Antifreeze Proteins Market Antifreeze Proteins Market:

Get More Information on Antifreeze Proteins Market - Request Sample Report

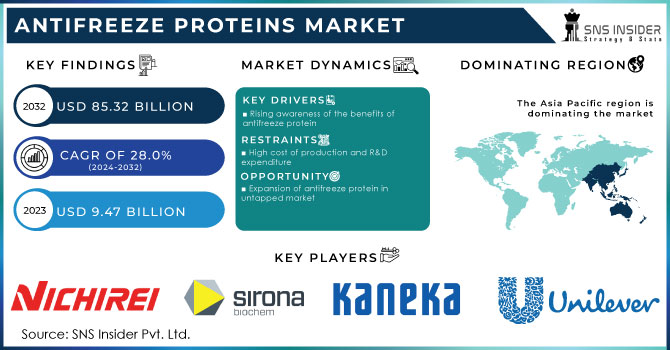

The Antifreeze Proteins Market size was valued at USD 9.47 billion in 2023 and is expected to reach USD 85.32 billion by 2032 and grow at a CAGR of 28.0% over the forecast period of 2024-2032.

Antifreeze proteins, also referred to as ice-structuring proteins, are polypeptides produced by bacteria, fungi, plants, and fish in response to freezing conditions. These proteins bind to microscopic ice crystals to prevent the cell from being damaged by ice growth and recrystallization. Extremophiles are organisms that have antifreeze proteins and can survive in extreme conditions. Antifreeze proteins are complicated proteins that have a sugar group added to them to give them a charge.

MARKET DYNAMICS

KEY DRIVERS

-

Rising awareness of the benefits of antifreeze protein

Antifreeze proteins are produced by several plants, insects, fungi, fishes, and bacteria in order to survive in subzero temperatures. These limit the development of ice crystals by binding to them. By reducing the freezing temperature in the organism, antifreeze proteins can prevent the formation of ice crystals in insects and fish. Because of their mechanism, antifreeze proteins have a broader range of applications in cosmetics, food industries, and medicine.

RESTRAIN

-

High cost of production and R&D expenditure

Any corporation involved in the mining and production of antifreeze proteins bears the significant cost of R&D. R&D expenditures are one of the most significant direct costs that businesses encounter while creating any product. It includes consumables, labor, power, research, and utilities. Extraction of antifreeze proteins from fish is a challenging and costly R&D process. All these reasons hamper the market growth.

OPPORTUNITY

-

Expansion of antifreeze protein in untapped market

Convenience is always chosen by younger generations because it is so readily available. Consumers can now enjoy interesting experiences thanks to technological advancement. Increasing living standards and lifestyle changes in emerging countries have an indirect impact on the sector by increasing demand for convenience foods, cosmetics, and vaccines. The market is experiencing fantastic opportunities in developing countries like Russia, India, China, and Brazil. They are providing enormous opportunities, which are promoting market expansion.

CHALLENGES

-

Advanced effects of vegan trends on antifreeze proteins from animal sources

Fish is a rich source of antifreeze proteins, but because there are more and more vegans in the world, consumers are choosing foods without animal products. Bacteria, plants, fungi, and other organisms are also sources of antifreeze proteins. However, because extraction from these sources is so new or in its infancy, there is a lower acceptance of fish antifreeze proteins among vegans, which can pose a challenge to the market's expansion.

MARKET SEGMENTATION

By Type

-

Type I

-

Type III

-

Antifreeze Glycoprotein

By Source

-

Fish

-

Plant

-

Insects

By Form

-

Solid

-

Liquid

By End-use

-

Medical

-

Food

-

Cosmetics

By Type Analysis

Based on Type, the antifreeze proteins market is segmented into Type I, Type III, and Antifreeze Glycoproteins. The Type III segment is estimated to show lucrative growth in the market owing to its rising usage in the medicine industry. It works well in combination with type I antifreeze protein. The market is projected to exhibit a CAGR of 28.1% during the forecast period. In addition, the segment held the second-largest revenue share of more than 18.0% in 2023. Type III antifreeze proteins have the best cryopreservation of any antifreeze protein.

By Source Insights

Based on the source, the market is segregated into fish, insects, and plants. Insect antifreeze proteins a high-quality proteins extracted from various types of insects such as black soldierflies, ants, grasshoppers, and crickets. Insects such as beetles and grasshoppers are also utilized in the treatment of human diseases.

By Form analysis

Based on form, the liquid form segment is expected to develop significantly due to rising demand in the food and pharmaceutical sectors. The liquid segment is expected to grow at a CAGR of 25.9%. Since liquid antifreeze proteins are easier to use and more soluble than solid antifreeze proteins, they are perfect for goods like functional drinks and dietary supplements. Furthermore, the market is expected to increase significantly due to the wide range of applications for liquid antifreeze protein in the pharmaceutical sector.

By End-user Analysis

Based on end-use, the antifreeze proteins market is categorized into medical, food, and cosmetics. In 2023, the medical end-use sector had the biggest revenue share of over 80.0% in the global market. The growth is attributed to increased R&D activity in the biotechnology and pharmaceutical industry. The proteins are utilized as cryoprotectants to preserve human tissues and cells, which is critical for a variety of medical operations including fertility therapies and organ transplantation. Antifreeze proteins' cryoprotective qualities have also led to their increased application in vaccine development, including the COVID-19 vaccine, which requires ultra-low temperature storage.

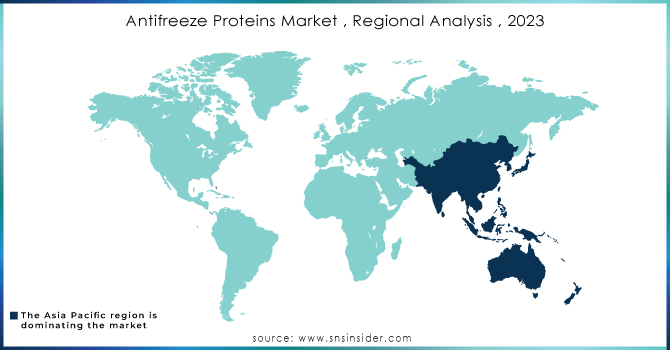

REGIONAL ANALYSIS

Asia Pacific contributed the most to the antifreeze protein market with a revenue share of more than 38.42% in 2023. This is due to the fact that the majority of aquaculture production and marine capture occurs throughout the region. The cosmetic and pharmaceutical sectors' increasing demand for antifreeze proteins is moving the sector ahead. Antifreeze proteins are widely used in vaccine manufacturing, and the existence of world-leading vaccine manufacturers in this region contributes to market growth. The growing consumption of sashimi-smoked items in China is fueling market expansion.

North America is expected to have the highest CAGR of 29%. This can be attributed to the region's increased demand from the food, pharmaceutical, and cosmetic industries. Furthermore, the generation and manufacturing of antifreeze proteins in this region have increased significantly. Furthermore, the US Fishery Department expanded and funded the salmon fish catchers' preservation capacity. This type of initiative is projected to fuel market expansion.

Need any customization research on Antifreeze Proteins Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Antifreeze Proteins Market are Unilever, Nichirei Corporation, Beijing Huacheng Jinke Technology Co., Ltd., A/F Protein Inc., Sirona Biochem, Kaneka Corporation, Shanghai Yu Tao Industrial Co., Ltd., Kodera Herb Garden Co., Ltd, ProtoKinetix, Inc, and other key players.

RECENT DEVELOPMENTS

In 2022, Beijing Huacheng Jinke Technology introduced two distinct Type I antifreeze membranes, which are unique peptides and glycopeptides produced by many animals to allow cells to live at sub-zero temperatures.

In 2021, Kaneka Corporation introduced a line of type I antifreeze proteins for use in rice and noodles. With the introduction of these items, the company strengthened its presence in the food industry.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.47 Billion |

| Market Size by 2032 | US$ 85.32 Billion |

| CAGR | CAGR of 28.0 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Type I, Type III, Antifreeze Glycoprotein) • By Source (Fish, Plant, Insects) • By Form (Solid, Liquid) • By End-use (Medical, Food, Cosmetics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Unilever, Nichirei Corporation, Beijing Huacheng Jinke Technology Co., Ltd., A/F Protein Inc., Sirona Biochem, Kaneka Corporation, Shanghai Yu Tao Industrial Co., Ltd., Kodera Herb Garden Co., Ltd, ProtoKinetix, Inc |

| Key Drivers | • Rising awareness of the benefits of antifreeze protein |

| Market Challenges | • Advanced effects of vegan trends on antifreeze proteins from animal sources |