Get more information on the Antimicrobial Coatings Market - Request Sample Report

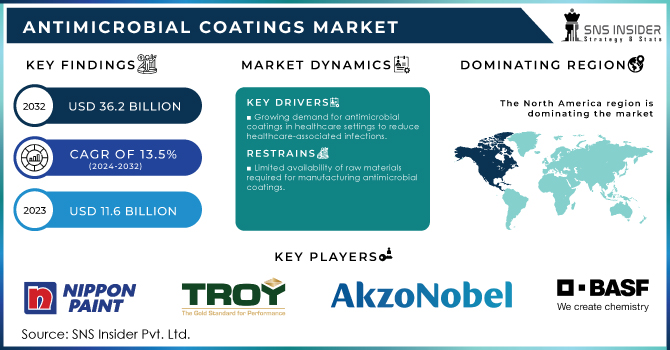

The Antimicrobial Coatings Market Size was valued at USD 11.6 billion in 2023, and is expected to reach USD 36.2 billion by 2032, and grow at a CAGR of 13.5% over the forecast period 2024-2032.

The growth rate in the antimicrobial coatings market is dynamic because of the upsurge in demand for surface protection in various industries, including healthcare, electronics, construction, and consumer goods. With increasing infections and the importance of cleanliness all over the world, antimicrobial coatings have appeared as the crucial solution in preventing the spread of bacteria and viruses. The technology behind the coatings has changed substantially and includes the utilization of contemporary materials such as metal oxides, polymeric complexes, and even photocatalytic solutions. Companies have been investing in the research and development of this technology to make antimicrobial coatings improve their efficiency, transparency, and durability, while also being environmentally friendly and sustainable.

In August 2024, antibacterial waterborne polymeric coatings that employed iodine complexes were reported development which indicated the changing face of polymer-based solutions that are helping to provide adequate microbial resistance. Such an iodine-based coating is much of a step forward in creating coatings that can be applied to any surface for long-lasting antimicrobial protection. Similarly, innovations in transparent and antimicrobial surfaces for touch displays caught headlines in May 2024, where such coatings could find their worth in the avoidance of frequently touched devices like smartphones, tablets, and kiosks. The inclusion of antimicrobial technology in consumer electronics is among the examples of higher utilisations than industrial applications. Other developments focus on the optimization and development of metal oxide-based photocatalytic coatings to improve antimicrobial activity, as outlined in May 2024. These coatings work bimodally because this is an activation by the light to act as an antimicrobial coating, and excellent for use outdoors or well-lit indoors. This innovation falls in line with the wider push for more energy-efficient, eco-friendly solutions. While this was going on, in July 2024, antimicrobial coatings targeted to industrial uses were launched. These coatings are aimed at protecting high-touch surfaces in factories and production facilities, which means that the scope of antimicrobial coatings penetrates an even rougher environment where durability is a gold standard.

There are a couple of companies that have significantly advanced regarding antimicrobial coatings during the last couple of years. As of 31 May 2023, for instance, scientists created a new coating material that was efficient in killing bacteria and viruses, which would be specifically very beneficial for those in use in hospitals or other healthcare settings involving high-contact surfaces. Antimicrobial paints became more popular than ever before in domestic and commercial environments throughout June 2023 with households and businesses continuing to implement the enhancement of indoor air quality and microbial growth on the walls. By October 2023, antimicrobial additive-enhanced coatings were launched as part of a larger effort to enhance the effectiveness and efficacy of surface protection in various industries. There is a growing trend for antimicrobial coatings in various industries and continues product innovation. In April 2023, a newly developed antimicrobial coating was launched for surfaces that needed extended microbial resistance. These coatings are designed to keep the medical setting clean because of susceptibility to contamination. In March 2023, focus was given on how antimicrobial coatings could keep the environment clean from hospitals transportation systems, and food processing plants. Earlier studies conducted in April 2022 revolved around offering protection for years against the Omicron virus, thus resulting in new research in smart coatings that could offer continuous microbial resistance for public environments.

The development of antimicrobial coatings is highly accelerating with the ongoing research and launching of new products that are directed at increased application across sectors in various industries. Introducing iodine-based waterborne polymeric coatings to strategies enhancing metal oxide-based coatings are some of the companies' efforts towards developing such solutions that would be more efficient and durable as well as versatile. Further, it is the increasing market demand in health care, electronics, and construction sectors, which drives up the growth of the antimicrobial coatings market because there is always a push towards innovation and protection.

Drivers:

The rising infection rates in healthcare increasingly shape the market for antimicrobial coatings, as hospitals and clinics begin to realize that a clean environment is necessary both for patient protection and for employee protection. Therefore, healthcare-associated infections provide much concern, and more often they start from the transfer of pathogens on surfaces, devices, and equipment. This is because healthcare facilities are taking proactive measures against these risks through the application of antimicrobial coatings. For instance, a leading manufacturer of medical devices made coatings on surgical instruments and implants. On contact, it kills bacteria actively with a significant reduction of possibility of infections post-surgery. For instance, high-touch healthcare facility surfaces like bed railings and door handles as well as light switches can be coated with an antimicrobial coating. These are the commonly identified hotspots of germs in hospitals. Using coatings infused with silver ions, other antimicrobial agents can continuously reduce microbial load as another layer of protection against the assailant to vulnerable patients. In addition, regulatory bodies like the CDC emphasize strategies for preventing infections. This encourages healthcare providers to implement such technologies within their premises. Furthermore, such antimicrobial coatings would support high cleanliness standards and increase patients' comfort level in the case of patients while creating a much safer environment. This will result in a hike in demand for novel approaches such as antimicrobial coatings in light of the rising threat of antibiotic-resistant bacteria, thereby making antimicrobial coatings a vital element in infection control measures applied in healthcare settings.

Development in coating materials and formulation is driving huge growth in the antimicrobial coatings market by increasing their effectiveness, durability, and versatility for varied applications. Advances in nanotechnology have led to coatings utilizing nanosilver and other nano scale agents, which alone are highly potent on microbial activity with little needing to be used for the desired effectiveness. This has led to the development of new formulations that involve a combination of polymeric materials with nanoscale silver particles, amongst others, that make the coatings not only kill bacteria on contact but also withstand repeated cleaning processes. The newest development in biopolymer-based coatings offers an even more ecologic alternative which remains effective in antimicrobial activity yet is environmentally benign. This development opens up possibilities for food packaging applications where the coating can lengthen shelf life by preventing bacteria proliferation, appealing to a food industry that is increasingly concerned with food safety. Moreover, developments in self-cleaning and photocatalytic coatings have indeed enabled surfaces to retain their microbicidal effects even in the presence of light, so the surfaces can be used in lit, partially lit, or no-lit environments, respectively, such as hospitals, public transportation, and outdoor applications. These versatile formulations can be used to meet different needs. They include industry-to-industry applications where strong, durable coatings are required for withstanding aggressive environments, as well as consumer textiles that provide long-lasting protection against microbes. Alongside the movement of manufacturers along the scales of materials and technologies, the scope and the effectiveness of antimicrobial coatings also keep expanding, positioning them as essential components in various industries trying to achieve high standards of hygiene and safety.

Restraint:

The expense of manufacture, primarily in price-sensitive markets, is one of the primary restraints to the adoption of advanced antimicrobial coatings. Most high-performance antimicrobial coatings involve the production of complex ingredients and hybrids, including nanoparticles or special polymer formulations, which command significantly higher production costs. For instance, although nanosilver is an excellent antimicrobial, synthesis and incorporation of these particles in coatings are costly, requiring precise methods to do this uniformly into the matrix. This can result in an unacceptably high cost for small and medium sized enterprise firms or industries working on very low budgets, for example, budget-conscious consumer goods manufacturers or low-income healthcare facilities. As a consequence, these companies may opt for cheaper, relatively less effective products that are not so effective in microbial protection. This would, therefore, hinder overall growth of the market for antimicrobial coatings in regions where cost becomes a deciding factor. Requirements of cost-effective production methods and affordable formulations are large needs for building market penetration and accessibility across various segments.

Opportunity:

The increasing interest of consumer electronics and public infrastructure is a large opportunity in the antimicrobial coatings market, especially about hygiene and safety on touch surfaces and high-traffic areas. Given that such devices as smartphones, tablets, and kiosks are handled by countless users several times a day, the risk of bacterial and viral transmission increases and manufacturers start looking for solutions that will minimize that risk. For example, there has been interest in having antimicrobial coating on screens and casings of electronic products that stay cleaner for longer periods and eliminate the need to disinfect frequently. Coatings that can be applied to handrails, doorknobs, and seating areas are gaining in demand for public infrastructures such as transportation systems, schools, and hospitals. This trend is augmented even further by increasing public awareness of hygiene, particularly following world health concerns. For manufacturers, this trend presents an opportunity to develop products specifically designed for these applications, thus further expanding their market reach and supporting the changing demands of consumers and institutions alike.

Challenge:

The safety and efficacy of the coatings are now set by more stringent government regulations, making it relatively challenging for manufacturers to meet market requirements. After comprehensive testing by the regulatory bodies, accompanied by extensive documentation that such antimicrobial coatings satisfy health and safety requirements, they can be used commercially, however, this comes with a good deal of time and expense. For example, manufacturers may be expected to conduct rigorous scientific studies demonstrating the antimicrobial effectiveness of their products against particular microorganisms and assess possible toxicological risks for humans and the environment. The rigorous procedure of approval will also make it impossible for a company to come up with a product within a timely manner and effectively respond to the needs of markets. To this end, the ever-changing rules between regions add to the complexity of the situation and force manufacturers to adapt products as well as testing protocols to suit the various regulatory frameworks. It thus means that the long, extremely technical pathway can even deter innovations and restrict the entry of new antimicrobial coatings into the market, making it difficult for companies in their quest to gain some competence.

By Type

The silver segment dominated the antimicrobial coatings market in 2023 with a market share estimated to be around 45%. Silver, as a preservative, is well-known to be disrupting the cell membranes of bacteria and is reported to have extended action against a broad spectrum of pathogens. It is thus perfect for a variety of applications such as medical applications, where it is applied to coatings for medical devices, surgical equipment, and hospital surfaces due to its ability to minimize infections. For instance, silver-infused coatings have been effectively applied to catheters and wound dressings with those patients who received the silver engrafted catheters and wound dressings reporting a drastic reduction in instances of CAUTIs and accelerating healing. Their use in consumer products textiles and paints, owing to the wide-ranging versatility of silver coatings boosts their market. The need for increased hygiene solutions is expected to be on the rise, due to which the silver segment will be sure to continue having a leadership position in the antimicrobial coatings market.

By Application

In 2023, the medical and healthcare segment dominated the antimicrobial coatings market with a market share of nearly 38%. The high urgency demand in this domain is mainly linked to infection control in healthcare settings, which arises largely from the concern for healthcare-associated infections. Antimicrobial coatings are widely applied to medical devices, surgical instruments, and high-touch surfaces of hospitals for the prevention of colonization by bacteria, thus enhancing patient safety. For example, silver-based coating is widely utilized in catheters and wound dressings to reduce infections significantly. Moreover, as antimicrobial coating is gradually becoming popular in the interiors of hospitals, which is applied to walls and other equipment, this ensures that the environment stays sterile aspect that is of importance for the care of patients. With the healthcare facility focussing on implementing advanced hygiene practices, the medical and healthcare application segment is expected to continue dominating the market shortly.

