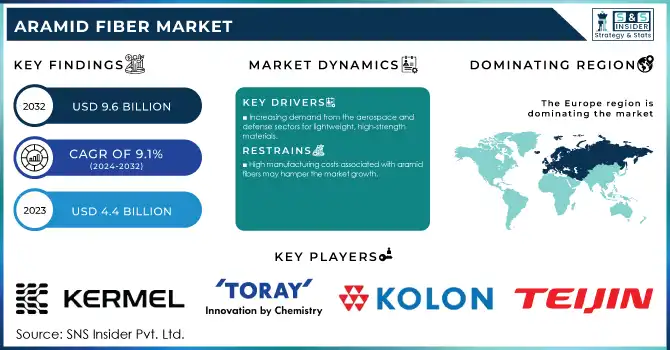

Aramid Fiber Market Report Scope & Overview:

The Aramid Fiber Market size was USD 4.4 billion in 2023 and is expected to reach USD 9.6 billion by 2032 and grow at a CAGR of 9.1% over the forecast period of 2024-2032. In telecommunications, the expanded use of aramid fibers is one of the vital growth factors for the market. As 5G networks are rapidly being deployed and the demand for high-speed internet connectivity increases, the demand for lightweight and high-durability materials is increasing for fiber optic cables. They are used as a strength member in fiber optic cables, as they have high tensile strength, and heat resistance, and are capable of withstanding extreme environmental conditions. Moreover, the increasing trend of smart cities and IoT applications accelerates the growth of aramid-reinforced cables, as they deliver fast and long-lasting performance. The ever-growing telecommunication infrastructures around the world especially in developing economies and the potential growth opportunity of aramid fibers to support the development.

Get More Information on Aramid Fiber Market - Request Sample Report

The U.S. Government Accountability Office (GAO) estimated that recent federal broadband initiatives would require a peak of 23,000 additional skilled telecommunications workers in 2023, assuming a 10-year funding timeline. If the funds are utilized over a shorter period, such as five years, the demand could increase to 34,000 workers annually at its peak.

The growing use of aramid fibers across aerospace & defense industries on account of high-strength-to-weight ratio, thermal resistance, and durability is projected to drive the market over the forecast period. Aramid fibers are also widely used in aerospace for the manufacture of aircraft components that require weight reduction, such as fuselage reinforcements, wing structures, and interior panels, to achieve fuel efficiency and performance. Likewise, these fibers are used in defense applications such as ballistic-resistant body armor, helmets, and vehicle armor; they provide these protection qualities at minimal weight. With governments around the globe spending more on defense to meet new security demands and the aviation sector pushing for lighter and more fuel-efficient aircraft, the need for aramid fibers is expected to grow considerably. These applications highlight the unique strategic value of aramid fibers as we know them advancing aerospace and defence technology for the modern world.

Aramid Fiber Market Dynamics

Drivers

-

Increasing demand from the aerospace and defense sectors for lightweight, high-strength materials.

-

Growing adoption in automotive applications to achieve lightweight and improve fuel efficiency.

One of the key factors fueling the growth of aramid fibers in automotive applications is the automotive industry's emphasis on lightweight and improving fuel efficiency. There is wide use of aramid fibers, which offer high strength, low weight, and durable performance and are applied in tires, brake pads, and clutches, and composites used as structural reinforcements. These materials are essential to reducing vehicle mass, driving improvements in fuel economy, and helping vehicle manufacturers meet increasingly stringent global emissions requirements. This trend has only been exacerbated with the emergence of electric vehicles (EVs), which need lightweight materials to maximize battery range and efficiency. With the automotive sector increasingly focusing on sustainability coupled with performance, the demand for advanced materials like aramid fibers is projected to remain steady, revolutionizing the dynamics surrounding vehicle design and manufacturing.

For example, according to the U.S. Department of Energy, a 10% reduction in a vehicle's weight can lead to an 8% improvement in fuel efficiency. This improvement is essential for reducing emissions and increasing the range of electric vehicles. Lightweight materials such as aluminum, carbon fiber, and advanced high-strength steels (AHSS) have been shown to reduce vehicle weight by significant percentages, which in turn enhances fuel economy.

Restraint

-

High manufacturing costs associated with aramid fibers may hamper the market growth.

The growth of the market is restrained owing to the high manufacturing costs of aramid fibers. Aramid fibers are manufactured through a highly involved, often energy-driven procedure with unique equipment that requires higher-grade raw material. Those factors also increase the production price of stone bathtubs, which makes them pricier than other types of materials such as fiberglass or polyester. The large-scale adoption of aramid fibers can be limited by their high prices which restrict them for price-sensitive industries like automotive and construction. Take the automotive sector: even though aramid fibers provide exceptional strength-weight ratios their expensive nature has continued to limit their use in mass-market vehicles. Aramid fibers are a staple of premium and specialty vehicles, but industry experts say their high expense limits their application in more cost-sensitive endeavors.

Opportunities

-

Popularity of aramid fibers in sports equipment and recreational goods due to their durability and impact resistance.

-

Rising need for protective clothing in industrial and military settings due to stringent safety regulations

Aramid Fiber Market Segmentation

By Type

The para-aramid fiber segment held the largest market share around 72% in 2023. It is owing to its unique balance of strength, heat resistance, and durability, that suits a variety of applications requiring high-performance enhancements. Examples of some commonly used para-aramid fibers in various industries include aerospace, automotive biofuels, military, motorcycle clothing, oil and gas, as well as the protective gear we wear daily, such as bulletproof helmets, gloves, and vests. In particular, their lightweight properties equally balanced with high temperature and physical stress tolerance make them a requisite to be used in safety gear such as bulletproof vests and helmets which have been popularly sought after by the defense and law enforcement sectors.

By Application

The security & protection segment held the largest market share around 38% in 2023. It is used for their best-in-class strength, heat-resistance, and lightweight qualities, aramid fibers are low elongation synthetic fibers with a very high tensile strength, making them essential in the manufacturing of protective garments, such as bulletproof vests, helmets, and gloves. With an increasing global focus on defense and security, including military personnel, law enforcement officers, and first responders, these products are critical. The rise of this segment is further supported by increasing geopolitical tensions and rising military expenditure across the globe. For instance, the use of these fibers is one of the major aspects of the U.S. Department of Defense budget, and the specific use of aramid fibers has significant funding associated with advanced body armor systems for all military branches, emphasizing the prominence of aramid fibers in national security.

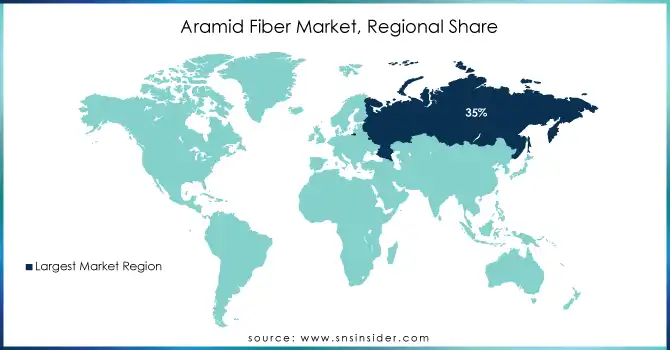

Aramid Fiber Market Regional Analysis

Europe dominated the Aramid Fiber Market with the highest revenue share of more than 35% in 2023 influenced by various factors, including the conflict between Russia and Ukraine. This geopolitical tension has disrupted the global supply chain for key materials used in aramid fiber production, affecting availability and pricing. Despite these challenges, Europe's robust manufacturing infrastructure, stringent safety regulations, and focus on innovation position the region as a key player in the aramid fiber market. Moreover, the instability caused by the war highlights the importance of local sourcing and diversified supply chains, further emphasizing Europe's significance in ensuring continuity in aramid fiber supply. In addition, stringent safety regulations in industries such as aerospace, automotive, and defense drive the demand for advanced protective materials like aramid fibers.

The Asia-Pacific region is forecasted to grow at the highest CAGR from 2024-2032 in the Aramid Fiber Market. Increasing investments in infrastructure development and military modernization initiatives boost the demand for aramid fibers in the region. Additionally, the availability of skilled labor and lower production costs compared to other regions enhance the competitiveness of Asia-Pacific in the aramid fiber market, fostering its substantial growth prospects.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Kermel (Kermel HT, Kermel Tech)

-

Toray Industries, Inc. (Torayca, Teflon Aramid)

-

Kolon Industries Inc. (Heracron, Wonderex)

-

Teijin Ltd. (Twaron, Technora)

-

DuPont De Numerous, Inc. (Kevlar, Nomex)

-

SRO Aramid (Jiangsu) Co. Ltd. (Aramid 1313, MetaStar)

-

Hyosung Corp. (Conex, Tansome)

-

China National Bluestar (Group) Co., Ltd. (Bluestar Aramid, MetaStar)

-

Huvis Corporation (MetaOne, Aramid 1414)

-

Yantai Tayho Advanced Materials Co., Ltd. (Taparan, NewStar)

-

BASF SE (Ultramid, Ultradur)

-

DSM N.V. (Dyneema, Arnitel)

-

Toyobo Co., Ltd. (Zylon, Vestaron)

-

Evonik Industries AG (VESTAMID, P84)

-

Sinopec Yizheng Chemical Fiber Co., Ltd. (Aramid Y1414, Y1166)

-

Asahi Kasei Corporation (Leona, Tenac)

-

Mitsubishi Chemical Corporation (Pyrofil, Kyron)

-

Kaneka Corporation (Kanekalon, Apilon)

-

AKSA Acrylic Chemical Co. (Aksa Aramid, Acrylux)

-

Kolon Global Corporation (Xincore, Superfin).

Recent Development:

-

In 2023, DuPont introduced Kevlar EXO aramid fiber, marking a groundbreaking advancement in aramid fiber technology. This innovative fiber represents the most significant development in over 50 years, offering a new technology platform designed to meet the demands of various applications requiring exceptional performance and protection in challenging conditions.

-

In 2023, Bluestar expanded its production facilities in China with government incentives to cater to the growing domestic and export markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.4 Billion |

| Market Size by 2032 | US$ 9.6 Billion |

| CAGR | CAGR of 9.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Meta-Aramid Fiber, Para-Aramid Fiber) • By Application (Security & Protection, Frictional Materials, Industrial Filtration, Optical Fibers, Rubber Reinforcement, Tire Reinforcement, Electrical Insulation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Kermel,Toray Industries, Inc.,Kolon Industries Inc.,Teijin Ltd.,DuPont De Numerous, Inc.,SRO Aramid Co. Ltd.,Hyosung Corp.,China National Bluestar Co., Ltd.,Huvis Corporation,Yantai Tayho Advanced Materials Co., Ltd.,BASF SE,DSM N.V.,Toyobo Co., Ltd.,Evonik Industries AG,Sinopec Yizheng Chemical Fiber Co., Ltd.,Asahi Kasei Corporation,Mitsubishi Chemical Corporation,Kaneka Corporation,AKSA Acrylic Chemical Co.,Kolon Global Corporation, and Others |

| Key Drivers | • Increasing demand from the aerospace and defense sectors for lightweight, high-strength materials. • Growing adoption in automotive applications to achieve lightweight and improve fuel efficiency. |

| Restraints | • High manufacturing costs associated with aramid fibers may hamper the market growth. |