Get More Information on Airless Packaging Market - Request Sample Report

The Airless Packaging Market size was USD 6.11 billion in 2023 and is expected to Reach USD 10.67 billion by 2032 and grow at a CAGR of 6.4 % over the forecast period of 2024-2032.

Market growth is expected over the forecast period as a result of increasing demand for premium cosmetic products worldwide. In recent years there has been a substantial increase in global demand for high quality cosmetic products, e.g. natural skincare creams, foundations and serums. Another key factor that contributes to the growing demand for premium cosmetic products is rising demand of natural skin care products, an increasing number of women working and product introduction throughout the world.

Their widespread acceptance in applications industries is hindered by a number of factors, including high costs associated with airless bottles and jars as well as their sustainability issues. In April 2021, a 50 ml airless plastic bottle will cost about USD 1.50 to 2.5, whereas a 25 ml non-airless bottle costs around USD 0.25 to 0.45 prices vary by volume of procurement.

KEY DRIVERS:

Increasing demand for Hygiene Solution in the Packaging Industry

In particular with regard to the Covid 19 pandemic, hygiene and cleanliness are becoming increasingly important for consumers. Due to the pandemic, demand for products which are packaged in an environment of hygiene and cleanliness is increasing. Strict rules on the safety and hygiene of products are applied to a large number of industries such as pharmaceuticals and cosmetics.

By providing a hygienic packaging solution, airless packaging can help manufacturers to comply with these regulatory requirements. Exposure to air and bacteria may compromise the efficacy of products that are likely to be contaminated, for example skin care or cosmetic products. In order to retain the efficiency of these products it may be possible to use airless packaging in order to protect against outside contaminants.

RESTRAIN:

Compatibility with more than one product may not be possible with airless packaging

Material compatible with a wide range of product formulations is usually used in the manufacture of airlessly packaged products. However, some products may contain ingredients that are not compatible with the packaging material and can result in degradation, lysis or other issues which might have an impact on product quality and safety. The use of airless packaging is intended for products that have different characteristics. However, given the pressure that is necessary to dispense them, specific products such as thick or very viscous formulations may not work well in airless packaging.

OPPORTUNITY:

Increased demand in the area of alternatives to plastic packaging

The demand for packaging solutions which are produced from alternative raw materials such as paper or recycled metal has increased in view of increasing environmental concerns caused by plastic. With the introduction of packaging solutions as an alternative to plastic packaging, a number of competent and reliable market players responded to changing demands from the cosmetic industry for sustainability and environmental protection.

CHALLENGES:

Technological Complexity and Cost

In order to deliver the product without exposure to air, airless packaging involves complex mechanisms. Compared to traditional packaging, the complexity of these mechanisms and related production costs are likely to make airless packaging more expensive.

The war has led to shortages of basic materials such as glass, plastic and metal. For the manufacture of airless packaging, these materials are essential. Due to the disruptions, there was a shortfall of raw materials and higher prices. By 4 March, the price of aluminum that had fallen to as low as $2,885 per tonne just before the war began in early February was up to $3,825.2 per tonne. The world's largest producers of aluminium are both China and Russia, with Russia accounting for six per cent of total production.

The cost of energy has also increased as a result of the war. As the process is very energy intensive, this has made it difficult to produce Airless Packaging. The cost of the production of airless packaging has increased as a result of higher energy costs.

The volatility of energy commodity prices started rising in December 2021, when reports about the possible invasion of Ukraine by Russia reached a fever pitch. Prices of oil, coal and gas have increased by approximately 40%, 130% and 1800% respectively over the two weeks following the invasion.

The decrease in demand for consumer products is one of the major factors which are anticipated to have a negative effect on the market for insulated packaging during the recession. In particular in the pharmaceutical and personal care sectors, airless packaging has been widely used but a recession could lead to reduced demand for these products.

The increased competition for other packaging materials is another factor which is expected to have an impact on the airless packaging market. Airless packaging costs more than other forms of packaging, such as plastic and aluminium, which may be why businesses are more inclined to make use of cheaper packaging materials in times of recession.

By Material

Plastic

Metal

Glass

In 2023, plastic accounted for 65.5% of worldwide sales, and is projected to retain its dominance over the forecast period. In the production of airless containers, cups and tubes it is widely used different types of plastic resins such as PE, PET, ABS, PMMA or SAN.

By Packaging Type

Bags & Pouches

Bottles & Jars

Tubes

In 2023, bottles & jars accounted for more than 85 % of global volume and are expected to maintain their leading position until forecast period. The shape of bottles and containers makes it possible to incorporate airless pumps in them, which is also a common type of packaging due to the ease with which products can be evacuated or used from bottle & jar.

By Packaging Type

Pumps

Twist & Clicks

Dropper

By Application

Pharmaceutical

Personal & Homecare

Pet care

Others

The segment of Personal & Home Care led the market in 2023, with a total revenue share of 80.3%. In the personal care sector, packaging of semisolids such as lotions, creams, ointments, gels and pastes are used in airless containers & jars, pouches or tubes. This product maintains the integrity of its formulations and prolongs their shelf life by preventing oxidation.

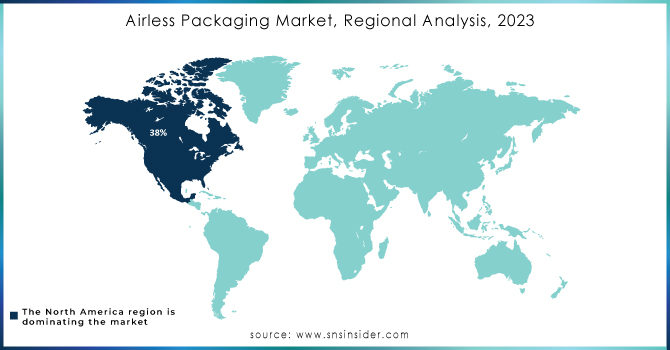

The biggest market shares are held in North America of around 38%; this region is projected to continue its dominance over the forecast period. Sustainable alternatives for airless packaging have been developed in response to increasing concerns regarding the environment, which include marine litter and a range of general impacts on packaging in North America. Furthermore, the development of airless packaging markets in North America is underlined by the presence of potential consumers who are buying luxury cosmetic and personal care products.

Europe remains the most attractive market for airless packaging, and is expected to remain in this position during the analysis period. Europe held the market share of around 28%. In order to supplement the growth of airless packaging in Europe, increasing demand for luxury packages specially formulated for personal care and beauty products is a significant factor.

The Asia Pacific region, with countries such as China, Japan, India and South Korea leading the way, is a fastest growing market for airless packaging. In China, the use of sustainable packaging solutions is gaining increasing awareness and consumers have become more aware of their environmental impact in order to seek eco-friendly alternatives. Airless packaging is an environmentally responsible solution because it reduces waste and can be easily recycled.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Airless Packaging market are APC Packaging, HCP Packaging, Silgan Holdings, Quadpack, Aptar Group Inc, Albea SA, Fusion PKG, Lumson SPA and other players.

RECENT DEVELOPMENT

The NUORI Skincare brand in Denmark has been supplied with Regula Airless Packaging by a global cosmetic packaging manufacturer Quadpack and its new line of "The One" products.

Lumson introduces APP Light, a lightweight airless solution for PCR PE

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.11 Bn |

| Market Size by 2032 | US$ 10.67 Bn |

| CAGR | CAGR of 6.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Metal, Glass) • by Packaging Type (Bags & Pouches, Bottles & Jars, Tubes) • by Dispensing Systems (Pumps, Twist & Clicks, Dropper) • by Application (Pharmaceutical, Personal & Homecare, Pet care, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | APC Packaging, HCP Packaging, Silgan Holdings, Quadpack, Aptar Group Inc, Albea SA, Fusion PKG, Lumson SPA |

| Key Drivers | • Increasing demand for Hygiene Solution in the Packaging Industry |

| Key Restraints | • Compatibility with more than one product may not be possible with airless packaging |

Ans. The Compound Annual Growth rate for Airless Packaging Market over the forecast period is 6.2 %.

Ans. USD 9.30 billion is the projected Airless Packaging market size of market by 2030.

Ans. North America is the dominating region of the Airless Packaging Market.

Ans. Compatibility with more than one product may not be possible with airless packaging which can restrain the market growth.

