To get more information on Aircraft Wire and Cable Market - Request Free Sample Report

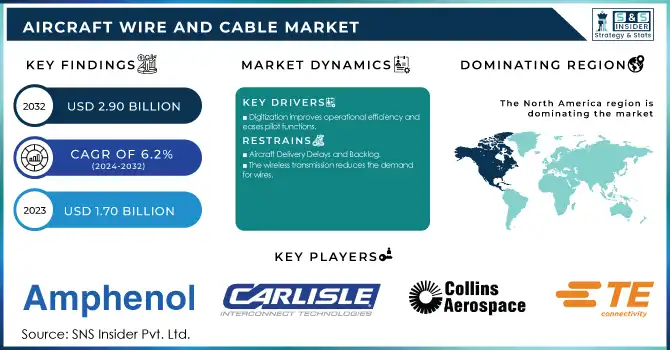

The Aircraft Wire and Cable Market size was valued at USD 1.70 billion in 2023 and is projected to reach USD 2.90 billion by 2032, growing at a CAGR of 6.2% over the forecast period of 2024–2032.

This market's expansion is being driven primarily by the digitization and electrification of aircraft systems, a rise in aircraft renewals and deliveries, and ongoing technical breakthroughs.

The harness category is expected to lead the market throughout the projected period, accounting for 50% of the market in 2023. Aircraft contains kilometres of electrical harnesses in the aerospace sector. Engine, fuselage, wing, landing gear, avionics, and a variety of additional functions are all used in the aircraft business. Composite, Ethernet, and data bus wire harnesses are also included in aircraft wire harnesses.

KEY DRIVERS

Digitization improves operational efficiency and eases pilot functions. airline software and services Strategic digital advancements deliver a range of intuitive Thereby improving overall operations It provides immediate and future benefits to flight for airline operations by assisting the due to digitization responsibilities involved at each stage Work operations in the cockpit have been completely computerized. A networked ecosystem of services, apps and documents defining the future flight deck is becoming more accessible to pilots. Data and power cables are required to connect these digital systems in every aircraft section. Alternative energy is required because of carbon emissions and higher fuel costs.

Thus, electrifying aircraft provides more efficient, silent, and Digitization increases operational efficiency and simplifies pilot tasks. Strategic digital improvements enable the delivery of a variety of user-friendly airline software and services. It assists airlines' flight operations both now and in the future by aiding the duties involved at each step, hence boosting overall operations. Because of digitalization, work processes in the cockpit have become totally automated. Pilots are growing increasingly familiar with a networked ecosystem of applications, services, and documents that define the future flight deck. Every aeroplane segment requires data and power lines to link these digital systems. Higher fuel costs and carbon emissions necessitate the usage of alternative energy. As a result, electrifying aircraft allows for more efficient, silent, and sustainable flight. It also cuts aeroplane operators' fuel usage and operational costs. For faster, more flexible, more efficient transmission, electric aircraft system needs wire and cables.

RESTRAINTS

Aircraft Delivery Delays and Backlog

The wireless transmission reduces the demand for wires.

OPPORTUNITIES

Electric technology demand is predicted to add to the military and aerospace fibre optic cable market. Incorporating more electric technology decreases fuel consumption and gives aeroplanes with a dependable power supply. Electrically powered systems are a viable replacement for mechanically powered engine accessories, pumps, and generators. Over the previous few decades, aircraft systems have undergone revolutionary design and power distribution improvements. Companies including Boeing, Bombardier (Canada), and Airbus are developing electrical systems to replace older systems for improved aeroplane performance and lower maintenance costs. Airbus will begin developing hybrid-electric propulsion systems in September 2021. The flying testing of the Airbus Flight Lab helicopter with a backup engine system have begun. In the event of a turbine failure, this would serve as an emergency electrical power system.

CHALLENGES

Airlines are working with aircraft wire and cable producers to develop lightweight cables and wires. Nexans, for example, inked a deal with Airbus in January 2021 to supply specialist aerospace cables and wires for passenger and military aircraft and helicopters. Nexans will offer high-performance, lightweight cables that contribute significantly to aircraft efficiency, passenger comfort, and safety, according to the new deal. It would concentrate on developing innovative solutions for the production of electric and hybrid aircraft. It will supply the majority of the cables needed for Airbus aircraft, including those for the cockpit, engine, cabin, in-flight entertainment, and wings. Hook-up, wire, power, data, avionics, and fire-resistant cables are among the cable kinds. GKN Aerospace and Eviation inked a deal with Alice All-Electric Aircraft in May 2020 for the innovative lightweight wing, empennage, and wiring systems. The contract includes the design and manufacture of wings, empennage, and Electrical Wiring Interconnection Systems (EWIS). The aircraft intends to make long-distance flights of up to 650 miles more environmentally friendly.

THE IMPACT OF COVID-19

Amphenol Corporation, Carlisle Interconnect Technologies, Collins Aerospace, TE Connectivity, and Nexans SA are among the key companies in the Aircraft Wire and Cable industry. These companies have expanded their operations into nations such as North America, Europe, Asia Pacific, the Middle East, Africa, and Latin America. enterprises had influence on them by COVID-19.

According to industry analysts, COVID-19 might reduce Aircraft Wire and Cable manufacturing and services by 7–10% globally by 2020. The COVID-19 epidemic has had a negative influence on the end-use sectors, resulting in a dramatic drop in 2020 aircraft sales and delivery. This is projected to have a short-term negative impact on the aviation market, with a modest recovery expected in Q1 of 2021.

Impact of Ukraine and Russia Crisis

The worldwide Aircraft Engine Electrical Wiring Harnesses and Cable Assembly market research report includes a detailed examination of the various processes and materials utilised in the manufacture of Aircraft Engine Electrical Wiring Harnesses and Cable Assembly market items. The study studies many elements, including the production and end-use sectors of the Aircraft Engine Electrical Wiring Harnesses and Cable Assembly market goods, beginning with an industry chain analysis and ending with a cost structure analysis. The study details the most recent pharmaceutical industry developments in order to assess their influence on the manufacturing of Aircraft Engine Electrical Wiring Harnesses and Cable Assembly market items. The Aircraft Engine Electrical Wiring Harnesses and Cable Assembly market research study has also highlighted the current market standards. unbiasedly depicted the most recent strategic changes and patterns of market participants The study is a hypothetical business document that may assist purchasers in the worldwide market in planning their next steps toward the market's future position.

Aircraft Type Segment Insights

The worldwide aviation wire & cable market is divided into commercial and military aircraft types. Commercial aircraft are likely to lead the market in terms of market share throughout the forecast period, owing to a spectacular increase in the number of commercial aircraft deliveries.

Fit Type Segment Insights

Based on fit type, the worldwide aircraft wire & cable market is led by the line fit segment, which had the majority of the market share in 2023 and is expected to maintain its dominance throughout the forecast period.

Application Segment Insights

According to application, the aviation wire & cable market is dominated by the power transfer segment, which held the greatest market share in 2023 and is expected to maintain its dominance throughout the forecast period.

MARKET ESTIMATION:

In military aircraft, Aircraft Wire and Cable are utilised for a number of functions. Aircraft Wire & Cable is most commonly used as an electrical conductor, although it may also be used in hydraulic or pneumatic systems. Furthermore, these cables offer structural support, which is critical for preserving flying integrity during high-g manoeuvres or other pressures on the aircraft.

The market is divided into five regions: North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa. North America is Due to the rising number of passengers carried by low-cost airlines in this area, this region is likely to dominate the worldwide Aircraft Wire and Cable market over the forecast period. Because of increased investment in the area, Latin America is likely to be the fastest-growing market. The rising usage of Aviation Wire & Cable in civil aircraft applications is predicted to drive stable growth in Europe. Because of nations' growing military budgets, the Asia Pacific market is predicted to have the greatest CAGR. Because of the minimal utilisation of Aviation Wire & Cable in civil aircraft applications, the Middle East and Africa are likely to be the slowest-growing markets.

By Component

Aircraft Harness

Aircraft Wire

Aircraft Cable

By Application

Lighting

Data Transfer

Power Transfer

Avionics

Others

By Conductor Material

Stainless Steel Alloys

Copper Alloys

Aluminum Alloys

Others

By Insulation Type

Thermosetting

By Aircraft Type

Fixed Wing

Rotary Wing

AAM

By End Use

OEM

Aftermarket

REGIONAL COVERAGE

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

Need any customization research on Aircraft Wire and Cable Market - Enquiry Now

The Major Players are Amphenol Corporation, Carlisle Interconnect Technologies, Collins Aerospace, TE Connectivity, Nexans SA. & Other Players.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.70 billion |

| Market Size by 2032 | US$ 2.90 Million |

| CAGR | CAGR of 6.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Aircraft Harness, Aircraft Wire, Aircraft Cable) • By Application (Flight Control Systems, Lighting, Data Transfer, Power Transfer, Avionics, Others) • By Conductor Material (Stainless Steel Alloys, Copper Alloys, Aluminum Alloys, Others) • By Insulation Type (Thermoplastic, Thermosetting) • By Aircraft Type (Fixed Wing, Rotary Wing, Unmanned Aerial Vehicles, AAM) • By End Use (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amphenol Corporation, Carlisle Interconnect Technologies, Collins Aerospace, TE Connectivity, Nexans SA. |

| Key Drivers | • The growing demand for commercial and military aircraft worldwide is a major driver for the aircraft wire and cable market. • Rising focus on aircraft modernization |

| Market Restraints | • Aircraft Delivery Delays and Backlog • Wireless transmission reduces the demand for wires. |

Aircraft Wire and Cable Market is expected to be worth USD 1.77 billion in 2023, rising to USD 2.68 billion by 2031 at a CAGR of 5.3% during the forecast period 2024-2031.

Asia Pacific market is predicted to have the greatest CAGR. Because of the minimal utilisation of Aviation Wire & Cable in civil aircraft applications, the Middle East and Africa are likely to be the slowest-growing markets.

Digitization improves operational efficiency and eases pilot functions. airline software and services Strategic digital advancements deliver a range of intuitive Thereby improving overall operations It provides immediate and future benefits to flight for airline operations by assisting the due to digitization responsibilities involved at each stage Work operations in the cockpit have been completely computerized.

The sample for the Aircraft Wire and Cable Market report is available on the website upon request. To obtain the sample report, you can also use the 24*7 chat support and direct call services.

Yes, you will get an free sample of this report for that you have to make an contact with our team.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia War

4.3 Impact of Ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Aircraft wires and cables Market Segmentation, By Component

8.1 Aircraft Harness

8.2 Aircraft Wire

8.3 Aircraft Cable

9. Aircraft wires and cables Market Segmentation, By Application

9.1 Flight Control Systems

9.2 Lighting

9.3 Data Transfer

9.4 Power Transfer

9.5 Avionics

9.6 Others

10. Aircraft wires and cables Market Segmentation, By Conductor Material

10.1 Stainless Steel Alloys

10.2 Copper Alloys

10.3 Aluminum Alloys

10.4 Others

11. Aircraft wires and cables Market Segmentation, By Insulation Type

11.1 Thermoplastic

11.2 Thermosetting

12. Aircraft wires and cables Market Segmentation, By Aircraft Type

12.1 Fixed Wing

12.2 Rotary Wing

12.3 Unmanned Aerial Vehicles

12.4 AAM

13. Aircraft wires and cables Market Segmentation, By End Use

13.1 OEM

13.2 Aftermarket

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 USA

14.2.2 Canada

14.2.3 Mexico

14.3 Europe

14.3.1 Germany

14.3.2 UK

14.3.3 France

14.3.4 Italy

14.3.5 Spain

14.3.6 The Netherlands

14.3.7 Rest of Europe

14.4 Asia-Pacific

14.4.1 Japan

14.4.2 South Korea

14.4.3 China

14.4.4 India

14.4.5 Australia

14.4.6 Rest of Asia-Pacific

14.5 The Middle East & Africa

14.5.1 Israel

14.5.2 UAE

14.5.3 South Africa

14.5.4 Rest

14.6 Latin America

14.6.1 Brazil

14.6.2 Argentina

14.6.3 Rest of Latin America

15. Company Profiles

15.1 HITACHI LTD.

15.1.1 Financial

15.1.2 Products/ Services Offered

15.1.3 SWOT Analysis

15.1.4 The SNS view

15.2 AB VOLVO

15.3 CATERPILLAR INC.

15.4 CNH INDUSTRIAL N.V

15.5 DEERE AND COMPANY

15.6 DOOSAN INFRACOE CO.LTD

15.7 J C BAMFORD EXCAVATORS. LTD.

15.8 KOMATSU LTD.

15.9 Liebherr-International AG

15.10 XCMG GROUP

16. Competitive Landscape

16.1 Competitive Benchmark

16.2 Market Share Analysis

16.3 Recent Developments

17. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Aircraft Interface Device Market Size was valued at USD 244.32 million in 2023 and is expected to reach USD 921.60 million by 2032 with a growing CAGR of 17% over the forecast period 2024-2032.

The 5G From Space Market Size was valued at USD 291.5 million in 2023 and is expected to reach USD 24003.1 million by 2032 and grow at a CAGR of 63.3% over the forecast period 2024-2032.

Inertial Measurement Unit (IMU) Market was valued at USD 22.6 billion in 2023 and is projected to grow to USD 45.9 billion by 2032, registering a CAGR of 8.22% during the forecast period of 2024-2032.

The Weapon Mounts Market Size was valued at USD 1.39 billion in 2023, expected to reach USD 2.75 billion by 2032 with a growing CAGR of 7.86% over the forecast period 2024-2032.

The Combat Management System Market Size was valued at US$ 378.6 million in 2023 and is expected to reach USD 520.9 million by 2032 with a growing CAGR of 3.61% over the forecast period 2024-2032.

The aircraft docking systems market size was valued at USD 10.03 Billion in 2023 and is expected to reach USD 12.00 Billion by 2032 and grow at a CAGR of 2.02% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone