Get More Information on Algae Biofuel Market - Request Sample Report

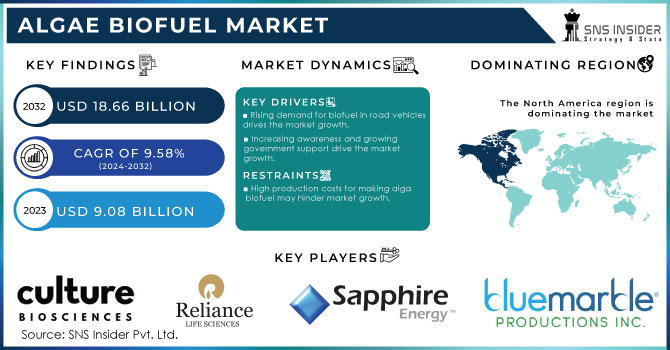

The Algae Biofuel Market Size was valued at USD 9.08 billion in 2023 and is expected to reach USD 18.66 billion by 2032 and grow at a CAGR of 9.58% over the forecast period 2024-2032.

The Algae Biofuel Market is growing and advances in algae cultivation and processing technologies have improved the efficiency and cost-effectiveness of algae biofuels. Innovations such as high-yield algae strains and more efficient extraction methods are making algae biofuels more competitive These techniques include closed-loop systems that minimize water usage while maximizing yield. In addition, scientists are on a mission to identify and engineer algae strains that boast superior qualities, such as higher oil content, faster growth rates, and improved tolerance to diverse environments.

Moreover, increased investment from both private and public sectors into research and development of algae biofuels is accelerating innovation and commercialization. This includes funding for pilot projects and scaling up production facilities.

For instance, TerraVia secured USD 150 million in funding from both private investors and government grants to advance its algae-based biofuel technologies. The investment is focused on scaling up production facilities and improving algae cultivation methods.

Furthermore, government support is also driving the market. Many governments are taking action by implementing policies and offering attractive incentives, such as grants and tax breaks, to propel research and development of algae biofuels forward. These measures not only foster innovation but also help improve the initial challenges associated with production costs. For Example, in April 2024, the U.S. Department of Energy announces USD 18.8 million in mixed algae development for less carbon bioproducts and biofuels.

Market Dynamics

Drivers

Rising demand for biofuel in road vehicles drives the market growth.

The algae biofuel market for road vehicles is experiencing a surge in demand, driven by a powerful interplay of environmental and economic forces. Environmental concerns are at the forefront, as growing awareness of climate change and air pollution compels the search for cleaner alternatives. Biofuels, especially those derived from sustainable sources, offer significant reductions in greenhouse gas emissions compared to traditional gasoline and diesel. Governments are also stepping up their game with policies and incentives that promote biofuel use. These can take the form of mandates for blending biofuels with gasoline and diesel, tax breaks for producers and consumers, and crucial investments in research and development of next-generation biofuels.

Furthermore, technology is another key driver, with advancements in biofuel production techniques leading to increased efficiency and cost-effectiveness. The development of second-generation biofuels derived from non-food sources like algae and waste materials addresses concerns about competition with food production.

Increasing awareness and growing government support drive the market growth.

Growing consumer awareness of environmental issues is driving the demand for the algae biofuel market. Consumers are accepting renewable energy sources more and more as an alternative to traditional fossil fuels as information on their benefits grows. Governments are responding to this shift in consumer behavior by implementing laws that promote the usage and production of renewable energy. These incentives cover a wide range of actions, from vital investments in research and development of innovative technology to providing the best quality product for both producers and consumers.

Moreover, according to the National Renewable Energy Laboratory, several government funding is empowering research organizations to refine microalgae production techniques. This public backing, coupled with the global drive for clean technologies, is igniting a surge of private-sector investment in microalgae. More than 100 companies, from established giants to nimble startups, are channeling resources into building demonstration plants, exploring microalgae as a feedstock, and optimizing production processes. This confluence of public and private sector investment underscores the burgeoning interest in and potential of microalgae technology.

Restrain

High production costs for making algae biofuel may hinder market growth.

High production costs for making algae biofuel can significantly hinder market growth by limiting its competitiveness compared to conventional fossil fuels and other biofuels. The process of cultivating algae, harvesting, and converting it into biofuel involves complex and costly technologies, such as maintaining optimal growth conditions in photobioreactors, extracting oil, and refining the product. These high costs are primarily due to the need for specialized equipment, energy-intensive processes, and the scale-up challenges associated with algae cultivation. This economic barrier can slow the adoption of algae biofuels, impacting the overall market growth and hindering the transition to more sustainable energy solutions.

By Type

The bioethanol held the largest market share around 32.22% in the overall type segment in 2023. Algae bioethanol is rapidly emerging as a sustainable champion within the biofuel arena. Unlike conventional bioethanol sources like corn and sugarcane, which put pressure on food production by competing for land, algae offer a game-changing advantage. They bloom on non-arable land, amplifying their environmental benefits by leaving food crops undisturbed. Moreover, government backing, through biofuel mandates and incentives, is further propelling the growth of the algae bioethanol sector. Scientists are relentlessly optimizing algae strains, cultivation techniques, and fermentation processes to squeeze out even greater bioethanol yields and enhance overall production efficiency. As the demand for sustainable solutions skyrockets, algae bioethanol is poised to take center stage, playing a critical role in meeting renewable energy targets and significantly reducing the carbon footprint associated with transportation fuels, paving the way for a cleaner future.

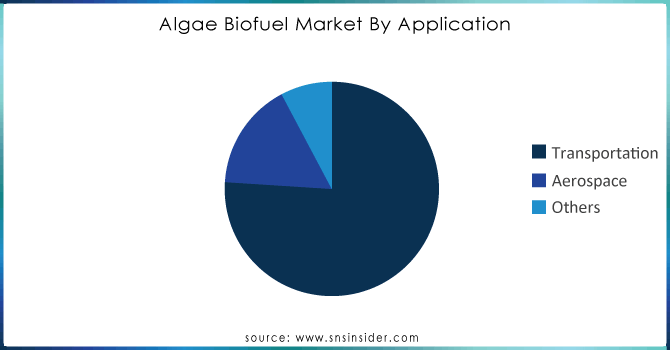

By Application

The Transportation segment held the largest revenue share around 76.02% in the application segment 2023 in the algae biofuel market. Algae biofuels significantly reduce greenhouse gas emissions compared to fossil fuels, offering a breath of fresh air for the planet. They are processed into biodiesel for trucks, buses, and ships, and bioethanol for cars, seamlessly blending with gasoline. Furthermore, unlike corn ethanol, algae biofuels don't compete with food production for land. This trifecta of environmental benefits, versatility, and sustainability is propelling the transportation segment forward. As technology advances and costs decrease, algae biofuels have the potential to become the fuel of choice for a cleaner transportation future.

Need any customization research on Algae Biofuel Market- Enquiry Now

Regional Analysis

North America held the largest market share of 42.22% in 2023 in the algae biofuel market due to the bioethanol demand being on a sharp upward trajectory, fueled by a growing awareness of environmental issues and regulations implemented by governments. The oil industry's inherently volatile nature, characterized by price fluctuations, is presenting a unique opportunity for investment in alternative fuel technologies across North America. Among these alternatives, algae bioethanol is rapidly gaining traction, capturing investor attention due to its immense potential. Recognizing this potential, manufacturers are channeling significant resources into research and development endeavors. Their relentless pursuit is to unlock the full photosynthetic efficiency of algae strains, thereby maximizing algae oil extraction. Algae oil is the linchpin of bioethanol production, and these advancements are expected to have a significant positive impact on the market's growth.

Moreover, a critical tailwind comes from the U.S. government's strategic policy shift. By mandating a transition away from biofuels derived from food crops like corn and towards microalgae-based options, the government is actively playing a pivotal role in fostering the growth of the algae biofuel market in North America. In essence, a combination of high demand, a dynamic oil market, relentless focus on R&D efficiency, and supportive government policies is painting a rosy picture for the future of the algae biofuel market in North America.

Asia Pacific is expected to rise at the fastest CAGR during the forecast period. Owing to the growing investments by private and public organizations in bio-based energy sources in Japan, India, and China are expected to grow in upcoming times.

Blue Marble Productions, Inc., Sapphire Energy, Culture Biosystems, Algae Systems, LLC., Reliance Life Sciences, Solix, AlgaEnergy, Origin Oils, Genifuel Corporation, Infinita Renovables SA, Culture BioSystems, Lgenol, Neste, and Others.

Recent Development:

In January 2024, Hutan Bio, a biotech company has secured the investment from the Clean Growth Fund. It invested USD 2.82 million in the company to accelerate the commercial use of its biofuel oil and so reduce greenhouse gas emissions.

In September 2023, EEL Biofuels announced an innovation in renewable energy technology viable algae-based biofuels with the development of its algae-based biofuels. This technology has helped to increase the energy sector by providing traditional fossil fuel alternatives.

In June 2023, BASF SE and Avient Corporation partnered to launch colored grades of Ultra Son high-performance polymers worldwide. This collaboration aimed to provide pre-colored solution and color solution with enhanced the option of high quality, and customized polymer solutions in various application.

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.08 Billion |

| Market Size by 2032 | US$ 18.66 Billion |

| CAGR | CAGR of 9.58 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Jet Fuel, Bioethanol, Biodiesel, Bio-Gasoline, Bio-Butanol, Methane, Green Diesel, Others) • By Application (Transportation, Aerospace, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Blue Marble Productions, Inc., Sapphire Energy, Culture Biosystems, Algae Systems, LLC., Reliance Life Sciences, Solix, AlgaEnergy, Origin Oils, Genifuel Corporation, Infinita Renovables SA, Culture BioSystems, Lgenol, Neste, and Others. |

| Key Drivers | • Rising demand for biofuel in road vehicles drives the market growth |

| RESTRAINTS | •High production costs for making algae biofuel may hinder market growth |

Ans: The Algae Biofuel Market was valued at USD 9.08 billion in 2023.

Ans: The expected CAGR of the global Algae Biofuel Market during the forecast period is 9.58%

Ans: The transportation segment will grow rapidly in the Algae Biofuel Market from 2024-2032.

Ans: Factors such as high production cost and limited scalability can restrict the growth of the Algae Biofuel market.

Ans: The U.S. led the Algae Biofuel Market in North America region with the highest revenue share in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Algae Biofuel Market Segmentation, By Type

7.1 Introduction

7.2 Jet Fuel

7.3 Bioethanol

7.4 Biodiesel

7.5 Bio-Gasoline

7.6 Bio-Butanol

7.7 Methane

7.8 Green Diesel

7.9 Others

8. Algae Biofuel Market Segmentation, By Application

8.1 Introduction

8.2 Transportation

8.3 Aerospace

8.4 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Algae Biofuel Market By Country

9.2.3 North America Algae Biofuel Market By Type

9.2.4 North America Algae Biofuel Market By Application

9.2.5 USA

9.2.5.1 USA Algae Biofuel Market By Type

9.2.5.2 USA Algae Biofuel Market By Application

9.2.6 Canada

9.2.6.1 Canada Algae Biofuel Market By Type

9.2.6.2 Canada Algae Biofuel Market By Application

9.2.7 Mexico

9.2.7.1 Mexico Algae Biofuel Market By Type

9.2.7.2 Mexico Algae Biofuel Market By Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Algae Biofuel Market By Country

9.3.2.2 Eastern Europe Algae Biofuel Market By Type

9.3.2.3 Eastern Europe Algae Biofuel Market By Application

9.3.2.4 Poland

9.3.2.4.1 Poland Algae Biofuel Market By Type

9.3.2.4.2 Poland Algae Biofuel Market By Application

9.3.2.5 Romania

9.3.2.5.1 Romania Algae Biofuel Market By Type

9.3.2.5.2 Romania Algae Biofuel Market By Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Algae Biofuel Market By Type

9.3.2.6.2 Hungary Algae Biofuel Market By Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Algae Biofuel Market By Type

9.3.2.7.2 Turkey Algae Biofuel Market By Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Algae Biofuel Market By Type

9.3.2.8.2 Rest of Eastern Europe Algae Biofuel Market By Application

9.3.3 Western Europe

9.3.3.1 Western Europe Algae Biofuel Market By Country

9.3.3.2 Western Europe Algae Biofuel Market By Type

9.3.3.3 Western Europe Algae Biofuel Market By Application

9.3.3.4 Germany

9.3.3.4.1 Germany Algae Biofuel Market By Type

9.3.3.4.2 Germany Algae Biofuel Market By Application

9.3.3.5 France

9.3.3.5.1 France Algae Biofuel Market By Type

9.3.3.5.2 France Algae Biofuel Market By Application

9.3.3.6 UK

9.3.3.6.1 UK Algae Biofuel Market By Type

9.3.3.6.2 UK Algae Biofuel Market By Application

9.3.3.7 Italy

9.3.3.7.1 Italy Algae Biofuel Market By Type

9.3.3.7.2 Italy Algae Biofuel Market By Application

9.3.3.8 Spain

9.3.3.8.1 Spain Algae Biofuel Market By Type

9.3.3.8.2 Spain Algae Biofuel Market By Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Algae Biofuel Market By Type

9.3.3.9.2 Netherlands Algae Biofuel Market By Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Algae Biofuel Market By Type

9.3.3.10.2 Switzerland Algae Biofuel Market By Application

9.3.3.11 Austria

9.3.3.11.1 Austria Algae Biofuel Market By Type

9.3.3.11.2 Austria Algae Biofuel Market By Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Algae Biofuel Market By Type

9.3.2.12.2 Rest of Western Europe Algae Biofuel Market By Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Algae Biofuel Market By Country

9.4.3 Asia Pacific Algae Biofuel Market By Type

9.4.4 Asia Pacific Algae Biofuel Market By Application

9.4.5 China

9.4.5.1 China Algae Biofuel Market By Type

9.4.5.2 China Algae Biofuel Market By Application

9.4.6 India

9.4.6.1 India Algae Biofuel Market By Type

9.4.6.2 India Algae Biofuel Market By Application

9.4.7 Japan

9.4.7.1 Japan Algae Biofuel Market By Type

9.4.7.2 Japan Algae Biofuel Market By Application

9.4.8 South Korea

9.4.8.1 South Korea Algae Biofuel Market By Type

9.4.8.2 South Korea Algae Biofuel Market By Application

9.4.9 Vietnam

9.4.9.1 Vietnam Algae Biofuel Market By Type

9.4.9.2 Vietnam Algae Biofuel Market By Application

9.4.10 Singapore

9.4.10.1 Singapore Algae Biofuel Market By Type

9.4.10.2 Singapore Algae Biofuel Market By Application

9.4.11 Australia

9.4.11.1 Australia Algae Biofuel Market By Type

9.4.11.2 Australia Algae Biofuel Market By Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Algae Biofuel Market By Type

9.4.12.2 Rest of Asia-Pacific Algae Biofuel Market By Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Algae Biofuel Market By Country

9.5.2.2 Middle East Algae Biofuel Market By Type

9.5.2.3 Middle East Algae Biofuel Market By Application

9.5.2.4 UAE

9.5.2.4.1 UAE Algae Biofuel Market By Type

9.5.2.4.2 UAE Algae Biofuel Market By Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Algae Biofuel Market By Type

9.5.2.5.2 Egypt Algae Biofuel Market By Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Algae Biofuel Market By Type

9.5.2.6.2 Saudi Arabia Algae Biofuel Market By Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Algae Biofuel Market By Type

9.5.2.7.2 Qatar Algae Biofuel Market By Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Algae Biofuel Market By Type

9.5.2.8.2 Rest of Middle East Algae Biofuel Market By Application

9.5.3 Africa

9.5.3.1 Africa Algae Biofuel Market By Country

9.5.3.2 Africa Algae Biofuel Market By Type

9.5.3.3 Africa Algae Biofuel Market By Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Algae Biofuel Market By Type

9.5.2.4.2 Nigeria Algae Biofuel Market By Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Algae Biofuel Market By Type

9.5.2.5.2 South Africa Algae Biofuel Market By Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Algae Biofuel Market By Type

9.5.2.6.2 Rest of Africa Algae Biofuel Market By Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Algae Biofuel Market By Country

9.6.3 Latin America Algae Biofuel Market By Type

9.6.4 Latin America Algae Biofuel Market By Application

9.6.5 Brazil

9.6.5.1 Brazil Algae Biofuel Market By Type

9.6.5.2 Brazil Algae Biofuel Market By Application

9.6.6 Argentina

9.6.6.1 Argentina Algae Biofuel Market By Type

9.6.6.2 Argentina Algae Biofuel Market By Application

9.6.7 Colombia

9.6.7.1 Colombia Algae Biofuel Market By Type

9.6.7.2 Colombia Algae Biofuel Market By Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Algae Biofuel Market By Type

9.6.8.2 Rest of Latin America Algae Biofuel Market By Application

10. Company Profiles

10.1 Blue Marble Productions, Inc.,

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Sapphire Energy

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Culture Biosystems

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Algae Systems LLC.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 Reliance Life Sciences

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Solix

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 AlgaEnergy

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Origin Oils

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Genifuel Corporation

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Infinita Renovables SA

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Jet Fuel

Bioethanol

Biodiesel

Bio-Gasoline

Bio-Butanol

Methane

Green Diesel

Others

By Application

Transportation

Aerospace

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Laminated Glass Market size was valued at USD 22.71 Billion in 2023 and is expected to reach USD 39.18 Billion by 2032, growing at a CAGR of 6.25% over the forecast period 2024-2032.

The 2-Ethyl-3,4-ethylenedioxythiophene Market size was USD 20.55 million in 2023 and is expected to reach USD 29.25 million by 2032 and grow at a CAGR of 4.00% over the forecast period of 2024-2032.

The Plastic To Fuel Market Size was valued at USD 520.10 million in 2023 and is expected to reach USD 4,097.76 million by 2032 and grow at a CAGR of 25.78% over the forecast period 2024-2032.

Acoustic Insulation Market was valued at USD 14.85 billion in 2023 and is expected to reach USD 23.14 billion by 2032, growing at a CAGR of 5.08% by 2024-2032.

Food Contact Paper Market size was USD 78.85 billion in 2023 and is expected to Reach USD 119.12 billion by 2032, growing at a CAGR of 4.69% from 2024-2032.

Air Handling Units Market was valued at $ 12.64 billion in 2023, and is expected to reach $ 20.10 billion by 2032, growing at a CAGR of 5.29% from 2024-2032.

Hi! Click one of our member below to chat on Phone