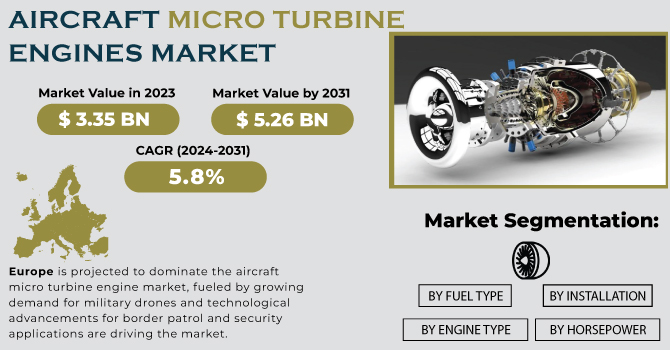

The Aircraft Micro Turbine Engines Market Size was valued at USD 3.35 Billion in 2023 and is expected to reach USD 5.26 Billion by 2031 and grow at a CAGR of 5.8% over the forecast period 2024-2031.

The International Air Transport Association (IATA) forecasts a surge in air travellers to 4 billion by 2024, necessitating more aircraft and potentially boosting the micro turbine market. Innovative hybrid aircraft designs are incorporating microturbines as power sources for small, unmanned drones. This technology offers efficient power generation and heat utilization simultaneously (cogeneration). Finally, the growing focus on reducing emissions makes microturbines attractive alternatives to traditional engines due to their lower emissions profile.

To get more information on Aircraft Micro Turbine Engines Market - Request Free Sample Report

Microturbines themselves are compelling due to their compact size and efficient design. They utilize micro combustion for cogeneration and can operate on various fuels with high efficiency. Imagine a refrigerator-sized engine – that's a microturbine, capable of generating 25 kW to 500 kW of power. Their simple design, with just one set of turbine and compressor blades, translates to fewer moving parts and easier maintenance, making them ideal for unmanned aerial vehicles (UAVs) and small aircraft.

However, the future of microturbines isn't without challenges. While the aviation industry aspires towards electrification, current battery technology lacks the energy density required for long-distance flights. This limitation keeps microturbines relevant in the near future. Nevertheless, research on next-generation battery chemistries like Sodium-ion or Lithium-metal is ongoing, aiming to surpass the energy density of jet fuel. These advancements could eventually challenge the dominance of microturbines.

MARKET DYNAMICS

KEY DRIVERS:

Hybrid aircraft development utilizing microturbines as power sources for small drones is driving growth in the aircraft micro turbine engine market

New hybrid aircraft designs are incorporating microturbines as power sources for small, unmanned aerial vehicles (UAVs or drones). Microturbines offer efficient power generation and the ability to utilize heat simultaneously (cogeneration), making them well-suited for hybrid applications.

The anticipated surge in air travellers fuels the demand for more aircraft and potentially boosts the micro turbine engine market.

RESTRAIN:

Limited Aftermarket for Newer Segments

Currently, the aftermarket for micro turbine engines is primarily focused on replacements for Auxiliary Power Units (APUs) in older aircraft. Newer segments like light aircraft, military drones, and urban air taxis (cargo drones and air taxis) are not yet widespread, limiting the aftermarket for these engines.

Microturbine engines themselves are expensive due to research and development (R&D) costs for specialized aircraft components

OPPORTUNITY:

The development of distributed power generation systems at airports and remote landing strips presents a new market opportunity for microturbine engines

These systems would provide on-site electricity generation, reducing reliance on traditional power grids that might be unavailable or unreliable in remote locations. The compact size, fuel flexibility, and efficiency of microturbines make them well-suited for this application, potentially powering facilities, ground equipment, and even contributing to electric or hybrid aircraft charging infrastructure

Integration with Electric Propulsion Systems

CHALLENGES:

High Manufacturing and Certification Costs

Microturbines involve specialized technology, leading to high research and development (R&D) expenses. Additionally, obtaining aviation authority certification for these engines adds a significant cost burden for manufacturers.

IMPACT OF RUSSIA UKRAINE WAR

On the downside, supply chain disruptions caused by the war could inflate transportation costs by 20-30% (McKinsey & Company), leading to production delays and price increases for microturbines due to difficulty acquiring materials. Additionally, sanctions on Russia, a former major supplier (10% of global aluminum exports in 2021 - Forbes), could limit access to crucial resources. Furthermore, the war's economic uncertainty might decrease demand for new civilian aircraft by 5-10% (Air Lease Corporation), potentially reducing the need for new microturbines in auxiliary power units.

The surge in military spending around 10-15% increase could boost demand for military drones powered by microturbines. Additionally, countries might prioritize domestic production of critical microturbine components with 20-25% increase to create a more geographically diverse supply chain.

IMPACT OF ECONOMIC SLOWDOWN

Airlines and private jet operators, tightening their budgets, might delay or cancel new aircraft orders by 15-20%, according to industry analysts. This translates to a direct drop in demand for new microturbines, especially those powering Auxiliary Power Units (APUs) in these grounded planes. Innovation might also stall as budget cuts lead to a 10-15% decrease in R&D spending for advanced microturbine technologies. With a focus on cost-cutting, airlines might delay scheduled maintenance or upgrades for existing microturbines by 5-10%, potentially impacting their performance and lifespan. Additionally, tight credit markets could make securing financing for new aircraft or microturbines difficult, with smaller aviation companies facing a potential 20% reduction in financing options.

Airlines prioritizing fuel efficiency might find microturbines, known for their efficiency, 10-15% more attractive compared to traditional engines in specific applications. Economic slowdowns could also lead to airlines extending the lifespan of existing aircraft, potentially boosting the aftermarket for replacement microturbines and parts by 15-20%.

KEY MARKET SEGMENTS

BY ENGINE TYPE

Turbojet

Turboprop

Turboshaft

BY FUEL TYPE

Jet Fuel

Multi Fuel

BY HORSEPOWER

Below 50 HP

50-100 HP

100-200 HP

Greater Than 200 HP

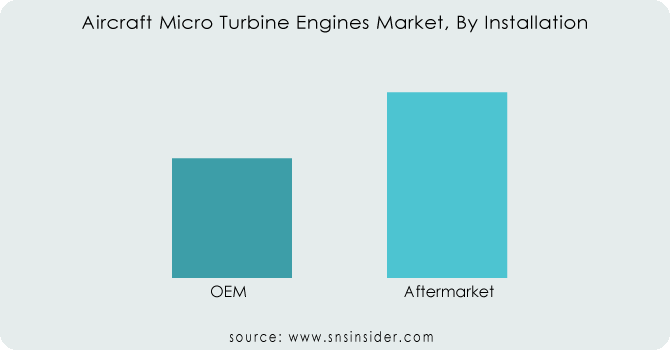

BY INSTALLATION

OEM

Aftermarket

In the aircraft micro turbine engine market, aftermarket parts, mainly for replacing Auxiliary Power Units (APUs) in older aircraft, are expected to lead in 2023 with the market share of 60%. This excludes newer segments like light aircraft, military drones, and urban air taxis (cargo drones and air taxis) since they're not yet widespread. Currently, only engine manufacturers supply replacement APUs. Though aftermarket parts for these newer segments are limited due to their recent development, advancements in micro turbine technology are expected to boost this market in the future.

Need any customization research on Aircraft Micro Turbine Engines Market - Enquiry Now

BY PLATFORM

General Aviation

Business Jets

Light Aircraft

Military Aviation

Military Drones

Military Aircraft

Commercial Aviation

Advanced Air Mobility

Cargo Drones

Air Taxis

BY END USE

Auxiliary Power

Propulsion

Auxiliary power units (APUs) are expected to be the dominant application for micro turbine engines in aircraft (2024-2031). Research suggests micro turbines (5-500 HP) could power APUs in light aircraft and business jets, reducing operating costs and emissions. Similar to aircraft gas turbines, micro turbines use compressors, combustors, turbines, and generators for on-board electricity. Compared to other technologies, micro turbines for aircraft propulsion offer advantages like fewer parts, lighter weight, and higher efficiency. They even utilize waste heat, achieving efficiencies over 80%.

REGIONAL ANALYSIS

Europe is projected to dominate the aircraft micro turbine engine market, fueled by growing demand for military drones and technological advancements for border patrol and security applications are driving the market. The surge in private jet usage post-pandemic is creating a need for new engines, with major European cities experiencing significant increases in private flights.

Overall growth in air traffic and investment in the aviation sector are contributing to the market's expansion. Research suggests the commercial drone market in Europe will balloon from 10,000 units in 2019 to 395,000 by 2035, highlighting the significant role drones will play in this market growth.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

Some of the major players in the Aircraft Micro Turbine Engines Market are General Electric Company, Sentient Blue Technologies, Turbotech SAS, Williams International, AeroDesignWorks GmbH, Elliott Company, Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., Honeywell International Inc., PBS Group. a.s, Raytheon Technologies Corporation, UAV Turbines Inc, Kratos Defense & Security Solutions Inc., and other players.

RECENT TRENDS

In June 2023, Czech engineering company PBS and Ukrainian engine designer Ivchenko Progress signed a memorandum of understanding to develop a compact turbojet for small UAVs and cruise missiles at Le Bourget.

In February 2020, UAV Turbines Inc. introduced the Micro Turbogenerator System 1.0 (MTS 1.0). This innovative system is designed to be portable and meet the needs of both ground power and auxiliary power applications. The MTS 1.0 offers flexibility, delivering on-demand electrical power in a range of outputs, from 3 kW to 40 kW.

Sentient Blue Technologies-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.35 Billion |

| Market Size by 2031 | US$ 5.26 Billion |

| CAGR | CAGR of 5.8% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Engine Type (Turbojet, Turboprop, Turboshaft) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | General Electric Company, Sentient Blue Technologies, Turbotech SAS, Williams International, AeroDesignWorks GmbH, Elliott Company, Kratos Defense & Security Solutions, Inc., Micro Turbine Technology B.V., Honeywell International Inc., PBS Group. a.s, Raytheon Technologies Corporation, UAV Turbines Inc, Kratos Defense & Security Solutions Inc |

| KEY DRIVERS |

• Hybrid aircraft development utilizing microturbines as power sources for small drones is driving growth in the aircraft micro turbine engine market |

| Restraints |

• Limited Aftermarket for Newer Segments |

Yes, this report cover top down , bottom up Quantitative Research.Qualitative Research, Fundamental Research, data triangulation, ID’s & FGD’s Analytical research, And other as per report requirement.

Raw material vendors, Distributors/traders/wholesalers/suppliers, Regulatory authorities, including government agencies and NGO, Commercial research & development (R&D) institutions, Importers and exporters, Government organizations, research organizations, and consulting firms, Trade/Industrial associations, End-use industries.

Manufacturers/Service provider, Consultant, Association, Research institute, private and universities libraries, Suppliers and Distributors of the product.

Europe is predicted to lead the market for aviation micro turbine engines. The demand for stealth and long-lasting aerial vehicles for military operations in Europe is projected to increase soon.

Aircraft Micro Turbine Engines Market Size was valued at USD 3.17 billion in 2022, expected to reach USD 4.98 billion by 2030, and grow at a CAGR of 5.8% over the forecast period 2023-2030.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenge

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Aircraft Micro Turbine Engines Market Segmentation, By Engine Type

9.1 Introduction

9.2 Trend Analysis

9.3 Turbojet

9.4 Turboprop

9.5 Turboshaft

10. Aircraft Micro Turbine Engines Market Segmentation, By Fuel Type

10.1 Introduction

10.2 Trend Analysis

10.3 Jet Fuel

10.4 Multi Fuel

11. Aircraft Micro Turbine Engines Market Segmentation, By Horsepower

11.1 Introduction

11.2 Trend Analysis

11.3 Below 50 HP

11.4 50-100 HP

11.5 100-200 HP

11.6 Greater Than 200 HP

12. Aircraft Micro Turbine Engines Market Segmentation, By Installation

12.1 Introduction

12.2 Trend Analysis

12.3 OEM

12.4 Aftermarket

13. Aircraft Micro Turbine Engines Market Segmentation, By Platform

13.1 Introduction

13.2 Trend Analysis

13.3 General Aviation

13.3.1 Business Jets

13.3.2 Light Aircraft

13.4 Military Aviation

13.4.1 Military Drones

13.4.2 Military Aircraft

13.5 Commercial Aviation

13.6 Advanced Air Mobility

13.6.1 Cargo Drones

13.6.2 Air Taxis

14. Aircraft Micro Turbine Engines Market Segmentation, By End Use

14.1 Introduction

14.2 Trend Analysis

14.3 Auxiliary Power

14.4 Propulsion

15. Regional Analysis

15.1 Introduction

15.2 North America

15.2.1 Trend Analysis

15.2.2 North America Aircraft Micro Turbine Engines Market By Country

15.2.3 North America Aircraft Micro Turbine Engines Market By Engine Type

15.2.4 North America Aircraft Micro Turbine Engines Market By Fuel Type

15.2.5 North America Aircraft Micro Turbine Engines Market By Horsepower

15.2.6 North America Aircraft Micro Turbine Engines Market, By Installation

15.2.7 North America Aircraft Micro Turbine Engines Market, By Platform

15.2.8 North America Aircraft Micro Turbine Engines Market, By End Use

15.2.9 USA

15.2.9.1 USA Aircraft Micro Turbine Engines Market By Engine Type

15.2.9.2 USA Aircraft Micro Turbine Engines Market By Fuel Type

15.2.9.3 USA Aircraft Micro Turbine Engines Market By Horsepower

15.2.9.4 USA Aircraft Micro Turbine Engines Market, By Installation

15.2.9.5 USA Aircraft Micro Turbine Engines Market, By Platform

15.2.9.6 USA Aircraft Micro Turbine Engines Market, By End Use

15.2.10 Canada

15.2.10.1 Canada Aircraft Micro Turbine Engines Market By Engine Type

15.2.10.2 Canada Aircraft Micro Turbine Engines Market By Fuel Type

15.2.10.3 Canada Aircraft Micro Turbine Engines Market By Horsepower

15.2.10.4 Canada Aircraft Micro Turbine Engines Market, By Installation

15.2.10.5 Canada Aircraft Micro Turbine Engines Market, By Platform

15.2.10.6 Canada Aircraft Micro Turbine Engines Market, By End Use

15.2.11 Mexico

15.2.11.1 Mexico Aircraft Micro Turbine Engines Market By Engine Type

15.2.11.2 Mexico Aircraft Micro Turbine Engines Market By Fuel Type

15.2.11.3 Mexico Aircraft Micro Turbine Engines Market By Horsepower

15.2.11.4 Mexico Aircraft Micro Turbine Engines Market, By Installation

15.2.11.5 Mexico Aircraft Micro Turbine Engines Market, By Platform

15.2.11.6 Mexico Aircraft Micro Turbine Engines Market, By End Use

15.3 Europe

15.3.1 Trend Analysis

15.3.2 Eastern Europe

15.3.2.1 Eastern Europe Aircraft Micro Turbine Engines Market By Country

15.3.2.2 Eastern Europe Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.3 Eastern Europe Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.4 Eastern Europe Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.5 Eastern Europe Aircraft Micro Turbine Engines Market By Installation

15.3.2.6 Eastern Europe Aircraft Micro Turbine Engines Market, By Platform

15.3.2.7 Eastern Europe Aircraft Micro Turbine Engines Market, By End Use

15.3.2.8 Poland

15.3.2.8.1 Poland Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.8.2 Poland Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.8.3 Poland Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.8.4 Poland Aircraft Micro Turbine Engines Market By Installation

15.3.2.8.5 Poland Aircraft Micro Turbine Engines Market, By Platform

15.3.2.8.6 Poland Aircraft Micro Turbine Engines Market, By End Use

15.3.2.9 Romania

15.3.2.9.1 Romania Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.9.2 Romania Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.9.3 Romania Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.9.4 Romania Aircraft Micro Turbine Engines Market By Installation

15.3.2.9.5 Romania Aircraft Micro Turbine Engines Market, By Platform

15.3.2.9.6 Romania Aircraft Micro Turbine Engines Market, By End Use

15.3.2.10 Hungary

15.3.2.10.1 Hungary Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.10.2 Hungary Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.10.3 Hungary Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.10.4 Hungary Aircraft Micro Turbine Engines Market By Installation

15.3.2.10.5 Hungary Aircraft Micro Turbine Engines Market, By Platform

15.3.2.10.6 Hungary Aircraft Micro Turbine Engines Market, By End Use

15.3.2.11 Turkey

15.3.2.11.1 Turkey Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.11.2 Turkey Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.11.3 Turkey Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.11.4 Turkey Aircraft Micro Turbine Engines Market By Installation

15.3.2.11.5 Turkey Aircraft Micro Turbine Engines Market, By Platform

15.3.2.11.6 Turkey Aircraft Micro Turbine Engines Market, By End Use

15.3.2.12 Rest of Eastern Europe

15.3.2.12.1 Rest of Eastern Europe Aircraft Micro Turbine Engines Market By Engine Type

15.3.2.12.2 Rest of Eastern Europe Aircraft Micro Turbine Engines Market By Fuel Type

15.3.2.12.3 Rest of Eastern Europe Aircraft Micro Turbine Engines Market By Horsepower

15.3.2.12.4 Rest of Eastern Europe Aircraft Micro Turbine Engines Market By Installation

15.3.2.12.5 Rest of Eastern Europe Aircraft Micro Turbine Engines Market, By Platform

15.3.2.12.6 Rest of Eastern Europe Aircraft Micro Turbine Engines Market, By End Use

15.3.3 Western Europe

15.3.3.1 Western Europe Aircraft Micro Turbine Engines Market By Country

15.3.3.2 Western Europe Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.3 Western Europe Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.4 Western Europe Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.5 Western Europe Aircraft Micro Turbine Engines Market By Installation

15.3.3.6 Western Europe Aircraft Micro Turbine Engines Market, By Platform

15.3.3.7 Western Europe Aircraft Micro Turbine Engines Market, By End Use

15.3.3.8 Germany

15.3.3.8.1 Germany Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.8.2 Germany Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.8.3 Germany Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.8.4 Germany Aircraft Micro Turbine Engines Market By Installation

15.3.3.8.5 Germany Aircraft Micro Turbine Engines Market, By Platform

15.3.3.8.6 Germany Aircraft Micro Turbine Engines Market, By End Use

15.3.3.9 France

15.3.3.9.1 France Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.9.2 France Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.9.3 France Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.9.4 France Aircraft Micro Turbine Engines Market By Installation

15.3.3.9.5 France Aircraft Micro Turbine Engines Market, By Platform

15.3.3.9.6 France Aircraft Micro Turbine Engines Market, By End Use

15.3.3.10 UK

15.3.3.10.1 UK Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.10.2 UK Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.10.3 UK Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.10.4 UK Aircraft Micro Turbine Engines Market By Installation

15.3.3.10.5 UK Aircraft Micro Turbine Engines Market, By Platform

15.3.3.10.6 UK Aircraft Micro Turbine Engines Market, By End Use

15.3.3.11 Italy

15.3.3.11.1 Italy Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.11.2 Italy Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.11.3 Italy Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.11.4 Italy Aircraft Micro Turbine Engines Market By Installation

15.3.3.11.5 Italy Aircraft Micro Turbine Engines Market, By Platform

15.3.3.11.6 Italy Aircraft Micro Turbine Engines Market, By End Use

15.3.3.12 Spain

15.3.3.12.1 Spain Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.12.2 Spain Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.12.3 Spain Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.12.4 Spain Aircraft Micro Turbine Engines Market By Installation

15.3.3.12.5 Spain Aircraft Micro Turbine Engines Market, By Platform

15.3.3.12.6 Spain Aircraft Micro Turbine Engines Market, By End Use

15.3.3.13 Netherlands

15.3.3.13.1 Netherlands Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.13.2 Netherlands Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.13.3 Netherlands Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.13.4 Netherlands Aircraft Micro Turbine Engines Market By Installation

15.3.3.13.5 Netherlands Aircraft Micro Turbine Engines Market, By Platform

15.3.3.13.6 Netherlands Aircraft Micro Turbine Engines Market, By End Use

15.3.3.14 Switzerland

15.3.3.14.1 Switzerland Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.14.2 Switzerland Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.14.3 Switzerland Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.14.4 Switzerland Aircraft Micro Turbine Engines Market By Installation

15.3.3.14.5 Switzerland Aircraft Micro Turbine Engines Market, By Platform

15.3.3.14.6 Switzerland Aircraft Micro Turbine Engines Market, By End Use

15.3.3.15 Austria

15.3.3.15.1 Austria Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.15.2 Austria Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.15.3 Austria Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.15.4 Austria Aircraft Micro Turbine Engines Market By Installation

