Ampoules Packaging Market Report Scope & Overview

Get More Information on Ampoules Packaging Market - Request Sample Report

The Ampoules Packaging Market Size was valued at USD 5.01 Billion in 2023 and is expected to reach USD 9.61 Billion by 2032, growing at a CAGR of 7.51% during 2024-2032.

There has been substantial growth in the ampoules packaging market due to the rising need for secure and sterile packaging in the pharmaceutical and healthcare industries. Ampoules are vessels made of glass or plastic that are utilized for storing medications, vaccines, and various liquid products, ensuring a sealed environment that maintains the effectiveness and strength of the substances. The market shows a growing preference for single-dose ampoules to reduce contamination and dosage errors, as well as an increasing demand for secure and sterile delivery due to the rise of biologics and parenteral drugs. Advancements in materials, like the creation of durable and light plastics, are improving market potential even more. Moreover, manufacturers are being compelled to invest in advanced packaging technologies due to strict regulations on product safety and quality. In terms of geography, North America has a large portion of the market because it has well-established pharmaceutical companies and strong healthcare systems, while the Asia-Pacific region is expected to experience rapid growth due to increasing healthcare spending and a growing number of patients. In general, the ampoules packaging industry is set to grow further due to changing consumer demands and advancements in packaging technology.

The packaging of ampoules is crucial in production, ensuring protection from outside impurities and preserving sterile conditions for pharmaceutical items. For a while now, glass ampoules have been a key packaging choice for the pharmaceutical sector, guaranteeing the transportation of medications in their initial, secure, and efficient state. The increasing need for tamper-evident packaging, crucial for maintaining the authenticity of products, has greatly fueled market expansion. In March 2023, Schott revealed a EUR 75 million (USD 81 million) investment to increase its pharmaceutical glass production in India. They will build a facility in Gujarat that will specialize in making borosilicate glass tubing for vials, ampoules, and syringes used in critical medications. Furthermore, the appeal of glass is further increased by its ability to be 100% recycled, maintaining its quality when reused, which ultimately results in less waste in landfills and decreased carbon footprints. Using recycled glass requires less raw materials and energy compared to making new glass, which makes it a sustainable option. The use of plastic ampoules also tackles issues with glass breakage, offering a substitute for manufacturers. Nevertheless, the adoption of plastic options may be impacted by regulatory changes. In general, the market for ampoules packaging is strongly connected to the pharmaceutical and life sciences industries, influencing the need for packaging advancements.

Ampoules Packaging Market Dynamics

Drivers

-

Progressing Pharmaceutical Packaging Meeting Worldwide Needs with Creative Container Solutions

Glass is an important material for packaging in the pharmaceutical and personal care sectors, providing benefits like reducing alkalinity and improving resistance to hydrolysis in glass ampoules. Its excellent clarity facilitates the examination of contents, while its resistance to air and moisture guarantees the safeguarding of medicinal items. In response to the increasing need for pharmaceutical containers such as ampoules, syringes, and vials in Asia, companies like Schott started manufacturing amber pharma glass in March 2023. Ampoules play a vital role in parenteral packaging, spurred by the growing elderly population, the increase in chronic illnesses, and a trend towards injection therapies. Manufacturers in the glass ampoule industry are taking action by introducing fast filling lines, improving the features and durability of glass ampoules, and increasing production capacity. Nipro Pharma Packaging intends to make substantial investments in boosting capacity in India within the next three years in order to enhance the production of glass tubing for markets at both domestic and international levels. The increasing need for pharmaceutical glass ampoules is evident in the fast expansion of the worldwide pharmaceutical sector, especially in densely populated areas such as India, Brazil, and China. Companies like South Korea's Celltrion Healthcare highlight this need, as they were awarded a contract in January 2023 to deliver 342,000 infliximab ampoules to Brazil for autoimmune diseases. Partnerships between SGD Pharma and Corning Life Sciences are helping expand globally and locally manufacture essential drugs to keep up with high demand. Glass ampoules are essential for storing vaccines and injectable medications because they are airtight and tamper-evident, guaranteeing the sterility and integrity of the products. This trend aids in the increasing vaccination campaigns for diseases like Hepatitis B and tuberculosis, with glass ampoules also being used in cosmetics and chemicals, packaging high-purity substances and delicate formulations.

Restraints

-

Managing obstacles in the glass ampoules packaging market regarding regulatory compliance and safety issues.

There is an increasing demand for secure and reliable pharmaceutical packaging options, leading to the expansion of the market for glass ampoules packaging. However, manufacturers must address significant obstacles that are hindering this growth. Stringent government regulations mandate the utilization of safe packaging, encouraging creative concepts that enhance protection and prevent pollution. Despite these advancements, the natural fragility of glass ampoules may lead to them cracking or breaking, potentially resulting in puncture wounds. The concern of potential contamination during production and handling remains a significant issue, necessitating stringent quality control measures to protect both manufacturers and consumers. To thrive in this competitive landscape, industry participants must prioritize implementing robust safety protocols, integrating cutting-edge manufacturing technologies, and adapting to evolving regulations. This report delves into the latest developments, trade regulations, and possible expansion prospects in the ampoules packaging sector. Stakeholders in the glass ampoules packaging market can effectively navigate the complexity by focusing on optimizing the value chain, grasping market share dynamics, and performing strategic growth analysis to enhance compliance and safety standards.

Ampoules Packaging Market Segment Analysis

By Material

In 2023, the glass material segment captured the largest revenue share of 67.50% in the ampoules packaging market, owing to its superior protective properties and ability to maintain the sterility of contents. Glass ampoules are chemically resistant, impermeable to air and moisture, and offer excellent visibility for product inspection, making them the preferred choice for pharmaceuticals. Notable companies, such as Schott, have expanded their production capabilities to meet this growing demand. In March 2023, Schott launched the production of amber pharma glass in India, specifically designed for ampoules, vials, and syringes, catering to the rising need for effective pharmaceutical containers in the Asian market. Similarly, Nipro Pharma Packaging is investing significantly in capacity expansion projects to increase the output of glass tubing for the Indian and global markets over the next three years. These developments are expected to enhance supply chain efficiencies and support the growing pharmaceutical sector, particularly in densely populated regions like India and Brazil. The emphasis on high-quality glass materials not only ensures product safety and integrity but also reinforces the dominance of the glass segment in the ampoules packaging market, further driven by advancements in manufacturing processes and product innovations.

By End User

By 2023, the pharmaceutical industry had a strong hold on the ampoule packaging market, with a substantial revenue share of 73.89%. This significant portion illustrates the vital importance of ampoules in providing medications like injectable drugs, vaccines, and biologics. These require strict packaging standards to maintain sterility and stability. Corporations such as Baxter International have been actively enhancing their product ranges to meet this increasing demand. In January 2023, Baxter introduced a new line of pre-filled glass ampoules tailored for their injectable drugs, improving safety and ease of use for healthcare professionals. Furthermore, Gerresheimer has broadened its product range by launching a collection of cutting-edge glass ampoules designed specifically for expensive medications, such as those utilized in cancer therapy. The company stresses the importance of dependable packaging solutions that preserve the quality of sensitive pharmaceuticals during their time on the shelf. Additionally, Nipro Pharma Packaging revealed intentions to enhance production capacities in India, specifically targeting glass ampoules to cater to the growing needs of local pharmaceutical companies. These efforts highlight how crucial the pharmaceutical end-user sector is for driving growth in the ampoules packaging market, with companies constantly coming up with new ideas to meet the changing demands of drug delivery and patient safety.

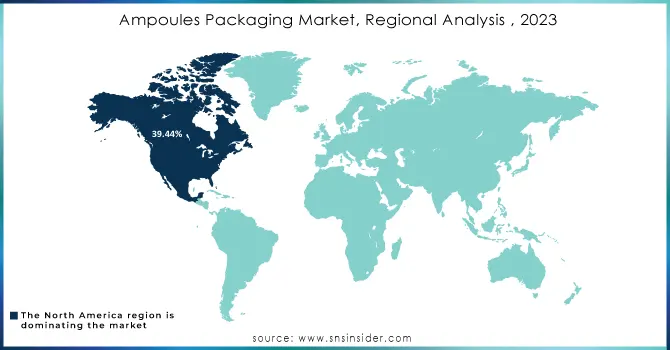

Ampoules Packaging Market Regional Analysis

In 2023, the ampoules packaging market in North America had a strong presence, accounting for 39.44% of the revenue, mainly because of its thriving pharmaceutical sector and strict regulations that focus on ensuring product safety and effectiveness. Key companies in the area, such as Baxter International, have been improving their products by introducing creative solutions designed specifically for healthcare providers. During the beginning of 2023, Baxter launched a fresh range of pre-filled glass ampoules aimed at enhancing the administration of injectable medications, with a focus on safety and ease of use. Moreover, Gerresheimer, a top producer of pharmaceutical packaging, increased its manufacturing sites in North America, particularly for glass ampoules to meet the growing need for premium packaging options. The company has recently released a range of specialized ampoules designed for biologics and vaccines to meet the growing demand for safe and sterile packaging choices. In addition, Schott revealed intentions to expand its production capabilities in the United States in order to accommodate the rising need for pharmaceutical glass packaging. This significant investment showcases the region's dedication to enhancing ampoules packaging technology, guaranteeing the safety and integrity of essential medicines, and strengthening North America's dominant position in the worldwide market.

By 2023, the Asia-Pacific region had become the swiftest-growing market for ampoules packaging, propelled by swift advancements in the pharmaceutical industry, growing healthcare spending, and an escalating need for injectable drugs. China, India, and Japan are at the forefront of this expansion, making substantial investments in pharmaceutical production and packaging advancements. For instance, Nipro Pharma Packaging recently opened a new manufacturing plant in India specifically for producing glass ampoules, with the goal of satisfying the increasing needs of Indian pharmaceutical companies and improving supply chain effectiveness. Furthermore, SGD Pharma enhanced its presence in China by launching a new range of eco-friendly glass ampoules designed for pharmaceuticals and cosmetics, in line with the area's emphasis on sustainable packaging options. In addition, Fujimori Kogyo Co., Ltd. introduced a range of new plastic ampoules aimed at reducing the chances of breakage and contamination, targeting manufacturers seeking dependable and affordable options to glass. The dynamic Asia-Pacific ampoules packaging market is driven by strategic developments focused on innovation and enhancing healthcare results through advanced packaging solutions, ensuring continued growth in the region.

Need Any Customization Research On Ampoules Packaging Market - Inquiry Now

Key Players in Ampoules Packaging Market

Some of the major key players in the ampoules packaging market with their product and offering :

-

Adelphi Healthcare Packaging (Glass ampoules, plastic ampoules, and specialized filling systems)

-

Ampersand S.A. (Plastic and glass ampoules for pharmaceuticals)

-

ESSCO (Custom glass ampoules and vials for pharmaceutical applications)

-

Gerresheimer AG (Glass ampoules, pre-filled ampoules, and pharmaceutical packaging solutions)

-

Hindusthan National Glass & Industries Limited (Glass ampoules and vials for injectable drugs)

-

James Alexander Corporation (Glass ampoules and related packaging solutions for pharmaceuticals)

-

Penner Corporation (Glass ampoules and specialty pharmaceutical packaging)

-

Sandfire Scientific Ltd. (Custom glass and plastic ampoules for various pharmaceutical applications)

-

Schott AG (Pharmaceutical glass ampoules, vials, and syringes)

-

Solopharm Company (Glass ampoules for vaccines and injectable medications)

-

Nipro Pharma Packaging (Glass ampoules, plastic ampoules, and prefilled syringes)

-

SGD Pharma (Glass ampoules and vials with a focus on sustainability)

-

Fujimori Kogyo Co., Ltd. (Plastic ampoules designed to reduce breakage and contamination)

-

Baxter International (Pre-filled glass ampoules for injectable medications)

-

Corning Life Sciences (High-quality glass ampoules and vials for laboratory and pharmaceutical use)

-

Ompi (Part of Stevanato Group) (Glass ampoules and vials, specializing in sterile packaging for injectables)

-

Roxane Laboratories, Inc. (Glass ampoules for injectable medications and solutions)

-

Schott Pharma (Customized glass ampoules and pharmaceutical packaging solutions, including sterile containers)

-

AptarGroup, Inc. (Innovative glass and plastic ampoules with a focus on drug delivery systems)

-

Amcor (Sustainable plastic and glass ampoules and packaging solutions for pharmaceuticals and consumer healthcare)

-

Others

Recent Development

-

In January 2023, Celltrion Healthcare, a South Korean company specializing in biosimilar and innovative drugs, secured a contract to supply Infliximab to Brazil's Ministry of Health. The item is utilized to address eight (8) autoimmune conditions like Rheumatoid Arthritis (RA) and Inflammatory Bowel Disease (IBD). Under the agreement, Celltrion healthcare is set to provide Brazil with 342,000 ampoules.

-

SCHOTT Pharma revealed in December 2023 its plan to increase its worldwide manufacturing footprint by investing a multi-million Euro sum to establish a new production facility for pharmaceutical drug containment solutions and delivery systems in central Serbia's Jagodina. Manufacturing of ampoules for the pharmaceutical industry is expected to start in 2024.

-

In Japan and China, Shiseido will introduce a fresh range of Beauty-from-Within supplements in the form of ampoule drinks in January 2024. This product will be added to the current lineup of INRYU brand that Shiseido introduced in January of the previous year. The INRYU Beauty-from-within line can be purchased in Japan and China through cross-border online shopping. Unlike the current version, the upcoming releases will be in powder packets and will be packaged in a case with ten (10) vials of drink for a ten-day treatment regimen.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.01 Billion |

| Market Size by 2032 | USD 9.61 Billion |

| CAGR | CAGR of 7.51% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Glass,Plastic) • By End User(Pharmaceutical ,Personal Care,Cosmetic ) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Adelphi Healthcare Packaging, Ampersand S.A., ESSCO, Gerresheimer AG, Hindusthan National Glass & Industries Limited, James Alexander Corporation, Penner Corporation, Sandfire Scientific Ltd., Schott AG, Solopharm Company, Nipro Pharma Packaging, SGD Pharma, Fujimori Kogyo Co., Ltd., Baxter International, Corning Life Sciences, Ompi (part of Stevanato Group), Roxane Laboratories, Inc., Schott Pharma, AptarGroup, Inc., Amcor & Others |

| Key Drivers | • Progressing Pharmaceutical Packaging Meeting Worldwide Needs with Creative Container Solutions |

| RESTRAINTS | • Managing obstacles in the glass ampoules packaging market regarding regulatory compliance and safety issues. |