To get more information on Aluminium Die Casting Machines Market - Request Free Sample Report

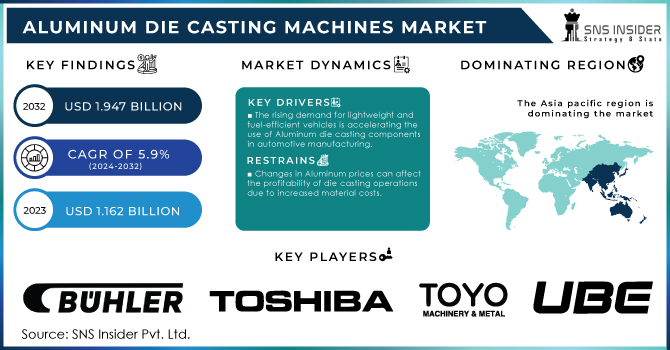

The Aluminum Die Casting Machines Market Size was esteemed at USD 1.162 Billion in 2023 and is supposed to arrive at USD 1.947 Billion by 2032 with a growing CAGR of 5.9% over the forecast period 2024-2032.

The use of Aluminum for manufacturing motor vehicles has seen vast expansion over the previous several years and is anticipated to continue growing in the future. Aluminum is less heavy than steel, with a density that is about one-third of steel. Furthermore, Aluminum has good ductility, corrosion resistance, and malleability. More advantageous braking, acceleration, and handlings are provided by cars that are made of Aluminum. The most significant benefit of using Aluminum for manufacturing motor vehicles is the fuel economy. Aluminum vehicles are safer, as they can stop in less time, significantly reducing the likelihood of crashing a vehicle. Additionally, there are notable environmental advantages. Approximately 90% of car scrap is recycled and extracted. These advancements will assist in the growth of the applications of Aluminum for manufacturing motor vehicles. Concerning this, U.S. made vehicles were charged the same 15% duty that China had imposed on most of her principal trading allies. Vehicles HS codes (8703 and 8704) were incorporated in the U.S. China Phase One Trade Agreement. As such, tariff dispensation was offered. These developments outline prospective openings for exporters in the United States. Such efforts include the realization of wholesale freedom of purchase for China 5 Emission Standard vehicles, the promotion of electric vehicles consumption, a decrease in the car sales tax, and facilitating the parallel import policy for vehicles. This tentative agreement would effectively add consumption by about USD 30 billion per year.

Oxygen-fuelled die casting can be used to produce a wide range of castings made of Aluminum including computer brackets, heat exchanger housings, hydraulic transmission valve bodies, and housing for hydraulic transmissions. Also, for die castings which require heat treatment or busting, have high air tightness, and are used at higher temperatures, oxygenated die casting provides technical and financial advantages. In the semi-solid metal casting process, a liquid metal is solidified while simultaneously being cooled, such as by cooling it to any temperature below its melting point and above its solidification temperature. As soon as possible thereafter, the slurry containing at least 50% solid phase material is then generated by die casting. There are currently two procedures for semi-solid die casting. Flow forming and thixoforming. In the former, liquid metal is fed into an injection moulding barrel specially made for this purpose. This barrel is then subjected to shearing by a screw mechanism, cooling by the shearing, to produce a semi-solid slurry, and finally die casting. In the second method, the die-casting semi-solid metal particles are fed into a screw injection moulding machine under heating and shearing conditions.

MARKET DYNAMICS

DRIVER

The rising demand for lightweight and fuel-efficient vehicles is accelerating the use of Aluminum die casting components in automotive manufacturing.

The automotive industry is gradually becoming more inclined to the creation of lightweight and fuel-efficient vehicles due to strict environmental regulations and consumer preferences varying from better performance to decreased emissions of carbon-based fuels. The increased interest towards the application of Aluminum die casting components in the automotive industry is being observed. Such a trend is supported by the fact that Aluminum die casting offers a range of important benefits for the automotive industry. First, Aluminum is a light material. Therefore, the replacement of the conventional materials used in the automotive industry with use of Aluminum casting, can let creating light-weighting vehicles. In other words, the overall weight of a vehicle can be reduced, which is important for both enhancing fuel efficiency and reducing carbon emissions.

