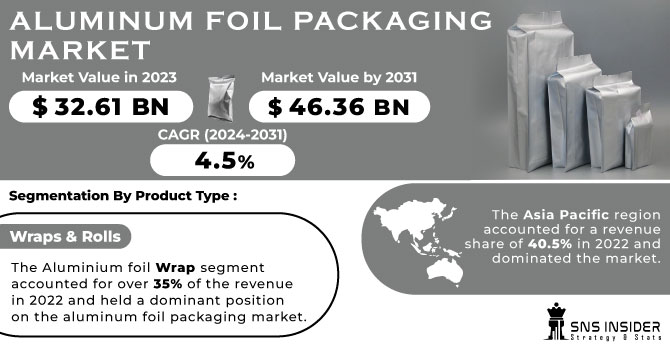

The Aluminum Foil Packaging Market size was USD 32.61 billion in 2023 and is expected to Reach USD 46.36 billion by 2031 and grow at a CAGR of 4.5% over the forecast period of 2024-2031.

The main driver for the industry's growth could be the increasing application of aluminum foil in food and beverage packaging applications. In view of the growing urban population as well as changes in consumer lifestyle, processed foods are experiencing strong growth.

Get More Information on Aluminum Foil Packaging Market - Request Sample Report

Moreover, China's annual production of aluminium in 2022 grew by 4.5% from last year to a record 40.21 million tonnes helped by the addition of new and expanded capacities as well as easing capacity constraints on energy supply etc. According to the National Bureau of Statistics it is already at an all time high.

Sustainability of aluminium provides businesses with a competitive advantage and at the same time gives rise to product development advantages. Almost 75% of all aluminium produced in the world continues to be used, according to the Aluminum Association. Furthermore, aluminum waste is not added to water or soil with toxic constituents and can be economically recycled and sustainable when it is disposed of.

KEY DRIVERS:

Increasing adoption of the food industry in the world

The main driving factor for the market's growth is considered to be the growing adoption of aluminum foil in the food sector. The superior barrier properties, such as high moisture resistance and protection from light, are provided by aluminum foil. Aluminum is an excellent material for transporting food materials due to these elements. The convenience and portability of aluminum foil packaging is a benefit to consumers. Aluminium foils offer an added value for food packaging solutions, due to their heat conductivity.

RESTRAIN:

Aluminium foil has been associated with undesirable effects on the health

The production of aluminium foil involves the extraction of bauxite ore that has a significant environmental impact, including habitat destruction and soil erosion. In addition, there is a large amount of energy to be consumed in the production process that contributes to greenhouse gas emissions and climate change. The growth of industries that have a large impact on the environment may be affected by increased awareness and regulations designed to reduce carbon footprints and promote environmentally sound practices.

OPPORTUNITY

Environmental concerns have led to an increase in the demand for Sustainable Packaging Materials

The sustainability objectives of consumers and businesses are aligned with aluminium foil, which is a highly recycled material. The manufacturer can exploit this opportunity by promoting the recycling and reuse characteristics of aluminum foil packaging. In addition, the sustainability profile of aluminium foil packaging can also be improved by exploring alternatives with a less impact on the environment, like bio based or compostable films.

CHALLENGES

Cost Fluctuations and availability of raw materials is a challenge

The production of aluminium foils is influenced by variations in raw material cost, including the price of alumina. Within the aluminium foil packaging sector, price fluctuations may have a bearing on production costs and total profitability.

The war had affected the supply of aluminium and, moreover, resulted in additional costs for these materials. The manufacturers of aluminium foil packaging have therefore had difficulty in producing and selling their products. Aluminium, which is a primary raw material used to produce aluminium foil packaging, was badly hit by the war. This lack has led to an increase in the price of aluminium and, consequently, a higher cost for aluminum foil packaging. The supply chain for aluminium foil packaging has also been adversely affected by the war. In order to obtain raw materials and components, a number of aluminium foil packaging producers are relying upon suppliers in Russia and Ukraine. These manufacturers were faced with difficulties in producing and marketing their products due to a disruption of the supply chain.

Disruptions in supply can also affect Russian aluminum production, since Rusal has been reduced from 68% of its alumina imports. In 2021, Ukraine had the highest share of these imports, amounting to 36%. However, the major The conflict has led to the closing down of Ukraine's alumina refinery. In 2021, Australia had been the second most significant source of alumina imports from Russia, accounting for 32%.

The duty on imported unprocessed aluminium from Russia has risen to between 10% and 25.0%, having been between 0 and 2.6%. 1 In addition, the major The concern that further import restrictions could also be imposed on Rusal aluminum products has arisen from the allegations of its association with the Kremlin. The U.S. imports the most aluminum in the world.

The decrease in consumer spending is one of the main reasons why growth is projected to slow down. Consumers are likely to reduce their discretionary spending, e.g. in the form of packaging goods, due to reduced amounts of cash at their disposal. This will lead to a decrease in demand for aluminum foil packaging. The increase in raw material costs is another factor likely to affect the aluminum foil packaging market. In recent months, as a result of many factors such as the war in Ukraine and supply chain disruption, aluminum prices have risen. The costs of aluminium foil packaging are expected to increase, which is likely to result in further pressure on demand.

By Type

Backed Foil

Rolled Foil

Others

By Product Type

Wraps & Rolls

Containers

Bags & Pouches

Blisters

Others

The aluminium foil wrap segment accounted for over 35% of the revenue in 2022 and held a dominant position on the aluminum foil packaging market. It is used in snack pouches, liquid boxes, candy wrappers, confectionery wraps and pharmaceutical packaging as one of the layers. Foil wraps have become an important product segment due to these extensive applications in the end use industries.

By Packaging Type

Flexible

Semi-Rigid

Others

By Application

Food & Beverages

Pharmaceutical

Personal Care & Cosmetics

Others

In 2022, the food and beverages sector was dominant, with a revenue share of 48 %. For the packaging of bakery products, dairy products, chocolates, coffee tea, dry foodstuffs, beverages and meat and shellfish it is generally used to include pouches, containers, capsules or lids. For the packaging of food and beverages, aluminium foils are also widely used for their flexibility, safety characteristics, wide availability and lower cost due to a variety of factors.

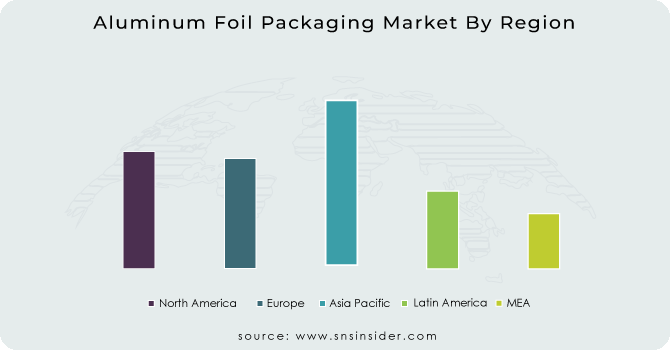

The Asia Pacific region accounted for a revenue share of 40.5% in 2022 and dominated the market. The market in Asia Pacific is growing, driven by an increasing middle class population and the growth of consumer markets for end use products such as food, beverages or pharmaceuticals. With high investments in the manufacturing sector, coupled with an extensive consumer base in these countries, India and China are likely to emerge as key markets for this product.

Due to their efficient single dose packaging and ease of use, pharmaceutical companies in the United States are gradually switching to flexible packaging products such as blisters. It is likely that this positive trend in the case of blister packs will provide significant growth opportunities for aluminum foil packaging.

Due to growing awareness amongst consumers of sustainable packaging solutions, the market in Europe is expected to experience significant growth. In addition, a positive impact on the industry may be achieved by strict government regulation in this area to limit use of plastic packaging.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Aluminum Foil Packaging market are Camvac, Constantia Flexibles, Amcor plc, Reynolds group holdings limited, Ardagh Group, Aleris Corporation, JW Aluminum, Eurofoil Luxembourg S.A, Express Flexi Pack, Ampco and other players.

In order to replace standard foils, Camvac has announced the introduction of Camfoil, a flexible, multi laminated, metallized laminate using the patented barrier coating technology of the company.

| Report Attributes | Details |

| Market Size in 2023 | US$ 32.61 Bn |

| Market Size by 2031 | US$ 46.36 Bn |

| CAGR | CAGR of 4.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Backed Foil, Rolled Foil, Others) • by Product Type (Wraps & Rolls, Containers, Bags & Pouches, Blisters, Others) • by Packaging Type (Flexible, Semi-Rigid, Others) • by Application (Food & Beverages, Pharmaceutical, Personal Care & Cosmetics, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Camvac, Constantia Flexibles, Amcor plc, Reynolds group holdings limited, Ardagh Group, Aleris Corporation, JW Aluminum, Eurofoil Luxembourg S.A, Express Flexi Pack, Ampco |

| Key Drivers | • Increasing adoption of the food industry in the world |

| Key Restraints | • Aluminium foil has been associated with undesirable effects on the health. |

Ans. The Compound Annual Growth rate for Aluminum Foil Packaging Market over the forecast period is 4.3 %.

Ans. USD 31.20 billion is the projected Aluminum Foil Packaging market size of market by 2030.

Ans. The Asia Pacific region accounted for a revenue share of 40.5 % in 2022 and dominated the market.

Ans. Aluminium foil has been associated with undesirable effects on the health which may affect the market growth.

Ans. Increasing adoption of the food industry in the world will drive the market growth.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Aluminum Foil Packaging Market Segmentation, by Type

8.1 Backed Foil

8.2 Rolled Foil

8.3 Others

9. Aluminum Foil Packaging Market Segmentation, by Product Type

9.1 Wraps & Rolls

9.2 Containers

9.3 Bags & Pouches

9.4 Blisters

9.5 Others

10. Aluminum Foil Packaging Market Segmentation, by Packaging Type

10.1 Flexible

10.2 Semi-Rigid

10.3 Others

11. Aluminum Foil Packaging Market Segmentation, by Application

11.1 Food & Beverages

11.2 Pharmaceutical

11.3 Personal Care & Cosmetics

11.4 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Aluminum Foil Packaging Market by Country

12.2.2North America Aluminum Foil Packaging Market by Type

12.2.3 North America Aluminum Foil Packaging Market by Product Type

12.2.4 North America Aluminum Foil Packaging Market by Packaging Type

12.2.5 North America Aluminum Foil Packaging Market by Application

12.2.6 USA

12.2.6.1 USA Aluminum Foil Packaging Market by Type

12.2.6.2 USA Aluminum Foil Packaging Market by Product Type

12.2.6.3 USA Aluminum Foil Packaging Market by Packaging Type

12.2.6.4 USA Aluminum Foil Packaging Market by Application

12.2.7 Canada

12.2.7.1 Canada Aluminum Foil Packaging Market by Type

12.2.7.2 Canada Aluminum Foil Packaging Market by Product Type

12.2.7.3 Canada Aluminum Foil Packaging Market by Packaging Type

12.2.7.4 Canada Aluminum Foil Packaging Market by Application

12.2.8 Mexico

12.2.8.1 Mexico Aluminum Foil Packaging Market by Raw Packaging Type

12.2.8.2 Mexico Aluminum Foil Packaging Market by Product Type

12.2.8.3 Mexico Aluminum Foil Packaging Market by Packaging Type

12.2.8.4 Mexico Aluminum Foil Packaging Market by Application

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Aluminum Foil Packaging Market by Country

12.3.1.2 Eastern Europe Aluminum Foil Packaging Market by Type

12.3.1.3 Eastern Europe Aluminum Foil Packaging Market by Product Type

12.3.1.4 Eastern Europe Aluminum Foil Packaging Market by Packaging Type

12.3.1.5 Eastern Europe Aluminum Foil Packaging Market by Application

12.3.1.6 Poland

12.3.1.6.1 Poland Aluminum Foil Packaging Market by Type

12.3.1.6.2 Poland Aluminum Foil Packaging Market by Product Type

12.3.1.6.3 Poland Aluminum Foil Packaging Market by Packaging Type

12.3.1.6.4 Poland Aluminum Foil Packaging Market by Application

12.3.1.7 Romania

12.3.1.7.1 Romania Aluminum Foil Packaging Market by Type

12.3.1.7.2 Romania Aluminum Foil Packaging Market by Product Type

12.3.1.7.3 Romania Aluminum Foil Packaging Market by Packaging Type

12.3.1.7.4 Romania Aluminum Foil Packaging Market by Application

12.3.1.8 Hungary

12.3.1.8.1 Hungary Aluminum Foil Packaging Market by Type

12.3.1.8.2 Hungary Aluminum Foil Packaging Market by Product Type

12.3.1.8.3 Hungary Aluminum Foil Packaging Market by Packaging Type

12.3.1.8.4 Hungary Aluminum Foil Packaging Market by Application

12.3.1.9 Turkey

12.3.1.9.1 Turkey Aluminum Foil Packaging Market by Type

12.3.1.9.2 Turkey Aluminum Foil Packaging Market by Product Type

12.3.1.9.3 Turkey Aluminum Foil Packaging Market by Packaging Type

12.3.1.9.4 Turkey Aluminum Foil Packaging Market by Application

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Aluminum Foil Packaging Market by Type

12.3.1.10.2 Rest of Eastern Europe Aluminum Foil Packaging Market by Product Type

12.3.1.10.3 Rest of Eastern Europe Aluminum Foil Packaging Market by Packaging Type

12.3.1.10.4 Rest of Eastern Europe Aluminum Foil Packaging Market by Application

12.3.2 Western Europe

12.3.2.1 Western Europe Aluminum Foil Packaging Market by Country

12.3.2.2 Western Europe Aluminum Foil Packaging Market by Type

12.3.2.3 Western Europe Aluminum Foil Packaging Market by Product Type

12.3.2.4 Western Europe Aluminum Foil Packaging Market by Packaging Type

12.3.2.5 Western Europe Aluminum Foil Packaging Market by Application

12.3.2.6 Germany

12.3.2.6.1 Germany Aluminum Foil Packaging Market by Type

12.3.2.6.2 Germany Aluminum Foil Packaging Market by Product Type

12.3.2.6.3 Germany Aluminum Foil Packaging Market by Packaging Type

12.3.2.6.4 Germany Aluminum Foil Packaging Market by Application

12.3.2.7 France

12.3.2.7.1 France Aluminum Foil Packaging Market by Type

12.3.2.7.2 France Aluminum Foil Packaging Market by Product Type

12.3.2.7.3 France Aluminum Foil Packaging Market by Packaging Type

12.3.2.7.4 France Aluminum Foil Packaging Market by Application

12.3.2.8 UK

12.3.2.8.1 UK Aluminum Foil Packaging Market by Type

12.3.2.8.2 UK Aluminum Foil Packaging Market by Product Type

12.3.2.8.3 UK Aluminum Foil Packaging Market by Packaging Type

12.3.2.8.4 UK Aluminum Foil Packaging Market by Application

12.3.2.9 Italy

12.3.2.9.1 Italy Aluminum Foil Packaging Market by Type

12.3.2.9.2 Italy Aluminum Foil Packaging Market by Product Type

12.3.2.9.3 Italy Aluminum Foil Packaging Market by Packaging Type

12.3.2.9.4 Italy Aluminum Foil Packaging Market by Application

12.3.2.10 Spain

12.3.2.10.1 Spain Aluminum Foil Packaging Market by Type

12.3.2.10.2 Spain Aluminum Foil Packaging Market by Product Type

12.3.2.10.3 Spain Aluminum Foil Packaging Market by Packaging Type

12.3.2.10.4 Spain Aluminum Foil Packaging Market by Application

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Aluminum Foil Packaging Market by Type

12.3.2.11.2 Netherlands Aluminum Foil Packaging Market by Product Type

12.3.2.11.3 Netherlands Aluminum Foil Packaging Market by Packaging Type

12.3.2.11.4 Netherlands Aluminum Foil Packaging Market by Application

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Aluminum Foil Packaging Market by Type

12.3.2.12.2 Switzerland Aluminum Foil Packaging Market by Product Type

12.3.2.12.3 Switzerland Aluminum Foil Packaging Market by Packaging Type

12.3.2.12.4 Switzerland Aluminum Foil Packaging Market by Application

12.3.2.13 Austria

12.3.2.13.1 Austria Aluminum Foil Packaging Market by Type

12.3.2.13.2 Austria Aluminum Foil Packaging Market by Product Type

12.3.2.13.3 Austria Aluminum Foil Packaging Market by Packaging Type

12.3.2.13.4 Austria Aluminum Foil Packaging Market by Application

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Aluminum Foil Packaging Market by Type

12.3.2.14.2 Rest of Western Europe Aluminum Foil Packaging Market by Product Type

12.3.2.14.3 Rest of Western Europe Aluminum Foil Packaging Market by Packaging Type

12.3.2.14.4 Rest of Western Europe Aluminum Foil Packaging Market by Application

12.4 Asia-Pacific

12.4.1 Asia Pacific Aluminum Foil Packaging Market by Country

12.4.2 Asia Pacific Aluminum Foil Packaging Market by Type

12.4.3 Asia Pacific Aluminum Foil Packaging Market by Product Type

12.4.4 Asia Pacific Aluminum Foil Packaging Market by Packaging Type

12.4.5 Asia Pacific Aluminum Foil Packaging Market by Application

12.4.6 China

12.4.6.1 China Aluminum Foil Packaging Market by Type

12.4.6.2 China Aluminum Foil Packaging Market by Product Type

12.4.6.3 China Aluminum Foil Packaging Market by Packaging Type

12.4.6.4 China Aluminum Foil Packaging Market by Application

12.4.7 India

12.4.7.1 India Aluminum Foil Packaging Market by Type

12.4.7.2 India Aluminum Foil Packaging Market by Product Type

12.4.7.3 India Aluminum Foil Packaging Market by Packaging Type

12.4.7.4 India Aluminum Foil Packaging Market by Application

12.4.8 Japan

12.4.8.1 Japan Aluminum Foil Packaging Market by Type

12.4.8.2 Japan Aluminum Foil Packaging Market by Product Type

12.4.8.3 Japan Aluminum Foil Packaging Market by Packaging Type

12.4.8.4 Japan Aluminum Foil Packaging Market by Application

12.4.9 South Korea

12.4.9.1 South Korea Aluminum Foil Packaging Market by Type

12.4.9.2 South Korea Aluminum Foil Packaging Market by Product Type

12.4.9.3 South Korea Aluminum Foil Packaging Market by Packaging Type

12.4.9.4 South Korea Aluminum Foil Packaging Market by Application

12.4.10 Vietnam

12.4.10.1 Vietnam Aluminum Foil Packaging Market by Type

12.4.10.2 Vietnam Aluminum Foil Packaging Market by Product Type

12.4.10.3 Vietnam Aluminum Foil Packaging Market by Packaging Type

12.4.10.4 Vietnam Aluminum Foil Packaging Market by Application

12.4.11 Singapore

12.4.11.1 Singapore Aluminum Foil Packaging Market by Type

12.4.11.2 Singapore Aluminum Foil Packaging Market by Product Type

12.4.11.3 Singapore Aluminum Foil Packaging Market by Packaging Type

12.4.11.4 Singapore Aluminum Foil Packaging Market by Application

12.4.12 Australia

12.4.12.1 Australia Aluminum Foil Packaging Market by Type

12.4.12.2 Australia Aluminum Foil Packaging Market by Product Type

12.4.12.3 Australia Aluminum Foil Packaging Market by Packaging Type

12.4.12.4 Australia Aluminum Foil Packaging Market by Application

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Aluminum Foil Packaging Market by Type

12.4.13.2 Rest of Asia-Pacific APAC Aluminum Foil Packaging Market by Product Type

12.4.13.3 Rest of Asia-Pacific Aluminum Foil Packaging Market by Packaging Type

12.4.13.4 Rest of Asia-Pacific Aluminum Foil Packaging Market by Application

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Aluminum Foil Packaging Market by country

12.5.1.2 Middle East Aluminum Foil Packaging Market by Type

12.5.1.3 Middle East Aluminum Foil Packaging Market by Product Type

12.5.1.4 Middle East Aluminum Foil Packaging Market by Packaging Type

12.5.1.5 Middle East Aluminum Foil Packaging Market by Application

12.5.1.6 UAE

12.5.1.6.1 UAE Aluminum Foil Packaging Market by Type

12.5.1.6.2 UAE Aluminum Foil Packaging Market by Product Type

12.5.1.6.3 UAE Aluminum Foil Packaging Market by Packaging Type

12.5.1.6.4 UAE Aluminum Foil Packaging Market by Application

12.5.1.7 Egypt

12.5.1.7.1 Egypt Aluminum Foil Packaging Market by Type

12.5.1.7.2 Egypt Aluminum Foil Packaging Market by Product Type

12.5.1.7.3 Egypt Aluminum Foil Packaging Market by Packaging Type

12.5.1.7.4 Egypt Aluminum Foil Packaging Market by Application

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Aluminum Foil Packaging Market by Type

12.5.1.8.2 Saudi Arabia Aluminum Foil Packaging Market by Product Type

12.5.1.8.3 Saudi Arabia Aluminum Foil Packaging Market by Packaging Type

12.5.1.8.4 Saudi Arabia Aluminum Foil Packaging Market by Application

12.5.1.9 Qatar

12.5.1.9.1 Qatar Aluminum Foil Packaging Market by Type

12.5.1.9.2 Qatar Aluminum Foil Packaging Market by Product Type

12.5.1.9.3 Qatar Aluminum Foil Packaging Market by Packaging Type

12.5.1.9.4 Qatar Aluminum Foil Packaging Market by Application

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Aluminum Foil Packaging Market by Type

12.5.1.10.2 Rest of Middle East Aluminum Foil Packaging Market by Product Type

12.5.1.10.3 Rest of Middle East Aluminum Foil Packaging Market by Packaging Type

12.5.1.10.4 Rest of Middle East Aluminum Foil Packaging Market by Application

12.5.2. Africa

12.5.2.1 Africa Aluminum Foil Packaging Market by country

12.5.2.2 Africa Aluminum Foil Packaging Market by Type

12.5.2.3 Africa Aluminum Foil Packaging Market by Product Type

12.5.2.4 Africa Aluminum Foil Packaging Market by Packaging Type

12.5.2.5 Africa Aluminum Foil Packaging Market by Application

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Aluminum Foil Packaging Market by Type

12.5.2.6.2 Nigeria Aluminum Foil Packaging Market by Product Type

12.5.2.6.3 Nigeria Aluminum Foil Packaging Market by Packaging Type

12.5.2.6.4 Nigeria Aluminum Foil Packaging Market by Application

12.5.2.7 South Africa

12.5.2.7.1 South Africa Aluminum Foil Packaging Market by Type

12.5.2.7.2 South Africa Aluminum Foil Packaging Market by Product Type

12.5.2.7.3 South Africa Aluminum Foil Packaging Market by Packaging Type

12.5.2.7.4 South Africa Aluminum Foil Packaging Market by Application

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Aluminum Foil Packaging Market by Type

12.5.2.8.2 Rest of Africa Aluminum Foil Packaging Market by Product Type

12.5.2.8.3 Rest of Africa Aluminum Foil Packaging Market by Packaging Type

12.5.2.8.4 Rest of Africa Aluminum Foil Packaging Market by Application

12.6. Latin America

12.6.1 Latin America Aluminum Foil Packaging Market by country

12.6.2 Latin America Aluminum Foil Packaging Market by Type

12.6.3 Latin America Aluminum Foil Packaging Market by Product Type

12.6.4 Latin America Aluminum Foil Packaging Market by Packaging Type

12.6.5 Latin America Aluminum Foil Packaging Market by Application

12.6.6 Brazil

12.6.6.1 Brazil Aluminum Foil Packaging Market by Type

12.6.6.2 Brazil Africa Aluminum Foil Packaging Market by Product Type

12.6.6.3 Brazil Aluminum Foil Packaging Market by Packaging Type

12.6.6.4 Brazil Aluminum Foil Packaging Market by Application

12.6.7 Argentina

12.6.7.1 Argentina Aluminum Foil Packaging Market by Type

12.6.7.2 Argentina Aluminum Foil Packaging Market by Product Type

12.6.7.3 Argentina Aluminum Foil Packaging Market by Packaging Type

12.6.7.4 Argentina Aluminum Foil Packaging Market by Application

12.6.8 Colombia

12.6.8.1 Colombia Aluminum Foil Packaging Market by Type

12.6.8.2 Colombia Aluminum Foil Packaging Market by Product Type

12.6.8.3 Colombia Aluminum Foil Packaging Market by Packaging Type

12.6.8.4 Colombia Aluminum Foil Packaging Market by Application

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Aluminum Foil Packaging Market by Type

12.6.9.2 Rest of Latin America Aluminum Foil Packaging Market by Product Type

12.6.9.3 Rest of Latin America Aluminum Foil Packaging Market by Packaging Type

12.6.9.4 Rest of Latin America Aluminum Foil Packaging Market by Application

13 Company Profile

13.1 Camvac

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Amcor plc

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Constantia Flexibles

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Reynolds group holdings limited

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Ardagh Group

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Aleris Corporation

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 JW Aluminum

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Eurofoil Luxembourg S.A

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Express Flexi Pack

13.9.1 Company Overview

13.9.2 Financials

13.9.3 Product/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Ampco

13.10.1 Company Overview

13.10.2 Financials

13.10.3 Product/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments’

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Disposable Straw Market size was USD 19.5 billion in 2023 and is expected to Reach USD 28.59 billion by 2031 and grow at a CAGR of 4.9% over the forecast period of 2024-2031.

The Rigid Plastic Packaging Market size was USD 147282.50 million in 2023 and is expected to Reach USD 224324.15 million by 2031 and grow at a CAGR of 5.4 % over the forecast period of 2024-2031.

In 2023, the E-Commerce Logistics Market was USD 462.26 billion. It is projected to grow significantly to USD 2585.37 billion by 2032, with CAGR of 21.56%.

The Secure Logistics Market Size was valued at USD 86 billion in 2023 and is projected to reach USD 173.35 billion by 2032 growing at a CAGR of 8.1% from 2024 to 2032.

The Interactive Packaging Market size was USD 33.9 billion in 2023 and is expected to Reach USD 54.06 billion by 2031 and grow at a CAGR of 6.0% over the forecast period of 2024-2031.

The Metalized Flexible Packaging Market size was valued at USD 4.72 billion in 2023 and is expected to Reach USD 6.98 billion by 2031 and grow at a CAGR of 5.01% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone