To Get More Information on Anti-Inflammatory Drugs Market - Request Sample Report

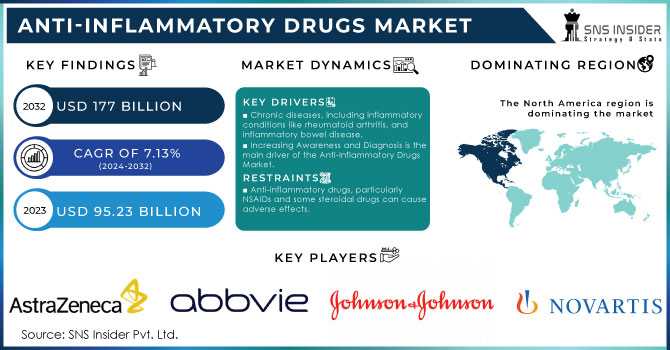

The Anti-Inflammatory Drugs Market Size was valued at USD 95.23 billion in 2023, and is expected to reach USD 177 billion by 2032, and grow at a CAGR of 7.13% over the forecast period 2024-2032.

The Anti-Inflammatory Drugs Market refers to the global pharmaceutical market segment that deals with the production, distribution, and sale of drugs designed to reduce inflammation in the body. Inflammation is the body's natural response to injury or infection, but it can also cause discomfort and contribute to various medical conditions if it becomes chronic or excessive. Anti-inflammatory drugs can be broadly categorized into two groups, Nonsteroidal Anti-Inflammatory Drugs (NSAIDs) are the most commonly used anti-inflammatory drugs and are available over the counter or by prescription. Examples of NSAIDs include ibuprofen, aspirin, diclofenac and naproxen. Steroidal Anti-Inflammatory Drugs are more potent than NSAIDs and are prescribed for more severe inflammatory conditions. They contain corticosteroids and are available in various forms, including pills, injections, creams, and inhalers. Conditions treated with anti-inflammatory drugs include arthritis (e.g., rheumatoid arthritis, osteoarthritis), autoimmune disorders (e.g., lupus, multiple sclerosis), inflammatory bowel disease (e.g., Crohn's disease, ulcerative colitis), and others. The market for anti-inflammatory drugs has been significant and is expected to continue growing due to the increasing prevalence of inflammatory diseases, an ageing population, and the continuous development of new and improved drugs by pharmaceutical companies.

The swelling of a wound or damage is referred to as inflammation. Swelling, redness, irritation, and discomfort are all symptoms of inflammation. Inflammation is the immune system's response to outside irritants such as pathogens, poisons, pollutants, and chemicals. Anti-inflammatory pharmaceuticals are anti-inflammatory medications. They relieve and soothe the patient by reducing oedema in the affected area. Nonsteroidal anti-inflammatory medicines (NSAIDs) are the most often used and well-known anti-inflammatory medications. Ibuprofen, naproxen, celecoxib, indomethacin, and celecoxib are examples of anti-inflammatory medications. Anti-inflammatory medications are also used to treat fever, headaches, and bodily discomfort. They can also be used to treat sprains, strains, colds, flu, and arthritis. They also help to alleviate menstruation pain. Anti-inflammatory medications are also used to relieve chronic pain. The rising frequency of acute ailments such as the common cold and flu, as well as chronic disorders such as arthritis, will drive market expansion. As a result of medical advancements, new medications that are effective in treating inflammation have been found. Demand for anti-inflammatory medications is projected to rise as people become more aware of their advantages. The increasing availability of pharmaceuticals will also help the industry flourish.

DRIVERS:

Chronic diseases, including inflammatory conditions like rheumatoid arthritis, and inflammatory bowel disease.

Increasing Awareness and Diagnosis is the main driver of the Anti-Inflammatory Drugs Market.

Better awareness of inflammatory diseases, improved diagnostic methods, and advancements in medical technology have led to more accurate and timely diagnoses of these conditions. This, in turn, boosts the prescription and use of anti-inflammatory drugs.

RESTRAIN:

Anti-inflammatory drugs, particularly NSAIDs and some steroidal drugs can cause adverse effects.

Patent expiry and generic competition are major market restraints for anti-inflammatory drugs.

Many popular anti-inflammatory drugs have faced or will face patent expirations, leading to the entry of generic versions into the market. Generic competition can significantly reduce the market share and revenue of branded drugs, as generics are typically more affordable.

OPPORTUNITY:

The prevalence of inflammatory diseases, such as arthritis, inflammatory bowel disease, and cardiovascular diseases, continues to rise globally.

Biologic and Targeted Therapies are the major opportunity in the Anti-Inflammatory Drugs Market.

Advancements in biotechnology have led to the development of biological drugs and targeted therapies for inflammatory conditions. These drugs are designed to be more specific in targeting inflammatory pathways, potentially reducing side effects and increasing treatment efficacy. The market opportunity lies in the continued research and development of these innovative therapies.

CHALLENGES:

Patent expirations of branded anti-inflammatory drugs lead to the entry of generic versions into the market.

The primary obstacles to the Anti-Inflammatory Drugs Market are regulatory hurdles.

The pharmaceutical industry is subject to stringent regulations and approvals from health authorities worldwide. Meeting regulatory requirements for safety and efficacy can be time-consuming and costly, potentially delaying drug development and market entry.

According to Pharmaceuticals Export Promotion Council of Asia, Asia shipped over $190 million in pharmaceutical goods to Ukraine in FY21, representing a roughly 44% increase over the previous year, while Russia contributed almost $602 million last fiscal year, representing a 7.05% increase over the previous year. Pharmaceuticals are facing the brunt of the damage. Russia and Ukraine are significant pharmaceutical export markets. Some Asian pharmaceutical businesses have a significant presence in these markets. The current Russian-Ukrainian war has had a huge impact on the Asian pharmaceutical business. Asia is Ukraine's third-largest pharmaceutical exporter, and the conflict has affected global commerce, leading to higher manufacturing and shipping costs, inflation, and trade payment concerns. Several Indian pharmaceutical businesses, notably Dr Reddy's Laboratories, Sun Pharma, and Glenmark Pharmaceuticals have a large presence in Russia and Ukraine, putting them at risk of diminishing trade and payments. US sanctions have also had an impact on Russian trade payments. The conflict's long-term implications are anticipated to destabilise the global economy and have a substantial influence on the Asian pharmaceutical sector. The anti-inflammatory drug market is grain profitable up to 3.4-4.5% in this conflict.

The top concern for the pharmaceutical business in 2023 will be inflation, followed by medication price and reimbursement. The study questioned industry professionals on which regulatory and macroeconomic issues will have the greatest influence on pharma in the coming year. The ordinary American has likely felt the most acutely as it pertains to grocery, petrol and rent prices were named as the top one difficulty for pharma by 40% of respondents. Pharma's yearly prescription price increases have resulted in a 6.2% increase in list prices so far this year, keeping below the national consumer inflation rate of around 7.5% in 2022. That increase in medicine prices is slightly lower than in previous years, indicating that the pharmaceutical industry has yet to respond to a new Inflation Reduction Act provision that entered into effect. In the ongoing recession, the anti-inflammatory market is increasing its product price uptown by 2.3-3.8%.

By Drug Class

Corticosteroids

Non-steroidal Anti-inflammatory Drugs (NSAIDs)

Anti-inflammatory Biologics

By Application

Rheumatoid Arthritis Psoriasis

Autoimmune Inflammatory Diseases

By Route of Administration

Inhalation

Injection

Oral

Topical

By Distribution Channel

Retail Pharmacy

Hospital Pharmacy

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

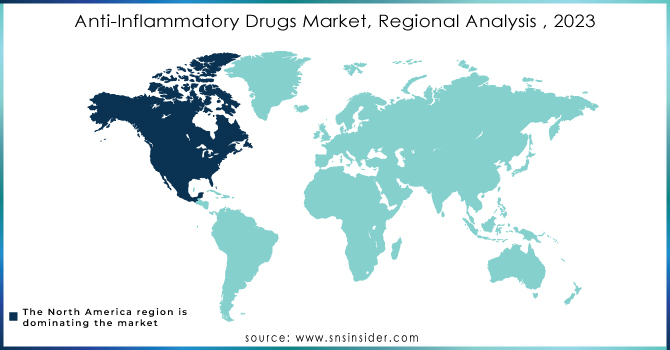

REGIONAL ANALYSIS

North America: North America is at the forefront of regional growth and a significant revenue provider on a worldwide scale. The region's expansion is being fueled by increased patient knowledge of illness remittance medicines, growing CF prevalence, and high public and private healthcare spending. The majority of CF patients in the United States are of Caucasian ethnicity. Furthermore, measures conducted by the CF Foundation and Cystic Fibrosis Canada are one of the primary reasons for its highest share.

Asia Pacific: Over the forecast period, the Asia Pacific market is expected to increase. Major players in the anti-inflammatory drug market will be lured to the area as the healthcare infrastructure expands and the region's population grows, pushing its growth during the forecast period.

Do You Need any Customization Research on Anti-Inflammatory Drugs Market - Enquire Now

Some major players in Anti-Inflammatory Drugs Market are AbbVie Inc., Eli Lilly and Company, Johnson & Johnson Services Inc., Hoffmann-La Roche AG, AstraZeneca Plc, Bristol-Myers Squibb, Amgen Inc., Novartis Pharmaceuticals Corporation, GlaxoSmithKline, Pfizer and other players.

In 2023: RINVOQ (upadacitinib) was approved by the US Food and Drug Administration (FDA) for the treatment of individuals with moderately to highly active Crohn's disease. This product clearance is likely to help the firm improve its anti-inflammatory medicine product portfolio and generate revenue growth.

In 2022: Arena Pharmaceuticals was purchased by Pfizer Inc. With this purchase, the firm may expand and improve its product offering in gastrointestinal, dermatology, and cardiology. This strategic purchase aided the corporation in supplementing its strengths and knowledge in the area of inflammation and immunology.

| Report Attributes | Details |

| Market Size in 2023 | US$ 95.23 Bn |

| Market Size by 2032 | US$ 177 Bn |

| CAGR | CAGR of 7.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug Class (Corticosteroids, Non-steroidal Anti-inflammatory Drugs (NSAIDs), Anti-inflammatory Biologics,) • By Application (Rheumatoid Arthritis Psoriasis, Autoimmune Inflammatory Diseases) • By Route of Administration (Inhalation, Injection, Oral, Topical) • By Distribution Channel (Retail Pharmacy, Hospital Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | AbbVie Inc., Eli Lilly and Company, Johnson & Johnson Services Inc., Hoffmann-La Roche AG, AstraZeneca Plc, Bristol-Myers Squibb, Amgen Inc., Novartis Pharmaceuticals Corporation, GlaxoSmithKline, Pfizer |

| Key Drivers | • Chronic diseases, including inflammatory conditions like rheumatoid arthritis, and inflammatory bowel disease. • Increasing Awareness and Diagnosis is the main driver of the Anti-Inflammatory Drugs Market. |

| Market Restraints | • Anti-inflammatory drugs, particularly NSAIDs and some steroidal drugs can cause adverse effects. • Patent expiry and generic competition are major market restraints for anti-inflammatory drugs. |

Ans. The compound annual growth rate for Anti-Inflammatory Drugs Market for the forecast period is 7.13%.

Ans. In 2023, the Anti-Inflammatory Drugs Market is expected to be valued at 95.23 billion USD.

Ans. The market for Anti-Inflammatory Drugs is anticipated to be worth USD 177 Billion by 2032.

Ans. North America would hold the greatest market share in the Anti-Inflammatory Drugs Market by 2023.

Ans. Over the predicted period (2024-2031), Asia Pacific is expected to expand at the fastest CAGR.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Anti-Inflammatory Drugs Market Segmentation, By Drug Class

8.1 Corticosteroids

8.2 Non-steroidal Anti-inflammatory Drugs (NSAIDs)

8.3 Anti-inflammatory Biologics

9. Anti-Inflammatory Drugs Market Segmentation, By Application

9.1 Rheumatoid Arthritis Psoriasis

9.2 Autoimmune Inflammatory Diseases

10. Anti-Inflammatory Drugs Market Segmentation, By Route of Administration

10.1 Inhalation

10.2 Injection

10.3 Oral

10.4 Topical

11. Anti-Inflammatory Drugs Market Segmentation, By Distribution Channel

11.1 Retail Pharmacy

11.2 Hospital Pharmacy

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Anti-Inflammatory Drugs Market by Country

12.2.2 North America Anti-Inflammatory Drugs Market by Drug Class

12.2.3 North America Anti-Inflammatory Drugs Market by Application

12.2.4 North America Anti-Inflammatory Drugs Market by Route of Administration

12.2.5 North America Anti-Inflammatory Drugs Market by Distribution Channel

12.2.6 USA

12.2.6.1 USA Anti-Inflammatory Drugs Market by Drug Class

12.2.6.2 USA Anti-Inflammatory Drugs Market by Application

12.2.6.3 USA Anti-Inflammatory Drugs Market by Route of Administration

12.2.6.4 USA Anti-Inflammatory Drugs Market by Distribution Channel

12.2.7 Canada

12.2.7.1 Canada Anti-Inflammatory Drugs Market by Drug Class

12.2.7.2 Canada Anti-Inflammatory Drugs Market by Application

12.2.7.3 Canada Anti-Inflammatory Drugs Market by Route of Administration

12.2.7.4 Canada Anti-Inflammatory Drugs Market by Distribution Channel

12.2.8 Mexico

12.2.8.1 Mexico Anti-Inflammatory Drugs Market by Drug Class

12.2.8.2 Mexico Anti-Inflammatory Drugs Market by Application

12.2.8.3 Mexico Anti-Inflammatory Drugs Market by Route of Administration

12.2.8.4 Mexico Anti-Inflammatory Drugs Market by Distribution Channel

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Anti-Inflammatory Drugs Market by Country

12.3.1.2 Eastern Europe Anti-Inflammatory Drugs Market by Drug Class

12.3.1.3 Eastern Europe Anti-Inflammatory Drugs Market by Application

12.3.1.4 Eastern Europe Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.5 Eastern Europe Anti-Inflammatory Drugs Market by Distribution Channel

12.3.1.6 Poland

12.3.1.6.1 Poland Anti-Inflammatory Drugs Market by Drug Class

12.3.1.6.2 Poland Anti-Inflammatory Drugs Market by Application

12.3.1.6.3 Poland Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.6.4 Poland Anti-Inflammatory Drugs Market by Distribution Channel

12.3.1.7 Romania

12.3.1.7.1 Romania Anti-Inflammatory Drugs Market by Drug Class

12.3.1.7.2 Romania Anti-Inflammatory Drugs Market by Application

12.3.1.7.3 Romania Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.7.4 Romania Anti-Inflammatory Drugs Market by Distribution Channel

12.3.1.8 Hungary

12.3.1.8.1 Hungary Anti-Inflammatory Drugs Market by Drug Class

12.3.1.8.2 Hungary Anti-Inflammatory Drugs Market by Application

12.3.1.8.3 Hungary Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.8.4 Hungary Anti-Inflammatory Drugs Market by Distribution Channel

12.3.1.9 Turkey

12.3.1.9.1 Turkey Anti-Inflammatory Drugs Market by Drug Class

12.3.1.9.2 Turkey Anti-Inflammatory Drugs Market by Application

12.3.1.9.3 Turkey Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.9.4 Turkey Anti-Inflammatory Drugs Market by Distribution Channel

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Anti-Inflammatory Drugs Market by Drug Class

12.3.1.10.2 Rest of Eastern Europe Anti-Inflammatory Drugs Market by Application

12.3.1.10.3 Rest of Eastern Europe Anti-Inflammatory Drugs Market by Route of Administration

12.3.1.10.4 Rest of Eastern Europe Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2 Western Europe

12.3.2.1 Western Europe Anti-Inflammatory Drugs Market by Country

12.3.2.2 Western Europe Anti-Inflammatory Drugs Market by Drug Class

12.3.2.3 Western Europe Anti-Inflammatory Drugs Market by Application

12.3.2.4 Western Europe Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.5 Western Europe Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.6 Germany

12.3.2.6.1 Germany Anti-Inflammatory Drugs Market by Drug Class

12.3.2.6.2 Germany Anti-Inflammatory Drugs Market by Application

12.3.2.6.3 Germany Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.6.4 Germany Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.7 France

12.3.2.7.1 France Anti-Inflammatory Drugs Market by Drug Class

12.3.2.7.2 France Anti-Inflammatory Drugs Market by Application

12.3.2.7.3 France Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.7.4 France Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.8 UK

12.3.2.8.1 UK Anti-Inflammatory Drugs Market by Drug Class

12.3.2.8.2 UK Anti-Inflammatory Drugs Market by Application

12.3.2.8.3 UK Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.8.4 UK Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.9 Italy

12.3.2.9.1 Italy Anti-Inflammatory Drugs Market by Drug Class

12.3.2.9.2 Italy Anti-Inflammatory Drugs Market by Application

12.3.2.9.3 Italy Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.9.4 Italy Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.10 Spain

12.3.2.10.1 Spain Anti-Inflammatory Drugs Market by Drug Class

12.3.2.10.2 Spain Anti-Inflammatory Drugs Market by Application

12.3.2.10.3 Spain Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.10.4 Spain Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Anti-Inflammatory Drugs Market by Drug Class

12.3.2.11.2 Netherlands Anti-Inflammatory Drugs Market by Application

12.3.2.11.3 Netherlands Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.11.4 Netherlands Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Anti-Inflammatory Drugs Market by Drug Class

12.3.2.12.2 Switzerland Anti-Inflammatory Drugs Market by Application

12.3.2.12.3 Switzerland Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.12.4 Switzerland Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.13 Austria

12.3.2.13.1 Austria Anti-Inflammatory Drugs Market by Drug Class

12.3.2.13.2 Austria Anti-Inflammatory Drugs Market by Application

12.3.2.13.3 Austria Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.13.4 Austria Anti-Inflammatory Drugs Market by Distribution Channel

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Anti-Inflammatory Drugs Market by Drug Class

12.3.2.14.2 Rest of Western Europe Anti-Inflammatory Drugs Market by Application

12.3.2.14.3 Rest of Western Europe Anti-Inflammatory Drugs Market by Route of Administration

12.3.2.14.4 Rest of Western Europe Anti-Inflammatory Drugs Market by Distribution Channel

12.4 Asia-Pacific

12.4.1 Asia Pacific Anti-Inflammatory Drugs Market by Country

12.4.2 Asia Pacific Anti-Inflammatory Drugs Market by Drug Class

12.4.3 Asia Pacific Anti-Inflammatory Drugs Market by Application

12.4.4 Asia Pacific Anti-Inflammatory Drugs Market by Route of Administration

12.4.5 Asia Pacific Anti-Inflammatory Drugs Market by Distribution Channel

12.4.6 China

12.4.6.1 China Anti-Inflammatory Drugs Market by Drug Class

12.4.6.2 China Anti-Inflammatory Drugs Market by Application

12.4.6.3 China Anti-Inflammatory Drugs Market by Route of Administration

12.4.6.4 China Anti-Inflammatory Drugs Market by Distribution Channel

12.4.7 India

12.4.7.1 India Anti-Inflammatory Drugs Market by Drug Class

12.4.7.2 India Anti-Inflammatory Drugs Market by Application

12.4.7.3 India Anti-Inflammatory Drugs Market by Route of Administration

12.4.7.4 India Anti-Inflammatory Drugs Market by Distribution Channel

12.4.8 Japan

12.4.8.1 Japan Anti-Inflammatory Drugs Market by Drug Class

12.4.8.2 Japan Anti-Inflammatory Drugs Market by Application

12.4.8.3 Japan Anti-Inflammatory Drugs Market by Route of Administration

12.4.8.4 Japan Anti-Inflammatory Drugs Market by Distribution Channel

12.4.9 South Korea

12.4.9.1 South Korea Anti-Inflammatory Drugs Market by Drug Class

12.4.9.2 South Korea Anti-Inflammatory Drugs Market by Application

12.4.9.3 South Korea Anti-Inflammatory Drugs Market by Route of Administration

12.4.9.4 South Korea Anti-Inflammatory Drugs Market by Distribution Channel

12.4.10 Vietnam

12.4.10.1 Vietnam Anti-Inflammatory Drugs Market by Drug Class

12.4.10.2 Vietnam Anti-Inflammatory Drugs Market by Application

12.4.10.3 Vietnam Anti-Inflammatory Drugs Market by Route of Administration

12.4.10.4 Vietnam Anti-Inflammatory Drugs Market by Distribution Channel

12.4.11 Singapore

12.4.11.1 Singapore Anti-Inflammatory Drugs Market by Drug Class

12.4.11.2 Singapore Anti-Inflammatory Drugs Market by Application

12.4.11.3 Singapore Anti-Inflammatory Drugs Market by Route of Administration

12.4.11.4 Singapore Anti-Inflammatory Drugs Market by Distribution Channel

12.4.12 Australia

12.4.12.1 Australia Anti-Inflammatory Drugs Market by Drug Class

12.4.12.2 Australia Anti-Inflammatory Drugs Market by Application

12.4.12.3 Australia Anti-Inflammatory Drugs Market by Route of Administration

12.4.12.4 Australia Anti-Inflammatory Drugs Market by Distribution Channel

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Anti-Inflammatory Drugs Market by Drug Class

12.4.13.2 Rest of Asia-Pacific Anti-Inflammatory Drugs Market by Application

12.4.13.3 Rest of Asia-Pacific Anti-Inflammatory Drugs Market by Route of Administration

12.4.13.4 Rest of Asia-Pacific Anti-Inflammatory Drugs Market by Distribution Channel

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Anti-Inflammatory Drugs Market by Country

12.5.1.2 Middle East Anti-Inflammatory Drugs Market by Drug Class

12.5.1.3 Middle East Anti-Inflammatory Drugs Market by Application

12.5.1.4 Middle East Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.5 Middle East Anti-Inflammatory Drugs Market by Distribution Channel

12.5.1.6 UAE

12.5.1.6.1 UAE Anti-Inflammatory Drugs Market by Drug Class

12.5.1.6.2 UAE Anti-Inflammatory Drugs Market by Application

12.5.1.6.3 UAE Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.6.4 UAE Anti-Inflammatory Drugs Market by Distribution Channel

12.5.1.7 Egypt

12.5.1.7.1 Egypt Anti-Inflammatory Drugs Market by Drug Class

12.5.1.7.2 Egypt Anti-Inflammatory Drugs Market by Application

12.5.1.7.3 Egypt Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.7.4 Egypt Anti-Inflammatory Drugs Market by Distribution Channel

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Anti-Inflammatory Drugs Market by Drug Class

12.5.1.8.2 Saudi Arabia Anti-Inflammatory Drugs Market by Application

12.5.1.8.3 Saudi Arabia Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.8.4 Saudi Arabia Anti-Inflammatory Drugs Market by Distribution Channel

12.5.1.9 Qatar

12.5.1.9.1 Qatar Anti-Inflammatory Drugs Market by Drug Class

12.5.1.9.2 Qatar Anti-Inflammatory Drugs Market by Application

12.5.1.9.3 Qatar Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.9.4 Qatar Anti-Inflammatory Drugs Market by Distribution Channel

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Anti-Inflammatory Drugs Market by Drug Class

12.5.1.10.2 Rest of Middle East Anti-Inflammatory Drugs Market by Application

12.5.1.10.3 Rest of Middle East Anti-Inflammatory Drugs Market by Route of Administration

12.5.1.10.4 Rest of Middle East Anti-Inflammatory Drugs Market by Distribution Channel

12.5.2. Africa

12.5.2.1 Africa Anti-Inflammatory Drugs Market by Country

12.5.2.2 Africa Anti-Inflammatory Drugs Market by Drug Class

12.5.2.3 Africa Anti-Inflammatory Drugs Market by Application

12.5.2.4 Africa Anti-Inflammatory Drugs Market by Route of Administration

12.5.2.5 Africa Anti-Inflammatory Drugs Market by Distribution Channel

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Anti-Inflammatory Drugs Market by Drug Class

12.5.2.6.2 Nigeria Anti-Inflammatory Drugs Market by Application

12.5.2.6.3 Nigeria Anti-Inflammatory Drugs Market by Route of Administration

12.5.2.6.4 Nigeria Anti-Inflammatory Drugs Market by Distribution Channel

12.5.2.7 South Africa

12.5.2.7.1 South Africa Anti-Inflammatory Drugs Market by Drug Class

12.5.2.7.2 South Africa Anti-Inflammatory Drugs Market by Application

12.5.2.7.3 South Africa Anti-Inflammatory Drugs Market by Route of Administration

12.5.2.7.4 South Africa Anti-Inflammatory Drugs Market by Distribution Channel

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Anti-Inflammatory Drugs Market by Drug Class

12.5.2.8.2 Rest of Africa Anti-Inflammatory Drugs Market by Application

12.5.2.8.3 Rest of Africa Anti-Inflammatory Drugs Market by Route of Administration

12.5.2.8.4 Rest of Africa Anti-Inflammatory Drugs Market by Distribution Channel

12.6. Latin America

12.6.1 Latin America Anti-Inflammatory Drugs Market by Country

12.6.2 Latin America Anti-Inflammatory Drugs Market by Drug Class

12.6.3 Latin America Anti-Inflammatory Drugs Market by Application

12.6.4 Latin America Anti-Inflammatory Drugs Market by Route of Administration

12.6.5 Latin America Anti-Inflammatory Drugs Market by Distribution Channel

12.6.6 Brazil

12.6.6.1 Brazil Anti-Inflammatory Drugs Market by Drug Class

12.6.6.2 Brazil Anti-Inflammatory Drugs Market by Application

12.6.6.3 Brazil Anti-Inflammatory Drugs Market by Route of Administration

12.6.6.4 Brazil Anti-Inflammatory Drugs Market by Distribution Channel

12.6.7 Argentina

12.6.7.1 Argentina Anti-Inflammatory Drugs Market by Drug Class

12.6.7.2 Argentina Anti-Inflammatory Drugs Market by Application

12.6.7.3 Argentina Anti-Inflammatory Drugs Market by Route of Administration

12.6.7.4 Argentina Anti-Inflammatory Drugs Market by Distribution Channel

12.6.8 Colombia

12.6.8.1 Colombia Anti-Inflammatory Drugs Market by Drug Class

12.6.8.2 Colombia Anti-Inflammatory Drugs Market by Application

12.6.8.3 Colombia Anti-Inflammatory Drugs Market by Route of Administration

12.6.8.4 Colombia Anti-Inflammatory Drugs Market by Distribution Channel

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Anti-Inflammatory Drugs Market by Drug Class

12.6.9.2 Rest of Latin America Anti-Inflammatory Drugs Market by Application

12.6.9.3 Rest of Latin America Anti-Inflammatory Drugs Market by Route of Administration

12.6.9.4 Rest of Latin America Anti-Inflammatory Drugs Market by Distribution Channel

13. Company Profile

13.1 AbbVie Inc

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Eli Lilly and Company

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Johnson & Johnson Services Inc

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Hoffmann-La Roche AG

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 AstraZeneca Plc

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Bristol-Myers Squibb

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Amgen Inc

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Novartis Pharmaceuticals Corporation

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 GlaxoSmithKline

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Pfizer

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Hemophilia Market size was valued at USD 13.6 billion in 2023 and is expected to reach USD 22.50 billion by 2031 and grow at a CAGR of 6.5 % over the forecast period of 2024-2031.

Genotyping Market was valued at USD 17.9 billion in 2023 and is expected to reach USD 59.31 billion by 2032, growing at a CAGR of 14.27% from 2024 to 2032.

Pharmaceutical Processing Seals Market was valued at USD 2.55 Bn in 2023, and expected to reach USD 6.07 Bn by 2032, growing at a CAGR of 10.13% from 2024-2032.

The Bioactive Wound Care Market was valued at USD 11.06 billion in 2023 and is expected to reach USD 21.18 billion by 2032, growing at a CAGR of 7.52% from 2024-2032.

The Analgesics Market was estimated at USD 47.32 billion in 2023 and is expected to reach at USD 75.73 billion by 2032, and develop at a CAGR of 5.39% over the forecast period 2024-2032.

The Digital PCR Market size was valued at USD 6.77 billion in 2023 & projected to reach USD 14.89 billion by 2032, at a CAGR of 9.16% by 2024-2032.

Hi! Click one of our member below to chat on Phone