15.3.3.15.5 Austria Aircraft Micro Turbine Engines Market, By Platform

15.3.3.15.6 Austria Aircraft Micro Turbine Engines Market, By End Use

15.3.3.16 Rest of Western Europe

15.3.3.16.1 Rest of Western Europe Aircraft Micro Turbine Engines Market By Engine Type

15.3.3.16.2 Rest of Western Europe Aircraft Micro Turbine Engines Market By Fuel Type

15.3.3.16.3 Rest of Western Europe Aircraft Micro Turbine Engines Market By Horsepower

15.3.3.16.4 Rest of Western Europe Aircraft Micro Turbine Engines Market By Installation

15.3.3.16.5 Rest of Western Europe Aircraft Micro Turbine Engines Market, By Platform

15.3.3.16.6 Rest of Western Europe Aircraft Micro Turbine Engines Market, By End Use

15.4 Asia-Pacific

15.4.1 Trend Analysis

15.4.2 Asia-Pacific Aircraft Micro Turbine Engines Market By country

15.4.3 Asia-Pacific Aircraft Micro Turbine Engines Market By Engine Type

15.4.4 Asia-Pacific Aircraft Micro Turbine Engines Market By Fuel Type

15.4.5 Asia-Pacific Aircraft Micro Turbine Engines Market By Horsepower

15.4.6 Asia-Pacific Aircraft Micro Turbine Engines Market By Installation

15.4.7 Asia-Pacific Aircraft Micro Turbine Engines Market, By Platform

15.4.8 Asia-Pacific Aircraft Micro Turbine Engines Market, By End Use

15.4.9 China

15.4.9.1 China Aircraft Micro Turbine Engines Market By Engine Type

15.4.9.2 China Aircraft Micro Turbine Engines Market By Fuel Type

15.4.9.3 China Aircraft Micro Turbine Engines Market By Horsepower

15.4.9.4 China Aircraft Micro Turbine Engines Market By Installation

15.4.9.5 China Aircraft Micro Turbine Engines Market, By Platform

15.4.9.6 China Aircraft Micro Turbine Engines Market, By End Use

15.4.10 India

15.4.10.1 India Aircraft Micro Turbine Engines Market By Engine Type

15.4.10.2 India Aircraft Micro Turbine Engines Market By Fuel Type

15.4.10.3 India Aircraft Micro Turbine Engines Market By Horsepower

15.4.10.4 India Aircraft Micro Turbine Engines Market By Installation

15.4.10.5 India Aircraft Micro Turbine Engines Market, By Platform

15.4.10.6 India Aircraft Micro Turbine Engines Market, By End Use

15.4.11 Japan

15.4.11.1 Japan Aircraft Micro Turbine Engines Market By Engine Type

15.4.11.2 Japan Aircraft Micro Turbine Engines Market By Fuel Type

15.4.11.3 Japan Aircraft Micro Turbine Engines Market By Horsepower

15.4.11.4 Japan Aircraft Micro Turbine Engines Market By Installation

15.4.11.5 Japan Aircraft Micro Turbine Engines Market, By Platform

15.4.11.6 Japan Aircraft Micro Turbine Engines Market, By End Use

15.4.12 South Korea

15.4.12.1 South Korea Aircraft Micro Turbine Engines Market By Engine Type

15.4.12.2 South Korea Aircraft Micro Turbine Engines Market By Fuel Type

15.4.12.3 South Korea Aircraft Micro Turbine Engines Market By Horsepower

15.4.12.4 South Korea Aircraft Micro Turbine Engines Market By Installation

15.4.12.5 South Korea Aircraft Micro Turbine Engines Market, By Platform

15.4.12.6 South Korea Aircraft Micro Turbine Engines Market, By End Use

15.4.13 Vietnam

15.4.13.1 Vietnam Aircraft Micro Turbine Engines Market By Engine Type

15.4.13.2 Vietnam Aircraft Micro Turbine Engines Market By Fuel Type

15.4.13.3 Vietnam Aircraft Micro Turbine Engines Market By Horsepower

15.4.13.4 Vietnam Aircraft Micro Turbine Engines Market By Installation

15.4.13.5 Vietnam Aircraft Micro Turbine Engines Market, By Platform

15.4.13.6 Vietnam Aircraft Micro Turbine Engines Market, By End Use

15.4.14 Singapore

15.4.14.1 Singapore Aircraft Micro Turbine Engines Market By Engine Type

15.4.14.2 Singapore Aircraft Micro Turbine Engines Market By Fuel Type

15.4.14.3 Singapore Aircraft Micro Turbine Engines Market By Horsepower

15.4.14.4 Singapore Aircraft Micro Turbine Engines Market By Installation

15.4.14.5 Singapore Aircraft Micro Turbine Engines Market, By Platform

15.4.14.6 Singapore Aircraft Micro Turbine Engines Market, By End Use

15.4.15 Australia

15.4.15.1 Australia Aircraft Micro Turbine Engines Market By Engine Type

15.4.15.2 Australia Aircraft Micro Turbine Engines Market By Fuel Type

15.4.15.3 Australia Aircraft Micro Turbine Engines Market By Horsepower

15.4.15.4 Australia Aircraft Micro Turbine Engines Market By Installation

15.4.15.5 Australia Aircraft Micro Turbine Engines Market, By Platform

15.4.15.6 Australia Aircraft Micro Turbine Engines Market, By End Use

15.4.16 Rest of Asia-Pacific

15.4.16.1 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market By Engine Type

15.4.16.2 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market By Fuel Type

15.4.16.3 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market By Horsepower

15.4.16.4 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market By Installation

15.4.16.5 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market, By Platform

15.4.16.6 Rest of Asia-Pacific Aircraft Micro Turbine Engines Market, By End Use

15.5 Middle East & Africa

15.5.1 Trend Analysis

15.5.2 Middle East

15.5.2.1 Middle East Aircraft Micro Turbine Engines Market By Country

15.5.2.2 Middle East Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.3 Middle East Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.4 Middle East Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.5 Middle East Aircraft Micro Turbine Engines Market By Installation

15.5.2.6 Middle East Aircraft Micro Turbine Engines Market, By Platform

15.5.2.7 Middle East Aircraft Micro Turbine Engines Market, By End Use

15.5.2.8 UAE

15.5.2.8.1 UAE Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.8.2 UAE Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.8.3 UAE Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.8.4 UAE Aircraft Micro Turbine Engines Market By Installation

15.5.2.8.5 UAE Aircraft Micro Turbine Engines Market, By Platform

15.5.2.8.6 UAE Aircraft Micro Turbine Engines Market, By End Use

15.5.2.9 Egypt

15.5.2.9.1 Egypt Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.9.2 Egypt Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.9.3 Egypt Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.9.4 Egypt Aircraft Micro Turbine Engines Market By Installation

15.5.2.9.5 Egypt Aircraft Micro Turbine Engines Market, By Platform

15.5.2.9.6 Egypt Aircraft Micro Turbine Engines Market, By End Use

15.5.2.10 Saudi Arabia

15.5.2.10.1 Saudi Arabia Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.10.2 Saudi Arabia Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.10.3 Saudi Arabia Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.10.4 Saudi Arabia Aircraft Micro Turbine Engines Market By Installation

15.5.2.10.5 Saudi Arabia Aircraft Micro Turbine Engines Market, By Platform

15.5.2.10.6 Saudi Arabia Aircraft Micro Turbine Engines Market, By End Use

15.5.2.11 Qatar

15.5.2.11.1 Qatar Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.11.2 Qatar Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.11.3 Qatar Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.11.4 Qatar Aircraft Micro Turbine Engines Market By Installation

15.5.2.11.5 Qatar Aircraft Micro Turbine Engines Market, By Platform

15.5.2.11.6 Qatar Aircraft Micro Turbine Engines Market, By End Use

15.5.2.12 Rest of Middle East

15.5.2.12.1 Rest of Middle East Aircraft Micro Turbine Engines Market By Engine Type

15.5.2.12.2 Rest of Middle East Aircraft Micro Turbine Engines Market By Fuel Type

15.5.2.12.3 Rest of Middle East Aircraft Micro Turbine Engines Market By Horsepower

15.5.2.12.4 Rest of Middle East Aircraft Micro Turbine Engines Market By Installation

15.5.2.12.5 Rest of Middle East Aircraft Micro Turbine Engines Market, By Platform

15.5.2.12.6 Rest of Middle East Aircraft Micro Turbine Engines Market, By End Use

15.5.3 Africa

15.5.3.1 Africa Aircraft Micro Turbine Engines Market By Country

15.5.3.2 Africa Aircraft Micro Turbine Engines Market By Engine Type

15.5.3.3 Africa Aircraft Micro Turbine Engines Market By Fuel Type

15.5.3.4 Africa Aircraft Micro Turbine Engines Market By Horsepower

15.5.3.5 Africa Aircraft Micro Turbine Engines Market By Installation

15.5.3.6 Africa Aircraft Micro Turbine Engines Market, By Platform

15.5.3.7 Africa Aircraft Micro Turbine Engines Market, By End Use

15.5.3.8 Nigeria

15.5.3.8.1 Nigeria Aircraft Micro Turbine Engines Market By Engine Type

15.5.3.8.2 Nigeria Aircraft Micro Turbine Engines Market By Fuel Type

15.5.3.8.3 Nigeria Aircraft Micro Turbine Engines Market By Horsepower

15.5.3.8.4 Nigeria Aircraft Micro Turbine Engines Market By Installation

15.5.3.8.5 Nigeria Aircraft Micro Turbine Engines Market, By Platform

15.5.3.8.6 Nigeria Aircraft Micro Turbine Engines Market, By End Use

15.5.3.9 South Africa

15.5.3.9.1 South Africa Aircraft Micro Turbine Engines Market By Engine Type

15.5.3.9.2 South Africa Aircraft Micro Turbine Engines Market By Fuel Type

15.5.3.9.3 South Africa Aircraft Micro Turbine Engines Market By Horsepower

15.5.3.9.4 South Africa Aircraft Micro Turbine Engines Market By Installation

15.5.3.9.5 South Africa Aircraft Micro Turbine Engines Market, By Platform

15.5.3.9.6 South Africa Aircraft Micro Turbine Engines Market, By End Use

15.5.3.10 Rest of Africa

15.5.3.10.1 Rest of Africa Aircraft Micro Turbine Engines Market By Engine Type

15.5.3.10.2 Rest of Africa Aircraft Micro Turbine Engines Market By Fuel Type

15.5.3.10.3 Rest of Africa Aircraft Micro Turbine Engines Market By Horsepower

15.5.3.10.4 Rest of Africa Aircraft Micro Turbine Engines Market By Installation

15.5.3.10.5 Rest of Africa Aircraft Micro Turbine Engines Market, By Platform

15.5.3.10.6 Rest of Africa Aircraft Micro Turbine Engines Market, By End Use

15.6 Latin America

15.6.1 Trend Analysis

15.6.2 Latin America Aircraft Micro Turbine Engines Market By country

15.6.3 Latin America Aircraft Micro Turbine Engines Market By Engine Type

15.6.4 Latin America Aircraft Micro Turbine Engines Market By Fuel Type

15.6.5 Latin America Aircraft Micro Turbine Engines Market By Horsepower

15.6.6 Latin America Aircraft Micro Turbine Engines Market By Installation

15.6.7 Latin America Aircraft Micro Turbine Engines Market, By Platform

15.6.8 Latin America Aircraft Micro Turbine Engines Market, By End Use

15.6.9 Brazil

15.6.9.1 Brazil Aircraft Micro Turbine Engines Market By Engine Type

15.6.9.2 Brazil Aircraft Micro Turbine Engines Market By Fuel Type

15.6.9.3 Brazil Aircraft Micro Turbine Engines Market By Horsepower

15.6.9.4 Brazil Aircraft Micro Turbine Engines Market By Installation

15.6.9.5 Brazil Aircraft Micro Turbine Engines Market, By Platform

15.6.9.6 Brazil Aircraft Micro Turbine Engines Market, By End Use

15.6.10 Argentina

15.6.10.1 Argentina Aircraft Micro Turbine Engines Market By Engine Type

15.6.10.2 Argentina Aircraft Micro Turbine Engines Market By Fuel Type

15.6.10.3 Argentina Aircraft Micro Turbine Engines Market By Horsepower

15.6.10.4 Argentina Aircraft Micro Turbine Engines Market By Installation

15.6.10.5 Argentina Aircraft Micro Turbine Engines Market, By Platform

15.6.10.6 Argentina Aircraft Micro Turbine Engines Market, By End Use

15.6.11 Colombia

15.6.11.1 Colombia Aircraft Micro Turbine Engines Market By Engine Type

15.6.11.2 Colombia Aircraft Micro Turbine Engines Market By Fuel Type

15.6.11.3 Colombia Aircraft Micro Turbine Engines Market By Horsepower

15.6.11.4 Colombia Aircraft Micro Turbine Engines Market By Installation

15.6.11.5 Colombia Aircraft Micro Turbine Engines Market, By Platform

15.6.11.6 Colombia Aircraft Micro Turbine Engines Market, By End Use

15.6.12 Rest of Latin America

15.6.12.1 Rest of Latin America Aircraft Micro Turbine Engines Market By Engine Type

15.6.12.2 Rest of Latin America Aircraft Micro Turbine Engines Market By Fuel Type

15.6.12.3 Rest of Latin America Aircraft Micro Turbine Engines Market By Horsepower

15.6.12.4 Rest of Latin America Aircraft Micro Turbine Engines Market By Installation

15.6.12.5 Rest of Latin America Aircraft Micro Turbine Engines Market, By Platform

15.6.12.6 Rest of Latin America Aircraft Micro Turbine Engines Market, By End Use

16. Company Profiles

16.1 General Electric Company

16.1.1 Company Overview

16.1.2 Financial

16.1.3 Products/ Services Offered

16.1.4 SWOT Analysis

16.1.5 The SNS View

16.2 Sentient Blue Technologies

16.2.1 Company Overview

16.2.2 Financial

16.2.3 Products/ Services Offered

16.2.4 SWOT Analysis

16.2.5 The SNS View

16.3 Turbotech SAS

16.3.1 Company Overview

16.3.2 Financial

16.3.3 Products/ Services Offered

16.3.4 SWOT Analysis

16.3.5 The SNS View

16.4 Williams International

16.4.1 Company Overview

16.4.2 Financial

16.4.3 Products/ Services Offered

16.4.4 SWOT Analysis

16.4.5 The SNS View

16.5 AeroDesignWorks GmbH

16.5.1 Company Overview

16.5.2 Financial

16.5.3 Products/ Services Offered

16.5.4 SWOT Analysis

16.5.5 The SNS View

16.6 Elliott Company

16.6.1 Company Overview

16.6.2 Financial

16.6.3 Products/ Services Offered

16.6.4 SWOT Analysis

16.6.5 The SNS View

16.7 Kratos Defense & Security Solutions, Inc

16.7.1 Company Overview

16.7.2 Financial

16.7.3 Products/ Services Offered

16.7.4 SWOT Analysis

16.7.5 The SNS View

16.8 Micro Turbine Technology B.V

16.8.1 Company Overview

16.8.2 Financial

16.8.3 Products/ Services Offered

16.8.4 SWOT Analysis

16.8.5 The SNS View

16.9 Honeywell International Inc

16.9.1 Company Overview

16.9.2 Financial

16.9.3 Products/ Services Offered

16.9.4 SWOT Analysis

16.9.5 The SNS View

16.10 PBS Group. a.s

16.10.1 Company Overview

16.10.2 Financial

16.10.3 Products/ Services Offered

16.10.4 SWOT Analysis

16.10.5 The SNS View

16.11 Raytheon Technologies Corporation

16.12 UAV Turbines Inc

16.13 Kratos Defense & Security Solutions Inc.

17. Competitive Landscape

17.1 Competitive Benchmarking

17.2 Market Share Analysis

17.3 Recent Developments

17.3.1 Industry News

17.3.2 Company News

17.3.3 Mergers & Acquisitions

18. Use Case and Best Practices

19. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Weather Forecasting Systems Market was valued at USD 2.8 billion in 2023 and is expected to grow to USD 5.0 billion by 2032, achieving a compound annual growth rate (CAGR) of 6.36% over the forecast period of 2024-2032.

The Combat Management System Market Size was valued at US$ 378.6 million in 2023 and is expected to reach USD 520.9 million by 2032 with a growing CAGR of 3.61% over the forecast period 2024-2032.

The Aircraft Computers Market Size was valued at USD 8.38 billion in 2023 and is expected to reach USD 14.10 Billion by 2032 with an emerging CAGR of 5.96% over the forecast period 2024-2032.

The Commercial Radars Market Size was valued at USD 6.63 Billion in 2023 and will reach USD 12.80 Billion by 2032 and grow at a CAGR of 7.62% by 2024-2032.

The Aircraft Seat Upholstery Market Size was valued at USD 1.97 billion in 2023 and is expected to reach USD 2.74 billion by 2032 with a growing CAGR of 3.75% over the forecast period 2024-2032.

The Unmanned Aerial Vehicle Market Size was valued at USD 35.76 billion in 2023 and is expected to reach USD 104.46 billion by 2032 with a growing CAGR of 12.65% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone