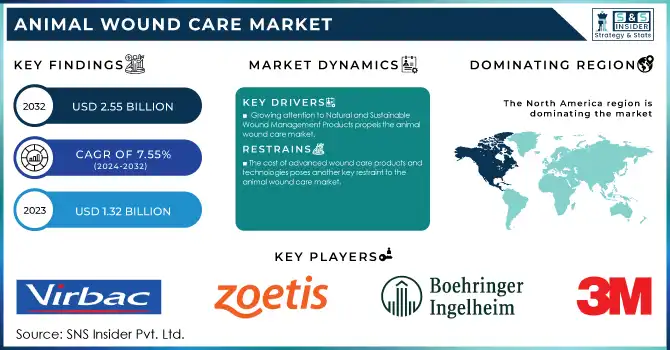

The Animal Wound Care Market was valued at USD 1.32 billion in 2023 and is expected to reach USD 2.55 billion by 2032, growing at a CAGR of 7.55% from 2024 to 2032.

To get more information on Animal Wound Care Market - Request Free Sample Report

Animal Wound Care Market is gaining major traction as a result of a rise in pet ownership, an increase in the number of veterinary procedures, and a rapid advancement of technologies in the management of wounds. "The range includes surgical instruments and therapy, among many other products, as needed for injury treatment and healing in pets and even livestock. Open wound products include sutures, wound closure devices, and hemostatic agents, that support tissue repair. Therapy devices such as negative pressure wound therapy systems and various advanced bandages cater to healing and preventing the wound from getting infected.

The rise in pet ownership has greatly influenced this boom, with households increasingly seeking veterinary care from practices internationally, including surgical procedures that rely on proper wound management. According to NAPHIA’s State of the Industry Report 2024, pet insurance premiums in the U.S. reached USD 3.9 billion in 2023. Additionally, nearly 5.7 million pets were insured by the end of 2023, reflecting a 17% increase compared to 2022. The American Animal Hospital Association estimates that millions of pets undergo surgical procedures each year, driving demand for post-operative care. In addition, an increase in the number of veterinary infrastructure is propelling the demand for wound care of high quality.

Education initiatives, like those offered in workshops and conferences by companies like Essity, help vet interests and awareness of best practices. It also aids in disseminating knowledge regarding advances in wound care practices and promotes the use of the latest products on the clinical front, which aids market growth.

Market developments are fueled by product innovations and regulatory approvals as well. Vet Aid's eco-friendly wound care products, introduced in November 2024, fill a demand for natural, sustainable alternatives to chemical-based treatments. Research and development activities are expanding as well, like the USD 34.2 million grant that Health Care just received to help advance infection prevention solutions. This will also reflect the rising partnerships, such as that of Epiq Animal Health with KeraVet Bio which will accelerate the growth of the market.

Drivers

Increasing Pet Ownership and Veterinary Care Demand

The increasing number of pet owners worldwide is significantly contributing to the growth of the animal wound care market.

According to the American Pet Products Association (APPA), over 67% of U.S. households own a pet, and this figure is steadily increasing. As pet ownership rises, so does the demand for veterinary services, particularly surgeries that require effective wound management. More pets are undergoing surgery every year. Advanced wound care solutions, such as surgical devices and post-operative therapy systems, are thus called for. With this increase in demand, the veterinary wound care products market is being driven upward as owners try to get their pets the best possible treatment after an injury.

Growing attention to Natural and Sustainable Wound Management Products propels the animal wound care market

Animal wound care of natural and eco-friendly products is a trend. Consumer demand for safer, more sustainable alternatives triggered this trend. A survey conducted by the American Pet Products Association in 2023 revealed that 35% of pet owners prefer natural and organic pet care products over synthetic options. This can be seen more in the veterinary wound treatment market where companies like Vet Aid have focused on creating natural solutions like their "Vet Aid Wound Care Spray and Foam" made of Red Sea minerals. The growing inclination towards holistic and environmentally friendly care also adds to the rising demand for these products and thereby fuels market growth. Growing awareness of sustainable practices among both veterinarians and pet owners means there is a call for effective yet eco-friendly products, and this has spurred innovation in the sector.

Restraint

The cost of advanced wound care products and technologies poses another key restraint to the animal wound care market.

Advanced wound care products may consist of negative pressure wound therapy systems, advanced bandages, and surgical devices, among others. Such products are costly and, consequently, may be out of reach for most veterinary practices in developing regions. Such expensive treatments are likely to be cost-prohibitive for pet owners and livestock farmers who have many animals or limited funds to afford good quality care. This is one of the major reasons that these advanced solutions would be adopted at a slower rate, which can further restrict market growth in those areas.

By Animal Type

In the animal wound care market, the segment of companion animals segment witnessed a maximum market share of 38% in 2023. This participation is owing to the course of the pet population throughout the world and the growing burden of veterinarians for their pets. The increasing investment in pet healthcare, from advanced wound care solutions to new medications, showcases a deep commitment to improving the well-being of the animals. Wound care products such as dressings are increasingly used in non-healing wounds, which are most frequently found on the limbs of animals, such as wounds caused by cuts, abrasions, surgical wounds, or chronic ailments that include diabetes. Innovative advancements in companion animal care, like antimicrobial dressings, hydrogel therapies, and pain management solutions, are also driving the market growth. The rise in disposable income and the increasing willingness of pet owners to spend on premium-range veterinary procedures further cements the companion animal segment’s significant share in the animal wound care market.

By animal type, the livestock segment is expected to grow at the fastest rate of 7.55% CAGR during the forecast period. This growth is attributed to growing awareness among farmers and veterinary professionals regarding the importance of advanced wound care. Many market participants are investing in and raising funds for the development of wound care solutions specifically designed for livestock animals. For instance, in March 2023, NoBACZ Healthcare Ltd. designed USD 3.4 million in seed funding to commercialize wound care solutions for dairy and beef cattle. The investment would help the company to grow and advance its development of wound-dressing solutions for horses and companion animals as well. Such strategic partnerships and investments are anticipated to propel the growth of the livestock animal segment during the forecast period.

By End Use

Veterinary hospitals and clinics segment dominated the market, accounting for 42% of the market share in 2023, as there is a huge volume of surgeries performed in veterinary hospitals and clinics, which require effective wound management solutions. Veterinary hospitals and clinics are well-equipped with the required infrastructure and human resources to deliver a variety of therapies, including sutures, staples, dressings, and others. The professional environment ensures that the animals receive appropriate care and monitoring during recovery, which has put the segment at the top.

The homecare segment is projected to grow at the fastest CAGR over the forecast period. The increasing demand for at-home treatment options among pet owners drives this growth. Increasing costs of clinical visits, convenience, and user-friendly wound care products all contribute to this trend. For instance, there is wound spray and gel as well as bandage products designed to be easily used at home so that minor wounds can be managed effectively with post-operative care. Further development in telemedicine and remote consultation with veterinary services also support this segment because professional guidance will also be given by veterinarians through remote means of communication for administering proper wound care at home. The homecare segment is an important growth driver in the animal wound care industry, mainly due to the increasing emphasis on reducing stress for animals during recovery and the demand for cost-effective treatment options.

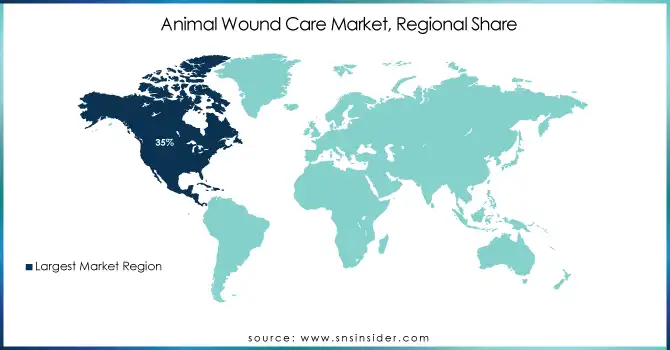

North America dominated the animal wound care market in 2023 with the highest market share of 35%. This is mainly because of the high adoption rates of pets and the region's advanced veterinary healthcare infrastructure. Major industry players are expected to increase their efforts toward enhancing their product portfolios and ensuring high-quality standards, which will further drive the demand for wound care solutions in the region. It even includes, in the list, U.S. based Armis Biopharma, developing such a professional, a wound cleanser for animals termed as VeriClenz.

Asia-Pacific is estimated to grow at the fastest CAGR of 8.85% CAGR during the forecast period, becoming the most potentially growing animal wound care market; this is backed by pet acquisition, high disposal incomes, along improvements taking place in countries like China and India in vet healthcare infra, and the improving veterinary healthcare conditions in Japan. There is also a significant demand due to the heavy dependency of the region on agricultural production and exports, coupled with the high population of farm animals. In addition, increasing awareness regarding livestock animal health and continuous healthcare infrastructure upgrades are likely to provide huge growth opportunities over the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

3M (Vetrap Bandaging Tape, Tegaderm Transparent Film Dressing)

Boehringer Ingelheim (Vetera Wound Spray, Equitrol II Wound Ointment)

Zoetis (DermaGel Spray, Tri-Otic Ointment)

Elanco Animal Health (Fly Ban Wound Treatment, Synovex Wound Dressing)

Ceva Animal Health (Logic Wound Gel, DOUXO S3 CALM Spray)

Virbac (CORTAVANCE Spray, Epiotic Advanced Ear Cleanser)

Dechra Pharmaceuticals (CleanAural Ear Cleaner, Malaseb Medicated Shampoo)

Henry Schein (Hexa-Caine Spray, Animalintex Poultice)

Huvepharma (Vetramil Honey Cream, Tetravet Wound Powder)

Vetoquinol (Flexivet Advanced, T8 Keto Wound Solution)

Innovacyn (Vetericyn Plus Antimicrobial Hydrogel, Vetericyn Plus Wound and Skin Care)

Neogen Corporation (AluShield Aerosol Bandage, BotVax B Wound Vaccine)

KRUUSE (Buster Collars, Wound Care Manuka Honey Dressing)

Merial (Acarexx, UlcerGard)

Bayer Animal Health (Drontal Plus Topical Cream, Advantage Wound Ointment)

Farnam (Wound-Kote Blue Lotion Spray, Aloe Heal Veterinary Cream)

Absorbine (Silver Honey Rapid Wound Repair, Veterinary Liniment Gel)

Ecoplus (Aloe Vera Wound Gel, Silver Wound Spray)

Animal Ethics Pty Ltd (MEPORE Film Dressing, RapidHeal Ointment)

Nutri-Vet (Liquid Bandage for Dogs, Bitter Bandage Wound Wrap)

Key suppliers

These suppliers ensure the availability of products across veterinary hospitals, clinics, e-commerce platforms, and retail stores.

Fisher Scientific

Patterson Veterinary

Medline Industries

Vetoquinol USA Distributor

Henry Schein Veterinary Solutions

MWI Animal Health

Covetrus

Zoetis Supply Chain Partners

Huvepharma Distribution Channels

VetOne

In January 2024, 3M Health Care's Medical Solutions Division, a global leader in advanced wound care, secured a USD 34.2 million grant from the U.S. Army Medical Research Acquisition Activity. The funding will support the development of innovative solutions for infection prevention, wound management, and wound healing.

In November 2024, Boehringer Ingelheim introduced VETMEDIN Solution (pimobendan oral solution), the first FDA-approved oral solution for the treatment of congestive heart failure in dogs, marking a significant milestone in veterinary medicine.

In September 2024, Zoetis and Danone unveiled a joint business development initiative aimed at promoting sustainability in the dairy industry. This collaboration leverages Danone’s environmental stewardship and Zoetis’ expertise in animal genetics to advance sustainable breeding practices for healthier cows on modern dairy farms.

In May 2024, epiq Animal Health partnered with KeraVet Bio to broaden the distribution of an animal wound care product. This collaboration underscores epiq’s mission to work with manufacturers and distributors to bring innovative solutions to veterinary professionals and pet owners.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.32 Billion |

| Market Size by 2032 | US$ 2.55 Billion |

| CAGR | CAGR of 7.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Surgical Wound Care Products, Advanced Wound Care Products, Traditional Wound Care Products, Therapy Devices) • By Animal Type (Companion Animal, Livestock Animal) • By End Use (Veterinary Hospitals/Clinics, Homecare, Research Institutes) • By Distribution Channel (Retail, E-commerce, Veterinary Hospitals/Clinics) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M, Boehringer Ingelheim, Zoetis, Elanco Animal Health, Ceva Animal Health, Virbac, Dechra Pharmaceuticals, Henry Schein, Huvepharma, Vetoquinol, Innovacyn, Neogen Corporation, KRUUSE, Merial, Bayer Animal Health, Farnam, Absorbine, Ecoplus, Animal Ethics Pty Ltd, Nutri-Vet. |

| Key Drivers | •Increasing Pet Ownership and Veterinary Care Demand The increasing number of pet owners worldwide is significantly contributing to the growth of the animal wound care market. •Growing Attention Towards Natural and Sustainable Wound Management Products propels animal wound care market |

| Restraints | •The cost of advanced wound care products and technologies poses another key restraint to the animal wound care market. |

Ans- The Animal Wound Care Market was valued at USD 1.32 billion in 2023 and is expected to reach USD 2.55 billion by 2032.

Ans – The CAGR rate of the Animal Wound Care Market during 2024-2032 is 7.55%.

Ans- The Companion Animal segment dominated the market by 60%

Ans- North America held the largest revenue share by 35%.

Ans- Asia Pacific is the fastest-growing region in the Animal Wound Care Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence of Animal Wounds (2023)

5.2 Treatment Trends and Product Usage (2023), by Region

5.3 Drug Volume: Production and usage volumes of pharmaceuticals

5.4 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Animal Wound Care Market Segmentation, by Product

7.1 Chapter Overview

7.2 Surgical Wound Care Products

7.2.1 Surgical Wound Care Products Market Trends Analysis (2020-2032)

7.2.2 Surgical Wound Care Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Sutures & staplers

7.2.3.1 Sutures & staplers Market Trends Analysis (2020-2032)

7.2.3.2 Sutures & staplers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Tissue Adhesive

7.2.4.1 Tissue Adhesive Market Trends Analysis (2020-2032)

7.2.4.2 Tissue Adhesive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Advanced Wound Care Products

7.3.1 Advanced Wound Care Products Market Trends Analysis (2020-2032)

7.3.2 Advanced Wound Care Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.1 Foam Dressings

7.3.1.1 Foam Dressings Market Trends Analysis (2020-2032)

7.3.1.2 Foam Dressings Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.2 Hydrocolloid dressing

7.3.2.1 Hydrocolloid Dressing Market Trends Analysis (2020-2032)

7.3.2.2 Hydrocolloid Dressing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Film Dressing

7.3.3.1 Film Dressing Market Trends Analysis (2020-2032)

7.3.3.2 Film Dressing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Hydrogel Dressing

7.3.4.1 Hydrogel Dressing Market Trends Analysis (2020-2032)

7.3.4.2 Hydrogel Dressing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Others

7.3.5.1 Others Market Trends Analysis (2020-2032)

7.3.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Traditional Wound Care Products

7.4.1 Traditional Wound Care Products Market Trends Analysis (2020-2032)

7.4.2 Traditional Wound Care Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.3 Tapes

7.4.3.1 Tapes Market Trends Analysis (2020-2032)

7.4.3.2 Tapes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.4 Bandages

7.4.4.1 Bandages Market Trends Analysis (2020-2032)

7.4.4.2 Bandages Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.5 Dressing

7.4.5.1 Dressing Market Trends Analysis (2020-2032)

7.4.5.2 Dressing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.6 Absorbants

7.4.6.1 Absorbants Market Trends Analysis (2020-2032)

7.4.6.2 Absorbants Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4.7 Others

7.4.7.1 Others Market Trends Analysis (2020-2032)

7.4.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Therapy Devices

7.5.1 Therapy Devices Market Trends Analysis (2020-2032)

7.5.2 Therapy Devices Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Animal Wound Care Market Segmentation, by Animal Type

8.1 Chapter Overview

8.2 Companion Animal

8.2.1 Companion Animal Market Trends Analysis (2020-2032)

8.2.2 Companion Animal Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Dogs

8.2.3.1 Dogs Market Trends Analysis (2020-2032)

8.2.3.2 Dogs Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.4 Cats

8.2.4.1 Cats Market Trends Analysis (2020-2032)

8.2.4.2 Cats Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.5 Horses

8.2.5.1 Horses Market Trends Analysis (2020-2032)

8.2.3.2 Horses Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.6 Other (small mammals, birds)

8.2.6.1 Other (small mammals, birds) Market Trends Analysis (2020-2032)

8.2.6.2 Other (small mammals, birds) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Livestock Animal

8.3.1 Livestock Animal Market Trends Analysis (2020-2032)

8.3.2 Livestock Animal Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Animal Wound Care Market Segmentation, by End User

9.1 Chapter Overview

9.2 Veterinary Hospitals/Clinics

9.2.1 Veterinary Hospitals/Clinics Market Trends Analysis (2020-2032)

9.2.2 Veterinary Hospitals/Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Homecare

9.3.1 Homecare Market Trends Analysis (2020-2032)

9.3.2 Homecare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Research Institutes

9.4.1 Research Institutes Market Trends Analysis (2020-2032)

9.4.2 Research Institutes Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Animal Wound Care Market Segmentation, by Distribution Channel

10.1 Chapter Overview

10.2 Retail

10.2.1 Retail Market Trends Analysis (2020-2032)

10.2.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 E-commerce

10.3.1 E-commerce Market Trends Analysis (2020-2032)

10.3.2 E-commerce Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Veterinary Hospitals/Clinics

10.4.1 Veterinary Hospitals/Clinics Market Trends Analysis (2020-2032)

10.4.2 Veterinary Hospitals/Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.4 North America Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.2.5 North America Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.6 North America Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.7.2 USA Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.2.7.3 USA Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.7.4 USA Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.8.2 Canada Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.2.8.3 Canada Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.8.4 Canada Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.9.2 Mexico Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.2.9.4 Mexico Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.7.4 Poland Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.8.4 Romania Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.6 Western Europe Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.7.4 Germany Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.8.2 France Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.8.3 France Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.8.4 France Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.9.2 UK Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.9.4 UK Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.10.4 Italy Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.11.4 Spain Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.14.4 Austria Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.5 Asia Pacific Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.6 Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.7.2 China Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.7.3 China Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.7.4 China Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.8.2 India Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.8.3 India Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.8.4 India Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.9.2 Japan Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.9.3 Japan Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.9.4 Japan Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.10.2 South Korea Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.10.4 South Korea Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.11.4 Vietnam Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.12.2 Singapore Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.12.4 Singapore Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.13.2 Australia Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.13.3 Australia Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.13.4 Australia Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.4 Middle East Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.6 Middle East Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.7.4 UAE Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.4 Africa Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.2.5 Africa Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.6 Africa Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Animal Wound Care Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.4 Latin America Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.6.5 Latin America Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.6 Latin America Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.7.2 Brazil Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.7.4 Brazil Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.8.2 Argentina Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.8.4 Argentina Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.9.2 Colombia Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.9.4 Colombia Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Animal Wound Care Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Animal Wound Care Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Animal Wound Care Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Animal Wound Care Market Estimates and Forecasts, by Distribution Channel (2020-2032) (USD Billion)

12. Company Profiles

12.1 3M

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Boehringer Ingelheim

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Zoetis

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Elanco Animal Health

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Ceva Animal Health

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Virbac

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Dechra Pharmaceuticals

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Henry Schein

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Huvepharma

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Vetoquinol

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Surgical Wound Care Products

Sutures & staplers

Tissue Adhesive

Advanced Wound Care Products

Foam Dressings

Hydrocolloid dressing

Film Dressing

Hydrogel Dressing

Others

Traditional Wound care Products

Tapes

Bandages

Dressing

Absorbants

Others

Therapy Devices

By Animal Type

Companion Animal

Dogs

Cats

Horses

Other (small mammals, birds)

Livestock Animal

By End Use

Veterinary Hospitals/Clinics

Homecare

Research Institutes

By Distribution Channel

Retail

E-commerce

Veterinary Hospitals/Clinics

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization to meet the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Ureteroscope Market Size was valued at USD 1,056.2 Million in 2023 and is expected to reach USD 1,685.14 Million by 2032 and grow at a CAGR of 5.54% over the forecast period 2024-2032.

The Healthcare IT Integration Market was valued at USD 4.43 billion in 2023 and is expected to reach USD 12.97 billion by 2032, and grow at a CAGR of 12.69%.

The Respiratory Devices Market was valued at USD 22.62 billion in 2023 and is projected to reach USD 46.10 billion by 2032, growing at a robust CAGR of 8.27 % during the forecast period of 2024-2032.

The Influenza Diagnostics Market Size was USD 1.49 billion in 2023 and will reach USD 2.45 billion by 2032, growing at a CAGR of 5.69% from 2024-2032.

The Diet Pills Market size is expected to reach USD 3.77 Bn by 2032 and was valued at USD 1.61 Bn in 2023, the CAGR is expected to be 9.9% over the forecast period of 2024-2032.

The Smart Bandages Market was valued at USD 767.6 million in 2023 and is expected to reach USD 2111.5 million in 2032 and grow at a CAGR of 11.9% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone