Antimicrobial Resistance Surveillance Market Report Scope & Overview:

Get More Information on Antimicrobial Resistance Surveillance Market - Request Sample Report

The Antimicrobial Resistance Surveillance Market was valued at USD 5.90 Billion in 2023 and is projected to grow to USD 9.50 billion by 2032 with a CAGR of 5.47% over the forecast period 2024-2032.

Antimicrobial resistance (AMR) is a growing public health crisis, with pathogens like bacteria and fungi developing mechanisms to evade the effects of life-saving drugs. This is where antimicrobial resistance surveillance comes in – it's the continuous monitoring of these microbial populations to understand how resistance patterns are evolving.

Globally, AMR is responsible for an estimated 700,000 deaths annually. This highlights the severity of the threat. Surveillance programs like the ATLAS platform, which recently in April 2020 expanded to include antifungal data alongside its existing bacterial data, play a vital role.

ATLAS, with its access to data from over 15,500 fungal isolates across 40 countries, offers a unique window into global resistance trends. This real-world data, updated yearly, empowers decision-makers like doctors and public health officials. By analyzing these trends, they can adapt treatment strategies, implement stricter antibiotic stewardship programs, and refine infection control measures. This ultimately helps to stay ahead of the curve in the fight against AMR.

A prime example of global antimicrobial resistance surveillance is the WHO's GLASS program. Launched in 2015, it tracks resistance patterns in bacteria responsible for common infections. GLASS has since expanded to cover antifungal resistance and antibiotic consumption data, promoting a "One Health" approach that considers animal and human health as interconnected. With participation from over 127 countries by late 2022, GLASS provides crucial data for informed strategies to combat the growing threat of AMR.

The National Antimicrobial Resistance Monitoring System (NARMS) stands as an example of a successful antimicrobial resistance surveillance program. Established in 1996, NARMS is a collaborative effort between various US agencies, including the CDC, FDA, USDA, and state public health departments. Furthermore, NARMS data plays a crucial role in the FDA's regulatory decisions regarding antibiotics. By understanding resistance trends, the FDA can make informed choices to preserve the effectiveness of these life-saving drugs for both humans and animals.

Antimicrobial resistance (AMR) stands as a stark example of a global health threat with far-reaching consequences. In 2019 alone, it's estimated to have been responsible for a staggering 4.95 million deaths. This grim statistic underscores the urgency of addressing this issue. The potential future impact of AMR paints an even more alarming picture. If left unchecked, it's projected to claim up to 10 million lives annually by 2050. Beyond the human cost, AMR poses a significant economic challenge, with estimates suggesting a potential reduction in global GDP by 1.1% to 3.8% by the same year. This example highlights the multifaceted challenge of AMR. It's not just a healthcare concern; it has the potential to cripple economies and devastate societies worldwide. The disproportionate impact on low- and middle-income countries further complicates the issue, demanding a global, coordinated response to effectively combat this growing threat.

Market Dynamics

Drivers

-

Burgeoning Burden of Antibiotic-Resistant Infections

Antibiotic resistance has become a critical public health concern. A Pew Charitable Trusts article from July 2023 paints a grim picture that is in the US alone, over 2.8 million antibiotic-resistant bacterial infections occur annually, leading to more than 35,000 deaths. This alarming trend is mirrored globally, with the World Health Organization (WHO) identifying antibiotic-resistant bacteria as a major threat.

-

Desperate Need for New Therapies

The diminishing effectiveness of existing antibiotics necessitates the development of novel treatment options. A beacon of hope emerged in a recent Science Daily article in July 2023 highlighting a groundbreaking discovery by Adela Melcrova. Her research revealed a new antibiotic, AMC-109, that works through a unique mechanism, offering promise for overcoming existing resistance patterns and paving the way for future drug development. The WHO, recognizing this critical need, collaborated with the Global AMR R&D Hub to present a report to G7 finance in May 2023. This report emphasizes progress in encouraging the development of new antibacterial treatments, highlighting the importance of a "One Health" approach that considers the interconnectedness of human and animal health.

-

Heightened Public Health Awareness and Economic Concerns

The global rise of antibiotic resistance has significant economic consequences. A WHO article from November 2023 underscores this point, revealing the impact on international trade, healthcare costs, and overall productivity. Furthermore, the WHO's Global Antimicrobial Resistance and Use Surveillance System (GLASS) report in November 2023 sheds light on the alarming resistance rates observed in common bacterial pathogens. The report highlights concerning statistics, such as a median rate of 42% for third-generation cephalosporin-resistant E. coli and 35% for methicillin-resistant Staphylococcus aureus across 76 countries. Additionally, the report reveals a disturbing trend – in 2020, 1 in 5 urinary tract infections caused by E. coli exhibited reduced susceptibility to standard antibiotics. This growing public health concern and economic strain are driving the demand for effective surveillance solutions.

-

Collaborative Efforts for Novel Treatment Methods:

Researchers and pharmaceutical companies are joining forces to combat the challenge of antibiotic resistance. A recent example is the collaboration between Karolinska Institute and Therakind in November 2023. This partnership aims to discover innate molecules within the human body that possess potent antimicrobial properties, specifically targeting infections caused by antibiotic-resistant bacteria, particularly those affecting the brain. This innovative approach highlights the growing focus on finding alternative solutions to combat these "superbugs."

In conclusion, the antimicrobial resistance surveillance market is being propelled by the alarming rise of antibiotic-resistant infections, the urgent need for new treatment options, heightened public health awareness, and collaborative efforts to discover novel therapeutic strategies. As the fight against superbugs intensifies, the market for surveillance solutions will continue to flourish.

Restraints

-

The High Cost of AMR Diagnostic Systems

The high cost of AMR diagnostic systems acts as a significant barrier to wider adoption, particularly in resource-limited settings. Addressing this cost issue is crucial for ensuring more widespread access to these essential tools and ultimately achieving better control over the growing threat of antimicrobial resistance.

Automated systems, while offering advantages, come at a hefty price tag. According to NorthShore University Health System, the annual cost of reagents for an automated system processing 29,200 tests is a staggering USD 165,856. This is a stark contrast to the USD 43,508 spent annually on reagents for the disk diffusion method, a more traditional approach.

Key Market Segmentation

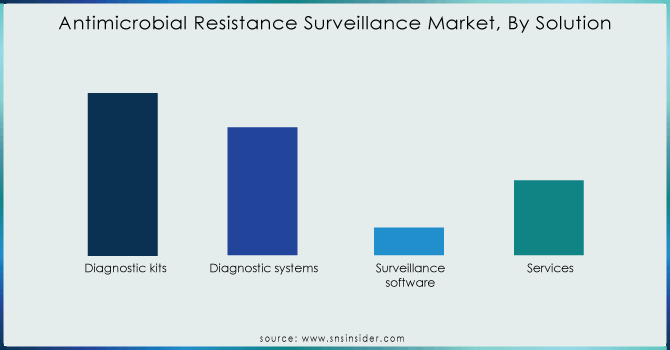

By Solution

The tools used to track antimicrobial resistance fall into different categories, but one dominated: diagnostic kits. In 2023, this segment held the biggest slice of the antimicrobial resistance surveillance market with 46%. This dominance is driven by the growing need for fast and reliable ways to identify resistant bacteria. These kits are the workhorses in labs, analyzing patient samples like blood, urine, and respiratory secretions to detect the presence of such resistant bacteria.

Need any customization research on Antimicrobial Resistance Surveillance Market - Enquiry Now

By Application

Clinical diagnostics led the pack with 44% in 2023, and this segment is projected for continued growth. The rise in antibiotic-resistant infections is a key driver, as doctors need faster, more precise tools to guide treatment. These diagnostic solutions determine a bacteria's susceptibility to different drugs, empowering healthcare providers to make informed decisions and improve patient outcomes.

By End User

Hospitals and clinics were the battleground for antimicrobial resistance, make them the unsurprised leader in this market segment with 56% share in 2023. They account for the biggest slice of the pie due to two key factors. Firstly, these facilities are on the frontlines, witnessing and treating the most cases of resistant infections. Secondly, hospitals and clinics are often mandated to conduct surveillance themselves, actively monitoring resistance trends within their walls.

Regional Analysis

North America held the top spot, with a dominated 37% market share in 2023. This lead can be attributed to their strong emphasis on research and development. Here, substantial funding fuels scientific breakthroughs, technological advancements, and the creation of innovative antibiotic therapies.

However, the fastest growth is expected to surge from the Asia Pacific region. Here, governments are taking a proactive stance by developing and implementing national action plans. China's recently launched plan (2022-2025) exemplifies this commitment. These plans often go beyond traditional methods, incorporating areas like vaccination, tackling AMR in the environment, and fostering collaboration across different sectors. This proactive approach by regional governments in Asia Pacific is poised to significantly shape the future of the global market.

Key Players

Danaher, Bioanalyse, Luminex Corporation, Alifax S.r.l., Thermo Fisher Scientific, Wolters Kluwer N.V., Lumed, BioSpace, Roche Diagnostics, OpGen, Inc., Cepheid, Abbott Laboratories, Accelerate Diagnostics, Inc., Qiagen, Liofilchem S.r.l., Bio-Rad, Becton, Merck KgaA, Dickinson and Company, Bruker, Biomerieux, and others.

Recent Developments

In a recent advancement to combat antimicrobial resistance (AMR), the Food and Agriculture Organization (FAO) launched a global information system called InFARM. This ambitious program aims to strengthen national surveillance systems for tracking AMR in animals and food products. InFARM facilitates the collection of reliable and timely data at national, regional, and global levels. To jumpstart this initiative, FAO is calling on its member countries to participate in the first-ever InFARM annual data collection effort in 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.90 billion |

| Market Size by 2032 | US$ 9.50 Billion |

| CAGR | CAGR of 5.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (Diagnostic kits, Diagnostic systems, Surveillance software, Services) • By Application (Clinical Diagnostics, Public Health Surveillance, Other Applications) • By End User (Hospitals & Clinics, Research & Academic Institutes, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher, Bioanalyse, Luminex Corporation, Alifax S.r.l., Thermo Fisher Scientific, Wolters Kluwer N.V., Lumed, BioSpace, Roche Diagnostics, OpGen, Inc., Cepheid, Abbott Laboratories, Accelerate Diagnostics, Inc., Qiagen, Liofilchem S.r.l., Bio-Rad, Becton, Merck KgaA, Dickinson and Company, Bruker, Biomerieux, and others. |

| Key Drivers | • Burgeoning Burden of Antibiotic-Resistant Infections •Desperate Need for New Therapies •Heightened Public Health Awareness and Economic Concerns •Collaborative Efforts for Novel Treatment Methods |

| RESTRAINTS | • The High Cost of AMR Diagnostic Systems |