Analog Servo Motors and Drives Market Size Analysis:

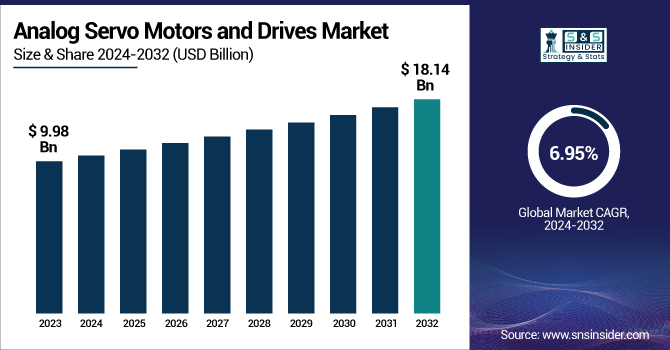

The Analog Servo Motors and Drives Market Size was valued at USD 9.98 billion in 2023 and is expected to reach USD 18.14 billion by 2032 and grow at a CAGR of 6.95% over the forecast period 2024-2032.

To Get more information on Analog Servo Motors and Drives Market - Request Free Sample Report

This expansion is driven by increased demand for precise motion control among packaging, metal forming, robotics, and material handling markets. Analog systems continue to be implemented in cost-driven and legacy systems where stability and speed are mission-critical. Furthermore, advancements in analog drive efficiency and integration of analog drives into hybrid automation systems are accelerating adoption. Africa and North America's commercial space is a little behind, given that most of the metal resource is taken by Asia Pacific, the lead, but in high-performance manufacturing environments, North America and Europe still lead the charge.

The U.S. Analog Servo Motors and Drives Market size was USD 1.78 billion in 2023 and is expected to reach USD 3.31 billion by 2032, growing at a CAGR of 7.23% over the forecast period of 2024–2032. This growth is fueled by the increasing need for accurate and dependable motion control systems across various sectors, including automotive, packaging, and industrial automation. Analog systems remain in use for their simplicity, cost savings, and dependable operation in legacy and precision-based applications. As investments in industrial modernization and automation increase across the U.S., interest in analog servo technologies will likewise remain fairly strong, especially with small to mid-sized manufacturing facilities still seeking proven, effective drive systems.

Analog Servo Motors and Drives Market Dynamics

Key Drivers:

-

Growing Demand for Precision Motion Control in Industrial Automation Accelerates Analog Servo Motors and Drives Market Growth.

The growing demand for high-accuracy motion control in many industrial automation processes is directly impacting the analog servo motors and drives market growth. The requirement of efficient and reliable motor control systems is imperative for enhancing accuracy and repeatability in metal cutting, packaging, material handling, and robotics industries. These industries tend to favour analog servo drives for their fast response times, low cost, and simplicity of merging with legacy systems. Additionally, small and medium production firms remain faithful to analog due to their strong reputation and simplicity compared to their electronic equivalents. This continued trend through both legacy and emerging automation configurations has ultimately translated into stable market expansion. With industrial upgrading continuing in alignment with markets worldwide, particularly in developing economies, there should be steady expansion in demand for analog servo systems during the forecast period.

Restrain:

-

Increasing Shift Toward Digital Servo Systems Hampers Analog Servo Motors and Drives Market Expansion.

The rapid transition toward advanced digital servo systems is emerging as a hindrance to the development of the analog servo motors and drives market. Digital drives offer better functionality, such as networkability, real-time monitoring, remote diagnostic facilities, and adaptive control functionality, which attracts industries adopting Industry 4.0 and intelligent manufacturing solutions. As a result, numerous organizations are focusing on digital advancements to maintain their competitiveness as well as future-proof their manufacturing lines. The shift has been gradual, but this increasing tendency is relieving analog systems in favor of digital substitutes, particularly in high-end automation and advanced applications. OEMs are also increasing investments in digital innovations, which also widens the technology gap. While a significant portion of the automation environments of several industries still rely on analog systems, their market share may be small, since the new-generation industrial control settings in many systems have a penchant for going digital.

Opportunities:

-

Rising Adoption of Hybrid Servo Systems Opens New Opportunities for Analog Servo Motors and Drives Market Players.

The trend towards hybrid automation systems combining analog and digital technologies is a significant driver in the analog servo motors and drives market. But most industries are not yet ready to transfer to an all-digital basis, due to cost, training, or compatibility issues. Analog servo drives can remain in the frame in hybrid environments, where they can integrate easily with digital controllers and interfaces. Analog drives that manufacturers can benefit from cost savings, while some advancements from the digital systems have not yet been lost. This trend enables analog servo products to be incorporated in modernization plans without doing complete system rework. This transition provides broader MARA market access and application diversity suited for suppliers providing analog components with flexible integration capabilities.

Challenges:

-

Limited Compatibility with Advanced Smart Manufacturing Platforms Challenges Analog Servo Motors and Drives Market Penetration.

A few key restraints in the analog servo motors and drives market are limited integration with advanced smart manufacturing and IIoT platforms. As factories are increasingly moving towards integrated automation and networked systems, analog drives fall short of providing features such as data analytics, remote connectivity, predictive maintenance, and communication across the network efficiently. Tools that do not support high-end diagnostic functionalities and cloud integration are limited in application in today's systems, relying on real-time data sharing and remote monitoring. This compatibility shortfall thus not only lowers operational efficiency but also acts as a drag on long-term investment for Analog Systems. Analogue products and their penetration in digitally led sectors can then be undermined by original equipment manufacturers (OEMs) who appear to have future-proofed solutions. The players of the market will have to bring innovation or have to adapt systems analog in function to fill these functional gaps without losing the principle of its benefits to remain viable.

Analog Servo Motors and Drives Market Segment Analysis:

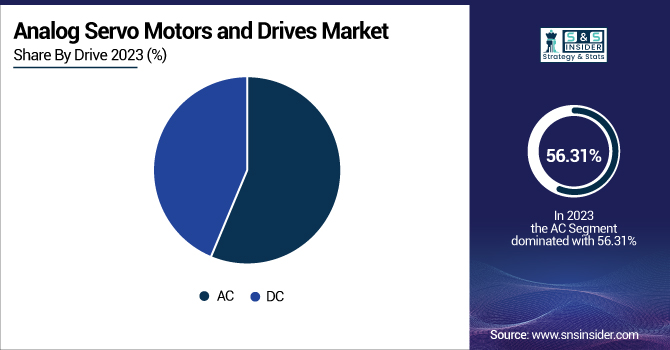

By Drive

AC drive held the largest revenue share of 56.31% in the Analog Servo Motors and Drives Market in 2023. AC drives outperform their counterparts in high starting current handling, torque, high-speed operation, and quieter operation. Technology innovation has also helped strengthen their uptake; for instance, in September 2023, Mitsubishi Electric expanded its MELSERVO-J5 range to include high-speed HK-KT/ST servo motors, which had 3,000 rpm ratings. Likewise, Yaskawa Electric introduced its next-generation AC drives GA700 series in October 2023 with a broader range of 400V-class capacity options. These advancements fulfill a growing need for precise and effective motion control in the packaging, material handling, and robotics industries, consolidating the AC segment's dominance in the analog servo market.

The DC drives segment is expected to have the Fastest CAGR of the Analog Servo Motors and Drives Market during the forecast period. This growth is due to the demand for compact, energy-efficient, and high-precision motion control solutions in applications from automated guided vehicles (AGVs), robots, and medical equipment. Specifically, in October 2023, Applied Motion Products introduced updated models of its SM Series Servo Motors that were suitable for high-speed, low-power applications and offered magnetic encoders. Also in April 2024, JVL A/S introduced the MAC320-P brushless DC motor, delivering 320W RMS power, an Ethernet capability, and precise positioning properties. Such product innovations reflect both the high-velocity innovation currently being launched in the DC sector and its apex status to respond to the changing demand of state-of-the-art automation systems.

By Application

The Metal Cutting and Forming segment was the largest dominated sector, accounting for approximately 20.34% share in the Analog Servo Motors and Drives Market in 2023. The increase is derived from the increasing need for metal cutting and shaping processes done with efficiency and precision in industries including automobile, aerospace, and heavy machinery. For these types of applications, analog servo systems are chosen due to their trusted performance, low cost, and compatibility with installed systems. As an example, Mitsubishi Electric in Oct 2023 expanded the MELSERVO-J5 series by launching new high-speed HK-KT/ST servo motors (3,000 r/min) for high-precision metalworking applications. In addition, Siemens introduced the SINAMICS S200 servo drive system in May 2023, designed for applications that require accurate speed and torque regulation, such as metal cutting and metal forming. The fact of dust and dirt is a contributing factor to the designation of an analog servo system by the powerful needs that should be answered by those metal fabrication processes due to the previous developments.

The Warehousing segment is forecast to have the Fastest CAGR during the forecast period in the Analog Servo Motors and Drives Market. Automation in logistics and distribution centers enhances the efficiency and precision of operations, driving market growth. Analog servo systems are used in many warehousing systems, such as conveyor systems and automatic storage and retrieval systems (AS/RS), robot working picking systems, etc., as they provide accurate movement control and act reliably. Likewise, in January 2024, Aerotech Inc. unveiled the Automation1 XA4 and iXA4 PWM servo drives — extremely compact and cost-effective control solutions with integrated motion control and I/O expansion for multi-axis warehousing applications. In addition, SANYO DENKI announced in February 2024 new servo motors and amplifiers intended for high-speed and high-precision control in the factory setting, including in warehousing, to accompany its SANMOTION G servo system. The news is an indicator of increasing demand for analog servo systems for warehouses' modernization for more speedy order handling and inventory control.

Analog Servo Motors and Drives Market Regional Analysis:

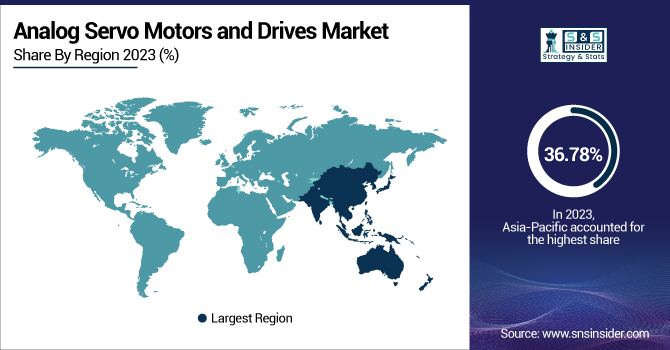

Asia-Pacific region led the Analog Servo Motors and Drives Market in 2023 with a revenue share of 36.78%. The reason for this lies in the rapid industrialization of the region, its growing manufacturing base, as well as the rising implementation of automation technology. China, Japan, and South Korea are heavily investing in smart manufacturing and robots, which has propelled the demand for more accurate motion control systems. The MINAS A7 Family of servo (motor and drive) systems was introduced to the market last month (September 2023) by Panasonic Industry, featuring AI that auto sets precision tuning for reduced tuning operation time. SANYO DENKI similarly expanded its SANMOTION G servo system range in February 2024, offering high-speed and high-precision for a wide range of industrial uses. These advances are a testament to the region’s commitment to enhancing manufacturing efficacy and precision, propelling it ahead in the analog servo motors and drives market.

North America is expected to capture the Fastest CAGR of 7.98% during the forecast duration. The region has focused on advanced manufacturing, energy efficiency, and Industry 4.0 technologies as part of this effort. Increasing demand for accurate motion control solutions is led by the U.S. government's push to boost domestic semiconductor manufacturing and the adoption of EVs by the EV industry. Launched at this summer’s SPECTRUM + LOAD trade show, Siemens’ servo drive system, the SINAMICS S200, is aimed at high-precision applications, electronics, and battery production industries. KEB Automation also launched the EC High-Torque, high efficiency DL4 series of Brushless servo motors for heavy industrial machines in December 2023. North America is the undisputed analog servo motors and drives prospering region, which is characterized by tech progress, and the launches here help satisfy the demand for state of the art features.

Get Customized Report as per Your Business Requirement - Enquiry Now

Analog Servo Motors and Drives Companies are:

-

Hitachi – (SJ700D Series Inverter, L700 Series Inverter)

-

KEB Automation – (COMBIVERT F6 Servo Drive, DL3 Servo Motor)

-

Mitsubishi Electric – (MELSERVO-J5 Series, HG Series Servo Motors)

-

Nidec – (Nidec Servo Motor with In-house Magnetic Encoder, EtherCAT-Compatible Servo Amplifier)

-

Omron – (G5 Series Servo Motors, 1S Series Servo Drives)

-

Rockwell Automation – (Kinetix 5500 Servo Drive, Kinetix VP-Series Servo Motors)

-

Schneider Electric – (Lexium 32 Servo Drives, BMH Servo Motors)

-

Siemens – (SINAMICS S210 Servo Drive, SIMOTICS S-1FK2 Servo Motor)

-

Yaskawa – (Sigma-7 Servo Motors, Sigma-7 Servo Amplifiers)

-

WEG – (WEMOVE Servo Drive, WSM Series Servo Motors)

Recent Development:

-

October 2024, Mitsubishi Electric Automation collaborated with Genesis Packaging Technologies to implement MR-J5 Servo Drives and Amplifiers, resulting in a 300% increase in production output. This standardization reduced lead times and enhanced compatibility with third-party devices.

-

December 2024, Siemens introduced the SINAMICS S210 next-generation servo-drive system, enhancing motion control in mid-range operations. This system offers high-dynamic motion control, integrated safety features up to SIL3, and is suitable for applications in packaging, printing, labeling, and more.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 9.98 Billion |

| Market Size by 2032 | USD 18.14 Billion |

| CAGR | CAGR of 6.95 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Drive – (AC, DC) •By Application – (Oil and gas, Metal cutting & forming, Material handling equipment, Packaging and labelling machinery, Robotics, Medical robotics, Rubber & plastics machinery, Warehousing, Automation, Extreme environment applications, Semiconductor machinery, AGV, Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hitachi, KEB Automation, Mitsubishi Electric, Nidec, Omron, Rockwell Automation, Schneider Electric, Siemens, WEG, Yaskawa. |