Alternative Data Market Report Scope & Overview:

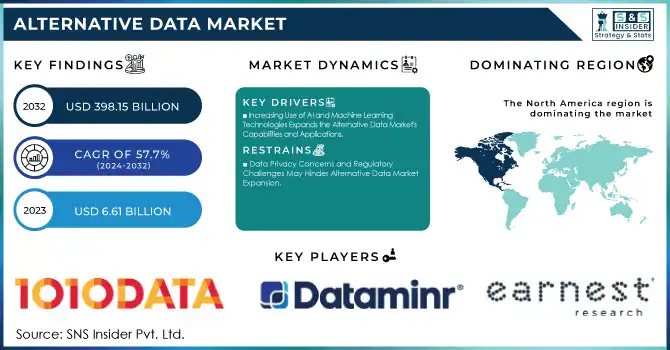

The Alternative Data Market Size was valued at USD 6.61 Billion in 2023 and is expected to reach USD 398.15 Billion by 2032 and grow at a CAGR of 57.7% over the forecast period 2024-2032.

Get More Information on Alternative Data Market - Request Sample Report

The Alternative Data Market has experienced rapid growth in recent years, driven by the increasing need for organizations to make more informed and data-driven decisions. Alternative data is data from non-traditional sources that may be used to get unique insights about different business, economic, and consumer behaviors. While conventional data comes from structured sources like financial reports, sales figures, or market surveys, alternative data comes from unstructured or non-traditional sources like social media, satellite imagery, web scraping, geolocation data, sensor data, and transaction records.

For instance, hedge funds are planning a 'budget boom' in 2025 for datasets that cost them millions annually, with 95% of buyers, including hedge funds and venture capital managers, expecting their budgets to grow or remain the same in 2025.

Additionally, the proliferation of digital transformation and the Internet of Things has resulted in increasing data generation. This has led to alternative streams of data from businesses to be analyzed. Most importantly, the growth of sustainable and ESG (Environmental, Social, and Governance) investing has influenced market growth significantly, as investors and companies look for ways to evaluate sustainability metrics. Overall, the market for alternative data is going to continue growing forward with technological growth, increasing access to data and the growing requirements for data-informed decision making across all areas.

Alternative Data Market Dynamics

Key Drivers:

-

Increasing Use of AI and Machine Learning Technologies Expands the Alternative Data Market's Capabilities and Applications

High-speed AI and ML technology has greatly improved data processing and analysis capabilities for large alt data volumes. With automation of data processing, AI and ML models can draw out otherwise intractable patterns and insights from complex, unstructured datasets that are hard to interpret using traditional methods. The use cases for alternative data have proliferated across various sectors, such as finance, healthcare, retail, and real estate.

For example, in finance hedge funds and institutional investors are using AI and ML to predict market movements and identify investment opportunities based on alternative data such as satellite imagery, social media sentiment, and transaction data. Similarly, retailers are leveraging AI to analyze consumer behavior, enabling them to optimize inventory management and personalize marketing campaigns.

With AI and ML processing alternative data in real-time, businesses gain insights that enable them to make faster, better decisions. With time, AI and ML are improving, so is the business value of alternative data, hence pushing the market's growth forward in the next years.

-

Rise of Sustainable and ESG Investing Creates New Demand for Alternative Data Solutions

Increasing interest in sustainability and ESG investing has greatly increased demand for alternative data solutions. More and more investors and companies rely on alternative data to analyze the ESG performance of organizations, industries, and markets. Traditional financial metrics have proven inadequate as concerns about climate change, social responsibility, and corporate governance gain greater attention and are not considered sufficient enough for evaluating the long-term sustainability of a company. Alternative data used include satellite imagery, geospatial data, and supply chain transparency tools used in tracking the environmental impact and social engagement for assessing governance practice in real time.

For instance, satellite images are used to detect deforestation, track carbon emissions, or monitor agricultural practices, providing valuable insights that were previously unavailable or difficult to assess.

Alternative data would be integrated into ESG analysis, providing an investor with a more holistic view of the company's performance to make better-informed decisions, which are sustainability-oriented. Sustainable investing is a growing focus; therefore, demand for alternative data solutions will be on the increase, fueling market growth.

Restrain:

-

Data Privacy Concerns and Regulatory Challenges May Hinder Alternative Data Market Expansion

The most important hindrance to growth in the alternative data market will be concerns around data privacy, coupled with issues around regulation. Data from non-traditional sources such as social media, geolocation tracking, and IoT devices are collecting enormous volumes of information that seriously raises questions over consumer privacy and data protection. Governments around the globe are introducing data privacy regulations to be stricter; for example, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States require organizations to be more transparent about collecting data, requiring consent from the users, and having tighter control over data use. This regulation may reduce access to certain kinds of alternative data or drive-up compliance costs for businesses looking to incorporate these datasets.

Furthermore, the potential legal liabilities and reputational damage due to breaches or misuse of data makes companies reluctant to embrace alternative data solutions without adequate safeguards. The privacy concerns will continue to evolve, and navigating the complex regulatory landscapes will become challenging for companies in the alternative data market; otherwise, it may limit their ability to fully capitalize on the market's potential.

Alternative Data Market Segments Analysis

By Type

In 2023, the Credit & Debit Card Transactions segment captured the largest share of the alternative data market with a 19% revenue share, and it continues to play a vital role in business decision-making. Card transaction data provides real-time information on consumer spending habits, purchase patterns, and preferences, which makes it an invaluable resource for financial institutions, retailers, and market researchers.

For instance, Mastercard recently introduced its "Mastercard SpendingPulse" service, which utilizes aggregated card transaction data to give insights into retail sales trends across industries. It helps businesses monitor shifts in consumer spending and makes strategic decisions accordingly.

Growth in e-commerce and digital payments has further intensified the demand for credit and debit card transaction data. As companies increasingly rely on alternative data to improve operations, the Credit & Debit Card Transactions segment will continue to lead and support broader growth in the alternative data market.

The Social & Sentiment Data segment is experiencing the largest CAGR of 61.07% within the forecasted period, this reflects a rapidly expanding market demand for insights from social media, online reviews, and digital interactions. The data is increasingly being used by businesses to track brand health, understand consumer sentiment, and gain real-time market intelligence.

For example, Brandwatch, a leading digital consumer intelligence platform, has launched advanced sentiment analysis features that enable businesses to track public opinion across different social channels, thereby enabling brands to fine-tune their marketing strategies. Similarly, Sprinklr has launched AI-powered sentiment analysis tools to deliver deeper insights into customer feedback on social platforms.

By End Use

In 2023, the Hedge Fund Operators segment dominated the alternative data market with a substantial 55% revenue share, reflecting the increasing dependence of hedge funds on alternative data to outsmart their peers in investment strategy, hedge fund operators use alternative data sources like satellite imagery, credit card transactions, social media sentiment, and web scraping to unearth market trends, assess risks, and spot opportunities that are overlooked by traditional financial data.

For example, Bridgewater Associates and Two Sigma, two of the largest hedge funds, have incorporated advanced analytics platforms to analyze unstructured data, such as social media feeds and geopolitical news, to inform trading strategies.

Additionally, AQR Capital Management, meanwhile, has been experimenting with alternative data to enrich their systematic investment models. Since hedge funds are ever-hungry alpha generators and predictors with increasing accuracy, demand for high-quality, diversified alternative data sets will continue.

The Retail Companies segment is witnessing the largest CAGR of 60.79% within the forecasted period, From the increasing usage of alternative data by retailers in maximizing customer experience, optimizing supply chains, and also sales forecasting, retailers have been embracing much alternative data from multiple alternative sources, such as foot traffic analytics, credit card transaction data, e-commerce behavior, and social media sentiment.

For instance, Walmart has collaborated with companies like Quantifind in analyzing social and transactional data, which deepens the insights of consumer behavior and enhances product offerings. Similarly, Target has integrated sophisticated analytics tools that analyze alternative data to predict shopping trends and optimize inventory management to ensure more effective product availability.

Regional Analysis

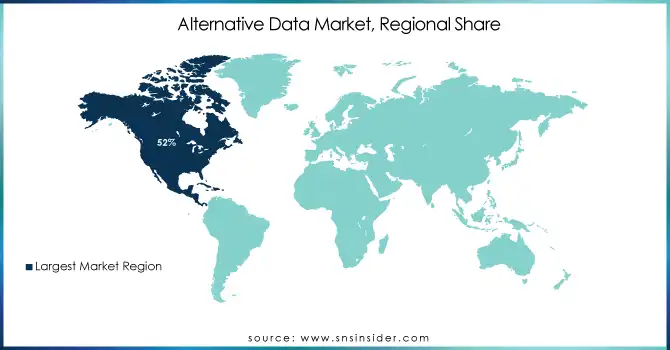

In 2023, North America held the largest market share in the alternative data market, commanding approximately 52% of the total revenue. This is because of the region's strong technological infrastructure, high investment in data analytics, and many financial institutions and technology companies. The United States, for example, is host to some of the world's leading hedge funds, venture capitals, and other financial organizations, which are keen on using alternative data in formulating investment strategies, managing risk, and in market analysis.

For example, companies like BlackRock, Bridgewater Associates, and Two Sigma integrate alternative data such as satellite imagery, credit card transactions, and social media sentiment to predict market trends and enhance their trading strategies.

Moreover, the presence of major technology firms such as Google, Amazon, and Microsoft, who also rely on big data and alternative data to enhance their products and services, contributes significantly to North America's market dominance.

The Asia Pacific region is the fastest-growing market for alternative data in 2023, with an estimated CAGR of 60.15% within the forecasted period. This rapid growth is being driven by the increasing digital transformation, growing e-commerce activities, and adoption of AI and big data analytics across several industries. In specific terms, it includes countries like China, Japan, and India that are expanding the data-driven businesses handling alternative data to make informed decisions within sectors such as retail, finance, and real estate.

For example, Alibaba and JD.com in China use alternative data sources such as transaction records and social media sentiment to enhance customer targeting and optimize inventory management. In India, the fintech companies Paytm and Razorpay make use of credit card transaction data, mobile payment records, and consumer behavior analytics to offer personalized financial products.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

Some of the major players in the Alternative Data Market are:

-

1010Data (1010Data Insights Platform, 1010Data Retail Analytics)

-

Advan (Advan GeoData, Advan Foot Traffic Analytics)

-

Dataminr (Dataminr Alerts, Dataminr Pulse)

-

Earnest Research (Earnest Consumer Spend, Earnest Foot Traffic)

-

M Science (M Science Transaction Insights, M Science Mobile Data Solutions)

-

Preqin (Preqin Insights+, Preqin Pro)

-

RavenPack (RavenPack News Analytics, RavenPack Sentiment Indicators)

-

UBS Evidence Lab (UBS Alternative Data Insights, UBS GeoData Analytics)

-

YipitData (YipitData Consumer Insights, YipitData E-commerce Trends)

-

Preqin Ltd. (Preqin Hedge Fund Data, Preqin Private Equity Intelligence)

-

7Park Data Inc. (7Park Transaction Insights, 7Park App Usage Analytics)

-

Convergence Inc. (Convergence Asset Management Data, Convergence Fund Insights)

-

Eagle Alpha Ltd. (Eagle Alpha Data Sourcing, Eagle Alpha Sentiment Analysis)

-

Geotab Inc. (Geotab Fleet Analytics, Geotab Location Intelligence)

-

Jumpshot (Jumpshot Web Traffic Insights, Jumpshot E-commerce Analytics)

-

JWN Energy (JWN Energy Market Intelligence, JWN Energy Data Insights)

-

The Earnest Research Company (Earnest Consumer Data, Earnest Market Trends)

-

Thinknum Inc. (Thinknum Web Data, Thinknum Alternative Data Platform)

-

Talkingdata (Talkingdata Mobile Analytics, Talkingdata Consumer Insights)

Recent Trends

-

In October 2024, RavenPack launched Bigdata.com, an advanced AI platform designed to transform financial research and decision-making. The platform enables users to interact with billions of financial documents in real-time, create custom research tools, and automate tasks, thereby accelerating the research process.

-

In November 2024, Advan Research Corporation, a leader in foot traffic and transaction data analytics for the financial, real estate, and retail industries, acquired Real Estate Intelligence (REI) from RetailStat, a retailer health data and analytics company. REI, powered by mobile device location data, offers a custom graphical user interface and associated data feeds for retail real estate analytics.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 6.61 Billion |

| Market Size by 2032 | US$ 398.15 Billion |

| CAGR | CAGR of 57.7 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Credit & Debit Card Transactions, Email Receipts, Geo-location (Foot Traffic) Records, Mobile Application Usage, Satellite & Weather Data, Social & Sentiment Data, Web Scraped Data, Web Traffic, Other Data Types) • By Industry (Automotive, BFSI, Energy, Industrial, IT & Telecommunications, Media & Entertainment, Real Estate & Construction, Retail, Transportation & Logistics, Other Industries) • By End Use (Hedge Fund Operators, Investment Institutions, Retail Companies, Other End Use) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 1010Data, Advan, Dataminr, Earnest Analytics, M Science, Preqin, RavenPack, UBS Evidence Lab, YipitData, Preqin Ltd., 7Park Data Inc., Convergence Inc., Eagle Alpha Ltd., Geotab Inc., Jumpshot, JWN Energy, The Earnest Research Company, Thinknum Inc., Talkingdata. |

| Key Drivers | • Increasing Use of AI and Machine Learning Technologies Expands the Alternative Data Market's Capabilities and Applications • Rise of Sustainable and ESG Investing Creates New Demand for Alternative Data Solutions |

| Restraints | • Data Privacy Concerns and Regulatory Challenges May Hinder Alternative Data Market Expansion |