The Alcohol Sensor Market size was valued at USD 1.78 billion in 2023 and is expected to grow to USD 5.42 billion by 2032, expanding at a robust CAGR of 12.74% over the forecast period of 2024-2032.

Get more information on Alcohol Sensor Market - Request Sample Report

The alcohol sensor market is poised for substantial growth due to increasing awareness of the dangers of drunk driving and stronger regulatory measures aimed at reducing alcohol-impaired driving. With nearly 30 fatalities per day in the U.S. attributed to drunk driving (NHTSA, 2023), the need for effective alcohol detection technology is urgent. The implementation of the Driver Alcohol Detection System for Safety (DADSS) has gained momentum, with both public and private sectors supporting its development. The Bipartisan Infrastructure Law mandates the inclusion of alcohol detection technology in new vehicles by 2024, further accelerating market growth. In states like Florida, drunk driving fatalities remain a significant concern, prompting organizations such as MADD to advocate for stricter regulations. The DADSS system, which detects ethanol and carbon dioxide in the driver’s breath, offers a promising solution to prevent impaired driving, and its integration into future vehicle models will drive demand for such technology. The National Highway Traffic Safety Administration (NHTSA) highlighted that 43% of drivers aged 65 and older who died in crashes were alcohol-impaired, and with this age group now accounting for 20% of drivers on the road, the risk of accidents continues to rise. The Substance Abuse and Mental Health Services Administration (SAMHSA) warns that the number of older adults with alcohol use disorders is expected to double by 2050, exacerbating the risks. Older adults are more sensitive to alcohol’s effects, which, combined with age-related issues such as slower reaction times and cognitive decline, increases the likelihood of impaired driving. Drunk driving remains the leading cause of fatalities on U.S. roads, claiming over 10,000 lives annually and costing USD 194 billion, making the alcohol sensor market an essential growth sector for both safety and technology advancements.

Market Dynamics

Drivers

Advancing Road Safety with the Growing Demand for Alcohol Detection Technologies in Vehicles

Alcohol detection technologies are emerging as vital tools in preventing impaired driving, addressing a significant cause of road accidents and fatalities. Integrating alcohol detection systems into all new vehicles could save up to 9,000 lives annually. The National Transportation Safety Board (NTSB) advocates for blood alcohol concentration (BAC) monitoring systems in vehicles to prevent individuals from driving under the influence. According to the National Highway Traffic Safety Administration (NHTSA), 31% of all traffic fatalities involve impaired drivers with a BAC level of 0.08 or higher. As these figures highlight the urgency of addressing drunk driving, the automotive industry is witnessing a rising demand for alcohol detection systems. The Bipartisan Infrastructure Law mandates that new vehicles be equipped with alcohol detection technologies by 2024, accelerating the market growth for these sensors. With innovations such as the Driver Alcohol Detection System for Safety (DADSS), which is supported by both public and private sector investments, the focus is shifting towards passive alcohol detection systems. These systems are expected to become standard in all new vehicles, contributing to enhanced road safety. Furthermore, the growing regulatory support from organizations like NHTSA and NTSB is paving the way for widespread adoption of alcohol detection technologies, creating a significant opportunity for the alcohol sensor market to expand and make a lasting impact on reducing traffic fatalities.

Restraints

High maintenance and repair costs pose a significant barrier to the growth of the alcohol sensor market.

Alcohol detection systems embedded in vehicles require regular upkeep to maintain their functionality, including recalibration, servicing, and occasional replacements. The cost of maintaining such sensors can be substantial, with repairs for sensors, such as dashboard sensors, ranging from USD 250 to USD 1,000, depending on the type of sensor and vehicle model. Additionally, alcohol interlock devices—often mandated for impaired driving prevention—incur further costs, as they too require consistent servicing and recalibration. This continuous maintenance process may discourage cost-conscious consumers from adopting alcohol sensors in their vehicles. Moreover, the increasing complexity of automotive sensors, particularly digital sensors, has resulted in higher repair costs and a greater dependence on specialized professionals for maintenance, driving up expenses. As these added costs accumulate over time, vehicle owners may become reluctant to invest in alcohol detection technologies, especially in regions where affordability is a concern. This financial burden, coupled with the perceived long-term costs of sensor upkeep, slows the adoption of alcohol sensors in vehicles. To overcome this challenge, the alcohol sensor market must focus on developing more affordable sensor technologies and streamlined maintenance solutions to ensure broader consumer acceptance and integration. This will help make alcohol detection systems more accessible and reduce the financial deterrents that currently limit their adoption.

