Antimicrobial Preservatives Market Report Scope & Overview:

The Antimicrobial Preservatives Market size was USD 3.1 Billion in 2023 and is expected to reach USD 4.6 Billion by 2032 and grow at a CAGR of 4.5% over the forecast period of 2024-2032.

Get E-PDF Sample Report on Antimicrobial Preservatives Market - Request Sample Report

The growth of the antimicrobial preservatives market is driven by the increase in processed food consumers. The global processed food sector is expanding at a rapid rate because consumers want convenience and ready-to-eat products owing to the busy lifestyles they are leading. Antimicrobials are required in many food products such as frozen meals, snacks, baked goods, and beverages to prevent spoilage by microorganisms and to improve product shelf life and quality during storage and distribution. Moreover, the development of e-commerce and the globalization of the food supply chain has increased the demand for longer shelf-life products. The trend has been prominent in urban parts and developing nations where the per capita income is expanding, together with changing eating habits that increase the usage of packaged foods. This is mainly due to the implementation of antimicrobial preservatives, which ensure food safety and adherence to stringent food safety regulations required not only in the US but also in many developed countries across the globe, for which the role of preservatives has become critical to cater to the needs of modern consumers.

In India, this trend is particularly evident. The World Health Organization reported that retail sales of ultra-processed foods in India increased at a compound annual growth rate of 13% from 2011 to 2021.

The substantial rise of natural and organic preservatives is one of the key trends interspersed within the antimicrobial preservatives landscape supported by growing consumer inclination towards clean-label, chemical-free products. The growing cognizance of health-sensitive people regarding synthetic preservatives' side-effects has increased natural alternatives like essential oils, vinegar, rosemary extracts, and organic acids over the past years. Such preservatives are not only answerable to the rising demand for transparency in food labeling but also to sustainable and environment-friendly practices. Increased government regulations and directives advocating the application of natural additives, recognizing that safety and environmental compliance are vital to the future development of food, cosmetics, and pharmaceuticals is also supporting this trend. In addition, extraction and formulation technologies have improved the effectiveness of natural preservatives, giving manufacturers an option to satisfy rising consumer demand without sacrificing product quality or shelf life.

Furthermore, the U.S. Department of Agriculture's Economic Research Service reported that U.S. organic retail sales surpassed $53 billion in 2020, marking an average annual increase of 8% per year.

Antimicrobial Preservatives Market Dynamics:

Drivers

-

Rising demand for cosmetic products drives market growth.

Increasing usage of cosmetic products is one of key factors bolstering the growth of the antimicrobial preservatives market. The global cosmetics industry is growing as the consumer interest in keeping themselves, their appearance and their beauty is growing and so, the demand for preservatives in cosmetics is increasing accordingly. Antimicrobial preservatives are essential to prohibit microbial contamination in active formulations, including creams, lotions, shampoos, and makeup, to maintain cosmetic safety over time. The increasing consumption of cosmetic products is further fuelled by factors such as the increasing penetration of e-commerce platforms, rising disposable incomes, and the growing awareness of self-care in emerging economies. Furthermore, rising demand among consumers for natural and sustainable cosmetics has compelled manufacturers to increasingly investigate new preservative solutions that conform to regulatory requirements while still delivering results. Such a demand trend reflects the critical need for antimicrobial preservatives which supports the growth of the cosmetics sector.

In 2023, Lonza launched the Vantocil antimicrobial preservative line, specifically designed to cater to the growing demand for high-performance and eco-friendly preservatives in cosmetic formulations. The product aims to prevent microbial contamination without compromising product efficacy, aligning with consumer preferences for cleaner and more sustainable beauty products.

Restraint

-

High cost associated with the production of Antimicrobial Preservatives may hamper the market growth.

The high price of natural and organic replacement materials to traditional antimicrobial preservatives is a major hindrance in the antimicrobial preservatives market place. Despite increasing consumer demand for cleaner and greener products, the natural preservatives like plant-based extracts, essential oils, and organic acids are typically more costly to manufacture than synthetic chemicals. This is because high-quality raw materials are typically more difficult to source or need sustainable farming practices, pushing production costs higher. Moreover, extraction and formulation processes for natural preservatives may be more complicated and labor-intensive, thereby increasing costs. This can lead to increased overall production costs for manufacturers which are then eventually transferred to consumers, making such products less competitive, especially in price-sensitive markets. Additionally, natural preservatives may not be as effective or as stable as their synthetic counterparts, leaving innovation and investment further behind in riding the buckwheat trend wave. This is a challenge for companies when responding to demand for sustainable and green products and solutions while remaining competitive in price

Antimicrobial Preservatives Market Segmentation

By Type

The sorbic acid segment held the largest market share around 31% in 2023. Sorbic acid is used in the food & beverage, cosmetics, and pharmaceutical industry, as a mold, yeast, and bacteria inhibitor for spoilage. It is a popular choice among manufacturers, owing to its broad-spectrum antibacterial action and also its stability in the product that extends the shelf life. Moreover, the safety of sorbic acid on human consumption has been approved by multiple regulatory bodies such as the FDA and the European Food Safety Authority (EFSA), augmenting its increase in adoption in multiple end-use industries. It is prevalent in processed food, where prevention against fungal infection is especially important. Despite strong competition from natural preservatives, sorbic acid has maintained its position as a market leader aided by its cost-effectiveness, approved status, and wide-ranging effectiveness against yeasts, bacteria, and a wide variety of product formulations.

By Application

The food & beverages segment held the largest market share around 48% in 2023. The food and beverage sector is estimated to hold the largest market share of the antimicrobial preservatives market owing to regulatory approvals from health authorities such as the FDA and EFSA and rising knowledge regarding food safety. The rise in global consumption of packaged and processed foods, combined with these factors, categorizes food and beverage as the largest market segment for antimicrobial preservatives. The increasing demand for these products globally owing to the increasing reliance on processed, packaged, and ready-to-eat food due to busy lifestyles and booming online food delivery services, preservatives are necessities in the products as they help maintain freshness while preventing microbial contamination. From beverages, and sauces to dairy and bakery goods, as well as snacks, wide application of antimicrobial preservatives like sorbic acid, benzoic acid, and sodium benzoate, is witnessed to prevent the growth of spoilage-causing bacteria, yeasts & molds.

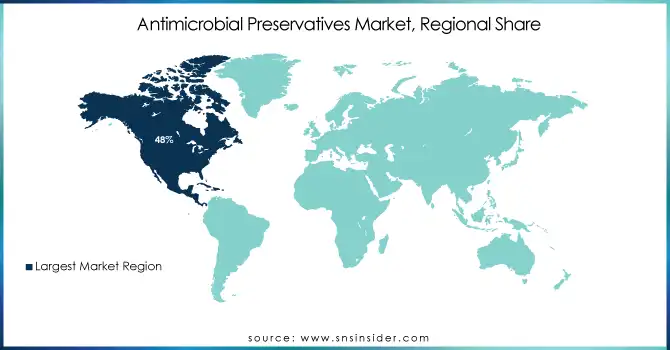

Antimicrobial Preservatives Market Regional Analysis

North America region held the major share of the Antimicrobial Preservatives market of more than 48% in 2023. It is due to stringent regulatory standards, robust packaged and processed foods sector, and significant consumer demand in the region. Additionally, presence of strict food safety regulations by authorities, such as the U.S. Food and Drug Administration (FDA), and the Canadian Food Inspection Agency (CFIA), ensures the presence of preservatives in order to maintain the safety and quality of food products in the region. Furthermore, with the growing preference for convenient, processed, packaged, foods, and beverages across North America, considerable consumption of antimicrobial preservatives will fuel market growth, due to manufacturers focusing on extending shelf life, and retaining freshness during distribution. Besides which, the U.S. and Canada maintain a thriving cosmetics and pharmaceutical industry, both of which depend on antimicrobial preservatives to serve their stability and safety requirements. In addition to this, the consumers from North America are very much knowledgeable and human food safety, and product quality has the capability to contribute toward the growth of the preservative market. North America has been a leader in this market, as key market players are strongly positioned in this region, along with their huge manufacturing capabilities and high investment in research and development for newer preservatives; all of these factors strongly anchor North America in the global market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

-

Albemarle Corporation (C-TEC™, X-TEND)

-

BASF SE (Myacide, Protectol)

-

Celanese Corporation (Nutrinova Sorbates, Sunett)

-

Archer Daniels Midland Company (Noxol, ProSweet)

-

The Dow Chemical Company (DOWICIL, ROCIMA)

-

Brenntag (Acticide, Isocil)

-

Lonza Group AG (Glycacil, Vantocil)

-

Clariant AG (Nipacide, Nipaguard)

-

Evonik Industries AG (Tego Preservatives, VORANOL)

-

Ashland Inc.(Optiphen, Germaben)

-

Thor Group (Acticide, Microcare)

-

Kemin Industries (NaturFORT, SHIELD)

-

Croda International Plc (NatraSense, Myramaze)

-

Symrise AG (SymOcide, Hydrolite)

-

Chemtura Corporation (Dantogard, Neolone)

-

Lanxess AG (Preventol, Acticide)

-

Akzo Nobel N.V. (Arquad, Myacide)

-

Sharon Laboratories (Sharon Biomix, Sharon Proline)

-

Corbion N.V. (PURAC, PATIONIC)

-

Eastman Chemical Company (Optifilm, Velcorin)

Recent Development:

-

In 2023: BASF launched a new Preservative Solutions portfolio, which includes a range of antimicrobial preservatives designed to meet the growing demand for safe and effective preservation systems in cosmetics, personal care products, and food applications.

-

In 2022: Kraton Polymers launched Kraton Polymers for Personal Care with a focus on creating preservatives with reduced environmental impact. These innovations were intended to meet the growing demand for effective antimicrobial solutions that are both safe and eco-friendly, particularly in the cosmetic and personal care markets.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.1 Billion |

| Market Size by 2032 | US$ 4.6 Billion |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Benzoic Acid. Sorbic Acid, Sulfur Dioxide, Propionic Acid, Nitrates, and others) • By Application (Food & Beverages, Pharmaceuticals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Albemarle Corp., BASF SE, Celanese Corporation, Archer Daniels Midland Company, The Dow Chemical Co. and Brenntag, and other |

| Key Drivers | • Rising demand for cosmetic products drives market growth. |

| Market Opportunities | • High costs associated with the production of Antimicrobial Preservatives may hamper the market growth. |