Get more information on Anti-Money Laundering Market - Request Sample Report

Anti-money Laundering Market was valued at USD 2.53 Billion in 2023 and is expected to reach USD 9.35 Billion by 2032 and grow at a CAGR of 15.67% from 2024-2032.

The Anti-Money Laundering (AML) market has seen substantial growth in recent years, fueled by stricter regulatory scrutiny, a rise in financial crimes, and innovations in digital payment systems, all boosting demand for advanced AML solutions. Financial institutions worldwide are increasingly adopting technologies like artificial intelligence, machine learning, and blockchain to streamline AML operations, strengthening their ability to detect and prevent suspicious activities. With global digital transactions nearing 1.3 trillion in 2023, addressing money laundering risks has become more urgent, creating a need for AML systems capable of real-time, high-volume transaction analysis to meet international compliance standards. An example of this trend is HSBC’s USD 800 million investment in AML infrastructure in 2023 to comply with tighter regulations and enhance fraud detection. Similarly, Deutsche Bank recently launched an AI-driven AML platform that can analyze over 10 million transactions daily, greatly improving its anomaly detection capabilities. These examples underscore the role of advanced AML technology in meeting regulatory demands and handling the surge in digital transactions.

With AML regulations tightening, companies are urged to upgrade or replace legacy systems. The European Union, for instance, introduced stricter regulations, including mandatory Know Your Customer (KYC) protocols, which will become even more stringent by 2025, driving additional growth in the AML market. Data from the Financial Crimes Enforcement Network (FinCEN) reveals a 20% increase in AML non-compliance fines in 2023 compared to 2022, highlighting stricter enforcement and motivating firms to enhance their AML systems. As regulatory pressures mount, alongside technological advancements and a rise in cyber-enabled financial crimes, the AML market is poised for continued growth. Key technologies like real-time data analytics, AI-powered monitoring, and blockchain-based verification are expected to be central to AML’s evolution, establishing it as a fundamental component of risk management for financial institutions worldwide.

Drivers

Growth in cyber-enabled fraud and complex financial crimes drives demand for sophisticated AML solutions.

Financial institutions leverage AI to streamline AML processes, improve accuracy, and reduce false positives.

Stricter Know Your Customer (KYC) requirements globally increase the need for comprehensive AML measures.

One of the significant factors fueling the growth of the global AML market is increasing stringent Know Your Customer (KYC) requirements across the globe. Know Your Customer ( KYC ), or Know Your Client, is a procedure of categorizing customers and other entities financial institutions must follow to know the identities of their clients, their coping patterns, and whether they are linked to organized crime. In a bid to put an end to money launderers and terrorist financiers, regulators are tightening the noose around KYC mandates which is putting increasing pressure on financial institutions to implement AML solutions in line with continuously changing standards.

Rigorously enforced KYC regulations force companies to carry out extensive verification of customers that not only requires the collection and storage of vast amounts of data but also necessitates thorough background checks and real-time transaction monitoring. Financial institutions must collect and verify identification documents and source-of-wealth information for customers, as well as monitor account activity for suspicious behavior on an ongoing basis. This broadened know-your-customer KYC model exists to ensure that criminal actors or any other groups do not gain access to the financial system, which is very common under AML initiatives.

The rapid growth of digital payments and the increasing speed of transactions require financial institutions to deploy AML solutions capable of processing large volumes of data in real time. In order to tackle this issue, next-gen technologies like artificial Intelligence, machine learning, and blockchain are being combined into anti-money laundering solutions so as to automate KYC processes with greater accuracy and compliance. AI can, for example, scrutinize large data sets to detect trends and patterns signaling financial crime; machine learning limits the false positive rate in all monitoring.

In addition, KYC standards in many parts of the world including the European Union are subject to constant updates, which means financial institutions must be able to respond quickly to avoid hefty non-compliance fines. As EU KYC regulations are expected to become even stricter by 2025, institutions need a solid plan to either upgrade or replace stale AML systems to remain compliant. Such a shift is substantially affecting the AML market, as organizations are focusing on innovative, flexible, and compliance-driven solutions to meet new KYC standards. In conclusion, the changing landscape of KYC further highlights the importance of effective and flexible AML solutions that scale with these changes to maintain compliance with regulators and protect organizations from financial crime globally.

Restraints

Stricter data protection regulations can limit the ability of financial institutions to collect and analyze customer data necessary for effective AML processes.

Legacy systems often pose integration difficulties with new AML technologies, hindering efficient data flow and compliance.

A lack of skilled personnel with expertise in AML technologies and regulatory compliance can impede the effective implementation of AML strategies.

One of the barriers to the successful implementation of AML in the financial sector will be the unavailability of personnel with subject matter expertise about AML technologies and regulatory compliance. With growing regulation and money laundering methods constantly changing, the need for skilled individuals to handle this has never been higher in financial services. AML specialists are also onboarding AML solutions; they have the skills to help develop, run, and improve systems that identify, limit, and prosecute financial crime.

To gear up for the pace of change that new anti-money laundering technologies, specifically artificial intelligence and machine learning as a whole and more exciting blockchain technologies set before our very eyes: AI needs to be understood but also calendared in should all epochs to come from this point outwards. Sadly, the supply of this talent rarely meets demand creating a skills gap in the market. This discrepancy may lead to poor governance and oversight of AML systems, increasing the potential for compliance failures and ultimately leaving institutions subject to large financial penalties. With regulators tightening AML requirements and revising standards, financial institutions need to continuously adjust their strategies and technologies. The rapidly evolving AML landscape underscores the demand for professionals who can interpret new regulations, institute requisite changes and ensure that AML systems comply with compliance requirements. Without a talented pool of Human Capital, institutions find themselves poorly positioned to respond proactively to regulatory discontinuity and consequently vulnerable to criminal exploitation. And, the absence of experts cannot be covered only by technology. While a plethora of alarm bells can be run by automated systems, without the presence of trained analysts able to assess those alarms, sophisticated suspicious behaviors will likely go undetected. Therefore, both the AML strategies in practice and readiness to tackle unexpected changes or instabilities due to regulatory pressures or privacy policies can be ensured by catering to this skill shortage which is a huge step toward strengthening financial systems against the risk of money laundering and financial crime. Getting smarter about the AML landscape we navigate, institutions should also be investing in programs that both develop and share, fundamental business principles to build beneficial ways of working for success in fighting financial crime.

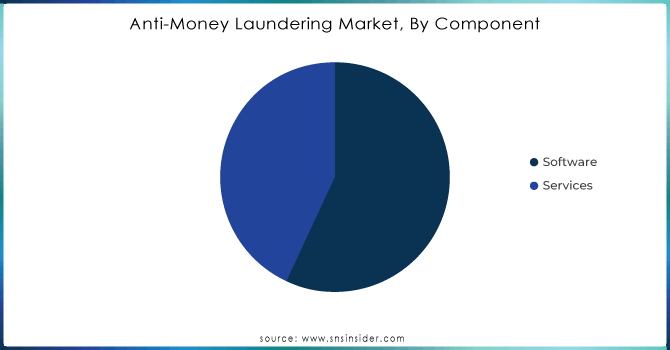

By Component

In 2023, the software segment dominated the market and represented over 63.1% of revenue share. This growth can be attributed to the increasing demand for anti-money laundering solution among banks and payment solution providers to identify suspicious activities and minimize the risks of genuine transaction rejection. Widespread Adoption of AI/ML and Big Data — Technologies like artificial intelligence, machine learning, and big data analytics have been incorporated into increasingly sophisticated AML software that makes it possible to analyze massive volumes of information in seconds. Apart from this, it improves the efficiency of AML programs/measures and also relieves operational cost pressure from manual compliance processes.

