To get more information on All-wheel Drive Market - Request Free Sample Report

The All-wheel Drive Market was valued at USD 39.4 Billion in 2023 and is expected to reach USD 83.3 Billion by 2032, growing at a CAGR of 8.70% from 2024-2032.

The AWD market has experienced significant growth due to the rising demand for vehicles that provide increased levels of safety, performance, and comfort in a variety of road conditions. AWD distributes power across all four wheels which improves traction and stability and is especially helpful when weather conditions are poor, For instance, in conditions where the pavement is wet, snowy, or icy, AWD vehicles are particularly in demand, making them especially popular in colder regions like North America and Europe. One of the significant factors responsible for the growth of the all-wheel drive market is the increasing demand for SUVs and crossovers among consumers, which are commonly offered with an all-wheel drive system as standard or an option. More than 40% of new vehicle sales in North America were SUVs in 2024, with many models available with AWD. Plus, the awareness of the advantages of AWD, including improved handling, off-road performance, and resale values, led to a rapid adoption rate.

Technological advances have also proven to be the foundation of the growth of the market. AWD systems are being developed to be more fuel-efficient and weigh less, such as systems that use electric motors to drive one or two wheels. For example, the 2024 Ford Mustang Mach-E features an electric AWD system for improved performance and energy efficiency compared to conventional AWD systems. Further, the increasing penetration of AWD in EVs is driving the market growth. As the number of electric vehicles (EVs) on the road continues to rise, manufacturers are incorporating a variety of AWD systems to enhance the power and performance of their electric models. A great example is the tri-motor AWD setup in the Tesla Model S Plaid, allowing for fast acceleration and impressive handling that will appeal to the performance consumer market for EVs.

|

Aspect |

Improvement with AWD |

Percentage Improvement |

|

Traction & Stability |

Better grip on slippery surfaces |

25-30% |

|

Handling |

Enhanced cornering and stability at high speeds |

15-20% |

|

Off-Road Capability |

Improved performance on rugged or uneven terrain |

35-40% |

|

Comfort |

Smoother ride in adverse conditions |

20-25% |

|

Safety |

Reduced risk of skidding and loss of control in wet or icy conditions |

30-40% |

Market Dynamics

Drivers

Enhanced safety features provided by AWD systems, reducing the risk of skidding and loss of control on slippery roads.

The safety improvement associated with All-Wheel Drive (AWD) systems is one of the major factors promoting the growth of the AWD market. All-wheel drive (AWD) systems send power to all four wheels of a vehicle, increasing traction and stability, especially on loose or uneven surfaces. It makes this traction able to help avoid skidding, loss of control, and accidents, especially when the road is wet, rainy, snowy, or icy. AWD is gaining appreciation in parts of North America and Europe that experience extreme weather, where icy or wet roads are common — AWD helps maintain vehicle stability while improving handling. AWD systems can engage all four wheels, improving vehicle grip on slippery surfaces and reducing the chances of wheel spin, which in turn enables smoother acceleration and braking. This is especially useful for drivers who have to drive on difficult roads, like icy interstate roads or snow-covered city streets.

AWD systems provide safety advantages, so they are now increasingly used on everything from SUVs and crossovers to sedans and even EVs. In markets with severe weather conditions, buyers are increasingly realizing the added safety that comes with AWD. Because consumers want more secure, more dependable automobiles, automobile manufacturers are placing AWD systems under more designs. The rise of consumer preference to equip cars with all-wheel drive (AWD)—combined with consumer's growing emphasis on safety—plays an important role in expanding the AWD market.

Increased consumer preference for SUVs and crossovers, which commonly feature AWD systems for enhanced performance.

Growing demand for AWD vehicles in regions with harsh weather conditions like snow, ice, and rain, for improved traction and stability.

Restraints

AWD systems increase the overall cost of vehicles, making them less affordable for some consumers.

In price-sensitive markets, the added cost of AWD systems can be a deciding factor, influencing whether a consumer makes a purchase or opts out. AWD system adds components like a transfer case, more drivetrain hardware, and more complex suspensions. These additional components drive up both the cost of producing the vehicle and its MSRP. Consequently, cars with all-wheel drivetrain systems typically cost more than their 2WD equivalents, so they can be out of reach for price-oriented customers. To consumers, the advantages of AWD might not be worth the higher upfront cost, especially if they are in a region where a 2WD vehicle would do. Though AWD can provide benefits such as enhanced traction, handling, and the perception of safety when the weather turns bad, not all buyers see the value. The additional cost of AWD systems can be a major hurdle for consumers in markets where fuel consumption and lower purchase prices are important purchase considerations.

The complexity and additional components of AWD systems also can increase maintenance and repair costs, which may deter some potential buyers. This is especially important in developing markets or first-time buyers who may be more concerned about initial purchase prices and lifetime running costs.

Consequently, even though AWD systems enjoy widespread acceptance in regions with extreme climates, the high cost of AWD systems continues to hold them back from widespread market penetration, especially in segments where cost sensitivity is a primary consideration.

The added components of AWD systems increase the weight of the vehicle, potentially reducing fuel efficiency and performance.

AWD vehicles tend to consume more fuel compared to two-wheel drive vehicles due to the additional power needed to drive all four wheels.

By Vehicle

In 2023, the passenger vehicle segment dominated the market and represented a significant revenue share of more than 62%. The all-wheel drive systems offer additional traction and stability — especially when the weather takes a turn for the worse and rain, snow and ice are present — making them very appealing to drivers looking for more control and assurance behind the wheel. Moreover, the growing adoption of sport utility vehicles (SUVs) and crossovers, where many come standard or offered with all-wheel drive, has bolstered passenger all-wheel drive market share. The right combination of comfort, utility, and rugged capabilities make them desirable for any consumer group from urban to adventure enthusiasts. In addition, improved technologies for all-wheel drive have created far simpler and lighter systems which has allowed for lowered fuel usage. This has contributed to making them more practical for everyday applications, which is also a factor in their increased adoption in the passenger vehicle market. and upkeep, delivering a dependable service that serves the urban commuter.

The commercial vehicle segment is expected to register the fastest CAGR during the forecast period, The rapid growth of commercial all-wheel vehicles mirrors changing commercial needs and demands. AWD systems have become clearer of benefit as businesses and industries aim to optimize operational efficiency and facilitate reliable transport over various terrains. Ultimate traction, optimal stability, and robust off-road approach—these are key conditions for commercial all-wheel drive vehicles indispensable for industries and processes such as construction, logistics, and agriculture, which commonly operate in adverse conditions. Demand for all-wheel drive vans and trucks capable of cruising through both urban and rural landscapes has continued to rise on the back of the e-commerce and last-mile delivery growth trend which has emphasized the need for timely and effective goods deliveries.

By Propulsion

ICE segment dominated the market in 2023 with a revenue share of more than 69%, In 2023, manufacturers have spent considerable energy on optimizing ICE hallmark all-wheel drive, and that means improved mileage coupled with superior performance and overall vehicular integrity. ICE all-wheel drive vehicles are proven and convenient and remain a good fit for many, whether the buyer needs something to hit the trails with or just wants to ensure traction in wet weather.

The electric segment is expected to register the fastest CAGR during the forecast period, owing to the technological advancements in electric vehicle (EV) technology and the increasing consumer preference towards sustainable transportation solutions. In addition, increasing environmental concerns, tightening emission rules, and fierce investments by leading automobile manufacturers in EV technology are also supporting the electric all-wheel drive market. Recent innovations in battery technology, as well as electric drivetrains, have also made electric all-wheel drive vehicles considerably more range, performance, and reliability than ever before. Regenerative braking, advanced battery management systems, and precise placement of high-performance electric motors at each axle all help augment vehicle dynamics and driving experience.

Regional Analysis

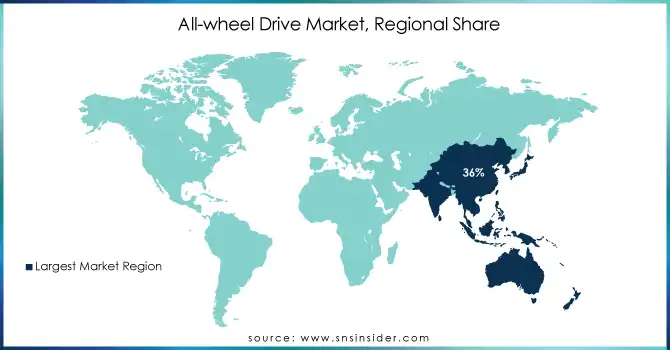

In 2023, Asia Pacific dominated the market with a revenue share of more than 36% of the market. Urbanization trends, increasing disposable income, and the rising automotive industry are driving rapid growth of the all-wheel drive vehicle market. China, Japan, and India are leading this growth, where consumers are opting for all-wheel drive vehicles due to their powerful and safety characteristics. The wide range of climatic challenges across the Asia Pacific region, between monsoons and mountainous regions, has driven demand for all-wheel drive systems.

North America is expected to grow at the fastest CAGR during the forecast period. Widespread snow and rain have made consumer demand for all-wheel drive vehicles popular in many parts of the region That would not typically prioritize traction and stability. The emergence of new All-wheel Drive technology is a significant contributing factor to growth in the market as manufacturers are now providing more efficient and responsive all-wheel drive solutions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Bosch Group, Magna International Inc., ZF Friedrichshafen AG, GKN Automotive, Aisin Seiki Co., Ltd., Dana Incorporated, BorgWarner Inc., Delphi Technologies, JTEKT Corporation, Toyota Motor Corporation, Ford Motor Company, General Motors (GM)

RECENT DEVELOPMENTS:

In August 2024, Ford introduced the 2025 Maverick Hybrid with an optional AWD system. This model offers improved fuel efficiency and towing capacity, catering to the growing demand for hybrid pickup trucks.

In November 2024, Jeep launched the Avenger 4xe Hybrid SUV in the UK, featuring a smart AWD system that adjusts power distribution based on driving conditions. This vehicle combines off-road capabilities with affordability, appealing to a broader market segment.

|

Report Attributes |

Details |

|---|---|

|

CAGR |

CAGR of 8.70% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2022-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Vehicle (Passenger Vehicle, Commercial Vehicle) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Bosch Group, Magna International Inc., ZF Friedrichshafen AG, GKN Automotive, Aisin Seiki Co., Ltd., Dana Incorporated, BorgWarner Inc., Delphi Technologies, JTEKT Corporation, Toyota Motor Corporation, Ford Motor Company, General Motors (GM) |

|

Key Drivers |

• Increased consumer preference for SUVs and crossovers, which commonly feature AWD systems for enhanced performance. |

|

RESTRAINTS |

• The added components of AWD systems increase the weight of the vehicle, potentially reducing fuel efficiency and performance. |

The forecast period of the All-Wheel Drive Market is 2024-2031.

The ongoing Russia-Ukraine conflict has thrown a painfull stress into the previously steady growth trajectory of the All-Wheel Drive (AWD) market.

The North America region high share of the All-Wheel Drive Market

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Vehicle Production and Sales Volumes, 2020-2032, by Region

5.2 Emission Standards Compliance, by Region

5.3 Vehicle Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on vehicle maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. All-wheel Drive Market Segmentation, By Vehicle

7.1 Chapter Overview

7.2 Passenger Vehicle

7.2.1 Passenger Vehicle Market Trends Analysis (2020-2032)

7.2.2 Passenger Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Commercial Vehicle

7.3.1 Commercial Vehicle Market Trends Analysis (2020-2032)

7.3.2 Commercial Vehicle Market Size Estimates and Forecasts to 2032 (USD Billion)

8. All-wheel Drive Market Segmentation, by Propulsion

8.1 Chapter Overview

8.2 ICE

8.2.1 ICE Market Trends Analysis (2020-2032)

8.2.2 ICE Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Electric

8.3.1 Electric Market Trends Analysis (2020-2032)

8.3.2 Electric Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. All-wheel Drive Market Segmentation, by System

9.1 Chapter Overview

9.2 Automatic

9.2.1 Automatic Market Trends Analysis (2020-2032)

9.2.2 Automatic Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3Manual

9.3.1Manual Market Trends Analysis (2020-2032)

9.3.2Manual Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.2.4 North America All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.2.5 North America All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.2.6.2 USA All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.2.6.3 USA All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.2.7.2 Canada All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.2.7.3 Canada All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.2.8.2 Mexico All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.2.8.3 Mexico All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.6.2 Poland All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.6.3 Poland All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.7.2 Romania All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.7.3 Romania All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.8.2 Hungary All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.8.3 Hungary All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.9.2 Turkey All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.9.3 Turkey All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.4 Western Europe All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.5 Western Europe All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.6.2 Germany All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.6.3 Germany All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.7.2 France All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.7.3 France All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.8.2 UK All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.8.3 UK All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.9.2 Italy All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.9.3 Italy All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.10.2 Spain All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.10.3 Spain All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.13.2 Austria All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.13.3 Austria All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.4 Asia Pacific All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.5 Asia Pacific All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.6.2 China All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.6.3 China All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.7.2 India All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.7.3 India All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.8.2 Japan All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.8.3 Japan All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.9.2 South Korea All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.9.3 South Korea All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.10.2 Vietnam All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.10.3 Vietnam All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.11.2 Singapore All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.11.3 Singapore All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.12.2 Australia All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.12.3 Australia All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.4 Middle East All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.5 Middle East All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.6.2 UAE All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.6.3 UAE All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.7.2 Egypt All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.7.3 Egypt All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.9.2 Qatar All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.9.3 Qatar All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.2.4 Africa All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.2.5 Africa All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.2.6.2 South Africa All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.2.6.3 South Africa All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America All-wheel Drive Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.6.4 Latin America All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.6.5 Latin America All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.6.6.2 Brazil All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.6.6.3 Brazil All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.6.7.2 Argentina All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.6.7.3 Argentina All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.6.8.2 Colombia All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.6.8.3 Colombia All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America All-wheel Drive Market Estimates and Forecasts, By Vehicle (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America All-wheel Drive Market Estimates and Forecasts, by Propulsion (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America All-wheel Drive Market Estimates and Forecasts, by System (2020-2032) (USD Billion)

11. Company Profiles

11.1 Bosch Group

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Magna International Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 ZF Friedrichshafen AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 GKN Automotive

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Aisin Seiki Co., Ltd.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Dana Incorporated

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 BorgWarner Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Delphi Technologies

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 JTEKT Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Toyota Motor Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Vehicle

By Propulsion

By System

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Automotive Data Management Market size is expected to reach USD 8.01 Bn by 2030, the market was valued at USD 2.10 Bn in 2022 and will grow at a CAGR of 20.05% over the forecast period of 2023-2030.

The AC Charger for EVs Market Size was valued at USD 6.48 billion in 2023, and will reach $93.34 billion by 2032, and grow at a CAGR of 34.5% by 2024-2032

The Luxury Car Rental Market Size was USD 39.68 Billion in 2023, and is expected to reach USD 78.36 Bn by 2032, and grow at a CAGR of 7.88% by 2024-2032.

Automatic Number Plate Recognition (ANPR) System Market Size was valued at USD 3.17 Billion in 2023 and is expected to reach USD 6.96 Billion by 2032 and grow at a CAGR of 9.15% over the forecast period 2024-2032.

The Semi-Autonomous Vehicle Market was valued at USD 49.3 Billion in 2023 and is expected to reach USD 239.0 Billion by 2032, growing at a CAGR of 19.18% from 2024-2032.

The Rolling Stock Market Size was valued at USD 64 billion in 2023 and is expected to reach USD 105.92 billion by 2031 and grow at a CAGR of 6.5% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone