To get more information on Aircraft Insurance Market - Request Free Sample Report

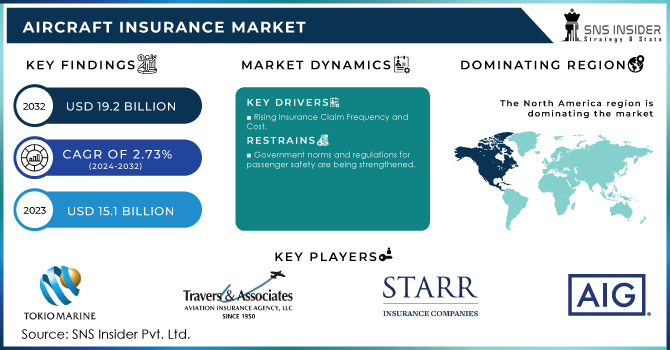

The Aircraft Insurance Market Size was valued at USD 15.1 billion in 2023 and is forecasted to grow to USD 19.2 billion by 2032, representing a CAGR of 2.73% over the forecast period of 2024-2032.

Aviation insurance is a non-life insurance policy that often covers physical damage to the aircraft as well as legal liabilities stemming from its ownership and operation. Furthermore, specialist insurance are offered to protect airport owners' legal liabilities deriving from the operation of hangars or the selling of various aviation items. These insurance are analogous to other kinds of liability contracts. Furthermore, the rise in air passenger traffic and the increase in government rules and regulations for passenger safety have a favorable impact on the expansion of the aviation insurance business. However, concerns such as high aviation insurance premiums and an increase in the frequency and expense of claims are constraining industry expansion. On the contrary, growing spending on international airlines is likely to provide lucrative chances for market expansion during the forecast period.

MARKET DYNAMICS

KEY DRIVERS

Construction of New Airports

Rising Insurance Claim Frequency and Cost

RESTRAINTS

Government norms and regulations for passenger safety are being strengthened.

The Asset Recovery Risk of Airline Bankruptcy

OPPORTUNITIES

The number of travelers choosing air travel has expanded dramatically in the market.

Increase in the number of foreign carriers

THE IMPACT OF COVID-19

The COVID-19 epidemic has had a substantial impact on the growth of the aviation insurance sector, owing to huge, well-documented claims from aerospace Original Equipment Manufacturers (OEMs). Furthermore, since the COVID-19 impact, there has been a constant and large increase in passenger traffic. Government norms and regulations for passenger safety have also increased. Furthermore, as growing nations seek to expand their current airport terminals, globalization has increased the demand for airline services. Furthermore, COVID-19 has significantly impacted the travel business. For example, with about 19.2 million visitors in 2020, tourist arrivals in Spain fell by 78 percent.

This stifles the expansion of the aviation insurance business. However, in such circumstances, insurance companies can create fresh tailored offers for customers. Furthermore, the reduced airline activity had a significant influence on aviation insurance, as airline premiums are often assessed based on hours flown; global aviation premiums collected were anticipated to be 25% lower in 2019 than in 2018. Furthermore, claims for weather and ground impact damage, such as specific occurrences of hail and wind damage to sitting aircraft, continued to be filed. For example, in 2020, five airports in the United States were directly hit by tornadoes, resulting in $125 million in insured damage. As a result, a number of such advancements around the world are expected to present attractive potential for the growth of the aviation insurance market.

Because of the high hull values and high liability limitations connected with aviation insurance policies, most insurance providers must obtain insurance to help spread the risk, preventing any single claim from bankrupting a company. However, due to increased demand for travel and tourism with airlines and an expanding number of skydiving institutions, the general and business aviation insurance industry is predicted to grow the fastest in the future years.

Passenger liability insurance is predicted to gather a considerable aviation insurance market size during the forecast period, owing to severe government rules that make it mandatory to obtain passenger liability insurance to safeguard passengers from losses. Furthermore, businesses are concentrating their efforts on developing new chances for growth and income generation, which is growing the popularity of AI and advanced machine learning algorithms across industries. However, the in-flight insurance market is predicted to develop at the fastest rate throughout the projection period, owing to an increase in airline accidents caused by a variety of factors such as bird collisions, bad weather, engine failure, and others.

The market is divided into two applications: private aircraft insurance and commercial aviation. Commercial Aviation leads the global Aircraft Insurance Market and is expected to grow at the quickest rate over the estimated period. The market is expected to grow due to increased commercial aircraft development to accommodate rising air passenger traffic. Among these, the passenger liability industry is likely to grow the fastest over the forecast period.

The market is divided into three segments based on end-user industry: service providers, airport operators, and others. Airport operators have a monopoly on the market. The development of smart airports in countries like as China and India, greater airport refurbishment activities, and the expensive cost of expanding airports are expected to drive the category's growth.

By Insurance Type

Public liability insurance

Passenger liability insurance

Combined Single Limit

In-flight Insurance

Others

By Application

Commercial Aviation Insurance

General and Business Aviation Insurance

Others

By End User

Service Providers

Airport operators

Others

REGIONAL ANALYSIS

Because of the existence of significant insurance carriers such as Berkshire Hathaway Inc. and American International Group, Inc., the North American region was expected to dominate the industry. Furthermore, due to the presence of important aircraft manufacturers such as Airbus SAS in the region, the European region is expected to drive the Aircraft Insurance Market.