The services segment is anticipated to register significant growth between 2024 to 2032. As AML compliance has become more complicated, financial institutions have sought specialists which in turn has attracted attention in this area. Many companies in the world develop and provide AI-based AML services to assist banks in dealing with AML risk. For instance, in April of 2024, Oracle Financial Services Compliance Agent introduced by Oracle An AI-based cloud service designed to help banks manage their AML risks more effectively. Banks can leverage this for scenario testing, identifying suspicious transactions, and enhancing transaction monitoring system efficiency. AI and machine learning offer important efficiencies to AML programs while also limiting costs and improving decision-making capabilities to propel this tool even further.

Need any customization research on Anti-Money Laundering Market - Ask For Customization

By Product

The transaction monitoring segment dominated the market and represented a significant revenue share in 2023. The increasing volume of financial crimes leading to the need for advanced monitoring systems that are capable of analyzing millions and billions of transactions in real-time has propelled the growth of this segment. Moreover, increasing regulatory pressure from global and regional authorities has inspired financial institutions to take a stricter approach toward the use of transaction monitoring tools that could help them avoid heavy penalties. On a parallel ground, we have a variety of companies around the world writing AML solutions to concentrate and shut down high-definitive activities. As an example, in October 2023 Workn Fusion introduced a new AI solution called Isaac that is aimed to automatically perform first-level alert reviews to improve AML transaction monitoring-related processes. Isaac uses machine learning to evaluate alerts, and automatically escalate suspicious ones for review while closing out non-suspicious alerts with documentation. It alleviated some of the work that AML analysts needed to do and shifted their focus to higher-risk activities.

Customer identity management segment is anticipated to register the highest CAGR during the forecast period. The segment growth is driven by the increasing necessity of strong Know Your Customer (KYC) processes against money laundering. Customer identity management solutions are being adopted by more financial institutions to ensure that they are not unknowingly helping their clients to finance any illegal activities. The growing digital banking and transactions have also increased the need for correct identity verification processes. These solutions have now begun to integrate advanced technologies like biometric authentication and AI-driven identity verification to make them more reliable, and accurate.

By Deployment

In 2023, the greatest revenue share of the market was held by the on-premise segment. The anti-money laundering on-premise segment is still important for companies that value control and security in their compliance systems. On-premise solutions are another preferred approach for many institutions across the globe which has allowed them to customize and blend into their existing IT infrastructure while also giving a higher level of control on data security and regulatory compliance. The benefit of an on-premise anti-money laundering system is that it can be created around each organization's specific requirements, testing for compliance at a far deeper level.

The cloud deployment form is projected to witness prominent growth from 2024 to 2032. The cloud segment in the global anti-money laundering market has become one of the fastest-growing categories, as it provides flexibility, scalability, and cost-related advantages. For organizations looking for streamlining, cloud-based anti-money laundering solutions provide the benefit of making frequent updates or easy integration which can be a hassle with on-premise systems. These solutions allow financial institutions to leverage next-generation capabilities and technologies – artificial intelligence, real-time data analytics, etc. — while avoiding the need for heavy investments in infrastructure. The emergence of remote work and the growing reliance on digital banking services have further boosted the transition to cloud-native AML options.

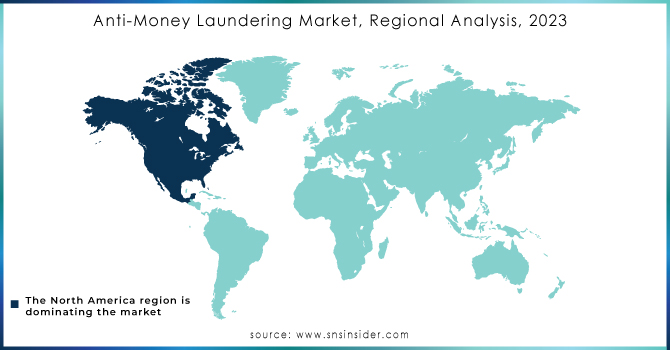

Regional Analysis

North America held the largest share of the market in 2023 with it being 30.4% of the total share. Thanks to its robust regulatory framework and strict enforcement of AML laws, this leadership stands firm. As complex regulations arise with bigger financial institutions to regulate them, the market for advanced AML Solutions needs it as a necessity in North America. It also commits extensive resources to emergent technologies such as artificial intelligence and machine learning, both of which are instrumental in the most effective modern AML constructs. Moreover, the high concentration of financial hubs coupled with the rapid increase in the volume of transaction types add to North America being a country having a higher share in the AML market.

The Asia Pacific anti-money laundering market is expected to grow significantly during 2024-2032. Increasing demand for sophisticated AML solutions across the region after growing cross-border transactions and expanding financial services will increase the growth of this market here. Additionally, accelerating economic development and financial system modernization within Asia Pacific regions are driving enhanced emphasis on AML compliance.

Key Players

The major key players with their products are

FICO - FICO TONBELLER

Oracle - Oracle Financial Services Analytical Applications

SAS Institute - SAS Anti-Money Laundering

LexisNexis Risk Solutions - LexisNexis AML Compliance

ACI Worldwide - ACI Universal Payments

NICE Actimize - NICE Actimize Anti-Money Laundering

InfrasoftTech - InfrasoftTech AML Compliance Solution

ComplyAdvantage - ComplyAdvantage Screening

Bae Systems - BAE Systems NetReveal

Palantir Technologies - Palantir Foundry

KYC Portal - KYC Portal

Actico - Actico Compliance Suite

Elliptic - Elliptic Navigator

AML Partners - AML360

Verafin - Verafin Fraud Detection

CaseWare RCM - CaseWare AML Risk Assessment

Quantexa - Quantexa Decision Intelligence Platform

Refinitiv - Refinitiv World-Check

Amlify - Amlify AML Solution

FinScan - FinScan AML Screening

Recent Developments

January 2024: FICO Launched an enhanced version of its AML solution with improved machine-learning algorithms for better anomaly detection.

February 2024: LexisNexis Risk Solutions: Introduced a new AML compliance tool designed to streamline KYC processes for financial institutions.

March 2024: SAS Institute: Announced updates to its AML solution, integrating advanced analytics to enhance fraud detection capabilities.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size by 2032 | USD 9.35 Billion |

| CAGR | CAGR of 15.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software And Services) • By Deployment Model (Cloud And On-Premise) • By Organization Size (Large Enterprises, Small & Medium Enterprises) • By Product (Compliance Management, Currency Transaction Reporting, Customer Identity Management, Transaction Monitoring) • By End-Use (BFSI, Government, Healthcare, IT & Telecom, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

FICO, Oracle, SAS Institute, LexisNexis Risk Solutions, ACI Worldwide, NICE Actimize, InfrasoftTech, ComplyAdvantage, Bae Systems, Palantir Technologies, KYC Portal, Actico, Elliptic, AML Partners, Verafin, CaseWare RCM, Quantexa |

| Key Drivers | •Growth in cyber-enabled fraud and complex financial crimes drives demand for sophisticated AML solutions. •Financial institutions leverage AI to streamline AML processes, improve accuracy, and reduce false positives. •Stricter Know Your Customer (KYC) requirements globally increase the need for comprehensive AML measures. |

| Market Opportunities | •Stricter data protection regulations can limit the ability of financial institutions to collect and analyze customer data necessary for effective AML processes. •Legacy systems often pose integration difficulties with new AML technologies, hindering efficient data flow and compliance. •A lack of skilled personnel with expertise in AML technologies and regulatory compliance can impede the effective implementation of AML strategies. |

Ans- Challenges in the Anti-money Laundering Market are

Ans- one main growth factor for the Anti-money Laundering Market is

Ans- In 2023, North America dominated the market and held a significant revenue share.

Ans- the CAGR of the Anti-money Laundering Market during the forecast period is 15.67% from 2024-2032.

Ans- Anti-money Laundering Market was valued at USD 2.53 Billion in 2023 and is expected to reach USD 9.35 Billion by 2032 and grow at a CAGR of 15.67% from 2024-2032.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Anti-money Laundering Market Segmentation, by Component

7.1 Chapter Overview

7.2Software

7.2.1Software Market Trends Analysis (2020-2032)

7.2.2Software Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.432 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 8. Anti-money Laundering Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 Cloud

8.2.1 Cloud Market Trends Analysis (2020-2032)

8.2.2 Cloud Market Size Estimates and Forecasts To 2032 (USD Billion)

8.3On-premise

8.3.1On-premise Market Trends Analysis (2020-2032)

8.3.2On-premise Market Size Estimates and Forecasts To 2032 (USD Billion)

9. Anti-money Laundering Market Segmentation, By Product

9.1 Chapter Overview

9.2 Compliance Management

9.2.1 Compliance Management Market Trends Analysis (2020-2032)

9.2.2 Compliance Management Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 Currency Transaction Reporting

9.3.1 Currency Transaction Reporting Market Trends Analysis (2020-2032)

9.3.2 Currency Transaction Reporting Market Size Estimates and Forecasts To 2032 (USD Billion)

9.4 Customer Identity Management

9.4.1 Customer Identity Management Market Trends Analysis (2020-2032)

9.4.2 Customer Identity Management Market Size Estimates and Forecasts To 2032 (USD Billion)

9.5 Transaction Monitoring

9.5.1 Transaction Monitoring Market Trends Analysis (2020-2032)

9.5.2 Transaction Monitoring Market Size Estimates and Forecasts To 2032 (USD Billion)

10. Anti-money Laundering Market Segmentation, By End User

10.1 Chapter Overview

10.2 BFSI

10.2.1 BFSI Market Trends Analysis (2020-2032)

10.2.2 BFSI Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 Government

10.3.1 Government Market Trends Analysis (2020-2032)

10.3.2 Government Market Size Estimates and Forecasts To 2032 (USD Billion)

10.4 Healthcare

10.4.1 Healthcare Market Trends Analysis (2020-2032)

10.4.2 Healthcare Market Size Estimates and Forecasts To 2032 (USD Billion)

10.5 IT & Telecom

10.5.1 IT & Telecom Market Trends Analysis (2020-2032)

10.5.2 IT & Telecom Market Size Estimates and Forecasts To 2032 (USD Billion)

10.7 Others

10.7.1 Others Market Trends Analysis (2020-2032)

10.7.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

11. Anti-money Laundering Market Segmentation, By Enterprise Size

11.1 Chapter Overview

11.2 Large Enterprise

11.2.1 Large Enterprise Market Trends Analysis (2020-2032)

11.2.2 Large Enterprise Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 Small & Medium Enterprise

11.3.1 Small & Medium Enterprise Market Trends Analysis (2020-2032)

11.3.2 Small & Medium Enterprise Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.4 North America Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.5 North America Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.2.6 North America Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.7 North America Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.8.2 USA Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.8.3 USA Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.2.8.4 USA Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.8.5 USA Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.9.2 Canada Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.9.3 Canada Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.2.9.4 Canada Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.9.5 Canada Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.2.10.2 Mexico Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.2.10.3 Mexico Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.2.10.4 Mexico Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.10.5 Mexico Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.8.2 Poland Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.8.3 Poland Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.8.4 Poland Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.8.5 Poland Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.9.2 Romania Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.9.3 Romania Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.9.4 Romania Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.9.5 Romania Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.4 Western Europe Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.5 Western Europe Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.6 Western Europe Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.7 Western Europe Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.8.2 Germany Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.8.3 Germany Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.8.4 Germany Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.8.5 Germany Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.9.2 France Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.9.3 France Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.9.4 France Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.9.5 France Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.10.2 UK Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.10.3 UK Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.10.4 UK Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.10.5 UK Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.11.2 Italy Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.11.3 Italy Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.11.4 Italy Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.11.5 Italy Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.12.2 Spain Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.12.3 Spain Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.12.4 Spain Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.12.5 Spain Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.15.2 Austria Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.15.3 Austria Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.15.4 Austria Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.15.5 Austria Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.4 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.5 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.6 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.7 Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.8.2 China Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.8.3 China Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.8.4 China Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.8.5 China Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.9.2 India Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.9.3 India Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.9.4 India Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.9.5 India Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.10.2 Japan Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.10.3 Japan Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.10.4 Japan Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.10.5 Japan Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.11.2 South Korea Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.11.3 South Korea Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.11.4 South Korea Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.11.5 South Korea Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.12.2 Vietnam Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.12.3 Vietnam Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.12.4 Vietnam Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.12.5 Vietnam Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.13.2 Singapore Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.13.3 Singapore Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.13.4 Singapore Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.13.5 Singapore Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.14.2 Australia Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.14.3 Australia Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.14.4 Australia Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.14.5 Australia Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.4 Middle East Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.5 Middle East Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.6 Middle East Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.7 Middle East Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.8.2 UAE Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.8.3 UAE Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.8.4 UAE Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.8.5 UAE Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.4 Africa Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.5 Africa Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.6 Africa Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.7 Africa Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Anti-money Laundering Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.6.4 Latin America Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.5 Latin America Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.6.6 Latin America Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.7 Latin America Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.6.8.2 Brazil Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.8.3 Brazil Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.6.8.4 Brazil Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.8.5 Brazil Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.6.9.2 Argentina Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.9.3 Argentina Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.6.9.4 Argentina Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.9.5 Argentina Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.6.10.2 Colombia Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.10.3 Colombia Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.6.10.4 Colombia Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.10.5 Colombia Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Anti-money Laundering Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Anti-money Laundering Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Anti-money Laundering Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Anti-money Laundering Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Anti-money Laundering Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

13. Company Profiles

13.1FICO

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Oracle

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 SAS Institute

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 LexisNexis Risk Solutions

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 ACI Worldwide

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6NICE Actimize

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 InfrasoftTech

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8ComplyAdvantage

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Bae Systems

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Palantir Technologies

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Software

Services

By Product

Compliance Management

Currency Transaction Reporting

Customer Identity Management

Transaction Monitoring

By Deployment

Cloud

On-premise

By Organization Size

Large Enterprises

Small & Medium Enterprises

By End-Use

BFSI

Government

Healthcare

IT & Telecom

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Video Intercom Devices Market size was valued at USD 41.79 billion in 2023 and is expected to reach USD 128.62 billion by 2032, growing at a CAGR of 13.27% over the forecast period of 2024-2032.

The Artificial Intelligence in Accounting Market size was valued at USD 3.35 billion in 2023 and is expected to reach USD 93.30 billion by 2032, growing at a CAGR of 44.77% Over the Forecast Period of 2024-2032.

The E-Invoicing Market size was valued at USD 12.7 Billion in 2023. It is expected to Reach USD 63.93 Billion by 2032 and grow at a CAGR of 19.69% over the forecast period of 2024-2032.

The Natural Language Processing Market was valued at USD 22.4 Billion in 2023 and is expected to reach USD 187.9 Billion by 2032, growing at a CAGR of 26.68% from 2024-2032.

The No-code AI Platform Market was valued at USD 3.7 Billion in 2023 and is expected to reach USD 53.1 Billion by 2032, growing at a CAGR of 34.44% from 2024-2032.

The Self-Service Analytics Market was valued at USD 4.5 billion in 2023 and will reach USD 19.75 billion by 2032, growing at a CAGR of 17.90% by 2032.

Hi! Click one of our member below to chat on Phone