Antimicrobial Additives Market Report Scope & Overview:

Get More Information on the Antimicrobial Additives Market - Request Sample Report

The Antimicrobial Additives Market Size was valued at USD 3.24 billion in 2023 and is expected to reach USD 6.86 billion by 2032 and grow at a CAGR of 9.20% over the forecast period 2024-2032.

The antimicrobial additives market growth is propelled by escalating demand across diverse sectors such as healthcare, packaging, and consumer goods driven by increasing awareness of hygiene and health concerns. Regulatory mandates promoting antimicrobial solutions in various applications further propel market expansion. The emergence of antimicrobial resistance and the need for effective microbial control in industrial settings are driving the adoption of these additives. Additionally, advancements in antimicrobial formulations and heightened R&D efforts aimed at improving product efficacy are contributing to market growth.

For instance, the regulatory approvals in major markets like Europe, and the U.S. have expanded the permissible use of certain antimicrobial additives in food contact materials and medical devices, supporting market growth.

Customers are in greater need of products that offer antimicrobial protection due to growing consumer knowledge of the risks that bacteria, viruses, and other illnesses can pose. This shift in consumer behavior may be seen in the increasing popularity of antimicrobial soaps, hand sanitizers, and surface disinfectant products that enhance safety and hygiene. Businesses' marketing initiatives highlighting their antibacterial products' effectiveness and health benefits have also raised demand.

Furthermore, the trend extends beyond personal care items to include household goods including kitchenware, cleaning supplies, and high-touch surfaces coated with antimicrobial agents. This suggests a more widespread movement in society to preserve a healthier and safer living environment. For instance, in 2023, BASF SE launched a new line of eco-friendly antimicrobial additives aimed at the packaging industry. These additives are designed to be biodegradable, aligning with global sustainability goals.

Market Dynamics:

Drivers

-

Growing emphasis on preventing microbial contamination in industrial sectors.

The increasing focus on avoiding microbe pollutants in industries is increasingly translating into a powerful growth determinant for the antimicrobial additives market. Hygiene and contamination control the potential of the associated product; reticular industries like food & beverage, pharmaceuticals, and manufacturing are paying big significance to hygiene concerns to ensure the purity of their products at all times and fulfilment by security standards. For example, one of the challenging processes is preventing microbial contamination in the food & beverage sector to avoid Foodborne illness and increase product shelf life- both essential requirements that allow establishments to maintain their brand competitiveness and comply with strict health regulations. Likewise, cleanliness must be adhered to in all phases of pharmaceutical manufacturing due the significant impact it has on product efficacy and long-term human health.

Additives can also be used in manufacturing processes, particularly high-touch and mechanically intensive equipment to minimize the risk of microorganism growth that might otherwise lead certain surfaces to fail prematurely or cross-contaminate products. The proliferation of global supply chains and a host of other factors have led to an increased awareness in the complex nature that drives these risks creating fresh demand for modern antimicrobial solutions by companies looking to protect their operations, bolster product quality, and across the expanding scope of industrial sectors.

-

Stringent regulations promote the use of antimicrobial additives in various applications.

Strict rules and regulation are proving to be the major market booster for antimicrobial additives throughout numerous applications. To ensure public health and safety, many governments have even imposed strict guidelines in such industries where cleanliness is essential. The food and beverages industry, for example, is by law highly regulated in the US with its FDA agency or EFSA across Europe because of regulations to prevent contagious diseases through consumables including antimicrobial additives requirement for packaging as well as processing. These strict laws enable better safety of the people but also encourage innovation to bring in more advanced antimicrobial technologies into different applications. These regulatory requirements also drive companies to pour more money into antimicrobial additives for their processes, improving the overall product safety as they meet stringent guidelines leading to wider market enlargement.

Restrain

-

Regulatory hurdles associated with the approval and use of antimicrobial agents.

Regulatory hurdles linked to the approval and utilization of antimicrobial agents pose a significant restraint for the antimicrobial additives market. Compliance with stringent regulations demands extensive testing and documentation, increasing time-to-market and development costs for manufacturers. Additionally, navigating diverse regulatory frameworks across different regions adds complexity and can hinder market penetration, constraining the growth potential of antimicrobial additives.

Market Segmentation:

By Type

By Type, the Inorganic segment dominated the antimicrobial additives market with the highest revenue share of more than 55% in 2023 due to its widespread use and effectiveness across various applications. Inorganic antimicrobial additives, such as silver-based compounds and copper, are known for their potent antimicrobial properties, durability, and stability, making them preferred choices in industries like healthcare, packaging, and consumer goods. Moreover, advancements in inorganic antimicrobial formulations have further boosted their market penetration and demand.

By Application

Plastic application held the largest revenue share of more than 38% in 2023. It is driven by the versatile nature of plastics across industries such as packaging, healthcare, and consumer goods. The increasing demand for antimicrobial properties in plastic products, coupled with advancements in antimicrobial additive technologies tailored for plastics, has further propelled this market segment. Additionally, heightened awareness regarding hygiene and safety standards in various sectors has accelerated the integration of antimicrobial additives into plastic materials, sustaining market growth.

By End-Use Industry

The healthcare segment dominated the end-use industry segment of the antimicrobial additives market with more than 30% share of the market revenue in 2023. It is primarily attributed to stringent hygiene requirements and the critical need for infection control in the healthcare sector. Antimicrobial additives play a vital role in medical devices, equipment, and packaging, ensuring the prevention of microbial contamination and the spread of infections. Additionally, advancements in antimicrobial technologies tailored for healthcare applications, coupled with increasing healthcare expenditures globally, have fueled the demand for antimicrobial additives in this sector, sustaining its market dominance.

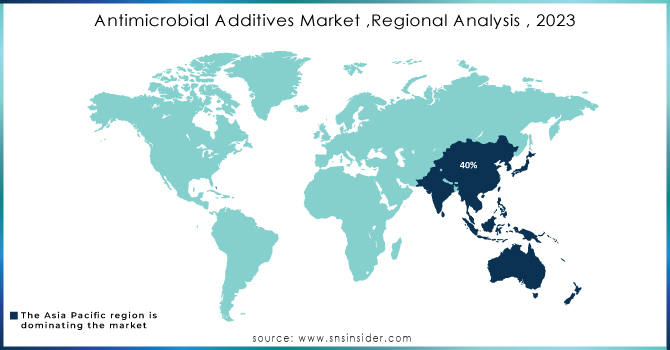

Regional Analysis:

Asia Pacific dominated the Antimicrobial Additives Market with the largest revenue share of more than 40% in 2023. The region's burgeoning population, coupled with rapid industrialization and urbanization, drives demand for antimicrobial solutions across various sectors. Additionally, supportive government initiatives, favorable investment climates, and a robust manufacturing base in countries like China and India further bolster Asia Pacific's market leadership in antimicrobial additives.

North America is estimated to grow at a significant CAGR during the forecast period of 2024-2031 primarily due to increasing awareness regarding health and hygiene standards, driving demand for antimicrobial additives across various industries. Moreover, stringent regulatory frameworks and rising concerns about antimicrobial resistance propel the adoption of these additives in North America. Additionally, technological advancements and innovations in antimicrobial formulations tailored for specific applications further contribute to the region's growth in the Antimicrobial Additives Market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players:

Milliken Chemical, Polyone Corporation (Avient Corporation), BASF SE, Lyondell Basell, Sanitized ag, Clariant ag, Kingplastic corporation, Biocote limited, Dow Inc., Microban international limited.

Recent Development:

-

In December 2023, Avient Corporation introduced an expansion of its Cesa Withstand™ portfolio. This expansion includes new grades of antimicrobial and antifungal additives specifically designed to enhance the performance of thermoplastic polyurethane (TPU) film-laminated products and devices in applications where preventing microbe development is crucial.

-

In September 2023, Microban International announced its latest technology-Ascera. This patent-pending, next-generation antimicrobial technology utilizes an active ingredient inspired by nature and is intended for use in olefinic polymers and solvent-based coatings.

-

In 2023 Clariant AG, expanded its range of natural and sustainable antimicrobial additives derived from plant-based sources.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.24 Billion |

| Market Size by 2032 | US$ 6.86 Billion |

| CAGR | CAGR of 9.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Organic (DCOIT, OBPA, and Triclosan) and Inorganic (Zinc, Silver, and Copper)) • By Application (Plastic, Paints & Coatings, Pulp & Paper, and Others) • By End-Use Industry (Healthcare, Food & Beverage, Packaging, Automotive, Construction, Consumer Goods, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Milliken Chemical, Polyone corporation (Avient corporation), BASF SE, Lyondell Basell, Sanitized ag, Clariant ag, Kingplastic corporation, Biocote limited, Dow Inc., Microban International Limited |

| DRIVERS | • Stringent regulations promoting the use of antimicrobial additives in various applications. • Growing emphasis on preventing microbial contamination in industrial sectors. |

| Restraints | • Regulatory hurdles associated with the approval and use of antimicrobial agents. |