Aside from that, the Asia-Pacific regional market is expected to grow at the fastest rate during the study period. This region is growing as a result of increased air passenger traffic in nations such as India and China. as well as

The Middle East Africa region is driving market expansion due to the increased development of new airports in countries such as the UAE and the region's growing manufacturing of UAVs. Furthermore, aircraft OEMs such as Embraer SA contribute to the growth of the Aircraft Insurance Market in the rest of the world.

Need any customization research on Aircraft Insurance Market - Enquiry Now

REGIONAL COVERAGE

North America

USA

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

The Netherlands

Rest of Europe

Asia-Pacific

Japan

South Korea

China

India

Australia

Rest of Asia-Pacific

The Middle East & Africa

Israel

UAE

South Africa

Rest of Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

The Key Players are Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, Experimental Aircraft Association Inc., USAA, USAIG & Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 15.1 Billion |

| Market Size by 2030 | US$ 19.2 Billion |

| CAGR | CAGR of 2.73% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End User (Service Providers, Airport operators, Others) • By Insurance Type (Public Liability Insurance, Passenger Liability Insurance, Combined Single Limit (CSL), In-Flight Insurance, and Others) • By Application (Commercial Aviation, General & Business Aviation and Others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, Experimental Aircraft Association Inc., USAA, USAIG |

| DRIVERS | • Construction of New Airports • Rising Insurance Claim Frequency and Cost |

| RESTRAINTS | • Government norms and regulations for passenger safety are being strengthened. • The Asset Recovery Risk of Airline Bankruptcy |

The market size of the Aircraft Insurance Market was valued at USD 12.52 billion in 2022.

Ans: The Aircraft Insurance Market is to grow at a CAGR of 3.07% over the forecast period 2023-2030.

The key players of the Aircraft Insurance Market are Global Aerospace Services Inc., Tokio Marine Holdings, Inc., Travers & Associates Aviation Insurance Agency, Llc., Starr International Company, Inc., American International Group, Inc., Axa, Bwi Aviation Insurance, and Experimental Aircraft Association Inc.

North America region dominated the Aircraft Insurance Market.

The Aircraft Insurance Market is segmented into 3 types: By Insurance Type, By End-user, and By Application.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 COVID-19 Impact Analysis

4.2 Impact of Ukraine- Russia war

4.3 Impact of ongoing Recession

4.3.1 Introduction

4.3.2 Impact on major economies

4.3.2.1 US

4.3.2.2 Canada

4.3.2.3 Germany

4.3.2.4 France

4.3.2.5 United Kingdom

4.3.2.6 China

4.3.2.7 Japan

4.3.2.8 South Korea

4.3.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Aircraft Insurance Market, by Insurance Type

8.1 Public liability insurance

8.2 Passenger liability insurance

8.3 Combined Single Limit

8.4 In-flight Insurance

8.5 Others

9. Aircraft Insurance Market, by Application

9.1 Commercial Aviation Insurance

9.2 General and Business Aviation Insurance

9.3 Others

10. Aircraft Insurance Market, by End User

10.1 Service Providers

10.2 Airport operators

10.3 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 USA

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 UK

11.3.3 France

11.3.4 Italy

11.3.5 Spain

11.3.6 The Netherlands

11.3.7 Rest of Europe

11.4 Asia-Pacific

11.4.1 Japan

11.4.2 South Korea

11.4.3 China

11.4.4 India

11.4.5 Australia

11.4.6 Rest of Asia-Pacific

11.5 The Middle East & Africa

11.5.1 Israel

11.5.2 UAE

11.5.3 South Africa

11.5.4 Rest

11.6 Latin America

11.6.1 Brazil

11.6.2 Argentina

11.6.3 Rest of Latin America

12. Company Profiles

12.1 Global Aerospace Services Inc.

12.1.1 Financial

12.1.2 Products/ Services Offered

12.1.3 SWOT Analysis

12.1.4 The SNS view

12.2 Tokio Marine Holdings, Inc.

12.3 Travers & Associates Aviation Insurance Agency, LLC.

12.4 STARR INTERNATIONAL COMPANY, INC.

12.5 American International Group, Inc.

12.6 AXA

12.7 BWI AVIATION INSURANCE

12.8 EXPERIMENTAL AIRCRAFT ASSOCIATION INC.

12.9 USAA

12.10 USAIG

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The In-flight Entertainment & Connectivity Market Size was valued at USD 5.21 billion in 2023 and is projected to reach USD 8.20 billion by 2031, at a CAGR of 5.7% Over the forecast period 2024-2031.

The Hydrogen Aircraft Market Size was valued at USD 308.09 million in 2023 expected to reach USD 2861.67 million by 2032 and grow at a CAGR of 28.10% over the forecast period 2024-2032.

The Electronically Scanned Array Market size was valued at USD 8.51 billion in 2023 and is projected to reach USD 15.28 billion by 2032 with a growing CAGR of 6.7% from 2024 to 2032.

The Aircraft Seals Market Size was valued at USD 3.04 billion in 2023 and is expected to reach USD 4.32 billion by 2031 and grow at a CAGR of 4.3% over the forecast period 2024-2031.

The Aircraft Insurance Market Size was valued at USD 15.1 billion in 2023 and is forecasted to grow to USD 19.2 billion by 2032, representing a CAGR of 2.73% over the forecast period of 2024-2032.

The Global Aerospace & Defense Market Size is valued to reach USD 1417.87 Bn by 2031, and the market size in 2023 was recorded at USD 899.72 Bn. The CAGR calculated for this market is 5.85% for the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone