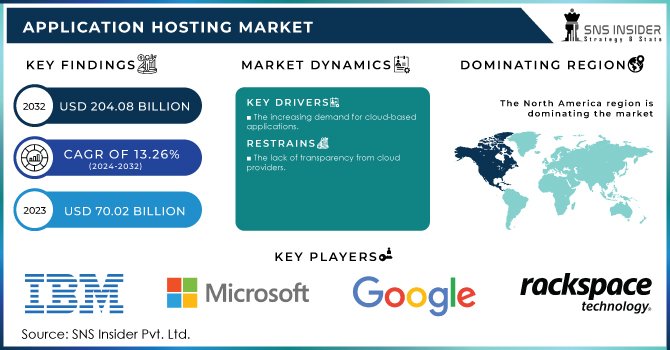

Application Hosting Market Report Scope & Overview:

The Application Hosting Market Size was valued at USD 74.52 Billion in 2023 and is expected to reach USD 210.61 Billion by 2032 and grow at a CAGR of 12.3% over the forecast period 2024-2032.

Get more information on Application Hosting Market - Request Sample Report

The Application Hosting Market has emerged as a critical enabler of digital transformation for businesses worldwide. By providing the infrastructure and services necessary to deploy, manage, and maintain applications, hosting providers support organizations in achieving scalability, flexibility, and operational efficiency. This market is witnessing robust growth, driven by several key factors, including the increasing adoption of cloud technologies, the proliferation of digital applications, and the rising demand for seamless user experiences.

This expansion is further supported by the U.S. government's increasing utilization of cloud services. A report by Statista indicates that in 2023, 37% of U.S. government IT decision-makers reported their agencies were working with one to two infrastructures as a service (IaaS) providers, such as Amazon Web Services (AWS) and Microsoft Azure.

Additionally, data from Web Tribunal reveals that 50% of U.S. government organizations are now using cloud services, with federal spending on cloud technology surpassing $6.6 billion in 2023. These statistics underscore the critical role of cloud adoption in propelling the application hosting market, as both public and private sectors seek scalable, secure, and efficient hosting solutions to meet evolving technological demands.

Application Hosting Market Dynamics

Key Drivers:

-

Rising Adoption of Cloud Technologies for Seamless Scalability and Flexibility Fuels the Application Hosting Market Growth

The growing shift towards cloud-based solutions is one of the foremost drivers of the application hosting market. Organizations are increasingly embracing cloud platforms due to their flexibility, scalability, and cost-efficiency. Cloud hosting allows businesses to scale their infrastructure dynamically based on demand, which is especially critical in industries with fluctuating workloads. Companies are no longer constrained by physical hardware, as cloud solutions enable them to deploy, manage, and maintain applications in a virtual environment. Leading cloud service providers such as AWS, Microsoft Azure, and Google Cloud offer a broad range of hosting options that cater to various business needs, from storage and computing to database management. The increasing reliance on cloud hosting reduces the need for costly on-premise infrastructure and offers businesses the advantage of pay-as-you-go pricing models.

Furthermore, cloud platforms enhance collaboration and data accessibility, allowing companies to operate from multiple locations and devices. As organizations continue to adopt cloud-first strategies to maintain competitive advantage, the application hosting market is expected to expand rapidly, driven by the growing demand for efficient and adaptable cloud solutions.

-

Proliferation of Digital Transformation Initiatives Across Industries Accelerates the Demand for Reliable Application Hosting Solutions

Digital transformation is reshaping how organizations approach technology, and its widespread adoption across industries is another significant factor propelling the growth of the application hosting market. As businesses focus on modernizing their operations and customer interactions, there is an increasing need for reliable application hosting solutions to support various digital platforms. Applications such as customer relationship management (CRM) tools, enterprise resource planning (ERP) software, and e-commerce platforms are critical to business operations, and they must be efficiently hosted to ensure optimal performance and user experience. These digital solutions help organizations enhance customer engagement, improve operational efficiency, and make data-driven decisions. Hosted applications offer the infrastructure and resources necessary for organizations to scale and support growing digital ecosystems, while also providing high availability and minimal downtime. With industries such as retail, healthcare, and financial services heavily investing in digital transformation, the demand for application hosting services is growing rapidly. As organizations continue to digitize their processes and services, the application hosting market will continue to experience growth driven by these transformation efforts.

Restrain:

-

High Dependency on External Hosting Providers Exposes Businesses to Security and Compliance Risks, Limiting Market Growth

Despite the numerous advantages of application hosting, businesses face significant challenges related to security and compliance when relying on third-party providers. The increasing sophistication of cyber threats poses a constant risk to hosted applications, making businesses vulnerable to data breaches, loss of sensitive information, and attacks such as ransomware. Ensuring data security while maintaining compliance with industry standards and regulations (e.g., GDPR, HIPAA) is essential for organizations to protect their reputation and avoid legal liabilities. Many application hosting providers are taking steps to bolster their security offerings, but organizations are still concerned about handing over control of their critical systems to external parties. This dependence on hosting providers for security measures can be a barrier for organizations that prioritize complete control over their applications and data.

Additionally, data sovereignty issues, where data must remain within specific geographic boundaries, can complicate matters further, especially when hosting solutions span multiple jurisdictions. The need for enhanced security protocols and adherence to compliance standards continues to challenge businesses, limiting the widespread adoption of third-party hosting solutions. As a result, security concerns represent a significant restraint on the growth of the application hosting market.

Application Hosting Market Segments Analysis

By Hosting Type

The managed hosting segment has been a significant contributor to the growth of the application hosting market, commanding the largest market share of 44.00% in 2023. Managed hosting provides businesses with the benefits of dedicated servers without the complexities of managing them internally. Providers in this segment offer end-to-end management services that include server setup, monitoring, security, software updates, and data backup.

For instance, Rackspace launched its managed Kubernetes service, providing enterprises with a comprehensive managed hosting solution for containerized applications. Similarly, Liquid Web has introduced enhanced support for WordPress hosting, offering tailored solutions to businesses looking to deploy and maintain robust web applications.

The cloud hosting segment is poised to experience the largest growth rate in the application hosting market, with a projected CAGR of 13.71% during the forecast period. Cloud hosting services allow businesses to run applications in a virtualized environment, with resources allocated dynamically based on demand. This model provides unmatched scalability, flexibility, and cost efficiency, which is especially appealing to businesses adopting digital transformation strategies.

For example, AWS introduced the Graviton3 processors in 2023, which are designed to offer faster and more cost-efficient computing power for cloud-hosted applications. Microsoft Azure launched its Azure OpenAI Service, enabling businesses to leverage powerful artificial intelligence tools hosted in the cloud.

By Service Type

The Data-Based Administration segment remains the dominant player in the application hosting market, with a substantial revenue share of 32.00% in 2023. This service type focuses on providing data management solutions, including storage, database management, backup, and recovery, which are crucial for businesses to ensure data integrity and security.

For instance, Oracle recently introduced its Autonomous Database on Shared Infrastructure, which automates database management and scaling, offering businesses improved performance and lower costs.

The Infrastructure Services segment is poised for the largest growth in the application hosting market, with a projected CAGR of 14.12% during the forecast period. This segment focuses on providing essential infrastructure solutions such as server hosting, storage, network management, and hardware maintenance, which are foundational for businesses to deploy and manage applications effectively.

Microsoft recently launched Azure VMware Solution, allowing businesses to run VMware workloads seamlessly in Azure, thus enhancing infrastructure flexibility and integration. AWS also introduced its AWS Outposts service, providing businesses with a fully managed hybrid cloud infrastructure that integrates with on-premise environments.

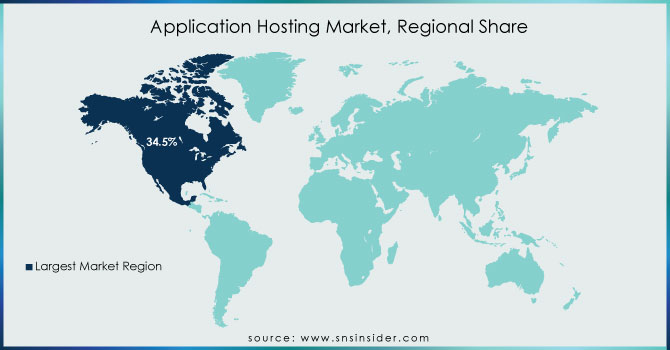

Regional Analysis

North America continues to dominate the application hosting market, holding an estimated market share of approximately 37.00% in 2023. The region's dominance can be attributed to its advanced technological infrastructure, widespread adoption of cloud-based solutions, and the presence of several key players such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and IBM. The U.S., in particular, remains the largest market, with enterprises across various sectors, including finance, healthcare, and retail, heavily relying on hosting services for their business-critical applications.

For example, AWS continues to expand its infrastructure across the region, with the launch of new data centers and services tailored to meet the needs of enterprises.

Asia Pacific is the fastest-growing region in the application hosting market, with an estimated CAGR of 13.91% in 2023. The rapid adoption of cloud computing and digital transformation strategies in countries such as China, India, Japan, and South Korea are driving the region’s market growth. As organizations across these countries embrace new technologies to enhance operational efficiency and customer engagement, the demand for scalable, secure, and cost-effective hosting solutions is rising rapidly.

For instance, India’s IT sector is undergoing a massive digital shift, with numerous businesses adopting cloud-hosted applications to streamline their operations. In China, government initiatives such as the "Made in China 2025" policy are accelerating the adoption of digital technologies, further boosting the demand for application hosting services.

Need any customization research on Application Hosting Market - Enquiry Now

Key Players

Some of the major players in the Application Hosting Market are:

-

Amazon Web Services, Inc. (Amazon EC2, Amazon S3)

-

DigitalOcean, LLC. (Droplets, App Platform)

-

IBM (IBM Cloud, Watson AI)

-

DreamHost (DreamCompute, DreamObjects)

-

Google (Google Cloud Platform, Google Kubernetes Engine)

-

Rackspace (Rackspace Technology, Cloud Sites)

-

Microsoft (Azure Virtual Machines, Azure DevOps)

-

Liquid Web (Managed WordPress Hosting, Cloud VPS Hosting)

-

Sungard AS (Managed Recovery Program, Cloud Hosting Services)

-

DXC Technology (DXC Cloud Services, Modern Workplace)

-

Apprenda (Apprenda Cloud Platform, SaaSGrid)

-

Navisite (Managed Cloud Services, Database Management)

-

Spectrum Enterprise (Managed Network Edge, Ethernet Services)

-

Capgemini (Capgemini Insights & Data, Capgemini Cloud Platform)

-

AWS (AWS Lambda, Amazon RDS)

-

Oracle (Oracle Cloud Infrastructure, Oracle Database)

-

NEC Corporation (NEC Cloud Solutions, NEC AI)

-

HostGator (Shared Web Hosting, Gator Website Builder)

-

Netmagic Solutions (Cloud Management Platform, Managed Security Services)

-

GreenGeeks (EcoSite Lite Hosting, Reseller Hosting)

Recent Trends

-

September 2023: DreamHost introduced an AI-powered business name generator designed to assist online entrepreneurs in selecting names and domains. This tool particularly benefits small business owners looking to enhance their online presence.

-

August 2023: Rackspace Technology unveiled a hosted private cloud generative AI solution in partnership with NVIDIA and Dell Technologies. This offering, supported by ecosystem partner FAIR, simplifies the adoption of generative AI for organizations.

-

August 2023: DigitalOcean expanded its services by launching “DigitalOcean Spaces” in its Bangalore, India, data center. This initiative underscores the company’s dedication to meeting the object storage needs of small businesses worldwide through robust data storage solutions.

| Report Attributes | Details |

| Market Size in 2023 | US$ 74.52 Billion |

| Market Size by 2032 | US$ 210.61 Billion |

| CAGR | CAGR of 12.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Hosting Type (Managed, Cloud, Colocation) • By Service Type (Application Monitoring, Application Programming Interface Management, Infrastructure Services, Database Administration, Backup, Application Security) • By Application (Mobile-based, Web-based) • By Organization Size (Large Enterprise, Small and Medium-sized Enterprise) • By Industry (BFSI, Retail and E-commerce, Healthcare, Media and Entertainment, Energy and Utilities, Telecommunications and IT, Manufacturing) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services, Inc., DigitalOcean, LLC., IBM, DreamHost, Google, Rackspace, Microsoft, Liquid Web, Sungard AS, DXC Technology, Apprenda, Navisite, Spectrum Enterprise, Capgemini, AWS, Oracle, NEC Corporation, HostGator, Netmagic Solutions, GreenGeeks. |

| Key Drivers | • Rising Adoption of Cloud Technologies for Seamless Scalability and Flexibility Fuels the Application Hosting Market Growth • Proliferation of Digital Transformation Initiatives Across Industries Accelerates the Demand for Reliable Application Hosting Solutions |

| Restraints | • High Dependency on External Hosting Providers Exposes Businesses to Security and Compliance Risks, Limiting Market Growth |