Get More Information on Antimicrobial Plastics Market - Request Sample Report

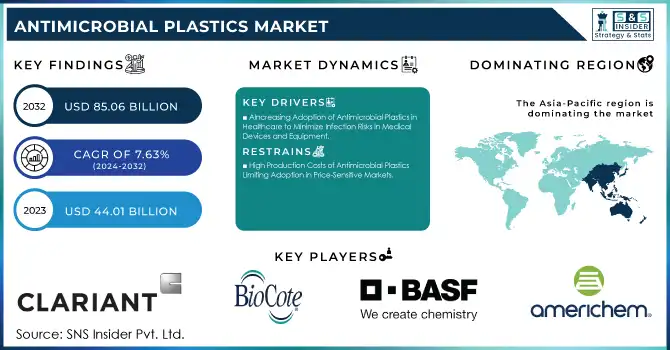

The Antimicrobial Plastics Market Size was valued at USD 44.01 billion in 2023 and is expected to reach USD 85.06 billion by 2032 and grow at a CAGR of 7.63% over the forecast period 2024-2032.

The antimicrobial plastics market is expanding with an increasing need for hygiene-based materials across the healthcare, packaging, and consumer goods industries. Increasing awareness regarding health and safety and the regulatory standards for products with stringent protection requirements drive the demand. In healthcare, for example, these plastics can be used in most medical devices and supplies at hospitals to reduce infection risks. They prevent the packaging industry from lowering product quality and shelf life. Consumer goods manufacturers have, therefore, embraced antimicrobial solutions to add a second layer of safety and strength to products such as electronic devices and personal care goods. In addition, an increasing interest in sustainability has led to the adoption of green antimicrobial agents and the creation of recycled plastic.

Some developments in the antimicrobial plastics market indicate the path that antimicrobial plastics have been taking. New technologies such as a plant-based antimicrobial solution launched in 2023 have shown the way forward for the industry by shifting towards sustainable alternatives. As observed early in 2024, the health industry has taken on materials that adhere to the highest standards of safety and improve the efficacy of medical equipment. Research developments that appeared in mid-2024 involve the utilization of natural substances to make plastics antibacterial-friendly, a movement that goes along with green thinking. By the end of 2024, a new, advanced antimicrobial material was approved to pave the way for mass production. Earlier, this year, in 2021, there was another effort to combine functionality and sustainability. The antibacterial recycled refuse sacks for households were launched. This is part of that dynamic market landscape where that convergence will meet the rapidly growing global demand in terms of technological innovations and environmental considerations.

Drivers:

Increasing Adoption of Antimicrobial Plastics in Healthcare to Minimize Infection Risks in Medical Devices and Equipment

The healthcare sector has emerged as a prominent driver for antimicrobial plastics, with their application in medical devices, surgical instruments, and hospital furniture steadily rising. These materials help mitigate infection risks by preventing bacterial growth on surfaces, making them indispensable in critical healthcare environments. The heightened focus on hygiene, especially in the wake of stricter hospital safety standards, has accelerated their adoption. Furthermore, advancements in antimicrobial additives have enabled the creation of plastics that remain effective over prolonged periods, ensuring long-lasting protection. The global push to combat healthcare-associated infections (HAIs) further bolsters demand, with hospitals and clinics increasingly investing in antimicrobial solutions to meet regulatory requirements and enhance patient safety.

Rising Use of Antimicrobial Packaging to Extend Shelf Life and Improve Food Safety

Growing Consumer Awareness About Hygiene and Safety Boosting Demand for Antimicrobial Products in Everyday Applications

Sustainability Trends Encouraging the Development of Recycled Antimicrobial Plastics for Eco-Friendly Applications

Sustainability is becoming a key driver for innovation in antimicrobial plastics, with growing efforts to incorporate recycled materials into their production. Recycled antimicrobial plastics cater to both functional and environmental requirements, enabling manufacturers to align with global sustainability goals. These materials address the dual need for hygiene and eco-consciousness, appealing to environmentally aware consumers and businesses alike. The rise in green certifications and government incentives for using recycled plastics is further propelling this trend, positioning antimicrobial plastics as a solution for sustainable growth.

Restraint:

High Production Costs of Antimicrobial Plastics Limiting Adoption in Price-Sensitive Markets

The relatively high cost of antimicrobial plastics remains a significant barrier to widespread adoption, particularly in price-sensitive markets. The production of these plastics involves advanced additives and manufacturing processes, which drive up costs compared to conventional materials. Small and medium-sized enterprises (SMEs) often face challenges in adopting these solutions due to budget constraints, despite their long-term benefits. Additionally, the higher cost of antimicrobial packaging can deter its use in low-margin industries, where cost optimization is critical. Balancing functionality, affordability, and scalability remains a pressing challenge for the market.

Opportunity:

Rising Demand for Sustainable Antimicrobial Solutions Driving Innovation in Bio-Based Additives and Recycled Plastics

The shift towards sustainability presents a significant opportunity for innovation in bio-based additives and recycled antimicrobial plastics. These solutions cater to environmentally conscious consumers and industries, aligning with global efforts to reduce plastic waste and carbon footprints. As demand grows for sustainable materials, manufacturers have a chance to differentiate themselves by offering eco-friendly antimicrobial solutions that meet both hygiene and environmental standards.

|

Aspect |

Details |

|---|---|

|

Raw Material Sourcing |

Efforts to use renewable or recycled raw materials to reduce carbon footprint and minimize environmental harm. |

|

Manufacturing Process |

Adoption of energy-efficient manufacturing techniques and reduced emissions in production to lower environmental impact. |

|

Biodegradability |

Some antimicrobial plastics are being designed for improved biodegradability, reducing plastic waste accumulation. |

|

Recyclability |

Focus on making antimicrobial plastics recyclable to ensure they are reused and do not contribute to landfill waste. |

|

Eco-Friendly Additives |

Use of environmentally safe, non-toxic antimicrobial agents (e.g., silver and zinc) to reduce ecological footprint. |

|

End-of-Life Management |

Efforts to improve post-consumer recycling programs and responsible disposal methods to prevent environmental contamination. |

|

Sustainability Certifications |

Companies are pursuing eco-certifications like ISO 14001, ensuring environmentally responsible manufacturing practices. |

|

Green Packaging |

Companies adopting antimicrobial plastics in packaging that is both functional and sustainable, reduce plastic pollution. |

The antimicrobial plastics industry is increasingly focusing on sustainability, adopting practices that mitigate its environmental footprint. Companies are prioritizing the use of renewable or recycled materials and adopting energy-efficient production methods to lower emissions. Additionally, there is a strong push toward creating plastics that are biodegradable or recyclable, thus addressing long-term plastic waste concerns. Eco-friendly antimicrobial additives, such as silver and zinc, are replacing harmful chemicals, reducing the ecological impact. Furthermore, sustainable packaging solutions and improved end-of-life management strategies, including enhanced recycling programs, are becoming a key focus for the industry. These sustainability efforts contribute to the industry’s evolving role in the larger global movement toward environmental responsibility

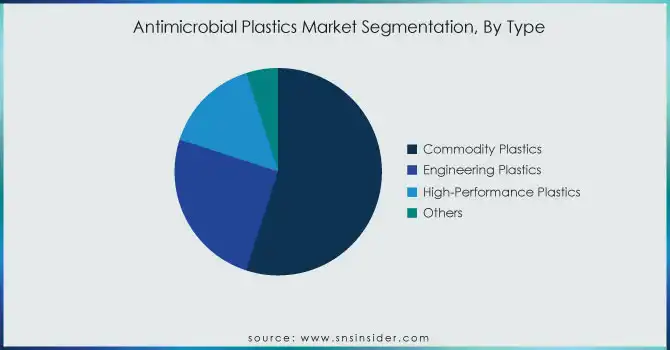

By Type

Commodity plastics dominated the antimicrobial plastics market in 2023, accounting for an estimated 55% market share. Within this category, polypropylene (PP) emerged as the leading subsegment, holding approximately 20% of the commodity plastics market share. The dominance of commodity plastics is attributed to their extensive use across various industries due to their cost-effectiveness, durability, and versatility. Polypropylene, in particular, is widely utilized in packaging, medical devices, and consumer goods, thanks to its lightweight nature and strong resistance to microbial growth. For instance, antimicrobial PP is extensively used in food packaging to enhance product safety and shelf life, while its application in healthcare includes syringes and protective equipment.

By Additive

Inorganic antimicrobial additives dominated the antimicrobial plastics market in 2023, capturing a 65% market share. Among these, silver-based additives dominated, contributing approximately 40% to the inorganic additives segment's share. Silver's high efficacy against a broad spectrum of microorganisms and its long-lasting antimicrobial properties make it the preferred choice across industries. For example, silver-based antimicrobial plastics are commonly used in medical instruments, food storage containers, and water filtration systems, providing enhanced safety and hygiene. Silver additives are particularly favored in healthcare, where infection control is critical.

By End-use

The healthcare segment dominated the end-use sector for antimicrobial plastics in 2023, holding a 40% market share. Within this category, medical devices and equipment accounted for approximately 25% of the healthcare segment's share. The widespread adoption in healthcare is driven by the critical need to minimize healthcare-associated infections (HAIs) through antimicrobial solutions. Applications such as surgical instruments, hospital furniture, and diagnostic devices rely heavily on antimicrobial plastics for improved hygiene and patient safety. For instance, antimicrobial coatings on catheters and ventilators have become standard practice to reduce infection risks in hospitals.

The Asia-Pacific region dominated the antimicrobial plastics market in 2023, accounting for a 45% market share. This dominance is primarily driven by the region's robust industrial base, rapid urbanization, and increasing awareness of hygiene across sectors such as healthcare, packaging, and consumer goods. Countries like China, Japan, and India played a significant role in this leadership. China, being the largest contributor, demonstrated extensive use of antimicrobial plastics in healthcare applications, such as medical devices and hospital infrastructure, backed by government initiatives to modernize the healthcare system. For instance, China's substantial investments in improving healthcare facilities have led to an increased demand for antimicrobial materials to ensure safety and infection control. Similarly, Japan's advanced manufacturing capabilities and strong emphasis on innovation have propelled the use of antimicrobial plastics in electronics and packaging. In India, the growing demand for hygienic packaging in the booming e-commerce and food delivery sectors has further fueled the market. Reports highlight that over 30% of the region's demand for antimicrobial plastics in 2023 came from healthcare and packaging applications, reflecting their significant role in driving Asia-Pacific’s dominance.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Americhem Inc (AMERGY Antimicrobial Additives, Polymer Masterbatches)

BASF SE (Ultramid C37LC, Ultradur B1520)

BioCote Limited (Antimicrobial Coatings, Polymer Additives)

Clariant AG (AddWorks AGC 970, AddWorks PKG 902)

Dupont (Delrin Antimicrobial Resins, Zytel Antimicrobial Resins)

Ensinger (TECAFORM AH, TECANYL MT)

King Plastic Corporation (King StarBoard, King MicroShield)

Lifespan Technologies (Guardian Antimicrobial Polymers, Lifespan Resins)

Lonza (Lonzabac Antimicrobial Additives, Densil Antimicrobial Solutions)

Microban International Ltd. (Microban Antimicrobial Additives, Microban Embedded Polymers)

Milliken Chemical (AlphaSan Silver Antimicrobial, Millad NX)

Parx Materials N.V (Saniconcentrate, PlasticShield)

Polyone Corporation (OnColor Antimicrobial Solutions, OnCap Antimicrobial Masterbatch)

RTP Company (Antimicrobial Masterbatches, Thermoplastic Compounds)

Sanitized AG (Sanitized PL 14-32, Sanitized BC 02-16)

Teknor Apex Company (Apex Flexible Vinyl, Monprene Thermoplastic Elastomers)

The Dow Chemical Company (INFUSE Olefin Block Copolymers, SURLYN Ionomers)

Toray Industries, Inc. (Torayca Resin, Amilan Nylon Resins)

Toyobo Co., Ltd. (Nerbrid Antimicrobial Resin, VYLON Polymer Additives)

Tosaf Compounds Ltd. (Antibacterial Masterbatches, Flame Retardant Compounds)

Recent Developments

January 2024: BASF partnered with Kingfa Sci & Tech to produce and distribute Ultramid B10TW3 polyamide 6 resin with silver ion antibacterial technology across China, boosting BASF's presence in the Asian market.

January 2024: Milliken launched ALPHA GUARD PLUS, an antimicrobial coating for textiles offering long-lasting protection against bacteria, fungi, and mold, targeting healthcare, hospitality, and athletic wear applications.

December 2023: Avient Corporation expanded its Cesa Withstand portfolio with new grades designed to prevent microbe development in critical applications.

September 2023: Microban International unveiled Ascera, a new technological advancement in antimicrobial solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 44.01 Billion |

| Market Size by 2032 | USD 85.06 Billion |

| CAGR | CAGR of 7.63% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Commodity Plastics [Polyethylene (PE), Polyvinyl Chloride (PVC), Polypropylene (PP), Polystyrene (PS), Polyethylene Terephthalate (PET), Poly (methyl methacrylate) (PMMA), Polyurethane (PUR), Acrylonitrile Butadiene Systems (ABS)), Engineering Plastics [Polycarbonate (PC), Polyoxymethylene (POM), Polyamide (PA), Thermoplastic polyurethane (TPU), Others], High-Performance Plastics, Others) • By Additive (Inorganic Antimicrobial Additives [Copper, Silver, Zinc], Organic Antimicrobial Additives [Triclosan, Oxybisphenoxarsine (OBPA), Others]) • By End-use (Building & Construction, Healthcare, Packaging, Automotive, Electronics, Commercial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PARX Materials N.V, King Plastic Corporation, BioCote Limited, BASF SE, Microban International Ltd., Americhem Inc, Lonza, Sanitized AG, Polyone Corporation, Clariant AG and other key players |

| Key Drivers | • Growing Consumer Awareness About Hygiene and Safety Boosting Demand for Antimicrobial Products in Everyday Applications • Sustainability Trends Encouraging the Development of Recycled Antimicrobial Plastics for Eco-Friendly Applications |

| Restraints | • High Production Costs of Antimicrobial Plastics Limiting Adoption in Price-Sensitive Markets |

Ans: The Asia-Pacific region led the antimicrobial plastics market in 2023 with a 45% market share, driven by industrial growth, urbanization, and heightened hygiene awareness, particularly in healthcare, packaging, and consumer goods, with China, Japan, and India as key contributors.

Ans: Stringent regulatory compliance and varying approval processes across regions delay the development and commercialization of antimicrobial plastic products.

Ans: Rising demand for sustainability, industrial growth in emerging markets, and integration into smart devices are driving the expansion of antimicrobial plastics.

Ans: The Antimicrobial Plastics Market Size was valued at USD 44.01 billion in 2023 and is expected to reach USD 85.06 billion by 2032.

Ans: The Antimicrobial Plastics Market is expected to grow at a CAGR of 7.63%

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Antimicrobial Plastics Market Segmentation, by Type

7.1 Chapter Overview

7.2 Commodity Plastics

7.2.1 Commodity Plastics Market Trends Analysis (2020-2032)

7.2.2 Commodity Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Polyethylene (PE)

7.2.3.1 Polyethylene (PE) Market Trends Analysis (2020-2032)

7.2.3.2 Polyethylene (PE) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Polyvinyl Chloride (PVC)

7.2.4.1 Polyvinyl Chloride (PVC) Market Trends Analysis (2020-2032)

7.2.4.2 Polyvinyl Chloride (PVC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Polypropylene (PP)

7.2.5.1 Polypropylene (PP) Market Trends Analysis (2020-2032)

7.2.5.2 Polypropylene (PP) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Polystyrene (PS)

7.2.6.1 Polystyrene (PS) Market Trends Analysis (2020-2032)

7.2.6.2 Polystyrene (PS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Polyethylene Terephthalate (PET)

7.2.7.1 Polyethylene Terephthalate (PET) Market Trends Analysis (2020-2032)

7.2.7.2 Polyethylene Terephthalate (PET) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Poly (methyl methacrylate) (PMMA)

7.2.8.1 Poly (methyl methacrylate) (PMMA) Market Trends Analysis (2020-2032)

7.2.8.2 Poly (methyl methacrylate) (PMMA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.9 Polyurethane (PUR)

7.2.9.1 Polyurethane (PUR) Market Trends Analysis (2020-2032)

7.2.9.2 Polyurethane (PUR) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.10 Acrylonitrile Butadiene Systems (ABS)

7.2.10.1 Acrylonitrile Butadiene Systems (ABS) Market Trends Analysis (2020-2032)

7.2.10.2 Acrylonitrile Butadiene Systems (ABS) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Engineering Plastics

7.3.1 Engineering Plastics Market Trends Analysis (2020-2032)

7.3.2 Engineering Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Polycarbonate (PC)

7.3.3.1 Polycarbonate (PC) Market Trends Analysis (2020-2032)

7.3.3.2 Polycarbonate (PC) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Polyoxymethylene (POM)

7.3.4.1 Polyoxymethylene (POM) Market Trends Analysis (2020-2032)

7.3.4.2 Polyoxymethylene (POM) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Polyamide (PA)

7.3.5.1 Polyamide (PA) Market Trends Analysis (2020-2032)

7.3.5.2 Polyamide (PA) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.6 Thermoplastic polyurethane (TPU)

7.3.6.1 Thermoplastic polyurethane (TPU) Market Trends Analysis (2020-2032)

7.3.6.2 Thermoplastic polyurethane (TPU) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.7 Others

7.3.7.1 Others Market Trends Analysis (2020-2032)

7.3.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 High-Performance Plastics

7.4.1 High-Performance Plastics Market Trends Analysis (2020-2032)

7.4.2 High-Performance Plastics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Antimicrobial Plastics Market Segmentation, by Additive

8.1 Chapter Overview

8.2 Inorganic Antimicrobial Additives

8.2.1 Inorganic Antimicrobial Additives Market Trends Analysis (2020-2032)

8.2.2 Inorganic Antimicrobial Additives Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Copper

8.2.3.1 Copper Market Trends Analysis (2020-2032)

8.2.3.2 Copper Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Silver

8.2.4.1 Silver Market Trends Analysis (2020-2032)

8.2.4.2 Silver Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Zinc

8.2.5.1 Zinc Market Trends Analysis (2020-2032)

8.2.5.2 Zinc Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Organic Antimicrobial Additives

8.3.1 Organic Antimicrobial Additives Market Trends Analysis (2020-2032)

8.3.2 Organic Antimicrobial Additives Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Triclosan

8.2.3.1 Triclosan Market Trends Analysis (2020-2032)

8.2.3.2 Triclosan Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Oxybisphenoxarsine (OBPA)

8.2.3.1 Oxybisphenoxarsine (OBPA) Market Trends Analysis (2020-2032)

8.2.3.2 Oxybisphenoxarsine (OBPA) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Others

8.2.4.1 Others Market Trends Analysis (2020-2032)

8.2.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Antimicrobial Plastics Market Segmentation, by End User

9.1 Chapter Overview

9.2 Building & Construction

9.2.1 Building & Construction Market Trends Analysis (2020-2032)

9.2.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Healthcare

9.3.1 Healthcare Market Trends Analysis (2020-2032)

9.3.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Packaging

9.4.1 Packaging Market Trends Analysis (2020-2032)

9.4.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Automotive

9.5.1 Automotive Market Trends Analysis (2020-2032)

9.5.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Electronics

9.6.1 Electronics Market Trends Analysis (2020-2032)

9.6.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Commercial

9.7.1 Commercial Market Trends Analysis (2020-2032)

9.7.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.2.5 North America Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.2.6.3 USA Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.2.7.3 Canada Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.2.8.3 Mexico Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.6.3 Poland Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.7.3 Romania Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.5 Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.6.3 Germany Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.7.3 France Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.8.3 UK Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.9.3 Italy Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.10.3 Spain Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.13.3 Austria Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.5 Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.6.3 China Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.7.3 India Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.8.3 Japan Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.9.3 South Korea Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.10.3 Vietnam Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.11.3 Singapore Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.12.3 Australia Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.5 Middle East Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.6.3 UAE Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.2.5 Africa Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Antimicrobial Plastics Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.6.5 Latin America Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.6.6.3 Brazil Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.6.7.3 Argentina Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.6.8.3 Colombia Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Antimicrobial Plastics Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Antimicrobial Plastics Market Estimates and Forecasts, by Additive (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Antimicrobial Plastics Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 PARX Materials N.V

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 King Plastic Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 BioCote Limited

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 BASF SE

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Microban International Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Americhem Inc

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Lonza

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Sanitized AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Polyone Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Clariant AG

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Commodity Plastics

Polyethylene (PE)

Polyvinyl Chloride (PVC)

Polypropylene (PP)

Polystyrene (PS)

Polyethylene Terephthalate (PET)

Poly (methyl methacrylate) (PMMA)

Polyurethane (PUR)

Acrylonitrile Butadiene Systems (ABS)

Engineering Plastics

Polycarbonate (PC)

Polyoxymethylene (POM)

Polyamide (PA)

Thermoplastic polyurethane (TPU)

Others

High-Performance Plastics

Others

By Additive

Inorganic Antimicrobial Additives

Copper

Silver

Zinc

Organic Antimicrobial Additives

Triclosan

Oxybisphenoxarsine (OBPA)

Others

By End-use

Building & Construction

Healthcare

Packaging

Automotive

Electronics

Commercial

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Syntactic Foam Market Size was valued at USD 152.50 million in 2023 and is expected to reach USD 240.66 million by 2032 and grow at a CAGR of 5.20% over the forecast period 2024-2032.

The Specialty Tapes Market Size was valued at USD 55.4 billion in 2023 and is expected to reach USD 96.3 billion by 2032 and grow at a CAGR of 6.3% over the forecast period 2024-2032.

The Aliphatic Hydrocarbon Market size was USD 3.95 billion in 2023 and is expected to reach USD 6.02 billion by 2032 and grow at a CAGR of 4.81% over the forecast period of 2024-2032.

The Ethylene Vinyl Acetate Market Size was valued at USD 11.0 billion in 2023 and is expected to reach USD 19.2 billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The Flat Glass Market size was USD 128.69 Billion in 2023 and is expected to reach USD 224.35 Billion by 2032 and grow at a CAGR of 6.37% from 2024 to 2032.

The Biocomposites Market was valued at USD 32.59 billion in 2023 and is supposed to reach USD 122.22 billion by 2032. It is expected to grow at a CAGR of 15.8% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone