Allulose Market Report Scope & Overview:

To get more information on the Allulose Market - Request Sample Report

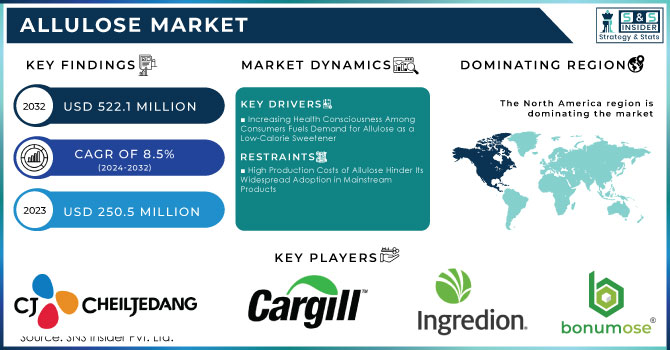

The Allulose Market Size was valued at USD 250.5 million in 2023 and is expected to reach USD 522.1 million by 2032 and grow at a CAGR of 8.5% over the forecast period 2024-2032.

The Allulose market has become one of rising momentum due to the growing demand in low-calorie sweeteners and healthy foods. This rare sugar, occurring in trace amounts in fruits such as figs and raisins, has been adopted as being able to impart sweetness without the caloric effect of usual sugars. More recent research has also focused on benefits that can be realized from its use, specifically in terms of managing blood sugar levels. For instance, research from Toronto Metropolitan University in August 2024 indicated that allulose can be an effective method of regulating blood sugar levels and therefore provides new avenues for control of diabetes. This is part of a broader, more holistic trend of incorporating functional ingredients into foods to be consumed by health-conscious consumers.

The Allulose market is highly affected by the increasing health consciousness and the constantly rising obese and diabetic rate in most parts of the world. With consumers likelier to pursue choices that complement their wellness objectives, there's a growing interest in allulose as a potential sugar substitute. According to Nutraceuticals World, an article published last June 2023, claims that allulose has been demonstrated to inhibit glucose and insulin responses, further giving it the status as a favorite sweetener. Such qualities make allulose an attractive proposition for producers interested in innovation and offering healthier alternatives in their portfolios. This advocacy on the aspect of health has also been supported by endorsement from experts in nutrition as well as health institutions.

Infrastructure investment to support allulose production has also witnessed some significant developments. In September 2024, Samyang Corporation announced a major expansion in plans to build a new plant for allulose production. It would enhance the supply chain in making allulose availability to become more adequate for increasing market demands. Such initiatives portray the commitment of the industry in meeting current consumer demand but trying to look into future trends associated with healthier types of sweeteners. The new production capabilities that are being set up speak towards the direction and sustainability of this product in the future market.

Innovation into the Allulose market remains a focus area in the activities of many manufacturers, considering the unique properties of this product that can be leveraged in various applications. Recent developments have led to the development of products based on allulose to cater for the needs of the consumers, including keto-friendly options and low-glycemic foods. As the market matures, companies are anticipated to continue investing in research and development of allulose to gain more benefits of the sweetener. This can lead to new uses of it in the food and beverage industry. This establishes a dynamic, responsive market and its preparedness to move forward as consumer preferences continue to evolve and healthier options are increasingly sought.

Allulose Market Dynamics:

Drivers:

-

Increasing Health Consciousness Among Consumers Fuels Demand for Allulose as a Low-Calorie Sweetener

The rising awareness regarding health and wellness is driving consumers to seek healthier food alternatives, significantly boosting the demand for low-calorie sweeteners like allulose. As obesity rates and diabetes prevalence continue to rise globally, consumers are becoming increasingly mindful of their dietary choices, often opting for products that do not compromise on taste while minimizing caloric intake. Allulose, a rare sugar with about 70% of the sweetness of sucrose but only 10% of the calories, has gained traction among health-conscious individuals looking to reduce sugar consumption. This growing trend is not limited to individuals but is also embraced by food manufacturers aiming to cater to this shifting consumer landscape. They are increasingly formulating products with allulose, particularly in beverages, baked goods, and snacks, to meet the demand for healthier options without sacrificing flavor. The trend is further supported by endorsements from nutritionists and health organizations, which recognize allulose as a suitable alternative for those managing their sugar intake. Overall, the increasing health consciousness among consumers is a significant driver of the allulose market, pushing both demand and innovation in this sector.

-

Rising Popularity of Keto and Low-Carb Diets Enhances Allulose Market Growth

The increasing popularity of ketogenic and low-carb diets has created a substantial opportunity for allulose in the market. These dietary approaches emphasize reduced carbohydrate intake to promote weight loss and improved metabolic health, leading to a surge in demand for low-glycemic sweeteners that do not spike blood sugar levels. Allulose fits seamlessly into these dietary frameworks, as it has a minimal impact on blood glucose and insulin levels, making it an attractive choice for individuals adhering to low-carb and keto diets. Manufacturers are recognizing this trend and are formulating a variety of keto-friendly products, including snacks, desserts, and beverages, that incorporate allulose as a primary sweetening agent. The versatility of allulose allows it to be used in diverse applications, enhancing its appeal in this rapidly growing segment. As more consumers adopt keto and low-carb lifestyles, the demand for allulose is expected to increase, driving further growth in the market. Additionally, the association of allulose with healthy eating trends positions it favorably among consumers who prioritize their dietary choices.

Restraint:

-

High Production Costs of Allulose Hinder Its Widespread Adoption in Mainstream Products

Despite the growing demand for allulose, its high production costs present a significant restraint to its widespread adoption in mainstream food products. Allulose is typically produced through enzymatic conversion of fructose or can be derived from certain plant sources, which involves complex processing and technology. These production methods lead to elevated costs compared to conventional sweeteners, making it less accessible for manufacturers who aim to keep their products competitively priced. As a result, many food and beverage companies may hesitate to incorporate allulose into their formulations, fearing that the added costs could deter price-sensitive consumers. Additionally, the relatively limited scale of allulose production compared to traditional sweeteners like sucrose or high-fructose corn syrup further exacerbates this issue, contributing to price volatility. Until more efficient production methods are developed to lower costs, the high price of allulose may continue to restrain its market growth and limit its penetration into various product categories, especially those that rely on cost competitiveness.

Opportunity:

-

Growing Trend of Natural and Clean Label Ingredients Opens Doors for Allulose in Food Products

The increasing consumer demand for natural and clean label ingredients presents a significant opportunity for the allulose market. As consumers become more aware of the ingredients in their food, they are actively seeking products made with recognizable and wholesome components. Allulose, being a naturally occurring sugar found in certain fruits, aligns well with this clean label trend, as it can be marketed as a natural sweetener devoid of artificial additives. This consumer preference for natural ingredients has prompted manufacturers to reformulate existing products and develop new ones that utilize allulose, thereby enhancing their market appeal. The opportunity is particularly pronounced in health-focused food segments, including organic, non-GMO, and functional foods, where allulose can provide sweetness without compromising on quality. Companies that can effectively position their products with allulose as a key ingredient stand to gain a competitive edge in the market. As the trend toward transparency and health continues to evolve, the allulose market is well-positioned to benefit from this shift, potentially increasing its adoption in various food and beverage applications.

Challenge:

-

Regulatory Hurdles and Consumer Perception Challenges Affecting Allulose Market Expansion

Despite its advantages, the allulose market faces challenges related to regulatory hurdles and consumer perception that may affect its expansion. Regulatory bodies in various regions, including the FDA in the United States and the EFSA in Europe, have specific guidelines and assessments for the approval of new food ingredients. While allulose has received Generally Recognized As Safe (GRAS) status in the U.S., the evolving regulatory landscape can pose uncertainties for producers looking to market allulose in different jurisdictions. Additionally, consumer perception plays a crucial role in market expansion. Some consumers may still associate allulose with artificial sweeteners or have misconceptions about its safety and health benefits. Overcoming these challenges requires effective education and marketing strategies to inform consumers about the benefits of allulose and dispel any myths surrounding its use. Manufacturers will need to invest in consumer education initiatives and work closely with regulatory authorities to navigate these challenges and facilitate the broader acceptance and adoption of allulose in the food industry.

Allulose Market Segments

By Product Type

In 2023, the Natural Sugar Alternative segment dominated the allulose market with an estimated market share of 45%. This segment has seen significant growth due to the increasing consumer preference for healthier sweetening options that provide similar taste profiles to traditional sugar while offering lower caloric content. As more consumers adopt health-conscious lifestyles, natural sugar alternatives are being recognized as preferable choices. For example, brands like Quest Nutrition and Chobani have incorporated allulose as a natural sweetener in their protein bars and yogurts, respectively. The shift towards using allulose in products marketed as low-sugar or keto-friendly is driving its popularity as a natural sugar alternative, further solidifying this segment's leading position in the market.

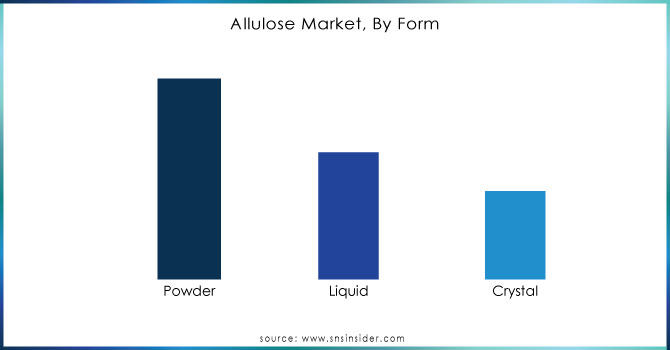

By Form

The Powder form of allulose led the market in 2023, capturing an estimated market share of 55%. This dominance can be attributed to the versatility of powdered allulose, making it easy to incorporate into various food and beverage formulations. Powdered allulose is particularly favored by manufacturers for its convenience in measuring and mixing into recipes, which is essential for products like baked goods, snacks, and beverages. For instance, popular brands such as Perfect Keto use powdered allulose in their keto-friendly baking mixes, allowing consumers to enjoy sweet treats without the added calories. The powder form's broad applicability in both commercial and home cooking further enhances its appeal, securing its position as the leading segment in the allulose market.

To Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, the Food and Beverages segment dominated the allulose market with an estimated market share of 60%. This significant share reflects the growing incorporation of allulose into a wide range of products, including soft drinks, sports drinks, and snack foods. Many beverage manufacturers are increasingly turning to allulose to reduce sugar content while maintaining sweetness, responding to consumer demands for healthier options. For instance, several brands, such as Zevia and Bai, have launched allulose-sweetened beverages that cater to health-conscious consumers. The versatility of allulose in enhancing flavor profiles without the associated calories makes it a favored ingredient in the food and beverage sector, driving its market dominance in this application.

By Distribution Channel

In 2023, the Supermarkets/Hypermarkets segment led the allulose market with an estimated market share of 50%. This segment's dominance is primarily due to the widespread availability and accessibility of allulose products through these retail channels. Supermarkets and hypermarkets offer a diverse range of allulose-containing products, enabling consumers to easily find their preferred brands in one location. Major grocery chains, such as Walmart and Kroger, have increasingly included allulose products in their health and wellness aisles, catering to the growing consumer interest in low-calorie sweeteners. Additionally, the physical presence and trust associated with established retail outlets further contribute to the popularity of allulose in supermarkets, solidifying this distribution channel's leading position in the market.

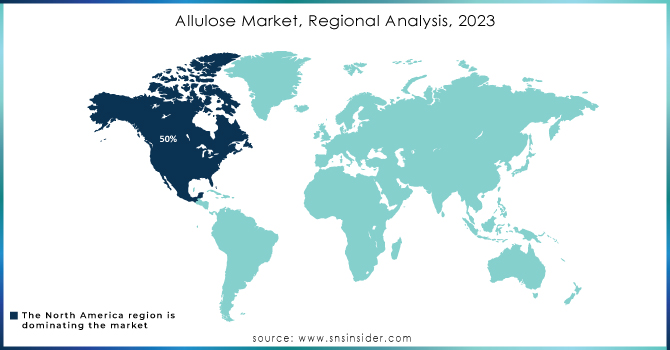

Allulose Market Regional Outlook

In 2023, North America dominated the allulose market with a market share of approximately 50%. The region's leadership can be attributed to the increasing consumer awareness of health and wellness trends, leading to a significant demand for low-calorie and natural sweeteners. The United States, in particular, has seen a surge in the adoption of allulose across various food and beverage products, fueled by a growing population of health-conscious consumers. Major brands such as PepsiCo and Coca-Cola have incorporated allulose into their product lines, offering beverages with reduced sugar content while retaining the sweetness consumers desire. This strong presence of key players, combined with the region's robust distribution channels and increasing availability of allulose products in grocery stores and online platforms, has solidified North America's position as the leading market for allulose in 2023.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the allulose market, with a CAGR of around 18%. This rapid growth can be attributed to the rising health consciousness among consumers in countries like China and India, where there is an increasing shift towards healthier dietary choices. The growing prevalence of lifestyle diseases, such as obesity and diabetes, has prompted consumers to seek out low-calorie sweeteners, including allulose, as alternatives to traditional sugar. Additionally, local manufacturers are beginning to explore the production and incorporation of allulose in various food applications, including snacks and beverages, in response to this demand. For instance, companies like Samyang Corporation have recently announced plans to establish allulose production facilities in South Korea, further enhancing the supply chain in the region. This combination of consumer demand and increased production capabilities positions the Asia-Pacific region as a key player in the allulose market, driving its impressive growth rate.

Key Players

-

Anderson Global Group (Allulose Powder, Allulose Liquid)

-

Bonumose LLC (Allulose Syrup, Allulose Crystals)

-

Cargill Inc (Allulose Sweetener, Allulose Blend)

-

CJ Cheil Jedang (Allulose Powder, Allulose Granules)

-

Eat Just Inc. (Just Egg (with allulose), Just Cookies (with allulose))

-

Ingredion Incorporated (Allulose Sweetener, Allulose Liquid)

-

Matsutani Chemical Industry Co. Ltd (AminoSweet (Allulose), AjiSweet (Allulose))

-

Samyang Corporation (Allulose Powder, Allulose Syrup)

-

Tate & Lyle (Allulose Sweetener, Lyle's Golden Syrup (with allulose))

-

Wellversed (Allulose Sugar Substitute, Wellversed Allulose Powder)

-

Archer Daniels Midland Company (ADM) (Allulose Powder, Allulose Liquid)

-

DuPont Nutrition & Biosciences (Allulose Sweetener, Danisco Sweeteners)

-

Hawkins Watts Limited (Hawkins Watts Allulose, Allulose Blend)

-

Merisant Company (Equal Allulose Sweetener, Allulose Blend)

-

Natural Sweeteners (Natural Sweeteners Allulose, Allulose Syrup)

-

Nutraceutical International Corporation (Nutraceutical Allulose Powder, Allulose Sweetener)

-

Pioneer Sugar (Pioneer Allulose, Allulose Crystals)

-

Pure Sweeteners (Pure Allulose, Allulose Powder)

-

Stevia First Corporation (Stevia and Allulose Blend, Allulose Sweetener)

-

Zhejiang Ginkgo BioWorks Co. Ltd (Allulose Powder, Ginkgo Allulose Blend)

Top 10 Users of Allulose In the Market:

-

Food and Beverage Manufacturers

-

Baked Goods and Confectionery Producers

-

Dairy and Plant-Based Product Companies

-

Dietary Supplement Manufacturers

-

Health and Wellness Food Brands

-

Sugar Alternatives and Sweetener Companies

-

Sauces and Dressings Producers

-

Snack Food Manufacturers

-

Frozen Dessert Producers

-

Private Label Brands and Retailers

Recent Developments

- September 2024: Samyang Corporation completed Korea's largest allulose production facility, enhancing its capabilities to meet the growing demand for this low-calorie sweetener.

- August 2024: Food Standards Australia New Zealand (FSANZ) prepared to approve D-allulose as a novel food, facilitating its inclusion in various products and addressing the rising consumer demand for healthier sweetening alternatives.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 250.5 Billion |

| Market Size by 2032 | USD 522.1 Billion |

| CAGR | CAGR of 8.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Sugar, Natural Sugar Alternative, Artificial Sweetener) •By Form (Powder, Liquid, Crystal) •By Application (Food and Beverages, Pharmaceuticals, Bakery & Confectionery, Sauces & Dressings, Others) •By Distribution Channel (Online Stores, Supermarkets/Hypermarkets, Specialty Stores, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Matsutani Chemical Industry Co. Ltd, Cargill Inc, Samyang Corporation, Eat Just Inc., Wellversed, CJ Cheil Jedang, Bonumose LLC, Anderson Global Group, Ingredion Incorporated, Tate & Lyle and other key players |

| Drivers | •Increasing Health Consciousness Among Consumers Fuels Demand for Allulose as a Low-Calorie Sweetener •Rising Popularity of Keto and Low-Carb Diets Enhances Allulose Market Growth |

| Restraints | •High Production Costs of Allulose Hinder Its Widespread Adoption in Mainstream Products |