Ans. Increasing demand for Hygiene Solution in the Packaging Industry.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of the Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

4.3 Supply Demand Gap Analysis

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Airless Packaging Market Segmentation, by Material

8.1 Plastic

8.2 Metal

8.3 Glass

9. Airless Packaging Market Segmentation, by Packaging Type

9.1 Bags & Pouches

9.2 Bottles & Jars

9.3 Tubes

10. Airless Packaging Market Segmentation, by Dispensing Systems

10.1 Pumps

10.2 Twist & Clicks

10.3 Dropper

11. Airless Packaging Market Segmentation, by Application

11.1 Pharmaceutical

11.2 Personal & Homecare

11.3 Pet care

11.4 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 North America Airless Packaging Market by Country

12.2.2North America Airless Packaging Market by Material

12.2.3 North America Airless Packaging Market by Packaging Type

12.2.4 North America Airless Packaging Market by Dispensing Systems

12.2.5 North America Airless Packaging Market by Application

12.2.6 USA

12.2.6.1 USA Airless Packaging Market by Material

12.2.6.2 USA Airless Packaging Market by Packaging Type

12.2.6.3 USA Airless Packaging Market by Dispensing Systems

12.2.6.4 USA Airless Packaging Market by Application

12.2.7 Canada

12.2.7.1 Canada Airless Packaging Market by Material

12.2.7.2 Canada Airless Packaging Market by Packaging Type

12.2.7.3 Canada Airless Packaging Market by Dispensing Systems

12.2.7.4 Canada Airless Packaging Market by Application

12.2.8 Mexico

12.2.8.1 Mexico Airless Packaging Market by Raw Dispensing Systems

12.2.8.2 Mexico Airless Packaging Market by Packaging Type

12.2.8.3 Mexico Airless Packaging Market by Dispensing Systems

12.2.8.4 Mexico Airless Packaging Market by Application

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Eastern Europe Airless Packaging Market by Country

12.3.1.2 Eastern Europe Airless Packaging Market by Material

12.3.1.3 Eastern Europe Airless Packaging Market by Packaging Type

12.3.1.4 Eastern Europe Airless Packaging Market by Dispensing Systems

12.3.1.5 Eastern Europe Airless Packaging Market by Application

12.3.1.6 Poland

12.3.1.6.1 Poland Airless Packaging Market by Material

12.3.1.6.2 Poland Airless Packaging Market by Packaging Type

12.3.1.6.3 Poland Airless Packaging Market by Dispensing Systems

12.3.1.6.4 Poland Airless Packaging Market by Application

12.3.1.7 Romania

12.3.1.7.1 Romania Airless Packaging Market by Material

12.3.1.7.2 Romania Airless Packaging Market by Packaging Type

12.3.1.7.3 Romania Airless Packaging Market by Dispensing Systems

12.3.1.7.4 Romania Airless Packaging Market by Application

12.3.1.8 Hungary

12.3.1.8.1 Hungary Airless Packaging Market by Material

12.3.1.8.2 Hungary Airless Packaging Market by Packaging Type

12.3.1.8.3 Hungary Airless Packaging Market by Dispensing Systems

12.3.1.8.4 Hungary Airless Packaging Market by Application

12.3.1.9 Turkey

12.3.1.9.1 Turkey Airless Packaging Market by Material

12.3.1.9.2 Turkey Airless Packaging Market by Packaging Type

12.3.1.9.3 Turkey Airless Packaging Market by Dispensing Systems

12.3.1.9.4 Turkey Airless Packaging Market by Application

12.3.1.10 Rest of Eastern Europe

12.3.1.10.1 Rest of Eastern Europe Airless Packaging Market by Material

12.3.1.10.2 Rest of Eastern Europe Airless Packaging Market by Packaging Type

12.3.1.10.3 Rest of Eastern Europe Airless Packaging Market by Dispensing Systems

12.3.1.10.4 Rest of Eastern Europe Airless Packaging Market by Application

12.3.2 Western Europe

12.3.2.1 Western Europe Airless Packaging Market by Country

12.3.2.2 Western Europe Airless Packaging Market by Material

12.3.2.3 Western Europe Airless Packaging Market by Packaging Type

12.3.2.4 Western Europe Airless Packaging Market by Dispensing Systems

12.3.2.5 Western Europe Airless Packaging Market by Application

12.3.2.6 Germany

12.3.2.6.1 Germany Airless Packaging Market by Material

12.3.2.6.2 Germany Airless Packaging Market by Packaging Type

12.3.2.6.3 Germany Airless Packaging Market by Dispensing Systems

12.3.2.6.4 Germany Airless Packaging Market by Application

12.3.2.7 France

12.3.2.7.1 France Airless Packaging Market by Material

12.3.2.7.2 France Airless Packaging Market by Packaging Type

12.3.2.7.3 France Airless Packaging Market by Dispensing Systems

12.3.2.7.4 France Airless Packaging Market by Application

12.3.2.8 UK

12.3.2.8.1 UK Airless Packaging Market by Material

12.3.2.8.2 UK Airless Packaging Market by Packaging Type

12.3.2.8.3 UK Airless Packaging Market by Dispensing Systems

12.3.2.8.4 UK Airless Packaging Market by Application

12.3.2.9 Italy

12.3.2.9.1 Italy Airless Packaging Market by Material

12.3.2.9.2 Italy Airless Packaging Market by Packaging Type

12.3.2.9.3 Italy Airless Packaging Market by Dispensing Systems

12.3.2.9.4 Italy Airless Packaging Market by Application

12.3.2.10 Spain

12.3.2.10.1 Spain Airless Packaging Market by Material

12.3.2.10.2 Spain Airless Packaging Market by Packaging Type

12.3.2.10.3 Spain Airless Packaging Market by Dispensing Systems

12.3.2.10.4 Spain Airless Packaging Market by Application

12.3.2.11 Netherlands

12.3.2.11.1 Netherlands Airless Packaging Market by Material

12.3.2.11.2 Netherlands Airless Packaging Market by Packaging Type

12.3.2.11.3 Netherlands Airless Packaging Market by Dispensing Systems

12.3.2.11.4 Netherlands Airless Packaging Market by Application

12.3.2.12 Switzerland

12.3.2.12.1 Switzerland Airless Packaging Market by Material

12.3.2.12.2 Switzerland Airless Packaging Market by Packaging Type

12.3.2.12.3 Switzerland Airless Packaging Market by Dispensing Systems

12.3.2.12.4 Switzerland Airless Packaging Market by Application

12.3.2.13 Austria

12.3.2.13.1 Austria Airless Packaging Market by Material

12.3.2.13.2 Austria Airless Packaging Market by Packaging Type

12.3.2.13.3 Austria Airless Packaging Market by Dispensing Systems

12.3.2.13.4 Austria Airless Packaging Market by Application

12.3.2.14 Rest of Western Europe

12.3.2.14.1 Rest of Western Europe Airless Packaging Market by Material

12.3.2.14.2 Rest of Western Europe Airless Packaging Market by Packaging Type

12.3.2.14.3 Rest of Western Europe Airless Packaging Market by Dispensing Systems

12.3.2.14.4 Rest of Western Europe Airless Packaging Market by Application

12.4 Asia-Pacific

12.4.1 Asia Pacific Airless Packaging Market by Country

12.4.2 Asia Pacific Airless Packaging Market by Material

12.4.3 Asia Pacific Airless Packaging Market by Packaging Type

12.4.4 Asia Pacific Airless Packaging Market by Dispensing Systems

12.4.5 Asia Pacific Airless Packaging Market by Application

12.4.6 China

12.4.6.1 China Airless Packaging Market by Material

12.4.6.2 China Airless Packaging Market by Packaging Type

12.4.6.3 China Airless Packaging Market by Dispensing Systems

12.4.6.4 China Airless Packaging Market by Application

12.4.7 India

12.4.7.1 India Airless Packaging Market by Material

12.4.7.2 India Airless Packaging Market by Packaging Type

12.4.7.3 India Airless Packaging Market by Dispensing Systems

12.4.7.4 India Airless Packaging Market by Application

12.4.8 Japan

12.4.8.1 Japan Airless Packaging Market by Material

12.4.8.2 Japan Airless Packaging Market by Packaging Type

12.4.8.3 Japan Airless Packaging Market by Dispensing Systems

12.4.8.4 Japan Airless Packaging Market by Application

12.4.9 South Korea

12.4.9.1 South Korea Airless Packaging Market by Material

12.4.9.2 South Korea Airless Packaging Market by Packaging Type

12.4.9.3 South Korea Airless Packaging Market by Dispensing Systems

12.4.9.4 South Korea Airless Packaging Market by Application

12.4.10 Vietnam

12.4.10.1 Vietnam Airless Packaging Market by Material

12.4.10.2 Vietnam Airless Packaging Market by Packaging Type

12.4.10.3 Vietnam Airless Packaging Market by Dispensing Systems

12.4.10.4 Vietnam Airless Packaging Market by Application

12.4.11 Singapore

12.4.11.1 Singapore Airless Packaging Market by Material

12.4.11.2 Singapore Airless Packaging Market by Packaging Type

12.4.11.3 Singapore Airless Packaging Market by Dispensing Systems

12.4.11.4 Singapore Airless Packaging Market by Application

12.4.12 Australia

12.4.12.1 Australia Airless Packaging Market by Material

12.4.12.2 Australia Airless Packaging Market by Packaging Type

12.4.12.3 Australia Airless Packaging Market by Dispensing Systems

12.4.12.4 Australia Airless Packaging Market by Application

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Airless Packaging Market by Material

12.4.13.2 Rest of Asia-Pacific APAC Airless Packaging Market by Packaging Type

12.4.13.3 Rest of Asia-Pacific Airless Packaging Market by Dispensing Systems

12.4.13.4 Rest of Asia-Pacific Airless Packaging Market by Application

12.5 Middle East & Africa

12.5.1 Middle East

12.5.1.1 Middle East Airless Packaging Market by country

12.5.1.2 Middle East Airless Packaging Market by Material

12.5.1.3 Middle East Airless Packaging Market by Packaging Type

12.5.1.4 Middle East Airless Packaging Market by Dispensing Systems

12.5.1.5 Middle East Airless Packaging Market by Application

12.5.1.6 UAE

12.5.1.6.1 UAE Airless Packaging Market by Material

12.5.1.6.2 UAE Airless Packaging Market by Packaging Type

12.5.1.6.3 UAE Airless Packaging Market by Dispensing Systems

12.5.1.6.4 UAE Airless Packaging Market by Application

12.5.1.7 Egypt

12.5.1.7.1 Egypt Airless Packaging Market by Material

12.5.1.7.2 Egypt Airless Packaging Market by Packaging Type

12.5.1.7.3 Egypt Airless Packaging Market by Dispensing Systems

12.5.1.7.4 Egypt Airless Packaging Market by Application

12.5.1.8 Saudi Arabia

12.5.1.8.1 Saudi Arabia Airless Packaging Market by Material

12.5.1.8.2 Saudi Arabia Airless Packaging Market by Packaging Type

12.5.1.8.3 Saudi Arabia Airless Packaging Market by Dispensing Systems

12.5.1.8.4 Saudi Arabia Airless Packaging Market by Application

12.5.1.9 Qatar

12.5.1.9.1 Qatar Airless Packaging Market by Material

12.5.1.9.2 Qatar Airless Packaging Market by Packaging Type

12.5.1.9.3 Qatar Airless Packaging Market by Dispensing Systems

12.5.1.9.4 Qatar Airless Packaging Market by Application

12.5.1.10 Rest of Middle East

12.5.1.10.1 Rest of Middle East Airless Packaging Market by Material

12.5.1.10.2 Rest of Middle East Airless Packaging Market by Packaging Type

12.5.1.10.3 Rest of Middle East Airless Packaging Market by Dispensing Systems

12.5.1.10.4 Rest of Middle East Airless Packaging Market by Application

12.5.2. Africa

12.5.2.1 Africa Airless Packaging Market by country

12.5.2.2 Africa Airless Packaging Market by Material

12.5.2.3 Africa Airless Packaging Market by Packaging Type

12.5.2.4 Africa Airless Packaging Market by Dispensing Systems

12.5.2.5 Africa Airless Packaging Market by Application

12.5.2.6 Nigeria

12.5.2.6.1 Nigeria Airless Packaging Market by Material

12.5.2.6.2 Nigeria Airless Packaging Market by Packaging Type

12.5.2.6.3 Nigeria Airless Packaging Market by Dispensing Systems

12.5.2.6.4 Nigeria Airless Packaging Market by Application

12.5.2.7 South Africa

12.5.2.7.1 South Africa Airless Packaging Market by Material

12.5.2.7.2 South Africa Airless Packaging Market by Packaging Type

12.5.2.7.3 South Africa Airless Packaging Market by Dispensing Systems

12.5.2.7.4 South Africa Airless Packaging Market by Application

12.5.2.8 Rest of Africa

12.5.2.8.1 Rest of Africa Airless Packaging Market by Material

12.5.2.8.2 Rest of Africa Airless Packaging Market by Packaging Type

12.5.2.8.3 Rest of Africa Airless Packaging Market by Dispensing Systems

12.5.2.8.4 Rest of Africa Airless Packaging Market by Application

12.6. Latin America

12.6.1 Latin America Airless Packaging Market by country

12.6.2 Latin America Airless Packaging Market by Material

12.6.3 Latin America Airless Packaging Market by Packaging Type

12.6.4 Latin America Airless Packaging Market by Dispensing Systems

12.6.5 Latin America Airless Packaging Market by Application

12.6.6 Brazil

12.6.6.1 Brazil Airless Packaging Market by Material

12.6.6.2 Brazil Africa Airless Packaging Market by Packaging Type

12.6.6.3 Brazil Airless Packaging Market by Dispensing Systems

12.6.6.4 Brazil Airless Packaging Market by Application

12.6.7 Argentina

12.6.7.1 Argentina Airless Packaging Market by Material

12.6.7.2 Argentina Airless Packaging Market by Packaging Type

12.6.7.3 Argentina Airless Packaging Market by Dispensing Systems

12.6.7.4 Argentina Airless Packaging Market by Application

12.6.8 Colombia

12.6.8.1 Colombia Airless Packaging Market by Material

12.6.8.2 Colombia Airless Packaging Market by Packaging Type

12.6.8.3 Colombia Airless Packaging Market by Dispensing Systems

12.6.8.4 Colombia Airless Packaging Market by Application

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Airless Packaging Market by Material

12.6.9.2 Rest of Latin America Airless Packaging Market by Packaging Type

12.6.9.3 Rest of Latin America Airless Packaging Market by Dispensing Systems

12.6.9.4 Rest of Latin America Airless Packaging Market by Application

13 Company Profile

13.1 APC Packaging

13.1.1 Company Overview

13.1.2 Financials

13.1.3 Product/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 HCP Packaging

13.2.1 Company Overview

13.2.2 Financials

13.2.3 Product/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Silgan Holdings

13.3.1 Company Overview

13.3.2 Financials

13.3.3 Product/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Quadpack

13.4 Company Overview

13.4.2 Financials

13.4.3 Product/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Aptar Group Inc

13.5.1 Company Overview

13.5.2 Financials

13.5.3 Product/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Albea SA

13.6.1 Company Overview

13.6.2 Financials

13.6.3 Product/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Fusion PKG

13.7.1 Company Overview

13.7.2 Financials

13.7.3 Product/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Lumson SPA

13.8.1 Company Overview

13.8.2 Financials

13.8.3 Product/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments’

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. USE Cases and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Molded Fiber Packaging Market Size was valued at USD 10.20 Billion in 2023 and is expected to reach USD 15.69 Billion by 2032 and grow at a CAGR of 5% over the forecast period 2024-2032.

The Connected Logistics Market size was USD 29.54 billion in 2023 and is expected to Reach USD 43.68 billion by 2031 and grow at a CAGR of 5.02 % over the forecast period of 2024-2031.

The Sustainable Pharmaceutical Packaging Market size was USD 82 billion in 2023 and is expected to Reach USD 299.95 billion by 2032 and grow at a CAGR of 15.5 % over the forecast period of 2024-2032.

The Corrugated Boxes Market size was valued at USD 75.71 billion in 2023. It is expected to reach USD 107.75 billion by 2032 and grow at a CAGR of 4% over the forecast period 2024-2032.

Packaging Material Market Size was valued at USD 1136 billion in 2023 and is expected to reach USD 1433.47 billion by 2031 and grow at a CAGR of 2.95% over the forecast period 2024-2031.

The Biodegradable Packaging Market Size was valued at USD 454.68 billion in 2023 and is expected to reach USD 780.73 billion by 2032 and grow at a CAGR of 6.19% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone