Application Security Market Size & Overview:

Application Security Market Size was valued at USD 9.4 Billion in 2023 and is expected to reach USD 37.7 Billion by 2032, growing at a CAGR of 16.7% over the forecast period of 2024-2032.

Get more information on Application Security Market - Request Sample Report

The application security market analysis how the market has become a cornerstone of cybersecurity strategies globally owing to the surging cyber threats, compliance needs, and the rapid adoption of digital technologies. In 2023, the global market reached a valuation of USD 31 billion, underscoring its critical role in protecting sensitive applications across sectors. Governments have been instrumental in shaping the market. For instance, the U.S. government introduced the Cybersecurity Maturity Model Certification (CMMC) to the security posture of defense contractors, emphasizing secure application practices. Similarly, the European Union’s General Data Protection Regulation (GDPR) continues to enforce stringent rules to protect personal data, with fines for non-compliance reaching as high as €20 million or 4% of global turnover, whichever is greater.

The rise in cyberattacks further amplifies the demand for application security solutions. A report by the European Union Agency for Cybersecurity (ENISA) highlighted a 300% increase in cyberattacks since 2020, with web and mobile applications frequently targeted due to their ubiquity and vulnerability. Governments in regions, such as Asia Pacific have also implemented protective frameworks, such as India’s Personal Data Protection Bill, which mandates robust security for applications managing personal and financial data. These regulatory efforts, combined with the growing digitization of industries and increased adoption of cloud services, have established application security as an essential investment for enterprises.

Organizations are increasingly integrating intelligent solutions into their application security systems for enhanced threat detection and prevention. These technologies help businesses identify and address potential security risks in real-time, reducing the likelihood of data breaches and other incidents. By analyzing patterns and detecting anomalies, these systems can proactively spot emerging threats. Additionally, they enable a rapid response to security incidents, minimizing potential damage. In October 2023, Digital.ai Software Inc. introduced Denali, a DevSecOps platform for web applications, designed to automate software delivery and manage security using intelligent solutions. This platform empowers organizations to govern and orchestrate code with AI-assisted development, streamlining their security processes and improving efficiency.

Application Security Market Dynamics:

Drivers:

-

The use of AI and machine learning (ML) in application security has substantially enhanced prioritization and vulnerability detection, improving the efficiency and accuracy of security solutions.

-

The surging adoption of APIs has expanded attack surfaces, making API security a critical focus for enterprises. Application security solutions now emphasize attack surface management to ensure continuous monitoring and risk prioritization for APIs.

-

Organizations are adopting continuous security testing during all stages of the software development lifecycle (SDLC) to identify vulnerabilities proactively.

The integration of artificial intelligence (AI) and machine learning (ML) into application security is revolutionizing threat detection and mitigation. AI-powered tools can analyze vast amounts of code and system data to identify vulnerabilities with precision. For instance, in 2023, organizations using AI-enhanced application security reported detecting 40% more vulnerabilities compared to traditional methods. AI's capabilities in predictive analytics have enabled early identification of potential threats.

For instance, companies implementing AI-based anomaly detection systems have reduced false positive rates by over 30%, allowing security teams to focus on critical risks. A notable case is Google's implementation of ML algorithms for its application security, which helped automate code vulnerability assessments across its global infrastructure. Additionally, AI and ML streamline remediation. Automated tools can prioritize threats based on severity and provide actionable insights. GitHub Copilot, an AI assistant for developers, has incorporated security checks to assist programmers in writing secure code during development and addressing vulnerabilities before deployment.

The rapid evolution of generative AI has also enhanced attack simulation techniques. Organizations now simulate complex attacks on applications to fortify defenses. With AI's growing adoption, it is estimated that by 2025, automated security tools will handle 75% of application vulnerability management tasks, significantly decreasing the response times. These advancements highlight AI's transformative role in the application security domain, which makes it vital for modern enterprises.

Restraints:

-

Several organizations utilize multiple tools for vulnerabilities detection, which complicates integration and also limits the effectiveness of visibility and prioritization.

-

Conducting comprehensive security reviews for code changes is time-consuming and expensive. Many organizations fail to review many code changes, leaving potential vulnerabilities unaddressed.

Relying on disparate security tools to identify and prioritize application vulnerabilities poses huge complications for organizations. These tools often lack seamless integration, resulting in fragmented workflows and inconsistent data interpretations, further hampering the application security market growth. It also makes it difficult to obtain complete visibility into application vulnerabilities and effectively prioritize threats. A common complaint from organizations is that being able to correlate disparate data has proven challenging, wasting time and resources while hindering effective remediation. The overlapping features of these tools introduce redundancies that force already resource-challenged security teams to expend operational overhead. Moreover, as organizations do not have unified platforms or centralized management to tackle vulnerabilities their real-time addressability becomes difficult which increases the risk of real-time exploitation.

Application Security Market Segmentation Analysis:

By Deployment

In 2023, the on-premises enterprise video segment held the largest revenue share of 62%, as the on-premises solution is popular among industries paying high attention to data security and control. Such deployment is favored especially in regulated industries organizations like healthcare, BFSI, and Government services, requiring adherence to strict data protection laws. For instance, the California Consumer Privacy Act (CCPA), has forced organizations to keep more stringent control of consumer data, which on-premises solutions help facilitate.

Another factor that drives organizations with legacy IT infrastructures to on-premises deployments, and systems can easily be integrated with existing systems and it avoids the cumbersome task of migrating sensitive data to the cloud. Additionally, on-premise solutions enable organizations to customize all security protocols to match the environment within which they work, providing maximum protection. This segment is also bolstered by the government's focus on local data storage and compliance. For instance, India, in its current data protection bill, aims for data localization, which compels firms to move towards on-premises systems for compliance.

By Type

The web application security segment led the market in 2023 with the largest market share owing to the high volume and growing sophistication of web-based attacks. As per the official statement from ENISA, credential theft and phishing scams are the most common cyber threats having the most direct impact on web app security requirements. Especially in BFSI and retail spaces, where applications manage sensitive financial information and high transaction volumes.

This segment has been largely driven by government mandates. For instance, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) recommended organizations to protect web applications from commonly exploited vulnerabilities, such as SQL injection and Cross-site scripting (XSS) among others. Likewise, GDPR in Europe lays heavy emphasis on securing consumer data on digital platforms, making web app security protocols imperative. The "new normal" created by COVID-19 and the subsequent shift toward e-commerce and online platforms to keep the business afloat has now made it increasingly apparent why there is a growing need to invest in advanced security technology.

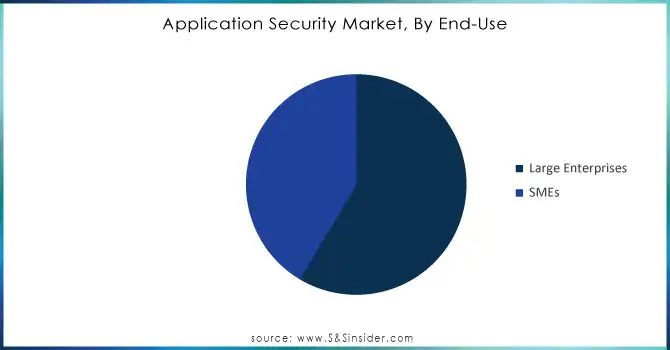

By End-Use

In 2023, the Application Security market was led by the BFSI sector, which commanded more than 19% of the overall revenue across the globe as it holds an unprecedented amount of exposure against cyber-attacks. The financial services sector is under attack nearly 300 times more than any other service sector due to the value that financial data and transactions hold. To address such risk factors, governments and regulatory bodies have established stringent guidelines. The Reserve Bank of India (RBI) made multi-factor authentication on online banking apps mandatory, while Europe is now focused on strong customer authentication (SCA) of payment apps under the revised Payment Services Directive (PSD2).

Also, the increased pace of the digital banking transition has been important. The COVID-19 pandemic accelerated the adoption of digital financial services, with mobile banking transactions surging by over 50% globally. But this transition has also resulted in a larger attack surface, and as such, it has forced financial institutions to make substantial investments in application security. Real-time monitoring, Encryption, and AI-Driven Threat Detection are some of the unique and innovative solutions that are being integrated into BFSI applications to ensure customer trust and the integrity of the data being exchanged.

Need any customization research on Application Security Market - Enquiry Now

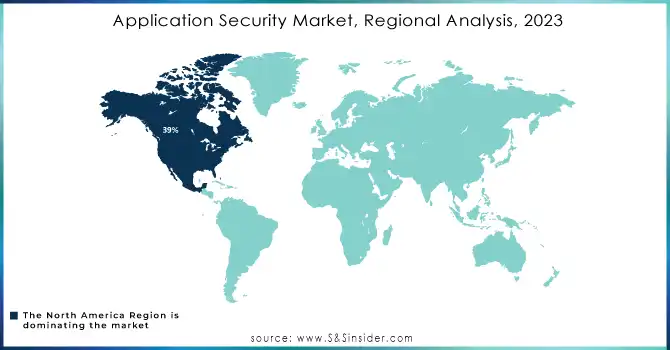

Application Security Market Regional Outlook:

In 2023, North America held the application security market share of 39% globally, driven by the technological advancements in application security solutions and services, and strict compliance regulatory frameworks including the California Consumer Privacy Act (CCPA) and the Health Insurance Portability and Accountability Act (HIPAA). North America is expected to maintain its dominance throughout the forecast period, owing to the early implementation of cloud services and an increase in the number of data breaches affecting enterprises in this region U.S. firms lose an average of USD 9.48 million per data breach, claims IBM's Cost of a Data Breach Report.

Europe held a significant share of the market in terms of revenue owing to an increasing need for GDPR compliance and a tremendous jump in cyberattacks. ENISA says attacks aimed at European businesses have increased threefold, calling for better security solutions.

Meanwhile, the fastest growth rate will be seen by the application security market in the Asia-Pacific region where the digitalization boom, smartphone proliferation, and increase in cyber market spending are privy to the only reasons for this expected growth of the region. The strong CAGR of the region in 2023 is attributed to the several government initiatives including Digital India by India and Internet Plus by China, which further lead to the application wealth. With increasing cyber threats and more regulations, such as the India Personal Data Protection Bill, advanced security solutions are a necessity. Furthermore, the growing application security market trend of elastically using cloud resources by SMEs across various countries, including Singapore and Australia, broadened the market as Asia Pacific becomes a faster-growing market for application security investments.

Key Players:

The leading application security companies in the market are:

-

IBM Corporation (IBM AppScan, IBM Security Verify)

-

Synopsys, Inc. (Coverity, Black Duck)

-

Checkmarx (Checkmarx SAST, Checkmarx IAST)

-

Imperva (Imperva Data Security Platform, Imperva Web Application Firewall)

-

Veracode (Veracode Static Analysis, Veracode Dynamic Analysis)

-

Fortinet, Inc. (FortiWeb, FortiWeb Cloud WAF-as-a-Service)

-

Palo Alto Networks, Inc. (Prisma Cloud, App-ID)

-

Micro Focus (OpenText) (Fortify Static Code Analyzer, Fortify on Demand)

-

Trend Micro (Trend Micro Cloud One, Trend Micro Deep Security)

-

Qualys, Inc. (Qualys Web Application Scanning, Qualys Web Application Firewall)

Users of Application Security Solutions

-

JPMorgan Chase & Co.

-

Amazon Web Services (AWS)

-

Walmart, Inc.

-

Meta Platforms, Inc.

-

Microsoft Corporation

-

UnitedHealth Group

-

Tencent Holdings

-

PayPal Holdings, Inc.

-

Samsung Electronics

-

Bank of America

Recent Developments

-

The Imperva Data Security Platform was integrated through a partnership with Help AG in December 2023 to provide additional visibility into data sources. This partnership will also allow Help AG to provide Imperva Application Security solutions customized for the developers.

-

In August 2023, Synopsys, Inc. partnered with NowSecure and Secure Code Warrior to make its application security testing solutions better. This partnership brought with it Synopsys Developer Security Training and Synopsys Mobile Application Security Testing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 |

USD 9.4 Billion |

| Market Size by 2031 |

USD 37.7 Billion |

| CAGR | CAGR 16.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• by Component (Solution and Services) • by types ( Web Application Security, Mobile Application Security) • by Deployment (Cloud, On-premise) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, Synopsys, Inc., Checkmarx, Imperva, Veracode, Fortinet, Inc., Palo Alto Networks, Inc., Micro Focus (OpenText), Trend Micro, Qualys, Inc. |

| Key Drivers |

• The use of AI and machine learning (ML) in application security has significantly improved vulnerability detection and prioritization, enhancing the accuracy and efficiency of security solutions. • The rising adoption of APIs has expanded attack surfaces, making API security a critical focus for enterprises. Application security solutions now emphasize attack surface management to ensure continuous monitoring and risk prioritization for APIs • Organizations are adopting continuous security testing during all stages of the software development lifecycle (SDLC) to identify vulnerabilities proactively. |

| Market Restraints |

• Many organizations use multiple tools to detect vulnerabilities, which complicates integration and limits the effectiveness of prioritization and visibility • Conducting comprehensive security reviews for code changes is time-consuming and expensive. Many organizations fail to review many code changes, leaving potential vulnerabilities unaddressed |