Segment Analysis

By Technology

Semiconductor oxide sensors dominates the alcohol sensor market in 2023, accounting for 36% of the market share. These sensors operate by detecting alcohol vapors using a semiconductor material that reacts with the alcohol molecules, creating a change in resistance. They are widely preferred due to their high reliability, precision, and cost-efficiency, making them ideal for applications such as breathalyzers, alcohol interlock systems, and vehicle safety features. The ability to deliver real-time, accurate measurements at affordable manufacturing costs has fueled their adoption, especially in the automotive and law enforcement sectors.

Fuel technology is the fastest-growing segment in the alcohol sensor market, with significant expansion anticipated from 2024 to 2032. This technology integrates alcohol sensors into automotive systems to detect alcohol levels in fuel mixtures, playing a key role in ensuring driver safety. Growth is being driven by regulations like the Bipartisan Infrastructure Law, which mandates alcohol detection in all new vehicles. Fuel-based alcohol sensors are crucial in preventing impaired driving by detecting blood alcohol content (BAC) in fuel samples. Advances in sensor miniaturization, improved precision, and better system integration are expected to boost the demand for fuel-based alcohol detection systems, as vehicle manufacturers increasingly adopt these technologies to meet evolving safety standards.

By Application

The vehicle controlling application segment dominates the alcohol sensor market in 2023, accounting for 59% in 2023. This dominance is primarily driven by the growing demand for safety features in vehicles, including alcohol detection systems aimed at preventing impaired driving. Alcohol sensors in vehicles are crucial for enforcing safety measures, particularly in systems like alcohol interlock devices, which prevent the vehicle from starting if the driver’s blood alcohol content (BAC) exceeds a set limit. The integration of these sensors is becoming mandatory in some regions due to regulations focused on reducing alcohol-related road accidents. With stricter laws and growing safety awareness, the vehicle controlling segment is expected to continue leading the market during the forecast period.

The healthcare application segment is expected to be the fastest growing in the Alcohol Sensor Market between 2024 and 2032. Alcohol sensors are increasingly being adopted for medical applications, such as monitoring alcohol consumption in patients, particularly those undergoing treatment for alcohol dependence or in rehabilitation centers. These sensors are used in medical devices like breath analyzers and wearable alcohol monitoring devices, helping healthcare professionals track patients’ progress in real-time. With rising concerns about alcohol abuse and its health implications, the demand for alcohol sensors in healthcare settings is anticipated to increase rapidly

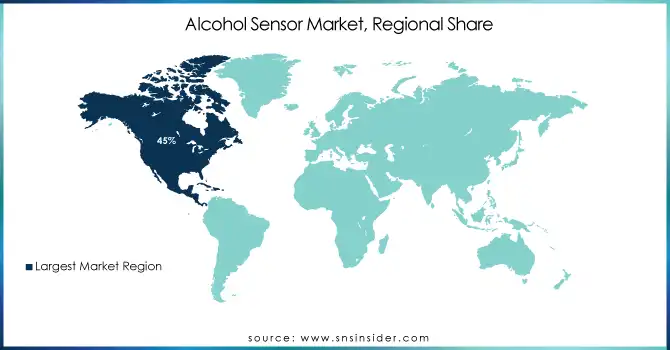

Regional Analysis

North America dominates the alcohol sensor market, holding around 45% of the share in 2023, primarily due to robust regulatory frameworks, rising demand for automotive safety features, and an increasing emphasis on public health and safety. The United States is particularly influential in driving the adoption of alcohol detection systems in vehicles, supported by regulations such as the Bipartisan Infrastructure Law. Additionally, the healthcare sector in North America is increasingly incorporating alcohol sensors for medical applications, including addiction treatment and rehabilitation monitoring. This combination of regulatory support, automotive innovation, and healthcare advancements ensures that North America leads the market not only in revenue but also in product development and technological progress.

The Asia-Pacific region is the fastest-growing market for alcohol sensors, projected to experience significant growth between 2024 and 2032. This expansion is driven by the increasing demand for safety features in automotive industries, particularly in countries like China, India, Japan, and South Korea. Governments in the region are increasingly focusing on improving public safety standards, with regulations encouraging the integration of alcohol detection systems in vehicles. Additionally, the rise in alcohol-related accidents and the growing awareness of impaired driving risks are propelling market growth. Furthermore, the region's burgeoning healthcare sector is also adopting alcohol sensors for medical applications, such as addiction monitoring and treatment, contributing to the market's rapid expansion.

Need any customization research on Alcohol Sensor Market - Enquiry Now

Key Players

Some of the major Key Players in Alcohol Sensor Market along with their product:

Drägerwerk AG & Co. KGaA – (Dräger Alcotest series, Interlock devices)

Giner Labs – (Fuel Cell Alcohol Sensors, Breath Analyzers)

Honeywell International Inc. – (Semiconductor Alcohol Sensors, Portable Analyzers)

AlcoPro Inc. – (Evidential Breath Testers, AlcoMate AlcoBlow)

Intoximeters Inc. – (Alco-Sensor series, Intox EC/IR II)

BACtrack Inc. – (BACtrack Mobile Pro, BACtrack S80 Professional)

Lifeloc Technologies – (Phoenix 6.0, LifeGuard Interlock)

Abbott Laboratories – (Fuel Cell Breathalyzers, Rapid Diagnostic Alcohol Tests)

Alcohol Countermeasure System (International) Inc. – (ACS Alco-Screen, Interlock XT)

Asahi Kasei Corporation – (Semiconductor Gas Sensors, Breath Alcohol Detectors)

EnviteC – (Alcohol Sensors for Medical and Industrial Applications)

Quest Products – (Breathalyzer Disposable Tests, Keychain Testers)

AK GlobalTech – (ALCOSCAN Breathalyzers, Personal Alcohol Testers)

Zaphir Technologies – (Advanced Fuel Cell-Based Alcohol Detection Systems)

Pro-Tec Breathalyzers – (Professional and Portable Breathalyzers for Law Enforcement)

List of Suppliers for raw materials and components in the alcohol sensor market:

DuPont

Asahi Glass Co., Ltd.

NGK Insulators, Ltd.

BASF SE

Mitsubishi Chemical Corporation

3M

Johnson Matthey

Henkel AG & Co.

Hitachi Metals, Ltd.

Kyocera Corporation

Recent Trends

On August 15, 2024, a study introduced a chemiresistive ammonia gas sensor based on polyaniline/poly(vinyl alcohol) (PANI/PVA) hydrogel, offering high sensitivity and rapid response times. This innovative sensor, using micro girder printing technology and freeze-thaw cycles, demonstrates a promising solution for real-time environmental and healthcare monitoring applications.

On August 14, 2024, a study introduced a new antifreeze conductive organohydrogel (PGOPPy) made from carboxyl-modified polyvinyl alcohol, graphene oxide, and polypyrrole nanowires. The hydrogel maintains flexibility at temperatures as low as −75°C, offering high electrical conductivity and mechanical strength, making it suitable for use in flexible sensors in cold environments.

On October 4, 2024, Connecticut began testing a new alcohol detection system in vehicles aimed at preventing impaired driving. The system uses a steering wheel-mounted sensor to detect elevated carbon dioxide and ethanol levels to prevent a vehicle from starting if the driver is impaired.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.78 Billion |

| Market Size by 2032 | USD 5.42 Billion |

| CAGR | CAGR of 12.74% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Fuel Cell Technology, Semiconductor Oxide Sensor Technology, Others) • By Application (Vehicle Controlling, Healthcare Application) • By End-users (Law Enforcement Agencies, Commercial, Individuals) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Drägerwerk AG & Co. KGaA, Giner Labs, Honeywell International Inc., AlcoPro Inc., Intoximeters Inc., BACtrack Inc., Lifeloc Technologies, Abbott Laboratories, Alcohol Countermeasure System (International) Inc., Asahi Kasei Corporation, EnviteC, Quest Products, AK GlobalTech, Zaphir Technologies, Pro-Tec Breathalyzers. |

| Key Drivers | • Advancing Road Safety with the Growing Demand for Alcohol Detection Technologies in Vehicles |

| Restraints | • High maintenance and repair costs pose a significant barrier to the growth of the alcohol sensor market. |

Ans: Alcohol Sensor Market is anticipated to expand by 12.74 % from 2024 to 2032.

Ans: The Alcohol Sensor market is estimated to reach USD 5.24 billion by 2032.

Ans: The Alcohol Sensor Market size was valued at USD 1.78 billion in 2023.

Ans: The Alcohol Sensor Market is driven by increasing regulatory mandates for automotive safety, rising public awareness of impaired driving risks, and advancements in sensor technology.

Ans: North America is dominating the Alcohol Sensor Market

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Consumer and Industry Metrics by Region

5.2 Technology Trends by Region

5.3 Environmental and Social Impact

5.4 Manufacturing and Supply Chain Data

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Alcohol Sensor Market Segmentation, byTechnology

7.1 Chapter Overview

7.2 Fuel technology

7.2.1 Fuel technology Market Trends Analysis (2020-2032)

7.2.2 Fuel technology Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Semiconductor oxide sensor technology

7.3.1 Semiconductor oxide sensor technology Market Trends Analysis (2020-2032)

7.3.2 Semiconductor oxide sensor technology Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Alcohol Sensor Market Segmentation, by Application

8.1 Chapter Overview

8.2 Vehicle Controlling

8.2.1 Vehicle Controlling Market Trends Analysis (2020-2032)

8.2.2 Vehicle Controlling Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Healthcare Application

8.3.1 Healthcare Application Market Trends Analysis (2020-2032)

8.3.2 Healthcare Application Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Alcohol Sensor Market Segmentation, by End-Users

9.1 Chapter Overview

9.2 Law Enforcement Agencies

9.2.1 Law Enforcement Agencies Market Trends Analysis (2020-2032)

9.2.2 Law Enforcement Agencies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Commercial

9.3.1 Commercial Market Trends Analysis (2020-2032)

9.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Individuals

9.4.1 Individuals Market Trends Analysis (2020-2032)

9.4.2 Individuals Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.4 North America Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.6.2 USA Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.7.2 Canada Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.2.8.2 Mexico Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.6.2 Poland Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.7.2 Romania Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.4 Western Europe Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.6.2 Germany Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.7.2 France Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.8.2 UK Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.9.2 Italy Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.10.2 Spain Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.13.2 Austria Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.6.2 China Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.7.2 India Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.8.2 Japan Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.9.2 South Korea Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.10.2 Vietnam Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.11.2 Singapore Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.12.2 Australia Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.4 Middle East Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.6.2 UAE Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.4 Africa Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Alcohol Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.4 Latin America Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.6.2 Brazil Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.7.2 Argentina Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.8.2 Colombia Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Alcohol Sensor Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Alcohol Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Alcohol Sensor Market Estimates and Forecasts, by End-Users (2020-2032) (USD Billion)

11. Company Profiles

11.1 Drägerwerk AG & Co. KGaA

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Giner Labs

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Honeywell International Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 AlcoPro Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Intoximeters Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 BACtrack Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Lifeloc Technologies

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Abbott Laboratories

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Alcohol Countermeasure System (International) Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Asahi Kasei Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Technology

Fuel technology

Semiconductor oxide sensor technology

Others

By Application

Vehicle Controlling

Healthcare Application

By End-Users

Law Enforcement Agencies

Commercial

Individuals

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Microphone Market Size was valued at USD 6.10 Billion in 2023 and is expected to grow at a CAGR of 5.63% to reach USD 9.98 Billion by 2032.

The Industrial Sensors Market size was valued at USD 25.12 billion in 2023 and is expected to reach USD 54.24 billion by 2032 and grow at a CAGR of 8.93% over the forecast period 2024-2032.

The Integrated Circuit Market Size will be valued at USD 1846.29 billion by 2032, and it accounted for USD 619.52 billion in 2023, and grow at a CAGR of 12.9% over the forecast period 2024-2032.

Building Information Modeling (BIM) Market was valued at USD 7.42 Billion in 2023. It is estimated to reach USD 20.91 Billion at 12.24% CAGR by 2024-2032

The Capacitive Sensor market size was $ 30.62 Billion in 2023 & expects a good growth by reaching USD 49.06 billion till end of year2032 at CAGR about 5.43% during forecast period 2023-2032

The IoT Device Management Market Size was valued at USD 3.54 Billion in 2023 and is expected to grow at a CAGR of 30.97% to reach USD 40.15 Billion by 2032.

Hi! Click one of our member below to chat on Phone