Aluminum die casting is a relatively expensive process, it is unsuitable for stainless steel and some other relatively strong and corrosion-resistant materials. However, on the other hand, this process offers better opportunities for shaping and hollowing the workpiece. Moreover, producing complex details with high precision and good quality of surface that is important in the modern automotive construction becomes possible. Finally, the die-cast components can be produced faster and cheaper due to the process high efficacy and possibility to manufacture large batches of workpieces with minimum waste. It is not to be wondered that in the context of continuous increase in performance characteristics and beauty of modern vehicles the technology is becoming increasingly popular. In particular, Aluminum die casting is perfectly suited for producing the most critical car components like blocks of engines, cases of transmissions, and various structural components. Overall, the tendency of the automotive industry to increasing technology intensity, safer and more comfortable cars favour the use of Aluminum die casting because the pressure-resistant safety components and many other parts that meet the stringent requirement for durability, strength, lightness, etc. are made of Aluminum.

Aluminum superior thermal conductivity and lightweight properties make it ideal for electric vehicle (EV) components, increasing the need for die casting machines.

Aluminum’s outstanding thermal conductivity and lightweight make it ideal for electric vehicle components. Hence, the demand for die casting machines has been on the rise. Notably, Aluminum’s outstanding thermal conductivity allows effective heat dissipation which is an essential characteristic required for any electric vehicle component. Some notable Aluminum electric vehicle components that require effective heat management include battery housings, motor housings, and the thermal management system. The optimization of heat is crucial since it is widely regarded as a performance and life-determining factor of the electric vehicle components. The die casting process is particularly important for electric vehicles since it produces high-quality products that make using Aluminum the best choice. The reduced weight that comes Aluminum is also another consideration that makes the use of die casting the best choice. Notably, the reduced weight of the component makes the product less clear. The lightweight components also account for the reduced weight of the electric vehicle since more electric vehicle components are made up of Aluminum. For electric vehicles, every pound reduced extends the distance that the battery can travel per charge. Additionally, the parts manufactured using the die casting process is loved due to its surface finish quality that provides an excellent aesthetic. The outstanding die casting machine can produce large quantities of electric vehicle components made of Aluminum. The quality produced is also very precise due to the dimensional accuracy of the die-cast machine. Therefore, given that the rest of the automotive industry is getting electrified, the need for die casting machines is expected to rise.

RESTRAIN

Changes in Aluminum prices can affect the profitability of die casting operations due to increased material costs.

Aluminum price fluctuations could affect the profitability of die casting operations. The fact that Aluminum is a primary material in the die casting process denotes that it would always be a significant percentage of the production costs. When procedural costs increase due to rising Aluminum prices, companies are unable to pass them to the customer, and therefore profit margins would be squeezed. On the other hand, falling Aluminum prices would erode production costs and might increase the prospect of better profitability in the industry. Therefore, it is apparently clear that there is a need to prefer long-term contracts or the use of hedging in addressing the potential impacts of price fluctuations. This is an important strategy when one realizes that effectual management of Aluminum costs is critical in subsidizing fair pricing and minimizing financial implications.

Environmental Concerns the die casting process may produce emissions and waste, requiring investments in pollution control measures.

The die casting process creates considerable environmental concerns due to emissions and waste. At high temperatures necessary for the melting and casting of metals, the release of pollutants is inevitable; namely, volatile organic compounds and particulate matter, among others, are released. At the same time, waste castings including spent sand from the casting process, as well as scrap metal, also contribute to environmental depletion. The solution to these problems presupposes the use of pollution control equipment, which means a considerable financial investment. Regulations make the use of advanced filtration devices and recycling mandatory for die casters. Although these measures are likely to reduce the negative impact of a facility on the environment, the use of these devices will result in a higher cost.

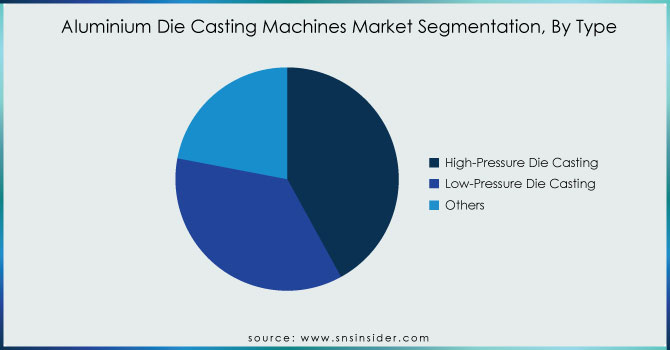

By Type

High-Pressure Die Casting

Low-Pressure Die Casting

Others

The high-pressure dominated the die casting market in 2023 with the market share of over 42%. It is the most common method as it allows producing complex shapes with an excellent surface finish and very high precision. In general, it is an efficient high-productivity method for largescale production, and it is widely used in the automotive and related, aerospace, and consumer electronics industries.

The low-pressure die casting market is fastest-growing segment during the forecast period. This method provides casting with a near-net shape and exceptional smoothness of the surface. It is not a fast method as the cycle times are usually from a minute to four or five minutes per die. However, the labor is very cheap. Casting production is usually the least expensive method. Furthermore, HPDC is a process in which liquid Aluminum is injected under high pressure into steel molds with specialized equipment. Finally, the most used method for Aluminum casting is cold chamber die casting.

Need any customization research on Aluminium Die Casting Machines Market - Enquiry Now

By End Use

Power & Energy

Automotive

Industrial

Construction

Aerospace & Defense

Others

The automotive sector dominates a market share of over 30% in 2023.This is due to the rising demand for lightweight and high strength components among the automotive industry. The automotive industry is shifting towards lightweight materials to satisfy the requirements for fuel efficiency and emission standards for lightweight materials, hence, driving the demand for Aluminum die casting. Engine blocks, transmission housings, and wheels are all examples of products that are frequently produced via these methods.

The aerospace & defense sub-segment is expected to be the fastest-growing. Technology development and increased spending on new aircraft and defense technologies are major reasons for this sector’s expansion. Since the aerospace sector is more interested in weight reduction to foster fuel efficiency and performance, it will require the utilization of lightweight Aluminum components. In addition, the defense industry’s needs are anticipated to be for high performance materials.

By Customer

OEM

Reseller

The OEM segment dominate the global market share of over 62% in 2023. OEMs often require customized, high-quality machines to meet specific production needs. The demand for premium Aluminum dies casting machines from OEMs is high due to the precision, durability, and efficiency these machines offer in the manufacturing process. These aspects are critical to these sectors, thus driving the demand for the segment.

The reseller segment is expected to be the fastest–growing segment during the forecast period. Growth in the Resellers segment can be attributed to the increasing globalized nature of the manufacturing industry. Resellers provide localized support, service and repair, vital to an industry that cannot afford extended downtimes. Further, resellers can carry multiple models and machine types. This makes it more convenient for a wide variety of customers to purchase the technology they need.

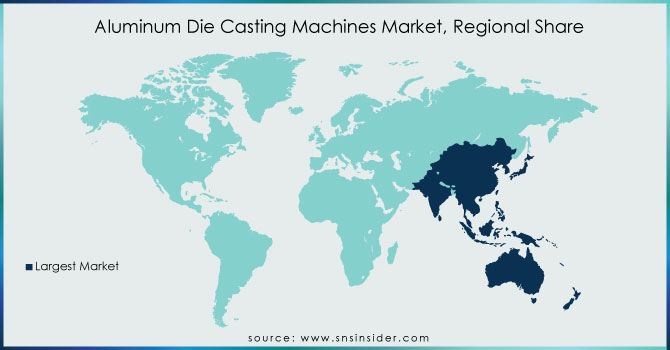

REGIONAL ANALYSIS

The Asia pacific Aluminum die casting machine market accounted for largest market share in 2023. Owing to the growing automotive industry in this region, Asia-Pacific is also projected to witness a rapid growth over the forecast period. Moreover, it is expected that rising investments in the building of the project and an increase in the production in growing countries of mechanical and manufacturing equipment will further support the growth in Asia Pacific Aluminum die casting machine market.

The major key players are Buhler AG, K. Technology Holdings Limited, Toshiba Machine Co., Ltd, TOYO Machinery & Metal, Ube Industries, Ltd, Walbro, Alcast Company, Consolidated Metco, Inc, Zitai Precision Machinery Co., Ltd, Gibbs Die Casting Corp, Birch Machining Co, Endurance Technologies Limited and others.

RECENT DEVELOPMENT

In April 2022: Yoshiaki Murakami Fun filed a hostile bid for the Toshiba Machine in January 2020 as the government advocates for corporate governance reform to increase management's accountability to investors.

In January 2022: The LK Group, Severda, Longda Aluminum, and other companies held the "Integrated Body Structural Die Casting Technology Forum and Signing Ceremony for Strategic Cooperation Projects" to discuss new materials and technologies like integrated die casting and lightweight body structure design. Jingcheng Gongke Automotive Systems Co., Ltd. Die-casting Branch, also known as "Seiko Die-casting," is a renowned manufacturer of die-casting Aluminum alloy structural parts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.162 Billion |

| Market Size by 2032 | US$ 1.947 Billion |

| CAGR | CAGR of 5.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (High-Pressure Die Casting, Low-Pressure Die Casting, Others) • By End Use (Power & Energy, Automotive, Industrial, Construction, Aerospace & Defense, Others) • By Customer (OEM, Reseller) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Buhler AG, K. Technology Holdings Limited, Toshiba Machine Co., Ltd, TOYO Machinery & Metal, Ube Industries, Ltd, Walbro, Alcast Company, Consolidated Metco, Inc, Zitai Precision Machinery Co., Ltd, Gibbs Die Casting Corp, Birch Machining Co, Endurance Technologies Limited |

| DRIVERS | • The rising demand for lightweight and fuel-efficient vehicles is accelerating the use of Aluminum die casting components in automotive manufacturing. • Aluminum superior thermal conductivity and lightweight properties make it ideal for electric vehicle (EV) components, increasing the need for die casting machines. |

| RESTRAINTS | • Changes in Aluminum prices can affect the profitability of die casting operations due to increased material costs. • Environmental Concerns the die casting process may produce emissions and waste, requiring investments in pollution control measures. |

Ans: The Aluminum Die Casting Machines Market is expected to grow at a CAGR of 5.9%.

Ans: Aluminum Die Casting Machines Market size was USD 1.162 Billion in 2023 and is expected to Reach USD 1.947 Billion by 2032.

Ans: High-Pressure Die Casting is the dominating segment by type capacity in the Aluminum Die Casting Machines Market.

Ans: Aluminum’s superior thermal conductivity and lightweight properties make it ideal for electric vehicle (EV) components, increasing the need for die-casting machines.

Ans: Asia-Pacific is the dominating region in the Aluminum Die Casting Machines Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Aluminum Die Casting Machines Market Segmentation, By Type

7.1 Introduction

7.2 High-Pressure Die Casting

7.3 Low-Pressure Die Casting

7.4 Others

8. Aluminum Die Casting Machines Market Segmentation, By End Use

8.1 Introduction

8.2 Power & Energy

8.3 Automotive

8.4 Industrial

8.5 Construction

8.6 Aerospace & Defense

8.7 Others

9. Aluminum Die Casting Machines Market Segmentation, By Customer

9.1 Introduction

9.2 OEM

9.3 Reseller

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Aluminum Die Casting Machines Market, By Country

10.2.3 North America Aluminum Die Casting Machines Market, By Type

10.2.4 North America Aluminum Die Casting Machines Market, By End-User

10.2.5 North America Aluminum Die Casting Machines Market, By Customer

10.2.6 USA

10.2.6.1 USA Aluminum Die Casting Machines Market, By Type

10.2.6.2 USA Aluminum Die Casting Machines Market, By End-User

10.2.6.3 USA Aluminum Die Casting Machines Market, By Customer

10.2.7 Canada

10.2.7.1 Canada Aluminum Die Casting Machines Market, By Type

10.2.7.2 Canada Aluminum Die Casting Machines Market, By End-User

10.2.7.3 Canada Aluminum Die Casting Machines Market, By Customer

10.2.8 Mexico

10.2.8.1 Mexico Aluminum Die Casting Machines Market, By Type

10.2.8.2 Mexico Aluminum Die Casting Machines Market, By End-User

10.2.8.3 Mexico Aluminum Die Casting Machines Market, By Customer

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Aluminum Die Casting Machines Market, By Country

10.3.2.2 Eastern Europe Aluminum Die Casting Machines Market, By Type

10.3.2.3 Eastern Europe Aluminum Die Casting Machines Market, By End-User

10.3.2.4 Eastern Europe Aluminum Die Casting Machines Market, By Customer

10.3.2.5 Poland

10.3.2.5.1 Poland Aluminum Die Casting Machines Market, By Type

10.3.2.5.2 Poland Aluminum Die Casting Machines Market, By End-User

10.3.2.5.3 Poland Aluminum Die Casting Machines Market, By Customer

10.3.2.6 Romania

10.3.2.6.1 Romania Aluminum Die Casting Machines Market, By Type

10.3.2.6.2 Romania Aluminum Die Casting Machines Market, By End-User

10.3.2.6.4 Romania Aluminum Die Casting Machines Market, By Customer

10.3.2.7 Hungary

10.3.2.7.1 Hungary Aluminum Die Casting Machines Market, By Type

10.3.2.7.2 Hungary Aluminum Die Casting Machines Market, By End-User

10.3.2.7.3 Hungary Aluminum Die Casting Machines Market, By Customer

10.3.2.8 Turkey

10.3.2.8.1 Turkey Aluminum Die Casting Machines Market, By Type

10.3.2.8.2 Turkey Aluminum Die Casting Machines Market, By End-User

10.3.2.8.3 Turkey Aluminum Die Casting Machines Market, By Customer

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Aluminum Die Casting Machines Market, By Type

10.3.2.9.2 Rest of Eastern Europe Aluminum Die Casting Machines Market, By End-User

10.3.2.9.3 Rest of Eastern Europe Aluminum Die Casting Machines Market, By Customer

10.3.3 Western Europe

10.3.3.1 Western Europe Aluminum Die Casting Machines Market, By Country

10.3.3.2 Western Europe Aluminum Die Casting Machines Market, By Type

10.3.3.3 Western Europe Aluminum Die Casting Machines Market, By End-User

10.3.3.4 Western Europe Aluminum Die Casting Machines Market, By Customer

10.3.3.5 Germany

10.3.3.5.1 Germany Aluminum Die Casting Machines Market, By Type

10.3.3.5.2 Germany Aluminum Die Casting Machines Market, By End-User

10.3.3.5.3 Germany Aluminum Die Casting Machines Market, By Customer

10.3.3.6 France

10.3.3.6.1 France Aluminum Die Casting Machines Market, By Type

10.3.3.6.2 France Aluminum Die Casting Machines Market, By End-User

10.3.3.6.3 France Aluminum Die Casting Machines Market, By Customer

10.3.3.7 UK

10.3.3.7.1 UK Aluminum Die Casting Machines Market, By Type

10.3.3.7.2 UK Aluminum Die Casting Machines Market, By End-User

10.3.3.7.3 UK Aluminum Die Casting Machines Market, By Customer

10.3.3.8 Italy

10.3.3.8.1 Italy Aluminum Die Casting Machines Market, By Type

10.3.3.8.2 Italy Aluminum Die Casting Machines Market, By End-User

10.3.3.8.3 Italy Aluminum Die Casting Machines Market, By Customer

10.3.3.9 Spain

10.3.3.9.1 Spain Aluminum Die Casting Machines Market, By Type

10.3.3.9.2 Spain Aluminum Die Casting Machines Market, By End-User

10.3.3.9.3 Spain Aluminum Die Casting Machines Market, By Customer

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Aluminum Die Casting Machines Market, By Type

10.3.3.10.2 Netherlands Aluminum Die Casting Machines Market, By End-User

10.3.3.10.3 Netherlands Aluminum Die Casting Machines Market, By Customer

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Aluminum Die Casting Machines Market, By Type

10.3.3.11.2 Switzerland Aluminum Die Casting Machines Market, By End-User

10.3.3.11.3 Switzerland Aluminum Die Casting Machines Market, By Customer

10.3.3.12 Austria

10.3.3.12.1 Austria Aluminum Die Casting Machines Market, By Type

10.3.3.12.2 Austria Aluminum Die Casting Machines Market, By End-User

10.3.3.12.3 Austria Aluminum Die Casting Machines Market, By Customer

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Aluminum Die Casting Machines Market, By Type

10.3.3.13.2 Rest of Western Europe Aluminum Die Casting Machines Market, By End-User

10.3.3.13.3 Rest of Western Europe Aluminum Die Casting Machines Market, By Customer

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Aluminum Die Casting Machines Market, By Country

10.4.3 Asia-Pacific Aluminum Die Casting Machines Market, By Type

10.4.4 Asia-Pacific Aluminum Die Casting Machines Market, By End-User

10.4.5 Asia-Pacific Aluminum Die Casting Machines Market, By Customer

10.4.6 China

10.4.6.1 China Aluminum Die Casting Machines Market, By Type

10.4.6.2 China Aluminum Die Casting Machines Market, By End-User

10.4.6.3 China Aluminum Die Casting Machines Market, By Customer

10.4.7 India

10.4.7.1 India Aluminum Die Casting Machines Market, By Type

10.4.7.2 India Aluminum Die Casting Machines Market, By End-User

10.4.7.3 India Aluminum Die Casting Machines Market, By Customer

10.4.8 Japan

10.4.8.1 Japan Aluminum Die Casting Machines Market, By Type

10.4.8.2 Japan Aluminum Die Casting Machines Market, By End-User

10.4.8.3 Japan Aluminum Die Casting Machines Market, By Customer

10.4.9 South Korea

10.4.9.1 South Korea Aluminum Die Casting Machines Market, By Type

10.4.9.2 South Korea Aluminum Die Casting Machines Market, By End-User

10.4.9.3 South Korea Aluminum Die Casting Machines Market, By Customer

10.4.10 Vietnam

10.4.10.1 Vietnam Aluminum Die Casting Machines Market, By Type

10.4.10.2 Vietnam Aluminum Die Casting Machines Market, By End-User

10.4.10.3 Vietnam Aluminum Die Casting Machines Market, By Customer

10.4.11 Singapore

10.4.11.1 Singapore Aluminum Die Casting Machines Market, By Type

10.4.11.2 Singapore Aluminum Die Casting Machines Market, By End-User

10.4.11.3 Singapore Aluminum Die Casting Machines Market, By Customer

10.4.12 Australia

10.4.12.1 Australia Aluminum Die Casting Machines Market, By Type

10.4.12.2 Australia Aluminum Die Casting Machines Market, By End-User

10.4.12.3 Australia Aluminum Die Casting Machines Market, By Customer

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Aluminum Die Casting Machines Market, By Type

10.4.13.2 Rest of Asia-Pacific Aluminum Die Casting Machines Market, By End-User

10.4.13.3 Rest of Asia-Pacific Aluminum Die Casting Machines Market, By Customer

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Aluminum Die Casting Machines Market, By Country

10.5.2.2 Middle East Aluminum Die Casting Machines Market, By Type

10.5.2.3 Middle East Aluminum Die Casting Machines Market, By End-User

10.5.2.4 Middle East Aluminum Die Casting Machines Market, By Customer

10.5.2.5 UAE

10.5.2.5.1 UAE Aluminum Die Casting Machines Market, By Type

10.5.2.5.2 UAE Aluminum Die Casting Machines Market, By End-User

10.5.2.5.3 UAE Aluminum Die Casting Machines Market, By Customer

10.5.2.6 Egypt

10.5.2.6.1 Egypt Aluminum Die Casting Machines Market, By Type

10.5.2.6.2 Egypt Aluminum Die Casting Machines Market, By End-User

10.5.2.6.3 Egypt Aluminum Die Casting Machines Market, By Customer

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Aluminum Die Casting Machines Market, By Type

10.5.2.7.2 Saudi Arabia Aluminum Die Casting Machines Market, By End-User

10.5.2.7.3 Saudi Arabia Aluminum Die Casting Machines Market, By Customer

10.5.2.8 Qatar

10.5.2.8.1 Qatar Aluminum Die Casting Machines Market, By Type

10.5.2.8.2 Qatar Aluminum Die Casting Machines Market, By End-User

10.5.2.8.3 Qatar Aluminum Die Casting Machines Market, By Customer

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Aluminum Die Casting Machines Market, By Type

10.5.2.9.2 Rest of Middle East Aluminum Die Casting Machines Market, By End-User

10.5.2.9.3 Rest of Middle East Aluminum Die Casting Machines Market, By Customer

10.5.3 Africa

10.5.3.1 Africa Aluminum Die Casting Machines Market, By Country

10.5.3.2 Africa Aluminum Die Casting Machines Market, By Type

10.5.3.3 Africa Aluminum Die Casting Machines Market, By End-User

10.5.3.4 Africa Aluminum Die Casting Machines Market, By Customer

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Aluminum Die Casting Machines Market, By Type

10.5.3.5.2 Nigeria Aluminum Die Casting Machines Market, By End-User

10.5.3.5.3 Nigeria Aluminum Die Casting Machines Market, By Customer

10.5.3.6 South Africa

10.5.3.6.1 South Africa Aluminum Die Casting Machines Market, By Type

10.5.3.6.2 South Africa Aluminum Die Casting Machines Market, By End-User

10.5.3.6.3 South Africa Aluminum Die Casting Machines Market, By Customer

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Aluminum Die Casting Machines Market, By Type

10.5.3.7.2 Rest of Africa Aluminum Die Casting Machines Market, By End-User

10.5.3.7.3 Rest of Africa Aluminum Die Casting Machines Market, By Customer

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Aluminum Die Casting Machines Market, By Country

10.6.3 Latin America Aluminum Die Casting Machines Market, By Type

10.6.4 Latin America Aluminum Die Casting Machines Market, By End-User

10.6.5 Latin America Aluminum Die Casting Machines Market, By Customer

10.6.6 Brazil

10.6.6.1 Brazil Aluminum Die Casting Machines Market, By Type

10.6.6.2 Brazil Aluminum Die Casting Machines Market, By End-User

10.6.6.3 Brazil Aluminum Die Casting Machines Market, By Customer

10.6.7 Argentina

10.6.7.1 Argentina Aluminum Die Casting Machines Market, By Type

10.6.7.2 Argentina Aluminum Die Casting Machines Market, By End-User

10.6.7.3 Argentina Aluminum Die Casting Machines Market, By Customer

10.6.8 Colombia

10.6.8.1 Colombia Aluminum Die Casting Machines Market, By Type

10.6.8.2 Colombia Aluminum Die Casting Machines Market, By End-User

10.6.8.3 Colombia Aluminum Die Casting Machines Market, By Customer

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Aluminum Die Casting Machines Market, By Type

10.6.9.2 Rest of Latin America Aluminum Die Casting Machines Market, By End-User

10.6.9.3 Rest of Latin America Aluminum Die Casting Machines Market, By Customer

11. Company Profiles

11.1 Buhler AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 K. Technology Holdings Limited

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Toshiba Machine Co., Ltd

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 TOYO Machinery & Metal

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Ube Industries, Ltd

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Walbro

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Alcast Company

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Consolidated Metco, Inc

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Zitai Precision Machinery Co., Ltd,

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Gibbs Die Casting Corp

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Type

High-Pressure Die Casting

Low-Pressure Die Casting

Others

By End Use

Power & Energy

Automotive

Industrial

Construction

Aerospace & Defense

Others

By Customer

OEM

Reseller

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Arc Welding Torch Market was estimated at USD 2.10 billion in 2023 and is expected to reach USD 3.28 billion by 2032, with a growing CAGR of 5.09% over the forecast period 2024-2032.

The Mining Drill Bits Market Size was valued at USD 1.76 Bn in 2023 and is expected to reach USD 2.86 Bn by 2032 with a growing CAGR of 5.56 % over the forecast period 2024-2032.

The Sodium-Ion Battery Market Size was estimated at USD 295.93 million in 2023 and is expected to arrive at USD 1668.88 million by 2032 with a growing CAGR of 21.19% over the forecast period 2024-2032.

The Postal Automation Systems Market size was USD 0.76 Billion in 2023 and will reach to USD 1.38 Billion by 2032 and grow at a CAGR of 6.9% by 2024-2032.

The Fire Suppression Market Size was valued at USD 21.5 billion in 2023 and is expected to reach USD 32.92 billion by 2032 and grow at a CAGR of 4.85% over the forecast period 2024-2032.

The Fertilizer Spreader Market size was estimated at USD 763.39 million in 2023 and is expected to reach USD 1216.11 million by 2032 at a CAGR of 5.31% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone