Get E-PDF Sample Report on Alpha Olefin Market - Request Sample Report

The Alpha Olefin Market Size was valued at USD 10.5 Billion in 2023 and is expected to reach USD 16.6 Billion by 2032 and grow at a CAGR of 5.3% over the forecast period 2024-2032.

One of the key factors propelling the growth of the alpha-olefin market is the increasing consumption of polyethylene, which finds extensive application in the packaging, construction, and automotive industry. E-commerce, sustainability standards, and a growing interest in flexible packaging solutions have led to an increase in demand for polyethylene for packaging applications. Moreover, the high strength and light weight of polyethylene, used in piping, insulation, and geomembranes for building applications and fuel tanks, bumpers, and interior parts in the automotive industry necessitate its escalating market requirement.

In 2023, for example, Chevron Phillips Chemical declared plans to increase its alpha olefin production capacity at its Baytown site in Texas as part of efforts to ensure a sufficient supply of comonomers for the polyethylene sector. Similarly, INEOS Oligomers has been expanding its alpha-olefin capacity in order to supply a growing demand for polyethylenes, and its major new build in Jubail, Saudi Arabia is due onstream by 2024. This underscores the capital investments of leading players and aims at competitively benefiting as well as addressing current trends in this market for polyethylene into sectors like packaging, construction, automotive, etc.

The versatility and durability of polyethylene make it a preferred choice for manufacturers, leading to a surge in demand for alpha olefins as a raw material. Furthermore, the growing awareness regarding environmental concerns has prompted the adoption of bio-based alpha olefins. These renewable alternatives offer a sustainable solution, reducing the carbon footprint associated with traditional petroleum-based alpha olefins. This shift towards eco-friendly options has opened up new avenues for market players, creating opportunities for innovation and development.

However, fluctuating crude oil prices and the volatility of raw material availability pose significant hurdles for market players. Additionally, stringent regulations regarding emissions and waste management necessitate continuous research and development to ensure compliance. For instance, Shell Chemical has been advancing its bio-based alpha olefin production through the development of innovative feedstock technologies. In 2022, the company announced its intention to invest heavily in bio-based technologies to enhance the sustainability of its alpha olefin offerings.

Drivers

Increasing demand for polyethylene

Rising demand for synthetic lubricants, plasticizers, and surfactants

The automotive industry is experiencing significant growth, with a rising number of vehicles hitting the roads each year. As a result, the demand for lubricants that can enhance the performance and efficiency of these vehicles has also surged. This need for high-performance lubricants has become a crucial factor propelling the Alpha Olefin Market forward. Alpha olefins, which are key components in the production of lubricants, possess exceptional properties that make them ideal for this purpose. These olefins exhibit excellent thermal stability, oxidation resistance, and low-temperature fluidity, enabling them to withstand the demanding conditions within automotive engines. By utilizing lubricants derived from alpha olefins, automotive manufacturers can ensure optimal engine performance, reduce friction, and enhance fuel efficiency.

Recent events with major players have underscored this trend even more. For example, ExxonMobil Chemical is increasing its PAO production capacities to cater to the growing demand for high-performance lubricants from the automotive industry. In 2023, the company said it would expand its alpha-olefin production plant in Baytown, Texas to respond to the increased demand for synthetic lubricants in the worldwide automotive market. Meanwhile, Chevron Phillips Chemical has also been working on new generation alpha-olefin products to help improve the performance of automotive lubricants.

Moreover, the automotive industry's shift towards electric vehicles (EVs) has further amplified the demand for high-performance lubricants. EVs rely heavily on lubricants to maintain the smooth operation of their electric motors and other vital components. Alpha olefins, with their superior lubricating properties, are well-suited to meet the specific requirements of these advanced electric propulsion systems. In 2023, the company announced a major capacity expansion in its Qatar facility, aimed at producing higher volumes of alpha olefins to support the growing need for EV lubricants.

Restraint

The growth of the alpha olefin market is crippled by the advent of alternative products and threat to the substitution that creates a significant amount of barrier. An improved performance profile and environmental credentials is also driving acceptance of alternative materials, in particular bio-based polymers and synthetic esters across a range of applications, particularly in polyethylene production and lubricants. The replacement also commands benefits such as minimal carbon footprints and enhanced sustainability, attracting end-users seeking compliance with stringent regulatory mandates. Examples include packaging and other industry applications, where some bio-based polymers are derived from renewable sources instead of traditionally produced alpha olefins.

Opportunities

Growing demand for high-performance polymers and specialty chemicals.

In recent years, there has been a remarkable surge in the need for high-performance polymers and specialty chemicals across various industries. These substances play a crucial role in enhancing the performance and durability of numerous products, ranging from automotive components to packaging materials. As a result, the Alpha Olefin Market has witnessed a substantial growth potential. These materials possess exceptional strength, chemical resistance, and thermal stability, making them ideal for demanding applications. Moreover, they offer enhanced flexibility, enabling manufacturers to create innovative and customized solutions for their customers. The automotive industry, for example, heavily relies on high-performance polymers and specialty chemicals to improve the efficiency and safety of vehicles. These substances are utilized in the production of lightweight components, such as bumpers and interior panels, which contribute to fuel efficiency and reduce emissions. Additionally, they enhance the durability and crash resistance of these components, ensuring passenger safety.

By Product

1-hexene product dominated the alpha-olefin market with a revenue share of about 35% in 2023. This is attributed to the increasing utilization of 1-hexene as a widely adopted monomer for the production of High-Density Polyethylene (HDPE) and Linear Low-Density Polyethylene (LLDPE) polymers. As a result, the segment is poised for significant growth. The demand for polyethylene is on the rise, primarily driven by the flourishing automotive and consumer goods markets in the emerging economies of China, India, and Brazil. These countries have witnessed a surge in economic development, leading to an increased need for polyethylene-based products. Consequently, this surge in demand is expected to further propel the growth of the 1-hexene segment.

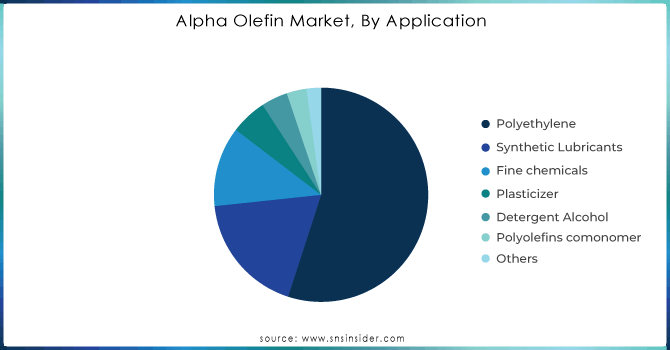

By Application

Polyethylene held the largest the market with a share of 55.0% in 2023. Polyethylene compounds find maximum adoption in construction industry, as a key market. They are also widely used in plastics industries like Manufacturing or processors and packagers since they can be produced as film, block moulding, pipe or rotational moulding which is being used for manufacturing of low-carbon duct work. Conversely, low-density polyethylene is considered the material of choice for certain applications, due to its cheapness in manufacturing, heat saleability and relatively high tensile strength that makes it deal well with stretching plus its soft nature.

Need any customization research on Alpha Olefin Market - Enquiry Now

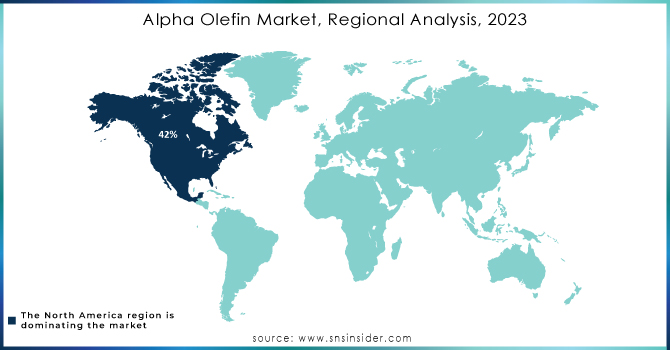

Regional Analysis

North America dominated the Alpha Olefin Market with the highest revenue share of about 42% in 2023. This is attributed to the shale gas boom in the United States, which has significantly boosted ethylene production in the region, consequently driving alpha olefin production as well. Moreover, the ongoing increase in oil exploration activities along the Gulf of Mexico is expected to further propel the growth of the alpha-olefin market. Canada, too, is poised to contribute to the surge in alpha olefin production, because of its escalating crude oil production. The region's abundant natural resources make it an attractive investment hub for both domestic and foreign businesses seeking to produce alpha olefins. Furthermore, the presence of numerous manufacturing enterprises, coupled with the expansion of petrochemical and infrastructural projects in the gas and oil sectors, is anticipated to fuel the growth of the regional market.

Asia Pacific is expected to grow with the highest CAGR of about 5.5% in the Alpha Olefin Market during the forecast period. This growth is attributed to the rapid urbanization and industrialization occurring in emerging economies such as China and India, which are expected to drive the demand for polyethylene products. Furthermore, the manufacturing sector in the Asia Pacific has witnessed significant growth due to various government incentives and a favorable regulatory environment in countries like China, India, Malaysia, and Indonesia. Alpha olefins find extensive applications in industries such as polyethylene, detergent alcohols, synthetic lubricants, and plasticizers. The increasing urbanization and industrialization in China and India's emerging economies are anticipated to further boost the demand for polyethylene products. Moreover, the Asia Pacific region is expected to witness a surge in the production of these products, which will contribute to the growth of the regional market. In terms of market share, China currently dominates the alpha olefins market, while India's market is experiencing the fastest growth in the Asia-Pacific region. This highlights the significant potential and opportunities present in these markets.

Key Players

Chevron Phillips Chemical Company LLC (1-Hexene, 1-Decene)

Royal Dutch Shell plc (Shell Neodene Alpha Olefins, Shell Higher Olefins)

INEOS Oligomers (Durasyn Polyalphaolefins, INEOS Oligomer Alpha Olefins)

SABIC (SABIC Alpha Olefins, SABIC Linear Alpha Olefins)

ExxonMobil Chemical Company (ExxonMobil Elevex PAO, ExxonMobil AlphaPlus)

Sasol Limited (Sasol Alpha Olefins, Sasol Oligomers)

Qatar Chemical Company Ltd. (Q-Chem) (Q-Chem Alpha Olefins, Q-Chem Linear Alpha Olefins)

Evonik Industries AG, (Viscodrive PAO, Evonik Linear Alpha Olefins)

Mitsubishi Chemical Corporation (Mitsubishi LAO, Mitsubishi Oligomer Alpha Olefins)

Idemitsu Kosan Co., Ltd. (Idemitsu PAO, Idemitsu Alpha Olefins)

Petrochemical Corporation of Singapore (PCS Alpha Olefins, PCS Linear Alpha Olefins)

Saudi Basic Industries Corporation (SABIC Low-Density Alpha Olefins, SABIC High-Performance Olefins)

Royal Dutch Shell

Petro Rabigh (Rabigh Alpha Olefins, Rabigh Higher Olefins)

TASCO Group (TASCO LAO, TASCO Olefins)

Sinopec (Sinopec Alpha Olefins, Sinopec Linear Alpha Olefins)

Dow Chemical Company (Dow Polyalphaolefin, Dow XLAO)

Westlake Chemical Corporation (Westlake LAO, Westlake Alpha Olefins)

LyondellBasell Industries N.V. (LyondellBasell Alpha Olefins, LyondellBasell Polyalphaolefins)

In Sept 2023, ExxonMobil made an exciting announcement regarding the commencement of operations for two chemical production units at its Baytown manufacturing facility in Texas. This remarkable $2 billion expansion project is a crucial component of ExxonMobil's extensive growth strategy, aimed at providing enhanced value through the production of top-tier products at its refining and chemical facilities along the U.S. Gulf Coast.

In August 2023, Chevron Phillips Chemical achieved a significant milestone by successfully completing the construction of the world's largest on-purpose 1-hexene unit in Old Ocean, Texas. This groundbreaking achievement positions Chevron Phillips Chemical at the forefront of innovation, with operations at the plant scheduled to commence by early September.

| Report Attributes | Details |

| Market Size in 2023 | US$ 10.5 Bn |

| Market Size by 2032 | US$ 16.6 Bn |

| CAGR | CAGR of 5.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (1-butene, 1-hexene, 1-octene, 1-decene, 1-dodecene, and Others) • By Application (Polyethylene, Synthetic Lubricants, Fine chemicals, Plasticizer, Detergent Alcohol, Polyolefins comonomer, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Evonik Industries AG, INEOS Oligomers, Dow Chemical Company, Chevron Phillips Chemical Company LLC, Qatar Chemical Company Ltd, Exxon Mobil Corporation, Royal Dutch Shell, SABIC, Sasol Limited, Mitsubishi Chemical Corp. |

| Key Drivers | • Increasing demand for polyethylene • Rising demand for synthetic lubricants, plasticizers, and surfactants • Expanding automotive industry and the need for high-performance lubricants drives the market growth |

| Market Restraints | • Volatility of raw material prices • Availability of alternative products and the threat of substitution hamper the market growth |

Ans. The Compound Annual Growth rate for the Alpha Olefin Market over the forecast period is 5.3%.

Ans. The projected market size for the Alpha Olefin Market is USD 16.6 billion by 2032.

Ans: The Polyethylene application segment dominated the Alpha Olefin Market with the highest revenue share of about 56% in 2023.

Ans: Royal Dutch Shell, SABIC, Evonik Industries AG, Exxon Mobil Corporation, INEOS Oligomers, Dow Chemical Company, Chevron Phillips Chemical Company LLC, Qatar Chemical Company Ltd, Sasol Limited, and Mitsubishi Chemical Corp are the key players in the Alpha Olefin Market.

Ans: Yes, you can ask for the customization as per your business requirement.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Product, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Alpha Olefin Market Segmentation, by Product

7.1 Chapter Overview

7.2 1-butene

7.2.1 1-butene Market Trends Analysis (2020-2032)

7.2.2 1-butene Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 1-hexene

7.3.1 1-hexene Market Trends Analysis (2020-2032)

7.3.2 1-hexene Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 1-octene

7.4.1 1-octene Market Trends Analysis (2020-2032)

7.4.2 1-octene Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 1-decene

7.5.1 1-deceneMarket Trends Analysis (2020-2032)

7.5.2 1-decene Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 1-dodecene

7.6.1 1-dodecene Market Trends Analysis (2020-2032)

7.6.2 1-dodecene Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Alpha Olefin Market Segmentation, by Application

8.1 Chapter Overview

8.2 Polyethylene

8.2.1 Polyethylene Market Trends Analysis (2020-2032)

8.2.2 Polyethylene Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Synthetic Lubricants

8.3.1 Synthetic Lubricants Market Trends Analysis (2020-2032)

8.3.2 Synthetic Lubricants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Fine chemicals

8.4.1 Fine chemicals Market Trends Analysis (2020-2032)

8.4.2 Fine chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Plasticizer

8.5.1 Plasticizer Market Trends Analysis (2020-2032)

8.5.2 Plasticizer Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Detergent Alcohol

8.6.1 Detergent Alcohol Market Trends Analysis (2020-2032)

8.6.2 Detergent Alcohol Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Polyolefins comonomer

8.7.1 Polyolefins comonomer Market Trends Analysis (2020-2032)

8.7.2 Polyolefins comonomer Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8 .2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.4 North America Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.5.2 USA Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.6.2 Canada Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Mexico Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.5.2 Poland Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.6.2 Romania Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.4 Western Europe Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.5.2 Germany Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.6.2 France Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.7.2 UK Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.8.2 Italy Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.9.2 Spain Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.12.2 Austria Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.4 Asia Pacific Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 China Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 India Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.5.2 Japan Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.6.2 South Korea Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.2.7.2 Vietnam Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.8.2 Singapore Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.9.2 Australia Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.4 Middle East Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.5.2 UAE Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.4 Africa Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Alpha Olefin Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.4 Latin America Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.5.2 Brazil Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.6.2 Argentina Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.7.2 Colombia Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Alpha Olefin Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Alpha Olefin Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 Evonik Industries AG

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 INEOS Oligomers

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Dow Chemical Company

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Chevron Phillips Chemical Company LLC

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Qatar Chemical Company Ltd

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Exxon Mobil Corporation

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Royal Dutch Shell

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 SABIC

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Sasol Limited

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Mitsubishi Chemical Corp

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product

1-butene

1-hexene

1-octene

1-decene

1-dodecene

Others

By Application

Polyethylene

Synthetic Lubricants

Fine chemicals

Plasticizer

Detergent Alcohol

Polyolefins comonomer

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Insoluble Sulfur Market was valued at USD 1.13 Billion in 2023 and is expected to reach USD 1.91 Billion by 2032, growing at a CAGR of 6.00% from 2024-2032.

The Choline Chloride Market size was USD 551.84 Million in 2023 and is expected to reach USD 973.61 Million by 2032, at a CAGR of 6.51 % from 2024-2032.

The Electrocoating Market Size was valued at USD 4.3 billion in 2023 and is expected to reach USD 6.4 billion by 2032 and grow at a CAGR of 4.6% over the forecast period 2024-2032.

Ion Exchange Membranes Market size was valued at $ 1.25 billion in 2023 and is expected to reach $ 2.06 billion by 2032, at a CAGR of 5.73% from 2024-2032.

The Cellulosic Fire Protection Intumescent Coatings Market size was USD 599 Bn in 2023 & will reach $823.5 Bn by 2032 with a CAGR of 3.6% by 2024 to 2032.

The Black Phosphorus Market Size was valued at USD 18.69 Million in 2023 and is expected to reach USD 468.60 Million by 2032, growing at a CAGR of 43.05% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone