Aluminum Aerosol Cans Market report scope & overview:

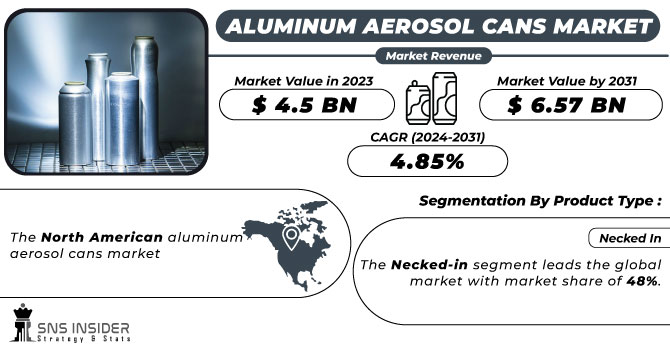

Aluminum Aerosol Cans Market Size was valued at USD 4.5 billion in 2023 and is projected to reach USD 6.57 billion by 2031 and grow at a CAGR of 4.85% over the forecast period 2024-2031.

The aluminum aerosol cans market is poised for significant growth driven by rising disposable income, changing lifestyles, and urbanization, particularly in the cosmetic and personal care sectors. The increasing adoption of these cans for food storage, automotive packaging, and agricultural products enhances market expansion. Consumer awareness of eco-friendly, hygienic, and convenient packaging further propels demand, as does the 100% recyclability and high quality of aluminum cans.

Get More Information on Aluminum Aerosol Cans Market - Request Sample Report

Manufacturers are advancing the market with various designs, lightweight, cost-effective products, and sustainability initiatives. Rapid trends in e-commerce and online shopping bolster sales, while promotional activities on social media increase brand engagement. The market is expected to see short-term growth from standardized product demand and urbanization, medium-term growth from innovations in emerging economies like China, and long-term growth from government initiatives, R&D, and sustainability investments.

MARKET DYNAMICS:

KEY DRIVERS:

The confluence of rising disposable income, changing lifestyles, and accelerating urbanization is acting as a key driver of market expansion.

The booming popularity of cosmetics and personal care products is driving a surge in the use of aluminum aerosol cans for packaging.

End-use sectors like industrial, household products, and cosmetics have been driving significant market growth, generating substantial revenue in recent years. Presently, manufacturers are creating aluminum aerosol cans that are high-strength, lightweight, and corrosion-resistant. Furthermore, the storage of various products such as sanitizers, skincare, deodorants, and fragrances are boosting demand for aluminum aerosol cans.

RESTRAINTS:

The price of aluminum is subject to fluctuations due to market demand, geopolitical issues, and supply chain disruptions.

Developing and implementing advanced printing and design technologies can be expensive.

Developing and implementing advanced printing and design technologies can be costly, necessitating significant investments in research and development. This financial burden can be particularly challenging for small and medium-sized enterprises, which may lack the resources and capital to invest in the latest technological innovations. These companies often struggle to compete with larger corporations that have the financial capacity to adopt and integrate cutting-edge technologies more rapidly.

OPPORTUNITIES:

Market players are increasing their investment and engaging in more research and development activities.

Recent technological advancements in printing and design have revolutionized the creation of aluminum aerosol cans, enabling highly innovative and customizable solutions. These developments allow brands to differentiate themselves more effectively in the market and engage consumers on a deeper level. Advanced printing techniques facilitate intricate and vibrant designs, while modern design capabilities enable unique shapes and features tailored to specific brand identities.

Government efforts are aimed at encouraging the use of products that can be recycled or reused.

CHALLENGES:

Competition from Alternative Packaging.

There is growing competition from alternative packaging materials such as plastics, glass, and other eco-friendly options like biodegradable and compostable materials. These alternatives can be more cost-effective or have a smaller environmental footprint, posing a threat to the aluminum aerosol can market.

While aluminum is recyclable, the process requires significant infrastructure and consumer participation.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Ukraine has significantly impacted the aluminum aerosol can market. Disruptions to metal production and transportation in the region have caused a decrease in aluminum supply, driving prices up. The international price of aluminium surged 28% in 2022, reaching US$3,849 per tonne on 4 March, then settling back to US$3,398, approximately level with the price following a spike that occurred on 24 February, right after the invasion began. This price increase, coupled with market uncertainty due to the conflict, has led companies to hesitate on investments. The ripple effect extends beyond the aluminum market, impacting the global economy through increased costs of goods and services due to rising metal prices in general. Furthermore, sanctions and the need for companies to find alternative suppliers are causing a shift in how the aluminum market operates.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown or recession can be a significant challenge for the aluminum aerosol can market. It reduced economic activity leads to lower demand from key consumer industries like packaging, potentially causing a glut of aluminum and driving prices down. This can squeeze profits for can manufacturers. Second, inflation often accompanying a slowdown, increases the cost of raw materials and operations, further pressuring margins. Additionally, a cautious investment climate during recessions can limit funding for innovation in can design and production, hindering the industry's ability to stay competitive in the long term.

KEY MARKET SEGMENTS:

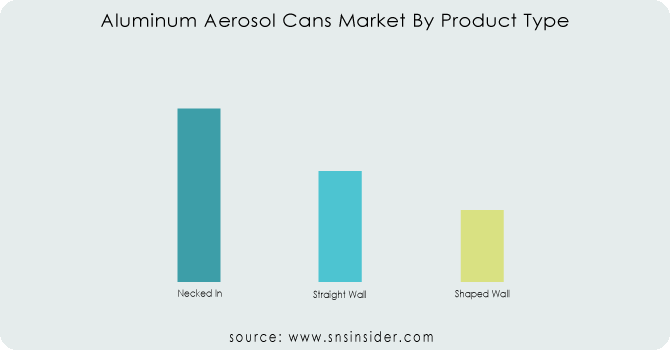

By Product Type

Necked In

Straight Wall

Shaped Wall

By product type, the necked-in segment leads the global market with market share of 48%. These cans are widely adopted for packaging a variety of products, from automotive to cosmetics, due to their durability, flexibility, portability, and convenience, which drive market growth.

Need any customization research on Aluminum Aerosol Cans Market - Enquiry Now

By Capacity Type

Less than 100 ml

100 to 250 ml

251 to 500 ml

More than 500 ml

Aluminum aerosol cans ranging from 100 to 250 ml dominate the global market, a trend anticipated to persist in the coming years. Their popularity is particularly notable in the personal care and automotive sectors, where their convenient size is a key advantage. Despite the 100-250 ml segment leading the market, other can sizes are also experiencing robust growth and making substantial contributions to overall market revenue.

By End-use Industry

Cosmetics & Personal Care

Household Products

Automotive/Industrial

Others

In terms of end-use industry, the cosmetic and personal care sector is generating significant. The increasing use of cosmetic products for healthier skin and improved hair growth is boosting the sales of aluminum aerosol cans. Products like creams, lotions, deodorants, shaving creams, and sanitizers are key contributors to market growth.

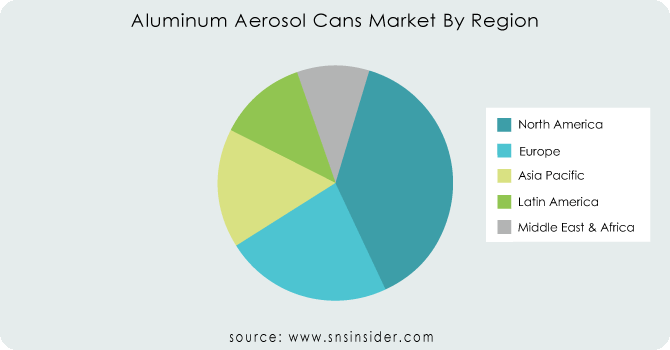

REGIONAL ANALYSES

The North American aluminum aerosol cans market, particularly the United States, is set to dominate due to aluminum's high recyclability and growing emphasis on sustainability. The U.S. market is driven by increased consumer spending on cosmetic brands, a high standard of living, a rapidly growing automotive sector, and strong R&D activities. Manufacturers in the U.S. are focusing on sustainable packaging to reduce toxicity, supported by government initiatives promoting recycling.

Europe holds the second-largest market share, with significant demand in the personal care and beauty industry. Germany leads in market share, while the UK is the fastest-growing market in the region. The Asia-Pacific market is anticipated to grow at the fastest, fueled by technological innovations in printing and design that enable customizable and visually appealing cans. China leads the region due to the booming automotive and cosmetic sectors, along with rising demand for agricultural packaging solutions. India follows as the fastest-growing market in the Asia-Pacific region.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

KEY PLAYERS

The major key players are CPMC Holdings Ltd, Alucon PCL, Kian Joo Can Factory Bhd., Crown Holdings, Inc., China Aluminum Cans Holdings Ltd., CCL Industries Inc., Toyo Seikan Group Holdings Ltd, BWAY Corporation, Linhardt GmbH & Co KG, Nampak Limited, Montebello Packaging Inc, Ball Corporation, Euro Asia Packaging (Guangdong) Co., Ltd and other players.

CPMC Holdings Ltd-Company Financial Analysis

RECENT DEVELOPMENT

In December 2022, Trivium Packaging promised money for the UK Aerosol Recycling Initiative led by Alupro, a company that recycles aluminum packaging. This effort wants to teach people about recycling, figure out how much aerosol cans are recycled already, and come up with ways to recycle more in the UK. The goal is to make more people aware of aerosol recycling and get them involved all across the country.

In July 2022, Jamestrong Packaging, a company that makes food and aerosol cans, invested $6 million in a factory that makes aerosol cans. They plan to grow their business in Taree, New South Wales, by making more metal pieces for aerosol cans. This will help meet the growing demand for their products and create new jobs in the area with a new metal casting plant.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.5 Bn |

| Market Size by 2031 | US$ 6.57 Bn |

| CAGR | CAGR of 4.85% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flip Chip Scale Package, Flip Chip Ball Grid Array, Wafer Level Chip Scale Packaging, 5D/3D, Fan Out Wafer-Level Packaging, Others) • By End User (Consumer Electronics, Healthcare, Industrial, Aerospace And Defense, Automotive, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CPMC Holdings Ltd, Alucon PCL, Kian Joo Can Factory Bhd., Crown Holdings, Inc., China Aluminum Cans Holdings Ltd., CCL Industries Inc., Toyo Seikan Group Holdings Ltd, BWAY Corporation, Linhardt GmbH & Co KG, Nampak Limited, Montebello Packaging Inc, Ball Corporation, Euro Asia Packaging (Guangdong) Co., Ltd |

| Key Drivers | • The confluence of rising disposable income, changing lifestyles, and accelerating urbanization is acting as a key driver of market expansion. • The booming popularity of cosmetics and personal care products is driving a surge in the use of aluminum aerosol cans for packaging. |

| Key Restraints | • The price of aluminum is subject to fluctuations due to market demand, geopolitical issues, and supply chain disruptions. • Developing and implementing advanced printing and design technologies can be expensive. |

Ans: The Aluminum Aerosol Cans Market is expected to grow at a CAGR of 4.85%.

Ans: Aluminum Aerosol Cans Market size was USD 4.5 billion in 2023 and is expected to Reach USD 6.57billion by 2031.

Ans: The confluence of rising disposable income, changing lifestyles, and accelerating urbanization is acting as a key driver of market expansion.

Ans: The price of aluminum is subject to fluctuations due to market demand, geopolitical issues, and supply chain disruptions.

Ans: North America holds the dominant position in Aluminum Aerosol Cans Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Aluminum Aerosol Cans Market Segmentation, By Product Type

9.1 Introduction

9.2 Trend Analysis

9.3 Necked In

9.4 Straight Wall

9.5 Shaped Wall

10. Aluminum Aerosol Cans Market Segmentation,

10.1 Introduction

10.2 Trend Analysis

10.3 Less than 100 ml

10.4 100 to 250 ml

10.5 251 to 500 ml

10.6 More than 500 ml

11. Aluminum Aerosol Cans Market Segmentation, By End-use Industry

11.1 Introduction

11.2 Trend Analysis

11.3 Cosmetics & Personal Care

11.4 Household Products

11.5 Automotive/Industrial

11.6 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Aluminum Aerosol Cans Market by Country

12.2.3 North America Aluminum Aerosol Cans Market By Product Type

12.2.4 North America Aluminum Aerosol Cans Market By Capacity Type

12.2.5 North America Aluminum Aerosol Cans Market By End-use Industry

12.2.6 USA

12.2.6.1 USA Aluminum Aerosol Cans Market By Product Type

12.2.6.2 USA Aluminum Aerosol Cans Market By Capacity Type

12.2.6.3 USA Aluminum Aerosol Cans Market By End-use Industry

12.2.7 Canada

12.2.7.1 Canada Aluminum Aerosol Cans Market By Product Type

12.2.7.2 Canada Aluminum Aerosol Cans Market By Capacity Type

12.2.7.3 Canada Aluminum Aerosol Cans Market By End-use Industry

12.2.8 Mexico

12.2.8.1 Mexico Aluminum Aerosol Cans Market By Product Type

12.2.8.2 Mexico Aluminum Aerosol Cans Market By Capacity Type

12.2.8.3 Mexico Aluminum Aerosol Cans Market By End-use Industry

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Aluminum Aerosol Cans Market by Country

12.3.2.2 Eastern Europe Aluminum Aerosol Cans Market By Product Type

12.3.2.3 Eastern Europe Aluminum Aerosol Cans Market By Capacity Type

12.3.2.4 Eastern Europe Aluminum Aerosol Cans Market By End-use Industry

12.3.2.5 Poland

12.3.2.5.1 Poland Aluminum Aerosol Cans Market By Product Type

12.3.2.5.2 Poland Aluminum Aerosol Cans Market By Capacity Type

12.3.2.5.3 Poland Aluminum Aerosol Cans Market By End-use Industry

12.3.2.6 Romania

12.3.2.6.1 Romania Aluminum Aerosol Cans Market By Product Type

12.3.2.6.2 Romania Aluminum Aerosol Cans Market By Capacity Type

12.3.2.6.4 Romania Aluminum Aerosol Cans Market By End-use Industry

12.3.2.7 Hungary

12.3.2.7.1 Hungary Aluminum Aerosol Cans Market By Product Type

12.3.2.7.2 Hungary Aluminum Aerosol Cans Market By Capacity Type

12.3.2.7.3 Hungary Aluminum Aerosol Cans Market By End-use Industry

12.3.2.8 Turkey

12.3.2.8.1 Turkey Aluminum Aerosol Cans Market By Product Type

12.3.2.8.2 Turkey Aluminum Aerosol Cans Market By Capacity Type

12.3.2.8.3 Turkey Aluminum Aerosol Cans Market By End-use Industry

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Aluminum Aerosol Cans Market By Product Type

12.3.2.9.2 Rest of Eastern Europe Aluminum Aerosol Cans Market By Capacity Type

12.3.2.9.3 Rest of Eastern Europe Aluminum Aerosol Cans Market By End-use Industry

12.3.3 Western Europe

12.3.3.1 Western Europe Aluminum Aerosol Cans Market by Country

12.3.3.2 Western Europe Aluminum Aerosol Cans Market By Product Type

12.3.3.3 Western Europe Aluminum Aerosol Cans Market By Capacity Type

12.3.3.4 Western Europe Aluminum Aerosol Cans Market By End-use Industry

12.3.3.5 Germany

12.3.3.5.1 Germany Aluminum Aerosol Cans Market By Product Type

12.3.3.5.2 Germany Aluminum Aerosol Cans Market By Capacity Type

12.3.3.5.3 Germany Aluminum Aerosol Cans Market By End-use Industry

12.3.3.6 France

12.3.3.6.1 France Aluminum Aerosol Cans Market By Product Type

12.3.3.6.2 France Aluminum Aerosol Cans Market By Capacity Type

12.3.3.6.3 France Aluminum Aerosol Cans Market By End-use Industry

12.3.3.7 UK

12.3.3.7.1 UK Aluminum Aerosol Cans Market By Product Type

12.3.3.7.2 UK Aluminum Aerosol Cans Market By Capacity Type

12.3.3.7.3 UK Aluminum Aerosol Cans Market By End-use Industry

12.3.3.8 Italy

12.3.3.8.1 Italy Aluminum Aerosol Cans Market By Product Type

12.3.3.8.2 Italy Aluminum Aerosol Cans Market By Capacity Type

12.3.3.8.3 Italy Aluminum Aerosol Cans Market By End-use Industry

12.3.3.9 Spain

12.3.3.9.1 Spain Aluminum Aerosol Cans Market By Product Type

12.3.3.9.2 Spain Aluminum Aerosol Cans Market By Capacity Type

12.3.3.9.3 Spain Aluminum Aerosol Cans Market By End-use Industry

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Aluminum Aerosol Cans Market By Product Type

12.3.3.10.2 Netherlands Aluminum Aerosol Cans Market By Capacity Type

12.3.3.10.3 Netherlands Aluminum Aerosol Cans Market By End-use Industry

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Aluminum Aerosol Cans Market By Product Type

12.3.3.11.2 Switzerland Aluminum Aerosol Cans Market By Capacity Type

12.3.3.11.3 Switzerland Aluminum Aerosol Cans Market By End-use Industry

12.3.3.1.12 Austria

12.3.3.12.1 Austria Aluminum Aerosol Cans Market By Product Type

12.3.3.12.2 Austria Aluminum Aerosol Cans Market By Capacity Type

12.3.3.12.3 Austria Aluminum Aerosol Cans Market By End-use Industry

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Aluminum Aerosol Cans Market By Product Type

12.3.3.13.2 Rest of Western Europe Aluminum Aerosol Cans Market By Capacity Type

12.3.3.13.3 Rest of Western Europe Aluminum Aerosol Cans Market By End-use Industry

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Aluminum Aerosol Cans Market by Country

12.4.3 Asia-Pacific Aluminum Aerosol Cans Market By Product Type

12.4.4 Asia-Pacific Aluminum Aerosol Cans Market By Capacity Type

12.4.5 Asia-Pacific Aluminum Aerosol Cans Market By End-use Industry

12.4.6 China

12.4.6.1 China Aluminum Aerosol Cans Market By Product Type

12.4.6.2 China Aluminum Aerosol Cans Market By Capacity Type

12.4.6.3 China Aluminum Aerosol Cans Market By End-use Industry

12.4.7 India

12.4.7.1 India Aluminum Aerosol Cans Market By Product Type

12.4.7.2 India Aluminum Aerosol Cans Market By Capacity Type

12.4.7.3 India Aluminum Aerosol Cans Market By End-use Industry

12.4.8 Japan

12.4.8.1 Japan Aluminum Aerosol Cans Market By Product Type

12.4.8.2 Japan Aluminum Aerosol Cans Market By Capacity Type

12.4.8.3 Japan Aluminum Aerosol Cans Market By End-use Industry

12.4.9 South Korea

12.4.9.1 South Korea Aluminum Aerosol Cans Market By Product Type

12.4.9.2 South Korea Aluminum Aerosol Cans Market By Capacity Type

12.4.9.3 South Korea Aluminum Aerosol Cans Market By End-use Industry

12.4.10 Vietnam

12.4.10.1 Vietnam Aluminum Aerosol Cans Market By Product Type

12.4.10.2 Vietnam Aluminum Aerosol Cans Market By Capacity Type

12.4.10.3 Vietnam Aluminum Aerosol Cans Market By End-use Industry

12.4.11 Singapore

12.4.11.1 Singapore Aluminum Aerosol Cans Market By Product Type

12.4.11.2 Singapore Aluminum Aerosol Cans Market By Capacity Type

12.4.11.3 Singapore Aluminum Aerosol Cans Market By End-use Industry

12.4.12 Australia

12.4.12.1 Australia Aluminum Aerosol Cans Market By Product Type

12.4.12.2 Australia Aluminum Aerosol Cans Market By Capacity Type

12.4.12.3 Australia Aluminum Aerosol Cans Market By End-use Industry

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Aluminum Aerosol Cans Market By Product Type

12.4.13.2 Rest of Asia-Pacific Aluminum Aerosol Cans Market By Capacity Type

12.4.13.3 Rest of Asia-Pacific Aluminum Aerosol Cans Market By End-use Industry

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Aluminum Aerosol Cans Market by Country

12.5.2.2 Middle East Aluminum Aerosol Cans Market By Product Type

12.5.2.3 Middle East Aluminum Aerosol Cans Market By Capacity Type

12.5.2.4 Middle East Aluminum Aerosol Cans Market By End-use Industry

12.5.2.5 UAE

12.5.2.5.1 UAE Aluminum Aerosol Cans Market By Product Type

12.5.2.5.2 UAE Aluminum Aerosol Cans Market By Capacity Type

12.5.2.5.3 UAE Aluminum Aerosol Cans Market By End-use Industry

12.5.2.6 Egypt

12.5.2.6.1 Egypt Aluminum Aerosol Cans Market By Product Type

12.5.2.6.2 Egypt Aluminum Aerosol Cans Market By Capacity Type

12.5.2.6.3 Egypt Aluminum Aerosol Cans Market By End-use Industry

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Aluminum Aerosol Cans Market By Product Type

12.5.2.7.2 Saudi Arabia Aluminum Aerosol Cans Market By Capacity Type

12.5.2.7.3 Saudi Arabia Aluminum Aerosol Cans Market By End-use Industry

12.5.2.8 Qatar

12.5.2.8.1 Qatar Aluminum Aerosol Cans Market By Product Type

12.5.2.8.2 Qatar Aluminum Aerosol Cans Market By Capacity Type

12.5.2.8.3 Qatar Aluminum Aerosol Cans Market By End-use Industry

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Aluminum Aerosol Cans Market By Product Type

12.5.2.9.2 Rest of Middle East Aluminum Aerosol Cans Market By Capacity Type

12.5.2.9.3 Rest of Middle East Aluminum Aerosol Cans Market By End-use Industry

12.5.3 Africa

12.5.3.1 Africa Aluminum Aerosol Cans Market by Country

12.5.3.2 Africa Aluminum Aerosol Cans Market By Product Type

12.5.3.3 Africa Aluminum Aerosol Cans Market By Capacity Type

12.5.3.4 Africa Aluminum Aerosol Cans Market By End-use Industry

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Aluminum Aerosol Cans Market By Product Type

12.5.3.5.2 Nigeria Aluminum Aerosol Cans Market By Capacity Type

12.5.3.5.3 Nigeria Aluminum Aerosol Cans Market By End-use Industry

12.5.3.6 South Africa

12.5.3.6.1 South Africa Aluminum Aerosol Cans Market By Product Type

12.5.3.6.2 South Africa Aluminum Aerosol Cans Market By Capacity Type

12.5.3.6.3 South Africa Aluminum Aerosol Cans Market By End-use Industry

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Aluminum Aerosol Cans Market By Product Type

12.5.3.7.2 Rest of Africa Aluminum Aerosol Cans Market By Capacity Type

12.5.3.7.3 Rest of Africa Aluminum Aerosol Cans Market By End-use Industry

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Aluminum Aerosol Cans Market by country

12.6.3 Latin America Aluminum Aerosol Cans Market By Product Type

12.6.4 Latin America Aluminum Aerosol Cans Market By Capacity Type

12.6.5 Latin America Aluminum Aerosol Cans Market By End-use Industry

12.6.6 Brazil

12.6.6.1 Brazil Aluminum Aerosol Cans Market By Product Type

12.6.6.2 Brazil Aluminum Aerosol Cans Market By Capacity Type

12.6.6.3 Brazil Aluminum Aerosol Cans Market By End-use Industry

12.6.7 Argentina

12.6.7.1 Argentina Aluminum Aerosol Cans Market By Product Type

12.6.7.2 Argentina Aluminum Aerosol Cans Market By Capacity Type

12.6.7.3 Argentina Aluminum Aerosol Cans Market By End-use Industry

12.6.8 Colombia

12.6.8.1 Colombia Aluminum Aerosol Cans Market By Product Type

12.6.8.2 Colombia Aluminum Aerosol Cans Market By Capacity Type

12.6.8.3 Colombia Aluminum Aerosol Cans Market By End-use Industry

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Aluminum Aerosol Cans Market By Product Type

12.6.9.2 Rest of Latin America Aluminum Aerosol Cans Market By Capacity Type

12.6.9.3 Rest of Latin America Aluminum Aerosol Cans Market By End-use Industry

13. Company Profiles

13.1 CPMC Holdings Ltd

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Alucon PCL

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Kian Joo Can Factory Bhd.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Crown Holdings, Inc.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 China Aluminum Cans Holdings Ltd.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 CCL Industries Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Toyo Seikan Group Holdings Ltd

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 BWAY Corporation

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Linhardt GmbH & Co KG

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Nampak Limited

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

13.11 Montebello Packaging Inc

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services Offered

13.11.4 SWOT Analysis

13.11.5 The SNS View

13.12 Ball Corporation

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

13.12.5 The SNS View

13.13 Euro Asia Packaging (Guangdong) Co., Ltd

13.13.1 Company Overview

13.13.2 Financial

13.13.3 Products/ Services Offered

13.13.4 SWOT Analysis

13.13.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Modular Construction Market size was valued at USD 91.14 billion in 2023 and is expected to grow to USD 160.52 billion by 2032 and grow at a CAGR of 6.49% over the forecast period of 2024-2032.

The Cup Sleeves Market Size was valued at USD 32.5 billion in 2023 and is projected to reach USD 46.65 billion by 2032 and grow at a CAGR of 4.1% over the forecast periods 2024 -2032.

The Tamper-proof packaging Market is experiencing substantial growth on a global scale, driven by heightened consumer awareness regarding product safety, stringent regulations mandating tamper-evident features, and its expanding use across diverse industr

The Bubble Wrap Packaging Market size was USD 3.03 billion in 2023, which is forecast to increase to US 6.26 billion by 2032 and grow at a compound annual growth rate of 8.4 % between 2024 and 2032.

Medical device packaging market Size was valued at USD 39 billion in 2023 and is expected to reach USD 59.62 billion by 2031 and grow at a CAGR of 5.45% over the forecast period 2024-2031.

The Packaging Automation Market size was valued at USD 70.94 billion in 2023 and reach USD 136.98 billion by 2032, growing at a CAGR of 7.59% by 2032.

Hi! Click one of our member below to chat on Phone