Antiarrhythmic Drugs Market Report Scope & Overview:

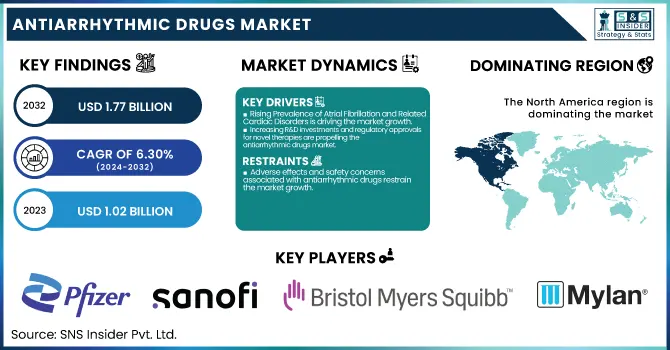

The Antiarrhythmic Drugs Market was valued at USD 1.02 billion in 2023 and is expected to reach USD 1.77 billion by 2032, growing at a CAGR of 6.30% from 2024-2032.

To Get more information on Antiarrhythmic Drugs Market - Request Free Sample Report

This report provides a statistical perspective by providing intricate information on the incidence and prevalence of cardiac arrhythmias, highlighting the region-wise disease burden. Additionally, it reviews pharmaceutical expenditure incurred on antiarrhythmic medicines by major geographies, pay-type-wise. The report also showcases drug approval and pipeline trends, with a focus on regulatory trends and up-and-coming therapies. Further, it contains a detailed examination of hospitalization and rehospitalization rates for arrhythmias and provides a generic vs. branded drug market share forecast comparison with unique long-term commercial visibility.

The U.S. Antiarrhythmic Drugs Market was valued at USD 0.30 billion in 2023 and is expected to reach USD 0.51 billion by 2032, growing at a CAGR of 6.28% from 2024-2032. The United States dominates the North American Antiarrhythmic Drugs Market due to a high rate of atrial fibrillation and an established healthcare system. This is complemented by the dominance of key pharma companies and robust regulatory structures.

Market Dynamics

Drivers

Rising Prevalence of Atrial Fibrillation and Related Cardiac Disorders is driving the market growth.

The rising global incidence of atrial fibrillation (AF) is one of the key market drivers for the antiarrhythmics drugs industry. The Centers for Disease Control and Prevention (CDC) reports that an estimated 12.1 million Americans will have AF by 2030, a rise from about 6 million in 2023. AF is linked to serious risks, including stroke and heart failure, making long-term rhythm and rate control, mainly treated with antiarrhythmic drug therapy, a necessity. In addition, elderly populations in the likes of Europe and Japan have led to an acute increase in cardiac arrhythmia prevalence. This increased clinical demand has stimulated pharmaceutical firms to diversify their product lines. For instance, Sanofi's Multaq (dronedarone) continues to be a popular treatment for AF, whereas investigations into new agents such as abelacimab by Anthos Therapeutics have accelerated with the acquisition by Novartis in 2025.

Increasing R&D investments and regulatory approvals for novel therapies are propelling the antiarrhythmic drugs market.

The antiarrhythmic drugs market is significantly driven by growing R&D investment and a surge in regulatory approvals for innovative therapies. Between 2020 and 2025, the U.S. FDA and European Medicines Agency (EMA) have increasingly supported expedited pathways for drugs targeting unmet needs in arrhythmia care. Notably, Multaq by Sanofi was the first antiarrhythmic drug to demonstrate reduced cardiovascular hospitalization, a key milestone in drug approval standards. Furthermore, pipeline drugs such as Omacetaxine mepesuccinate and Vernakalant are in advanced clinical trials, showcasing the industry's innovation pipeline. Large pharma companies like Pfizer, Novartis, and Bristol-Myers Squibb have raised R&D expenditures on cardiovascular therapeutics. Collaborations, like Novartis' 2025 acquisition of Anthos Therapeutics for access to abelacimab, reflect the strategic interest in new antiarrhythmic solutions for both safety and efficacy improvement.

Restraint

Adverse effects and safety concerns associated with antiarrhythmic drugs restrain the market growth.

