To get more information on Armorred Personnel Carrier Market - Request Free Sample Report

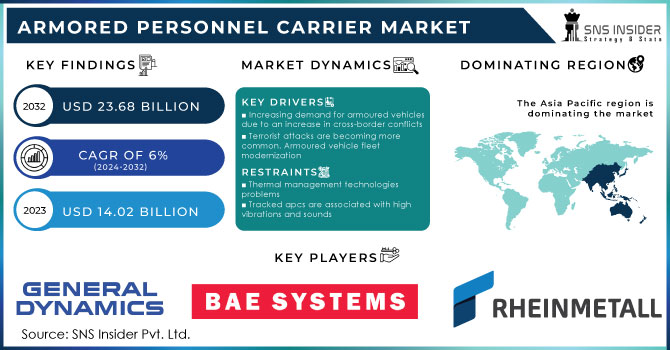

The Armored Personnel Carrier Market Size was valued at USD 14.02 billion in 2023 and is expected to reach USD 23.68 billion by 2032 with a growing CAGR of 6% over the forecast period 2024-2032.

The APCs weigh less than the newborn war chariots and the main battle tanks so they go much further. Unlike infants (IFVs), APCs do not participate in direct fire fighting and are designed to transport. However, they are well equipped to defend themselves and armed to protect themselves from reduced weapons, small arms, and shotguns. In addition, certain types of APCs are used by non-military organizations.

The growth of the global arms market is due to the increasing cost of war and the increase in terrorist incidents worldwide. In addition, the modern manufacture of armored vehicles also drives the growth of the market carrying armed workers. However, issues related to heat management technology and high vibration and noise associated with the APC process are expected to disrupt the market in a negative way. In contrast, technological advances and the introduction of new armored vehicles are expected to provide significant growth opportunities in the labor market carrying armed workers.

MARKET DYNAMICS

KEY DRIVERS

Increasing demand for armoured vehicles due to an increase in cross-border conflicts

Terrorist attacks are becoming more common. Armoured vehicle fleet modernization

RESTRAINTS

Thermal management technologies problems

Tracked apcs are associated with high vibrations and sounds

CHALLENGES

Main combat tanks are expensive

Issues of Survivability

OPPORTUNITIES

Armoured vehicle development that is modular and scalable

Increased use of unmanned combat ground vehicles by many countries' military forces

THE IMPACT OF COVID-19

The COVID-19 pandemic has had a multifaceted influence on world economies. Global automotive part, component, and assembly line manufacturing has been badly hit. Although the construction of armoured vehicles is critical, supply chain issues have slowed production for the time being.

The level of COVID-19 exposure a country faces, the level at which manufacturing operations are running, and import-export rules, among other factors, all influence the resumption of armoured vehicle manufacturing and deliveries. Although businesses may still accept orders, delivery timetables may not be fixed.

The worldwide armoured personnel carrier market has been divided into two types based on design: wheeled APC and tracked APC. The wheeled APC category dominated in terms of value and is predicted to grow at a rapid pace throughout the forecast period. Because of the lower friction losses, wheeled APCs often offer superior fuel efficiency than tracked APCs. As a result, wheeled APC have wider operational ranges. Furthermore, wheeled APCs are less expensive and require less maintenance and spare parts than tracked APCs, making wheeled APCs more reliable than tracked APCs.

The global armoured personnel carrier market is divided into two types: amphibious and non-amphibious. Amphibious APCs are frequently outfitted with propellers or water jets, or they are propelled by their tracks. The speed of water traversal varies widely between vehicles and is much slower than terrestrial speed. The armoured vehicles market has been divided into combat vehicles, combat support vehicles, and unmanned armoured ground vehicles based on platform. During the forecast period, the combat vehicle sector is expected to lead the armoured vehicles market. Global demand for Armored Personnel Carriers and Light Armored Vehicles is driving expansion in the combat vehicle section of the market.

By Design

Wheeled APC

Tracked APC

By Range

Less than 500 km

More than 500 km

By Carrying Capacity

Less than 10,000 Kg

Greater than & Equal to 10,000 Kg

By Configuration

Amphibious

Non-Amphibious

By Number of Occupants

Less than 10

10-15

More than 15

By End User

Military

Law Enforcement

Others

REGIONAL ANALYSIS

The Asia Pacific armored market market is expected to grow at a very high CAGR from till 2028. . Countries like India and China have increased their defense budget and purchased advanced armored vehicles to carry out their military duties. This, in turn, is expected to further the growth of the Asia Pacific armored market during the forecast period.

The latest pandemic of COVID-19 is expected to have an impact on the global automotive industry, including the armaments industry. The entire supply chain is disrupted due to limited availability of components. Chinese suppliers around the world have suspended production lines or closed them altogether. Also, legal and commercial restrictions, such as closed borders, increase the shortage of required components. Such disruptions in the supply chain are expected to affect the integration of OEMs in Europe and North America.

Need any customization research on Armorred Personnel Carrier Market - Enquiry Now

REGIONAL COVERAGE:

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

south Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The Major Players are General Dynamics Corporation, BAE Systems plc, NORINCO, Rheinmetall AG, Textron Inc, Oshkosh Corporation, UralVagonZavod, Ukroboronprom, Katmerciler A.S., KMDB A.A., and other players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 14.02 Billion |

| Market Size by 2032 | US$ 23.68 Billion |

| CAGR | CAGR of 6% From 2023 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design (Wheeled APC and Tracked APC) • By Range (Less than 500 km and More than 500 km) • By Carrying Capacity (Less than 10,000 Kg and Greater than & Equal to 10,000 Kg) • By Configuration (Amphibious and Non-Amphibious) • By Number of Occupants (Less than 10, 10-15, and More than 15) • By End User (Military, Law Enforcement, and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | General Dynamics Corporation, BAE Systems plc, NORINCO, Rheinmetall AG, and Textron Inc, Oshkosh Corporation, UralVagonZavod, Ukroboronprom, Katmerciler A.S., KMDB A.A., and other players. |

| DRIVERS | • Increasing demand for armoured vehicles due to an increase in cross-border conflicts • Terrorist attacks are becoming more common. Armoured vehicle fleet modernization |

| RESTRAINTS | • Thermal management technologies problems • Tracked apcs are associated with high vibrations and sounds |

According to SNS insiders, the Armored Personnel Carrier Market size was USD 14.02 billion in 2023 and is expected to reach USD 23.68 billion by 2032 with a CAGR of 6% over the forecasted period.

Main combat tanks are expensive and Issues of Survivability

The sample for the Armored Personnel Carrier Market report is available on the website upon request. To obtain the sample report, you can also use the 24*7 chat support and direct call services.

Yes, this report cover top down , bottom up Quantitative Research. Qualitative Research, Fundamental Research, data triangulation, ID’s & FGD’s Analytical research, And other as per report requirement.

Manufacturers/Service provider, Consultant, Association, Research institute, private and universities libraries, Suppliers and Distributors of the product.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenge

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Armored Personnel Carrier Market Segmentation, By Design

9.1 Introduction

9.2 Trend Analysis

9.3 Wheeled APC

9.4 Tracked APC

10. Armored Personnel Carrier Market Segmentation, By Range

10.1 Introduction

10.2 Trend Analysis

10.3 Less than 500 km

10.4 More than 500 km

11. Armored Personnel Carrier Market Segmentation, By Carrying Capacity

11.1 Introduction

11.2 Trend Analysis

11.3 Less than 10,000 Kg

11.4 Greater than & Equal to 10,000 Kg

12. Armored Personnel Carrier Market Segmentation, By Configuration

12.1 Introduction

12.2 Trend Analysis

12.3 Amphibious

12.4 Non-Amphibious

13. Armored Personnel Carrier Market Segmentation, By Number of Occupants

13.1 Introduction

13.2 Trend Analysis

13.3 Less than 10

13.4 10-15

13.5 More than 15

14. Armored Personnel Carrier Market Segmentation, By End User

14.1 Introduction

14.2 Trend Analysis

14.3 Military

14.4 Law Enforcement

14.5 Others

15. Regional Analysis

15.1 Introduction

15.2 North America

15.2.1 Trend Analysis

15.2.2 North America Armored Personnel Carrier Market By Country

15.2.3 North America Armored Personnel Carrier Market By Design

15.2.4 North America Armored Personnel Carrier Market By Range

15.2.5 North America Armored Personnel Carrier Market By Carrying Capacity

15.2.6 North America Armored Personnel Carrier Market, By Configuration

15.2.7 North America Armored Personnel Carrier Market, By Number of Occupants

15.2.8 North America Armored Personnel Carrier Market, By End User

15.2.9 USA

15.2.9.1 USA Armored Personnel Carrier Market By Design

15.2.9.2 USA Armored Personnel Carrier Market By Range

15.2.9.3 USA Armored Personnel Carrier Market By Carrying Capacity

15.2.9.4 USA Armored Personnel Carrier Market, By Configuration

15.2.9.5 USA Armored Personnel Carrier Market, By Number of Occupants

15.2.9.6 USA Armored Personnel Carrier Market, By End User

15.2.10 Canada

15.2.10.1 Canada Armored Personnel Carrier Market By Design

15.2.10.2 Canada Armored Personnel Carrier Market By Range

15.2.10.3 Canada Armored Personnel Carrier Market By Carrying Capacity

15.2.10.4 Canada Armored Personnel Carrier Market, By Configuration

15.2.10.5 Canada Armored Personnel Carrier Market, By Number of Occupants

15.2.10.6 Canada Armored Personnel Carrier Market, By End User

15.2.11 Mexico

15.2.11.1 Mexico Armored Personnel Carrier Market By Design

15.2.11.2 Mexico Armored Personnel Carrier Market By Range

15.2.11.3 Mexico Armored Personnel Carrier Market By Carrying Capacity

15.2.11.4 Mexico Armored Personnel Carrier Market, By Configuration

15.2.11.5 Mexico Armored Personnel Carrier Market, By Number of Occupants

15.2.11.6 Mexico Armored Personnel Carrier Market, By End User

15.3 Europe

15.3.1 Trend Analysis

15.3.2 Eastern Europe

15.3.2.1 Eastern Europe Armored Personnel Carrier Market By Country

15.3.2.2 Eastern Europe Armored Personnel Carrier Market By Design

15.3.2.3 Eastern Europe Armored Personnel Carrier Market By Range

15.3.2.4 Eastern Europe Armored Personnel Carrier Market By Carrying Capacity

15.3.2.5 Eastern Europe Armored Personnel Carrier Market By Configuration

15.3.2.6 Eastern Europe Armored Personnel Carrier Market, By Number of Occupants

15.3.2.7 Eastern Europe Armored Personnel Carrier Market, By End User

15.3.2.8 Poland

15.3.2.8.1 Poland Armored Personnel Carrier Market By Design

15.3.2.8.2 Poland Armored Personnel Carrier Market By Range

15.3.2.8.3 Poland Armored Personnel Carrier Market By Carrying Capacity

15.3.2.8.4 Poland Armored Personnel Carrier Market By Configuration

15.3.2.8.5 Poland Armored Personnel Carrier Market, By Number of Occupants

15.3.2.8.6 Poland Armored Personnel Carrier Market, By End User

15.3.2.9 Romania

15.3.2.9.1 Romania Armored Personnel Carrier Market By Design

15.3.2.9.2 Romania Armored Personnel Carrier Market By Range

15.3.2.9.3 Romania Armored Personnel Carrier Market By Carrying Capacity

15.3.2.9.4 Romania Armored Personnel Carrier Market By Configuration

15.3.2.9.5 Romania Armored Personnel Carrier Market, By Number of Occupants

15.3.2.9.6 Romania Armored Personnel Carrier Market, By End User

15.3.2.10 Hungary

15.3.2.10.1 Hungary Armored Personnel Carrier Market By Design

15.3.2.10.2 Hungary Armored Personnel Carrier Market By Range

15.3.2.10.3 Hungary Armored Personnel Carrier Market By Carrying Capacity

15.3.2.10.4 Hungary Armored Personnel Carrier Market By Configuration

15.3.2.10.5 Hungary Armored Personnel Carrier Market, By Number of Occupants

15.3.2.10.6 Hungary Armored Personnel Carrier Market, By End User

15.3.2.11 Turkey

15.3.2.11.1 Turkey Armored Personnel Carrier Market By Design

15.3.2.11.2 Turkey Armored Personnel Carrier Market By Range

15.3.2.11.3 Turkey Armored Personnel Carrier Market By Carrying Capacity

15.3.2.11.4 Turkey Armored Personnel Carrier Market By Configuration

15.3.2.11.5 Turkey Armored Personnel Carrier Market, By Number of Occupants

15.3.2.11.6 Turkey Armored Personnel Carrier Market, By End User

15.3.2.12 Rest of Eastern Europe

15.3.2.12.1 Rest of Eastern Europe Armored Personnel Carrier Market By Design

15.3.2.12.2 Rest of Eastern Europe Armored Personnel Carrier Market By Range

15.3.2.12.3 Rest of Eastern Europe Armored Personnel Carrier Market By Carrying Capacity

15.3.2.12.4 Rest of Eastern Europe Armored Personnel Carrier Market By Configuration

15.3.2.12.5 Rest of Eastern Europe Armored Personnel Carrier Market, By Number of Occupants

15.3.2.12.6 Rest of Eastern Europe Armored Personnel Carrier Market, By End User

15.3.3 Western Europe

15.3.3.1 Western Europe Armored Personnel Carrier Market By Country

15.3.3.2 Western Europe Armored Personnel Carrier Market By Design

15.3.3.3 Western Europe Armored Personnel Carrier Market By Range

15.3.3.4 Western Europe Armored Personnel Carrier Market By Carrying Capacity

15.3.3.5 Western Europe Armored Personnel Carrier Market By Configuration

15.3.3.6 Western Europe Armored Personnel Carrier Market, By Number of Occupants

15.3.3.7 Western Europe Armored Personnel Carrier Market, By End User

15.3.3.8 Germany

15.3.3.8.1 Germany Armored Personnel Carrier Market By Design

15.3.3.8.2 Germany Armored Personnel Carrier Market By Range

15.3.3.8.3 Germany Armored Personnel Carrier Market By Carrying Capacity

15.3.3.8.4 Germany Armored Personnel Carrier Market By Configuration

15.3.3.8.5 Germany Armored Personnel Carrier Market, By Number of Occupants

15.3.3.8.6 Germany Armored Personnel Carrier Market, By End User

15.3.3.9 France

15.3.3.9.1 France Armored Personnel Carrier Market By Design

15.3.3.9.2 France Armored Personnel Carrier Market By Range

15.3.3.9.3 France Armored Personnel Carrier Market By Carrying Capacity

15.3.3.9.4 France Armored Personnel Carrier Market By Configuration

15.3.3.9.5 France Armored Personnel Carrier Market, By Number of Occupants

15.3.3.9.6 France Armored Personnel Carrier Market, By End User

15.3.3.10 UK

15.3.3.10.1 UK Armored Personnel Carrier Market By Design

15.3.3.10.2 UK Armored Personnel Carrier Market By Range

15.3.3.10.3 UK Armored Personnel Carrier Market By Carrying Capacity

15.3.3.10.4 UK Armored Personnel Carrier Market By Configuration

15.3.3.10.5 UK Armored Personnel Carrier Market, By Number of Occupants

15.3.3.10.6 UK Armored Personnel Carrier Market, By End User

15.3.3.11 Italy

15.3.3.11.1 Italy Armored Personnel Carrier Market By Design

15.3.3.11.2 Italy Armored Personnel Carrier Market By Range

15.3.3.11.3 Italy Armored Personnel Carrier Market By Carrying Capacity

15.3.3.11.4 Italy Armored Personnel Carrier Market By Configuration

15.3.3.11.5 Italy Armored Personnel Carrier Market, By Number of Occupants

15.3.3.11.6 Italy Armored Personnel Carrier Market, By End User

15.3.3.12 Spain

15.3.3.12.1 Spain Armored Personnel Carrier Market By Design

15.3.3.12.2 Spain Armored Personnel Carrier Market By Range

15.3.3.12.3 Spain Armored Personnel Carrier Market By Carrying Capacity

15.3.3.12.4 Spain Armored Personnel Carrier Market By Configuration

15.3.3.12.5 Spain Armored Personnel Carrier Market, By Number of Occupants

15.3.3.12.6 Spain Armored Personnel Carrier Market, By End User

15.3.3.13 Netherlands

15.3.3.13.1 Netherlands Armored Personnel Carrier Market By Design

15.3.3.13.2 Netherlands Armored Personnel Carrier Market By Range

15.3.3.13.3 Netherlands Armored Personnel Carrier Market By Carrying Capacity

15.3.3.13.4 Netherlands Armored Personnel Carrier Market By Configuration

15.3.3.13.5 Netherlands Armored Personnel Carrier Market, By Number of Occupants

15.3.3.13.6 Netherlands Armored Personnel Carrier Market, By End User

15.3.3.14 Switzerland

15.3.3.14.1 Switzerland Armored Personnel Carrier Market By Design

15.3.3.14.2 Switzerland Armored Personnel Carrier Market By Range

15.3.3.14.3 Switzerland Armored Personnel Carrier Market By Carrying Capacity

15.3.3.14.4 Switzerland Armored Personnel Carrier Market By Configuration

15.3.3.14.5 Switzerland Armored Personnel Carrier Market, By Number of Occupants

15.3.3.14.6 Switzerland Armored Personnel Carrier Market, By End User

15.3.3.15 Austria

15.3.3.15.1 Austria Armored Personnel Carrier Market By Design

15.3.3.15.2 Austria Armored Personnel Carrier Market By Range

15.3.3.15.3 Austria Armored Personnel Carrier Market By Carrying Capacity

15.3.3.15.4 Austria Armored Personnel Carrier Market By Configuration

15.3.3.15.5 Austria Armored Personnel Carrier Market, By Number of Occupants

15.3.3.15.6 Austria Armored Personnel Carrier Market, By End User

15.3.3.16 Rest of Western Europe

15.3.3.16.1 Rest of Western Europe Armored Personnel Carrier Market By Design

15.3.3.16.2 Rest of Western Europe Armored Personnel Carrier Market By Range

15.3.3.16.3 Rest of Western Europe Armored Personnel Carrier Market By Carrying Capacity

15.3.3.16.4 Rest of Western Europe Armored Personnel Carrier Market By Configuration

15.3.3.16.5 Rest of Western Europe Armored Personnel Carrier Market, By Number of Occupants

15.3.3.16.6 Rest of Western Europe Armored Personnel Carrier Market, By End User

15.4 Asia-Pacific

15.4.1 Trend Analysis

15.4.2 Asia-Pacific Armored Personnel Carrier Market By country

15.4.3 Asia-Pacific Armored Personnel Carrier Market By Design

15.4.4 Asia-Pacific Armored Personnel Carrier Market By Range

15.4.5 Asia-Pacific Armored Personnel Carrier Market By Carrying Capacity

15.4.6 Asia-Pacific Armored Personnel Carrier Market By Configuration

15.4.7 Asia-Pacific Armored Personnel Carrier Market, By Number of Occupants

15.4.8 Asia-Pacific Armored Personnel Carrier Market, By End User

15.4.9 China

15.4.9.1 China Armored Personnel Carrier Market By Design

15.4.9.2 China Armored Personnel Carrier Market By Range

15.4.9.3 China Armored Personnel Carrier Market By Carrying Capacity

15.4.9.4 China Armored Personnel Carrier Market By Configuration

15.4.9.5 China Armored Personnel Carrier Market, By Number of Occupants

15.4.9.6 China Armored Personnel Carrier Market, By End User

15.4.10 India

15.4.10.1 India Armored Personnel Carrier Market By Design

15.4.10.2 India Armored Personnel Carrier Market By Range

15.4.10.3 India Armored Personnel Carrier Market By Carrying Capacity

15.4.10.4 India Armored Personnel Carrier Market By Configuration

15.4.10.5 India Armored Personnel Carrier Market, By Number of Occupants

15.4.10.6 India Armored Personnel Carrier Market, By End User

15.4.11 Japan

15.4.11.1 Japan Armored Personnel Carrier Market By Design

15.4.11.2 Japan Armored Personnel Carrier Market By Range

15.4.11.3 Japan Armored Personnel Carrier Market By Carrying Capacity

15.4.11.4 Japan Armored Personnel Carrier Market By Configuration

15.4.11.5 Japan Armored Personnel Carrier Market, By Number of Occupants

15.4.11.6 Japan Armored Personnel Carrier Market, By End User

15.4.12 South Korea

15.4.12.1 South Korea Armored Personnel Carrier Market By Design

15.4.12.2 South Korea Armored Personnel Carrier Market By Range

15.4.12.3 South Korea Armored Personnel Carrier Market By Carrying Capacity

15.4.12.4 South Korea Armored Personnel Carrier Market By Configuration

15.4.12.5 South Korea Armored Personnel Carrier Market, By Number of Occupants

15.4.12.6 South Korea Armored Personnel Carrier Market, By End User

15.4.13 Vietnam

15.4.13.1 Vietnam Armored Personnel Carrier Market By Design

15.4.13.2 Vietnam Armored Personnel Carrier Market By Range

15.4.13.3 Vietnam Armored Personnel Carrier Market By Carrying Capacity

15.4.13.4 Vietnam Armored Personnel Carrier Market By Configuration

15.4.13.5 Vietnam Armored Personnel Carrier Market, By Number of Occupants

15.4.13.6 Vietnam Armored Personnel Carrier Market, By End User

15.4.14 Singapore

15.4.14.1 Singapore Armored Personnel Carrier Market By Design

15.4.14.2 Singapore Armored Personnel Carrier Market By Range

15.4.14.3 Singapore Armored Personnel Carrier Market By Carrying Capacity

15.4.14.4 Singapore Armored Personnel Carrier Market By Configuration

15.4.14.5 Singapore Armored Personnel Carrier Market, By Number of Occupants

15.4.14.6 Singapore Armored Personnel Carrier Market, By End User

15.4.15 Australia

15.4.15.1 Australia Armored Personnel Carrier Market By Design

15.4.15.2 Australia Armored Personnel Carrier Market By Range

15.4.15.3 Australia Armored Personnel Carrier Market By Carrying Capacity

15.4.15.4 Australia Armored Personnel Carrier Market By Configuration

15.4.15.5 Australia Armored Personnel Carrier Market, By Number of Occupants

15.4.15.6 Australia Armored Personnel Carrier Market, By End User

15.4.16 Rest of Asia-Pacific

15.4.16.1 Rest of Asia-Pacific Armored Personnel Carrier Market By Design

15.4.16.2 Rest of Asia-Pacific Armored Personnel Carrier Market By Range

15.4.16.3 Rest of Asia-Pacific Armored Personnel Carrier Market By Carrying Capacity

15.4.16.4 Rest of Asia-Pacific Armored Personnel Carrier Market By Configuration

15.4.16.5 Rest of Asia-Pacific Armored Personnel Carrier Market, By Number of Occupants

15.4.16.6 Rest of Asia-Pacific Armored Personnel Carrier Market, By End User

15.5 Middle East & Africa

15.5.1 Trend Analysis

15.5.2 Middle East

15.5.2.1 Middle East Armored Personnel Carrier Market By Country

15.5.2.2 Middle East Armored Personnel Carrier Market By Design

15.5.2.3 Middle East Armored Personnel Carrier Market By Range

15.5.2.4 Middle East Armored Personnel Carrier Market By Carrying Capacity

15.5.2.5 Middle East Armored Personnel Carrier Market By Configuration

15.5.2.6 Middle East Armored Personnel Carrier Market, By Number of Occupants

15.5.2.7 Middle East Armored Personnel Carrier Market, By End User

15.5.2.8 UAE

15.5.2.8.1 UAE Armored Personnel Carrier Market By Design

15.5.2.8.2 UAE Armored Personnel Carrier Market By Range

15.5.2.8.3 UAE Armored Personnel Carrier Market By Carrying Capacity

15.5.2.8.4 UAE Armored Personnel Carrier Market By Configuration

15.5.2.8.5 UAE Armored Personnel Carrier Market, By Number of Occupants

15.5.2.8.6 UAE Armored Personnel Carrier Market, By End User

15.5.2.9 Egypt

15.5.2.9.1 Egypt Armored Personnel Carrier Market By Design

15.5.2.9.2 Egypt Armored Personnel Carrier Market By Range

15.5.2.9.3 Egypt Armored Personnel Carrier Market By Carrying Capacity

15.5.2.9.4 Egypt Armored Personnel Carrier Market By Configuration

15.5.2.9.5 Egypt Armored Personnel Carrier Market, By Number of Occupants

15.5.2.9.6 Egypt Armored Personnel Carrier Market, By End User

15.5.2.10 Saudi Arabia

15.5.2.10.1 Saudi Arabia Armored Personnel Carrier Market By Design

15.5.2.10.2 Saudi Arabia Armored Personnel Carrier Market By Range

15.5.2.10.3 Saudi Arabia Armored Personnel Carrier Market By Carrying Capacity

15.5.2.10.4 Saudi Arabia Armored Personnel Carrier Market By Configuration

15.5.2.10.5 Saudi Arabia Armored Personnel Carrier Market, By Number of Occupants

15.5.2.10.6 Saudi Arabia Armored Personnel Carrier Market, By End User

15.5.2.11 Qatar

15.5.2.11.1 Qatar Armored Personnel Carrier Market By Design

15.5.2.11.2 Qatar Armored Personnel Carrier Market By Range

15.5.2.11.3 Qatar Armored Personnel Carrier Market By Carrying Capacity

15.5.2.11.4 Qatar Armored Personnel Carrier Market By Configuration

15.5.2.11.5 Qatar Armored Personnel Carrier Market, By Number of Occupants

15.5.2.11.6 Qatar Armored Personnel Carrier Market, By End User

15.5.2.12 Rest of Middle East

15.5.2.12.1 Rest of Middle East Armored Personnel Carrier Market By Design

15.5.2.12.2 Rest of Middle East Armored Personnel Carrier Market By Range

15.5.2.12.3 Rest of Middle East Armored Personnel Carrier Market By Carrying Capacity

15.5.2.12.4 Rest of Middle East Armored Personnel Carrier Market By Configuration

15.5.2.12.5 Rest of Middle East Armored Personnel Carrier Market, By Number of Occupants

15.5.2.12.6 Rest of Middle East Armored Personnel Carrier Market, By End User

15.5.3 Africa

15.5.3.1 Africa Armored Personnel Carrier Market By Country

15.5.3.2 Africa Armored Personnel Carrier Market By Design

15.5.3.3 Africa Armored Personnel Carrier Market By Range

15.5.3.4 Africa Armored Personnel Carrier Market By Carrying Capacity

15.5.3.5 Africa Armored Personnel Carrier Market By Configuration

15.5.3.6 Africa Armored Personnel Carrier Market, By Number of Occupants

15.5.3.7 Africa Armored Personnel Carrier Market, By End User

15.5.3.8 Nigeria

15.5.3.8.1 Nigeria Armored Personnel Carrier Market By Design

15.5.3.8.2 Nigeria Armored Personnel Carrier Market By Range

15.5.3.8.3 Nigeria Armored Personnel Carrier Market By Carrying Capacity

15.5.3.8.4 Nigeria Armored Personnel Carrier Market By Configuration

15.5.3.8.5 Nigeria Armored Personnel Carrier Market, By Number of Occupants

15.5.3.8.6 Nigeria Armored Personnel Carrier Market, By End User

15.5.3.9 South Africa

15.5.3.9.1 South Africa Armored Personnel Carrier Market By Design

15.5.3.9.2 South Africa Armored Personnel Carrier Market By Range

15.5.3.9.3 South Africa Armored Personnel Carrier Market By Carrying Capacity

15.5.3.9.4 South Africa Armored Personnel Carrier Market By Configuration

15.5.3.9.5 South Africa Armored Personnel Carrier Market, By Number of Occupants

15.5.3.9.6 South Africa Armored Personnel Carrier Market, By End User

15.5.3.10 Rest of Africa

15.5.3.10.1 Rest of Africa Armored Personnel Carrier Market By Design

15.5.3.10.2 Rest of Africa Armored Personnel Carrier Market By Range

15.5.3.10.3 Rest of Africa Armored Personnel Carrier Market By Carrying Capacity

15.5.3.10.4 Rest of Africa Armored Personnel Carrier Market By Configuration

15.5.3.10.5 Rest of Africa Armored Personnel Carrier Market, By Number of Occupants

15.5.3.10.6 Rest of Africa Armored Personnel Carrier Market, By End User

15.6 Latin America

15.6.1 Trend Analysis

15.6.2 Latin America Armored Personnel Carrier Market By country

15.6.3 Latin America Armored Personnel Carrier Market By Design

15.6.4 Latin America Armored Personnel Carrier Market By Range

15.6.5 Latin America Armored Personnel Carrier Market By Carrying Capacity

15.6.6 Latin America Armored Personnel Carrier Market By Configuration

15.6.7 Latin America Armored Personnel Carrier Market, By Number of Occupants

15.6.8 Latin America Armored Personnel Carrier Market, By End User

15.6.9 Brazil

15.6.9.1 Brazil Armored Personnel Carrier Market By Design

15.6.9.2 Brazil Armored Personnel Carrier Market By Range

15.6.9.3 Brazil Armored Personnel Carrier Market By Carrying Capacity

15.6.9.4 Brazil Armored Personnel Carrier Market By Configuration

15.6.9.5 Brazil Armored Personnel Carrier Market, By Number of Occupants

15.6.9.6 Brazil Armored Personnel Carrier Market, By End User

15.6.10 Argentina

15.6.10.1 Argentina Armored Personnel Carrier Market By Design

15.6.10.2 Argentina Armored Personnel Carrier Market By Range

15.6.10.3 Argentina Armored Personnel Carrier Market By Carrying Capacity

15.6.10.4 Argentina Armored Personnel Carrier Market By Configuration

15.6.10.5 Argentina Armored Personnel Carrier Market, By Number of Occupants

15.6.10.6 Argentina Armored Personnel Carrier Market, By End User

15.6.11 Colombia

15.6.11.1 Colombia Armored Personnel Carrier Market By Design

15.6.11.2 Colombia Armored Personnel Carrier Market By Range

15.6.11.3 Colombia Armored Personnel Carrier Market By Carrying Capacity

15.6.11.4 Colombia Armored Personnel Carrier Market By Configuration

15.6.11.5 Colombia Armored Personnel Carrier Market, By Number of Occupants

15.6.11.6 Colombia Armored Personnel Carrier Market, By End User

15.6.12 Rest of Latin America

15.6.12.1 Rest of Latin America Armored Personnel Carrier Market By Design

15.6.12.2 Rest of Latin America Armored Personnel Carrier Market By Range

15.6.12.3 Rest of Latin America Armored Personnel Carrier Market By Carrying Capacity

15.6.12.4 Rest of Latin America Armored Personnel Carrier Market By Configuration

15.6.12.5 Rest of Latin America Armored Personnel Carrier Market, By Number of Occupants

15.6.12.6 Rest of Latin America Armored Personnel Carrier Market, By End User

16. Company Profiles

16.1 General Dynamics Corporation

16.1.1 Company Overview

16.1.2 Financial

16.1.3 Products/ Services Offered

16.1.4 SWOT Analysis

16.1.5 The SNS View

16.2 BAE Systems plc

16.2.1 Company Overview

16.2.2 Financial

16.2.3 Products/ Services Offered

16.2.4 SWOT Analysis

16.2.5 The SNS View

16.3 NORINCO

16.3.1 Company Overview

16.3.2 Financial

16.3.3 Products/ Services Offered

16.3.4 SWOT Analysis

16.3.5 The SNS View

16.4 Rheinmetall AG

16.4.1 Company Overview

16.4.2 Financial

16.4.3 Products/ Services Offered

16.4.4 SWOT Analysis

16.4.5 The SNS View

16.5 Textron Inc.

16.5.1 Company Overview

16.5.2 Financial

16.5.3 Products/ Services Offered

16.5.4 SWOT Analysis

16.5.5 The SNS View

16.6 Oshkosh Corporation

16.6.1 Company Overview

16.6.2 Financial

16.6.3 Products/ Services Offered

16.6.4 SWOT Analysis

16.6.5 The SNS View

16.7 UralVagonZavod

16.7.1 Company Overview

16.7.2 Financial

16.7.3 Products/ Services Offered

16.7.4 SWOT Analysis

16.7.5 The SNS View

16.8 Ukroboronprom

16.8.1 Company Overview

16.8.2 Financial

16.8.3 Products/ Services Offered

16.8.4 SWOT Analysis

16.8.5 The SNS View

16.9 Katmerciler A.S.

16.9.1 Company Overview

16.9.2 Financial

16.9.3 Products/ Services Offered

16.9.4 SWOT Analysis

16.9.5 The SNS View

16.10 KMDB A.A.

16.10.1 Company Overview

16.10.2 Financial

16.10.3 Products/ Services Offered

16.10.4 SWOT Analysis

16.10.5 The SNS View

17. Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

17.3.1 Industry News

17.3.2 Company News

17.3.3 Mergers & Acquisitions

18. Use Case and Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Aircraft Lighting Market size was valued at USD 2.64 billion in 2023 and is expected to reach USD 6.00 billion by 2032 and grow at a CAGR of 9.56% over the forecast period 2024-2032.

The Military Trainer Aircraft Market Size was valued at USD 5.30 billion in 2023 and is expected to reach USD 6.78 billion by 2032 with a growing CAGR of 3.1% over the forecast period 2024-2032.

The Aerostat Systems Market size was valued at USD 14.90 billion in 2023 and is projected to reach USD 48.45 billion by 2032, registering a CAGR of 14% from 2024 to 2032.

The Fixed-Wing VTOL UAV Market was valued at USD 1.28 billion in 2023 and is projected to reach USD 8.84 billion by 2032, growing at a remarkable CAGR of 24.0% during the forecast period of 2024-2032.

The C5ISR Market Size was valued at USD 131.5 billion in 2023, expected to reach USD 167.5 billion by 2031 with a growing CAGR of 3.07% over the forecast period 2024-2031.

The Artificial Intelligence In Military Market Size was valued at US$ 9819.4 million in 2023, is expected to reach USD 39481.39 million by 2032, and grow at a CAGR of 16.72% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone