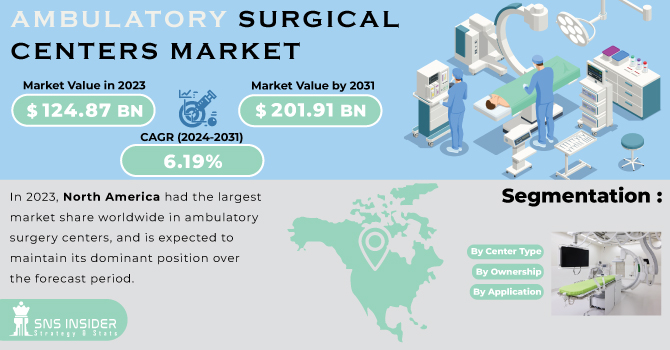

The Ambulatory Surgical Centers Market Size was valued at USD 124.87 billion in 2023 and is expected to reach USD 201.91 billion by 2031, and grow at a CAGR of 6.19% over the forecast period 2024-2031.

The ambulatory surgery center (ASC) market is flourishing, driven by a compelling combination of factors such as the growing burden of chronic diseases and an aging population are creating a strong demand for cost-effective and efficient surgical solutions. ASCs address this need perfectly, offering a cost-advantage compared to traditional hospitals. Studies show they save the US healthcare system billions annually. This affordability, coupled with advancements in minimally invasive surgeries, is making a wider range of procedures suitable for outpatient settings at ASCs. Patients are increasingly opting for these convenient outpatient procedures, transforming the healthcare landscape.

Get more information on Ambulatory Surgical Centers Market - Request Sample Report

Furthermore, supportive government policies and favorable reimbursement rates for ASC procedures incentivize their use. The COVID-19 pandemic even played a role, with ASCs taking on non-COVID surgeries to free up critical hospital resources. Recognizing this market potential, major healthcare players are strategically expanding their reach by acquiring ASCs.

DRIVERS

As ambulatory surgical centers are increasingly turning to IT

The growth of the ambulatory surgical center market is supported by government support and favourable reimbursement.

ASC market growth thrives on government backing and favorable reimbursements. Government incentives boost ASC development and ease regulations, while higher reimbursements for ASC procedures incentivize their use, making them a more attractive option for both patients and healthcare providers.

RESTRAINTS

Investing much on infrastructure and deploying at a high cost

The growth of the global market for Ambulatory Surgical Centres is projected to be restrained by high deployment costs and a lack of credibility among patients with regard to outpatient services, since new methods are not yet being adopted.

OPPORTUNITIES

Cloud-based solutions are in higher demand

Healthcare providers are increasingly seeking cloud-based solutions due to their scalability, cost-effectiveness, and improved accessibility compared to traditional on-premise IT systems. This shift opens doors for cloud-based platforms that can manage patient data, electronic health records (EHRs), and other healthcare applications.

Patient-centered care is becoming more popular

Increasing investments by healthcare companies

CHALLENGES

Issues concerning interoperability

ASCs face hurdles due to incompatible software systems and this creates data silos, forcing staff to re-enter information and hindering communication. Delays in care and increased costs are just some of the consequences.

Conflicts can lead to shortages or delays in obtaining essential supplies for ambulatory surgical procedures, affecting the supply chain of medical equipment, devices and pharmaceutical products. The 218 hospitals which have been reported damaged or destroyed, one out of every ten in Ukraine has sustained direct damage from an attack. In the eastern part of the country, destruction is most pronounced. Almost all health facilities have been exposed to some degree around certain cities and towns. Almost 8 out of 10 health care service establishments where medical assistance is provided were damaged or destroyed, according to the Ukrainian Health Centre's information in Mariupol and southern part of Donetsk oblast. Kharkivsk, Donetsk, Luhansk, Khersonsk, and Kyivsk were the regions with the highest number of hospital attacks. Also, the financial instability, currency fluctuations and inflation could result from geopolitical tensions and economic sanctions associated with the war, potentially increasing operating costs for ambulatory surgery centres.

Due to the documented links between employment, access to healthcare and health outcomes, the economic crisis has had a significant impact on the use of healthcare services. However, patients are choosing outpatient medical care for lower costs, greater accessibility and a better patient experience as a result of increasing and expanding ambulatory healthcare facilities. In view of the fact that costs for both patients and payers can be significantly lower in this category of care, it is estimated that ambulatory healthcare services will continue to grow at an exponential rate this year. In particular, because of the reduction in costs related to fewer staff, lower supplies and lesser facilities, ambulatory surgery centres tend to have lower operating costs than other hospitals. In order to take advantage of this shift in healthcare services, this economic opportunity has led to the acquisition of partnerships in the field of ambulatory healthcare by healthcare systems that are known to primarily operate hospitals. Healthcare systems buying into the ambulatory healthcare space may contribute to the aggressive growth of ambulatory healthcare facilities in the coming years, as these systems strategize to combat the projected economics slowdown.

Orthopedics

Pain Management/Spinal Injections

Gastroenterology

Ophthalmology

Plastic Surgery

Otolaryngology

Obstetrics/Gynecology

Dental

Podiatry

Others

The orthopedic segment dominates the ambulatory surgery center market due to the rising demand for orthopedic procedures. This surge is fueled by an aging population and increasing instances of joint problems. Knee and hip replacements are prime examples, with surgeries steadily growing by 5% annually. As the number of orthopedic surgeries climb, so will the need for ambulatory surgery centers equipped to handle these procedures efficiently. This trend positions the orthopedic segment as the key driver of growth in the ambulatory surgery center market.

Physician Owned

Hospital Owned

Corporate Owned

The physician-owned segment dominates in the ambulatory surgery center market, holding a dominant 62.17% share in 2023. This dominance attributed from several factors: direct communication with familiar physicians, focused treatment expertise, and potentially lower surgery costs. While physician-owned leads the pack, the hospital-owned segment is projected for the fastest growth. This is driven by the trend of patients moving from inpatient to hospital-affiliated outpatient facilities. Strategic partnerships, like the innovative joint program launched by Effingham Ambulatory Surgery Center, are propelling this segment's growth by enhancing the standard of care provided.

Single-Specialty

Multi-Specialty

Single-specialty centers rule the ambulatory surgery center market, boasting a dominant 61.78% share in 2023. This lead is fueled by rising occurrences of eye problems and the growing number of these focused facilities (over 3,000 in the U.S. alone as of June 2023). These centers specialize in specific procedures like hernia repair and colonoscopies, allowing for streamlined care and potentially higher reimbursements. However, the multi-specialty segment is projected for the fastest growth. Their comprehensive service offerings under one roof and focus on patient convenience are anticipated to propel them forward, especially in areas like gastroenterology and pain management.

Regional Analysis

In 2023, North America had the largest market share worldwide in ambulatory surgery centers, and is expected to maintain its dominant position over the forecast period. This region stands to be a major market leader globally due to factors such as rapid adoption of ambulatory healthcare services, including surgery centres, which bring down health costs more effectively. In addition, due to an increase in the number of patients and surgical procedures, the pressure on hospitals in North America has increased, which has allowed the rapid growth of ambulatory surgical centres in the region. Moreover, this region is home to a large number of key market players, which is a further advantage in positioning itself as a leader in other regions.

Asia Pacific is expected to be the fastest growing region during the forecast period. Due to an increase in the prevalence of chronic diseases, the ageing population, high healthcare costs and an increase in the number of hospital admissions, the expansion of outpatient facilities is due to an increase in healthcare costs. The growth of the ambulatory surgical centre market in the region is driven by all these factors.

Need any customization research on Ambulatory Surgical Centers Market - Enquiry Now

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some of the major key players of Ambulatory Surgical Centers Market are as follows: CHSPSC, LLC., TH Medical, Envision Healthcare Corporation, UNITEDHEALTH GROUP, Pediatrix Medical Group, Healthway Medical Group, Surgery Partners, Prospect Medical Holdings, Inc., SurgCenter, Edward-Elmhurst Health, Eifelhöhen-Klinik AG, Nexus Day Surgery Centre and Other Players.

In January 2023, Becker's Healthcare announced that Baylor Scott & White Health, based in Dallas, is planning to build a four-story medical office building. In December 2022, the City's Planning Committee authorised an expansion of the hospital grounds. An ASC, endocrine, gastroenterology, ophthalmology, and many other departments would be housed in the 1,00,000 square foot building.

In February 2023, Covenant Physician Partners in Hawaii became early adopters of AI technology. They implemented the GI Genius system at three locations to improve colonoscopy screenings.

UnitedHealth's Optum arm joined forces with SCA Health's parent company to acquire physician groups from four organizations in April 2023. This move aimed to enhance patient experiences and benefit medical providers as well.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 124.87 Billion |

| Market Size by 2031 | US$ 201.91 Billion |

| CAGR | CAGR of 6.19% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

|

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | CHSPSC, LLC., TH Medical, Envision Healthcare Corporation, UNITEDHEALTH GROUP, Pediatrix Medical Group, Healthway Medical Group, Surgery Partners, Prospect Medical Holdings, Inc., SurgCenter, Edward-Elmhurst Health, Eifelhöhen-Klinik AG, Nexus Day Surgery Centre |

| DRIVERS |

|

| RESTRAINTS | • Investing much on infrastructure and deploying at a high cost |

Ans: The Ambulatory Surgical Centers market is expected grow at a CAGR of 6.19% over the forecast period 2024-2031.

Ans: The Ambulatory Surgical Centers Market Size was valued at USD 124.87 billion in 2023

Ambulatory Surgical Centers Market is divided into three segments By Application, By Ownership, By Center Type.

The Ambulatory Surgical Centers Market is dominated by the North America.

The market for ambulatory surgical centers was dominated by the orthopedic segment.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Ambulatory Surgical Centers Market Segmentation, By Ownership

9.1 Introduction

9.2 Trend Analysis

9.3 Orthopedics

9.4 Pain Management/Spinal Injections

9.5 Gastroenterology

9.6 Ophthalmology

9.7 Plastic Surgery

9.8 Otolaryngology

9.9 Obstetrics/Gynecology

9.10 Dental

9.11 Podiatry

9.12 Others

10. Ambulatory Surgical Centers Market Segmentation, By Ownership

10.1 Introduction

10.2 Trend Analysis

10.3 Physician Owned

10.4 Hospital Owned

10.5 Corporate Owned

11. Ambulatory Surgical Centers Market Segmentation, By Center Type

11.1 Introduction

11.2 Trend Analysis

11.3 Single-Specialty

11.4 Multi-Specialty

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Ambulatory Surgical Centers Market by Country

12.2.3 North America Ambulatory Surgical Centers Market By Ownership

12.2.4 North America Ambulatory Surgical Centers Market By Ownership

12.2.5 North America Ambulatory Surgical Centers Market By Center Type

12.2.6 USA

12.2.6.1 USA Ambulatory Surgical Centers Market By Ownership

12.2.6.2 USA Ambulatory Surgical Centers Market By Ownership

12.2.6.3 USA Ambulatory Surgical Centers Market By Center Type

12.2.7 Canada

12.2.7.1 Canada Ambulatory Surgical Centers Market By Ownership

12.2.7.2 Canada Ambulatory Surgical Centers Market By Ownership

12.2.7.3 Canada Ambulatory Surgical Centers Market By Center Type

12.2.8 Mexico

12.2.8.1 Mexico Ambulatory Surgical Centers Market By Ownership

12.2.8.2 Mexico Ambulatory Surgical Centers Market By Ownership

12.2.8.3 Mexico Ambulatory Surgical Centers Market By Center Type

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Ambulatory Surgical Centers Market By Country

12.3.2.2 Eastern Europe Ambulatory Surgical Centers Market By Ownership

12.3.2.3 Eastern Europe Ambulatory Surgical Centers Market By Ownership

12.3.2.4 Eastern Europe Ambulatory Surgical Centers Market By Center Type

12.3.2.5 Poland

12.3.2.5.1 Poland Ambulatory Surgical Centers Market By Ownership

12.3.2.5.2 Poland Ambulatory Surgical Centers Market By Ownership

12.3.2.5.3 Poland Ambulatory Surgical Centers Market By Center Type

12.3.2.6 Romania

12.3.2.6.1 Romania Ambulatory Surgical Centers Market By Ownership

12.3.2.6.2 Romania Ambulatory Surgical Centers Market By Ownership

12.3.2.6.4 Romania Ambulatory Surgical Centers Market By Center Type

12.3.2.7 Hungary

12.3.2.7.1 Hungary Ambulatory Surgical Centers Market By Ownership

12.3.2.7.2 Hungary Ambulatory Surgical Centers Market By Ownership

12.3.2.7.3 Hungary Ambulatory Surgical Centers Market By Center Type

12.3.2.8 Turkey

12.3.2.8.1 Turkey Ambulatory Surgical Centers Market By Ownership

12.3.2.8.2 Turkey Ambulatory Surgical Centers Market By Ownership

12.3.2.8.3 Turkey Ambulatory Surgical Centers Market By Center Type

12.3.2.9 Rest Of Eastern Europe

12.3.2.9.1 Rest Of Eastern Europe Ambulatory Surgical Centers Market By Ownership

12.3.2.9.2 Rest Of Eastern Europe Ambulatory Surgical Centers Market By Ownership

12.3.2.9.3 Rest Of Eastern Europe Ambulatory Surgical Centers Market By Center Type

12.3.3 Western Europe

12.3.3.1 Western Europe Ambulatory Surgical Centers Market By Country

12.3.3.2 Western Europe Ambulatory Surgical Centers Market By Ownership

12.3.3.3 Western Europe Ambulatory Surgical Centers Market By Ownership

12.3.3.4 Western Europe Ambulatory Surgical Centers Market By Center Type

12.3.3.5 Germany

12.3.3.5.1 Germany Ambulatory Surgical Centers Market By Ownership

12.3.3.5.2 Germany Ambulatory Surgical Centers Market By Ownership

12.3.3.5.3 Germany Ambulatory Surgical Centers Market By Center Type

12.3.3.6 France

12.3.3.6.1 France Ambulatory Surgical Centers Market By Ownership

12.3.3.6.2 France Ambulatory Surgical Centers Market By Ownership

12.3.3.6.3 France Ambulatory Surgical Centers Market By Center Type

12.3.3.7 Uk

12.3.3.7.1 Uk Ambulatory Surgical Centers Market By Ownership

12.3.3.7.2 Uk Ambulatory Surgical Centers Market By Ownership

12.3.3.7.3 Uk Ambulatory Surgical Centers Market By Center Type

12.3.3.8 Italy

12.3.3.8.1 Italy Ambulatory Surgical Centers Market By Ownership

12.3.3.8.2 Italy Ambulatory Surgical Centers Market By Ownership

12.3.3.8.3 Italy Ambulatory Surgical Centers Market By Center Type

12.3.3.9 Spain

12.3.3.9.1 Spain Ambulatory Surgical Centers Market By Ownership

12.3.3.9.2 Spain Ambulatory Surgical Centers Market By Ownership

12.3.3.9.3 Spain Ambulatory Surgical Centers Market By Center Type

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Ambulatory Surgical Centers Market By Ownership

12.3.3.10.2 Netherlands Ambulatory Surgical Centers Market By Ownership

12.3.3.10.3 Netherlands Ambulatory Surgical Centers Market By Center Type

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Ambulatory Surgical Centers Market By Ownership

12.3.3.11.2 Switzerland Ambulatory Surgical Centers Market By Ownership

12.3.3.11.3 Switzerland Ambulatory Surgical Centers Market By Center Type

12.3.3.1.12 Austria

12.3.3.12.1 Austria Ambulatory Surgical Centers Market By Ownership

12.3.3.12.2 Austria Ambulatory Surgical Centers Market By Ownership

12.3.3.12.3 Austria Ambulatory Surgical Centers Market By Center Type

12.3.3.13 Rest Of Western Europe

12.3.3.13.1 Rest Of Western Europe Ambulatory Surgical Centers Market By Ownership

12.3.3.13.2 Rest Of Western Europe Ambulatory Surgical Centers Market By Ownership

12.3.3.13.3 Rest Of Western Europe Ambulatory Surgical Centers Market By Center Type

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Ambulatory Surgical Centers Market By Country

12.4.3 Asia-Pacific Ambulatory Surgical Centers Market By Ownership

12.4.4 Asia-Pacific Ambulatory Surgical Centers Market By Ownership

12.4.5 Asia-Pacific Ambulatory Surgical Centers Market By Center Type

12.4.6 China

12.4.6.1 China Ambulatory Surgical Centers Market By Ownership

12.4.6.2 China Ambulatory Surgical Centers Market By Ownership

12.4.6.3 China Ambulatory Surgical Centers Market By Center Type

12.4.7 India

12.4.7.1 India Ambulatory Surgical Centers Market By Ownership

12.4.7.2 India Ambulatory Surgical Centers Market By Ownership

12.4.7.3 India Ambulatory Surgical Centers Market By Center Type

12.4.8 Japan

12.4.8.1 Japan Ambulatory Surgical Centers Market By Ownership

12.4.8.2 Japan Ambulatory Surgical Centers Market By Ownership

12.4.8.3 Japan Ambulatory Surgical Centers Market By Center Type

12.4.9 South Korea

12.4.9.1 South Korea Ambulatory Surgical Centers Market By Ownership

12.4.9.2 South Korea Ambulatory Surgical Centers Market By Ownership

12.4.9.3 South Korea Ambulatory Surgical Centers Market By Center Type

12.4.10 Vietnam

12.4.10.1 Vietnam Ambulatory Surgical Centers Market By Ownership

12.4.10.2 Vietnam Ambulatory Surgical Centers Market By Ownership

12.4.10.3 Vietnam Ambulatory Surgical Centers Market By Center Type

12.4.11 Singapore

12.4.11.1 Singapore Ambulatory Surgical Centers Market By Ownership

12.4.11.2 Singapore Ambulatory Surgical Centers Market By Ownership

12.4.11.3 Singapore Ambulatory Surgical Centers Market By Center Type

12.4.12 Australia

12.4.12.1 Australia Ambulatory Surgical Centers Market By Ownership

12.4.12.2 Australia Ambulatory Surgical Centers Market By Ownership

12.4.12.3 Australia Ambulatory Surgical Centers Market By Center Type

12.4.13 Rest Of Asia-Pacific

12.4.13.1 Rest Of Asia-Pacific Ambulatory Surgical Centers Market By Ownership

12.4.13.2 Rest Of Asia-Pacific Ambulatory Surgical Centers Market By Ownership

12.4.13.3 Rest Of Asia-Pacific Ambulatory Surgical Centers Market By Center Type

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Ambulatory Surgical Centers Market By Country

12.5.2.2 Middle East Ambulatory Surgical Centers Market By Ownership

12.5.2.3 Middle East Ambulatory Surgical Centers Market By Ownership

12.5.2.4 Middle East Ambulatory Surgical Centers Market By Center Type

12.5.2.5 Uae

12.5.2.5.1 Uae Ambulatory Surgical Centers Market By Ownership

12.5.2.5.2 Uae Ambulatory Surgical Centers Market By Ownership

12.5.2.5.3 Uae Ambulatory Surgical Centers Market By Center Type

12.5.2.6 Egypt

12.5.2.6.1 Egypt Ambulatory Surgical Centers Market By Ownership

12.5.2.6.2 Egypt Ambulatory Surgical Centers Market By Ownership

12.5.2.6.3 Egypt Ambulatory Surgical Centers Market By Center Type

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Ambulatory Surgical Centers Market By Ownership

12.5.2.7.2 Saudi Arabia Ambulatory Surgical Centers Market By Ownership

12.5.2.7.3 Saudi Arabia Ambulatory Surgical Centers Market By Center Type

12.5.2.8 Qatar

12.5.2.8.1 Qatar Ambulatory Surgical Centers Market By Ownership

12.5.2.8.2 Qatar Ambulatory Surgical Centers Market By Ownership

12.5.2.8.3 Qatar Ambulatory Surgical Centers Market By Center Type

12.5.2.9 Rest Of Middle East

12.5.2.9.1 Rest Of Middle East Ambulatory Surgical Centers Market By Ownership

12.5.2.9.2 Rest Of Middle East Ambulatory Surgical Centers Market By Ownership

12.5.2.9.3 Rest Of Middle East Ambulatory Surgical Centers Market By Center Type

12.5.3 Africa

12.5.3.1 Africa Ambulatory Surgical Centers Market By Country

12.5.3.2 Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.3 Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.4 Africa Ambulatory Surgical Centers Market By Center Type

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Ambulatory Surgical Centers Market By Ownership

12.5.3.5.2 Nigeria Ambulatory Surgical Centers Market By Ownership

12.5.3.5.3 Nigeria Ambulatory Surgical Centers Market By Center Type

12.5.3.6 South Africa

12.5.3.6.1 South Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.6.2 South Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.6.3 South Africa Ambulatory Surgical Centers Market By Center Type

12.5.3.7 Rest Of Africa

12.5.3.7.1 Rest Of Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.7.2 Rest Of Africa Ambulatory Surgical Centers Market By Ownership

12.5.3.7.3 Rest Of Africa Ambulatory Surgical Centers Market By Center Type

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Ambulatory Surgical Centers Market By Country

12.6.3 Latin America Ambulatory Surgical Centers Market By Ownership

12.6.4 Latin America Ambulatory Surgical Centers Market By Ownership

12.6.5 Latin America Ambulatory Surgical Centers Market By Center Type

12.6.6 Brazil

12.6.6.1 Brazil Ambulatory Surgical Centers Market By Ownership

12.6.6.2 Brazil Ambulatory Surgical Centers Market By Ownership

12.6.6.3 Brazil Ambulatory Surgical Centers Market By Center Type

12.6.7 Argentina

12.6.7.1 Argentina Ambulatory Surgical Centers Market By Ownership

12.6.7.2 Argentina Ambulatory Surgical Centers Market By Ownership

12.6.7.3 Argentina Ambulatory Surgical Centers Market By Center Type

12.6.8 Colombia

12.6.8.1 Colombia Ambulatory Surgical Centers Market By Ownership

12.6.8.2 Colombia Ambulatory Surgical Centers Market By Ownership

12.6.8.3 Colombia Ambulatory Surgical Centers Market By Center Type

12.6.9 Rest Of Latin America

12.6.9.1 Rest Of Latin America Ambulatory Surgical Centers Market By Ownership

12.6.9.2 Rest Of Latin America Ambulatory Surgical Centers Market By Ownership

12.6.9.3 Rest Of Latin America Ambulatory Surgical Centers Market By Center Type

13. Company Profiles

13.1 CHSPSC, LLC.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Test Application/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 TH Medical

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Test Application / Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Envision Healthcare Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Test Application / Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 UNITEDHEALTH GROUP

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Test Application / Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Pediatrix Medical Group

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Test Application/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Healthway Medical Group

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Test Application/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Surgery Partners

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Test Application/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Prospect Medical Holdings, Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Test Application/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 SurgCenter

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Test Application/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Edward-Elmhurst Health

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Test Application/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Eifelhöhen-Klinik AG

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Test Application/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Nexus Day Surgery Centre

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Test Application/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Continuous Glucose Monitoring Market Size was valued at USD 4.62 Billion in 2023, and is expected to reach USD 8.82 Billion by 2032, and grow at a CAGR of 7.80%.

The Healthcare Market Size was valued at USD 21,222.5 Billion in 2023, and is expected to reach USD 44,760.73 Billion by 2032, and grow at a CAGR of 9.07% over the forecast period 2024-2032.

The Oligonucleotide Synthesis Market was valued at USD 3.72 billion in 2023 and is expected to reach USD 11.41 billion by 2032, growing at a CAGR of 13.27% over the forecast period of 2024-2032.

The Influenza Diagnostics Market Size was USD 1.49 billion in 2023 and will reach USD 2.45 billion by 2032, growing at a CAGR of 5.69% from 2024-2032.

The Laparoscopic Appendectomy Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 3.83 billion by 2032, growing at a CAGR of 5.08% over the forecast period of 2024-2032.

The Positron Emission Tomography (PET) Market to grow from USD 2.63 billion in 2023 to USD 4.69 billion by 2032, at 6.65%. CAGR

Hi! Click one of our member below to chat on Phone