One of the major constraints in the antiarrhythmic drugs market is the risk of severe side effects, which tends to limit long-term treatment and physician preference. Several Class I and Class III antiarrhythmic agents, including amiodarone and flecainide, have been implicated in proarrhythmic effects, hepatotoxicity, pulmonary toxicity, and thyroid dysfunction. These safety issues result in repeated treatment discontinuation and close monitoring needs, thus lowering patient compliance. As per research work published in the Journal of the American College of Cardiology (2023), almost 25–30% of the patients withdraw from amiodarone during the first year because of intolerance or complications. Additionally, the absence of biomarkers for forecasting adverse effects complicates patient stratification. The conservative regulatory environment and the reluctance of doctors in prescribing these medications add to the limited growth of the market despite growing demand for arrhythmia treatment services.

Opportunities

Expansion of antiarrhythmic therapies in emerging economies presents a significant opportunity to the market.

The increasing healthcare expenditures and enhancing access to cardiac treatment in emerging markets offer a favorable opportunity for growth in antiarrhythmic drugs. Asia Pacific, Latin America, and certain parts of the Middle East & Africa are experiencing a rise in cardiovascular disease incidence with increasing populations and lifestyles due to urbanization and aging. These markets continue to have insufficient availability of sophisticated cardiac drugs. As generic producers increase their presence and governments focus on managing non-communicable diseases, the penetration of antiarrhythmic drugs will increase substantially. For example, India's National Health Mission and other government initiatives are making cardiovascular drugs more accessible at public hospitals. Drug companies that provide affordable generics and collaborate with local distribution channels can take advantage of this unmet need and increase their worldwide market share.

Challenges

Limited Innovation and Slow Clinical Pipeline Progression are challenging the market to grow.

Notwithstanding the increased need for more effective and safer antiarrhythmics, the industry is constrained by the industry's low pace of clinical innovation. With few exceptions, all existing drugs have been formulated over decades, and very less have entered as a new class over that period. Complicated electrophysiology, in addition to the high likelihood of failure for clinical trials of new agents resulting from toxicity and proarrhythmia, constitutes a hindrance to innovation. For instance, many late-stage studies on atrial fibrillation medication have previously been stopped due to safety concerns. The expense of drug development, as well as demanding regulations on cardiac safety endpoints, deters numerous firms from investigating new molecules. This has resulted in a pipeline that is dominated by reformulations or combination therapies as opposed to first-in-class drugs, which presents a challenge for firms seeking to differentiate in a risk-averse and competitive environment.

Segmentation Analysis

By Drugs

In 2023, the Beta Blockers segment dominated the Antiarrhythmic Drugs Market with a 35.20% market share because of the wide range of therapeutic uses and long-standing clinician acceptance. They are predominantly prescribed not only for arrhythmias but also for comorbid cardiovascular illnesses like hypertension, heart failure, and ischemic heart disease—a first-line preferred treatment. Agents such as metoprolol, propranolol, and atenolol possess established safety profiles and are recommended in many clinical guidelines for rate control in atrial fibrillation. Their capacity to decrease myocardial oxygen demand, delay atrioventricular conduction, and reduce mortality in post-myocardial infarction patients also contributes to their prevalence. In 2023, beta blockers accounted for a significant majority of antiarrhythmic drug prescriptions in the hospital and ambulatory settings in particularly in high cardiovascular disease regions like North America and Europe.

Potassium Channel Blockers segment is the fastest growing segment over the forecast period, with growing embracement of rhythm-control strategies along with the appearance of newer as well as safer formulations. This segment contains powerful agents such as amiodarone, dofetilide, and dronedarone that are effective in the maintenance of sinus rhythm in atrial fibrillation and ventricular arrhythmias. Notwithstanding past issues regarding toxicity, newer agents such as dronedarone (Multaq) provide enhanced safety profiles, which is part of increasing physician confidence. In addition, research into selective potassium channel modulators continues with the goal of minimizing adverse effects while maintaining efficacy, further driving growth in this segment. The move towards individualized cardiology and increasing application of potassium channel blockers in managing complex arrhythmias, particularly in Asia Pacific and elderly populations, also drives this upward trend.

By Route of Administration

In 2023, the Oral segment dominated the Antiarrhythmic Drugs Market with a 72.13% market share due to its convenience of administration, patient compliance, and extensive application in long-term management of arrhythmia. The most frequently prescribed antiarrhythmic drugs, such as beta blockers (e.g., metoprolol), potassium channel blockers (e.g., amiodarone), and sodium channel blockers (e.g., flecainide), are oral formulations, and hence they are ideal for outpatient treatment. These drugs are favored for long-term rhythm and rate control in diseases like atrial fibrillation and supraventricular tachycardia. Oral medications are also inexpensive and readily available in hospitals and retail pharmacies, aiding their predominance. Favorable reimbursement policies and listing in guidelines for the treatment of arrhythmias have also contributed to the increased use of oral therapies, especially in high-disease prevalence areas like North America and Europe.

The Other segment, including new drug delivery methods like transdermal patches, sublingual products, and implantable drug delivery systems, is expected to see the fastest growth over the forecast period with 7.18% CAGR. The reason behind this growth is an increasing need for non-invasive, quick-onset, and targeted delivery systems, particularly among patients with low gastrointestinal tolerance or needing a quick therapeutic response. Emerging technologies, including drug-eluting cardiac devices and transdermal beta-blocker patches, are becoming increasingly popular because of their ability to enhance drug bioavailability and compliance. In addition, research and development in the pipeline are aimed at maximizing delivery in patients with challenging arrhythmias who are unable to tolerate standard oral or parenteral therapy. The transition towards precision medicine and innovation in drug formulation is expected to spur tremendous growth in this segment in the future.

By Distribution Channel

In 2023, the Hospital Pharmacies segment dominated the Antiarrhythmic Drugs Market with a 64.10% market share because of significant dependence on hospital-based treatment for complicated and acute cases of arrhythmias. Antiarrhythmic medications like amiodarone, lidocaine, and propafenone are often used in inpatient facilities, particularly during attacks of atrial fibrillation, ventricular tachycardia, or cardiac complications following surgery. Hospitals are usually the entry point of care for symptomatic or severe arrhythmias, which means they have to provide immediate access to strong antiarrhythmic drugs, usually via intravenous or high-dose oral administration. Hospitals also have an essential role in initiating treatment, dose adjustment, and following up on patients for possible drug-related side effects like QT prolongation or proarrhythmic activity, both of which need to be strictly supervised. In addition, the availability of cardiology units, electrophysiology laboratories, and integrated care pathways increases the utilization of these medications in hospital settings. Institutional procurement policies and government reimbursement further promote the dominant supply and administration of antiarrhythmic medications through hospital pharmacies, entrenching their leading market position.

Regional Analysis

North America dominated the Antiarrhythmic Drugs Market with a 38.19% market share in 2023 because of its well-developed healthcare infrastructure, high level of disease awareness, and high burden of cardiac arrhythmias like atrial fibrillation. The region is supported by the established presence of major pharmaceutical firms, strong clinical research, and favorable reimbursement policies that encourage early diagnosis and treatment. Besides, ongoing innovation and early uptake of novel antiarrhythmic treatments are responsible for the region's dominance in drug development as well as patient access. The U.S., specifically, boasts a huge patient base, which further fuels demand for antiarrhythmic drugs, as well as rapid expansion in the market for new therapies.

Asia Pacific is the fastest-growing region in the Antiarrhythmic Drugs Market with 6.76% CAGR throughout the forecast period, driven mainly by its rapidly aging population and cardiovascular disease incidence on the rise. Economic growth, wider healthcare access, and more government efforts to enhance cardiac care are fueling market growth. Also, increasing awareness, enhanced diagnostic technology, and increasing investments from international pharmaceutical firms are driving the growth of antiarrhythmic therapies in markets such as China, India, and Japan. Increased emphasis on healthcare infrastructure development and expanding healthcare insurance coverage also boosts market penetration, developing a favorable ground for antiarrhythmic drug uptake in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

Pfizer Inc. (Quinidex, Pronestyl)

Sanofi S.A. (Cordarone, Norpace)

Bristol-Myers Squibb Company (Coumadin, Cardarone)

Mylan N.V. (Disopyramide, Mexiletine)

Novartis AG (Tambocor, Betaloc)

Teva Pharmaceutical Industries Ltd. (Propafenone, Lidocaine)

Abbott Laboratories (Rythmol, Procan SR)

AstraZeneca plc (Tenormin, Toprol-XL)

GSK plc (Tenormin, Sotalol)

Zydus Lifesciences Ltd. (Amiodarone, Diltiazem)

Sun Pharmaceutical Industries Ltd. (Flecainide, Verapamil)

Dr. Reddy’s Laboratories Ltd. (Amiodarone, Mexiletine)

Lupin Limited (Dronedarone, Bisoprolol)

Glenmark Pharmaceuticals Ltd. (Amiodarone, Propranolol)

Aurobindo Pharma Ltd. (Sotalol, Propafenone)

Cipla Ltd. (Disopyramide, Flecainide)

Boehringer Ingelheim International GmbH (Multaq, Micardis)

Roche Holding AG (Lanoxin, Cardizem)

Takeda Pharmaceutical Company Limited (Cordanum, Lidocaine)

Merck & Co., Inc. (Betapace, Isoptin)

Suppliers (These suppliers commonly provide active pharmaceutical ingredients (APIs), excipients, and contract manufacturing services (CDMO) essential for the formulation, development, and large-scale production of antiarrhythmic drugs). In the Antiarrhythmic Drugs Market

BASF SE

Evonik Industries AG

Merck KGaA

Lonza Group AG

Thermo Fisher Scientific Inc.

Cambrex Corporation

WuXi AppTec

Hovione

Almac Group

Capua BioServices S.p.A.

Recent Developments

July 2024 – Sanofi-Aventis has announced that the U.S. Food and Drug Administration (FDA) has approved Multaq (dronedarone) 400 mg tablets. Approval offers a new treatment option for patients experiencing atrial fibrillation (AF) or atrial flutter (AFL). Multaq is the first product in the United States that has been shown to demonstrate a clinical benefit by decreasing cardiovascular hospitalization among this patient group.

February 2025 – Novartis confirmed that it signed a deal to acquire Anthos Therapeutics, Inc., a clinical-stage, private, biopharmaceutical corporation with operations based in Boston. The transaction consists of abelacimab, which is an investigative, late-stage drug intended to be used to prevent stroke and systemic embolism in individuals who have atrial fibrillation.

September 2024 – U.S. subsidiary Teva Pharmaceuticals announced new encouraging Phase 3 results for Teva's SOLARIS trial, testing TEV-'749, an extended-release olanzapine subcutaneous formulation. Results show encouraging efficacy, safety, and tolerability in adults diagnosed with schizophrenia.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.02 Billion |

| Market Size by 2032 | US$ 1.77 Billion |

| CAGR | CAGR of 6.30 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Type (Sodium Channel Blockers, Beta Blockers, Potassium Channel Blockers, Calcium Channel Blockers, Other) • By Route of Administration (Oral, Parenteral, Other) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Sanofi S.A., Bristol-Myers Squibb Company, Mylan N.V., Novartis AG, Teva Pharmaceutical Industries Ltd., Abbott Laboratories, AstraZeneca plc, GSK plc, Zydus Lifesciences Ltd., Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd., Lupin Limited, Glenmark Pharmaceuticals Ltd., Aurobindo Pharma Ltd., Cipla Ltd., Boehringer Ingelheim International GmbH, Roche Holding AG, Takeda Pharmaceutical Company Limited, Merck & Co., Inc., and other players. |

Ans: The Antiarrhythmic Drugs Market is expected to grow at a CAGR of 6.30% from 2024-2032.

Ans: The Antiarrhythmic Drugs Market was USD 1.02 billion in 2023 and is expected to reach USD 1.77 billion by 2032.

Ans: Increasing R&D investments and regulatory approvals for novel therapies are propelling the antiarrhythmic drugs market.

Ans: The “Oral” segment dominated the Antiarrhythmic Drugs Market.

Ans: North America dominated the Antiarrhythmic Drugs Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Cardiac Arrhythmias (2023)

5.2 Pharmaceutical Spending on Antiarrhythmic Drugs, by Region and Payer Type (2023)

5.3 Drug Approval & Pipeline Activity Trends (2020–2025).

5.4 Hospitalization and Rehospitalization Rates Due to Arrhythmias (2023)

5.5 Generic vs. Branded Drug Market Share (2023–2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Antiarrhythmic Drugs Market Segmentation, By Drugs

7.1 Chapter Overview

7.2 Sodium Channel Blockers

7.2.1 Sodium Channel Blockers Market Trends Analysis (2020-2032)

7.2.2 Sodium Channel Blockers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Beta Blockers

7.3.1 Beta Blockers Market Trends Analysis (2020-2032)

7.3.2 Beta Blockers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Potassium Channel Blockers

7.4.1 Potassium Channel Blockers Market Trends Analysis (2020-2032)

7.4.2 Potassium Channel Blockers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Calcium Channel Blockers

7.5.1 Calcium Channel Blockers Market Trends Analysis (2020-2032)

7.5.2 Calcium Channel Blockers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Other Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Antiarrhythmic Drugs Market Segmentation, By Route of Administration

8.1 Chapter Overview

8.2 Oral

8.2.1 Oral Market Trends Analysis (2020-2032)

8.2.2 Oral Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Parenteral

8.3.1 Parenteral Market Trends Analysis (2020-2032)

8.3.2 Parenteral Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Other

8.4.1 Other Market Trends Analysis (2020-2032)

8.4.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Antiarrhythmic Drugs Market Segmentation, By Distribution Channel

9.1 Chapter Overview

9.2 Hospital Pharmacies

9.2.1 Hospital Pharmacies Market Trends Analysis (2020-2032)

9.2.2 Hospital Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Retail Pharmacies

9.3.1 Retail Pharmacies Market Trends Analysis (2020-2032)

9.3.2 Retail Pharmacies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Other

9.4.1 Other Market Trends Analysis (2020-2032)

9.4.2 Other Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.2.4 North America Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.2.5 North America Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.2.6.2 USA Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.2.6.3 USA Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.2.7.2 Canada Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.2.7.3 Canada Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.2.8.2 Mexico Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.2.8.3 Mexico Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.6.2 Poland Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.6.3 Poland Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.7.2 Romania Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.7.3 Romania Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.4 Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.5 Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.6.2 Germany Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.6.3 Germany Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.7.2 France Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.7.3 France Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.8.2 UK Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.8.3 UK Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.9.2 Italy Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.9.3 Italy Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.10.2 Spain Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.10.3 Spain Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.13.2 Austria Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.13.3 Austria Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.4 Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.5 Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.6.2 China Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.6.3 China Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.7.2 India Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.7.3 India Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.8.2 Japan Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.8.3 Japan Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.9.2 South Korea Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.9.3 South Korea Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.10.2 Vietnam Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.10.3 Vietnam Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.11.2 Singapore Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.11.3 Singapore Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.12.2 Australia Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.12.3 Australia Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.4 Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.5 Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.6.2 UAE Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.6.3 UAE Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.2.4 Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.2.5 Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.6.4 Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.6.5 Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.6.6.2 Brazil Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.6.6.3 Brazil Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.6.7.2 Argentina Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.6.7.3 Argentina Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.6.8.2 Colombia Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.6.8.3 Colombia Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Drugs (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Route of Administration (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Antiarrhythmic Drugs Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11. Company Profiles

11.1 Pfizer Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Sanofi S.A.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Bristol-Myers Squibb Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Mylan N.V.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Novartis AG

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Teva Pharmaceutical Industries Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Abbott Laboratories

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 AstraZeneca plc

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 GSK plc

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Zydus Lifesciences Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Drugs

By Route of Administration

By Distribution Channel

Request for Segment Customization as per your Business Requirement: https://www.snsinsider.com/enquiry/6766

Regional Coverage:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: https://www.snsinsider.com/enquiry/6766

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Fluoroscopy Imaging Systems Market Size was valued at USD 1.99 billion in 2023 and is expected to reach USD 2.45 billion by 2032 and grow at a CAGR of 2.37% over the forecast period 2024-2032.

The Weight Management Services Market Size was valued at USD 4.78 Billion in 2023, and is expected to reach USD 8.54 Billion by 2032, and grow at a CAGR of 6.95% over the forecast period 2024-2032.

Spay And Neuter Market Size was valued at USD 2.32 billion in 2023 and is expected to reach USD 3.43 billion by 2032, growing at a CAGR of 4.44% over the forecast period 2024-2032.

The Menstrual Cup Market Size was valued at USD 890.15 million in 2023 and is expected to reach USD 1562.62 million 2032 and grow at a CAGR of 6.47% over the forecast period 2024-2032.

The MRI-guided Neurosurgical Ablation Market size was valued at USD 412.08 million in 2023 and is expected to reach USD 654.69 million by 2032, growing at a CAGR of 5.28% over the forecast period of 2024-2032.

The 3D Printed Prosthetics Market Size was valued at USD 1.51 Billion in 2023 and is expected to reach USD 2.97 Billion by 2032, growing at a CAGR of 7.84% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone