly because of the heavy cardiovascular disease burden, strong investment in the development of cardiac devices, and positive reimbursement policies favoring the use of life-supporting artificial heart devices.

Drivers

Key forces accelerating the adoption of artificial heart, backed by clinical and technological advancements.

The artificial heart market is mainly fueled by the increasing global incidence of end-stage heart failure and the chronic lack of donor organs. The American Heart Association estimates that more than 6.5 million adults in the U.S. have heart failure, with a considerable percentage needing mechanical circulatory support. Artificial hearts, especially LVADs and Total Artificial Hearts (TAHs), provide life-saving interventions for patients who are not candidates for or waiting for transplants. Technological advances have driven adoption further—new devices are nowadays miniaturized, more resistant, and have better biocompatibility, making infection and thrombosis risk lower. Additionally, supportive reimbursement policies and growing FDA approvals are driving the market favorably. For instance, SynCardia TAH approval and the emergence of newer, completely implantable LVADs have broadened the horizon of treatment. As clinical trials persist in announcing improved survival and quality-of-life results, faith in artificial hearts as both destination and bridge-to-transplant therapies grows. This, combined with growing awareness among patients and doctors, is greatly accelerating growth in the market.

Restraints

The artificial heart market faces substantial restraints, particularly due to high procedural and device-related costs.

Artificial heart implantation usually costs more than USD 100,000, not including pre-operative evaluation and post-operative management. This creates a major obstacle in nations with scarce healthcare budgets or without full insurance coverage. Additionally, the invasive nature of implantation procedures requires highly trained surgical teams and cutting-edge facilities, rendering these devices available mainly in tertiary care facilities. Post-operative complications like hemorrhage, infection, hemolysis, and device failure continue to be the order of the day and necessitate extended hospital stays or device replacement, thus escalating the total cost burden. These risks also discourage adoption by patients and physicians in marginal clinical instances. Furthermore, most developing countries lack the adequate infrastructure and training required to facilitate the artificial heart ecosystem, thus limiting penetration in the emerging markets. In addition, rigorous regulatory procedures and long periods of approval can decelerate the introduction of new devices into the marketplace. Consequently, even with technological advancement and growing need, the actual application of artificial hearts is limited by budgetary and infrastructural factors, especially beyond high-income healthcare systems.

Opportunities

The artificial hearts market holds substantial untapped opportunities, particularly in the realm of miniaturized, fully implantable, and smart cardiac assist systems.

Technologies like magnetically levitated pumps, wireless power delivery, and flow controllers with integrated sensors are defining the future of artificial hearts with improved durability, energy consumption, and physiological sensitivity. Businesses committing to wearable monitoring devices and AI-powered predictive maintenance solutions have the potential to disrupt patient care after implantation. In addition, broadening clinical applications, like pediatric or congenital heart defect patients, offers fertile ground for growth. Another major opportunity is in the worldwide unmet need—although North America and Europe are at the forefront of adoption, other areas such as Asia-Pacific and Latin America, where cardiovascular disease is increasing at a fast pace, are still underpenetrated because of cost and access barriers. Public-private initiatives and strategic alliances between worldwide manufacturers and regional healthcare providers can fill this gap. Also, continuous clinical trials with long-term survival benefits and enhanced quality of life are bound to spur regulatory endorsement and physician acceptance. As healthcare systems around the world continue to embrace value-based models, artificial hearts, especially for destination therapy, may prove to be cost-effective in the long run, creating new avenues of reimbursement and adoption.

Challenges

The artificial heart market faces critical challenges that extend beyond cost and access, including technological complexity, patient compatibility, and long-term management issues.

Among the major challenges is device longevity despite advancements; artificial hearts continue to be at risk of wear and tear from continuous mechanical function, often requiring replacement or revision within 5–7 years. Biocompatibility is another issue, as blood-contact surfaces lead to thrombosis, necessitating lifelong anticoagulation with attendant risks of bleeding. These clinical complications have a profound impact on patient outcome and satisfaction. Also, the production of artificial hearts involves sophisticated precision engineering and regulation compliance, rendering production time-consuming, expensive, and scale-resistant. Individualization to accommodate varied patient anatomy, particularly in female and pediatric patients, contributes to development challenges. Also, long-term follow-up and care of patients with artificial hearts are often via telehealth, advanced follow-up care, and multidisciplinary teams, which are not available in all healthcare systems. Device-related psychological effects like fear, restricted mobility, and way of life also contribute to a lower quality of life in certain patients. Collectively, these problems highlight the demand for increased innovation in materials technology, remote monitoring, and medical infrastructure to make wider and longer-term implementation of artificial hearts available globally.

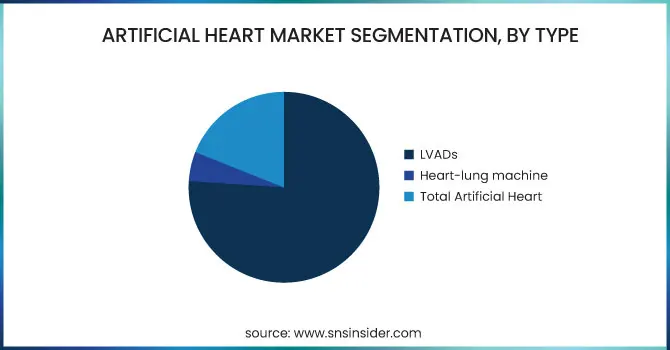

By Type

In 2023, the Left Ventricular Assist Devices (LVADs) segment held the largest share of the market, with a hefty 76.2% share. This is because LVADs have become universally accepted by clinicians as a standard of care for end-stage heart failure, specifically as a bridge to transplant or destination therapy. Their proven history of enhancing survival and quality of life, along with technology improvements in miniaturization and durability, have entrenched their hold in the market.

At the same time, the Total Artificial Heart (TAH) segment is expected to record the highest growth during the forecast period. This is fueled by increasing demand for full heart replacement therapy in the event of failure of both ventricles and the growing number of patients who are not eligible for heart transplantation. Technological advancements, better biocompatibility, and enhanced clinical trial success have also further spurred TAH's increasing uptake.

By Therapy

The Destination Therapy segment was the highest revenue generator in 2023, with the largest market share. This is indicative of a change in treatment trends, wherein artificial heart devices are being employed more and more as a long-term therapy instead of a short-term bridge to transplant. The increasing aged population, combined with shortages of donor hearts, has increased the demand for destination therapy as a final treatment option.

Of all the therapy segments, Destination Therapy is also likely to witness the fastest growth in the future. This trend is driven by positive regulatory support, technological advancements in device longevity, and the growing patient population who are not transplant candidates but need permanent circulatory support.

North America was the largest holder of the artificial hearts market in 2023, backed by advanced medical infrastructure, a high prevalence of end-stage heart failure, and favorable reimbursement policies. The United States is at the forefront of the use of LVADs and TAHs due to the availability of key players such as Abbott, SynCardia Systems, and Medtronic, along with robust clinical research infrastructure.

Europe is the most rapidly expanding region within the artificial heart market. Europeans are growing because of the expanding prevalence of heart failure, greater use of destination therapy, and increasing clinical trials in nations such as Germany, France, and the U.K. The European market also has great cardiac centers, government-funded healthcare, and fast CE approvals for new devices. For instance, Germany is among the region's biggest LVAD implant markets, with growing patient volumes year by year. Strategic partnerships among European research institutions and medical device firms are also driving the take-up of next-generation artificial heart technologies. With growing awareness and improving clinical results, Europe will see tremendous growth in the artificial hearts market, and it becomes a critical focus area for both manufacturers and healthcare providers.

Get Customized Report as per Your Business Requirement - Enquiry Now

SynCardia Systems, LLC – SynCardia Temporary Total Artificial Heart (TAH)

CARMAT – Aeson Total Artificial Heart

BiVACOR Inc. – BiVACOR Total Artificial Heart

RealHeart – RealHeart TAH

Abbott – HeartMate 3 LVAD

ABIOMED (Johnson & Johnson Services Inc.) – Impella Heart Pump

Jarvik Heart, Inc. – Jarvik 2000 LVAD

LivaNova PLC – Heart-Lung Machine HL 20

Getinge – Cardiohelp System

Terumo Corporation – Capiox Cardiopulmonary Bypass System

In February 2025, CARMAT announced having completed over 100 implants of its Aeson Total Artificial Heart. This achievement marks a significant advancement in the clinical adoption of artificial hearts for patients with advanced biventricular heart failure.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.87 billion |

| Market Size by 2032 | USD 7.55 billion |

| CAGR | CAGR of 11.36% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [LVADs, Heart-lung Machine, Total Artificial Heart] • By Therapy [Bridge to transplant, Destination therapy, Bridge to decision, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | SynCardia Systems, LLC, CARMAT, BiVACOR Inc., RealHeart, Abbott, ABIOMED (Johnson & Johnson Services Inc.), Jarvik Heart, Inc., LivaNova PLC, Getinge, Terumo Corporation. |

Ans: The Artificial Heart market is anticipated to grow at a CAGR of 11.36% from 2024 to 2032.

Ans: The market is expected to reach USD 7.55 billion by 2032, increasing from USD 2.87 billion in 2023.

Ans: The artificial heart market is mainly fueled by the increasing global incidence of end-stage heart failure and the chronic lack of donor organs.

Ans: The artificial heart market faces substantial restraints, particularly due to high procedural and device-related costs.

Ans: North America dominated the Artificial Heart market.

Table of contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of End-Stage Heart Failure (2023), by Region

5.2 Waitlist and Transplant Gap Statistics (2023)

5.3 Healthcare Spending on Mechanical Circulatory Support Devices (2023), by Payer Type (Government, Commercial, Private, Out-of-Pocket)

5.4 Technological Adoption & R&D Pipeline (2023)

5.5 Rehospitalization & Mortality Reduction Trends (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Service Benchmarking

6.3.1 Service specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Service launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Artificial Heart Market Segmentation, by Type

7.2 LVADs

7.2.1 LVADs Market Trends Analysis (2020-2032)

7.2.2 LVADs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Heart-Lung Machine

7.3.1 Heart-Lung Machine Market Trends Analysis (2020-2032)

7.3.2 Heart-Lung Machine Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Total Artificial Heart

7.4.1 Total Artificial Heart Market Trends Analysis (2020-2032)

7.4.2 Total Artificial Heart Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Artificial Heart Market Segmentation, by Therapy

8.2 Bridge to Transplant

8.2.1 Bridge to Transplant Market Trends Analysis (2020-2032)

8.2.2 Bridge to Transplant Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Destination Therapy

8.3.1 Destination Therapy Market Trends Analysis (2020-2032)

8.3.2 Destination Therapy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Bridge to Decision

8.4.1 Bridge to Decision Market Trends Analysis (2020-2032)

8.4.2 Bridge to Decision Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Artificial Heart Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Artificial Heart Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Artificial Heart Market Estimates and Forecasts, by Therapy (2020-2032) (USD Billion)

10. Company Profiles

10.1 SynCardia Systems, LLC

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 CARMAT

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 BiVACOR Inc.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 RealHeart

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Abbott

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 ABIOMED (Johnson & Johnson Services Inc.)

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Jarvik Heart, Inc.

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 LivaNova PLC

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Getinge

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Terumo Corporation

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

LVADs

Heart-lung machine

Total Artificial Heart

By Therapy

Bridge to transplant

Destination therapy

Bridge to decision

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Wellness Supplements Market was valued at USD 245.41 billion in 2023 and is expected to reach USD 470.93 billion by 2032, growing at a CAGR of 7.51% from 2024 to 2032.

The Pulsed Field Ablation Market size is projected to grow from USD 110.8 million in 2023 to USD 2,127.9 million by 2032, at a CAGR of 38.90% from 2024-2032.

The Digital Clinical Trials Market was valued at USD 8.70 Bn in 2023 and is expected to reach at $13.86 Bn in 2031 and grow at a CAGR of 6 % by 2024-2031.

Micro Syringes Market was valued at USD 333.98 million in 2023 and is expected to reach USD 1422.12 million by 2032, growing at a CAGR of 17.48% over the forecast period of 2024-2032.

Global Patient Monitoring Devices Market valued at USD 48.03 billion in 2023, projected to reach USD 93.53 billion by 2032, with a 7.71% CAGR during 2024-2032.

The Wound Care Devices Market Size was valued at USD 2.6 Billion in 2023 and is expected to reach USD 4.0 Billion by 2032, and grow at a CAGR of 4.9%.

Hi! Click one of our member below to chat on Phone