Amaranth Oil Market Report Scope & Overview

The Amaranth Oil Market size was USD 769.43 Million in 2023 and is expected to reach USD 2002.11 Million by 2032 and grow at a CAGR of 11.21 % over the forecast period of 2024-2032. This report on the amaranth oil market provides key insights into production volume and capacity utilization across major producing countries, along with raw material pricing trends influencing market costs. It examines the regulatory framework governing food, cosmetic, and pharmaceutical applications, ensuring compliance with industry standards. Additionally, the report highlights market demand by end-use industries, including food & beverages, cosmetics, and personal care. It also covers sustainability initiatives, such as eco-friendly farming practices and carbon footprint analysis. Lastly, the study explores innovation and R&D advancements, focusing on improved extraction techniques and new product applications driving market expansion.

To Get more information on Amaranth Oil Market - Request Free Sample Report

Amaranth Oil Market Dynamics

Drivers

-

Growing demand for functional foods incorporating amaranth oil which drives market growth.

Consumer preference for healthy and nutrition-dense diets, coupled with the rising popularity of functional foods comprising of amaranth oil are the primary factors propelling growth in consumption for the global keyword market. Because amaranth endows with essential squalene, omega-6 fatty acids, and antioxidants, it is preferable for functional food development to reduce heart disease, increase immunity, and reduce inflammation. Additionally, clean-label and plant-based ingredients are increasingly highlighted trends in the food industry, which supports the utilization of amaranth oil in fortified food products including energy bars, protein isolates, and dietary supply functional food development should reduce. Moreover, the growing health consciousness along with the ongoing acceptance of natural and organic components have attracted food companies to the production of amaranth oil. The demand for functional foods fortified with amaranth oil to cater to the consumer behavior towards the preventive health care through their diet will increase which is expected to boost the market growth.

Restraint

-

Limited availability of raw materials, as amaranth cultivation is not widespread which may hamper the market growth.

The availability of raw materials comes off as one of the significant restraints to the growth of amaranth oil market. Amaranth is a niche crop, by contrast, its profitable cultivation is stored in limited places which leads to supply constraints as opposed to conventional oilseed crops such as soybean or sunflower. With low production volume, raw materials costs are higher and amaranth oil is costlier than more alternatives of plant-based oils. Furthermore, not enough large-scale farming initiatives exist, and too few are aware of its financial potential as a limited element in the supply chain. Temperature-sensitive yield structure can lead to seasonal adaptability and climate-related challenges creating supply and price variations. These reasons in combination block market growth as increased needs are unable to be satisfied by manufacturers, more so in the cosmetics, food, and pharma industries. This is a factor hindering market growth which can be overcome by increasing amaranth cultivation and enhancement of farming practices.

Opportunity

-

Expansion of plant-based and vegan product lines using amaranth oil creates an opportunity in the market.

The increasing trend of plant-based and vegan lifestyles represents a considerable opportunity for the amaranth oil market, as consumers are searching for more natural and sustainable substitutes for industrial ingredients. Amaranth oil is rich in essential fatty acids, antioxidants, and squalene similar to plant sources It has gained prominence, especially after the increased call for cruelty-free, ethically sourced products in cosmetics and personal care, making it an adopted ingredient in plant-based beauty formulations. With the scaling up of amaranth oil production, food manufacturers are using amaranth oil in vegan protein powders, and alternatives to dairy, and other functional foods, which has expanded the consumer market of amaranth oil even more (Ratan et al., 2014). The growing popularity of amaranth oil as a premium plant-based ingredient will create an ample lucrative growth opportunity, with the introduction of vegan product lines across various end-use industries.

Challenges

-

Challenges in scaling up extraction technology for cost-effective production.

The amaranth oil production method by developing unscalable and cost-effective extraction technology, the low oil yield from amaranth seeds, and the complexity of the extraction technology remain major challenges to be overcome. Because the oil content in amaranth seeds amounts to only 5–8%, high-end, efficient extraction methods, such as supercritical CO₂ extraction, or low-temperature cold-pressing methods, are required to ensure purity and nutritional value. Nonetheless, these approaches require considerable capital investment, energy, and specialized equipment, resulting in high costs for large-scale production. Moreover, maximizing extraction efficiency with minimal degradation of bioactive compounds including squalene and omega fatty acids, represents a technical challenge. Pricing constraints often reprise them from instigating technological advances for production, relegating them to fourth in the rivalry of an industry where larger players establish the read. These factors present challenges that can only be adequately addressed by continued research into and development of affordable extraction processes and the construction of large-scale and efficient oil production processes that will allow us to meet the projected demand for amaranth oil.

Amaranth Oil Market Segmentation Analysis

By Extraction Process

Cold pressing process held the largest market share around 40% in 2023. It is due to the preservation of nutrition inside the oil, purity, and bioactive compounds. Coupled with the safe and effective nature relative to other oil-extraction methods such as solvent extraction or high-temperature methods, which employ high-pressure or chemical solvents and affect the natural properties of the oil, cold pressing is a very suitable method in cosmetics, pharmaceutical, and functional food products for further use. Moreover, the increasing consumer demand for organic and lightly processed oils is another important factor contributing to the market growth of cold-pressed amaranth oil, especially in health-conscious and vegan communities. Cold pressing continues to dominate the cold-pressed oil sector, despite its low extraction efficiency compared to other methods, due to increasing awareness about clean-label and natural ingredient sourcing.

By Application

Cosmetics & Personal Care held the largest market share around 32% in 2023. The high levels of essential fatty acids and antioxidants, as well as squalene, a potent bioactive compound found in amaranth oil, make the oil an effective agent for skin aging, skin hydration, and overall skin rejuvenation. The increase in consumer demand for natural and organic ingredients, as well as clean-label trends, have indirectly increased its application the premium cosmetic products. This strengthens amaranth oil's leading position in the market as manufacturers integrate it into formulations aimed at improving performance and safety. In addition to this, marketing strategies and endorsement from various regulatory agencies around the world supporting natural ingredients also play an important role in making this segment dominant.

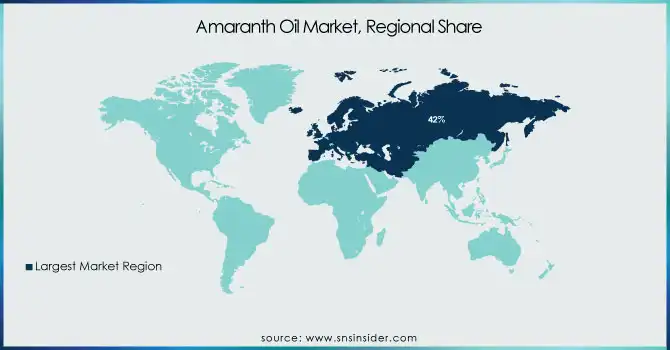

Amaranth Oil Market Regional Outlook

Europe held the largest market share around 42% in 2023. It is owing to various factors such as higher consumption of natural and organic ingredients due to higher demand from the consumers in the region along with the higher demand of Amaranth Oil from the cosmetics and personal care and food supplement sector. Rising consumption of clean-label products and sustainable sourcing in European countries have boosted the inclusion of high-purity amaranth oil among manufacturers. A strong regulatory framework and emphasis on stricter quality standards in the region also drive innovations and ensure product safety. Moreover, large-scale research and development investment and wide support from the government in sustainable agriculture have bolstered the supply chain support and improved production abilities. Together these factors place Europe at the front of the global amaranth oil market.

Asia Pacific held a significant market share in 2023. It can be attributed to favorable agriculture conditions and supply of cost-effective production capacity. It cools the region, has plentiful farmland and growing seasons suitable for growing amaranth in abundance, which lowers raw material prices. Demand in several sectors, such as food supplements, cosmetics, and pharmaceuticals, has also been driven by heightened consumer awareness of the health benefits of natural and organic ingredients. Investment in new processing technologies and progressive governmental policies has also increased production efficiency and product quality. All these factors make Asia Pacific a region that is expected to provide strong leadership to the global amaranth oil market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amaranth Bio Company (Amaranth Seed Oil, Amaranth Squalene Oil)

-

Proderna Biotech (Refined Amaranth Oil, Cold-Pressed Amaranth Oil)

-

Flavex Naturextrakte GmbH (CO2-Extracted Amaranth Oil, Organic Amaranth Oil)

-

Rusoliva Pvt. Ltd. (Pure Amaranth Oil, Cosmetic-Grade Amaranth Oil)

-

Sash Industries (Amaranth Carrier Oil, Natural Amaranth Oil)

-

Nans Products (Edible Amaranth Oil, Amaranth Extract)

-

Ashahi Chemical (Pharmaceutical-Grade Amaranth Oil, Squalene-Enriched Amaranth Oil)

-

D.K. Mass S.R.O. (Virgin Amaranth Oil, Squalene-Rich Amaranth Oil)

-

Nature Fuel Nordic (High-Purity Amaranth Oil, Amaranth Oil Capsules)

-

Shyam Industries (Cold-Pressed Amaranth Oil, Essential Amaranth Oil)

-

Ekologie Forte Pvt. Ltd. (Organic Amaranth Oil, Extra Virgin Amaranth Oil)

-

Nuvaria Ingredients (Food-Grade Amaranth Oil, Cosmetic-Grade Amaranth Oil)

-

AltaCare Laboratoires (Amaranth Oil for Skincare, Nutraceutical Amaranth Oil)

-

Greenfield USA Inc. (Refined Amaranth Oil, Amaranth Oil Concentrate)

-

Henry Lamotte Oils GmbH (Premium Amaranth Oil, Amaranth Oil for Pharmaceuticals)

-

Oilseed International Ltd. (Cold-Processed Amaranth Oil, Amaranth Oil Extract)

-

Erbacher Food Intelligence (Functional Amaranth Oil, Amaranth-Based Supplements)

-

Swanson Health Products (Amaranth Oil Softgels, Amaranth Oil for Dietary Supplements)

-

Unicorn Ingredients Ltd. (Organic Amaranth Oil, Sustainable Amaranth Oil)

-

Croda International Plc (Cosmetic Amaranth Oil, Amaranth-Based Emollients)

Recent Development:

-

In 2023, Amaranth Bio Company introduced a premium organic cold-pressed amaranth oil variant. This new offering is enriched with enhanced bioactive compounds, providing improved nutritional and therapeutic benefits.

-

In 2023, Proderna Biotech unveiled a state-of-the-art extraction facility. This new facility significantly enhances production capacity and efficiency in processing high-quality amaranth oil.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 769.43 Million |

| Market Size by 2032 | USD 2002.11 Million |

| CAGR | CAGR of 11.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Extraction (Supercritical Fluid CO2 Extraction Process, Cold Pressing Process, Organic Solvent (Hexane) Extraction Process, Others), •By Application (Cosmetics & Personal Care, Food Supplements, Pharmaceuticals, Aroma, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amaranth Bio Company, Proderna Biotech, Flavex Naturextrakte GmbH, Rusoliva Pvt. Ltd., Sash Industries, Nans Products, Ashahi Chemical, D.K. Mass S.R.O., Nature Fuel Nordic, Shyam Industries, Ekologie Forte Pvt. Ltd., Nuvaria Ingredients, AltaCare Laboratoires, Greenfield USA Inc., Henry Lamotte Oils GmbH, Oilseed International Ltd., Erbacher Food Intelligence, Swanson Health Products, Unicorn Ingredients Ltd., Croda International Plc. |