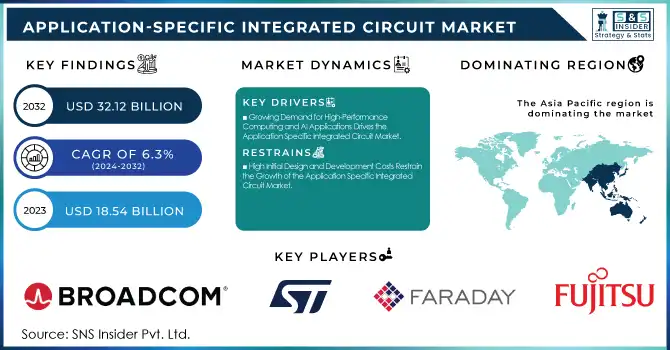

Application-Specific Integrated Circuit Market Size Analysis:

The Application-Specific Integrated Circuit Market Size was valued at USD 18.54 Billion in 2023 and is expected to reach USD 32.12 Billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

The Application Specific Integrated Circuit (ASIC) Market is a rapidly growing segment within the semiconductor industry, fueled by the increasing demand for tailored, efficient, and high-performance solutions across various applications. ASICs are custom-designed chips engineered to perform a specific function or set of functions, making them highly optimized for specific tasks such as processing, data handling, or control. This market has experienced significant growth due to the diverse range of sectors benefiting from ASIC technology, including consumer electronics, telecommunications, automotive, healthcare, and data centers.

Application-Specific Integrated Circuit (ASIC) Market Size and Forecast

-

Market Size in 2023: USD 18.54 Billion

-

Market Size by 2032: USD 32.12 Billion

-

CAGR: 6.3% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2021-2023

Get More Information on Gaming Hardware Market - Request Sample Report

Application-Specific Integrated Circuit (ASIC) Market Trends:

-

Surging demand for AI accelerators and data center workloads is driving custom ASIC adoption, with hyperscalers deploying ASICs that deliver 3–5× higher performance per watt than general-purpose GPUs/CPUs.

-

Rapid growth in cryptocurrency mining and blockchain hardware continues to support ASIC demand, where ASIC miners achieve over 90% energy efficiency improvement compared to GPU-based systems.

-

Expansion of 5G, IoT, and edge devices is increasing need for low-power ASICs, with edge ASIC deployments growing at over 12% CAGR for real-time processing.

-

Rising integration of ASICs in automotive ADAS and autonomous vehicles is accelerating, as vehicles incorporate 50+ specialized chips, many designed as custom ASICs for vision and sensor fusion.

-

Focus on power efficiency and miniaturization in consumer electronics is boosting ASIC design wins, enabling devices to achieve 30–40% lower power consumption and reduced board space.

This growth is propelled by advancements in technologies such as artificial intelligence, machine learning, and 5G communications, all of which require specialized hardware for optimal performance. For instance, the adoption of AI and machine learning applications has led to a surge in demand for custom-designed chips capable of handling complex algorithms efficiently. Similarly, the rollout of 5G networks necessitates high-speed, low-latency communication solutions, further driving the need for specialized ASICs. The U.S. government's recognition of the strategic importance of semiconductors has led to initiatives aimed at bolstering domestic manufacturing and innovation in this sector. These efforts are expected to further stimulate the growth of the ASIC market, positioning it as a critical component in the nation's technological advancement and economic development.

Application Specific Integrated Circuit Market Key Drivers:

-

Growing Demand for High-Performance Computing and AI Applications Drives the Application Specific Integrated Circuit Market

The demand for high-performance computing (HPC) systems and artificial intelligence (AI) applications is a key driver for the growth of the Application Specific Integrated Circuit (ASIC) market. With advancements in machine learning, deep learning, and neural networks, there is an increased need for custom-designed processors that can handle complex computations more efficiently than general-purpose chips. ASICs are specifically tailored for tasks such as pattern recognition, data analysis, and real-time processing, making them ideal for AI-driven applications.

For instance, AI-based technologies in sectors like healthcare, finance, and autonomous vehicles require powerful processing capabilities to analyze large datasets quickly and accurately.

The growing need for efficient data processing and faster decision-making, paired with the rising adoption of AI across industries, directly drives the demand for ASIC solutions. These chips not only offer higher performance but also ensure lower power consumption, which is vital for maintaining energy efficiency in AI systems. As the AI market expands, the need for specialized hardware like ASICs that are optimized for these tasks will continue to fuel market growth, positioning ASICs as a core enabler of next-generation AI technologies.

-

Increasing Use of Application Specific Integrated Circuits in Telecommunications and 5G Networks Boosts Market Growth

The rapid deployment of 5G technology and the increasing demand for telecommunications infrastructure are fueling the growth of the Application Specific Integrated Circuit (ASIC) market. As telecommunications companies shift to 5G, they require specialized hardware capable of handling higher data throughput, lower latency, and increased efficiency. ASICs are uniquely positioned to meet these demands because they can be custom-designed for specific functions such as signal processing, encryption, and data transmission within the 5G ecosystem. The global 5G rollout demands high-performance solutions for the development of network infrastructure, including base stations, routers, and small cells, all of which benefit from the efficiency and speed provided by ASICs. These custom chips enable faster and more reliable communication, essential for supporting the billions of connected devices in the growing Internet of Things (IoT) ecosystem. Moreover, the low power consumption of ASICs compared to general-purpose processors makes them an attractive option for 5G applications, where efficiency is crucial. As 5G networks become more prevalent globally, the need for ASIC-based components will continue to rise, further propelling the market's expansion.

Application Specific Integrated Circuit Market Restrain:

-

High Initial Design and Development Costs Restrain the Growth of the Application Specific Integrated Circuit Market

One significant restraint affecting the growth of the Application Specific Integrated Circuit (ASIC) market is the high initial design and development costs associated with creating custom chips. ASIC development requires specialized knowledge, advanced tools, and a considerable investment in research and development (R&D), which can make the process prohibitively expensive for some companies, particularly startups or smaller players in the market. Designing an ASIC involves multiple stages, including specification, design, testing, and manufacturing, each of which requires specialized expertise and resources.

Additionally, the need for high-end fabrication facilities, often limited to a few large semiconductor manufacturers, further escalates costs. For businesses without the required financial capacity, adopting ASIC technology may not be a viable option, limiting its accessibility to larger companies or those with more resources. Furthermore, the lengthy design cycle of ASICs means that companies might face delays in bringing new products to market, which can hinder their ability to respond quickly to changing consumer demands or technological advancements. As a result, the high development costs remain a key challenge that could restrict widespread adoption and growth within the market.

Application-Specific Integrated Circuit (ASIC) Market Segments Analysis

By Product

The Semi-Custom ASIC segment holds the largest share of the Application Specific Integrated Circuit market, accounting for 49.00% of the revenue in 2023. Semi-Custom ASICs combine the advantages of full customization with the cost-efficiency and shorter time-to-market of pre-designed core logic. These chips are ideal for applications in consumer electronics, telecommunications, and automotive industries, where specific processing requirements must be met without the need for entirely custom designs.

For example, in 2023, companies like Intel and AMD launched new generations of semi-custom ASIC solutions targeting AI, gaming, and data center applications. These companies are integrating advanced processing cores into semi-custom chips, enabling faster performance while reducing power consumption.

The Full Custom ASIC segment is experiencing the largest CAGR of 7.44% within the forecasted period, driven by the increasing demand for highly tailored solutions that deliver maximum performance for specific applications. Full Custom ASICs are uniquely designed from the ground up to meet the precise requirements of particular functions, offering optimal performance, power efficiency, and form factor. Industries such as automotive, aerospace, healthcare, and high-performance computing are particularly benefiting from the full custom approach, as these sectors require the utmost precision in their hardware.

For instance, TSMC's latest advancements in 5nm process technology allow for the development of ultra-small, high-performance custom ASICs, contributing to the acceleration of innovations in AI-driven applications and autonomous systems.

By Application

In 2023, the Consumer Electronics segment holds the largest revenue share of 37% in the Application Specific Integrated Circuit (ASIC) market. This segment is driven by the constant demand for more powerful, energy-efficient, and compact chips used in devices such as smartphones, tablets, wearables, and gaming consoles. ASICs in this market enable manufacturers to create devices with tailored performance capabilities, enhancing functions like multimedia processing, biometric authentication, and connectivity.

For instance, Apple’s custom-designed A-series chips, used in iPhones and iPads, are prime examples of ASIC technology, offering optimized performance for specific tasks like graphics processing and machine learning.

The Industrial segment of the Application Specific Integrated Circuit market is poised to experience the largest CAGR of 8.51% during the forecasted period. This growth is largely driven by the increasing use of automation, robotics, and IoT applications within industries such as manufacturing, energy, and logistics. Industrial applications require highly specialized ASIC solutions for tasks like sensor data processing, real-time control systems, and energy management, making them a key area for ASIC development.

For example, Texas Instruments recently launched a series of low-power, high-efficiency ASICs designed for industrial automation systems, offering improved processing speeds and reduced energy consumption.

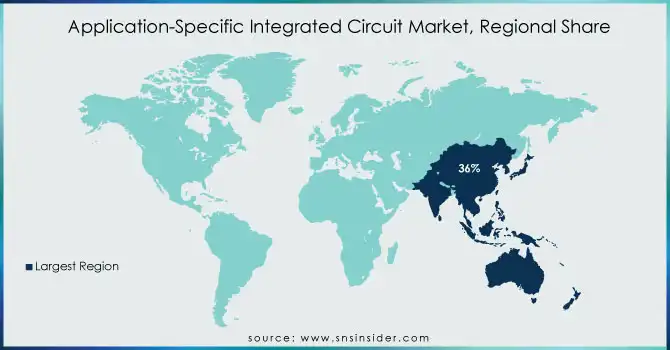

ASIC Market Regional Analysis

In 2023, the Asia Pacific region dominates the Application Specific Integrated Circuit market with an estimated market share of approximately 36%. This dominance is driven by several factors, including the strong presence of major semiconductor manufacturers, rapid industrialization, and the growing demand for consumer electronics and automotive products. Countries like China, Japan, South Korea, and Taiwan are at the forefront of ASIC development, with semiconductor giants such as TSMC, Samsung, and MediaTek leading the charge in manufacturing and designing custom chips. In particular, Taiwan’s TSMC (Taiwan Semiconductor Manufacturing Company) plays a significant role, providing advanced manufacturing capabilities for ASICs, powering industries across automotive, consumer electronics, and telecommunications.

North America is the fastest-growing region in the Application Specific Integrated Circuit market in 2023, with an estimated CAGR of 7.87%. This growth is largely attributed to the increasing demand for ASICs in high-performance computing, AI, data centers, and automotive applications, especially in the United States.

For instance, NVIDIA’s acquisition of Mellanox Technologies has helped strengthen its position in the data center and AI sectors, leveraging custom chips to accelerate computing performance.

Additionally, the U.S. government's initiatives to enhance semiconductor manufacturing capabilities, such as the CHIPS Act, are further boosting the region’s growth potential. With advancements in technologies like 5G, machine learning, and autonomous driving, the need for customized, high-performance ASIC solutions is growing rapidly.

Need any customization research on Gaming Hardware Market - Inquiry Now

Application-Specific Integrated Circuit Companies are:

-

Broadcom Inc. (BCM2711, BCM2837)

-

STMicroelectronics (STi7100, STM32F4 Series)

-

Faraday Technology Corporation (FA6280, FA5100)

-

FUJITSU (MB86S27, MB91F467)

-

Infineon Technologies AG (TLE9879, AURIX TC3xx)

-

Comport Data (CD-DSP100, CD-AI200)

-

Intel Corporation (Stratix 10, Agilex FPGA)

-

ASIX Electronics (AX88179, AX88796C)

-

OmniVision Technologies, Inc. (OV4689, OV8856)

-

Semiconductor Components Industries, LLC (NCP81239, NCL30086)

-

Seiko Epson Corporation (S1C31D50, S1C17702)

-

DWIN Technology (DGUS II, T5L ASIC)

-

Socionext America Inc. (SC1810, SC2000)

-

Tekmos Inc. (TK68HC000, TK80C51)

-

Analog Devices, Inc. (ADSP-BF609, ADXL372)

-

NXP Semiconductors (i.MX 8M, S32G2)

-

Microsemi Corporation (SmartFusion2, PolarFire FPGA)

Recent Trends

-

In October 2024, OpenAI, an artificial intelligence company, partnered with Broadcom, Inc., a provider of ASICs, to develop an artificial intelligence chip to enhance the efficiency of AI model inference.

-

In July 2023, Faraday Technology Corporation announced the launch of SerDes total solution. The newly launched solution comprises the SerDes IP design on UMC 28nm and the corresponding IP Advanced (IPA) service. In addition, it is designed to accelerate customer integration.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.54 Billion |

| Market Size by 2032 | USD 32.12 Billion |

| CAGR | CAGR of 6.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Full Custom ASIC, Semi-Custom ASIC [Cell-Based, Array-Based], Programmable ASIC) • By Application (Telecommunication, Industrial, Automotive, Consumer Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Broadcom Inc., STMicroelectronics, Faraday Technology Corporation, FUJITSU, Infineon Technologies AG, Comport Data, Intel Corporation, ASIX Electronics, OmniVision Technologies, Inc., Semiconductor Components Industries, LLC, Seiko Epson Corporation, DWIN Technology, Socionext America Inc., Tekmos Inc., Analog Devices, Inc., NXP Semiconductors, Microsemi Corporation. |

| Key Drivers | • Growing Demand for High-Performance Computing and AI Applications Drives the Application Specific Integrated Circuit Market • Increasing Use of Application Specific Integrated Circuits in Telecommunications and 5G Networks Boosts Market Growth. |

| Restraints | • High Initial Design and Development Costs Restrain the Growth of the Application Specific Integrated Circuit Market. |