Argon Market Report Scope & Overview:

The Argon Market Size was valued at USD 19.02 Billion in 2023 and is expected to reach USD 34.97 Billion by 2032, growing at a CAGR of 7.00% over the forecast period of 2024-2032.

To Get more information on Argon Market - Request Free Sample Report

The Argon Market is expanding, driven by its critical role in metal manufacturing, healthcare, and electronics. Production capacity analysis highlights supply-demand trends and capacity expansions by key manufacturers. The investment and funding landscape showcases financial commitments toward infrastructure and technological advancements. Stringent environmental regulations are shaping production methods, pushing companies toward sustainable extraction. R&D expenditure by major players focuses on enhancing purity and discovering new applications. Capital expenditure (CAPEX) trends reveal investments in cryogenic storage, on-site generation, and advanced distribution networks to ensure supply resilience. Our report provides exclusive insights into these aspects, backed by data-driven analysis and expert perspectives, offering a comprehensive understanding of the evolving market

Argon Market Dynamics

Drivers

-

Increasing Utilization of Argon in Metal Manufacturing and Fabrication Industry Accelerates the Market Growth

The widespread use of argon in the metal manufacturing and fabrication industry is a major driver of the argon market. Argon is extensively utilized as an inert shielding gas in welding processes, particularly in applications requiring precision and high-quality finishes, such as aerospace, automotive, and structural steel manufacturing. The metal fabrication industry relies heavily on argon to prevent oxidation and contamination, ensuring superior weld strength and durability. Additionally, the growing adoption of additive manufacturing (3D printing) in industrial production has increased the demand for argon in metal powder-based printing processes. The rise in global infrastructure development, coupled with the expansion of the automotive and construction sectors, has further boosted the need for argon in metal processing and fabrication. Countries with strong industrial bases, such as Germany, the United States, China, and Japan, are witnessing increased demand for argon as steel and aluminum production continues to grow. The push for sustainable and lightweight materials in automotive manufacturing, particularly in the production of electric vehicles, has also driven the need for precision welding and metal processing using argon. Furthermore, advancements in welding technologies, such as laser welding and plasma arc welding, have reinforced the importance of argon as an essential shielding gas. The increasing focus on improving production efficiency and reducing material wastage in metal fabrication processes is expected to sustain the demand for argon, making it a crucial component in modern manufacturing industries.

Restraints

-

High Production and Storage Costs of Argon Limit Market Expansion and Increase Operational Challenges for End-Users

The high production and storage costs of argon pose a significant restraint on market expansion, affecting its affordability and accessibility for end-users. Argon is primarily obtained as a byproduct of oxygen and nitrogen separation during air liquefaction in cryogenic distillation plants. The extraction process requires advanced separation technologies, high energy consumption, and significant capital investments, making argon production expensive. Additionally, the transportation and storage of argon, especially in its liquid form, demand specialized cryogenic tanks and infrastructure, further adding to the overall operational costs. Industries that rely on bulk argon supply, such as metal fabrication and electronics manufacturing, often face cost fluctuations due to energy price volatility and supply chain disruptions. Small and medium-sized enterprises (SMEs) with limited budgets may find it challenging to invest in the necessary storage and handling infrastructure for argon, leading to constrained adoption. The economic burden associated with maintaining a stable and cost-effective supply chain for argon remains a key challenge, impacting market growth.

Opportunities

-

Expansion of On-Site Argon Generation Technologies Enhances Supply Efficiency and Reduces Dependency on Bulk Storage and Transportation

The expansion of on-site argon generation technologies presents a significant opportunity for improving supply efficiency and reducing dependency on bulk storage and transportation. Many industries, particularly those requiring a continuous supply of argon, are adopting on-site generation systems to mitigate the risks associated with supply chain disruptions and fluctuating argon prices. On-site generation eliminates the need for bulk transportation and reduces storage costs, making it a cost-effective solution for end-users. Advancements in pressure swing adsorption (PSA) and membrane-based separation technologies have further enhanced the feasibility of on-site argon production. The growing preference for localized gas generation is expected to drive innovation and investment in decentralized argon supply solutions.

Challenge

-

Supply Chain Disruptions and Regional Dependence on Limited Production Facilities Affect Market Stability

The argon market faces challenges related to supply chain disruptions and production facility concentration. Since argon is primarily produced as a byproduct of oxygen and nitrogen manufacturing, any fluctuations in these industries directly impact argon availability. Additionally, some regions rely on a limited number of large-scale production plants, making them vulnerable to supply shortages during plant shutdowns, maintenance, or geopolitical disruptions. Logistics constraints, including high transportation costs and storage limitations, further complicate supply chain management. To address these challenges, manufacturers are exploring decentralized production models and regional expansion strategies to ensure a stable supply.

Argon Market Segmental Analysis

By Grade

The industrial-grade segment dominated the argon market in 2023, holding a 65.2% share due to its extensive use in welding, metal fabrication, and industrial processing. Argon’s inert properties make it essential for gas metal arc welding (GMAW) and tungsten inert gas (TIG) welding, particularly in the automotive and construction sectors. The International Institute of Welding (IIW) has highlighted the increasing adoption of industrial argon in advanced welding techniques. Furthermore, government infrastructure projects, such as the U.S. Bipartisan Infrastructure Law, which allocates significant funds for bridge and highway construction, have fueled demand for industrial-grade argon. Additionally, key manufacturers, including Linde and Air Liquide, have expanded production to meet the growing demand, reinforcing industrial-grade argon’s dominant position.

By Storage & Distribution

The cylinders segment dominated the argon market in 2023, capturing 45.1% of the share due to its convenience, cost-effectiveness, and widespread industrial use. Cylinder-based storage is preferred for welding, healthcare, and laboratory applications, where controlled supply is essential. The American Welding Society (AWS) has emphasized the increased use of portable gas cylinders for on-site welding operations, particularly in small-scale metal fabrication. Additionally, government-backed industrialization initiatives in emerging economies, such as India’s ‘Make in India’ campaign, have led to a surge in cylinder-based argon adoption in manufacturing units. Leading players like Air Products and Messer Group have expanded their cylinder-based distribution networks, further strengthening this segment’s market dominance.

By Form

Liquid form dominated the argon market in 2023 with a 55.6% share, primarily due to its extensive industrial applications, particularly in cryogenic processes and large-scale metal fabrication. The U.S. Department of Energy (DOE) has acknowledged liquid argon’s critical role in particle physics research, including projects like the Deep Underground Neutrino Experiment (DUNE). Additionally, steel manufacturers such as ArcelorMittal and Nippon Steel utilize liquid argon for refining processes to prevent oxidation, further driving demand. The expansion of air separation plants by companies like Linde and Air Liquide has increased the availability of liquid argon, making it the preferred choice for bulk consumers in metal production and research institutions.

By End-Use Industry

Metal manufacturing and fabrication dominated the argon market in 2023, accounting for 35.8% of the total share, driven by the gas’s indispensable role in welding and metal refining. The World Steel Association (WSA) has reported increasing steel production, with countries like China, India, and the United States heavily relying on argon for arc welding and degassing. Government initiatives such as China’s Belt and Road Initiative (BRI) and the European Green Deal, which emphasize infrastructure expansion and sustainable construction, have boosted metal fabrication activities. Moreover, prominent metal manufacturers like Tata Steel and POSCO have integrated argon-based refining techniques to enhance product quality, reinforcing this segment’s dominance in the global argon market.

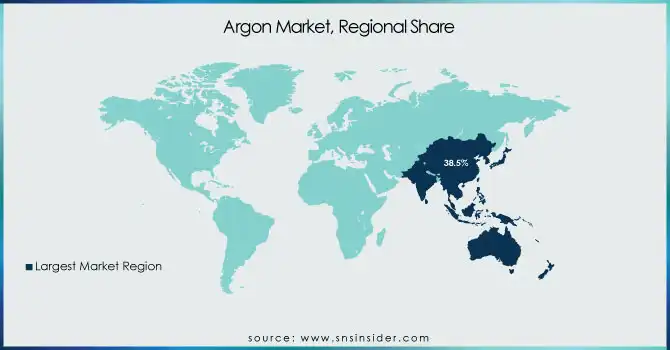

Argon Market Regional Outlook

Asia Pacific dominated the argon market in 2023 and accounted for a 38.5% market share, primarily due to the rapid expansion of the metal manufacturing, electronics, and automotive industries. China led the region, driven by its status as the world’s largest steel producer, with the World Steel Association reporting that the country produced over 1 billion metric tons of steel in 2023, significantly boosting argon demand for metal fabrication and welding. Japan, a leader in semiconductor production, also contributed to the market dominance, with the Japan Electronics and Information Technology Industries Association (JEITA) highlighting increasing semiconductor sales exceeding USD 50 billion in 2023. India’s growing industrialization, supported by initiatives like ‘Make in India,’ has further fueled argon adoption in metal processing and energy sectors. Additionally, the expansion of air separation plants by key players such as Linde, Air Liquide, and Nippon Sanso Holdings has strengthened regional supply chains, reinforcing Asia Pacific’s dominance.

On the other hand, North America emerged as the fastest-growing region in the argon market, with a significant CAGR during the forecast period. The dominance is driven by rising demand from the healthcare, aerospace, and energy sectors. The United States leads this growth, with the U.S. Department of Energy investing in clean energy projects that require argon for plasma arc cutting and insulation. Additionally, NASA’s increasing use of argon in spacecraft applications and the semiconductor industry's growth, supported by the CHIPS Act, are boosting demand. Canada’s expanding metal fabrication industry, particularly in automotive manufacturing, has also contributed to market growth, with the Canadian Steel Producers Association (CSPA) reporting increased steel production in 2023. Mexico’s growing electronics sector, driven by investments from global chip manufacturers, further supports the rising demand for high-purity argon. The presence of major players like Air Products and Messer Group expanding production facilities solidifies North America’s position as the fastest-growing region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Air Products and Chemicals Inc. (Liquid Argon, High-Purity Argon Gas, Argon Gas Mixtures)

-

Air Water Inc. (Industrial Argon Gas, Bulk Argon Supply, Argon Cylinders)

-

Buzwair Industrial Gases Factories (Argon for Welding, High-Purity Argon, Liquid Argon Supply)

-

Cryotec Anlagenbau GmbH (Argon Purification Systems, Cryogenic Argon Plants, Air Separation Units for Argon)

-

Dubai Industrial Gases (High-Purity Argon, Argon Gas Cylinders, Liquid Argon)

-

Gulf Cryo Holding K.S.C.C. (Industrial Argon Gas, Argon Mixtures, Liquid Argon for Metal Fabrication)

-

Hangzhou Hangyang Company Limited (Air Separation Units for Argon, Liquid Argon Storage Tanks, Bulk Argon Supply Systems)

-

Iwatani Corporation (High-Purity Argon Gas, Argon Cylinders, Liquid Argon Supply)

-

J.V.C. Industrial Corporation (Industrial Argon Gas, Argon Mixtures, Argon Cylinders)

-

Kanto Kagaku Co. Ltd. (Ultra-High Purity Argon, Semiconductor-Grade Argon, Argon Cylinders)

-

L'Air Liquide S.A. (High-Purity Argon, Argon Mixtures, Bulk & Cylinder Argon Supply)

-

Linde plc (Liquid Argon, Industrial Argon Gas, Argon Gas Mixtures)

-

Messer Group GmbH (Industrial Argon, Argon Mixtures for Welding, Liquid Argon Supply)

-

National Industrial Gas Plants (High-Purity Argon Gas, Argon Cylinders, Bulk Argon Delivery)

-

Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso Corporation) (High-Purity Argon, Argon Gas Mixtures, Liquid Argon)

-

SIAD S.p.A. (High-Purity Argon, Industrial Argon, Liquid Argon Supply)

-

SOL S.p.A. (Liquid Argon, High-Purity Argon Gas, Argon Mixtures)

-

Southern Industrial Gas Berhad (Industrial Argon Gas, Argon Gas Cylinders, Liquid Argon Supply)

-

Universal Industrial Gases Inc. (Bulk Argon Supply, Liquid Argon Storage, Argon Purification Systems)

-

Wesfarmers Company (Industrial Argon Gas, Argon Cylinders, Liquid Argon Supply)

Recent Highlights

-

October 2024: Syntax Systems acquired Argon Supply Chain Solutions to enhance its cloud-based supply chain management offerings. The acquisition aimed to strengthen Syntax’s digital transformation capabilities, providing advanced logistics and inventory solutions. This move aligned with Syntax’s strategy to expand its enterprise resource planning (ERP) and cloud solutions portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 19.02 Billion |

| Market Size by 2032 | USD 34.97 Billion |

| CAGR | CAGR of 7.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Grade (Industrial, High Purity, Ultra-High Purity) •By Storage & Distribution (Cylinders, Bulk & Microbulk, On-Site Generation) •By Form (Liquid Argon, Gaseous Argon) •By End-Use Industry (Metal Manufacturing & Fabrication, Chemicals, Energy, Healthcare, Electronics & Semiconductors, Aerospace & Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Linde plc, Air Products and Chemicals Inc., L'Air Liquide S.A., Nippon Sanso Holdings Corporation (Taiyo Nippon Sanso Corporation), Messer Group GmbH, Iwatani Corporation, Air Water Inc., Gulf Cryo Holding K.S.C.C., SIAD S.p.A., SOL S.p.A. and other key players |