In 2023, North America dominated the antimicrobial coatings market and accounted for a market share of around 40%. This is primarily due to the strict regulations in the region regarding health and safety standards, especially in the medical and healthcare fields, which enforce strict infection control. The presence of many key players and research work in the region also favors North America's market position. For instance, antimicrobial coatings on high-touch surfaces and medical devices in hospitals have become widely used to decrease the incidence of healthcare-associated infections. Companies such as Microban and Aegis are continually developing new antimicrobial products to address the growing need in the healthcare sector. Increasingly higher awareness for hygiene and cleanliness, particularly after pandemics, has spurred investment in antimicrobial technologies in many applications that have helped North America consolidate its leadership in the market.

Moreover, the Asia-Pacific region emerged as the fastest-growing region in the forecast period with an estimated CAGR of around 10% in the year 2023. The growth in the forecast period is attributed to several factors, including rapid industrialization, increased awareness of hygiene standards, and an increase in healthcare expenditures in countries such as China and India. The manufacturing sector of the region is gaining growth, adding to the demand for antimicrobial coatings in various applications like textiles, food packaging, and consumer products. For instance, many textile manufacturers in Asia-Pacific are using antimicrobial coatings in their fabrics due to the growing demand for hygiene-focused apparel and home textiles. The growth in the number of healthcare facilities, along with an increasing interest in infection control measures, is fueling the use of antimicrobial coatings in hospitals and clinics. Public awareness about health and hygiene is on the rise in the Asia-Pacific region and has a good basis for sustained growth in the market for antimicrobial coatings.

Get Customized Report as per your Business Requirement - Request For Customized Report

April 2024: Onkos Surgical, Inc. announced that the FDA has granted 510 clearances for its antibacterial-coated implants in the fight against bacterial contamination in the fields of Orthopedic Oncology and Revision Arthroplasty.

March 2023: AkzoNobel joined forces with BioCote to further extend its "Interpon" antimicrobial powder coatings for a multitude of internal surfaces, answering diversified customer needs and helping to improve their position in the marketplace.

AK Coatings (AK Coatings Antimicrobial Paint, AK Coatings Antimicrobial Clear Coat)

Akzonobel N.V. (Interpon D Antimicrobial Powder Coatings, Dulux Antimicrobial Paint)

Arch Lonza (Arch Biocides, Arch Antimicrobial Coatings)

Axalta Coating Systems (Axalta Refinish Antimicrobial Coatings, Imron Antimicrobial Coatings)

BASF SE (BASF's Ultranox Antimicrobial Coatings, Neopentyl Glycol Antimicrobial Coatings)

Diamond Vogel (Diamond Vogel Antimicrobial Coatings, Diamond Vogel Paint with Microban Technology)

Nippon Paint Company Ltd (Nippon Paint Antimicrobial Coatings, Nippon Paint DuraShield)

PPG Industries (PPG antimicrobial coatings, PPG Paint with Silver Ion Technology)

RPM International Inc. (Rust-Oleum Antimicrobial Coatings, Zinsser Perma-White Antimicrobial Paint)

Royal DSM (DSM Anti-Fog Coating, DSM Antimicrobial Coatings)

Sono Tek Corporation (Sono Tek Antimicrobial Coatings, Sono Tek Ultrasonic Coating Systems)

The DOW Chemical Company (DOW Antimicrobial Coatings, DOW Coating Materials)

The Sherwin-Williams Company (Sherwin-Williams Paint Shield, Sherwin-Williams SuperPaint with Antimicrobial Protection)

Troy Corporation (TroyAntimicrobial Coatings, Troy Antimicrobial Additives)

3M Company (3M Antimicrobial Coatings, 3M Novec Coatings)

BioCote Ltd (BioCote Antimicrobial Additives, BioCote Protected Products)

DuPont (DuPont Antimicrobial Surface Coatings, DuPont Corian Antimicrobial Surfaces)

Hexion Inc. (Hexion Antimicrobial Coatings, Hexion Acryloyldisulfide Coatings)

Inchem (Inchem Antimicrobial Additives, Inchem Coatings Solutions)

Microban International (Microban Antimicrobial Coatings, Microban Protected Products)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.6 Billion |

| Market Size by 2032 | US$ 36.2 Billion |

| CAGR | CAGR of 13.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Copper, Silver, Titanium Dioxide, Others (QACs, Zinc-Based, Polymer, Organic)) • By Application (Medical & Healthcare, Food & Beverage, Building & Construction, HVAC System, Protective Clothing, Transportation, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nippon Paint Company Ltd, AK Coatings, Troy Corporation, Akzonobel N.V., BASF SE, Arch Lonza, The DOW Chemical Company, Axalta Coating Systems, Diamond Vogel, Royal Dsm, Sono Tek Corporation, PPG Industrie, The Sherwin-Williams Company, RPM International Inc. |

| DRIVERS | • Growing demand for antimicrobial coatings in healthcare settings to reduce healthcare-associated infections. • Expansion of the food processing industry, driving the need for antimicrobial coatings in packaging materials. • Stringent regulations mandating the use of antimicrobial coatings in various industries for public health and safety. |

| Restraints | • High initial costs associated with the development and implementation of antimicrobial coatings. • Limited availability of raw materials required for manufacturing antimicrobial coatings. |

Ans. The Compound Annual Growth rate for the Antimicrobial Coatings Market over the forecast period is 13.5%.

Ans. The projected market size for the Antimicrobial Coatings Market is USD 36.2 billion by 2032.

Ans: The silver-type segment dominated the Antimicrobial coating market in 2023.

Ans: Asia Pacific region is expected to grow with the highest CAGR during the forecast period of 2023-2030.

Ans: The driving factors for the antimicrobial coatings market include increasing awareness about healthcare-associated infections, rising demand for antimicrobial coatings in medical devices and equipment, and stringent regulations governing hygiene standards across various industries.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Antimicrobial Coatings Market Segmentation, by Type

7.1 Chapter Overview

7.2 Copper

7.2.1 Copper Market Trends Analysis (2020-2032)

7.2.2 Copper Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Silver

7.3.1 Silver Market Trends Analysis (2020-2032)

7.3.2 Silver Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Titanium Dioxide

7.4.1 Titanium Dioxide Market Trends Analysis (2020-2032)

7.4.2 Titanium Dioxide Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Antimicrobial Coatings Market Segmentation, by Application

8.1 Chapter Overview

8.2 Medical & Healthcare

8.2.1 Medical & Healthcare Market Trends Analysis (2020-2032)

8.2.2 Medical & Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Food & Beverage

8.3.1 Food & Beverage Market Trends Analysis (2020-2032)

8.3.2 Food & Beverage Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Building & Construction

8.4.1 Building & Construction Market Trends Analysis (2020-2032)

8.4.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 HVAC System

8.5.1 HVAC System Market Trends Analysis (2020-2032)

8.5.2 HVAC System Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Protective Clothing

8.6.1 Protective Clothing Market Trends Analysis (2020-2032)

8.6.2 Protective Clothing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Transportation

8.7.1 Transportation Market Trends Analysis (2020-2032)

8.7.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 USA

9.2.6.1 USA Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 USA Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Canada

9.2.7.1 Canada Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Canada Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.8 Mexico

9.2.8.1 Mexico Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.8.2 Mexico Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Poland

9.3.1.6.1 Poland Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Poland Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Romania

9.3.1.7.1 Romania Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Romania Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Hungary

9.3.1.8.1 Hungary Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Hungary Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Turkey

9.3.1.9.1 Turkey Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Turkey Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 Germany

9.3.2.6.1 Germany Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 Germany Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 France

9.3.2.7.1 France Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 France Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 UK

9.3.2.8.1 UK Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 UK Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Italy

9.3.2.9.1 Italy Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Italy Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Switzerland

9.3.2.12.1 Switzerland Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Switzerland Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Austria

9.3.2.13.1 Austria Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Austria Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.14 Rest of Western Europe

9.3.2.14.1 Rest of Western Europe Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.14.2 Rest of Western Europe Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 China

9.4.6.1 China Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 China Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 India

9.4.7.1 India Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.7.2 India Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Japan

9.4.8.1 Japan Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Japan Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 South Korea

9.4.9.1 South Korea Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 South Korea Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Vietnam

9.4.9.1 Vietnam Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Vietnam Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Singapore

9.4.10.1 Singapore Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Singapore Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.12 Australia

9.4.12.1 Australia Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.12.2 Australia Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.13 Rest of Asia Pacific

9.4.13.1 Rest of Asia Pacific Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.13.2 Rest of Asia Pacific Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 UAE

9.5.1.6.1 UAE Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 UAE Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Egypt

9.5.1.7.1 Egypt Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Egypt Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Saudi Arabia

9.5.1.8.1 Saudi Arabia Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Saudi Arabia Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Qatar

9.5.1.9.1 Qatar Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Qatar Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 South Africa

9.5.2.6.1 South Africa Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 South Africa Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Nigeria

9.5.2.7.1 Nigeria Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Nigeria Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.8 Rest of Africa

9.5.2.8.1 Rest of Africa Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.8.2 Rest of Africa Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Antimicrobial Coatings Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Brazil

9.6.6.1 Brazil Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Brazil Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Argentina

9.6.7.1 Argentina Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Argentina Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Colombia

9.6.8.1 Colombia Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Colombia Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.9 Rest of Latin America

9.6.9.1 Rest of Latin America Antimicrobial Coatings Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.9.2 Rest of Latin America Antimicrobial Coatings Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Nippon Paint Company Ltd

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 AK Coatings

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Troy Corporation

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Akzonobel N.V.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 BASF SE

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Arch Lonza

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 The DOW Chemical Company

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Axalta Coating Systems

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Diamond Vogel

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Royal Dsm

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

10.11 Sono Tek Corporation

10.11.1 Company Overview

10.11.2 Financial

10.11.3 Products/ Services Offered

10.11.4 SWOT Analysis

10.12 PPG Industrie

10.12.1 Company Overview

10.12.2 Financial

10.12.3 Products/ Services Offered

10.12.4 SWOT Analysis

10.13 The Sherwin-Williams Company

10.13.1 Company Overview

10.13.2 Financial

10.13.3 Products/ Services Offered

10.13.4 SWOT Analysis

10.14 RPM International Inc.

10.14.1 Company Overview

10.14.2 Financial

10.14.3 Products/ Services Offered

10.14.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Copper

Silver

Titanium Dioxide

Others

By Application

Medical & Healthcare

Food & Beverage

Building & Construction

HVAC System

Protective Clothing

Transportation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Mulch Film Market Size was valued at USD 4.07 Billion in 2023 and is expected to reach USD 7.59 Billion by 2032, growing at a CAGR of 7.17% over the forecast period of 2024-2032.

Discover trends, growth drivers, and challenges in the global Medium Chain Triglycerides (MCT) market, including applications, key players, and forecast insights.

Roof Coating Market was valued at USD 2.66 Billion in 2023 and is expected to reach USD 3.64 Billion by 2032, growing at a CAGR of 3.54% from 2024 to 2032.

The Agricultural Enzymes Market Size was USD 530 Million in 2023 & expected reach to USD 1122.4 Million by 2032 and grow at a CAGR of 8.7% by 2024-2032.

Chromatography Resin Market Size was USD 2.6 billion in 2023 and is expected to reach $5.1 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032.

The Sustainable Apparel Market Size was valued at USD 11.20 billion in 2023 and will reach USD 24.53 billion by 2032, & grow at a CAGR of 9.1% by 2024-2032.

Hi! Click one of our member below to chat on Phone